Fillable Operating Agreement Document for New York

In the vibrant landscape of New York's business environment, the Operating Agreement form stands as a cornerstone document for Limited Liability Companies (LLCs). This critical piece of documentation offers a comprehensive framework that outlines the operational guidelines, financial distributions, and the overall governance structure of an LLC. Essential for both newly formed and established entities, this agreement ensures that all members are on the same page regarding the company's day-to-day operations and long-term strategy. Moreover, while New York State does not mandate the filing of this document with any government agency, its existence is crucial in safeguarding the LLC's limited liability status, preventing misunderstandings among members, and providing a clear protocol for the resolution of disputes. The Operating Agreement is tailored to the specific needs of the business and its members, underscoring its importance in the foundation and ongoing management of the LLC. Whether the company consists of a single member or multiple stakeholders, this document is key to delineating the rights, duties, liabilities, and profit-sharing among its members, thereby ensuring smooth operations and mitigating risks in the dynamic business environment of New York.

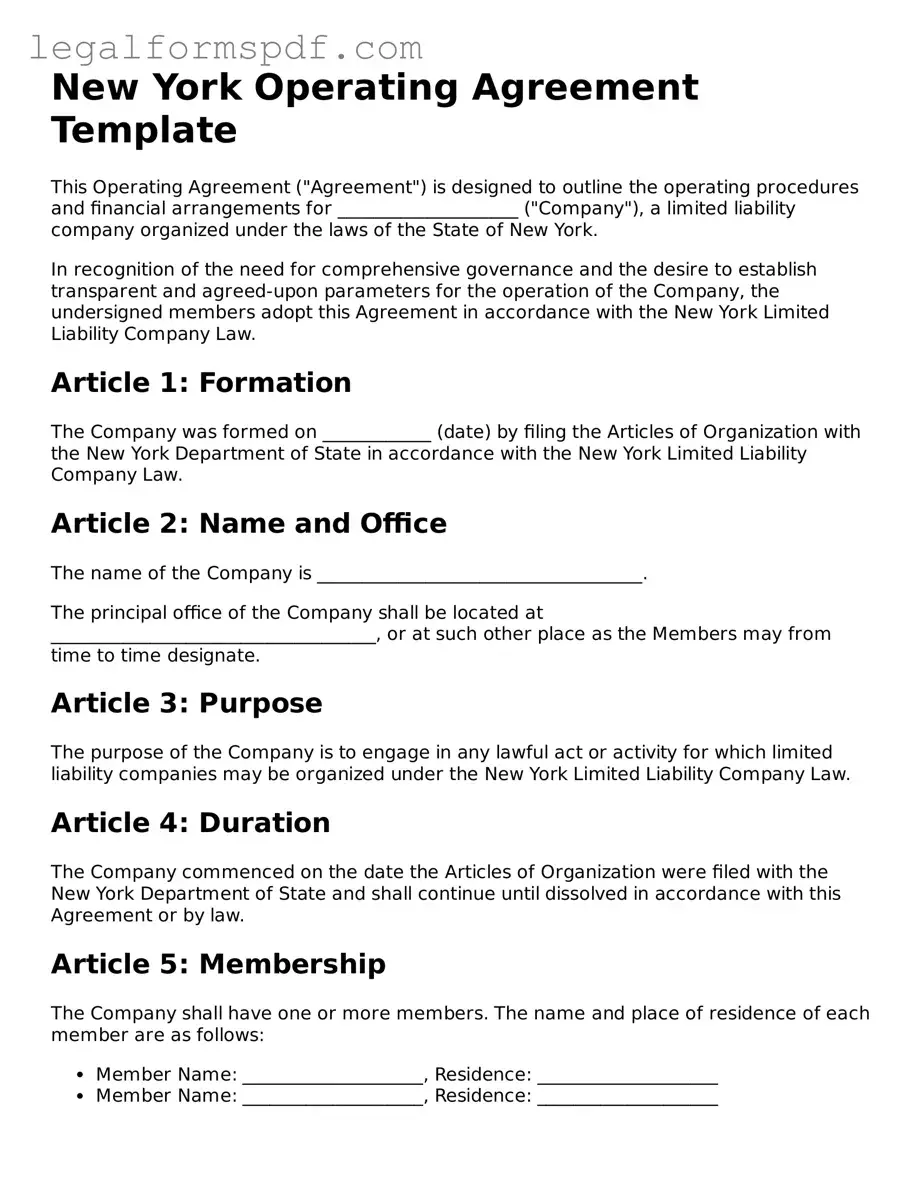

Document Example

New York Operating Agreement Template

This Operating Agreement ("Agreement") is designed to outline the operating procedures and financial arrangements for ____________________ ("Company"), a limited liability company organized under the laws of the State of New York.

In recognition of the need for comprehensive governance and the desire to establish transparent and agreed-upon parameters for the operation of the Company, the undersigned members adopt this Agreement in accordance with the New York Limited Liability Company Law.

Article 1: Formation

The Company was formed on ____________ (date) by filing the Articles of Organization with the New York Department of State in accordance with the New York Limited Liability Company Law.

Article 2: Name and Office

The name of the Company is ____________________________________.

The principal office of the Company shall be located at ____________________________________, or at such other place as the Members may from time to time designate.

Article 3: Purpose

The purpose of the Company is to engage in any lawful act or activity for which limited liability companies may be organized under the New York Limited Liability Company Law.

Article 4: Duration

The Company commenced on the date the Articles of Organization were filed with the New York Department of State and shall continue until dissolved in accordance with this Agreement or by law.

Article 5: Membership

The Company shall have one or more members. The name and place of residence of each member are as follows:

- Member Name: ____________________, Residence: ____________________

- Member Name: ____________________, Residence: ____________________

Article 6: Contributions

The Members have contributed capital to the Company as described below:

- Member Name: ____________________, Contribution: ____________________

- Member Name: ____________________, Contribution: ____________________

Article 7: Distributions

Distributions shall be made to the Members at the times and in the amounts as agreed by the Members in accordance with their capital accounts, as maintained by the Company for each Member.

Article 8: Management

The Company shall be managed by its Members. The rights and responsibilities of the Members, including any limitations therein, shall be as outlined in this Agreement.

Article 9: Voting

Each Member shall be entitled to vote on matters submitted to the members in proportion to their respective capital accounts. Matters shall be decided by a majority of the votes cast, unless otherwise required by this Agreement or applicable law.

Article 10: Amendments

This Agreement may be amended only by a written agreement signed by all Members.

Article 11: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of New York.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the ______ day of ____________, ______.

_____________________________________

Member Signature

_____________________________________

Member Signature

Add more signatures as neededPDF Specifications

| Fact | Detail |

|---|---|

| Purpose | Specifies the operations, structure, and governance of a Limited Liability Company (LLC) in New York. |

| Governing Law | New York Limited Liability Company Law. |

| Requirement | Although not required to be filed with the state, it's strongly recommended for establishing clear rules and procedures among members. |

| Flexibility | Allows LLC members to define their financial and working relationships in a way that suits their business needs. |

| Modification | Can be altered or amended as needed with the consent of members, according to the terms set within the agreement. |

| Key Components | Includes information on membership, management, allocations of profits and losses, and provisions for dissolution among other essential operational guidelines. |

Instructions on Writing New York Operating Agreement

Once you've decided to form a Limited Liability Company (LLC) in New York, one critical document you'll need to prepare is the Operating Agreement. This internal document outlines the ownership and operational frameworks of your LLC. While the state of New York does not mandate the filing of this document, having it serves as a legal safeguard and clarifies the business structure for all members involved. Here's a step-by-step guide to help you efficiently fill out the New York Operating Agreement form, ensuring that all relevant sections are accurately completed.

- Gather essential information: Before you start filling out the form, compile all necessary details such as the LLC name, principal place of business, member names, and their respective contributions.

- Specify the LLC name: Accurately write the full legal name of your LLC as registered with the New York State Division of Corporations.

- Define the principal place of business: Enter the complete address where your LLC's primary operations will be conducted.

- List the LLC members: Include the names and addresses of all members of the LLC, specifying their roles if they hold specific titles such as Managing Member.

- Detail member contributions: Clearly outline the capital contributions of each member, including cash, property, or services, and detail any agreed-upon future contributions.

- Outline the distribution of profits and losses: Describe how profits and losses will be distributed among members. This often correlates with the percentage of ownership or investment.

- Describe the management structure: Indicate whether your LLC will be managed by members or appointed managers and specify the duties and powers of those in management roles.

- Detail the voting rights: Clarify each member’s voting rights, including how decisions are made, whether votes are proportional to ownership interests, and any matters that require unanimous consent.

- Address the addition or withdrawal of members: Set the procedures for adding new members and the implications of a member’s withdrawal or death on the LLC.

- Specify the dissolution process: Define the circumstances under which the LLC may be dissolved and the steps for liquidation and distribution of assets.

- Signatures: Ensure all members sign and date the document, thereby acknowledging and agreeing to its terms. Depending on your LLC’s policy, you might also need the signatures of designated managers.

Completing the New York Operating Agreement is a foundational step in establishing the governance of your LLC. It's advisable to proceed with attention to detail to avoid any ambiguities, as this document will guide the operational and financial decisions of your LLC. After the agreement is fully executed, keep it with your other official company records for future reference. Remember, while this document is not filed with the state, it is pivotal in affirming your LLC's operational structures and resolving any internal disputes that may arise.

Understanding New York Operating Agreement

What is a New York Operating Agreement?

An Operating Agreement is a legal document outlining the ownership structure and operating procedures of a Limited Liability Company (LLC) in New York. This agreement is crucial for establishing clear rules and expectations among members, managing financial decisions, and providing instructions for handling changes or disputes within the company.

Is an Operating Agreement required for an LLC in New York?

Yes, New York state law requires all LLCs to have a written Operating Agreement. The agreement must be adopted within 90 days of forming your LLC. It is an internal document, so it does not need to be filed with the state, but it must be kept on record by the LLC.

What should be included in a New York Operating Agreement?

A comprehensive Operating Agreement for a New York LLC should include: the LLC's name and address, the names and addresses of the members, how profits and losses will be distributed, the LLC's management structure and voting procedures, and policies for adding or removing members, as well as procedures for dissolving the LLC.

Can an Operating Agreement be modified?

Yes, an Operating Agreement can be modified if the members of the LLC agree to the changes according to the procedures outlined in the original agreement. It's important to document these changes in writing and have all members sign the updated agreement.

Who needs to sign the Operating Agreement in New York?

All members of a New York LLC need to sign the Operating Agreement. If the LLC is managed by managers rather than its members, the managers may also be required to sign the agreement, depending on the LLC's specific provisions.

What happens if an LLC does not have an Operating Agreement?

If an LLC in New York operates without an Operating Agreement, its operations will be governed by default state laws. This situation could lead to unpredictable outcomes in profit distribution or conflict resolution, as the members have not set their own rules. Therefore, it's crucial for an LLC to create and maintain an Operating Agreement.

Does an Operating Agreement need to be notarized in New York?

While not a legal requirement, notarizing an Operating Agreement can lend an additional layer of validity, especially when the document is used as proof of the members' agreement in legal or financial transactions.

How does an Operating Agreement protect my LLC's members in New York?

An Operating Agreement protects the members of an LLC by setting clear expectations about their roles, rights, and responsibilities. It can prevent conflicts by providing agreed-upon procedures for making decisions and resolving disputes. Furthermore, it helps to ensure that owners’ personal assets are protected from the company’s liabilities.

Where should an LLC keep its Operating Agreement?

An LLC should keep its Operating Agreement in a secure location where it is easily accessible to all members. Common locations include with other important business documents at the company’s principal place of business or with a corporate attorney or trusted advisor.

Common mistakes

Filling out the New York Operating Agreement form is a critical step for anyone looking to establish an LLC (Limited Liability Company) in the state. However, it's not uncommon for people to make errors in the process. One common mistake is neglecting to specify the distribution of profits and losses. This agreement dictates how profits and losses will be shared among members, and failing to clearly outline this can lead to misunderstandings and disputes down the road.

Another frequent oversight is not setting clear guidelines for the addition or removal of members. An Operating Agreement should ideally include a detailed process for how new members can join the LLC and the conditions under which a member can be removed. This helps prevent future legal complications and ensures that every member is on the same page.

Many individuals also forget to define the roles and responsibilities of each member clearly. Specifying who is responsible for what within the LLC is crucial for smooth operations and accountability. Without this clarity, task overlaps or neglect can occur, hampering the effectiveness of the business.

Skipping the inclusion of a dissolution process is another mistake. While no one wants to think about the end of their business at the start, having a plan in place for dissolving the LLC can save a lot of headaches. It should outline the steps for winding down the business, distributing assets, and handling debts.

A significant number of people also incorrectly assume that a New York Operating Agreement does not need to be updated. As the business grows and changes, so should its Operating Agreement. Failing to update this document can lead to it being out of sync with the current structure and operations of the LLC, potentially leading to legal disputes.

Not including dispute resolution procedures within the agreement is a critical oversight. Detailing how disputes among members will be handled can help avoid lengthy and costly legal battles. Options like mediation or arbitration can be specified as the first steps before any court action.

Many also make the mistake of not having the agreement reviewed by a legal professional. Even if the form seems straightforward, having an attorney look over the agreement can prevent legal issues down the road. They can catch potential problems and ensure that the agreement complies with all state laws.

Some individuals neglect to sign the Operating Agreement, rendering it ineffective. All members must sign the document for it to be legally binding. This formalizes the agreement and ensures that all parties are legally committed to its terms.

Lastly, failing to provide each member with a copy of the Operating Agreement is a common mistake. Every member should have their own copy for their records. This ensures that all members have access to the agreement, can refer back to it when needed, and understand their rights and obligations within the LLC.

Documents used along the form

When forming a business in New York, the Operating Agreement is a pivotal document that outlines the operational procedures and financial arrangements of a Limited Liability Company (LLC). However, this document does not stand alone in the formation and maintenance of a business. Several other forms and documents are often used alongside the New York Operating Agreement to ensure legal compliance and efficient business operations. These documents help in various aspects, including registration, tax considerations, and ongoing compliance with state laws.

- Articles of Organization: This is the foundational document required to officially form an LLC in New York. It is filed with the New York Department of State and contains basic information about the LLC, such as the business name, address, and the names of its members.

- Employer Identification Number (EIN) Application: An EIN, also known as the Federal Tax Identification Number, is necessary for an LLC to open a bank account, hire employees, and pay taxes. It is obtained from the IRS following the formation of the company.

- Biennial Statement: New York requires all LLCs to file a Biennial Statement every two years. This statement updates the state on any changes to the company's address or the information about its managers or members.

- Operating Agreement Amendment Form: If members of an LLC decide to change any terms or conditions in the Operating Agreement, they must document these changes in an amendment form to maintain an accurate and current operating agreement.

- Certificate of Change: This form is used by an LLC to officially notify the New York Department of State about changes to the business’s address, the county location of the business, or changes regarding the designated service of process agent.

- DBA (Doing Business As) Certificate: If an LLC chooses to operate under a name different from the one registered with the Articles of Organization, a DBA certificate is required. This is filed with the county clerk’s office where the business is located.

In addition to the Operating Agreement, these documents play crucial roles in the lifecycle of an LLC, from its inception through its ongoing operation. While the Operating Agreement provides a framework for the internal workings of the LLC, the other documents assist in legal registration, tax preparation, and compliance with state regulations. Ensuring all relevant documents are in order can help safeguard the legal and financial well-being of the business.

Similar forms

The New York Operating Agreement, a crucial document for any Limited Liability Company (LLC) in New York, outlines the operational procedures and financial arrangements among its members. It bears resemblance to a Partnership Agreement, common in business arrangements where two or more individuals agree to share all assets, profits, and financial and legal liabilities of a venture. Similarly, both documents are foundational in defining the rights, responsibilities, and profit-sharing mechanisms among business partners, but the Operating Agreement is specific to LLCs, providing the flexibility to be managed by members or managers unlike a traditional partnership.

Also akin to the New York Operating Agreement is the Bylaws of a corporation, which detail the internal management structure of the company. While Operating Agreements are tailored for LLCs, Bylaws serve a parallel purpose for corporations, delineating the rules and responsibilities of the board of directors and officers, much like how the Operating Agreement lays out the procedures for the LLC's operations and member roles. Both are essential for the smooth functioning and governance of the respective entities they govern.

The Shareholder Agreement, often used in corporations, shares similarities with the New York Operating Agreement through its focus on the relationship among the shareholders and the operational guidelines of the business. This document goes into detail about shareholdings, distribution of profits, and decision-making processes, comparable to how an Operating Agreement specifies member contributions, distributions, and voting power in an LLC context.

Similarly, the Buy-Sell Agreement, a document designed to outline what happens if a member of a company wishes to sell their interest, or if they are forced to exit the business due to death or disability, mirrors aspects of the Operating Agreement. Many Operating Agreements for LLCs incorporate or are accompanied by Buy-Sell provisions to manage changes in membership and protect the business's and remaining members' interests.

The Employment Agreement, which outlines the conditions of employment between a business and an employee, bears resemblance to the Operating Agreement in that both establish the terms of an ongoing relationship. While the Employment Agreement focuses on the roles, responsibilities, and rewards of an individual employee, the Operating Agreement sets similar terms for the members of an LLC, covering capital contributions, management duties, and profit distribution.

The Non-Disclosure Agreement (NDA), designed to protect sensitive business information, is similar to the confidentiality provisions that can be included in an Operating Agreement. These provisions in an Operating Agreement prevent members from sharing proprietary information outside of the company, similar to how an NDA limits individuals from disclosing confidential information learned through their association with a business.

Loan Agreements, which delineate the terms, conditions, and obligations of a loan between a lender and a borrower, mirror parts of the Operating Agreement that might specify the financial contributions and distributions among the members of an LLC. Both types of documents are crucial in ensuring clear communication and understanding regarding financial transactions and obligations.

The Franchise Agreement, which outlines the relationship between a franchisor and franchisee, including brand use, operational control, and revenue sharing, has similarities to the Operating Agreement. Both are essential for laying the groundwork for business operations and profit distribution, yet the Operating Agreement serves an internal purpose for the management and operation of an LLC, whereas the Franchise Agreement governs the relationship between separate but related business entities.

Lastly, the Co-Founder Agreement, often used in the early stages of a startup, outlines the relationship among the founders, including their roles, responsibilities, and equity shares. This document is akin to an Operating Agreement in its purpose to prevent conflicts among the company's principals by clearly defining each person's commitment and expectations, similar to how an Operating Agreement structures the relationship among members in an LLC.

Dos and Don'ts

When filling out the New York Operating Agreement form, there are several practices to embrace and others to avoid ensuring the document is valid, clear, and enforceable. Here is a direct guide on what you should and shouldn't do:

Things You Should Do:- Review state requirements: Before you start, make sure you understand New York's specific requirements for operating agreements to ensure your document is compliant.

- Be detailed: Provide detailed information in each section to avoid ambiguity and ensure all aspects of your LLC's operations are clearly outlined.

- Use clear language: Write in clear, straightforward language to avoid misunderstandings or legal ambiguities down the line.

- Consult with all members: Make sure all members agree with the contents of the Operating Agreement before finalizing it.

- Include dispute resolution methods: Clearly outline how disputes among members will be resolved to minimize future conflicts.

- Update regularly: Review and update the Operating Agreement as needed to reflect changes in the LLC's management, membership, or operations.

- Seek legal advice: Consider consulting with a legal professional to ensure your operating agreement meets all legal requirements and best practices.

- Ignore state laws: Avoid overlooking New York's specific laws regarding LLC operations, as failing to comply can result in legal complications.

- Use vague terms: Avoid ambiguous language that could lead to misunderstandings or disputes among members.

- Exclude member information: Do not omit details about the members, such as their rights, responsibilities, and capital contributions.

- Forget about financial arrangements: Make sure to include clear details on profit sharing, losses, and financial contributions to avoid future disputes.

- Overlook exit strategies: Failing to include clear guidelines for members wishing to leave or dissolve the LLC can complicate those processes significantly.

- Rely solely on generic templates: Although templates can be a good starting point, avoid relying entirely on them without customizing the document to your LLC's specific circumstances.

- Delay the signing: Once completed, ensure all members sign the Operating Agreement promptly to avoid any governance issues under New York law.

Misconceptions

The New York Operating Agreement is a crucial document for Limited Liability Companies (LLCs) in New York. Despite its importance, there are many misconceptions surrounding its use and requirements. It is essential to debunk these myths to ensure that business owners are fully informed and can make the best decisions for their companies. Here are six common misconceptions about the New York Operating Agreement:

- It is not mandatory for every LLC. Many believe that an Operating Agreement isn't required for all New York LLCs, but this is incorrect. New York State law mandates that every LLC must adopt an Operating Agreement. This rule applies whether the LLC has one member or multiple members.

- It doesn't need to be in writing. Some think that an Operating Agreement can simply be an oral agreement. However, while informal agreements might exist, New York law strongly recommends having a written Operating Agreement. A written document provides clarity and reduces potential disputes among members by clearly laying out each member’s rights and obligations.

- An Operating Agreement is only beneficial for multi-member LLCs. Single-member LLCs also benefit from having an Operating Agreement. It can help affirm the separation between personal and business assets, which is vital for protecting personal assets from business liabilities. Additionally, it enhances the business’s credibility and can be required by banks when opening a business account.

- All Operating Agreements are similar, so a generic form will suffice. This assumption can lead to significant issues. While templates can serve as a starting point, each LLC is unique. Operating Agreements should be tailored to reflect the specific operating procedures, ownership structure, and financial arrangements of the LLC. A generic form may not adequately cover all the relevant aspects or anticipate potential issues specific to the business.

- The Operating Agreement doesn't need to be updated. Change is a constant in business, and this includes the operations, membership, and management of an LLC. As the business evolves, so too should the Operating Agreement. Regular reviews and updates ensure the document accurately reflects the current state of the LLC and continues to provide clear guidelines for resolving disputes, distributing profits, and managing changes in membership or structure.

- The Operating Agreement is only an internal document and has no external significance. While primarily an internal document, the importance of the Operating Agreement extends beyond the confines of the LLC. For instance, financial institutions often require an Operating Agreement when opening bank accounts or securing financing. Without an up-to-date Operating Agreement, LLC members may face challenges when seeking to establish or expand business relations.

Key takeaways

When creating an Operating Agreement in New York, it's imperative to understand its importance and implications thoroughly. This document not only sets the procedural groundwork for your limited liability company (LLC) but also ensures that the structure aligns with the specific needs of your business and its members. Here are key takeaways to consider:

- An Operating Agreement outlines the ownership structure, member roles, and operational procedures of an LLC, providing a clear framework for governance and decision-making.

- In New York, while not submitting the Operating Agreement to any state agency is required, having one is legally mandatory for all LLCs.

- The Agreement must be agreed upon by all members to ensure it accurately reflects their intentions and agreements regarding the business operations.

- It is crucial for protecting members' personal assets from the company's debts and liabilities, emphasizing the limited liability feature of an LLC.

- Without an Operating Agreement, your LLC will be governed by New York's default LLC laws, which may not be in the best interest of your business or its members.

- The document should detail the process for adding new members, outline procedures for member exits, and specify how profits and losses are distributed among members.

- It can and should be updated as the business grows or changes, keeping the agreement relevant and reflective of the current state of affairs.

- Having a well-drafted Operating Agreement can help prevent conflicts among members by providing clear guidelines and resolutions for potential disputes.

- For best results, consider consulting with a legal professional who can ensure that the Operating Agreement complies with New York law and accurately represents the agreement among the members.

Creating a New York Operating Agreement is a critical step in formalizing your business structure. It's not just about legal compliance; it's about setting a strong foundation for your business operations, management, and growth. Take the time to craft a document that serves your business well, now and in the future.

More Operating Agreement State Forms

North Carolina Llc Operating Agreement Template - It can serve as a reference in legal or financial disputes, providing evidence of agreed-upon terms and conditions.

Llc Operating Agreement Michigan - An Operating Agreement form allows for the documentation of initial investments by members, providing clarity and reducing future disputes.

How to Create an Operating Agreement for an Llc - This legal form is crucial for defining the profit distribution among members of an LLC.