Fillable Operating Agreement Document for Michigan

In the heart of the Midwest, Michigan businesses, particularly Limited Liability Companies (LLCs), embark on their journey with a crucial document that sets the stage for their operations, decision-making, and conflict resolution. This document, known as the Michigan Operating Agreement, serves as a foundational blueprint for establishing the internal workings of an LLC. While not mandated by state law, its importance cannot be overstated, as it offers a layer of protection and clarity for business owners. The Operating Agreement outlines the ownership structure, delineates the responsibilities of its members, and sets the procedures for financial management and dispute resolution. By codifying these elements, the agreement ensures that all members are on the same page, reducing the potential for misunderstandings and conflicts. Moreover, it reinforces the legal separateness between the company and its owners, further safeguarding personal assets. For entrepreneurs looking to solidify their business's organizational structure and operational guidelines, drafting a comprehensive Operating Agreement is a step that paves the way for future growth, stability, and success in the dynamic landscape of Michigan's economy.

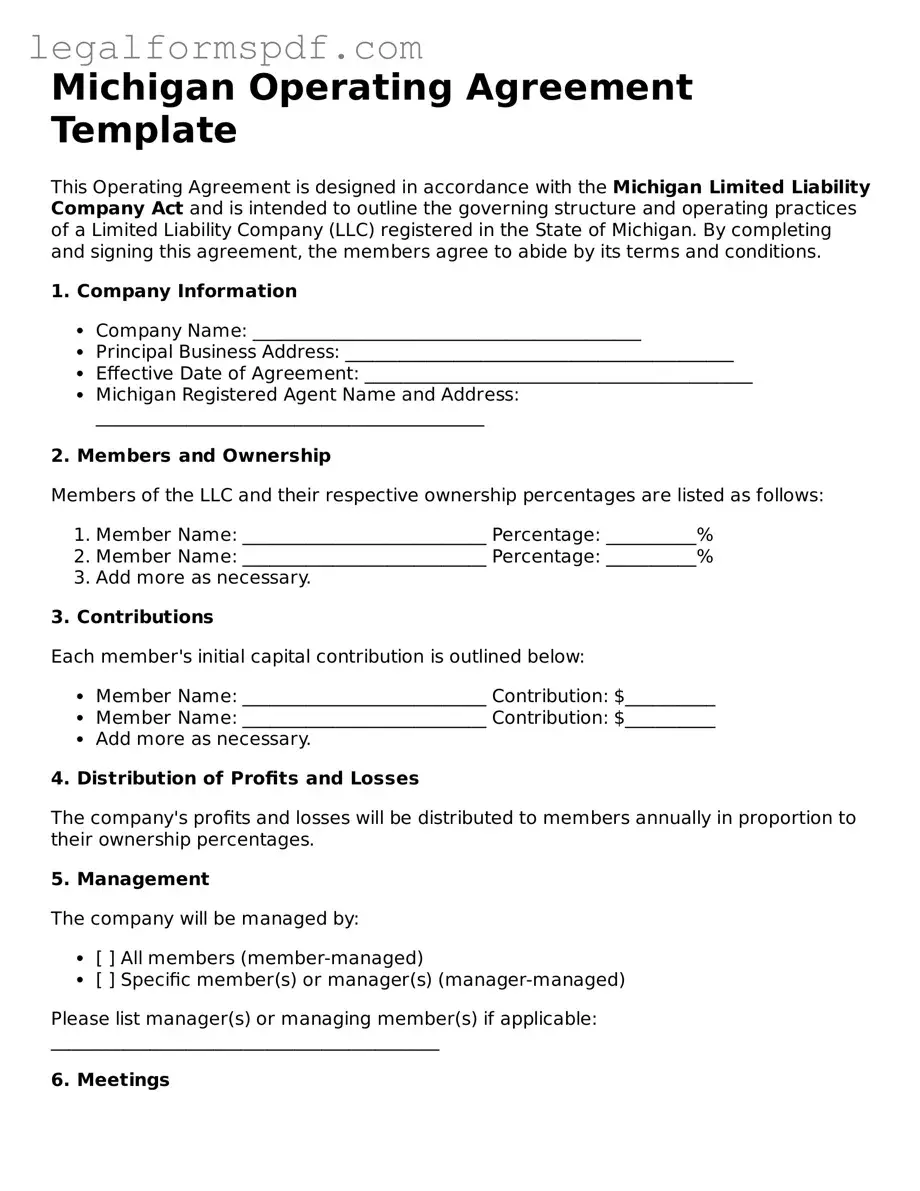

Document Example

Michigan Operating Agreement Template

This Operating Agreement is designed in accordance with the Michigan Limited Liability Company Act and is intended to outline the governing structure and operating practices of a Limited Liability Company (LLC) registered in the State of Michigan. By completing and signing this agreement, the members agree to abide by its terms and conditions.

1. Company Information

- Company Name: ___________________________________________

- Principal Business Address: ___________________________________________

- Effective Date of Agreement: ___________________________________________

- Michigan Registered Agent Name and Address: ___________________________________________

2. Members and Ownership

Members of the LLC and their respective ownership percentages are listed as follows:

- Member Name: ___________________________ Percentage: __________%

- Member Name: ___________________________ Percentage: __________%

- Add more as necessary.

3. Contributions

Each member's initial capital contribution is outlined below:

- Member Name: ___________________________ Contribution: $__________

- Member Name: ___________________________ Contribution: $__________

- Add more as necessary.

4. Distribution of Profits and Losses

The company's profits and losses will be distributed to members annually in proportion to their ownership percentages.

5. Management

The company will be managed by:

- [ ] All members (member-managed)

- [ ] Specific member(s) or manager(s) (manager-managed)

Please list manager(s) or managing member(s) if applicable: ___________________________________________

6. Meetings

Annual meetings will be held at a time and place agreed upon by the members. Special meetings may be called as needed.

7. Amendments

This Operating Agreement can only be amended in writing with consent from members holding more than 50% of the ownership interests.

8. Dissolution

The company may be dissolved upon the agreement of members holding more than 50% of the ownership interests. Upon dissolution, assets will be distributed to members according to their ownership percentages after all debts and liabilities have been settled.

9. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Michigan.

10. Signatures

By signing below, the members agree to the terms and conditions of this Operating Agreement.

- Member Signature: ___________________________ Date: _______________

- Member Signature: ___________________________ Date: _______________

- Add more as necessary.

PDF Specifications

| Fact | Description |

|---|---|

| 1. Purpose | The Michigan Operating Agreement form serves as an internal written document detailing the operating procedures, financial arrangements, and ownership percentages among members of a Limited Liability Company (LLC) in Michigan. |

| 2. Not a Requirement | Though highly recommended, forming an Operating Agreement is not a legal requirement for LLCs in Michigan according to state law. |

| 3. Governing Law | The Michigan Operating Agreement is governed under the Michigan Limited Liability Company Act, which stipulates the statutes LLCs must adhere to within the state. |

| 4. Flexibility | This document offers flexibility, allowing LLC members to customize their operating procedures and agreements as long as they comply with Michigan law. |

| 5. Dispute Resolution | An Operating Agreement can include provisions for dispute resolution among members, providing a clear framework for handling internal conflicts. |

| 6. Confidentiality | Unlike the Articles of Organization, the Operating Agreement does not need to be filed with the state and can remain confidential among the members of the LLC. |

Instructions on Writing Michigan Operating Agreement

Filling out an Operating Agreement is a critical step for any LLC established in Michigan. It outlines the financial and operational decisions of a business, setting clear rules and expectations for its members. This document, while not filed with the state, acts as an internal manual guiding the LLC. Creating a comprehensive Operating Agreement ensures that everyone involved understands their rights, responsibilities, and the allocation of profits and losses. Given its importance, it's essential to fill it out carefully and thoughtfully.

Below are the steps needed to fill out a Michigan Operating Agreement form:

- Identify the LLC's name exactly as it appears on your Articles of Organization filed with the Michigan state.

- Specify the effective date of the Agreement. This may be the date of LLC formation or another specified date.

- Detail the names and addresses of all members of the LLC.

- Outline the contributions of each member, including capital, property, or services, and state their corresponding ownership percentage.

- Describe the allocation of profits and losses among members, which is typically in proportion to their ownership percentages unless agreed otherwise.

- Define how and when meetings will be held, including the voting rights of members and the process for making decisions.

- Explain the process for adding or removing members, as well as any transferability of membership interests.

- Outline any management structures that differ from the default member-managed model, specifying roles and responsibilities if a manager-managed structure is chosen.

- Include clauses on dissolution, explaining the conditions under which the LLC may be dissolved and the process for winding up its affairs.

- Address any buyout or buy-sell rules, detailing what happens if a member wishes to leave the LLC or sell their interest.

- Determine how the Operating Agreement can be amended, specifying who can initiate changes and the required approval process.

Once all sections are carefully filled out, each member must review the entire document to ensure accuracy and agreement on all points. After review, all members should sign and date the Operating Agreement. Keep multiple copies in safe places and consider giving each member a copy. Remember, while the state of Michigan does not require the submission of this document, it serves as a crucial piece of your LLC's internal governance, potentially averting future disputes and misunderstandings among members.

Understanding Michigan Operating Agreement

What is an Operating Agreement and why is it important for an LLC in Michigan?

An Operating Agreement is a foundational document for a Limited Liability Company (LLC) that outlines the organization's financial and functional decisions, including rules, regulations, and provisions. The purpose of this document is to govern the internal operations of the business in a way that suits the specific needs of the business owners. For LLCs in Michigan, while not legally required by the state, having an Operating Agreement is profoundly important. It ensures that all business owners are on the same page regarding the company's operations, and it helps safeguard the limited liability status by showing that the LLC is operating as a separate business entity.

Does Michigan require LLCs to have an Operating Agreement?

No, the state of Michigan does not legally require LLCs to have an Operating Agreement. However, it's highly recommended to create one. This document plays a crucial role in preventing misunderstandings among the business owners by laying out clear guidelines and procedures for the business. Furthermore, it strengthens the credibility of the LLC as an independent entity, which can be vital for protecting members' personal assets from business liabilities.

What should be included in a Michigan Operating Agreement?

A Michigan Operating Agreement typically includes details such as the percentage of members' ownership, allocation of profits and losses, members' rights and responsibilities, management structure, voting rules, and provisions for adding or removing members. It might also detail the procedures for winding down the business. The exact contents can be tailored to fit the unique needs of your business, but it should cover all operational and financial aspects of the LLC.

Can an Operating Agreement be modified?

Yes, an Operating Agreement can be modified if the members of the LLC decide that changes are necessary as the business evolves. However, the process for modifying the Agreement should be established within the original document itself. This typically requires a certain percentage of the vote among members. It's essential that any amendments made to the Agreement are documented in writing and agreed upon by all members to ensure clarity and prevent future disputes.

Is an Operating Agreement necessary if I am the sole owner of an LLC?

Even if you are the sole owner of an LLC, having an Operating Agreement is still advisable. This document adds credibility to your business, establishing it as a separate legal entity. Moreover, it lays out the structure for your business operations and prepares your business for potential growth or changes in ownership. It also helps in clarifying any agreements with financial institutions or investors, ensuring that the limited liability status is recognized and respected.

Common mistakes

When filling out the Michigan Operating Agreement form, a common mistake is not fully understanding the purpose and impact of each section. This document is crucial as it outlines the operational procedures and financial decisions of a limited liability company (LLC). An oversight in comprehending the importance of the sections can lead to vague or incomplete entries, which in turn, might create ambiguity in the company's operations or dispute resolution processes.

Another frequently encountered error is neglecting to specify the distribution of profits and losses clearly. Members of an LLC have the flexibility to decide how they allocate their financial gains and losses, but these decisions need to be recorded in the Operating Agreement. When these allocations are not spelled out with precision, it may result in conflicts among members, especially when the business encounters financial challenges or successes.

Incorrectly listing the members and their respective contributions is yet another oversight seen in completing the Michigan Operating Agreement form. Every member’s contribution, whether in the form of capital, property, or services, must be accurately documented. This detailed record-keeping not only helps in maintaining fairness and transparency among the members but also plays a critical role in the future valuation of the LLC.

A failure to update the Operating Agreement is a significant mistake. As an LLC evolves, so too should its Operating Agreement. Circumstances such as the addition or departure of members, changes in the management structure, or adjustments in the distribution model necessitate updates to the agreement. Without these updates, the document might not reflect the current state of operations, leading to potential legal uncertainties or member disputes.

Lastly, overlooking the need for a detailed dispute resolution section is a common pitfall. Constructing a thorough procedure for handling internal conflicts, whether through mediation, arbitration, or another method, can safeguard the LLC's continuous operation and preserve member relationships. By failing to specify these procedures, members might find themselves entangled in prolonged and costly legal battles should disputes arise.

Documents used along the form

In Michigan, when forming a Limited Liability Company (LLC), the Operating Agreement plays a crucial role by laying out the rules and structures for the business operation. While this document is central to the organization and governance of an LLC, there are several other forms and documents often used alongside it to ensure comprehensive legal and operational setup. Understanding these documents can provide a clearer path for business owners to establish and maintain their businesses properly.

- Articles of Organization: This document is the foundation of any LLC in Michigan. It is filed with the state to legally form the company. The Articles of Organization include basic information such as the name of the LLC, its purpose, office address, and the names of the members.

- Employer Identification Number (EIN) Application: Obtained from the IRS, the EIN is essentially a Social Security number for a business. It is necessary for tax purposes, hiring employees, and setting up business bank accounts. Completing this form is a critical step after forming an LLC.

- Membership Certificates: While not legally required, these certificates serve as physical evidence of ownership in an LLC. They can help clarify and record each member’s stake in the company, complementing the details laid out in the Operating Agreement.

- Annual Report: Michigan requires LLCs to file an annual report with the Michigan Department of Licensing and Regulatory Affairs. This report keeps the state updated on essential information such as the LLC's current address and the names and addresses of its managers or members.

- Operating Agreement Amendment Form: Over time, an LLC may undergo changes in membership, management, or operation that require updates to the original Operating Agreement. This form is used to officially record any amendments to the initial agreement, ensuring that the document remains current and accurate.

These documents complement the Operating Agreement, helping to solidify the legal and operational framework of an LLC in Michigan. Each serves a distinct purpose in the life cycle of a business, from its creation through to its daily operations and compliance with state requirements. Together, they provide a comprehensive foundation for managing and growing a business effectively and within legal bounds. It’s advisable to consult with legal counsel to ensure that all documentation meets the specific needs of your business and complies with Michigan laws and regulations.

Similar forms

The Michigan Operating Agreement form shares similarities with a Partnership Agreement, primarily in structuring the internal operations of a business. Both documents outline the roles, responsibilities, and profit-sharing among participants. While the Operating Agreement is used by Limited Liability Companies (LLCs), Partnership Agreements are designed for partnerships. They're similar in function, providing a framework for resolving disputes, distributing profits and losses, and managing the business. This ensures a clear understanding between the partners or members about how the business will operate and what is expected from each party.

Similar to a Shareholders' Agreement, the Michigan Operating Agreement organizes the rights and obligations of the members within an LLC. Both documents outline procedures for critical business decisions, including the transfer of ownership, distribution of profits and losses, and governance. The difference lies in their use: the Shareholders' Agreement is for corporations with shareholders, while the Operating Agreement suits LLCs. Each serves to protect the interests of the company's stakeholders, ensuring a mutual agreement on business operations and decision-making processes.

A Bylaws document for a corporation has a lot in common with an LLC's Operating Agreement. Bylaws detail the rules and guidelines for the corporation's operations, including the process for holding meetings, electing officers, and making decisions. An Operating Agreement serves a similar purpose for an LLC, outlining the management structure and how decisions are made. Although Bylaws are for corporations and the Operating Agreement is for LLCs, both establish the framework needed to run the business smoothly and effectively.

The Buy-Sell Agreement is another document closely related to the Michigan Operating Agreement. This type of agreement specifies what happens if an owner wants to sell their interest, dies, or becomes disabled. While a Buy-Sell Agreement can stand alone or be incorporated into the Operating Agreement or Shareholders' Agreement, its purpose is to determine how a business transition will occur under various circumstances. The Operating Agreement typically includes similar provisions that control the transfer of membership interests, aligning the business's continuity plan with the owners' intentions.

Lastly, the Employment Agreement has parallels with the Michigan Operating Agreement, though it focuses more on individual employee relationships with the company. Both types of documents define roles and expectations but at different levels. The Operating Agreement lays out the structure, management, and overall operations of the LLC, whereas Employment Agreements detail the job responsibilities, compensation, and conditions of employment for individual workers. Despite their focus on different aspects of business operations, both are essential for delineating boundaries, ensuring compliance, and reinforcing obligations within a business context.

Dos and Don'ts

When you're filling out the Michigan Operating Agreement form for your LLC, getting it right is crucial. This document outlines the ownership and operating procedures of your LLC, so make sure every detail is accurate. Here's a friendly guide on what you should and shouldn't do:

Things You Should Do

- Review Michigan's specific requirements for Operating Agreements to ensure compliance with state laws.

- Ensure all members' information is accurate and complete, including full names and addresses.

- Clearly define each member's contribution to the LLC, whether it's in the form of money, property, or services.

- Detail the process for adding or removing members to avoid future disputes.

- Specify the allocation of profits and losses among members to prevent misunderstandings.

- Include a dispute resolution process within the agreement.

- Regularly update the agreement to reflect any changes in the LLC or its operating procedures.

- Have all members review and sign the agreement to confirm their understanding and agreement.

Things You Shouldn't Do

- Don't use generic templates without customizing them to meet the specific needs of your LLC and comply with Michigan laws.

- Don't leave any sections incomplete; an incomplete agreement may lead to legal ambiguities.

- Don't ignore the importance of specifying the management structure of the LLC.

- Don't forget to outline how decisions will be made within the LLC, including voting rights and procedures.

- Don't overlook the necessity of discussing and planning for the potential dissolution of the LLC.

- Don't include illegal or unenforceable terms in the agreement.

- Don't fail to consult with a legal professional if you have any doubts about the agreement's contents.

- Don't skip having the agreement reviewed by all members before signing, to ensure clarity and mutual understanding.

Misconceptions

When forming a Limited Liability Company (LLC) in Michigan, many entrepreneurs encounter confusion regarding the Operating Agreement. This essential document outlines the LLC's governance structure and how the business will operate. Despite its importance, several misconceptions persist about the Michigan Operating Agreement form. Understanding these can ensure your LLC is built on a solid foundation.

- All Michigan LLCs are required to have an Operating Agreement. It's a common belief that Michigan law mandates every LLC to adopt an Operating Agreement. In reality, while highly recommended for clarifying the roles and responsibilities of members, Michigan does not legally require LLCs to have an Operating Agreement. The decision to create one lies with the LLC members, but it is advisable to have one to ensure all members are on the same page regarding business operations and to protect the LLC's limited liability status.

- The Operating Agreement needs to be filed with the state. Another misconception is that the Operating Agreement must be filed with the Michigan Department of Licensing and Regulatory Affairs or any other state agency. This document is an internal agreement among the members of the LLC and does not need to be filed with the state. However, keeping it in company records and ensuring all members have access to it is crucial.

- There's a standard, one-size-fits-all template for all Michigan LLCs. While templates can serve as a helpful starting point, they should be customized to fit the specific needs and structure of your LLC. Each LLC has unique operations, membership structures, and goals, which should be reflected in the Operating Agreement. Tailoring the document ensures it effectively covers your LLC's operational specifics and member agreements.

- Only multi-member LLCs need an Operating Agreement. Whether you are the sole member of your LLC or have partners, having an Operating Agreement is beneficial. For single-member LLCs, the Operating Agreement reinforces the separate legal entity of the LLC and can provide clarity in cases of legal scrutiny. For multi-member LLCs, it can help resolve disputes and clearly define management and financial arrangements.

- Once created, the Operating Agreement cannot be altered. Quite the opposite, the Operating Agreement should be viewed as a living document that can evolve as the LLC grows and changes. Amendments to the Operating Agreement can be made as long as they follow the procedures set out in the original document or as agreed upon by LLC members. Regularly reviewing and updating the Operating Agreement ensures it remains relevant and effective for governance and operational needs.

Dispelling these misconceptions by providing clear and accurate information can empower LLC owners to make informed decisions about their business operations, ensuring a stronger foundation for their ventures in Michigan.

Key takeaways

When it comes to establishing a Limited Liability Company (LLC) in Michigan, the Operating Agreement is a fundamental document that shouldn’t be overlooked. This agreement outlines the structural, financial, and functional decisions of the business, effectively guiding its operations. Here are key takeaways about filling out and using the Michigan Operating Agreement form:

- Legally not required, but highly recommended: While the state of Michigan does not legally require LLCs to have an Operating Agreement, it is highly advised to create one. This document serves as a cornerstone for any business, ensuring that all members are on the same page regarding the company's operations, and helps to prevent misunderstandings. Additionally, it offers proof of the managerial and financial structure of the business to banks, lenders, and other entities when necessary.

- Flexibility in structure and protection: The Operating Agreement allows LLC members to structure their company in a way that best suits their operations, rather than defaulting to state law. This flexibility can contribute significant protection for members by detailing the operational processes, profit distributions, and even procedures for resolving disputes.

- Details are crucial: When filling out the Operating Agreement, it's critical to be thorough. This document should include the name of the LLC as registered with the state, the duration of the LLC (if not perpetual), the purposes for which the LLC was formed, the names of the members, the manner in which profits and losses will be distributed, and how the LLC will be managed. A well-drafted Operating Agreement can cover even more ground, dealing with the rights and duties of members, voting powers, and protocols for changing the agreement itself or adding and removing members.

- State compliance and amendments: Ensure the Operating Agreement aligns with Michigan laws. While the agreement itself is a private document not filed with any state agency, its contents must not conflict with Michigan statutes. Members should periodically review and update the agreement to reflect changes in the business or law, making sure it always remains compliant and relevant.

More Operating Agreement State Forms

North Carolina Llc Operating Agreement Template - It delineates member duties and responsibilities, ensuring that each person knows their role and expectations.

How to Create an Operating Agreement for an Llc - The agreement is used to ensure that all members are on the same page, reducing the potential for conflict.

How to Make an Operating Agreement - It helps establish a fair mechanism for decision-making, voting, and resolving deadlocks among members or managers.