Fillable Power of Attorney Document for California

In the heart of the bustling, ever-evolving state of California, the Power of Attorney (POA) form stands as a crucial legal document that empowers one individual to make decisions on behalf of another. This document is a cornerstone of proactive planning, ensuring that a trusted person or entity can act in your stead, whether for financial, legal, or health-related decisions, should the need arise. It's a testament to trust and foresight, containing specific instructions, limits, and durations determined by the one giving the power. Sifting through the legal landscape of California, which is as diverse as its population, the POA form's significance is magnified, given the state's strict regulations and requirements. Tailoring this document to fit one's unique circumstances insists on a meticulous understanding of its types, ranging from durable to non-durable, and from general to specific powers. Thus, embracing the complexity and importance of the California Power of Attorney form is the first step toward securing one's interests and ensuring that their voice is heard, no matter the circumstances.

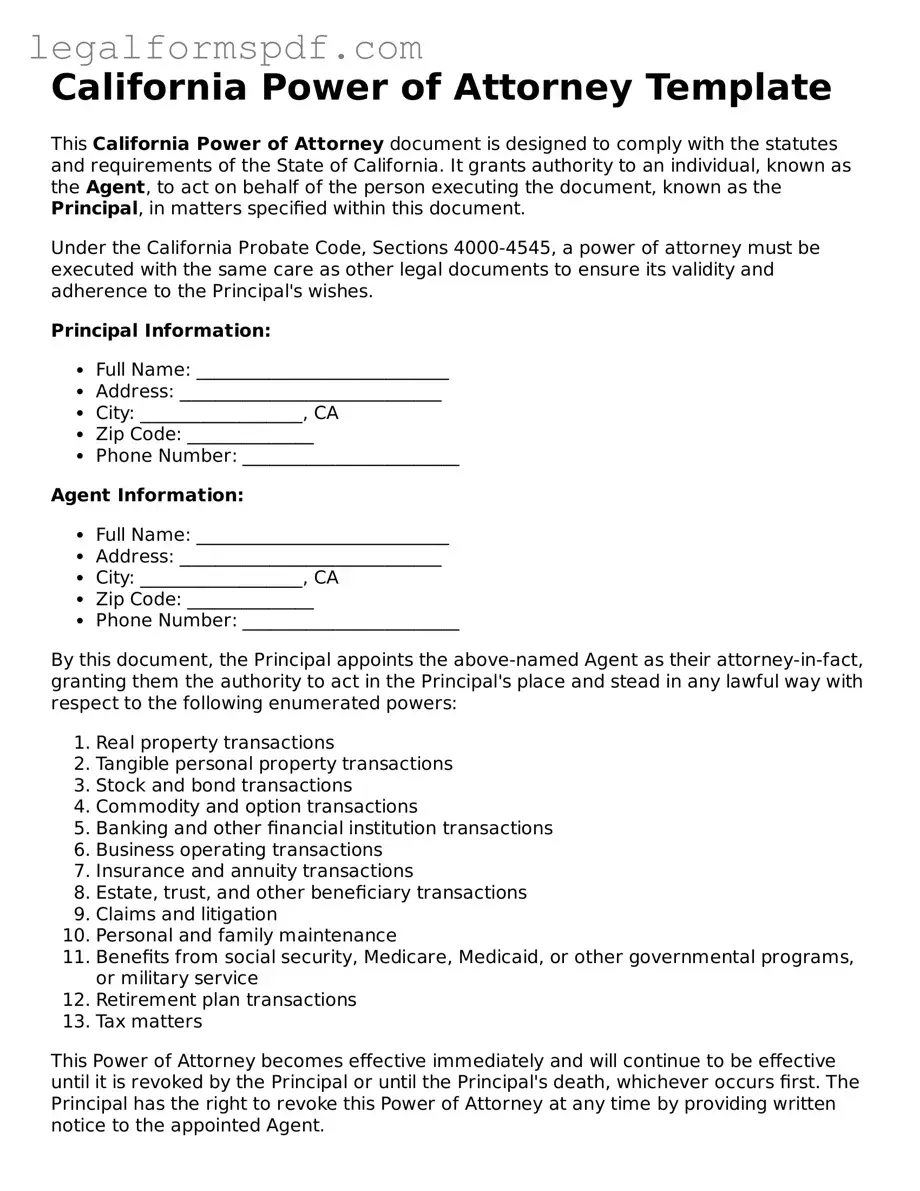

Document Example

California Power of Attorney Template

This California Power of Attorney document is designed to comply with the statutes and requirements of the State of California. It grants authority to an individual, known as the Agent, to act on behalf of the person executing the document, known as the Principal, in matters specified within this document.

Under the California Probate Code, Sections 4000-4545, a power of attorney must be executed with the same care as other legal documents to ensure its validity and adherence to the Principal's wishes.

Principal Information:

- Full Name: ____________________________

- Address: _____________________________

- City: __________________, CA

- Zip Code: ______________

- Phone Number: ________________________

Agent Information:

- Full Name: ____________________________

- Address: _____________________________

- City: __________________, CA

- Zip Code: ______________

- Phone Number: ________________________

By this document, the Principal appoints the above-named Agent as their attorney-in-fact, granting them the authority to act in the Principal's place and stead in any lawful way with respect to the following enumerated powers:

- Real property transactions

- Tangible personal property transactions

- Stock and bond transactions

- Commodity and option transactions

- Banking and other financial institution transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service

- Retirement plan transactions

- Tax matters

This Power of Attorney becomes effective immediately and will continue to be effective until it is revoked by the Principal or until the Principal's death, whichever occurs first. The Principal has the right to revoke this Power of Attorney at any time by providing written notice to the appointed Agent.

The Principal acknowledges they have read and understood the contents of this Power of Attorney and voluntarily affix their signature below, signifying their agreement to the terms herein outlined.

Principal's Signature: ___________________________ Date: _____________

Agent's Signature: _____________________________ Date: _____________

This document was prepared on the date last signed above and shall be governed by the laws of the State of California.

State of California

County of _______________

Subscribed and sworn to (or affirmed) before me on this ___ day of ___________, 20XX, by ________________________, proven to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

Notary Public Signature: ____________________________

Commission Number: _______________________________

My Commission Expires: ____________________________

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The California Power of Attorney forms are governed by the California Probate Code, Sections 4000 to 4465. |

| Types Available | California has different forms for financial and health care decisions, specifically General, Durable, Limited, and Medical Power of Attorney forms. |

| Requirement for Validity | For a Power of Attorney to be valid in California, it must be signed by the principal, or in the principal's conscious presence by another individual directed to do so, and either acknowledged before a notary public or signed by two witnesses. |

| Witness Requirements | Witnesses must be adults, not be the agent, and at least one must not be related to the principal by blood, marriage, or adoption or entitled to any part of the principal’s estate upon death. |

| Durability | A Power of Attorney in California can be made durable, meaning it remains effective even if the principal becomes incapacitated, provided it includes specific durability language stated in the California Probate Code. |

Instructions on Writing California Power of Attorney

After deciding to grant someone the authority to act on your behalf, completing the California Power of Attorney (POA) form is the next critical step. This document is crucial for ensuring that your chosen representative can legally make decisions and take certain actions for you if you are unable to do so yourself. Carefully filling out this form is essential for safeguarding your interests. Follow these steps to accurately complete the California Power of Attorney form, ensuring peace of mind for both you and your designated agent.

- Begin by downloading the latest California Power of Attorney form from a reliable source. Ensure it complies with the current California laws.

- Enter the full legal names and addresses of the principal (you) and the agent (the person you're granting authority to).

- Specify the powers you are granting to your agent. Be as clear and detailed as possible to avoid any confusion or misuse of the authority.

- If you wish to grant your agent authority over specific matters, like real estate or financial transactions, itemize these clearly in the designated section.

- Decide on the duration of the POA. Indicate if it's durable (remains in effect even if you become incapacitated) or springing (only comes into effect upon a certain condition, such as medical incapacitation).

- If there are any special instructions or limitations to the agent's powers, clearly document these in the form. This ensures your wishes are followed precisely.

- Review the form with your agent to ensure they understand the scope of their responsibilities and are willing to accept them.

- Sign and date the form in the presence of a notary public or witnesses, as required by California law, to validate the document.

- Keep the original signed document in a safe place and provide your agent with a copy. Inform a trusted family member or friend of the arrangement.

After completing these steps, your California Power of Attorney form will be fully executed, making it a legally binding document. This process doesn't just formalize an important legal and personal relationship; it also protects your interests and ensures your affairs can be managed according to your wishes. Remember, circumstances can change, so it's wise to review and update your Power of Attorney as necessary to reflect your current wishes and legal requirements.

Understanding California Power of Attorney

What is a California Power of Attorney form?

A California Power of Attorney (POA) form is a legal document that allows an individual, known as the 'principal', to appoint another person, known as the 'agent' or 'attorney-in-fact', to make decisions and act on their behalf in specific matters. These matters can range from financial decisions to medical care, depending on the type of POA form used.

Who can be named as an agent in a POA?

Any competent adult can be named as an agent. It's crucial that the principal trusts the agent completely, as they will be making decisions and taking actions that affect the principal's life and property.

Are there different types of POA forms in California?

Yes, there are several types of POA forms available in California. The most common include the General Power of Attorney, Limited Power of Attorney, Durable Power of Attorney, and Medical Power of Attorney. Each type serves different purposes and offers varying degrees of control and duration.

What makes a POA legally binding in California?

For a POA to be legally binding in California, certain requirements must be met. These typically include the principal's signature, the agent's acceptance, and the signatures of either two adult witnesses or a notary public. Specific forms may have additional requirements depending on their purpose.

Can a Power of Attorney be revoked?

Yes, a POA can be revoked at any time by the principal, provided they are of sound mind. The revocation must be done in writing and communicated to the agent and any institutions or parties that were relying on the original POA.

What happens if the agent is unable or unwilling to serve?

If the appointed agent is unable to serve or chooses not to, the POA can designate an alternate agent to take over. If no alternate is named, the principal will generally need to create a new POA to appoint someone else.

Do POA forms need to be filed with a government office in California?

No, POA forms do not typically need to be filed with any government office in California to be effective. However, for real estate transactions, the POA may need to be recorded with the county recorder's office where the property is located.

Is a lawyer required to create a POA in California?

While it's not mandatory to have a lawyer create a POA, consulting with one can help ensure that the document meets all legal requirements and accurately reflects the principal's wishes. This can be especially important for complex estates or situations.

Common mistakes

Filling out the California Power of Attorney (POA) form is an important step for anyone who wants to ensure their affairs are managed according to their wishes if they're unable to do so themselves. However, there are common mistakes people make during this process that can lead to complications later on. One significant error is not specifying the powers granted clearly. Without explicit details about what the agent can and cannot do, this can lead to confusion and potential misuse of the authority given.

Another mistake often made is choosing the wrong person as the agent. The agent's role is crucial and requires someone who is not only trustworthy but also capable of making decisions that align with the principal's wishes. Sometimes, people choose their agents based on emotions rather than considering the individual's ability and willingness to handle the responsibilities effectively.

Not having the POA document properly witnessed or notarized is yet another common oversight. The State of California has specific requirements for notarization or witnessing for a POA to be considered legal and valid. Failure to comply with these requirements can render the document invalid, which could lead to significant issues in the future when the document is needed the most.

Lack of specificity regarding the duration of the POA is also a frequent mistake. Some people assume the document automatically expires upon their death or incapacitation, but this is not always the case. It’s essential to clearly define the circumstances under which the power of attorney begins and ends, to avoid any legal ambiguity or unintentional continuation of the authority.

Finally, not consulting a legal professional is a mistake many people make when filling out the California POA form. While it's possible to complete the form without legal help, professional advice can ensure that it accurately reflects the person's wishes and meets all legal standards. This step can prevent future legal challenges and ensure the document’s effectiveness.

Documents used along the form

When individuals prepare for future uncertainties or plan the management of their affairs, a California Power of Attorney form often plays a pivotal role. This document grants someone else the authority to make decisions on your behalf, should you become unable to do so. However, the Power of Attorney form is usually not the only document needed to fully prepare for all legal and personal planning aspects. Several other forms and documents frequently complement this essential document, each serving a separate but complementary purpose.

- Advance Health Care Directive: This allows individuals to outline their preferences for medical care if they become incapacitated and cannot communicate their wishes. It often includes the appointment of a health care agent.

- Living Will: Often part of the Advance Health Care Directive, a living will specifies an individual's desires regarding life-sustaining treatment under certain medical conditions.

- HIPAA Authorization Form: This permits designated individuals to access your medical records, ensuring your health care agent has the information needed to make informed decisions.

- Durable Financial Power of Attorney: Specifically focusing on financial matters, this variation explicitly allows an agent to manage the financial affairs of the principal.

- Last Will and Testament: A crucial document that outlines how a person's estate should be distributed after their death, including who inherits property, assets, and guardianship of minors, if applicable.

- Revocation of Power of Attorney: This document legally cancels an existing Power of Attorney, allowing for the appointment of a new agent or the cessation of power delegation altogether.

- Trust Agreement: A legal document that allows for the management of an individual’s assets through a trust, potentially avoiding probate and allowing for more controlled distribution of assets.

- Real Estate Deeds: If the Power of Attorney includes the handling of real estate transactions, specific deeds may be required to transfer property ownership as directed by the principal.

- Vehicle Power of Attorney (Form REG 260): This document allows an agent to conduct transactions related to the Department of Motor Vehicles, such as transferring titles or registering vehicles.

- Bank-Specific Power of Attorney Forms: Some financial institutions require their form to recognize a Power of Attorney, necessitating completion for transactions involving specific banks.

Comprehensively preparing for future possibilities involves more than executing a Power of Attorney. By understanding and using additional legal documents, individuals can ensure that their health care preferences, financial matters, and estate are managed according to their wishes, providing peace of mind and legal clarity for themselves and their loved ones. Each document serves its unique purpose, contributing to a thorough and effective legal plan.

Similar forms

The California Power of Attorney form shares similarities with the Advance Health Care Directive. Both documents empower someone else to make decisions on your behalf, but they serve distinct purposes. An Advance Health Care Directive allows you to appoint someone to make health care decisions for you if you become unable to do so yourself. It gives your agent authority to consult with your doctors and make decisions about medical treatments, much like a Power of Attorney, but specifically for medical contexts.

Another document related is the Living Will, which like the Power of Attorney, outlines your wishes concerning medical treatment. However, a Living Will specifically addresses end-of-life care and life-sustaining treatment preferences, should you become incapacitated or seriously ill. It speaks directly to healthcare providers about your desires for life support measures, contrasting with a Power of Attorney, which appoints someone to make a range of decisions on your behalf.

The Durable Power of Attorney for Finances is particularly akin to a general Power of Attorney, yet with a specific focus. This document allows you to name someone to handle your financial affairs, including managing bank accounts, paying bills, and even selling property if needed. The "durable" aspect means that the document remains in effect even if you become incapacitated, focusing solely on financial decisions, unlike the broader scope of a standard Power of Attorney.

Lastly, the Trust Document has parallels with the Power of Attorney, as it entails appointing someone, known as a trustee, to manage your assets on behalf of a beneficiary. This document comes into play often in estate planning, where you transfer ownership of your property into the trust to be managed according to your wishes. While a Power of Attorney assigns general decision-making authority, a Trust Document deals specifically with the management and distribution of your assets according to the terms you set forth.

Dos and Don'ts

When filling out a California Power of Attorney (POA) form, it's essential to follow certain guidelines to ensure the document is valid and accurately reflects your wishes. Below are key dos and don'ts to consider:

Do:

Read the instructions for the POA form carefully to ensure you understand the scope and implications of the powers being granted.

Clearly identify the principal (the person granting the power) and the agent (the person receiving the power), including full legal names and addresses.

Specify the powers granted with as much detail as necessary. Be clear about what your agent can and cannot do on your behalf.

Discuss the responsibilities with the chosen agent before finalizing the POA to ensure they are willing and able to act on your behalf.

Have the POA form notarized if required. Although not all POA forms need to be notarized in California, doing so can add a layer of legality and help avoid challenges.

Provide copies of the completed POA to relevant parties, such as financial institutions or medical providers, as needed.

Review and update the POA as necessary, especially if your circumstances or wishes change.

Don't:

Don’t leave any sections blank. If a section does not apply, indicate with “N/A” (not applicable) instead of leaving it empty.

Don’t use vague language. Be specific about the powers you are granting to avoid any confusion or misinterpretation.

Don’t choose an agent without thoroughly considering their ability to act in your best interest. Trust is paramount in a POA relationship.

Don’t forget to sign and date the form. A POA is not considered valid until the principal has signed it.

Don’t fail to communicate your wishes and expectations to the agent. Clear communication can prevent misunderstandings later on.

Don’t neglect to consult with a legal professional if you have any questions or concerns about the POA form or process.

Don’t underestimate the importance of storing the POA document in a safe but accessible place, and letting your agent know where it can be found.

Misconceptions

The California Power of Attorney (POA) form is a powerful document, but many hold incorrect beliefs about its purpose and power. Understanding these misconceptions is essential for anyone considering creating or becoming a part of a POA agreement.

Misconception 1: A Power of Attorney grants absolute authority. Many believe that once appointed, an agent has unlimited power over the principal's affairs. In reality, a POA can be as broad or as specific as the document delineates, often limited to certain types of decisions or actions.

Misconception 2: The form is effective immediately and forever. Contrary to this belief, the POA can be designed to become effective upon certain conditions, such as the incapacity of the principal. Furthermore, it can be set to expire on a specific date or upon the occurrence of a specific event.

Misconception 3: Only the elderly need a Power of Attorney. While it's true that POAs are often associated with aging individuals, anyone can face situations where they're unable to manage their affairs, such as unexpected illness or injury, making a POA a prudent document at any age.

Misconception 4: Creating a POA is a complicated and expensive process. Though legal advice can be invaluable, California provides standardized forms that make creating a POA more accessible and affordable than many realize. It's crucial, however, to ensure the form is completed accurately and reflects the principal's wishes.

Misconception 5: A Power of Attorney includes healthcare decisions. In California, financial and healthcare decisions are covered by separate forms. A POA typically grants authority over financial matters, while a separate document, an Advance Health Care Directive, is used for health-related decisions.

Misconception 6: A Power of Attorney cannot be revoked. Many are under the impression that once a POA is created, it is set in stone. However, as long as the principal is competent, they can revoke or alter the POA at any time, ensuring they retain ultimate control over their affairs.

Understanding the realities behind these misconceptions is crucial for effectively using a Power of Attorney. Accurate knowledge ensures that individuals can make informed decisions about managing their affairs, both now and in the future.

Key takeaways

Filling out and using the California Power of Attorney form is an important legal process. This document allows an individual, known as the principal, to grant another party, termed an agent or attorney-in-fact, the authority to make decisions and take actions on their behalf. Understanding how to correctly fill out and utilize this document is crucial for ensuring the principal's wishes are followed, and their interests are protected. The following are key takeaways to consider:

- Choose the right form: California offers several types of Power of Attorney forms, including those for financial matters, healthcare decisions, and durable powers of attorney that remain in effect even if the principal becomes incapacitated. Select the form that best suits the principal's needs.

- Determine the scope of authority: Clearly specify the extent of powers granted to the agent. This may include the ability to make financial transactions, sell property, make health care decisions, or handle legal matters.

- Select a trustworthy agent: The agent should be someone the principal trusts implicitly, as they will have significant control over important aspects of the principal's life.

- Fill out the form thoroughly: Ensure all the necessary information is accurately provided on the form, including the names and addresses of the principal and agent, the scope of authority granted, and any limitations or special instructions.

- Sign in the presence of a notary: For the Power of Attorney to be legally binding in California, it must be signed by the principal in the presence of a notary public or two adult witnesses, depending on the type of Power of Attorney.

- Follow witnessing requirements: If using witnesses, ensure they are adults and understand their role in acknowledging the principal's signature and capacity to sign the document. Witnesses related by blood or marriage to the principal, or who have a vested interest in the principal's estate, may not be considered impartial.

- Keep the document accessible: The signed Power of Attorney should be kept in a safe but accessible place. The agent, along with institutions like banks or medical facilities, may need original copies to act on the principal's behalf.

- Review and update regularly: The principal’s circumstances and wishes may change over time. Regularly reviewing and updating the Power of Attorney ensures it reflects the principal's current wishes and addresses any changes in the law.

- Revoke if necessary: The principal can revoke the Power of Attorney at any time, as long as they are mentally competent. Revocation should be in writing, and all parties previously given a copy of the Power of Attorney should be notified.

- Seek professional advice: Considering the complexities and legal implications of a Power of Attorney, consulting with an attorney can provide guidance tailored to the principal’s specific situation and needs.

In conclusion, the California Power of Attorney form is a powerful document that requires careful consideration and proper execution. By heedfully addressing the above key points, individuals can ensure their interests and preferences are respected and legally protected.

More Power of Attorney State Forms

How to Get Power of Attorney for Elderly Parent in Georgia - It can also include provisions for the agent to make gifts or transfer assets for estate planning purposes.

Power of Attorney Michigan Pdf - Provide a responsible agent with the means to ensure your bills, from utilities to mortgage payments, are paid on time even if you're incapacitated.