Official Multiple Members Operating Agreement Document

In the realm of business, particularly when it involves the creation and operation of Limited Liability Companies (LLCs) with more than one member, the Multiple Members Operating Agreement stands as a crucial document. This legal form acts as the cornerstone for establishing the framework within which the company operates, detailing each member's financial contributions, responsibilities, and the distribution of profits and losses. Furthermore, it sets the stage for resolving disputes, facilitating changes in membership, and ultimately, outlining procedures for the possible dissolution of the company. By clearly specifying the rights and obligations of each member, the agreement not only ensures a smooth operational flow but also provides a layer of protection against potential legal issues. It is designed to preempt conflict by setting clear expectations and processes, thereby safeguarding the company's and its members' interests. The importance of this document cannot be overstated, serving as a vital tool for governance that aligns with the company's goals and regulatory requirements.

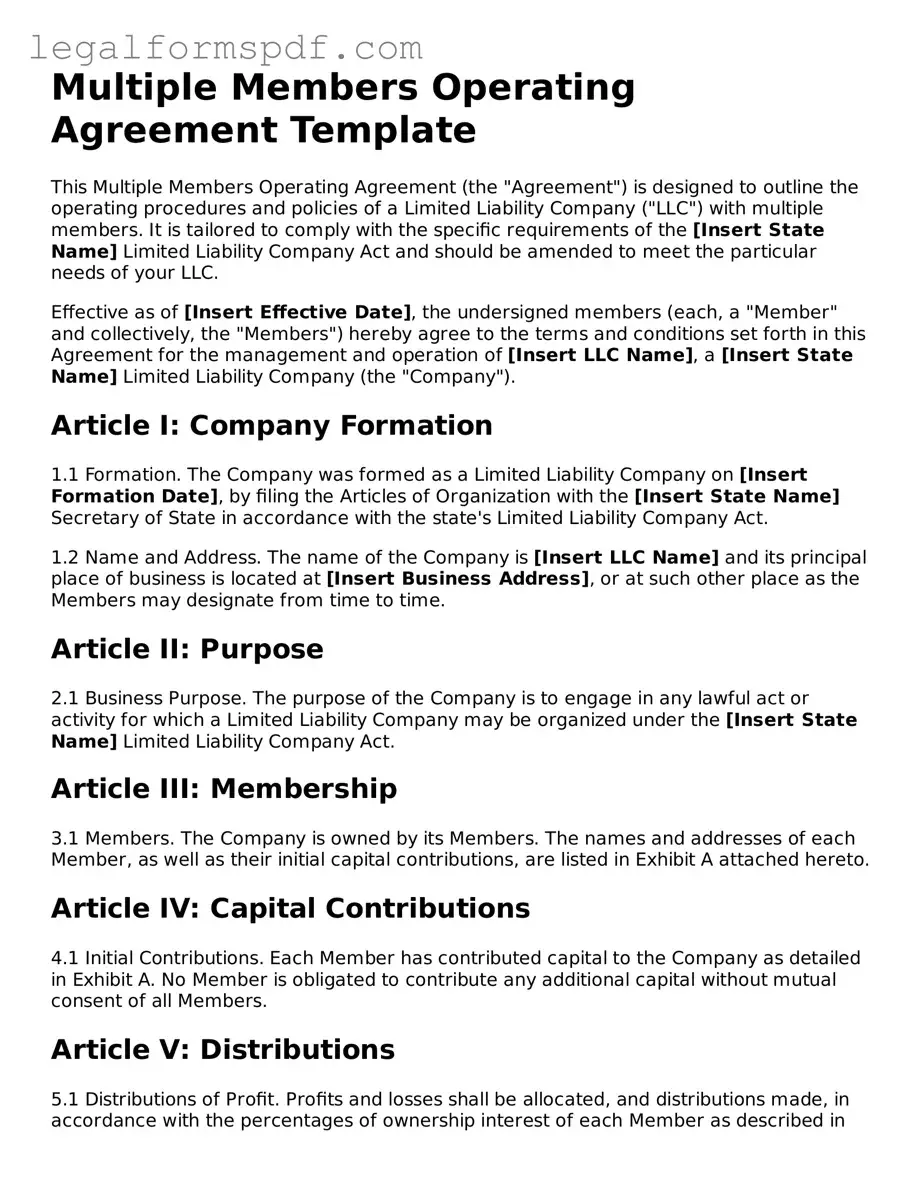

Document Example

Multiple Members Operating Agreement Template

This Multiple Members Operating Agreement (the "Agreement") is designed to outline the operating procedures and policies of a Limited Liability Company ("LLC") with multiple members. It is tailored to comply with the specific requirements of the [Insert State Name] Limited Liability Company Act and should be amended to meet the particular needs of your LLC.

Effective as of [Insert Effective Date], the undersigned members (each, a "Member" and collectively, the "Members") hereby agree to the terms and conditions set forth in this Agreement for the management and operation of [Insert LLC Name], a [Insert State Name] Limited Liability Company (the "Company").

Article I: Company Formation

1.1 Formation. The Company was formed as a Limited Liability Company on [Insert Formation Date], by filing the Articles of Organization with the [Insert State Name] Secretary of State in accordance with the state's Limited Liability Company Act.

1.2 Name and Address. The name of the Company is [Insert LLC Name] and its principal place of business is located at [Insert Business Address], or at such other place as the Members may designate from time to time.

Article II: Purpose

2.1 Business Purpose. The purpose of the Company is to engage in any lawful act or activity for which a Limited Liability Company may be organized under the [Insert State Name] Limited Liability Company Act.

Article III: Membership

3.1 Members. The Company is owned by its Members. The names and addresses of each Member, as well as their initial capital contributions, are listed in Exhibit A attached hereto.

Article IV: Capital Contributions

4.1 Initial Contributions. Each Member has contributed capital to the Company as detailed in Exhibit A. No Member is obligated to contribute any additional capital without mutual consent of all Members.

Article V: Distributions

5.1 Distributions of Profit. Profits and losses shall be allocated, and distributions made, in accordance with the percentages of ownership interest of each Member as described in Exhibit A, subject to adjustments as Members may agree in writing.

Article VI: Management

6.1 Management of the Company. The Company shall be managed by its Members. Each Member shall have authority and control over Company business as agreed upon by all Members and outlined in this Agreement.

Article VII: Voting

7.1 Voting Rights. Each Member shall have voting rights in proportion to their ownership interest. Decisions requiring a vote shall be made by a majority of the voting interest of the Members, except as otherwise required by law or specified in this Agreement.

Article VIII: Bookkeeping

8.1 Records. Accurate and complete records of the Company's business transactions will be maintained at the Company's principal place of business. All Members shall have access to these records upon reasonable request.

Article IX: Amendments

9.1 Amendments. This Agreement can only be amended by written consent of all the Members.

Article X: Dissolution

10.1 Dissolution. The Company may be dissolved with the consent of Members owning a majority of the Company's membership interest, or as otherwise provided by [Insert State Name] law.

Article XI: Governing Law

11.1 Governing Law. This Agreement and the rights of the Members shall be governed by and interpreted in accordance with the laws of the State of [Insert State Name], without regard to its conflict of laws principles.

IN WITNESS WHEREOF, the Members have executed this Multiple Members Operating Agreement as of the last date written below:

Member Signature: __________________________________ Date: _______________

Member Signature: __________________________________ Date: _______________

(Add additional signature lines as necessary)

Exhibit A: Members and Capital Contributions

- Member Name: _______________ Capital Contribution: _______________

- Member Name: _______________ Capital Contribution: _______________

- (Add additional lines as necessary)

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | An operating agreement for multiple members outlines the rules and structure for managing a Limited Liability Company (LLC) with more than one owner. |

| Flexibility | This agreement allows the members to define their financial and working relationships in a flexible way that suits their business needs. |

| Dispute Resolution | It typically includes provisions for resolving disputes among members, which can help prevent costly litigation and maintain business operations. |

| Governing Law | Operating agreements are governed by state laws, and each state has its own requirements and provisions for these agreements. |

| Protects Limited Liability Status | Having a formal operating agreement in place helps to ensure that courts respect the company's limited liability status, protecting members' personal assets from business debts and obligations. |

Instructions on Writing Multiple Members Operating Agreement

When establishing a Limited Liability Company (LLC) with multiple members, it's crucial to outline the rights, responsibilities, and profit and loss distribution among its members in a Multiple Members Operating Agreement. This agreement acts as a foundational document that governs the internal operations of the LLC in a way that suits the specific needs of its members. By filling out this agreement, members can ensure clarity and fairness in the management and financial arrangement of the LLC, reducing the risk of misunderstandings or disputes. Let's go through the steps necessary to fill out this form correctly.

- Gather Member Information: Start by collecting the full legal names and addresses of all members of the LLC. This information is critical to accurately identify who is involved in the business.

- Specify the LLC Name and Formation Date: Clearly write the official, registered name of the LLC as it appears in your legal documents, along with the date the company was officially formed and recognized by the state.

- Determine Management Structure: Decide whether the LLC will be member-managed or manager-managed and document this in the agreement. A member-managed LLC means all members participate in decision-making, while a manager-managed LLC appoints specific individuals (members or outsiders) to handle these responsibilities.

- Outline Member Contributions: List each member's contribution to the LLC, whether it's in the form of cash, property, or services. Detailing this helps determine each member's percentage of ownership in the LLC.

- Define Profit and Loss Distribution: Agree upon and document how the LLC's profits and losses will be distributed among members. This distribution often aligns with the percentage of ownership but can be adjusted as agreed by all members.

- Describe the Voting Process: Outline how decisions are made within the LLC. Include details on what constitutes a quorum, how many votes are needed for different types of decisions, and whether votes are proportional to ownership percentages or one vote per member.

- Include Provisions for Adding or Removing Members: Establish procedures for how new members can join the LLC and under what circumstances existing members can exit. Define any buyout terms or conditions for transferring membership interests.

- Detail Dispute Resolution Methods: Agree on how disputes among members will be handled. Options may include mediation, arbitration, or legal action, and the chosen method should be clearly documented in the agreement.

- Plan for Dissolution: Decide in advance how the LLC will be dissolved if necessary. This includes how assets will be distributed, debts paid, and the final closure of the business documented.

- Sign and Date the Agreement: After carefully reviewing the agreement, all members should sign and date the document. This formalizes the acceptance of the terms and conditions of the operating agreement.

Completing the Multiple Members Operating Agreement is a vital step in establishing a clear and structured foundation for your LLC. Not only does it serve to protect the interests of all members, but it also sets the stage for the efficient and harmonious operation of the business. Take the time to discuss and agree upon the terms carefully to ensure that the agreement accurately reflects the intentions and needs of all members.

Understanding Multiple Members Operating Agreement

What is a Multiple Members Operating Agreement?

A Multiple Members Operating Agreement is a document used by companies with more than one owner to outline the operational guidelines, financial arrangements, and ownership percentages among the members. It serves as a critical tool to ensure clarity and agreement on the company's operations and management.

Why is having a Multiple Members Operating Agreement important?

Having a Multiple Members Operating Agreement is crucial as it helps prevent conflicts among members by clearly defining each member's rights, responsibilities, and expectations. It also offers legal protection and establishes a formal structure that can be crucial for resolving disputes, managing changes in membership, and guiding decision-making processes.

What should be included in a Multiple Members Operating Agreement?

A comprehensive agreement should include information on the ownership structure, distributions of profits and losses, management roles and powers, voting rights and procedures, guidelines for admitting new members, buyout and exit provisions, and dispute resolution methods. Each company's needs may vary, so the agreement should be tailored accordingly.

How can members modify the Multiple Members Operating Agreement?

Members can modify the agreement at any time with the consent of all or a majority of the members, depending on the stipulations set forth in the original agreement. It's important to document any amendments formally and have them signed by all members to ensure the changes are legally binding and acknowledged by everyone involved.

Common mistakes

When individuals come together to form an LLC, the Multiple Members Operating Agreement (MMOA) serves as a crucial founding document, establishing the rules and structure by which the LLC will operate. Despite its importance, many people make common mistakes when filling out the MMOA, which can lead to complications or disputes down the line. Understanding these pitfalls can help ensure a smoother journey for your business.

One frequent error is not adequately defining the roles and responsibilities of each member. Without clear dissections of duties, expectations can become muddy, leading to internal conflicts. It's essential that the MMOA spells out who is responsible for what, from daily operations to financial decision-making, to ensure everyone is on the same page and accountable.

A lack of detailed financial arrangements also stands out as a significant misstep. This includes not just how profits and losses are distributed but also the specifics of capital contributions and procedures for future financial injections or the distribution of dividends. Without these details, members are often left in the dark about their financial rights and obligations, fostering an environment ripe for disagreements.

Another error involves overlooking the procedure for adding or removing members. The lifecycle of a business can be unpredictable, and the MMOA should anticipate changes in membership. Failing to include a clear process for these transitions can lead to operational impasses or legal challenges when the time comes.

Ignoring dispute resolution mechanisms is yet another oversight. Conflits among members are not uncommon, but without a predefined pathway for resolution outlined in the MMOA, such disagreements can escalate and even jeopardize the LLC's existence. Specifying whether mediation, arbitration, or litigation will be employed can save time, resources, and relationships.

Too often, the MMOA lacks a clear exit strategy or dissolution plan. Understanding from the start how the business can be wound down or what happens in the event of a member's departure or death is crucial. This foresight can prevent a scramble for solutions under less than ideal circumstances, ensuring a smoother transition for all involved.

Some members make the mistake of not addressing the issue of non-compete agreements within the MMOA. These clauses prevent members from starting or joining competing businesses, protecting the LLC’s interests. Neglecting to consider this aspect can leave the business vulnerable to competition from within its own ranks.

The absence of regular meeting schedules can also be a critical oversight. Regular meetings are essential for the ongoing governance of the LLC, yet failing to delineate when and how these meetings will occur within the MMOA can lead to operational stagnation and member disengagement.

Underestimating the importance of record-keeping provisions is another common mistake. The MMOA should specify the types of records to be kept and how they can be accessed by members. Accurate and accessible records are not just a legal requirement; they are a cornerstone of transparency and trust within the LLC.

Finally, a reluctance to seek professional advice when drafting the MMOA often leads to issues. While templates and online resources can provide a good starting point, every LLC has unique needs and challenges. Consulting with legal professionals ensures that the operating agreement is comprehensive, compliant with state laws, and tailored to the specific needs of the LLC.

Avoiding these common mistakes when completing the Multiple Members Operating Agreement can lay a strong foundation for the LLC and minimize the potential for internal strife. By dedicating the appropriate attention and resources to this critical document, members can set their LLC up for a more harmonious and prosperous path forward.

Documents used along the form

When business partners choose to form a Limited Liability Company (LLC), they often begin with a Multiple Members Operating Agreement. This document outlines the management structure, financial arrangements, and duties of the members. However, to comprehensively establish and manage an LLC, various other forms and documents are typically required. These additional documents help ensure legal compliance, define the operational scope of the business, and protect the members' rights and obligations.

- Articles of Organization: This is the primary document filed with the state to legally establish the LLC. It includes basic information about the LLC, such as the name, address, and the names of its members.

- Employer Identification Number (EIN) Application: Once the LLC is formed, it must obtain an EIN from the IRS. This federal tax identification number is necessary for opening bank accounts, hiring employees, and filing tax returns.

- Operating Agreement for Single Members: If the LLC transitions from multiple members to a single owner, a new operating agreement specifies this change. This document is crucial for outlining the rights, duties, and financial arrangements for the sole proprietor of the LLC.

- Minutes of Meeting: Documenting decisions and meetings is essential for maintaining clear records of the LLC's operations. Minutes of the meeting outline what was discussed and any decisions made during member meetings, ensuring transparency and accountability.

- Amendment to the Operating Agreement: Over time, changes may need to be made to the Operating Agreement due to shifts in membership, management, or the business itself. This document officially records any agreed-upon amendments to the original agreement.

Together with the Multiple Members Operating Agreement, these documents form a comprehensive framework for the effective and legally compliant operation of an LLC. Ensuring these documents are in place and properly maintained can help safeguard the business and its members against legal challenges and operational issues.

Similar forms

The Multiple Members Operating Agreement bears resemblance to the Partnership Agreement, primarily because both documents outline the workings of a business entity formed by two or more individuals. They specify the division of profits, the roles and responsibilities of each member, and the protocols for resolving disputes. Where they differ mainly is in their application to different legal business structures, with the operating agreement used for LLCs and the partnership agreement for partnerships, yet their core purpose of defining how a collaborative business endeavor operates remains fundamentally the same.

Similarly, a Shareholder Agreement found in corporations mirrors several aspects of the Multiple Members Operating Agreement. This document also focuses on the internal governance of the entity, detailing the rights and obligations of shareholders, dividend policies, and guidelines for the sale or transfer of shares. Both agreements aim to prevent conflicts within the business by establishing clear rules and expectations, even though they cater to different types of business entities.

A Buy-Sell Agreement is another document that shares common ground with the Multiple Members Operating Agreement, especially regarding contingency plans. This agreement comes into play for outlining what happens if a member dies, wishes to sell their interest, or undergoes a significant life event that could affect the business. Although a Buy-Sell Agreement can stand alone or be part of another business agreement, its preventative measures for potential future disputes and transitions are in line with the foresight seen in an operating agreement.

The Corporate Bylaws document that guides the internal management of a corporation is akin to the Multiple Members Operating Agreement in its function and purpose for an LLC. Both documents dictate the operational framework, detailing everything from meeting schedules to the decision-making process. While corporate bylaws are specific to corporations, and the operating agreement is for LLCs, their roles in defining the structural and governance aspects of a business are very much alike.

The Employment Agreement between an employer and an employee parallels the Multiple Members Operating Agreement in setting terms and expectations clearly. Although one deals with employment and the other with the operation of an LLC, both serve as preventive mechanisms against future misunderstandings by defining roles, responsibilities, and benefits. An Employment Agreement, much like an operating agreement, mitigates risk by ensuring all parties are on the same page from the outset.

Lastly, the Non-Disclosure Agreement (NDA), while primarily concerned with the confidentiality of information rather than the operation of a business, shares the preventive ethos found in a Multiple Members Operating Agreement. Both agreements aim to protect the entity’s interests through clearly laid out terms and conditions, albeit with a focus on different areas of protection. An NDA seeks to safeguard proprietary information, similarly to how an operating agreement aims to protect the operational integrity and revenue distribution of an LLC.

In essence, the function and utility of a Multiple Members Operating Agreement in ensuring a mutual understanding and setting expectations for the management of an LLC are mirrored across various types of business and legal agreements, each tailored to specific entities but similarly aimed at clarity, governance, and preventative conflict resolution.

Dos and Don'ts

When filling out the Multiple Members Operating Agreement, it's crucial to keep several dos and don'ts in mind. This agreement plays a significant role in structuring your business operations and relations among members. Here are the key guidelines to ensure the form is completed accurately and effectively:

Things You Should Do

Ensure all members' details are correct, including full names and addresses. Accuracy is key to avoid any future legal discrepancies.

Discuss and agree upon the profit and loss distribution ratio before filling out the form. This agreement must reflect all members' consensus to prevent disagreements.

Review the duties and powers of each member thoroughly. Clear definitions of roles help in the smooth operation of the business.

Include a detailed dispute resolution procedure. It's essential to have a predefined method of resolving disagreements among members.

Double-check and review the entire document before signing. Ensuring all information is correct and all necessary sections are completed can prevent future complications.

Things You Shouldn't Do

Don't leave any required fields blank. If a section does not apply, consider writing 'N/A' instead of leaving it empty.

Avoid using vague or unclear language. Clarity in the agreement prevents misunderstandings and legal issues.

Don't forget to consult a legal professional before finalizing the agreement. Professional advice can ensure that your agreement complies with state laws and best practices.

Resist the urge to skip over sections that seem unimportant. Every part of the agreement has potential legal significance.

Do not ignore state-specific requirements. Laws and regulations can vary greatly by state, and your agreement should reflect any specific mandates.

Misconceptions

When it comes to forming a business entity, particularly a Limited Liability Company (LLC), the Multiple Members Operating Agreement plays a crucial role. However, misunderstandings about this document are common. Here are eight widespread misconceptions regarding the Multiple Members Operating Agreement:

- All members must have equal shares and responsibilities. This is incorrect. The agreement allows for flexible structuring of ownership and duties. Members can have varying percentages of the business and different roles as outlined in the agreement.

- It's an optional document. While not all states require an Operating Agreement, having one is crucial. It provides legal protection and clear rules for governance, reducing potential conflicts among members.

- It's the same as the Articles of Organization. The Articles of Organization is a document filed with the state to legally form the LLC. The Operating Agreement, on the other hand, outlines the operating rules for the members of the LLC.

- There's a one-size-fits-all template. While templates can be a starting point, each LLC's situation is unique. The agreement should be customized to accurately reflect the members' agreement on how the LLC will be run.

- It doesn't need to be updated. Any time there are significant changes in the business or its operation, the agreement should be reviewed and, if necessary, updated to reflect these changes accurately.

- It's too complex for non-lawyers to understand. While legal documents can be complex, a well-crafted Operating Agreement should be clear and understandable. Members are encouraged to consult with legal counsel to ensure they fully understand the terms.

- Only large or formal LLCs need it. Regardless of size, every LLC can benefit from having an Operating Agreement. It's as beneficial for a two-member LLC as it is for one with multiple members and more complex structures.

- It must be filed with state authorities. Typically, the Operating Agreement is an internal document and does not need to be filed with the state. However, maintaining an updated copy amongst members is essential for legal and operational clarity.

Clearing up misconceptions about the Multiple Members Operating Agreement is crucial for the smooth operation and legal protection of any LLC. Members should strive to ensure that their agreement accurately reflects their business arrangement and understand that this document is flexible, designed to serve their specific needs.

Key takeaways

When filling out and using the Multiple Members Operating Agreement form, businesses must pay attention to several key points to ensure the document accurately reflects their operations, member responsibilities, and profit sharing. These takeaways guide members through the process of completing and employing the agreement effectively.

- It's critical to provide a complete list of all members, including their full legal names and contact information. This ensures every member is properly identified and can be contacted regarding any operational or legal matters.

- Clearly defining each member's contribution, whether in terms of capital, assets, or services, is essential. This lays the groundwork for understanding each member's stake in the company and their entitlement to profits or losses.

- Members need to agree on how operational decisions will be made. The agreement should specify if decisions are made by a majority vote, unanimous consent, or if certain members hold more decision-making power. This prevents future disputes by establishing a clear decision-making protocol.

- The agreement must detail the process for distributing profits and losses among members. It should outline how often distributions will occur and the formula used to calculate each member’s share. This clarity helps avoid misunderstandings and conflicts over financial matters.

- Finally, including a process for adding or removing members is advisable. Businesses evolve, and having a procedure in place for changing the membership ensures the company can adapt without needing to draft a new agreement.

By addressing these key points, members can create a comprehensive Multiple Members Operating Agreement that supports their business goals, clarifies the roles and responsibilities of all parties, and lays the foundation for a successful partnership.

Consider More Types of Multiple Members Operating Agreement Forms

Single Member Llc Operating Agreement Template - Customizable to match the specific needs and goals of the business owner, ensuring flexibility and control over business operations.