Fillable Operating Agreement Document for Texas

In the realm of business, the foundation upon which a Limited Liability Company (LLC) is built can significantly impact its sustainability and adaptability to the unforeseeable dynamics of the marketplace. Among the myriad documents that fortify such a foundation, the Texas Operating Agreement stands out as a quintessential blueprint for structuring the operations, management, and overall legal contours of an LLC. This document, while not mandated by the state law for LLCs to function, plays a pivotal role in delineating the rights, responsibilities, and profit distribution among its members, thereby preempting potential conflicts and ensuring a coherent operation. It serves not just as a legal formality but as a strategic tool that enables the entity to navigate through the complexities of legal compliance, taxation, and partnership dynamics in Texas. Moreover, the Texas Operating Agreement allows for the customization of provisions according to the unique needs and visions of the business, making it a versatile instrument in the hands of LLC members. Acknowledging its importance is the first step towards leveraging its benefits for the firm’s long-term prosperity and stability.

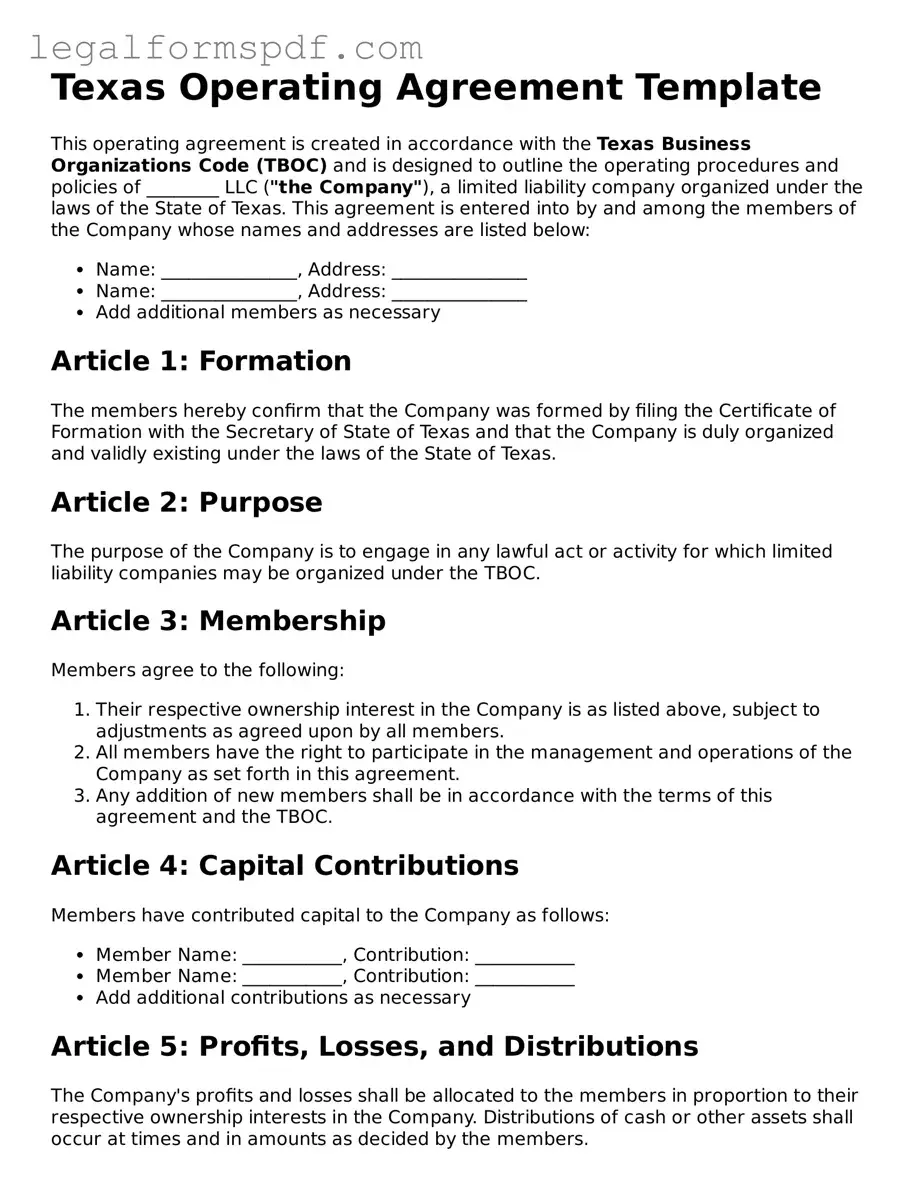

Document Example

Texas Operating Agreement Template

This operating agreement is created in accordance with the Texas Business Organizations Code (TBOC) and is designed to outline the operating procedures and policies of ________ LLC ("the Company"), a limited liability company organized under the laws of the State of Texas. This agreement is entered into by and among the members of the Company whose names and addresses are listed below:

- Name: _______________, Address: _______________

- Name: _______________, Address: _______________

- Add additional members as necessary

Article 1: Formation

The members hereby confirm that the Company was formed by filing the Certificate of Formation with the Secretary of State of Texas and that the Company is duly organized and validly existing under the laws of the State of Texas.

Article 2: Purpose

The purpose of the Company is to engage in any lawful act or activity for which limited liability companies may be organized under the TBOC.

Article 3: Membership

Members agree to the following:

- Their respective ownership interest in the Company is as listed above, subject to adjustments as agreed upon by all members.

- All members have the right to participate in the management and operations of the Company as set forth in this agreement.

- Any addition of new members shall be in accordance with the terms of this agreement and the TBOC.

Article 4: Capital Contributions

Members have contributed capital to the Company as follows:

- Member Name: ___________, Contribution: ___________

- Member Name: ___________, Contribution: ___________

- Add additional contributions as necessary

Article 5: Profits, Losses, and Distributions

The Company's profits and losses shall be allocated to the members in proportion to their respective ownership interests in the Company. Distributions of cash or other assets shall occur at times and in amounts as decided by the members.

Article 6: Management

The Company shall be managed by its members. Decisions shall be made by a vote of the majority of members, each member having one vote unless otherwise agreed upon. Specific duties and responsibilities may be assigned to certain members or to a manager, if appointed.

Article 7: Duration

The Company shall continue until dissolved in accordance with this agreement and the laws of the State of Texas.

Article 8: Amendments

This agreement may be amended only by a written agreement signed by all members.

This operating agreement is effective as of _______________ (Date).

In witness whereof, the members have executed this operating agreement as of the latest date written below:

- Name: _______________, Date: _______________

- Name: _______________, Date: _______________

- Add additional member signatures as necessary

PDF Specifications

| Fact Number | Fact Details |

|---|---|

| 1 | An Operating Agreement is used by LLCs in Texas to outline the company's financial and functional decisions including rules, regulations, and provisions. |

| 2 | The agreement is critical for governing the internal operations of the LLC in a way that suits the specific needs of its members. |

| 3 | Although not legally required in Texas, creating an Operating Agreement is highly recommended for LLCs of any size. |

| 4 | This document helps protect the LLC members' personal assets from the company's debts and liabilities. |

| 5 | Without an Operating Agreement, the LLC would be governed by default state laws, which may not be favorable to all LLC operations. |

| 6 | The Texas Business Organizations Code is the governing law for Operating Agreements in Texas, despite the absence of a requirement to have one. |

| 7 | It can be amended or revised as needed when the LLC's management structure or membership changes. |

| 8 | Operating Agreements in Texas can be written, oral, or implied based on the company's practices, although written agreements provide clear documentation. |

Instructions on Writing Texas Operating Agreement

Once you've decided to form an LLC in Texas, crafting an Operating Agreement is a crucial next step. This document outlines the owners' rights, duties, and the operational framework of the business. Although the state of Texas does not require LLCs to have an Operating Agreement, having one in place can provide clarity and protection for the members of the LLC. Below are the steps to fill out the Texas Operating Agreement form properly.

- Begin with the name of the LLC as officially registered with the Texas Secretary of State. Ensure the name matches the registration documents exactly.

- Specify the effective date of the agreement. This can be the date the LLC was formed or another date on which the agreement will start being effective.

- List the names and addresses of all members of the LLC. Include each member's contribution to the LLC, whether it's monetary, services, property, or a combination thereof.

- Define the management structure of the LLC. Indicate whether it is member-managed or manager-managed, and detail the roles and responsibilities of the managers or managing members.

- Detail the allocation of profits and losses. This should match the members’ contributions or as agreed upon in the agreement.

- Explain the voting rights of members. Typically, voting power is proportional to ownership percentages, but your agreement can specify different terms.

- Include provisions for meetings, including how they are called, how often they occur, and the quorum requirements for decision-making.

- Outline the process for admitting new members, including any approval requirements from existing members.

- Specify the procedure for members to exit or withdraw from the LLC, including buyout terms or transfer of ownership interest.

- Detail the dissolution process of the LLC. Specify the conditions under which the LLC can be dissolved and the steps for winding up its affairs.

- Signatures: Ensure that all members of the LLC sign and date the Operating Agreement. Include space for printed names and titles if applicable.

After completing these steps, each member should receive a copy of the Operating Agreement. It's advisable to store the original in a secure location with other important business documents. Remember, the Operating Agreement is a flexible document that can be updated as your business evolves. Always consult with a legal advisor to ensure that your Operating Agreement meets all your business needs and complies with Texas law.

Understanding Texas Operating Agreement

What is an Operating Agreement and why is it important for a Texas LLC?

An Operating Agreement is a crucial document for Limited Liability Companies (LLCs) in Texas, as it outlines the ownership and membership duties, responsibilities, rights, and the operating procedures of the business. Although Texas law does not mandate LLCs to have an Operating Agreement, having one in place is highly recommended. It provides clarity and structure, helps to protect the business owners' personal assets from the company's liabilities, and ensures that the business runs according to the owners' specific instructions rather than default state laws.

Does Texas require LLCs to have an Operating Agreement?

No, the state of Texas does not require LLCs to file an Operating Agreement with the Secretary of State or any other state agency. However, it is considered a best practice to create and maintain one to govern the internal operations of the LLC more effectively. This document is primarily for the benefit of the LLC members themselves.

What are the key elements that should be included in a Texas Operating Agreement?

A comprehensive Texas Operating Agreement should ideally include the following elements: the LLC's name and primary place of business, member ownership percentages, capital contributions of each member, management structure and voting rights, rules for meetings and decision-making processes, procedures for admitting new members, terms and conditions for the transfer of membership interests, and policies regarding dissolution and winding up of the business.

Can a single-member LLC have an Operating Agreement in Texas?

Yes, a single-member LLC in Texas can—and should—have an Operating Agreement. Even though there is only one member, this document is vital as it reinforces the separation between the owner's personal and business assets, potentially safeguarding the owner's personal assets from business-related liabilities. Additionally, it can help establish the business's credibility with financial institutions and other parties.

How does an Operating Agreement protect members of a Texas LLC?

An Operating Agreement protects members of a Texas LLC by clearly defining each member’s financial and managerial rights and responsibilities, thus minimizing disputes among members. It offers protection against misunderstandings by setting forth how decisions are made, profits and losses are shared, and what happens if a member wants to leave, sell, or transfer their interest in the company. Additionally, it reinforces the LLC's limited liability status, helping to ensure that members are not personally liable for the business's debts and liabilities.

Do all members need to sign the Operating Agreement in Texas?

While Texas law does not explicitly require all members of an LLC to sign the Operating Agreement, it is strongly advised that all members do so. Having all members sign the agreement underscores the consent and commitment of every member to abide by its terms and provisions. This can be pivotal in the event of disputes or legal challenges, serving as a binding contract among members.

How can an Operating Agreement be modified?

The Operating Agreement itself should lay out the procedures for making amendments. Typically, modifications require a certain percentage of member approval, as specified in the agreement. It's important for any changes to be documented in writing and signed by all members who agree to the modifications, ensuring that the updated agreement accurately reflects the current understanding and agreement of the members.

Where should the Operating Agreement be kept?

While the Operating Agreement does not need to be filed with any state agency in Texas, it is important to keep it in a safe and accessible place. This document should be kept at the principal place of business along with other important business records. Each member should have a copy, ensuring that they can refer to it as needed to guide the business's operation and resolve any disputes or questions that may arise.

Common mistakes

Filling out an operating agreement for a business in Texas is a critical step that requires attention to detail and a thorough understanding of what the document entails. A common mistake occurs when people do not specify the roles and responsibilities of each member clearly. Members often assume informal roles or operate based on verbal agreements, which can lead to confusion and disputes down the line. It's essential to outline each member's duties, voting rights, and profit-sharing details right from the start. Without this clarity, the business can face operational hiccups and internal conflicts that could have been easily avoided.

Another frequently observed error is neglecting to plan for the future. Many people focus on the present state of the business when drafting the operating agreement, forgetting to include procedures for adding or removing members, or what happens if the business dissolves. This oversight can create significant challenges if the business needs to adapt to changes. It's crucial to consider all possible scenarios and incorporate them into the agreement to ensure the business can navigate future changes smoothly.

Failure to define the decision-making process is yet another pitfall. When the operating agreement does not specify how decisions are made, members may assume equal voting rights, or worse, the process may become dominated by a few. To prevent this, the agreement should detail how decisions are made, including what constitutes a majority and how disputes will be resolved. This foresight can help maintain fairness and democracy within the business's governance.

Many people also make the mistake of omitting details on capital contributions and distributions. It's common for members to contribute different amounts of capital upfront, which should be accurately reflected in the operating agreement. Furthermore, the agreement should clearly state how profits will be distributed among members. Failing to outline these financial arrangements can lead to misunderstandings and resentment among members, potentially destabilizing the business.

Last but not least, overlooking the requirement to regularly update the operating agreement is a mistake that can render it obsolete. As businesses grow and evolve, their operating agreements need to reflect these changes. Members might come and go, roles may change, and financial arrangements could be adjusted. Regularly reviewing and updating the operating agreement ensures that it remains relevant and effective in guiding the business's operations and resolving any disputes that may arise.

Documents used along the form

When setting up a business in Texas, particularly a limited liability company (LLC), the Operating Agreement is a fundamental document that outlines the operational and financial decision-making protocols. It is a crucial step in structuring your business for success and clarity among members. However, this agreement does not stand alone. Several other forms and documents are often used alongside the Texas Operating Agreement to ensure thorough legal and operational coverage. These documents complement the Operating Agreement, each serving a specific purpose that contributes to the company's comprehensive legal framework.

- Articles of Organization: This is a required document for forming an LLC in Texas. It officially registers the company with the state, detailing essential information like the business name, address, and the names of its members.

- Employer Identification Number (EIN) Application: An EIN, issued by the IRS, is necessary for tax administration for most LLCs. This number is used for opening business bank accounts, filing tax returns, and handling employee payroll.

- Membership Certificates: These are formal documents that certify an individual's ownership interest in the LLC. They serve as a physical representation of each member's investment in the company.

- Operating Agreement Amendments: Over time, changes to the initial Operating Agreement may be necessary. These amendments formally document any updates to the company's operational or organizational structure agreed upon by its members.

- Minutes of Meeting: Records of meetings held by the LLC members or managers should be kept as part of the company's internal documentation. These minutes detail decisions made and actions agreed upon during these gatherings.

- Annual Report: Many states require LLCs to submit an annual report, summarizing significant business activities and changes throughout the year. While Texas does not mandate this, it's still considered best practice for maintaining organized records.

- Buy-Sell Agreement: This agreement outlines what happens if a member decides to sell their interest, passes away, or becomes incapacitated. It helps ensure the smooth transition of membership interest under various circumstances.

The integration of these documents with the Texas Operating Agreement forms a robust foundation for any LLC. They not only fulfill legal requirements but also establish clear protocols for the business's internal and external functions. Together, they provide a comprehensive framework that safeguards the business and its members, facilitating smoother operations and contributing to the overall sustainability and growth of the company.

Similar forms

The Bylaws of a Corporation serve a similar function to the Texas Operating Agreement form, albeit for corporations rather than limited liability companies (LLCs). Both sets of documents outline the governance structure and operational protocols of the entity. Whereas Operating Agreements govern LLCs by detailing member roles, contributions, and distributions, Bylaws serve a parallel purpose for corporations by setting out the roles of directors and officers, meeting procedures, and other essential corporate governance matters.

Partnership Agreements align closely with the Texas Operating Agreement in structure and intent, governing the operations of partnerships. Like Operating Agreements, Partnership Agreements outline the members' (partners') responsibilities, profit and loss distribution, and rules for adding or removing partners. Both documents are crucial for defining the internal management framework of the respective business entities, ensuring clear directives for managing disputes and decision-making processes.

Shareholder Agreements bear similarities to Operating Agreements as they both establish the rules among the owners of a business entity. For corporations, Shareholder Agreements delineate shareholders' rights, responsibilities, and procedural rules, echoing the way Operating Agreements set forth the operational guidance for LLC members. These agreements are vital in managing expectations and providing a blueprint for conflict resolution and decision-making strategies within their respective entities.

Employment Agreements, though more individualistic in nature, share common ground with the Texas Operating Agreement by specifying terms of employment that protect both the employee and the employer. Operating Agreements, in contrast, cover the broader operational functions of an LLC, including roles that members may take on, which could encompass managerial or employment-type roles within the company. Both types of agreements are pivotal in clarifying duties, compensation, and procedures for termination.

Non-Disclosure Agreements (NDAs) and Operating Agreements both contain confidentiality provisions, although their applications differ. NDAs specifically restrict the sharing of proprietary information to protect a company’s confidential data, while Operating Agreements may include clauses that address the confidentiality of the company’s internal operations and member information. In both instances, the aim is to safeguard the entity’s secrets and internal workings from being disclosed to unauthorized parties.

The Buy-Sell Agreement is another document akin to the Texas Operating Agreement, with a focus on the continuity and succession planning of a business. While Operating Agreements may define the procedure for transferring ownership shares within an LLC, Buy-Sell Agreements explicitly outline how a partner's share of a business may be bought out or sold, particularly in events like death, disability, or retirement. These agreements are essential for ensuring a smooth transition during such times.

Commercial Lease Agreements, while primarily real estate focused, encompass considerations similar to those found in an Operating Agreement, such as the allocation of responsibilities and defining the terms of engagement between parties. In a Commercial Lease, the terms and conditions of using a property for business purposes are outlined, analogous to how an Operating Agreement sets the framework for the operation and management of the LLC itself.

Lastly, Member-Managed vs. Manager-Managed LLC Documents diverge in management structure but are conceptually related to Operating Agreements. These documents specify whether an LLC is managed directly by its members or by designated managers. The choice affects how decisions are made within the company and mirrors the Operating Agreement's role in delineating governance structures and operational protocols. Through defining this structure, both document types contribute significantly to the clarity and functionality of the business’s management system.

Dos and Don'ts

When filling out the Texas Operating Agreement form for your Limited Liability Company (LLC), it's crucial to approach this document with a detailed eye and a clear understanding of your business structure, member roles, and financial processes. The Operating Agreement serves as a foundational document that outlines the operations of the LLC, member duties, and financial and management decisions. Here are eight essential do's and don'ts to keep in mind:

- Do review the default rules set forth by the state of Texas. Understanding these rules allows you to make informed decisions on whether your Operating Agreement should override any default provisions that might not be in the best interest of your LLC.

- Do ensure that all members of the LLC review and agree on the contents of the Operating Agreement. It’s crucial for maintaining a transparent and democratic process within your business structure.

- Do clearly define each member's capital contributions, ownership percentages, profit and loss distributions, and roles and responsibilities. This clarity prevents disputes and misunderstandings among members.

- Do provide procedures for adding or removing members, as well as any buyout options. Businesses evolve, and your Operating Agreement should be flexible enough to accommodate these changes.

- Don’t overlook the importance of having a detailed dispute resolution clause. Addressing how disputes among members will be managed ahead of time can save your LLC from future legal complications.

- Don’t forget to include a dissolution process. Though it may seem pessimistic to plan for the end of your business, having a clear protocol in place is essential for a smooth transition or closure.

- Don’t use vague language. Ambiguities in your Operating Agreement can lead to varying interpretations, which may result in internal conflicts and legal challenges down the road.

- Don’t file your Operating Agreement with the Texas Secretary of State. While it's a critical internal document, it’s not required to be filed with state agencies. However, keeping it updated and on file with your company records is crucial.

Treating the creation and maintenance of your Texas Operating Agreement with the seriousness it deserves sets a strong foundation for your LLC. By adhering to these guidelines, you ensure your business is well-prepared to handle the intricacies of operations, member relations, and growth over time.

Misconceptions

When it comes to the Texas Operating Agreement form, a number of misconceptions can lead business owners astray. Understanding these misconceptions is crucial for anyone who's looking to establish or manage a Limited Liability Company (LLC) in Texas. Let's clear up some of the most common misunderstandings.

- It's mandatory by law to have one. Unlike some states that require LLCs to have an Operating Agreement, Texas doesn't legally enforce the creation of these documents. However, having an Operating Agreement is highly advisable as it clarifies the business structure, financial arrangements, and operational guidelines, protecting against misunderstandings among members.

- There's a standard form provided by the state. This is a common misconception. Texas doesn't provide a "one-size-fits-all" Operating Agreement form for LLCs. Each business should draft its own agreement that caters to its unique needs, operations, and ownership structure. Templates can serve as a starting point, but customization is key.

- Only multi-member LLCs need an Operating Agreement. Even if you're starting a single-member LLC, having an Operating Agreement is beneficial. It adds credibility to your business, may be required by lenders or banks, and helps establish your company as a separate legal entity for legal and financial purposes.

- The details of the agreement don't need to be shared with anyone outside the company. While it's true that the Operating Agreement is an internal document and there's no requirement to file it with the state, certain situations might necessitate sharing it. For instance, banks might request to see your Operating Agreement when you apply for a business loan, or potential investors may want to review it before making any financial commitments.

- Once created, the Operating Agreement is set in stone. The needs of your business will evolve over time, and your Operating Agreement should be able to accommodate these changes. It can be amended as needed to reflect new agreements among members, changes in the management structure, or adjustments to the profit sharing formula. Ensuring your Operating Agreement is up to date is essential for the smooth operation of your business.

Understanding these misconceptions about the Texas Operating Agreement can help LLC owners and members make informed decisions about how to properly start and manage their business. It's all about ensuring legal protections, operational efficiency, and future flexibility for your LLC.

Key takeaways

When starting a business in Texas, particularly a Limited Liability Company (LLC), the Operating Agreement is a pivotal document that outlines the structure and function of your business. Despite not being legally required in Texas, creating one is highly advisable for the clarity and legal protection it provides. Here are six key takeaways to guide you through filling out and using the Texas Operating Agreement form effectively:

- Customizable Structure: The Operating Agreement offers the flexibility to define the ownership percentages, distribution rules, and operational procedures tailored to the specific needs of your business. This customization helps prevent misunderstandings among members down the line.

- Protects Personal Liability: One of the form's critical functions is to reinforce the LLC's status as a separate legal entity, which can protect members' personal assets from business debts and decisions.

- Decision-Making Clarity: The document should clearly outline the voting rights and responsibilities of each member. It ensures that all members are on the same page regarding how decisions are made, from daily operations to major business changes.

- Conflict Resolution: By setting forth dispute resolution procedures, the Operating Agreement can save time and legal expenses. It provides a roadmap for resolving disagreements, potentially avoiding court intervention.

- Succession Planning: It can specify what happens to a member's interest in the business if they wish to leave, pass away, or become incapacitated. This foresight can ensure the smooth transition of ownership and operations without interrupting the business.

- Validity across States: If your LLC operates in multiple states, the Texas Operating Agreement will generally be recognized, helping to maintain consistent operations and legal protections across state lines. However, it’s essential to also check the specific requirements of each state where you do business.

In conclusion, while the Texas Operating Agreement form may not be mandatory, its benefits for your LLC are significant. It’s a tool that offers legal protection, operational clarity, and flexibility, making it easier to manage and grow your business. Always consider consulting with a legal professional to ensure that your Operating Agreement aligns with the latest laws and best suits your business needs.

More Operating Agreement State Forms

Nys Llc - Provides a framework for resolving disputes among LLC members, protecting the business's continuity.

Operating Agreement Llc Georgia - Helps in defining the mission and long-term goals of the LLC, aligning members towards common objectives.

Does Llc Need Operating Agreement - Includes provisions for the handling of financial losses, outlining the path forward in challenging times to protect the business's future.

Florida Operating Agreement - An Operating Agreement can safeguard the LLC’s limited liability status by clearly separating members from the business.