Official Power of Attorney Document

When individuals consider planning for their future, especially regarding financial and medical decisions, the Power of Attorney (POA) form emerges as a crucial tool that ensures their affairs are managed according to their wishes, even if they become unable to make decisions themselves. This legal document grants another person or organization the authority to handle financial, legal, or health-related decisions on one's behalf. Its scope can range from broad, comprehensive control over nearly every aspect of an individual's life, to a more narrow focus, such as the authority to operate a business, sell a particular property, or make healthcare decisions only under specific conditions. The process of creating a POA involves carefully considering who is best suited to serve as an agent, understanding the responsibilities involved, and often, obtaining advice from legal professionals to ensure the document meets all necessary legal requirements and accurately reflects the person's wishes. As circumstances change, it may also be necessary to update or revoke this powerful document, making it an integral part of any comprehensive life planning strategy.

State-specific Information for Power of Attorney Forms

Power of Attorney Form Subtypes

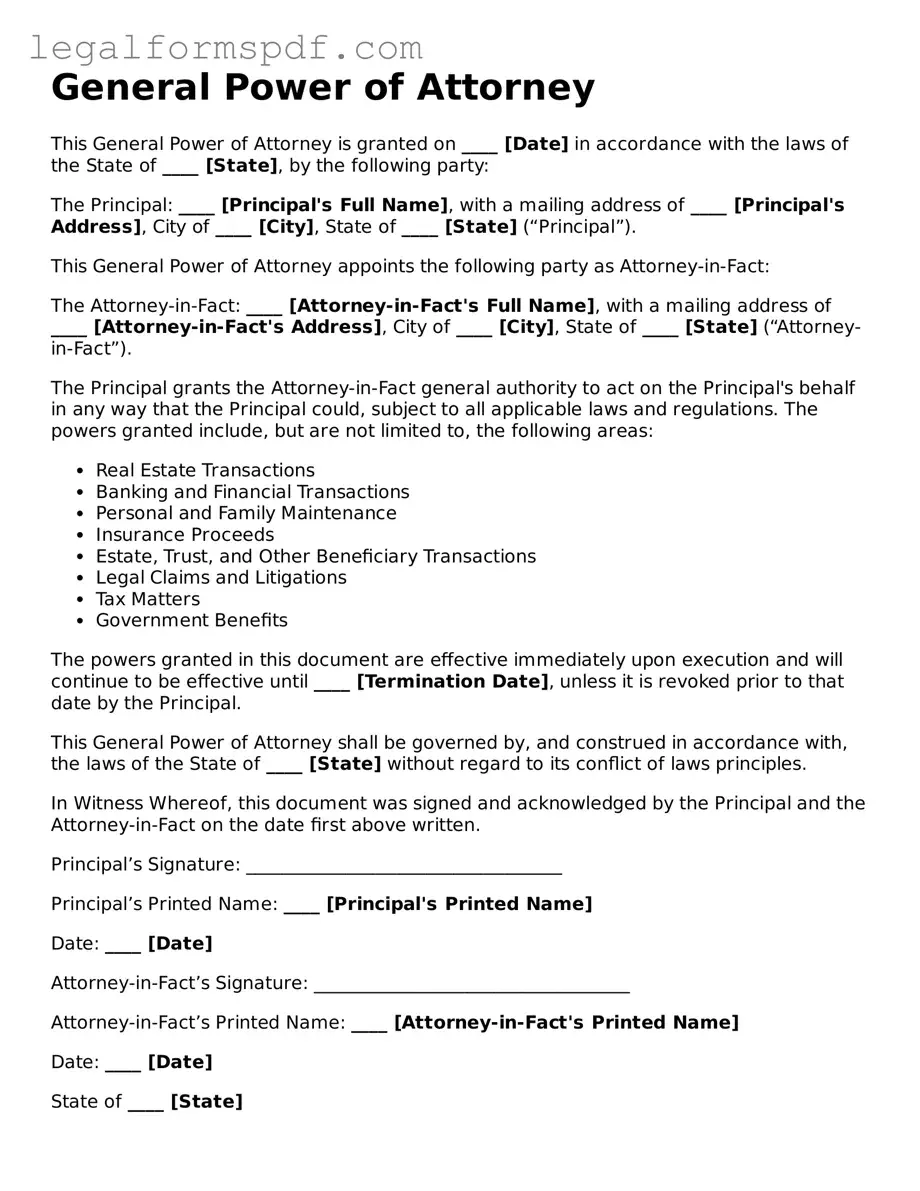

Document Example

General Power of Attorney

This General Power of Attorney is granted on ____ [Date] in accordance with the laws of the State of ____ [State], by the following party:

The Principal: ____ [Principal's Full Name], with a mailing address of ____ [Principal's Address], City of ____ [City], State of ____ [State] (“Principal”).

This General Power of Attorney appoints the following party as Attorney-in-Fact:

The Attorney-in-Fact: ____ [Attorney-in-Fact's Full Name], with a mailing address of ____ [Attorney-in-Fact's Address], City of ____ [City], State of ____ [State] (“Attorney-in-Fact”).

The Principal grants the Attorney-in-Fact general authority to act on the Principal's behalf in any way that the Principal could, subject to all applicable laws and regulations. The powers granted include, but are not limited to, the following areas:

- Real Estate Transactions

- Banking and Financial Transactions

- Personal and Family Maintenance

- Insurance Proceeds

- Estate, Trust, and Other Beneficiary Transactions

- Legal Claims and Litigations

- Tax Matters

- Government Benefits

The powers granted in this document are effective immediately upon execution and will continue to be effective until ____ [Termination Date], unless it is revoked prior to that date by the Principal.

This General Power of Attorney shall be governed by, and construed in accordance with, the laws of the State of ____ [State] without regard to its conflict of laws principles.

In Witness Whereof, this document was signed and acknowledged by the Principal and the Attorney-in-Fact on the date first above written.

Principal’s Signature: ___________________________________

Principal’s Printed Name: ____ [Principal's Printed Name]

Date: ____ [Date]

Attorney-in-Fact’s Signature: ___________________________________

Attorney-in-Fact’s Printed Name: ____ [Attorney-in-Fact's Printed Name]

Date: ____ [Date]

State of ____ [State]

County of ____ [County]

On ____ [Date], before me, ____ [Notary's Name], a Notary Public, personally appeared ____ [Principal's Full Name] and ____ [Attorney-in-Fact's Full Name], known to me (or satisfactorily proven) to be the persons whose names are subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In Witness Whereof, I hereunto set my hand and official seal:

Notary’s Signature: ___________________________________

Notary’s Printed Name: ____ [Notary's Printed Name]

Date: ____ [Date]

Commission Expires: ____ [Commission Expiry Date]

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Power of Attorney is a legal document that allows one person to grant another person the authority to make decisions on their behalf. |

| Types | Common types include General, Durable, Medical, and Limited Powers of Attorney. |

| Relevance of State Laws | The form and powers granted by the document can vary significantly depending on the state's legislation where it is executed. |

| Durability | A Durable Power of Attorney remains effective even if the principal becomes incapacitated, unlike a general Power of Attorney which typically ceases. |

| Revocation | The principal can revoke the Power of Attorney at any time, as long as they are mentally competent. |

Instructions on Writing Power of Attorney

Before embarking on filling out the Power of Attorney form, it is crucial to understand the gravity and impact this document will have. A Power of Attorney grants another person the authority to make decisions on your behalf, making it essential to consider carefully who is chosen as the agent. This document allows for a range of duties to be performed by the agent, from financial decisions to healthcare matters, depending on the type selected. With this in mind, filling out the form accurately is crucial. Here are step-by-step instructions to guide you through the process, ensuring that the document reflects your wishes accurately.

- Gather all necessary information, including the full legal names and addresses of the principal (you) and the agent (the person you're granting authority to).

- Decide on the type of Power of Attorney required (e.g., General, Durable, Health Care) based on the decisions you want the agent to have the authority to make.

- Read through the form completely before beginning to fill it out. Ensure you understand each section to avoid mistakes.

- Begin by entering your name and address as the principal at the top of the form.

- Enter the name and address of the person you are appointing as your agent in the designated section.

- Specify the powers you are granting to your agent. Be as detailed as possible to prevent any ambiguity about their scope of authority.

- For a Durable Power of Attorney, ensure there's a statement that the powers granted remain effective even if you become incapacitated. If this clause is not included, consider adding it under the directions of state law.

- Choose a successor agent, if desired, and fill in their details. This step is optional but recommended to ensure continuity in case the original agent is unable or unwilling to serve.

- Review the conditions under which the Power of Attorney will expire, if any are specified. Some states require an expiration date, while others do not.

- Sign and date the form in the presence of a notary public or as required by your state laws. Many states require the document to be notarized to be legally valid.

- Have the agent sign the form, if required by your state. This acknowledges their acceptance of the responsibilities bestowed upon them.

- Keep the original document in a safe but accessible place. Provide copies to the agent and any relevant financial institutions, health care providers, or other parties who need to be aware of its existence.

After completing the form, consider discussing its contents and your expectations with the appointed agent. This conversation can help ensure they are comfortable with the responsibilities and understand your wishes. Regularly review and update the form as needed, especially after major life events or changes in your relationship with the agent. Remember, the Power of Attorney is a powerful and versatile tool, but its effectiveness hinges on clear communication and careful drafting.

Understanding Power of Attorney

What is a Power of Attorney (POA)?

A Power of Attorney is a legal document that allows one person, known as the principal, to delegate authority to another person, known as the agent or attorney-in-fact, to make decisions on their behalf. This can include managing financial affairs, making medical decisions, or handling other personal matters. The scope of authority granted can vary widely based on the principal’s needs and preferences.

When does a Power of Attorney become effective?

The effectiveness of a Power of Attorney can vary depending on the wishes of the principal. Some POAs become effective immediately upon signing, while others may be designed to become effective only upon the occurrence of a certain event, such as the principal’s incapacity. The document should specify when it becomes effective.

Can a Power of Attorney be revoked?

Yes, a Power of Attorney can be revoked at any time by the principal, as long as the principal is mentally competent. To revoke a POA, the principal should provide written notice to the agent and to any institutions or individuals that were aware of the existence of the POA. It is important to also destroy all copies of the POA document to prevent future use.

How does one choose an agent for a Power of Attorney?

Choosing an agent is a significant decision, as this person will have the authority to make important decisions on your behalf. You should select someone who is trustworthy, reliable, and capable of handling the responsibilities. Many people choose a family member or a close friend, but it is also common to select a professional, such as an attorney or a financial advisor, especially for complex matters.

What types of Powers of Attorney are there?

There are several types of Power of Attorney, each serving different purposes. The most common types include: - General Power of Attorney: Grants broad powers to the agent in all matters. - Durable Power of Attorney: Remains in effect even if the principal becomes incapacitated. - Special or Limited Power of Attorney: Grants authority in specific matters or for limited periods. - Health Care Power of Attorney: Authorizes the agent to make medical decisions on behalf of the principal. Each type has its unique characteristics and should be chosen based on the principal’s specific needs.

Does a Power of Attorney need to be notarized?

The requirements for notarizing a Power of Attorney can vary by state. In many states, a POA must be notarized to be considered legally valid. Some states may also require witnesses. It is crucial to follow your state's regulations to ensure that the document is enforceable. Consulting with a legal professional in your state can help you understand the specific requirements.

Common mistakes

When it comes to creating a Power of Attorney (POA), the importance of attention to detail cannot be overstated. A small oversight can have huge implications. One common mistake is not specifying the powers clearly. People often assume that a general POA grants their agent carte blanche to make any and all decisions, but this isn't the case. Without clear directions about what the agent can and cannot do, confusion and legal complications can arise. It's critical to be explicit about the scope and limitations of the agent's authority.

Another area where people often slip up is in failing to update the document. Life circumstances change – relationships evolve, assets shift, and intentions alter. A POA that was drafted years ago may not align with the current situation or wishes of the person it concerns. Regularly reviewing and updating the POA ensures that it accurately reflects the creator's current circumstances and desires.

A third mistake is choosing the wrong agent. The role of an agent is pivotal, requiring trustworthiness, reliability, and often, financial acumen. Although it's common to appoint a close family member or friend, it's vital to consider whether the person chosen is genuinely the best fit for the responsibility. The decision should be based on capability and reliability, not just emotional closeness or convenience.

Last but not least, many forget the necessity of having the document properly witnessed or notarized, depending on state laws. This oversight can lead to the POA being considered invalid. Different states have various requirements for making a POA legally binding, including witnessing and notarization. Overlooking these formalities can render the document ineffective and leave the principal's wishes unenforceable.

Documents used along the form

When individuals prepare for future planning, especially in terms of legal and financial decision-making, a Power of Attorney (POA) is a crucial document. It authorizes someone else to act on your behalf in various capacities. However, to ensure comprehensive coverage of all aspects of one's life and wishes, other forms and documents are often used in conjunction. Here is a look at six commonly used forms and documents that supplement a POA, each serving its unique purpose in ensuring a person's affairs are well-managed and wishes respected.

- Advance Healthcare Directive: This document allows individuals to state their preferences for medical care if they become unable to make these decisions themselves. It can specify certain treatments to be used or avoided and appoint a healthcare agent.

- Living Will: Often part of the Advance Healthcare Directive, a Living Will specifically addresses end-of-life care preferences, such as the use of life-sustaining treatment in cases of terminal illness or permanent unconsciousness.

- Last Will and Testament: This document spells out how a person's assets and estate should be distributed after their death. It can also appoint guardians for minor children and specify wishes for funeral arrangements.

- Trust Agreement: A Trust Agreement is established to manage a person's assets during their lifetime and distribute them after death, potentially avoiding probate. It designates a trustee to manage the trust’s assets for the benefit of designated beneficiaries.

- Beneficiary Designations: Often used with insurance policies and retirement accounts, these forms allow individuals to specify who will receive the benefits upon their death, bypassing the probate process.

- Durable Financial Power of Attorney: This specific type of POA grants someone authority to handle financial decisions on behalf of the individual. Unlike a general POA, it remains effective even if the person becomes incapacitated.

Understanding and organizing these documents can provide peace of mind, knowing that one's health, financial matters, and final wishes are documented and in the hands of trusted individuals. It's wise to consult with legal professionals to ensure that these forms are properly executed and reflect current laws and personal circumstances. Remember, preparing these documents is a profound act of consideration for your loved ones, potentially sparing them difficult decisions and legal complications during challenging times.

Similar forms

The Living Will is closely related to the Power of Attorney (POA) because it also addresses decisions on someone's behalf, particularly about medical care. However, while the POA appoints another person to make decisions across various aspects (financial, property, health), a Living Will specifically outlines what medical treatments an individual does or does not want if they're unable to communicate their wishes, focusing on end-of-life care.

A Healthcare Proxy, much like a Power of Attorney for healthcare decisions, allows an individual to appoint someone else to make medical decisions for them if they're incapacitated. The main difference is that a Healthcare Proxy is exclusively for healthcare decisions. In contrast, a Healthcare POA might include broader authority, like accessing the individual's healthcare records or talking to insurance companies.

The Durable Power of Attorney is a subtype of the Power of Attorney, designed to remain in effect even if the person who made it becomes mentally incapacitated. This is crucial because a standard POA typically ends if the person can no longer make decisions for themselves. The "durable" aspect ensures that the appointed agent can manage affairs without interruption, which is particularly important for long-term planning and care.

A Will, or Last Will and Testament, shares the idea of appointing individuals to carry out wishes after one's death, much like a Power of Attorney appoints someone to make decisions while alive. However, the Will comes into play after death, distributing property, naming guardians for minors, and possibly setting up trusts. It’s a directive for after death, unlike a POA, which ceases to have effect once the person dies.

A Revocable Living Trust is another estate planning tool that, like a Power of Attorney, involves managing assets. The person who creates the trust (the grantor) can control the trust assets during their lifetime and specify how they should be distributed upon their death. Unlike a POA, which authorizes someone to act on your behalf, a trust is more about asset management and can continue to operate after death or incapacitation.

The Guardianship or Conservatorship Agreement is a legal mechanism, much like a Power of Attorney, allowing someone to make decisions on behalf of another, often due to incapacity or disability. However, obtaining guardianship or conservatorship usually requires court approval and is often considered when a POA is not in place or when the person’s capacity to make decisions is in question. It's a more controlled process, intended to protect the individual's welfare and rights.

An Advance Directive is an umbrella term that includes documents like Living Wills and Healthcare Proxies, making it akin to a Power of Attorney for health care. It specifies what kinds of medical treatment the person wants or doesn't want at the end of their life, ensuring their wishes are honored even if they're unable to communicate. It complements a Healthcare POA by providing detailed guidance on care preferences.

A Financial Power of Attorney specifically grants someone authority to handle financial matters, similar to the broader Power of Attorney but limited to financial actions. This includes managing bank accounts, paying bills, and making investment decisions. It's an essential tool for ensuring that financial affairs are taken care of if the individual becomes unable to manage them personally, tailored to provide peace of mind regarding financial matters.

Dos and Don'ts

When filling out a Power of Attorney (POA) form, certain practices should be followed to ensure the document is correctly executed and legally binding. Here's a list of ten do's and don'ts to consider:

- Do thoroughly review the POA form to ensure you understand all its sections and provisions.

- Do clearly identify the principal (the person granting the power) and the agent (the person receiving the power) with full legal names and addresses.

- Do specify the powers granted with as much detail as possible to avoid any ambiguity or future disputes.

- Do include limitations or conditions on the agent’s powers if any specific restrictions are desired.

- Do check state laws regarding the need for notarization or witnesses to make the POA legally binding.

- Do not sign the POA form without fully understanding every clause and its implications.

- Do not use vague language when defining the scope of the agent’s powers; clarity is key.

- Do not forget to specify the duration of the POA, especially if it's intended for a limited time.

- Do not overlook the importance of having a backup agent listed in case the primary agent is unable to act.

- Do not neglect to keep a copy of the signed and notarized POA form in a secure but accessible place.

By following these guidelines, one can ensure that the Power of Attorney form accurately reflects the principal's wishes and that it is executed in accordance with the law.

Misconceptions

When discussing the Power of Attorney (POA) form, there are several misconceptions that people often hold. Understanding these can help in making informed decisions regarding granting someone else the authority to act on your behalf.

A Power of Attorney grants unlimited control. Many believe that a POA gives the agent carte blanche to do anything with the principal's assets and decisions. In reality, a POA can be as broad or as specific as the principal desires, limiting the agent's authority to particular actions or decisions.

It remains in effect after the principal’s death. A common misconception is that a POA continues to be valid after the principal passes away. However, all powers of attorney terminate upon the principal’s death, at which point the executor of the estate takes over.

A Power of Attorney allows the agent to make health care decisions. This is incorrect unless the POA is specifically a Medical Power of Attorney. A general POA does not grant the agent the right to make health-related decisions; this power must be granted separately.

Only family members can be appointed as agents. While many people choose to appoint a family member as their agent, anyone can be designated, including friends or professionals, as long as the principal trusts them.

The principal loses their ability to make decisions. Granting someone else a POA does not deprive the principal of their right to make decisions. It merely allows the agent to act alongside the principal, or on their behalf if they are unable to do so themselves.

Creating a POA is a complicated and expensive process. In fact, creating a POA can be relatively straightforward and inexpensive. While it’s advisable to consult with a legal professional to ensure that the document meets the principal's needs and complies with state laws, the process doesn't have to be complex or costly.

The same POA document works in every state. POA laws can vary significantly from one state to another. A POA drafted in one state may not necessarily be recognized in another, so it's important to ensure that the document complies with the laws of the state where it will be used.

A Power of Attorney document can be executed at any time, regardless of the principal’s mental state. For a POA to be valid, the principal must be mentally competent at the time of its execution, understanding the implications of the document they are signing.

Key takeaways

Filling out and using a Power of Attorney (POA) form involves several critical steps and considerations. Understanding these key aspects can help ensure that your affairs are handled according to your wishes, should you become unable to make decisions yourself. Here are five key takeaways:

- Understand the Different Types of POA: It's crucial to recognize the various forms of Power of Attorney available. Each type serves different purposes, such as the General Power of Attorney, which grants broad powers, and the Healthcare Power of Attorney, which is specific to medical decisions. Choosing the right type depends on your needs and circumstances.

- Choose Your Agent Wisely: The person you appoint as your agent (or attorney-in-fact) will have significant control over your affairs, so it’s essential to select someone who is trustworthy, competent, and understands your wishes. This person should also be willing and able to carry out the responsibilities you are entrusting to them.

- Be Specific About Powers Granted: When filling out a POA form, be as precise as possible about the powers you are granting. This helps prevent confusion and ensures that your agent has the authority necessary to act in your best interest, without overstepping their bounds.

- The Importance of Legal Requirements: POA forms must adhere to the legal requirements of the state in which they are used. These requirements can include specific language, notarization, or witnesses. Failing to comply with these can invalidate the document, so it's advisable to consult legal advice or review state laws carefully.

- Regularly Update Your POA: Life changes, such as a divorce, the death of the designated agent, or a change in your wishes, necessitate updating your POA. Regular reviews and updates help ensure that the document remains valid and reflects your current intentions.

Other Templates

Free Printable Bill of Sale for Mobile Home - Including a detailed description of the mobile home’s condition in the Bill of Sale can protect the buyer from undisclosed issues.

How to Respond to Cease and Desist Letter - Offers a way for businesses or individuals to respectfully dispute unfounded claims or agree to reasonable demands made in a cease and desist letter.

How to Start a Letter to Immigration - A persuasive narrative that emphasizes the legitimacy and emotional depth of a marital relationship for immigration adjudication.