Official Single-Member Operating Agreement Document

For individuals embarking on the journey of single ownership in a Limited Liability Company (LLC), the Single-Member Operating Agreement stands as a pivotal document. Its importance transcends its function as a mere formal requirement; it's a foundational tool that delineates the structure of the business, outlines the financial and managerial decision-making process, and safeguards the owner's personal assets from business liabilities. This agreement ensures that the owner's vision for the company is clearly articulated, providing a roadmap for its operation and setting the groundwork for potential future growth or transition. Though the company is owned and operated by a single individual, the presence of this agreement adds a layer of professionalism and legitimacy, emphasizes the separation between personal and business assets, and details procedures for resolving disputes, should they arise. In essence, the Single-Member Operating Agreement is not just a document but a critical aspect of a business's foundation, designed to protect and guide the single member through the complexities of business ownership.

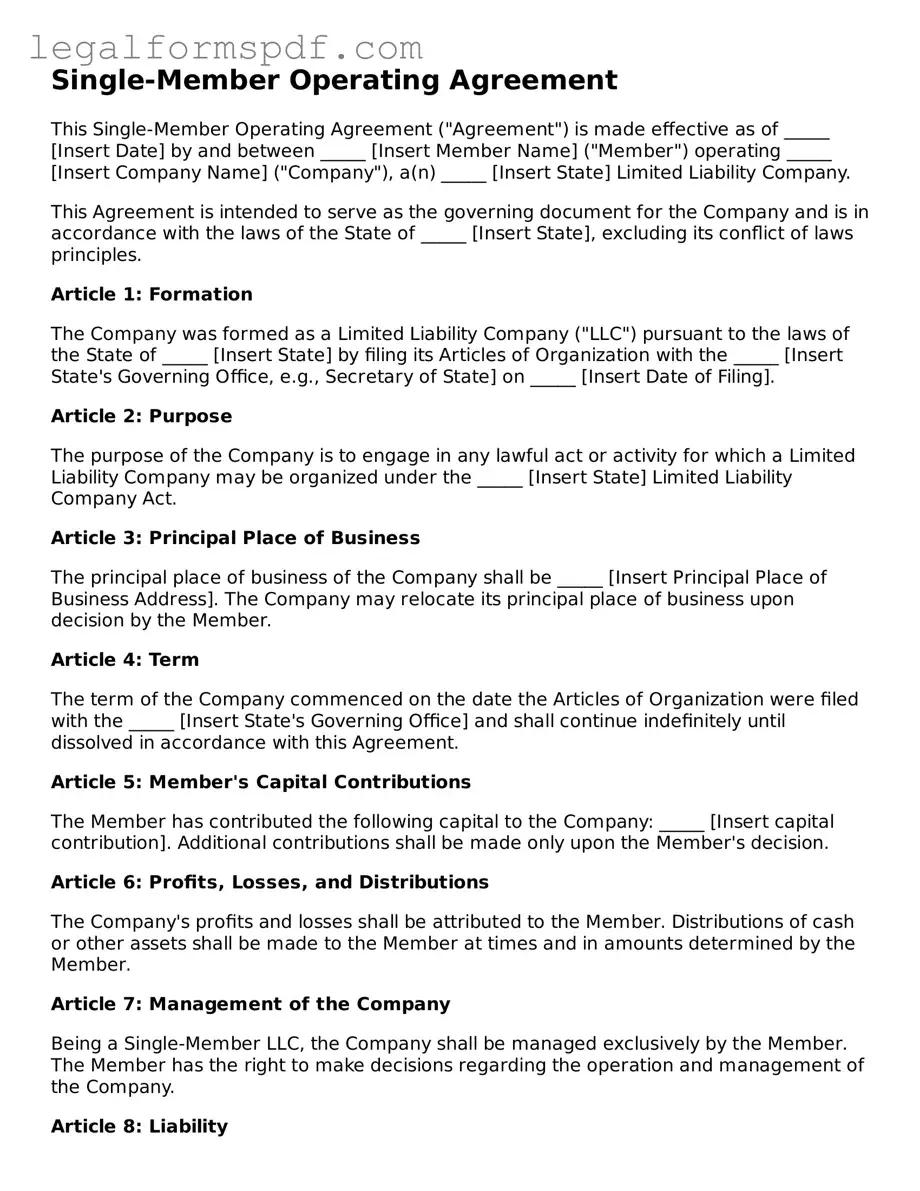

Document Example

Single-Member Operating Agreement

This Single-Member Operating Agreement ("Agreement") is made effective as of _____ [Insert Date] by and between _____ [Insert Member Name] ("Member") operating _____ [Insert Company Name] ("Company"), a(n) _____ [Insert State] Limited Liability Company.

This Agreement is intended to serve as the governing document for the Company and is in accordance with the laws of the State of _____ [Insert State], excluding its conflict of laws principles.

Article 1: FormationThe Company was formed as a Limited Liability Company ("LLC") pursuant to the laws of the State of _____ [Insert State] by filing its Articles of Organization with the _____ [Insert State's Governing Office, e.g., Secretary of State] on _____ [Insert Date of Filing].

Article 2: PurposeThe purpose of the Company is to engage in any lawful act or activity for which a Limited Liability Company may be organized under the _____ [Insert State] Limited Liability Company Act.

Article 3: Principal Place of BusinessThe principal place of business of the Company shall be _____ [Insert Principal Place of Business Address]. The Company may relocate its principal place of business upon decision by the Member.

Article 4: TermThe term of the Company commenced on the date the Articles of Organization were filed with the _____ [Insert State's Governing Office] and shall continue indefinitely until dissolved in accordance with this Agreement.

Article 5: Member's Capital ContributionsThe Member has contributed the following capital to the Company: _____ [Insert capital contribution]. Additional contributions shall be made only upon the Member's decision.

Article 6: Profits, Losses, and DistributionsThe Company's profits and losses shall be attributed to the Member. Distributions of cash or other assets shall be made to the Member at times and in amounts determined by the Member.

Article 7: Management of the CompanyBeing a Single-Member LLC, the Company shall be managed exclusively by the Member. The Member has the right to make decisions regarding the operation and management of the Company.

Article 8: LiabilityThe Member shall not be personally liable for the debts, obligations, or liabilities of the Company, except as provided by law.

Article 9: Books, Records, and AccountingThe Company shall maintain complete and accurate books and records of its business and operations in accordance with standard accounting practices. The Member shall have access to these books and records at reasonable times.

Article 10: AmendmentsThis Agreement can only be amended in writing by the Member. Any changes to this Agreement must be documented and signed by the Member.

Article 11: DissolutionThe Company may be dissolved at any time by the Member. Following dissolution, the Company shall cease its operations except as necessary to wind up its business, including the payment of debts and distribution of any remaining assets to the Member.

SignaturesThis Agreement has been executed on the date first above written:

Member: _________________________________________

Date: ___________________________________________

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Single-Member Operating Agreement is a document used by the sole owner of an LLC to establish the rules and structure of the business. |

| Purpose | This document helps to ensure that the business is properly structured and operates smoothly, providing a clear guide for how the business should be run. |

| Legal Protection | It provides legal protection by separating the business's activities from the owner's personal assets, reducing personal liability. |

| Financial Clarity | The agreement outlines how profits and losses will be handled, contributing to financial transparency and accountability. |

| State-Specific Requirements | While not always legally required, some states have specific requirements or provisions that must be included in the agreement. |

| Customization | It is adaptable to the needs of the business, allowing the owner to specify operational procedures, management styles, and other important aspects. |

| Governing Law | It is governed by state law, and thus, the terms and enforceability may vary significantly from state to state. |

Instructions on Writing Single-Member Operating Agreement

Once you've decided to start a single-member LLC, completing an Operating Agreement is a crucial next step. Although not always required by law, this document outlines the structure and operations of your business, protecting your business's limited liability status. It serves as an official guide to how the business will run and how certain situations will be handled. While it may seem daunting, filling out a Single-Member Operating Agreement can be straightforward if you follow these steps diligently.

- Start by entering the date the agreement is being executed at the top of the document.

- Next, fill in the full legal name of the single-member LLC as registered with your state.

- Insert the name of the state where your LLC is formed. This information establishes the legal jurisdiction of the agreement.

- Provide the principal place of business address. This should include the street address, city, state, and ZIP code where your LLC operates.

- Indicate your LLC's effective date, which can be the date of filing with the state or another specified date when the agreement and LLC will officially be in effect.

- Fill in your name as the sole member and operator of the LLC, ensuring to include any managing titles if applicable.

- Add specifics about contributions to the LLC. Even though you're the sole member, detailing contributions (cash, property, services) provides clear records for the business's assets.

- Describe the distribution of profits and losses. As a single member, this typically defaults to you, but outlining it adds formality and clarity to the agreement.

- Outline the powers and duties of the member. This section defines your role and responsibilities within the LLC.

- Specify the limitation of liability for actions taken on behalf of the LLC. This is an essential aspect of maintaining your limited liability status.

- Decide on a succession plan. Although you're a single-member LLC, having a plan for what happens to the company upon your incapacity or death is critical.

- Conclude with any other provisions specific to your business or state requirements not already covered.

- Sign and date the document. While not always legally required, having your signature notarized can add an extra layer of validity.

- If applicable, have a witness sign and date the agreement, depending on your state's requirements or personal preference for document validation.

After completing these steps, you will have a solid framework for the governance of your single-member LLC. It’s wise to keep this document in a safe place, like with your other essential business records, and review it annually or when significant changes occur in your business. Remember, this is your LLC's, so periodic updates may be necessary to reflect your evolving business structure or operations.

Understanding Single-Member Operating Agreement

What is a Single-Member Operating Agreement?

A Single-Member Operating Agreement is a legal document used by the sole owner of a Limited Liability Company (LLC) to establish the rules and structure of their business. This agreement outlines the financial and managerial rights and responsibilities of the sole member, helping to ensure that both legal and financial aspects of the business are clear and protected.

Why do I need a Single-Member Operating Agreement for my LLC?

Having a Single-Member Operating Agreement in place adds a layer of legitimacy and protection to your business. It helps to separate your personal liabilities from those of your business, which is crucial for protecting personal assets. Additionally, some banks and financial institutions require this document to open a business account, and it may be required by state law in some areas.

What should be included in a Single-Member Operating Agreement?

This document should detail the ownership structure, operating procedures, and financial management strategies of the LLC. It should include the LLC’s name and address, the nature of the business, the name and address of the sole member, how profits and losses are distributed, rules for changes to the agreement, and how the LLC will be dissolved if necessary.

Is a Single-Member Operating Agreement legally required?

While not all states require a Single-Member Operating Agreement, it is highly recommended to have one. Some states do mandate it, and having the agreement can help in other legal or financial processes. It's always a good idea to check the specific requirements of your state.

Can I write a Single-Member Operating Agreement by myself?

Yes, you can draft a Single-Member Operating Agreement on your own. However, it's advisable to follow a template or guide to ensure that all pertinent information is included. For peace of mind and accuracy, consulting with a legal expert can also be a wise decision.

How is a Single-Member LLC different from other LLCs?

The primary difference lies in ownership. A Single-Member LLC is owned and operated by one individual or entity, providing simplicity in decision-making and operations. Conversely, multi-member LLCs have multiple owners, requiring more complex agreements to manage relations and operations among members.

Can a Single-Member Operating Agreement be amended?

Absolutely. As your business evolves, it may become necessary to update your Single-Member Operating Agreement. It’s important to outline a process for amendments within the agreement itself, ensuring that changes are done methodically and are legally binding.

Do I need a lawyer to create a Single-Member Operating Agreement?

While it’s not mandatory to hire a lawyer to create a Single-Member Operating Agreement, consulting with one can ensure that all legal bases are covered, particularly in regard to state-specific requirements and protections. A legal professional can provide tailored advice and peace of mind that the document is in order.

How does a Single-Member Operating Agreement protect my business?

This agreement establishes the structure and operations of your LLC, differentiating the business and personal aspects of your finances and liabilities. It reinforces the legitimacy of your LLC, aids in financial and legal situations (like banking or disputes), and provides a clear guide for running your business. Essentially, it serves as a critical tool for both legal protection and operational clarity.

Common mistakes

When filling out a Single-Member Operating Agreement, there are common mistakes that can significantly impact the effectiveness of the document and the protection it provides. One such mistake is not fully personalizing the agreement. Many individuals default to using a template without adjusting the provisions to reflect the specific nature of their business. This oversight can lead to irrelevant or missing terms that do not fully encapsulate the owner's intentions or the business's unique needs.

Another common error is neglecting to thoroughly define the financial and management aspects. Often, there is a presumption that being the sole member eliminates the need for detailed financial provisions or management processes. However, clearly outlining how profits, losses, and draws are handled, as well as the decision-making process, provides guidance for future actions and assists in maintaining personal liability protection.

Failing to update the agreement over time is also a significant misstep. As businesses evolve, so too should their operating agreements. What was relevant at the inception might not be applicable after a few years of operation. Regularly revisiting and updating the agreement ensures that it remains current and aligned with both the state’s legal requirements and the business’s operations.

Lastly, overlooking the importance of the agreement in establishing the business’s legal structure can be detrimental. Some individuals may view crafting an operating agreement as a mere formality, especially in a single-member LLC where there's no risk of dispute with other members. However, this document serves as a key piece of evidence in illustrating the separation between the owner's personal and business assets, thereby reinforcing the liability protection that LLCs are known for. This underestimation can undermine the very foundation the business is built upon.

Documents used along the form

When forming a single-member Limited Liability Company (LLC), the Single-Member Operating Agreement is a crucial document that outlines the specifics of the business's operations and the owner's obligations. Yet, this agreement rarely stands alone in the establishment or operation of a business. A variety of other documents and forms are often required to ensure full legal compliance and operational efficiency. These can range from registrations with government entities to interna agreements that delineate further details about the business's practices and expectations.

- Articles of Organization: This foundational document is typically filed with a state government to legally establish the LLC. It includes vital information such as the business name, address, and the fact that the LLC will have a single member.

- Employer Identification Number (EIN) Application: Issued by the IRS, the EIN is crucial for tax purposes, akin to a Social Security number for the business. It is required for opening business bank accounts and filing federal taxes.

- Operating Agreement Amendment(s): Should any details of the Single-Member Operating Agreement change, amendments are essential to document these changes officially, keeping the agreement current with the operation of the business.

- Annual Report: Many states require LLCs to file an annual report, which updates the state on the company’s activities and any changes in address or management.

- Business Licenses and Permits: Depending on the nature of the business and its location, various local, state, and federal licenses and permits may be needed to operate legally.

- Bank Resolution: This document authorizes the opening of a business bank account in the name of the LLC and designates who has the authority to operate the account, vital for financial transparency and integrity.

Each of these documents plays a critical role in the formation, legal compliance, and smooth operation of a single-member LLC. Along with the Single-Member Operating Agreement, these forms ensure that the business meets all legal obligations and is set up for success from the start. Preparing and maintaining these documents carefully can protect the business owner's interests and facilitate the company's growth and development.

Similar forms

The Single-Member Operating Agreement shares similarities with a Sole Proprietorship Declaration, as both documents establish the structure and operations of a business owned by one person. They clarify the ownership, delineate operational procedures, and set forth guidelines for financial management. While the operating agreement is tailored for a single-member LLC, the declaration serves a sole proprietorship but both aim to formalize the business's operations and protect the owner's personal assets from business liabilities.

A Partnership Agreement is another document that mirrors the Single-Member Operating Agreement, albeit designed for businesses with two or more owners. It outlines the responsibilities, profit-sharing, and operational rules among partners. Despite the difference in the number of stakeholders, both agreements serve as foundational documents that guide the business's internal management, decision-making processes, and conflict resolution procedures.

Similar to a Single-Member Operating Agreement, a Shareholder Agreement for a corporation structures the relationship between the shareholders and manages how the business is run. Although it pertains to a corporation with potentially many shareholders compared to a single-member LLC, both documents specify operational controls, outline financial arrangements, and detail the mechanisms for dispute resolution among the invested parties.

An Employment Contract, while primarily focused on the terms between an employer and an employee, shares common ground with a Single-Member Operating Agreement by emphasizing roles and responsibilities. Both documents delineate obligations, performance expectations, and remuneration details. However, an employment contract is between an employer and an employee, whereas the operating agreement establishes the owner's relationship with their business.

The Bylaws of a Corporation, much like a Single-Member Operating Agreement, set forth the rules and guidelines for the company's internal operations. Bylaws focus on the structure of the corporation, officer roles, and board of directors' responsibilities, parallel to how an operating agreement organizes the LLC's operational and financial decision-making processes. Both are essential for clarity and efficiency within their respective business frameworks.

A Business Plan, although not a legal document, shares a kind of kinship with the Single-Member Operating Agreement because it lays out the strategic direction and goals of the business. Both documents are used to steer the business towards its objectives, with the operating agreement focusing more on the legal structure and daily operations, and the business plan emphasizing long-term goals, marketing strategies, and financial projections.

Non-Disclosure Agreements (NDAs) protect sensitive information, a concern also addressed in Single-Member Operating Agreements when outlining the confidentiality of business operations. While an NDA is specifically designed to safeguard proprietary information between parties, the operating agreement might include clauses that keep business practices, client lists, and other private data confidential within the framework of running the single-member LLC.

Commercial Lease Agreements, detailing the terms under which a business rents a commercial space, share structural similarities with Single-Member Operating Agreements in terms of outlining terms and conditions specific to a business's operation. Both agreements cover details such as payment schedules, responsibilities of each party, and conditions under which the agreement may be altered or terminated, providing a framework for the business’s physical location and its operational governance.

The Independent Contractor Agreement, though focusing on the relationship between a business and a freelance service provider, aligns with a Single-Member Operating Agreement in defining roles, responsibilities, and compensation. Both documents clarify the nature of the relationship, set expectations, and define the scope of work, ensuring that both the individual's and the business’s interests are protected and clearly understood.

Lastly, the Terms of Service Agreement, commonly found on websites and apps, indirectly resembles a Single-Member Operating Agreement by establishing the rules and guidelines users must follow. While targeting the end user rather than the business owner, both documents create a framework of operation that must be adhered to for the successful management and operation of the service, outlining procedures, rights, and responsibilities.

Dos and Don'ts

Filling out a Single-Member Operating Agreement is a crucial step for any individual owning a Limited Liability Company (LLC) alone. This document outlines the structure, operating procedures, and financial decisions of the business. To ensure accuracy and compliance, there are specific do's and don'ts one should follow:

Do:- Review state requirements: Prior to drafting your agreement, it's essential to familiarize yourself with any specific rules or regulations your state may have regarding single-member LLCs. This preparation ensures that your agreement is in full compliance with local law.

- Be detailed in your documentation: Clearly outline all aspects of your business operations, including management structure, member duties, and the process for any potential future changes or dissolution of the LLC. Detailed documentation helps avoid confusion and potential legal disputes.

- Plan for the future: Consider including provisions for evolving scenarios like adding new members, selling the business, or what happens in the event of your incapacity. While it may seem premature, addressing these possibilities upfront can save considerable trouble down the line.

- Seek professional advice: Even if you feel confident in your understanding, consulting with a legal professional to review your operating agreement can offer valuable insights and help catch any oversights or errors before they become problematic.

- Overlook important clauses: Certain clauses, like those covering fiscal decisions, member compensation, and dispute resolution, are vital. Failing to include these can lead to operational issues and legal vulnerabilities.

- Use vague language: Be as clear and specific as possible in your wording. Ambiguities in legal documents can lead to misunderstandings and conflicts, potentially requiring court intervention to resolve.

- Forget to update the document: As your business grows and changes, so too should your operating agreement. Neglecting to update your agreement to reflect current operations can result in discrepancies between practice and policy.

- Assume it’s optional: While not all states require a single-member LLC to have an operating agreement, having one is always in your best interest. It not only provides legal protection but also lends credibility to your business operations.

Misconceptions

A Single-Member Operating Agreement is vital for individuals who own a sole proprietorship and choose to set their business up as a Limited Liability Company (LLC). Despite its importance, there are several misconceptions surrounding this document. Below are eight common misconceptions and the facts that dispel them:

It's not legally required, so it's not necessary. While it's true that not all states require a Single-Member Operating Agreement, having one can protect the sole owner's personal assets from the company's liabilities and ensure that the business is run according to the owner's wishes.

It's too complex for a single owner. Despite the focus on singular ownership, an Operating Agreement helps clarify the financial and operational procedures, ensuring that there’s a formal plan in place for major business decisions.

There's no need to update it. Business needs and personal circumstances change over time. Regularly reviewing and updating the agreement ensures that it always reflects the current state of the business and the owner's goals.

It's only about the financial aspects of the business. While financial matters are a significant component, the agreement also covers roles, responsibilities, and processes for decision-making, dispute resolution, and potential business dissolution.

Templates found online are good enough. Although templates can serve as a starting point, a customized agreement is crucial for addressing the specific needs and structure of the business more effectively.

It prohibits flexibility in managing the business. On the contrary, a well-drafted agreement provides a framework that can offer guidance while still allowing the owner to adjust operations as the business grows and evolves.

It’s similar to the articles of organization. While both documents are important, the articles of organization officially register the business with the state. In contrast, the Operating Agreement outlines how the business is run, detailing internal operations and procedures.

Legal assistance isn't necessary to create one. While a business owner can draft an agreement on their own, consulting with a legal expert can ensure that the document is comprehensive, compliant with current laws, and tailored to the unique aspects of the business.

Key takeaways

Filling out and utilizing a Single-Member Operating Agreement is a pivotal step in formalizing your business operations. An effectively completed form lays down the groundwork for your company's financial and operational processes. Here are seven key takeaways to ensure you get the most out of your Single-Member Operating Agreement form:

- Clarify the business structure: This agreement is your opportunity to clearly define the structure of your business, ensuring that it is recognized as a separate legal entity. This distinction is crucial for protecting your personal assets.

- Detail the operational procedures: Use the agreement to outline the day-to-day operations of your business. This includes decision-making processes, duties, and how profits and losses will be handled.

- Include detailed financial arrangements: Specify the financial arrangements, including capital contributions, distribution of profits, and handling of financial losses. This clarity is essential for maintaining transparent financial records.

- Protect your assets: One of the fundamental reasons for this agreement is to protect your personal assets from your business liabilities. Ensure this is clearly stated to enforce the legal separation.

- Flexibility for future changes: Your business will evolve, and your Single-Member Operating Agreement should accommodate this. Include provisions for amending the agreement, allowing your business to adapt as necessary.

- Understanding legal obligations: This document helps you understand your legal obligations as a business owner, including taxes, compliance with regulations, and reporting requirements. Ensure these aspects are well documented.

- Formality adds credibility: Having a formalized Operating Agreement adds credibility to your business. It demonstrates to banks, investors, and partners that you are serious about your enterprise.

By keeping these takeaways in mind, you’ll ensure that your Single-Member Operating Agreement is a comprehensive and effective tool for managing your business. Remember, this document is more than a formality; it’s an essential component of your business structure that can safeguard your assets and pave the way for future success.

Consider More Types of Single-Member Operating Agreement Forms

Sample Operating Agreement for Two Member Llc - Helps to efficiently manage and allocate business resources, including labor and capital.