Fillable Operating Agreement Document for Pennsylvania

In the bustling state of Pennsylvania, businesses, particularly Limited Liability Companies (LLCs), often navigate through their formation and operation stages with various legal documents, among which the Operating Agreement stands out due to its significance. This crucial document, though not mandated by state law, plays a vital role in outlining the ownership, operating procedures, and financial and functional decisions of an LLC. It acts as a foundational blueprint that guides not only the company's current operations but its future direction as well. Furthermore, the Operating Agreement offers a layer of protection for the LLC members, reinforcing the legal distinction between the individual members and the entity itself, which is essential for safeguarding personal assets. Beyond its protective role, the Operating Agreement is instrumental in preempting potential conflicts by establishing clear protocols for dispute resolution, roles and responsibilities, and procedures for amending the document itself. The flexibility embodied in the Operating Agreement allows Pennsylvania LLCs to tailor their operations and governance to the unique needs of their business, without the constraints of one-size-fits-all regulations, making it an invaluable asset for businesses aiming to thrive in the dynamic market landscape.

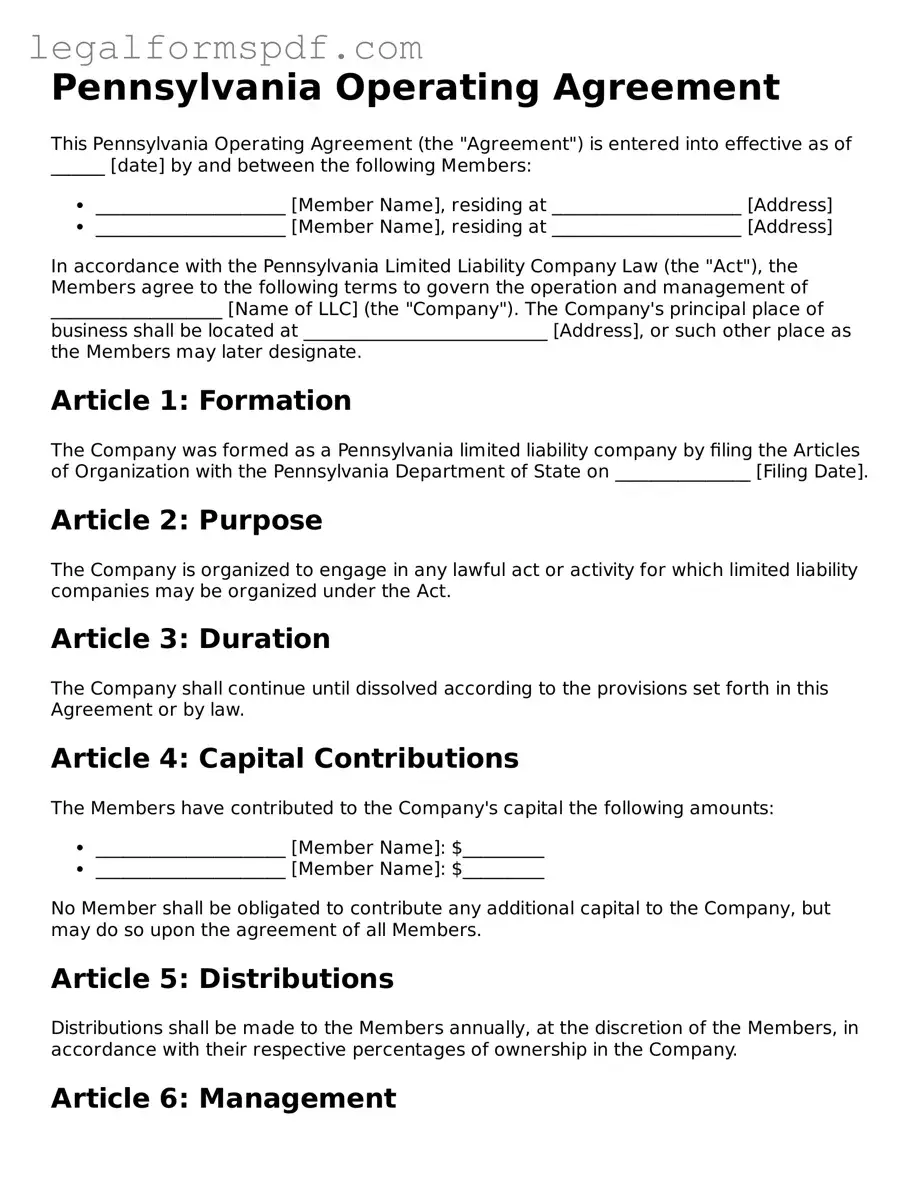

Document Example

Pennsylvania Operating Agreement

This Pennsylvania Operating Agreement (the "Agreement") is entered into effective as of ______ [date] by and between the following Members:

- _____________________ [Member Name], residing at _____________________ [Address]

- _____________________ [Member Name], residing at _____________________ [Address]

In accordance with the Pennsylvania Limited Liability Company Law (the "Act"), the Members agree to the following terms to govern the operation and management of ___________________ [Name of LLC] (the "Company"). The Company's principal place of business shall be located at ___________________________ [Address], or such other place as the Members may later designate.

Article 1: Formation

The Company was formed as a Pennsylvania limited liability company by filing the Articles of Organization with the Pennsylvania Department of State on _______________ [Filing Date].

Article 2: Purpose

The Company is organized to engage in any lawful act or activity for which limited liability companies may be organized under the Act.

Article 3: Duration

The Company shall continue until dissolved according to the provisions set forth in this Agreement or by law.

Article 4: Capital Contributions

The Members have contributed to the Company's capital the following amounts:

- _____________________ [Member Name]: $_________

- _____________________ [Member Name]: $_________

No Member shall be obligated to contribute any additional capital to the Company, but may do so upon the agreement of all Members.

Article 5: Distributions

Distributions shall be made to the Members annually, at the discretion of the Members, in accordance with their respective percentages of ownership in the Company.

Article 6: Management

The Company shall be managed by the Members. Decisions regarding the operation of the Company shall be made by a majority vote of the Members.

Article 7: Membership Changes

Changes to the membership, whether by adding new Members, transferring membership interest, or otherwise, shall be made in accordance with the terms of this Agreement and the Act.

Article 8: Dissolution

The Company may be dissolved by a majority vote of the Members or as otherwise provided by the Act. Upon dissolution, the Company's assets shall be distributed to the Members in accordance with their respective ownership percentages after all debts and liabilities have been paid.

Article 9: Miscellaneous

This Agreement constitutes the entire agreement between the Members concerning the Company's operation and may only be amended by a written document signed by all Members. This Agreement is governed by the laws of the Commonwealth of Pennsylvania.

IN WITNESS WHEREOF, the Members have executed this Pennsylvania Operating Agreement as of the date first above written.

- _____________________ [Member Name] (Signature)

- _____________________ [Member Name] (Signature)

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | Serves as a legal document that outlines the operating procedures and the ownership structure of a Limited Liability Company (LLC) in Pennsylvania. |

| Governing Law | Regulated by the Pennsylvania Uniform Limited Liability Company Act (15 Pa.C.S. §§ 8811-8994). |

| Not Mandatory | While highly recommended, Pennsylvania law does not require LLCs to have an Operating Agreement. |

| Flexibility | Allows LLC members to establish their own rules regarding the internal operations of the company, providing flexibility beyond the state's statutory law. |

| Oral Agreements Valid | In Pennsylvania, an Operating Agreement can be oral or in writing, though written agreements are easier to enforce. |

| LLC Types Applicable | Applies to all types of LLCs in Pennsylvania, including single-member LLCs, multi-member LLCs, professional LLCs, and series LLCs. |

Instructions on Writing Pennsylvania Operating Agreement

Filing an Operating Agreement in Pennsylvania is a crucial step for any LLC, aimed at safeguarding the business structure and clarifying the rules and procedures among members. This agreement outlines the financial and working relationships among business owners (members) and helps in the management of business operations. Although the state of Pennsylvania does not require an LLC to have an operating agreement, drafting one ensures that your business runs smoothly and according to the set preferences of its members. Here's how to fill out the form:

- Determine whether you will draft a single-member or multi-member Operating Agreement. This decision is based on the number of individuals owning the LLC.

- Gather all necessary information about your LLC: This includes the LLC's official name, principal place of business, and the names and addresses of all members.

- Specify the duration of the LLC: If your LLC has a specific end date, include this in the agreement. If not, state that the LLC will exist perpetually.

- Detail the contributions of each member: Clearly outline what each member has contributed to the LLC, including cash, property, or services, and the value of each contribution.

- Outline the allocation of profits and losses: Describe how the LLC's profits and losses will be divided among the members. Typically, this is proportionate to each member’s contribution or ownership percentage.

- Describe the management structure: Indicate whether your LLC will be member-managed or manager-managed and provide details about the voting rights of each member.

- Include rules for holding meetings and taking votes: This includes how often meetings will be held, how members will be notified, quorum requirements, and the voting process.

- Set forth the procedures for adding or removing members: Include the process for any changes in membership, as well as any transferability of membership interests.

- Explain the dissolution process: Detail the steps for dissolving the LLC, including the distribution of assets and liabilities among members.

- Sign and date the agreement: All members must sign the agreement, making it legally binding. Include the date of signing to document when the agreement took effect.

After filling out the form, ensure that all members have a copy of the agreement. This document should be kept with other important business records and reviewed periodically. As your business grows or changes, you may need to update the agreement. Regular reviews and updates will help ensure that the Operating Agreement continues to reflect the needs and structure of your LLC accurately.

Understanding Pennsylvania Operating Agreement

What is an Operating Agreement in Pennsylvania?

An Operating Agreement is a key document used by LLCs in Pennsylvania. It outlines how the business will be run, including the rights, duties, and responsibilities of the members. This document is not mandated by state law in Pennsylvania but is highly recommended as it provides a clear structure for the operation of the business, minimizes misunderstandings among members, and can offer legal protection in certain scenarios.

Do I need to file my Operating Agreement with the state of Pennsylvania?

No, you are not required to file your Operating Agreement with any state agency in Pennsylvania. While the agreement is not submitted to the state, it acts as an internal document that guides the LLC's operations and procedures. It's important to keep it updated and readily available for reference by the members of the LLC.

What should be included in a Pennsylvania Operating Agreement?

A comprehensive Operating Agreement should encompass a variety of provisions that detail the operation and governance of the LLC. These provisions often include the ownership structure, member contributions, profit and loss distribution, management structure, voting rights and procedures, rules for holding meetings, processes for adding or removing members, buyout and buy-sell rules, and dissolution procedures. Tailoring the agreement to fit the specific needs of your LLC is crucial.

Can an Operating Agreement be modified?

Yes, an Operating Agreement can be modified, but the process for doing so should be specified within the agreement itself. Typically, modifications require the consent of a certain percentage of members. Establishing a clear, agreed-upon process for amendments ensures that the document remains relevant and up-to-date with the needs of your LLC.

Is an Operating Agreement necessary for a single-member LLC in Pennsylvania?

While not required by law, having an Operating Agreement even for a single-member LLC is beneficial. It can help in affirming the limited liability status, separating personal and business interests, and detailing the business' operational procedures and expectations. It also serves as a form of protection for the sole owner when dealing with creditors or legal disputes.

How does an Operating Agreement protect the members of an LLC?

An Operating Agreement can protect members by specifying each member’s rights and responsibilities, thus preventing disputes. It can also delineate financial distributions, protecting members from personal liability for business decisions. Legally, it reinforces the separation between members and the business, potentially offering individual members protection against personal liability for the debts and obligations of the LLC.

Do all members need to sign the Operating Agreement?

Yes, ideally, all members of the LLC should sign the Operating Agreement to ensure that everyone agrees to its terms and acknowledges their rights and responsibilities as members of the LLC. Having all members sign the agreement adds a level of formality and binding commitment to the document.

What happens if there is no Operating Agreement in place?

Without an Operating Agreement, your LLC would default to the state’s regulations governing LLCs. These default rules may not be tailored to the specific needs and agreements of your LLC's members, potentially leading to unsatisfactory or unexpected outcomes in the management and distribution of profits of the business. Moreover, without this agreement, resolving disputes or changes in ownership can be significantly more challenging.

Can an Operating Agreement prevent future legal disputes amongst members?

While an Operating Agreement cannot guarantee the prevention of all legal disputes, it significantly reduces the risk by clearly defining procedures, rights, and responsibilities. This clarity can prevent misunderstandings that might otherwise escalate into disputes. Additionally, it can provide mechanisms for resolving conflicts, potentially avoiding litigation.

Common mistakes

When folks set out to fill the Pennsylvania Operating Agreement form for their LLC (Limited Liability Company), several common missteps can trip them up. This document is crucial as it outlines the operation of the LLC, member duties, and financial decisions, among other things. However, filling it out correctly can sometimes be more complicated than it seems. Understanding the most common mistakes can save people a lot of headaches down the line.

One common error is not giving the agreement the attention to detail it requires. An operating agreement is not just any form; it's the backbone of the LLC's internal structure. Often, individuals rush through filling it out or copy templates without customizing them to their specific needs. This oversight can lead to problems, such as unclear roles and responsibilities among members, which might result in operational inefficiencies or disputes.

Another mistake lies in not fully defining the financial arrangements within the LLC. This includes clarity on how profits and losses are distributed among members, as well as the specifics of member contributions. Failing to specify these details can lead to confusion and conflict, especially when the business starts making money or faces financial challenges.

Ignoring the importance of outlining the process for adding or removing members is also a pitfall. Life changes and so too might the makeup of the LLC. Without a clear process in place, outlined in the Operating Agreement, such transitions can become complicated, potentially harming the business.

Many also overlook the need to detail the decision-making process. Who gets to decide what, and how are votes counted? Without clear rules, making even simple decisions can become unnecessarily complex, slowing down operations and affecting the company's agility and responsiveness.

Lastly, people frequently fail to update the Operating Agreement over time. Businesses evolve, and so should their governing documents. Not revising the agreement to reflect changes in the company's structure, operations, or membership can lead to discrepancies between how the business operates and what the document states, potentially leading to legal issues or internal disputes.

Avoiding these mistakes requires a thoughtful approach and perhaps advice from a legal professional. It's much easier to address these issues from the start than to untangle problems after they've emerged. Properly filled and regularly updated, the Pennsylvania Operating Agreement can serve as a strong foundation for a smooth and efficient business operation.

Documents used along the form

In Pennsylvania, company owners often use an Operating Agreement to structure their business operations, outlining roles, responsibilities, and procedures. However, this foundational document is frequently accompanied by other important forms and documents to ensure comprehensive legal and operational coverage. These additional documents can vary based on the specific needs and structure of the business, but typically include the following:

- Articles of Organization: This is a mandatory document for LLCs filed with the Pennsylvania Department of State. It officially registers the business with the state, detailing basic information like the business name, address, and the names of its members.

- Employer Identification Number (EIN) Application: Often used alongside the Operating Agreement, the EIN Application form is necessary for tax purposes. It allows businesses to open bank accounts, hire employees, and comply with IRS requirements.

- Membership Certificates: These certificates are issued to the owners of the LLC, serving as proof of ownership. They include details such as the member’s name and the percentage of the company they own.

- Company Resolution to Open a Bank Account: This document is used by the LLC to authorize the opening of a business bank account. It specifies who within the company has the authority to conduct financial transactions on behalf of the LLC.

- Operating Agreement Amendment: Over time, an LLC might need to make changes to its Operating Agreement due to changes in membership, management structure, or operational procedures. This document formalizes such amendments.

- Buy-Sell Agreement: Also known as a buyout agreement, it outlines what happens if a member wishes to sell their interest, becomes disabled, or dies. It is crucial for ensuring the smooth continuation or dissolution of the business under unforeseen circumstances.

When forming a business, it's important to not only focus on the present but also prepare for future scenarios. Combining an Operating Agreement with these related documents can provide a solid foundation and flexible framework for Pennsylvania LLCs. This comprehensive approach helps safeguard the business's interests, ensures compliance with state requirements, and facilitates smooth operations and transitions.

Similar forms

The Pennsylvania Operating Agreement form shares similarities with the Articles of Incorporation. Both documents formalize the structure and operating procedures of a business entity, but while the Operating Agreement is used by LLCs to outline member roles, responsibilities, and profit distributions, the Articles of Incorporation establish a corporation's existence under state law, detailing the corporation's name, purpose, and the number of shares it is authorized to issue. This distinction is crucial for businesses choosing the right formation document that aligns with their needs.

Similar to a Partnership Agreement, which outlines the terms and conditions between partners in a business, the Pennsylvania Operating Agreement serves a parallel purpose for LLCs. It specifies the business operations and the distribution of profits and losses among members. Both documents are pivotal in preventing disputes by clarifying expectations and responsibilities, thereby ensuring the smooth operation of the business entity, whether it's a partnership or an LLC.

The Bylaws document of a corporation is akin to the Pennsylvania Operating Agreement for LLCs. Bylaws govern the internal management structure of a corporation, outlining rules for meetings, elections of directors, and other corporate activities. Similarly, an Operating Agreement spells out procedures for LLC governance, member meetings, and management decisions, establishing a framework for orderly business operations.

A Buy-Sell Agreement, often prepared for businesses, closely relates to provisions that may be found in a Pennsylvania Operating Agreement. This agreement outlines what happens to a member's share of the business in the event of death, disability, or departure. The Operating Agreement may contain similar clauses, ensuring that the LLC's remaining members have control over the membership interest transfer, thus preserving the continuity and structure of the business.

The Member Control Agreement is another document similar to the Pennsylvania Operating Agreement, specifically in the context of LLCs. While the Operating Agreement covers a broad range of operational and management issues, a Member Control Agreement focuses on the rights and obligations of the members themselves, including voting rights and the allocation of profits and losses. Both documents help to solidify the operational framework and member expectations within an LLC.

An Employment Agreement details the relationship between an employer and an employee, including job responsibilities, compensation, and termination conditions. This document, although more commonly associated with individual employment scenarios, shares common objectives with sections of the Pennsylvania Operating Agreement that may delineate roles, duties, and financial entitlements of LLC members who also work in the business. Thus, both documents are essential for clarifying expectations and protecting the interests of the parties involved.

Last but not least, a Shareholder Agreement, used by corporations, parallels the Pennsylvania Operating Agreement in several aspects. It focuses on the shareholders’ rights, responsibilities, and the operational mechanics of the corporation, similar to how the Operating Agreement structures the operations and member relations within an LLC. Both documents are instrumental in guiding the internal processes and preventing potential conflicts among its members or shareholders.

Dos and Don'ts

When filling out the Pennsylvania Operating Agreement form, parties should be mindful of the do's and don'ts to ensure it's completed accurately and complies with the state's regulations. The following guidelines will help in correctly preparing the agreement:

Do review Pennsylvania's state laws regarding LLCs before drafting the Operating Agreement. This ensures the agreement aligns with local requirements.

Do include detailed information about the roles, rights, and responsibilities of each member. Precise definitions help prevent misunderstandings.

Do specify the distribution of profits and losses. Clear financial arrangements are crucial for smooth business operation.

Do outline the process for adding or removing members to keep the agreement up-to-date with the company's changing structure.

Do have the agreement reviewed by all members before signing. This ensures everyone is aware and agrees to the terms.

Don't leave any sections blank. If a section does not apply, it's recommended to mark it as "Not Applicable" to show it was considered and intentionally left empty.

Don't use ambiguous language. Clear and concise wording prevents potential legal issues or disputes.

Don't forget to update the agreement as the business evolves. Regular updates reflect current operations, member contributions, and ownership structure.

Don't overlook the need for all members to sign the agreement. Without everyone's signature, the document may not be legally binding.

Misconceptions

Operating Agreements are essential for LLCs in Pennsylvania, guiding the internal operations of the entity in a manner that suits the members' needs. However, misconceptions about these agreements can lead to confusion or legal missteps. Below are four common misconceptions about the Pennsylvania Operating Agreement form:

It is required by state law. Contrary to popular belief, Pennsylvania does not legally require LLCs to have an Operating Agreement. However, having one is highly advisable as it ensures clarity on the governance and financial arrangements between members, thereby preventing disputes.

One size fits all. Many assume that an Operating Agreement is a standard document that doesn't need customization. This is incorrect. Each LLC's Operating Agreement should be uniquely tailored to fit its business operations, member structure, and specific needs. A generic form may not adequately cover all aspects of the individual LLC's operations or protect the members' interests effectively.

The same document will work throughout the life of the LLC. An Operating Agreement should evolve with the business. It's a misconception that once drafted, it doesn't need updating. Changes in the law, the LLC's business, or its membership necessitate reviews and possible amendments to the Operating Agreement to ensure it remains relevant and compliant.

Only large or multi-member LLCs need an Operating Agreement. Whether an LLC has one member or many, an Operating Agreement is crucial. For single-member LLCs, it solidifies the separation between the individual's and the business's assets and responsibilities, which is essential for liability protection. For multi-member LLCs, it outlines the decision-making processes and profit-sharing among members, preventing misunderstandings.

Understanding these misconceptions can guide LLC owners in Pennsylvania to better appreciate the importance of a thoughtfully drafted Operating Agreement tailored to their specific business needs.

Key takeaways

The Pennsylvania Operating Agreement form is an essential document for any LLC (Limited Liability Company) operating within the state. This agreement outlines the operational procedures, financial arrangements, and the roles of its members. It serves not only as a guide for the business’s internal functions but also as a legal document that can protect the members’ personal assets from business liabilities. Below are key takeaways to consider when filling out and using this form:

- Customization Is Key: The form should be customized to fit the specific needs and structure of your LLC. Pennsylvania does not provide a one-size-fits-all template, which means the agreement should be tailored to reflect your business's unique operational and financial arrangements.

- Outline Member Roles and Responsibilities: Clearly define the duties, powers, and obligations of each member within the agreement. This clarity helps prevent conflicts and ensures smooth operations.

- Financial Provisions Are Critical: Detail how profits and losses will be allocated, how contributions are made, and the process for distributing earnings. These financial arrangements are essential for maintaining transparency and fairness among members.

- Address Membership Changes: Include provisions for adding or removing members, as well as procedures for members who wish to leave the LLC. Having these policies in place can save a lot of confusion and legal trouble down the line.

- Dispute Resolution: Outline a process for resolving internal disputes. Whether through mediation, arbitration, or another method, having a predefined procedure helps manage conflicts efficiently.

- Operational Details: Spell out the day-to-day operations of the business, including decision-making processes, meeting schedules, and management structure. This ensures that all members are on the same page regarding how the business is run.

- State Compliance: Ensure that your operating agreement complies with Pennsylvania law. While the state offers flexibility, certain legal standards and requirements must be met to uphold the validity of your agreement.

- Review and Update Regularly: The operating agreement should be reviewed annually and updated as necessary to reflect changes in the business structure, membership, or operations. Keeping the document current is crucial for its effectiveness and relevance.

In summary, the Pennsylvania Operating Agreement is more than just a formality; it is a foundational document that guides your LLC's operations and management while offering vital legal protections for its members. Carefully drafting and regularly updating this agreement helps ensure the longevity and success of your business.

More Operating Agreement State Forms

How to Make an Operating Agreement - An Operating Agreement can be tailored to fit the specific needs of an LLC, covering everything from daily operations to long-term business planning.

Llc Operating Agreement Michigan - It may detail the specific contributions of each member, including cash, property, or services.