Fillable Operating Agreement Document for Georgia

An Operating Agreement stands as a foundational document for Limited Liability Companies (LLCs) in Georgia, detailing the internal operations and framework for the business's governance. This vital document, although not a mandatory requirement in the state of Georgia, serves as a critical tool for establishing clear guidelines on the management structure, profit sharing, roles and responsibilities of members, and protocols for addressing disputes or changes in ownership. Crafting a well-thought-out Operating Agreement can significantly contribute to the seamless functioning of an LLC, offering a customized blueprint that reflects the unique needs and goals of the business. Beyond its practical advantages in clarifying business operations, this agreement also reinforces the legal protection inherent in the LLC structure, by underscoring the separation between the members' personal assets and the liabilities of the business. Thus, while Georgia law does not enforce the creation of an Operating Agreement, its importance in ensuring the smooth and efficient operation of an LLC cannot be overstated, providing a solid foundation upon which businesses can build and grow confidently.

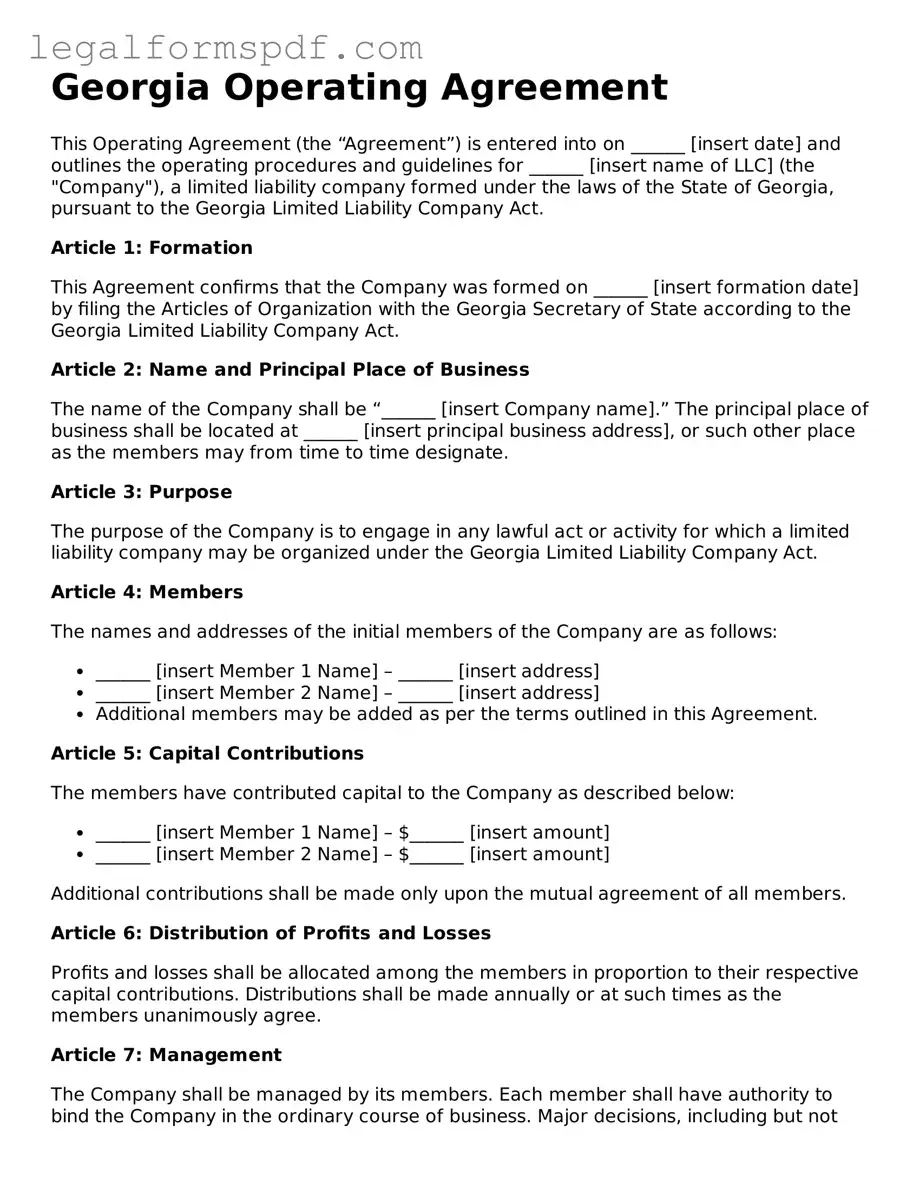

Document Example

Georgia Operating Agreement

This Operating Agreement (the “Agreement”) is entered into on ______ [insert date] and outlines the operating procedures and guidelines for ______ [insert name of LLC] (the "Company"), a limited liability company formed under the laws of the State of Georgia, pursuant to the Georgia Limited Liability Company Act.

Article 1: Formation

This Agreement confirms that the Company was formed on ______ [insert formation date] by filing the Articles of Organization with the Georgia Secretary of State according to the Georgia Limited Liability Company Act.

Article 2: Name and Principal Place of Business

The name of the Company shall be “______ [insert Company name].” The principal place of business shall be located at ______ [insert principal business address], or such other place as the members may from time to time designate.

Article 3: Purpose

The purpose of the Company is to engage in any lawful act or activity for which a limited liability company may be organized under the Georgia Limited Liability Company Act.

Article 4: Members

The names and addresses of the initial members of the Company are as follows:

- ______ [insert Member 1 Name] – ______ [insert address]

- ______ [insert Member 2 Name] – ______ [insert address]

- Additional members may be added as per the terms outlined in this Agreement.

Article 5: Capital Contributions

The members have contributed capital to the Company as described below:

- ______ [insert Member 1 Name] – $______ [insert amount]

- ______ [insert Member 2 Name] – $______ [insert amount]

Additional contributions shall be made only upon the mutual agreement of all members.

Article 6: Distribution of Profits and Losses

Profits and losses shall be allocated among the members in proportion to their respective capital contributions. Distributions shall be made annually or at such times as the members unanimously agree.

Article 7: Management

The Company shall be managed by its members. Each member shall have authority to bind the Company in the ordinary course of business. Major decisions, including but not limited to those relating to finance, expansion, and dissolution, shall require unanimous consent of all members.

Article 8: Amendments

This Agreement may be amended only by a written document signed by all members. Any such amendments shall comply with the Georgia Limited Liability Company Act.

Article 9: Dissolution

The Company may be dissolved upon the unanimous consent of its members or as otherwise provided by the Georgia Limited Liability Company Act. Upon dissolution, the assets of the Company shall be liquidated and distributed according to the members’ capital contributions after settling all debts and obligations.

Article 10: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Georgia, without giving effect to any principles of conflicts of law.

IN WITNESS WHEREOF, the undersigned have executed this Operating Agreement as of the date first above written.

Member Signature: ______ [signature]

Name: ______ [print name]

Date: ______ [date]

Member Signature: ______ [signature]

Name: ______ [print name]

Date: ______ [date]

Additional signature lines can be added for more members.PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Georgia Operating Agreement form is used to outline the operating procedures and financial decisions of a limited liability company (LLC) in Georgia. |

| Legality | This form is not mandatory by Georgia state law but is highly recommended to avoid future disputes among members or with the state. |

| Governing Law | It is governed under the 2010 Georgia Code, specifically Title 14, which pertains to corporations, partnerships, and associations. |

| Flexibility | The agreement offers flexibility, allowing LLC members to structure their financial and working relationships in a way that suits them best. |

Instructions on Writing Georgia Operating Agreement

When starting a business in Georgia, composing an Operating Agreement is a step towards ensuring that the operational aspects of the company are clearly defined and agreed upon by all members. Even though this document isn't filed with the state, it's crucial for defining the roles, responsibilities, and financial decisions of the business owners. Having this agreement in place can safeguard your business operations and provide a clear framework for resolving potential disputes. To effectively fill out a Georgia Operating Agreement form, follow these steps. Keep in mind, attention to detail will save you from potential headaches down the line.

- Gather all necessary information about your business, including the business name, principal place of business, and information about each member such as their names and addresses.

- Establish the company’s term of duration if it’s not intended to be perpetual.

- Outline the contributions of each member, whether in the form of cash, property, or services, and document this in the agreement.

- Specify the allocation of profits and losses among members. This usually aligns with their percentage of ownership unless agreed otherwise.

- Describe the process for managing the company, including voting rights and the roles of members in daily operations and decision-making.

- Document any restrictions on the transfer of membership interests, to ensure members who leave or sell their shares do so in a manner that's agreeable to remaining members.

- Outline procedures for admitting new members and handling the departure or death of existing members.

- Delineate the conditions under which the operating agreement can be amended in the future.

- Detail the dissolution process of the company, specifying how assets will be distributed among members if the company is dissolved.

- Have all members review the final draft of the Operating Agreement to ensure accuracy and mutual understanding of its contents.

- Ensure that each member signs and dates the Operating Agreement. Keep the signed document safe as part of your business records.

Completing the Operating Agreement is a foundational step towards establishing your business's operational framework. It is a testament to the commitment of each member to the success and longevity of the company. With this document finalized, you can proceed confidently, knowing that you have a well-defined structure for navigating your business towards its objectives.

Understanding Georgia Operating Agreement

What is an Operating Agreement in Georgia?

An Operating Agreement is a legal document that outlines the ownership structure and operating procedures of a Limited Liability Company (LLC) in Georgia. This agreement is crucial for establishing clear rules and expectations among members, managing financial and functional decisions, and providing legal protections by reinforcing the LLC's status as a separate legal entity.

Is an Operating Agreement required for LLCs in Georgia?

In Georgia, LLCs are not legally required to create or file an Operating Agreement with the state. However, having one is highly recommended as it provides evidence of the structure and policies of the business, which can be crucial in legal disputes, for tax purposes, and when opening business bank accounts.

What should be included in a Georgia Operating Agreement?

An Operating Agreement in Georgia should include details such as the LLC’s name, the principal place of business, the names of the members, the distribution of profits and losses, the management structure, voting rights and responsibilities of members, guidelines for meetings, buyout and buy-sell rules, and dissolution procedures. It may also outline initial contributions, membership changes, and dispute resolution procedures.

Can an Operating Agreement be modified?

Yes, an Operating Agreement can be modified if the members agree to the changes according to the procedures set forth in the original agreement. It is common for an Operating Agreement to require a majority or supermajority vote for amendments. After making changes, the revised agreement should be distributed to all members and kept with the company records.

How does an Operating Agreement protect an LLC's members in Georgia?

An Operating Agreement provides several protections for an LLC's members in Georgia. It clarifies the members' rights, roles, and responsibilities, thus reducing the potential for internal disputes. It helps to ensure that members' personal assets are protected from business liabilities, reinforcing the principle that the LLC is a separate legal entity. The agreement also offers credibility to the LLC, which can be beneficial in financial transactions.

Where can one obtain an Operating Agreement form for a Georgia LLC?

Operating Agreement forms for a Georgia LLC can be drafted by an attorney to ensure they meet the specific needs of the business. Additionally, several online resources and legal services offer customizable Operating Agreement templates that comply with Georgia law. It's important to ensure that any template used is tailored to the particular requirements of the LLC and reviewed by a legal professional.

Common mistakes

When starting a business in Georgia, one important step is creating an Operating Agreement for your Limited Liability Company (LLC). This document sets the foundation for how your business will operate. Unfortunately, many people make mistakes during this process. Understanding these common errors can help ensure your LLC is on solid ground from the start.

One frequent mistake is not customizing the Operating Agreement to fit the specific needs of the business. Often, individuals might find a generic template online and use it as is, without considering how their business might differ from the template. Every business is unique, and the Operating Agreement should reflect that uniqueness. This document should address specific arrangements, like profit sharing and management duties, that are tailored to the needs of your LLC.

Another common error is failing to clearly outline the roles and responsibilities of each member. This lack of clarity can lead to confusion and conflicts down the line. It's critical to detail what is expected from each member of the LLC in the Operating Agreement. Defining these roles early on ensures that everyone understands their responsibilities, contributing to a more efficient and harmonious business operation.

Many also neglect the importance of including provisions for dispute resolution within their Operating Agreement. Conflicts are almost inevitable in any business venture. Having predetermined methods for handling disputes outlined in your Operating Agreement can save a lot of stress and legal headaches. Options might include mediation, arbitration, or a specific dispute resolution process that suits your business style.

Forgetting to plan for the future is a mistake that can have serious implications for an LLC. This includes not having clear processes in place for adding or removing members and not considering the procedures for the eventual dissolution of the LLC. A strong Operating Agreement should also contain buyout schemes or succession plans. Planning for these events in advance can make transitions smoother and less contentious.

Last but not least, a critical oversight is not reviewing and updating the Operating Agreement regularly. As a business evolves, so too should its operating document. Changes in membership, management structures, or business operations might necessitate updates to the agreement. Failing to keep this document up-to-date can lead to operational inconsistencies and legal vulnerabilities. Regular reviews, at least annually, can help ensure that your LLC’s Operating Agreement continues to reflect the current state of your business accurately.

Documents used along the form

When setting up or running a Limited Liability Company (LLC) in Georgia, the Operating Agreement is a crucial document that outlines the operational and financial arrangements of the business, as well as the rights and responsibilities of its members. However, this is just one piece of the puzzle. To ensure a smooth and legally compliant business operation, there are several other forms and documents that are often used in conjunction with the Georgia Operating Agreement form. These documents help in various ways, from legal compliance to financial management and beyond. Understanding each one can provide valuable insights into the efficient management of an LLC.

- Articles of Organization: Before an Operating Agreement is even drafted, an LLC must officially form by filing the Articles of Organization with the Georgia Secretary of State. This document officially registers the business with the state and includes basic information such as the LLC's name, address, and the names of its members.

- Employer Identification Number (EIN) Application: Most LLCs will need to obtain an EIN from the IRS, which is essentially a Social Security number for a business. This number is required for tax purposes and to open a business bank account.

- Business License Application: Depending on the nature of its activities and its location, an LLC may need to apply for one or more business licenses or permits from the state of Georgia, local county, or city authorities to legally operate.

- Operating Agreement Amendment Form: Over time, an LLC might need to make changes to its Operating Agreement due to changes in membership, management, or the way it operates. An Operating Agreement Amendment Form is used to make these changes official.

- Annual Registration Form: Georgia requires LLCs to file an annual registration with the Secretary of State. This helps keep the state records up to date with current information about the business’s principal office address, mailing address, and the names of its managers or members.

Together with the Operating Agreement, these documents form a comprehensive legal framework that governs the operation of an LLC in Georgia. Each plays a specific role in ensuring that the business not only starts off on the right legal footing but also continues to operate smoothly, comply with state laws, and meet its obligations to members, employees, and the government. By staying informed about and utilizing these documents appropriately, LLC owners can focus on growing their businesses with confidence.

Similar forms

The Georgia Operating Agreement form shares similarities with the Partnership Agreement primarily in how it structures the relationship between the involved entities. Both documents serve to outline the operations, responsibilities, and financial arrangements among business partners, explicitly delineating roles, capital contributions, and procedures for dispute resolution. The key difference lies in their application to different types of business entities; limited liability companies (LLCs) use operating agreements, while partnerships use partnership agreements.

Similar to the Bylaws of a Corporation, the Georgia Operating Agreement provides a framework within which the business operates, but for LLCs. These documents establish the company's internal management structure, rules, and guidelines. While corporate bylaws are used by corporations, operating agreements fulfill a similar role for LLCs, detailing member duties, meetings, and the mechanisms for handling changes in membership.

The Shareholder Agreement bears resemblance to the Operating Agreement in terms of regulating the relationships between the owners of a business. Shareholder agreements are specific to corporations and deal with issues such as share transfers and the rights and obligations of shareholders, akin to how operating agreements detail the workings between members of an LLC.

The Members' Agreement of a Cooperative is another document akin to the Georgia Operating Agreement, as both lay out the operational and governance structure of the organization. While cooperatives use members' agreements to govern member roles, contributions, and benefits, LLCs use operating agreements for similar purposes among their members.

The Buy-Sell Agreement closely aligns with the Operating Agreement in its provision for the future transfer of business ownership. Although buy-sell agreements can apply across business types, they are akin to operating agreements in that they may specify conditions under which business interests can be sold or must be bought, providing a mechanism for business continuity and ownership transitions.

Employment Contracts, while more individual in nature, share the feature of outlining roles and responsibilities, this time between an employer and an employee. The Operating Agreement does this on a broader scale, delineating the roles, responsibilities, and financial entitlements of members within an LLC, ensuring that each party's obligations and benefits are clear.

The Franchise Agreement parallels the Operating Agreement in setting forth the rights, obligations, and operational guidelines between franchisors and franchisees, similar to how an operating agreement sets rules for LLC members. This includes management policies, brand use regulations, and financial arrangements, tailored to the franchising business model.

A Trust Agreement, though distinct in purpose, is similar to an Operating Agreement in that it outlines the administration and purpose of the entity it governs. In a trust, this involves stipulating how the trust's assets are to be managed and distributed, which mirrors the Operating Agreement's role in delineating how an LLC's operations and member contributions are managed.

The Joint Venture Agreement shares its core purpose with the Operating Agreement in establishing the terms of a business endeavor between two or more parties. Like operating agreements, these documents detail the venture's operational, financial, and management arrangements, tailored to projects owned and operated by more than one entity.

Lastly, the Non-Disclosure Agreement (NDA) shares with the Operating Agreement the aspect of confidentiality, albeit the NDA focuses specifically on protecting sensitive information. Within an LLC, the Operating Agreement might also contain clauses that safeguard the company's proprietary information, ensuring members adhere to confidentiality on business practices and internal affairs.

Dos and Don'ts

Filling out the Georgia Operating Agreement form requires attention to detail and a clear understanding of the requirements. Below are essential dos and don'ts one should follow to ensure the process is smooth and compliant.

- Do ensure that all members' names and addresses are accurately recorded. This foundational step prevents issues with identity and notices.

- Do specify each member's contribution to the LLC. Whether in terms of capital, property, or services, clarity in this area is critical for understanding ownership stakes.

- Do outline the process for admitting new members. Growth or changes in ownership can be managed seamlessly with a clear protocol.

- Do detail the distribution of profits and losses. By establishing this upfront, disagreements can be minimized.

- Do include a dispute resolution process. Should disagreements arise, a pre-established method of resolving them protects all parties.

- Don't overlook the importance of having the agreement reviewed by a legal professional. Their expertise can catch oversights and ensure compliance with state laws.

- Don't leave any section incomplete. If a section does not apply, explicitly note this rather than leaving it blank, to avoid the appearance of oversight.

- Don't neglect to update the agreement as the company evolves. Changes in operations, membership, or laws may necessitate revisions.

- Don't forget to have all members sign the document. An Operating Agreement is not legally binding without the signatures of all parties involved.

Misconceptions

When it comes to understanding the Georgia Operating Agreement form, several misconceptions can lead to confusion. Clarifying these can help ensure proper compliance and make the management of a Limited Liability Company (LLC) smoother. Here are five common misunderstandings:

The Operating Agreement is not required by law in Georgia. While it's true that Georgia does not mandate LLCs to have an Operating Agreement, having one in place is crucial. It outlines the operating procedures, financial arrangements, and provides clarity and structure that can prevent disputes among members.

All Operating Agreements are the same. This is a misconception. Although many Operating Agreements cover similar basic elements, each can be uniquely tailored to fit the specific needs and structure of an LLC. Variables such as management structure, capital contributions, and distribution of profits and losses can differ significantly from one agreement to another.

An attorney is required to draft an Operating Agreement. While consulting with a legal professional can ensure that an Operating Agreement complies with state laws and includes all necessary provisions, it is not a legal requirement. Many resources are available to help LLC members draft their agreements. However, the complexity of the business or its ownership might necessitate professional legal assistance.

Operating Agreements are only for multi-member LLCs. This misunderstanding might lead single-member LLC owners to overlook the importance of having an Operating Agreement. Even for a single-member LLC, an Operating Agreement can provide structure, outline the business’s financial and operational procedures, and offer legal protection.

Once signed, the Operating Agreement cannot be changed. Operating Agreements are meant to be dynamic documents that can evolve as the business grows and changes. Modifications can be made to the agreement as long as the changes are agreed upon by all LLC members according to the procedures outlined in the existing agreement or by state law.

Key takeaways

An Operating Agreement is crucial for Georgia LLCs as it outlines the ownership and operational guidelines of the business. When filling out and using the Georgia Operating Agreement form, keeping a few key points in mind is essential for the success and smooth operation of your LLC.

- Personalize Your Agreement: Ensure that the Operating Agreement is tailored to fit the specific needs and structure of your LLC. A generic agreement may not cover all the unique aspects of your business.

- Define Member Roles and Responsibilities: Clearly outline each member's roles, responsibilities, and obligations to avoid confusion and conflict in the future.

- Detail the Profit and Loss Distribution: Specify how profits and losses will be distributed among members. This should align with their contributions and ownership percentages to ensure fairness.

- Outline the Management Structure: Decide whether your LLC will be managed by its members or a designated manager. This decision should be reflected in your agreement.

- Include Buyout and Buy-Sell Provisions: Prepare for future changes in membership by detailing how a member's share will be handled in the event they wish to exit the LLC.

- Specify the Meeting and Voting Procedures: Establish clear protocols for how meetings will be held, how votes will be counted, and the percentage of votes needed for various decisions.

- Amendment Process: Outline a process for amending the Operating Agreement should it become necessary as your business evolves.

- Sign and Store Properly: Ensure all members sign the Operating Agreement. Keep the document in a secure location where it can be easily accessed by members when needed.

- Review Annually: Your LLC can change and grow; review and, if needed, amend your Operating Agreement annually to reflect any significant changes.

Remember, a well-crafted Operating Agreement serves as the foundation for your LLC's operations and can help prevent misunderstandings among members by providing clear guidelines and procedures. Take the time to ensure that your Georgia Operating Agreement accurately reflects the operations, structure, and goals of your LLC.

More Operating Agreement State Forms

How to Make an Operating Agreement - Creating an Operating Agreement allows members to opt out of default state laws that may not be to their advantage, customizing rules that better suit their business needs.

Llc Operating Agreement Michigan - An Operating Agreement form outlines the rules and procedures for the internal management of a limited liability company (LLC).

Florida Operating Agreement - An Operating Agreement can include provisions for the management of daily affairs, outlining the authority and duties of managers and members.