Fillable Operating Agreement Document for Ohio

In the world of business, especially when navigating the waters of forming a limited liability company (LLC) in Ohio, the importance of a well-crafted Operating Agreement cannot be overstated. This crucial document lays the foundation for how the LLC will be managed, delineates the rights and responsibilities of its members, and provides a clear protocol for handling financial transactions and potential disputes. Although Ohio law does not mandate the filing of this agreement with a state agency, its role in establishing the operational structure and governance of the LLC makes it indispensable for business owners. By outlining everything from the allocation of profits and losses to procedural norms for member meetings and votes, the Operating Agreement ensures that all members are on the same page, thereby preventing misunderstandings and providing a measure of protection against personal liability. In essence, it acts as a roadmap for the LLC, guiding it through the complexities of its operations and helping to secure its success and longevity.

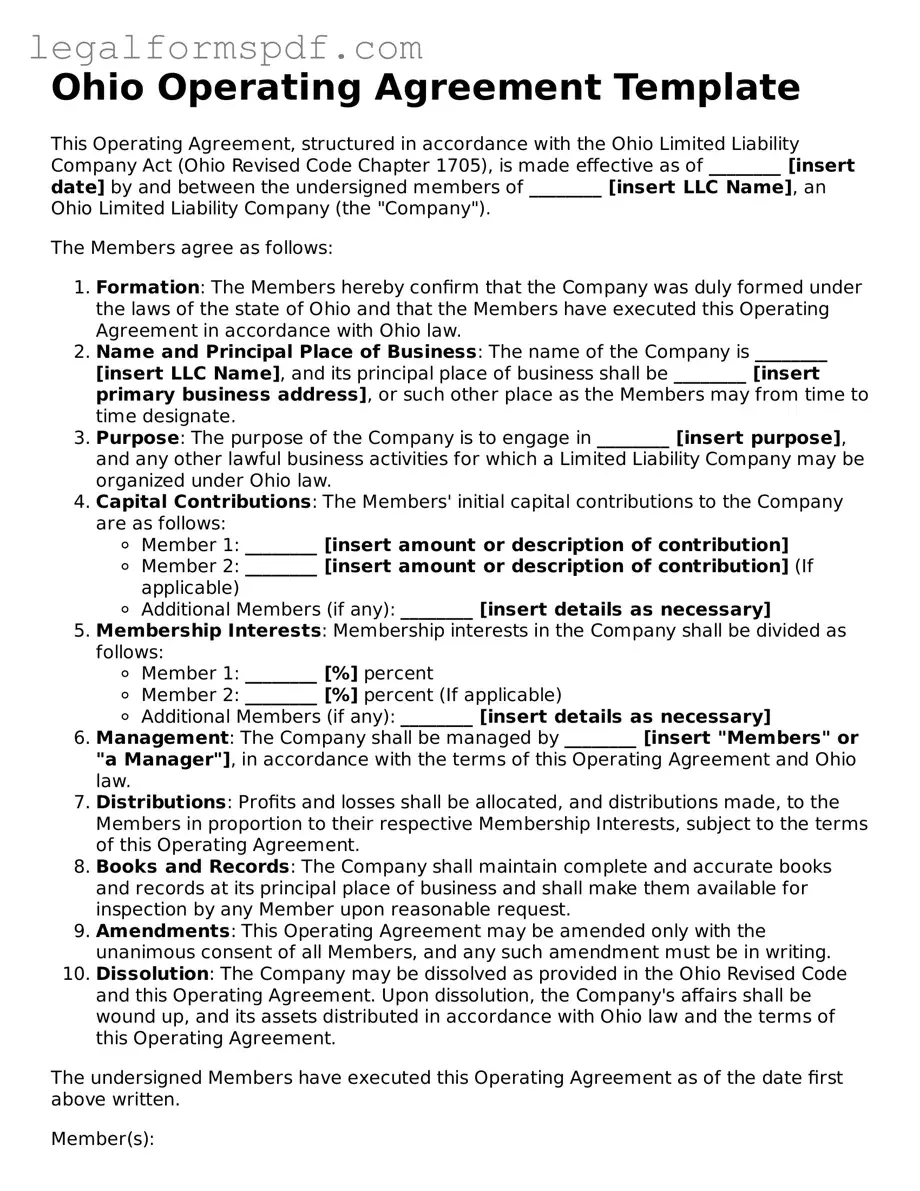

Document Example

Ohio Operating Agreement Template

This Operating Agreement, structured in accordance with the Ohio Limited Liability Company Act (Ohio Revised Code Chapter 1705), is made effective as of ________ [insert date] by and between the undersigned members of ________ [insert LLC Name], an Ohio Limited Liability Company (the "Company").

The Members agree as follows:

- Formation: The Members hereby confirm that the Company was duly formed under the laws of the state of Ohio and that the Members have executed this Operating Agreement in accordance with Ohio law.

- Name and Principal Place of Business: The name of the Company is ________ [insert LLC Name], and its principal place of business shall be ________ [insert primary business address], or such other place as the Members may from time to time designate.

- Purpose: The purpose of the Company is to engage in ________ [insert purpose], and any other lawful business activities for which a Limited Liability Company may be organized under Ohio law.

- Capital Contributions: The Members' initial capital contributions to the Company are as follows:

- Member 1: ________ [insert amount or description of contribution]

- Member 2: ________ [insert amount or description of contribution] (If applicable)

- Additional Members (if any): ________ [insert details as necessary]

- Membership Interests: Membership interests in the Company shall be divided as follows:

- Member 1: ________ [%] percent

- Member 2: ________ [%] percent (If applicable)

- Additional Members (if any): ________ [insert details as necessary]

- Management: The Company shall be managed by ________ [insert "Members" or "a Manager"], in accordance with the terms of this Operating Agreement and Ohio law.

- Distributions: Profits and losses shall be allocated, and distributions made, to the Members in proportion to their respective Membership Interests, subject to the terms of this Operating Agreement.

- Books and Records: The Company shall maintain complete and accurate books and records at its principal place of business and shall make them available for inspection by any Member upon reasonable request.

- Amendments: This Operating Agreement may be amended only with the unanimous consent of all Members, and any such amendment must be in writing.

- Dissolution: The Company may be dissolved as provided in the Ohio Revised Code and this Operating Agreement. Upon dissolution, the Company's affairs shall be wound up, and its assets distributed in accordance with Ohio law and the terms of this Operating Agreement.

The undersigned Members have executed this Operating Agreement as of the date first above written.

Member(s):

_________________________ [insert signature]

________ [insert printed name]

_________________________ [insert signature] (If applicable)

________ [insert printed name] (If applicable)

PDF Specifications

| Fact | Description |

|---|---|

| Definition | An Ohio Operating Agreement is a legal document outlining the ownership and operating procedures of an LLC in Ohio. |

| Legal Requirement | While not required by state law, it's highly recommended for LLCs in Ohio to have an Operating Agreement. |

| Governing Law | The Ohio Revised Code (ORC), specifically Chapter 1705, governs LLCs and Operating Agreements in Ohio. |

| Flexibility | Ohio law gives considerable flexibility in terms of how LLCs structure their Operating Agreements, allowing businesses to tailor the document to their specific needs. |

| Key Provisions | Typically includes sections on membership structure, management, distributions, and procedures for adding or removing members. |

Instructions on Writing Ohio Operating Agreement

When setting up an LLC in Ohio, an important step is the creation of an Operating Agreement. This legal document outlines the ownership structure and operational guidelines of your business, providing clarity and guidelines for resolving future disagreements. Although not required by state law, it's a critical tool for safeguarding your business operations. The process can seem daunting, but with careful attention, you can complete the form accurately. Below are the steps needed to fill out an Ohio Operating Agreement.

- Gather necessary information, including the official name of your LLC, the principal place of business, and the names and addresses of all members.

- Review any default rules set by Ohio law regarding LLC operations and decide if your agreement will override or adhere to these rules.

- Enter the name of your LLC as it's officially registered with the Ohio Secretary of State at the top of the agreement document.

- Specify the principal place of business, including the full address. This is where your LLC's primary operations are conducted.

- Detail the names and addresses of each member participating in the LLC. This helps to clearly define who has what stake in the company and the extent of their involvement.

- Outline the terms of ownership and how profits and losses will be distributed among members. Be specific to avoid future disputes.

- Describe the management structure of your LLC. Indicate whether it will be member-managed, where all members are actively involved in decision-making, or manager-managed, with selected individuals or outside managers overseeing operations.

- Include any agreements on meetings, including how often they will be held, the process for calling a meeting, and how decisions are made and documented.

- Explain the process for adding or removing members, as well as any procedures for members to exit the LLC. This should cover how their share of the profits and assets will be handled.

- Decide on a method for amending the Operating Agreement should it become necessary in the future. Include steps and votes required for changes.

- Have all members review the completed Operating Agreement to ensure accuracy and agreement on all points.

- Ensure all members sign and date the agreement. Keep a signed copy in a safe place and give copies to all members.

Completing your Ohio Operating Agreement is a thorough process that requires attention to detail. It's not only about compliance but also about protecting and maintaining the integrity of your business and its operations. Once the agreement is filled out and signed by all members, your LLC will have a solid foundation for its operational structure and a clear path for handling internal affairs. This proactive step is invaluable for the longevity and success of your business.

Understanding Ohio Operating Agreement

What is an Ohio Operating Agreement?

An Ohio Operating Agreement is a legally binding document that outlines the operating procedures, financial decisions, and ownership details among the members of a Limited Liability Company (LLC) within the state of Ohio. This agreement is crucial for defining the structure of the business, the roles of its members, and how decisions are made within the LLC. It's designed to ensure that all members are on the same page and to reduce potential conflicts.

Is an Operating Agreement required for LLCs in Ohio?

No, the state of Ohio does not legally require LLCs to have an Operating Agreement. However, having one is highly recommended as it provides clarity and protection for the business operations and its members. Without an Operating Agreement, LLCs will be governed by default state laws, which may not be in the best interest of the members. Crafting a custom Operating Agreement allows members to establish their own rules and procedures.

What are the key components of an Ohio Operating Agreement?

While Operating Agreements will vary based on the specific needs of each LLC, certain key components are commonly included:

- Ownership Structure: Details on the percentages of ownership among the members of the LLC.

- Management and Voting: Guidelines on how the LLC will be managed (member-managed vs. manager-managed) and the process for making major decisions.

- Capital Contributions: Information on the initial investments by members and the procedures for future contributions.

- Distributions: How profits and losses will be shared among members.

- Membership Changes: The process for adding or removing members, and guidelines for transferring ownership interests.

- Dissolution: The procedure for dissolving the LLC.

How can I create an Ohio Operating Agreement?

Creating an Ohio Operating Agreement involves several steps:

- Determine whether the LLC will be member-managed or manager-managed.

- Discuss and agree upon the key components of the Operating Agreement with all members involved.

- Consult with a legal expert to ensure that the agreement complies with Ohio law and suits the LLC’s needs.

- Draft the Operating Agreement, incorporating all agreed-upon terms and conditions.

- Have all members review the agreement, make any necessary adjustments, and then sign it to make it effective.

Common mistakes

One common mistake when filling out the Ohio Operating Agreement form is not customizing the document to match the specific needs of the business. Many people mistakenly use a generic template without tailoring it to their business structure, assuming all operating agreements are the same. This oversight can lead to significant issues down the line, as the document might not adequately address the unique aspects of the business or the members' expectations.

Another frequent error is neglecting to define the financial contributions and distribution plans clearly. Individuals often overlook the importance of detailing each member's initial contributions and the specific terms regarding profit sharing and losses. This lack of clarity can result in disputes among members about financial entitlements, which could have been easily avoided with a comprehensive agreement.

A third error involves inadequate or missing provisions for dispute resolution. Many people do not anticipate potential disagreements among members, leading them to omit this critical section from the agreement. However, including clear protocols for resolving disputes can save a lot of time and resources by avoiding court intervention and providing a roadmap for amicable solutions.

Incorrect or incomplete member information constitutes another frequent mistake. Sometimes, members fill out their names or the names of their entities inaccurately, or they fail to update the agreement when membership changes occur. This oversight can lead to confusion about who legally holds membership status, especially in situations requiring member consensus or in the distribution of assets.

Failure to specify the management structure is also a common oversight. The Ohio Operating Agreement form needs to clearly delineate whether the LLC will be member-managed or manager-managed, including the powers, duties, and limitations of the managers. Not making these distinctions clear can result in operational inefficiencies or legal challenges regarding authority and decision-making.

Not properly outlining the process for amending the agreement is another mistake often seen. Without a clearly defined procedure for making amendments, changes to the agreement can become cumbersome, leading to outdated provisions that no longer reflect the current operations and intentions of the members.

Leaving out succession planning is a critical error in preparing the Ohio Operating Agreement. Business continuity and transition plans are essential, especially for family-owned businesses or small businesses where the unexpected departure of a member could significantly impact operations. Without these plans in place, the remaining members may struggle to make decisions or transfer ownership smoothly.

Forgetting to include a severability clause is yet another oversight. This clause ensures that if one part of the agreement is found to be invalid or unenforceable, the remainder of the agreement still stands. Failing to include a severability clause can jeopardize the entire agreement if a dispute arises over a specific section.

Lastly, not having the agreement reviewed by a professional is a mistake that can render many of the above efforts ineffective. People often skip this step to save on costs or time, but a review by someone well-versed in Ohio law and LLC operations can catch mistakes or areas of concern that a layperson might miss. This professional insight can ultimately save time and protect the members' interests in the long run.

Documents used along the form

When setting up a new business in Ohio, especially a Limited Liability Company (LLC), the Operating Agreement is a crucial document that outlines the operational and financial arrangements of the company, as well as the rules and regulations to be followed. However, beyond the Operating Agreement, there are several other forms and documents that are typically required to fully establish and organize an LLC in Ohio. These documents complement the Operating Agreement, ensuring that the business is compliant with state laws and regulations, while also preparing it for various operational and financial scenarios. Understanding these documents is essential for anyone looking to form an LLC in Ohio.

- Articles of Organization: This is the foundational document required to officially form an LLC in Ohio. It needs to be filed with the Ohio Secretary of State. It includes basic information about the LLC, such as its name, address, and the names of its members.

- Employer Identification Number (EIN) Application: Obtained from the IRS, the EIN is essentially a social security number for your business. It’s critical for tax purposes, hiring employees, and setting up business bank accounts.

- Statement of Organizer: This document formally records the individual who organized the LLC and is often required for administrative purposes. It verifies the person who has taken the steps to form the LLC on behalf of its members.

- Operating Agreement Amendment Form: While the Operating Agreement sets the initial rules and structure for the LLC, situations may change. This form allows members to officially document any agreed-upon amendments to the original Operating Agreement.

- Membership Certificates: These certificates serve as physical proof of ownership in the LLC. They are issued to each member, outlining their share and interest in the company. It’s a useful document for clarifying member contributions and ownership stakes.

In conclusion, the Operating Agreement is just one of several important documents required when forming an LLC in Ohio. Together, the Articles of Organization, Employer Identification Number (EIN) Application, Statement of Organizer, Operating Agreement Amendment Form, and Membership Certificates create a comprehensive legal and operational framework for your business. Each document plays a specific role in ensuring that the business is properly established, can operate within the law, manage financial transactions correctly, and adapt to changes in its structure or operations over time. Being well-informed about these documents will facilitate a smoother setup process and contribute to the long-term success of the business.

Similar forms

An Ohio Operating Agreement shares similarities with a Partnership Agreement as both outline the operations of a business entity and define the roles and responsibilities of the parties involved. These agreements are designed to prevent future disputes by clearly laying out how decisions are made, profits shared, and the process for handling exits or dissolving the business. While an Operating Agreement is used for Limited Liability Companies (LLCs), a Partnership Agreement is specifically for partnerships, making them tailored to their respective business structures.

Similar to Bylaws in a corporation, an Ohio Operating Agreement serves as the foundational document that governs the internal operations of an LLC. Bylaws are crucial for corporations as they establish the rules and procedures for corporate governance, including the organization of the board of directors, the conduct of shareholder meetings, and other essential operations. Both documents ensure that the business complies with state laws while providing a structure for management and operational processes.

An Ohio Operating Agreement and a Shareholder Agreement both focus on the ownership structure of a business entity but differ in applicability. Operating Agreements are for LLCs and detail members' rights, responsibilities, and profit distributions. In contrast, Shareholder Agreements are used in corporations to outline the shareholders' rights, responsibilities, and the procedures for buying and selling shares. Despite these differences, both aim to protect the interests of the business owners and establish a clear framework for the company's governance.

The similarity between an Ohio Operating Agreement and an Employment Agreement lies in their function to define roles and responsibilities within a business entity. While an Operating Agreement outlines the structure and operational guidelines of an LLC, including the roles of its members, an Employment Agreement specifies the terms of employment, duties, and rights of an employee within the company. Both are crucial for clarifying expectations and responsibilities to ensure smooth operations.

An Ohio Operating Agreement bears resemblance to a Business Plan in that both are instrumental in the strategic planning and foundation of a company. A Business Plan outlines a company's goals, strategies, and financial forecasts, serving as a roadmap for growth and success. Though an Operating Agreement focuses more on the governance and operational aspects of an LLC, it similarly sets the stage for the company's functionality and approach to achieving its objectives.

A Buy-Sell Agreement is another document similar to an Ohio Operating Agreement, specifically regarding the procedures for transferring ownership interests. An Operating Agreement includes provisions for what happens if a member wants to leave the LLC, dies, or becomes incapacitated. A Buy-Sell Agreement, often used in partnerships and corporations, outlines how a partner's or shareholder's interests are bought out or sold, ensuring business continuity. Both documents help prevent conflicts by having predefined terms for handling such transitions.

An Ohio Operating Agreement and a Non-Disclosure Agreement (NDA) share the purpose of protecting sensitive business information. While the primary function of an Operating Agreement is to outline the structure and policies of an LLC, it can include clauses to safeguard proprietary information and trade secrets, similar to an NDA. An NDA specifically prohibits the disclosure of confidential information to unauthorized parties, directly focusing on the security of intellectual property and other confidential data.

Lastly, an Ohio Operating Agreement is akin to a Commercial Lease Agreement in that both involve agreements critical to the operation of a business. A Commercial Lease Agreement stipulates the terms under which a business rents commercial space, detailing rent, lease duration, and use of the property. While an Operating Agreement governs the overall operations of an LLC, provisions regarding the leasing or ownership of property necessary for the business can also be included, making both documents essential for business operations.

Dos and Don'ts

When filling out the Ohio Operating Agreement form, individuals must pay close attention to the details and legal requirements to ensure the document is valid and accurately reflects the intentions of the LLC members. Below are essential dos and don'ts to guide you through the process.

- Do thoroughly read through the entire form before beginning to fill it out. Understanding the overall structure and requirements can help prevent mistakes.

- Do ensure that the information provided is accurate and up-to-date. This includes member names, contributions, and percentages of ownership.

- Do use professional language that clearly states the agreement terms. Ambiguity can lead to disputes or legal complications down the line.

- Do check the Ohio state laws regarding LLCs to ensure your operating agreement complies with current regulations.

- Do have all LLC members review the completed form before it’s finalized. This step ensures that every member understands and agrees to the terms.

- Do not use generic templates without customizing them to fit the specific needs and agreement of your LLC. Templates can serve as a helpful starting point, but they often require adjustments.

- Do not leave any sections blank unless they are explicitly irrelevant to your LLC. Incomplete forms may lead to misunderstandings or be considered invalid.

- Do not forget to include dispute resolution procedures. Clearly defined mechanisms for managing disputes can save a lot of trouble.

- Do not sign without ensuring that every member has had the chance to consult with an independent attorney, should they choose. This can help prevent claims that the agreement was entered into without proper understanding or under duress.

- Do not fail to keep a copy of the signed agreement in a safe place. Each member should have a copy, and an extra may be kept with the company records for reference.

Misconceptions

Understanding the Ohio Operating Agreement is crucial for any business owner or entrepreneur operating within the state. A number of misconceptions surround this document, often leading to confusion or missteps in its application. By highlighting and correcting these misconceptions, individuals can ensure they are fully informed about the nature and requirements of the Ohio Operating Agreement.

It's mandatory for all businesses to have one: Many believe that all Ohio businesses must have an Operating Agreement. In reality, while highly recommended, it is specifically required only for LLCs (Limited Liability Companies) to outline the operational and financial decisions of the business.

The state provides a standardized form: There is a common misconception that the state of Ohio provides a standardized Operating Agreement form for use. Instead, Ohio allows businesses the flexibility to create their own agreement tailored to their unique needs, within legal boundaries.

Only multi-member LLCs need an Operating Agreement: Both single-member and multi-member LLCs in Ohio could benefit significantly from having an Operating Agreement. It not only helps in establishing clear rules and expectations but can also protect the owner’s personal assets from business liabilities.

It must be filed with a state agency: Unlike the articles of organization, an Operating Agreement does not need to be filed with any state agency in Ohio. It is an internal document that should be kept on file by the owners for reference and guidance.

There's no need to update it: Business needs and relationships evolve, and so should your Operating Agreement. It’s a misconception that once drafted, it doesn’t require updating. Periodic reviews and amendments are necessary to reflect current operations and ownership.

It’s too complex for DIY: Many assume that drafting an Operating Agreement requires professional legal help due to its complexity. While seeking legal advice is wise, especially for complex structures, many resources and templates exist to help owners draft their own agreements.

It only outlines the distribution of profits and losses: An Operating Agreement covers much more than just the financial aspects. It includes roles and responsibilities, voting rights, processes for adding or removing members, and other operational policies.

All members must have equal voting rights: This is a common misconception. Ohio Operating Agreements can define whatever voting rights the members agree upon, which may or may not include equal voting. These rights should be clearly outlined in the agreement.

Verbal agreements are sufficient: Although Ohio law might enforce some verbal contracts under certain conditions, relying on a verbal Operating Agreement is risky and not recommended. A written agreement ensures clarity and is far easier to enforce legally.

It’s only beneficial in the event of legal trouble: While an Operating Agreement certainly provides legal protections, its benefits extend to providing a clear framework for everyday operations and decision-making, enhancing overall business efficiency and dispute prevention.

Key takeaways

An Operating Agreement is a critical document for limited liability companies (LLCs) in Ohio, outlining the ownership and operating procedures. Here are seven key takeaways about filling out and using the Ohio Operating Agreement form to ensure you’re setting your LLC up for success:

- It’s Not Legally Required but Highly Recommended: While Ohio law doesn’t require LLCs to have an Operating Agreement, having one in place is beneficial. It provides a clear framework for the business’s operations and helps to protect the limited liability status of its members.

- Customization is Key: The Ohio Operating Agreement should be tailored to fit the specific needs of your LLC. This customization allows members to define their own rules governing their business, rather than defaulting to state laws.

- Detail Ownership Percentages: Clearly outline each member's ownership percentage within the Operating Agreement. This is crucial for understanding each member's stake in the company and how profits and losses will be distributed.

- Voting Rights and Responsibilities: Define the voting rights of each member, including how decisions are made and disputes resolved. This ensures that all members understand their role in the company’s governance.

- Management Structure: Decide whether your LLC will be member-managed or manager-managed and document this decision in your Operating Agreement. This clarifies the roles and responsibilities within the company's management.

- Succession Planning: Include provisions for what happens if a member wants to leave the LLC, passes away, or becomes incapacitated. This planning can save a lot of headaches and disagreements later on.

- Financial Arrangements: Detail how the finances will be handled, including capital contributions, distributions, and how to handle the financial losses or gains. It’s vital for maintaining transparency and trust between members.

Completing and implementing the Ohio Operating Agreement requires thoughtful consideration and possibly the consultation of a legal professional. This document isn't just a formality; it’s a foundational tool that helps ensure the smooth operation and longevity of your LLC. Remember, while templates and general advice can be helpful, tailoring the agreement to your specific situation is what truly makes it effective.

More Operating Agreement State Forms

Does Llc Need Operating Agreement - A customisable document that addresses the unique needs and agreements of the members of an LLC.

Florida Operating Agreement - An Operating Agreement helps establish clear roles and responsibilities for each member, promoting a smoother operational flow.