Fillable Operating Agreement Document for Illinois

Navigating the world of business in Illinois, especially when it comes to LLCs (Limited Liability Companies), calls for a comprehensive understanding and strategic planning. An essential part of this journey involves the Illinois Operating Agreement form. This document stands as the backbone of any LLC operating within the state, providing a detailed framework of the company's organizational structure, operational guidelines, and the responsibilities of its members. Not only does it offer a clear path for resolution in the face of internal disputes, but it also ensures a smooth operation in line with Illinois state laws. Tailored to fit the unique needs of each company, this agreement empowers business owners to dictate terms regarding profit distribution, governance, and the procedures for adding or removing members, among other critical aspects. Though the state does not mandate the submission of this document, having it can significantly protect the business's interests and provide a solid foundation for its operations.

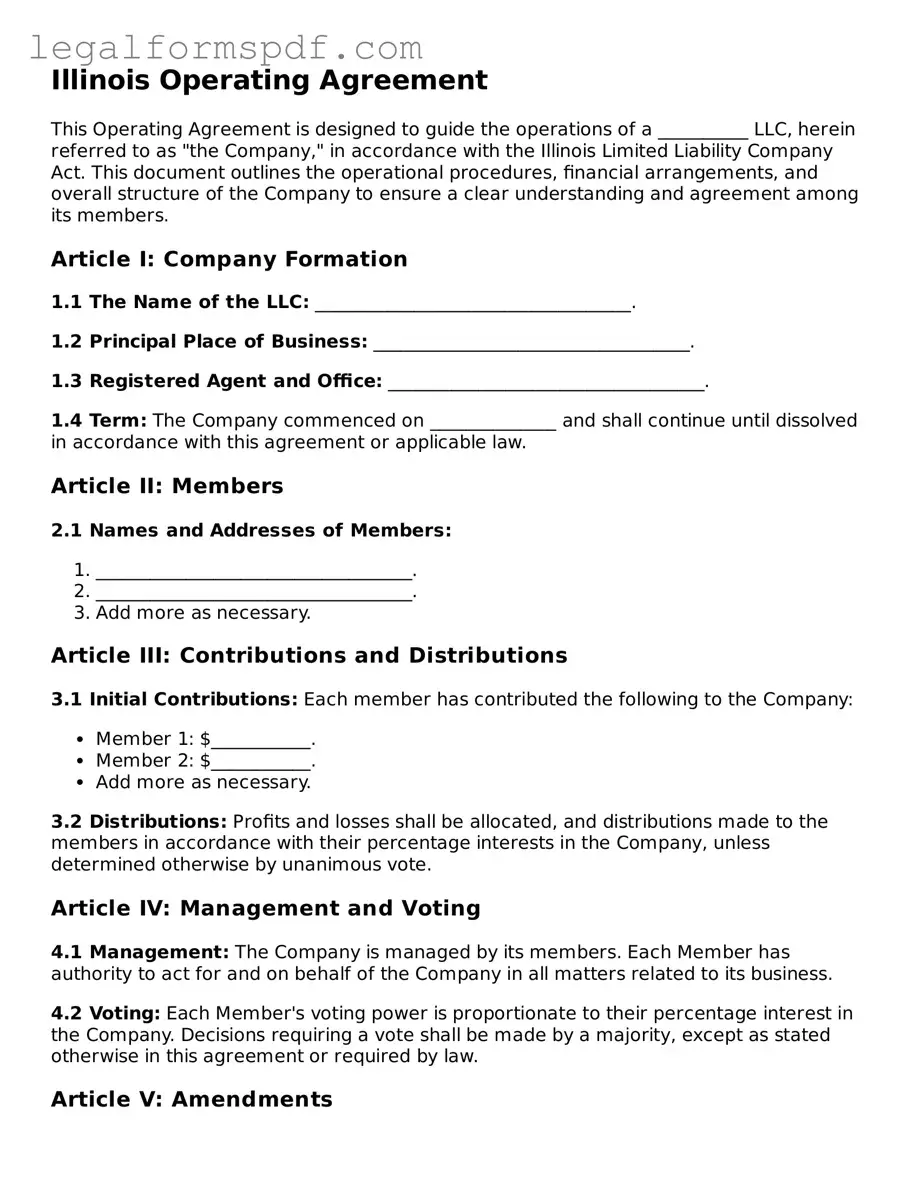

Document Example

Illinois Operating Agreement

This Operating Agreement is designed to guide the operations of a __________ LLC, herein referred to as "the Company," in accordance with the Illinois Limited Liability Company Act. This document outlines the operational procedures, financial arrangements, and overall structure of the Company to ensure a clear understanding and agreement among its members.

Article I: Company Formation

1.1 The Name of the LLC: ___________________________________.

1.2 Principal Place of Business: ___________________________________.

1.3 Registered Agent and Office: ___________________________________.

1.4 Term: The Company commenced on ______________ and shall continue until dissolved in accordance with this agreement or applicable law.

Article II: Members

2.1 Names and Addresses of Members:

- ___________________________________.

- ___________________________________.

- Add more as necessary.

Article III: Contributions and Distributions

3.1 Initial Contributions: Each member has contributed the following to the Company:

- Member 1: $___________.

- Member 2: $___________.

- Add more as necessary.

3.2 Distributions: Profits and losses shall be allocated, and distributions made to the members in accordance with their percentage interests in the Company, unless determined otherwise by unanimous vote.

Article IV: Management and Voting

4.1 Management: The Company is managed by its members. Each Member has authority to act for and on behalf of the Company in all matters related to its business.

4.2 Voting: Each Member's voting power is proportionate to their percentage interest in the Company. Decisions requiring a vote shall be made by a majority, except as stated otherwise in this agreement or required by law.

Article V: Amendments

5.1 Amendment Procedure: This agreement can be amended only with the consent of members holding a majority interest, except as required by law for further protection or to add clarity.

Article VI: Dissolution

The Company may be dissolved upon the agreement of members holding a majority interest, in accordance with the Illinois Limited Liability Company Act and other relevant laws. Upon dissolution, the assets of the Company shall be distributed first to creditors, including members who are creditors, and then to members in accordance with their respective rights and interests.

Signatures

This agreement has been entered into by the undersigned members as of the _____ day of ______________, 20____.

Member Name: ___________________________________

Signature: ___________________________________

Date: ___________________________________

Member Name: ___________________________________

Signature: ___________________________________

Date: ___________________________________

Add more as necessary.PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | An Illinois Operating Agreement is a legal document that outlines the ownership and member duties of a Limited Liability Company (LLC) within the state of Illinois. |

| Legal Requirement | In Illinois, having an Operating Agreement is not mandatory by law for LLCs, but it is highly recommended. |

| Governing Law | Illinois Limited Liability Company Act (805 ILCS 180/) governs the creation and operation of LLCs in Illinois, including Operating Agreements. |

| Flexibility | The document provides flexibility, allowing members to structure their business operations, financial decisions, and profit distribution as they see fit. |

| Protection | It offers a layer of protection for members’ personal assets against the company's debts and liabilities. |

| Conflict Resolution | The agreement can include terms for resolving disputes among members, which can prevent costly legal battles and ensure business continuity. |

| Customization | Operating Agreements are customizable to fit the specific needs and operation style of an LLC, regardless of its size or the number of members. |

Instructions on Writing Illinois Operating Agreement

Filling out the Illinois Operating Agreement form is a fundamental step in structuring your business, offering clarity and organization to the operational aspects. It acts as a legal document that outlines the ownership and member duties within a Limited Liability Company (LLC). Completing this form with due diligence ensures that all members are aware of their responsibilities and the company's procedures. Below is a comprehensive guide to assist you through each step of the process, aiming to make this task as straightforward as possible for you.

- Begin by gathering all necessary information about your LLC, including the business name, principal place of business, and details of all members.

- Enter the full legal name of your LLC as registered with the Illinois Secretary of State.

- Specify the principal place of business, including the complete address. This should be where the primary operations of the LLC occur.

- List all members of the LLC, including their full names and addresses. If the LLC is managed by managers rather than members, also include the managers’ details.

- Outline the contributions of each member to the LLC. This can include capital, property, or services, with a description and the value assigned to each.

- Detail the allocation of profits, losses, and distributions among members. This section should clarify how financial aspects are handled within the LLC.

- If your LLC will be managed by managers, describe the scope of their authority and the process for their selection and removal.

- Include any clauses related to meetings, voting rights, and the process for amending the operating agreement or adding new members.

- Discuss the terms under which the LLC may be dissolved and the procedure for winding up its affairs.

- Ensure that all members review the completed Operating Agreement form. Each member should sign and date the document to validate their agreement to its terms.

After the form is filled out and signed by all members, it is important to keep it in a secure place with other important business documents. Though the State of Illinois does not require LLCs to file their Operating Agreements, having this document is crucial for defining your business structure, protecting your legal rights, and avoiding future disputes among members.

Understanding Illinois Operating Agreement

What is an Illinois Operating Agreement?

An Illinois Operating Agreement is a legal document that outlines the ownership structure and operating procedures of a Limited Liability Company (LLC) in the state of Illinois. This agreement is crucial as it provides a framework for the LLC's operations and offers protection for the company’s members against personal liability for the company's debts and obligations.

Is an Operating Agreement required for an LLC in Illinois?

While the state of Illinois does not legally require LLCs to have an Operating Agreement, it is highly recommended to create one. An Operating Agreement helps to ensure that all business owners are on the same page regarding the company's operational structures and procedures, and it can help prevent conflicts among members by clearly outlining roles and responsibilities.

What should be included in an Illinois Operating Agreement?

An Illinois Operating Agreement should include sections detailing the LLC’s ownership structure, member roles and responsibilities, governance, capital contributions, profit and loss distribution, and procedures for adding or removing members. It should also cover how decisions are made, how meetings are held, and how the LLC will be dissolved if necessary.

Can an Illinois Operating Agreement be modified?

Yes, an Illinois Operating Agreement can be modified if necessary. Most agreements include a provision that outlines the process for making amendments. Typically, a majority or specified percentage of the LLC members must agree to any changes. It’s important that any amendments are documented in writing and acknowledged by all members.

Who should have a copy of the Operating Agreement?

All members of the LLC should have a copy of the Operating Agreement. It's also wise to keep a copy with the LLC's important documents. While it's not required to file this agreement with the state, having it accessible can prove invaluable in resolving disputes or clarifying operational procedures.

Does an Illinois Operating Agreement protect members from personal liability?

Yes, one of the key benefits of an Operating Agreement is that it helps to reinforce the legal separation between the members’ personal assets and the liabilities of the LLC. This separation is crucial in protecting members from being personally liable for the debts and obligations of the business.

How does an Illinois Operating Agreement impact taxes?

An Operating Agreement itself does not directly impact how a business is taxed. However, it can specify how the LLC's profits and losses are distributed among members, which will affect each member's individual tax obligations. Since LLCs can choose different tax treatments, the agreement might also document the chosen tax classification of the LLC.

Is legal assistance required to create an Illinois Operating Agreement?

While it's possible to create an Operating Agreement without legal assistance, consulting with a legal professional can provide valuable insights. A lawyer familiar with Illinois business laws can help ensure that the agreement complies with state requirements and adequately protects the members’ interests.

Common mistakes

When filling out the Illinois Operating Agreement form, one common mistake many people make is not thoroughly defining the roles and responsibilities of each member. This crucial section of the agreement lays the foundation for the company's operational structure and prevents future disputes by clarifying who is responsible for what. Without clear definitions and designations, confusion and disagreements among members may arise, potentially derailing the business's smooth operation.

Another frequent error is neglecting to outline the financial distributions in detail. This section should clearly specify how profits and losses will be divided among the members. A lack of specificity in this area can lead to misunderstandings or discontent down the line. It's essential to spell out the financial arrangements explicitly to ensure all members have aligned expectations regarding their investment returns or contributions.

A third mistake commonly made is failing to include provisions for dispute resolution. Disagreements among members are not uncommon, and the Operating Agreement should have a clear process for handling these situations. Without a pre-defined mechanism for resolution, members may find themselves in lengthy and costly legal disputes. Incorporating methods such as mediation or arbitration can save the company time and resources by providing a roadmap for resolving conflicts.

Lastly, people often overlook the importance of detailing the process for amending the Operating Agreement. As businesses evolve, their agreements must adapt too. Without a clear procedure for making changes, updating the agreement can become a contentious issue, potentially leading to gridlock among members. Ensuring the document includes a method for amendments empowers the company to adapt its governance as needed in a structured and agreed-upon manner.

Documents used along the form

When setting up a business in Illinois, particularly an LLC (Limited Liability Company), the Operating Agreement is a crucial document that outlines the operational structures and financial relationships between the owners of the company. Yet, this document doesn't stand alone in the establishment and operation of a business. Alongside the Operating Agreement, there are several other key forms and documents that are often used to ensure that the business is compliant with state laws, financially organized, and adequately protected. Understanding these documents can simplify the process considerably.

- Articles of Organization: This is the foundational document required to formally register your LLC with the state of Illinois. It includes basic information about your LLC, such as the business name, principal place of business, and the name and address of your registered agent.

- EIN Confirmation Letter: After applying for an Employer Identification Number (EIN) from the IRS, you receive a confirmation letter. This federal tax ID is necessary for tax purposes, hiring employees, and opening business bank accounts.

- Business Licenses and Permits: Depending on the type of business you're operating and its location, you might need specific licenses and permits to legally operate in Illinois. These documents vary greatly and could include anything from a general business license to industry-specific permits.

- Operating Procedures Manual: While not a legal requirement, creating an Operating Procedures Manual can help ensure that day-to-day operations run smoothly. This document outlines the standard operating procedures for tasks critical to the business.

- Member Certificates: These certificates serve as physical proof of ownership in the LLC. They can be important for establishing the legitimacy of the business and are useful during financial transactions or when bringing in new members.

- Annual Report: Illinois requires LLCs to file an annual report with the Secretary of State. This report keeps the state updated on key information about your business, such as addresses, members’ names, and the identity of the managing member or manager.

Together, these documents form a comprehensive framework that supports the Operating Agreement in establishing and maintaining the legal and operational structures of your LLC. Properly managing these documents can lead to smoother operations and help in avoiding legal or financial pitfalls. Keeping these documents updated and in compliance with Illinois state laws is not just about following the rules—it's about setting the groundwork for your business's success.

Similar forms

An Illinois Operating Agreement is quite similar to a Partnership Agreement, as both establish the working relationship between the business owners. Just like an Operating Agreement sets forth the rules and procedures for the operation of a Limited Liability Company (LLC), a Partnership Agreement outlines how a partnership will be managed. Both documents detail the distribution of profits and losses, governance, and what happens upon the dissolution of the business, thereby providing a framework for how the business is to be run.

Another document akin to the Illinois Operating Agreement is the Bylaws of a corporation. While the Operating Agreement applies to LLCs, Bylaws perform a similar function for corporations by detailing the internal management structure. They dictate how decisions are made within the corporation, the roles and responsibilities of the directors and officers, and how meetings are held. Both types of documents are crucial for ensuring that the business operations are clear to all members or shareholders involved.

The Shareholder Agreement also shares similarities with an Illinois Operating Agreement but is used by corporations rather than LLCs. It outlines how shares can be bought and sold, any restrictions on share transfers, and the rights and responsibilities of shareholders. Like the Operating Agreement, it helps prevent conflicts within the business by clearly stating how key issues are to be handled.

An Illinois Operating Agreement can be compared to a Buy-Sell Agreement as well. The latter is often included within an Operating Agreement or a Shareholder Agreement and delineates how a member's share of the business is reassigned if they die, become incapacitated, or leave the company. This ensures the business can continue operating smoothly without disputes over ownership or succession.

The Employee Handbook, while broader in scope, contains similarities to an Operating Agreement in that it outlines the policies and procedures of the workplace for employees. Though it doesn't govern the structure of the business itself, it similarly sets expectations and guidelines intended to prevent disputes and misunderstandings by clarifying rules and expectations within the company.

Indirectly similar, a Business Plan is a document that outlines the strategic direction and goals of a business, along with the steps to achieve these goals. While an Operating Agreement does not typically detail a company's strategic plans, both documents are crucial for the smooth operation and planning of a business, providing a roadmap for its growth and how it is to be managed.

A Commercial Lease Agreement, though primarily a contract between a landlord and a business for the rental of property, shares the commonality of stipulating terms and conditions crucial for business operations. Just as an Operating Agreement details the operational roles and responsibilities within an LLC, a Commercial Lease Agreement outlines the responsibilities of both the landlord and the tenant in the context of the business property, impacting the day-to-day operations of a business.

Finally, the Non-Disclosure Agreement (NDA) shares a conceptual similarity with an Illinois Operating Agreement. An NDA is often necessary when forming new business relationships, protecting confidential information. Similarly, an Operating Agreement may include clauses that protect the company's proprietary information and outline the consequences of disclosing such information, thereby safeguarding the business's interests.

Dos and Don'ts

When filling out the Illinois Operating Agreement form, it's important to approach the process with attention to detail and thorough understanding. This document serves as a critical foundation for your limited liability company (LLC), outlining the rights, responsibilities, and relationships among the members as well as between the members and the LLC itself. To ensure clarity and prevent future disputes, consider the following guidelines:

Do:

- Review the requirements specific to Illinois law to ensure your Operating Agreement complies.

- Clearly outline the distribution of profits and losses among members.

- Include detailed provisions for the addition or removal of members to facilitate smooth transitions as your business evolves.

- Specify the management structure of the LLC, whether it is member-managed or manager-managed.

- Prepare for the unexpected by including a dissolution clause, detailing the process for winding up the business.

- Ensure every member thoroughly reviews the Agreement before signing, to confirm it reflects the mutual understanding and agreement of all parties.

- Keep a signed copy of the Operating Agreement in a secure location, easily accessible to all members.

Don't:

- Avoid using vague or ambiguous language that can lead to misunderstandings.

- Do not skip over sections you feel are not currently relevant; future circumstances can change, making all parts of the Agreement potentially important.

- Resist the temptation to use a generic template without customizing it to your LLC's specific needs.

- Forget to update the Operating Agreement as your LLC grows or undergoes significant changes.

- Avoid leaving any sections blank; if certain areas do not apply, clearly mark them as "Not Applicable."

- Do not disregard the need for all members to consent to the changes when making amendments to the Operating Agreement.

- Do not file your Operating Agreement with the state of Illinois; it's an internal document, but make sure it is accessible to all members.

Misconceptions

When it comes to understanding the Illinois Operating Agreement form for LLCs, there are a number of misconceptions that can lead business owners astray. Correcting these misunderstandings is vital to ensure that you navigate your business’s legal landscape effectively.

An Operating Agreement is not necessary in Illinois. This is a common misconception. While Illinois does not legally require LLCs to have an Operating Agreement, having one in place is crucial. It outlines the managerial structure and financial decisions, reducing potential conflicts among members.

Operating Agreements are the same in every state. This is not true. State statutes can significantly influence the content of an Operating Agreement, and what might be advisable or mandatory in one state may not be in another. Illinois has specific requirements and customs that might not be present elsewhere.

Only multi-member LLCs need an Operating Agreement. Even if your LLC has just one member, having an Operating Agreement is beneficial. It helps establish your business as a separate entity, providing crucial legal protections.

The form can fully replace the need for legal counsel. Even though many templates and forms, including those for Operating Agreements, are available, they cannot replace personalized legal advice. Every business situation is unique and might have specific legal needs that a standard form can't address.

Once an Operating Agreement is made, it cannot be changed. Operating Agreements can and should be updated as your business grows and evolves. Changes in membership, business operations, or Illinois law may necessitate revisions to ensure the agreement remains relevant and effective.

Operating Agreements are only about the distribution of profits and losses. While profit and loss distribution is a crucial aspect, Operating Agreements cover a wide range of topics, including management structure, voting rights, and procedures for adding or removing members. They lay the groundwork for the company's operational procedures and governance.

All members must have equal shares and rights under the Operating Agreement. This is not necessarily the case. The Operating Agreement can specify different levels of investment, responsibilities, and profit shares among members, tailoring the business structure to its members' needs and contributions.

There is no deadline or ideal timing for creating an Operating Agreement. While it's true that Illinois does not set a specific deadline, it is highly advisable to adopt an Operating Agreement early in the life of your LLC. Doing so sets clear expectations and helps avoid potential disputes among members.

Every Operating Agreement must be filed with the state of Illinois. This is incorrect. While an Operating Agreement is a critical document for your LLC, it does not need to be filed with the state. It is an internal agreement and should be kept with your business records.

Clarifying these misconceptions ensures that your LLC is better prepared to handle the intricacies of operating in Illinois. Always remember, when in doubt, seeking professional legal advice is the best course of action.

Key takeaways

An Illinois Operating Agreement form is a crucial document for your Limited Liability Company (LLC). It outlines the ownership and member duties, which is essential for your business's smooth operation and legal protection. If you're in the process of filling out or using one, here are key takeaways to keep in mind:

- It's not required by the state, but it's critical: Unlike some legal documents, Illinois doesn't require LLCs to have an Operating Agreement. However, having one is highly recommended. It protects your business operations, clarifies legal details, and ensures everyone involved understands their responsibilities and rights.

- Customization is key: Use the Operating Agreement to tailor the structure of your LLC to fit your specific needs. Generic forms might not cover all aspects of your business, so it's worth the effort to customize your agreement.

- Define the financial and managerial structure: Clearly outline how profits and losses will be divided, and describe the decision-making processes. This clarity can prevent conflicts among members down the line.

- Detail the membership changes procedures: Life is unpredictable. Your Operating Agreement should include processes for adding or removing members, as well as handling an owner's departure, whether it's due to retirement, death, or another reason.

- Don't forget about dissolution: Though it might seem pessimistic, including a plan for dissolving the company is a smart move. This plan should outline the steps to be taken if the company needs to be wound up.

- The agreement should evolve: As your business grows and changes, your Operating Agreement should, too. Make it a living document that's reviewed and updated regularly to reflect changes in management, ownership, or business operations.

- Legal help can be invaluable: While it's possible to create an Operating Agreement on your own, consulting with a legal expert can ensure that your document is comprehensive and complies with Illinois law. This can provide peace of mind and prevent headaches down the road.

Remember, your LLC's Operating Agreement is more than just a formality; it's a foundational document that can help safeguard your business's future. Taking the time to craft a thorough and customized agreement is a wise investment in the stability and success of your enterprise.

More Operating Agreement State Forms

Pennsylvania Operating Agreement - The agreement is vital for managing member changes without disrupting the business's continuity or legal standing.

Does Llc Need Operating Agreement - In the event of legal scrutiny, provides documented evidence of the agreed-upon structure and practices of the LLC.

Llc Operating Agreement Michigan - The form can limit or define the power of members to enter into contracts, borrow money, or make significant decisions on behalf of the LLC.