Fillable Operating Agreement Document for Florida

When forming a Limited Liability Company (LLC) in Florida, one key document that often receives significant attention is the Operating Agreement. This internal document is not just a formality; it serves as the backbone for the establishment's structure and procedures, detailing the arrangements between members regarding the company's financial and functional decisions. Unlike some states, Florida does not require an LLC to have an Operating Agreement. However, having one in place is highly recommended as it provides a clear framework for operations and helps protect the members' personal assets from legal disputes and liability. Additionally, this agreement becomes particularly important in multi-member LLCs, where it can outline the distribution of profits and losses, voting rights, and what happens if a member decides to leave the LLC. Though the state of Florida provides a degree of flexibility, enabling LLC owners to customize their Operating Agreements to suit their specific needs, several essential sections should be considered to ensure comprehensive coverage of the company's governance and operational scope.

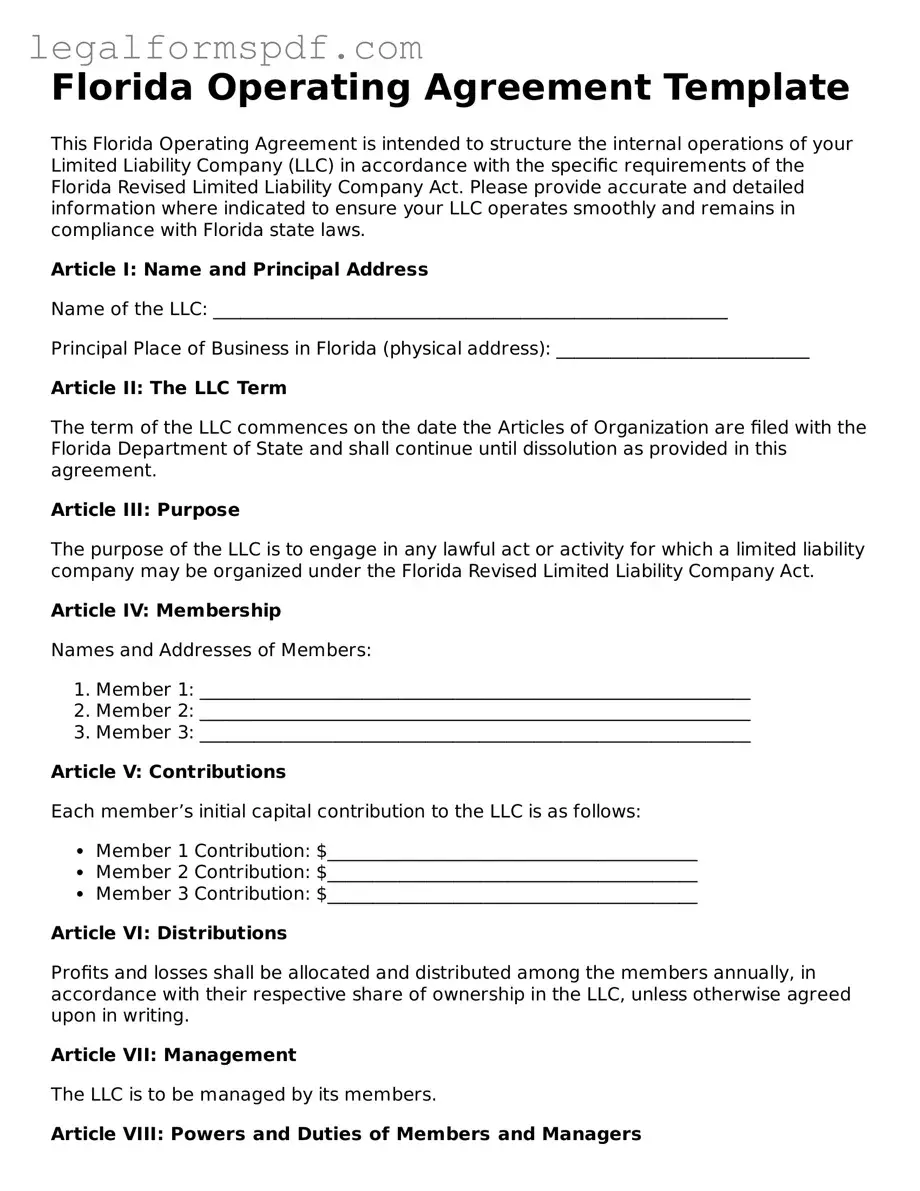

Document Example

Florida Operating Agreement Template

This Florida Operating Agreement is intended to structure the internal operations of your Limited Liability Company (LLC) in accordance with the specific requirements of the Florida Revised Limited Liability Company Act. Please provide accurate and detailed information where indicated to ensure your LLC operates smoothly and remains in compliance with Florida state laws.

Article I: Name and Principal Address

Name of the LLC: _________________________________________________________

Principal Place of Business in Florida (physical address): ____________________________

Article II: The LLC Term

The term of the LLC commences on the date the Articles of Organization are filed with the Florida Department of State and shall continue until dissolution as provided in this agreement.

Article III: Purpose

The purpose of the LLC is to engage in any lawful act or activity for which a limited liability company may be organized under the Florida Revised Limited Liability Company Act.

Article IV: Membership

Names and Addresses of Members:

- Member 1: _____________________________________________________________

- Member 2: _____________________________________________________________

- Member 3: _____________________________________________________________

Article V: Contributions

Each member’s initial capital contribution to the LLC is as follows:

- Member 1 Contribution: $_________________________________________

- Member 2 Contribution: $_________________________________________

- Member 3 Contribution: $_________________________________________

Article VI: Distributions

Profits and losses shall be allocated and distributed among the members annually, in accordance with their respective share of ownership in the LLC, unless otherwise agreed upon in writing.

Article VII: Management

The LLC is to be managed by its members.

Article VIII: Powers and Duties of Members and Managers

Each Member and any Managers shall have the power to bind the LLC in connection with the business of the LLC, subject to any limitations set forth in this agreement.

Article IX: Amendments

This Operating Agreement can only be amended in writing by unanimous consent of all the members.

Article X: Dissolution

The LLC may be dissolved upon the occurrence of any of the following events:

- The consent of all members to dissolve the LLC;

- An event that makes continuation of the business of the LLC unlawful under Florida law;

- Any other event causing dissolution as defined in the Florida Revised Limited Liability Company Act.

Article XI: Governing Law

This Operating Agreement shall be governed by and construed in accordance with the laws of the State of Florida.

IN WITNESS WHEREOF, the undersigned have executed this Operating Agreement as of the latest date written below:

Member(s) Signature(s): ____________________________________ Date: _____________

Member(s) Signature(s): ____________________________________ Date: _____________

Add more signature lines as necessaryPDF Specifications

| Fact | Description |

|---|---|

| Definition | An Operating Agreement is a legal document that outlines the ownership and operating procedures of an LLC in Florida. |

| Governing Law | The Florida Revised Limited Liability Company Act, under Chapter 605 of the Florida Statutes, governs the Operating Agreement and its provisions. |

| Requirement | While not mandated by state law, it's highly recommended to have an Operating Agreement to ensure the smooth operation of an LLC in Florida. |

| Flexibility | The Operating Agreement allows LLC members to structure their financial and working relationships in a way that suits them best, offering considerable flexibility beyond the basic legal requirements. |

| Protection | Having an Operating Agreement in place can offer members protection from personal liability to the LLC's debts and obligations, reinforcing the limited liability status. |

Instructions on Writing Florida Operating Agreement

When forming a Limited Liability Company (LLC) in Florida, an essential step is to prepare and complete an Operating Agreement. This document outlines the ownership and operating procedures of the LLC, providing a clear framework for how the business is run. Although the state of Florida doesn't require an Operating Agreement to be filed, having one in place is highly recommended for the smooth operation and management of the LLC. The following instructions aim to guide you through filling out a Florida Operating Agreement form comprehensively.

- Gather all necessary information about your LLC, including the official company name, principal place of business, and the names and addresses of all members (owners).

- Specify the duration of your LLC if it is not intended to be perpetual. This information goes into the section usually titled "Term."

- Detail the contributions of each member to the LLC. This generally includes cash, property, or services, and should be documented under the "Capital Contributions" section.

- Outline how profits and losses will be distributed amongst members. Typically, this is proportional to the members’ ownership percentages, but your agreement can specify a different arrangement.

- Describe the process for admitting new members and what happens when a member leaves the LLC, addressing both scenarios under the "Membership Changes" section.

- Detail the management structure of the LLC. Specify whether it will be member-managed or manager-managed, and note the duties and powers of the managers or managing members.

- Include provisions for regular meetings, including how often they will occur, how members will be notified, and what constitutes a quorum for decision-making purposes.

- Decide on voting rights and procedures. This includes how decisions are made, such as by majority vote, and the voting power of each member, usually based on their ownership interest.

- Specify any restrictions on the transfer of membership interests, detailing under what conditions interests can be transferred and any rights of first refusal.

- Outline the dissolution process for the LLC. Include how and when dissolution can occur, and how assets will be distributed amongst members thereafter.

- Sign and date the Operating Agreement. All members should sign the document to validate it. Depending on the internal rules of your LLC, witnesses or a notary public may also be required to sign.

Completing the Operating Agreement is a critical step in ensuring the stability and clarity of the operations and management of your LLC. It creates a binding agreement between members on key business processes and decisions, thus minimizing potential future disputes. Once completed, keep the Operating Agreement with your LLC's official records and distribute copies to all members to ensure everyone understands their rights and obligations.

Understanding Florida Operating Agreement

What is an Operating Agreement, and why is it important for my Florida-based LLC?

An Operating Agreement is a crucial document for any company, especially LLCs. In Florida, while not legally required, it serves as an internal manual that outlines how the business is run and the relationship between members. It covers everything from the allocation of profits and losses, holding meetings, and the addition or exit of members. This agreement brings structure and clarity, reducing potential disputes among members by clearly laying out rules and expectations.

Is an Operating Agreement mandatory for LLCs in Florida?

While the state of Florida doesn't require LLCs to have an Operating Agreement, it's highly advisable to create one. Without this agreement, your LLC will be governed by the default rules outlined in Florida's state statutes, which may not be suited to your business's unique needs. Having this agreement places you in control of your business's internal operations and decisions.

Can I write my own Operating Agreement for my Florida LLC, or do I need an attorney?

You can indeed draft your own Operating Agreement. Many resources and templates can guide you through the process. However, for more complex situations or if your LLC has multiple members, seeking legal advice might be beneficial. This ensures that the agreement is comprehensive and tailored to fit your business specifically, potentially preventing future legal issues.

What should be included in a Florida Operating Agreement?

A thorough Operating Agreement covers numerous aspects of your LLC's operations. Key sections should include the LLC's name and primary address, members' contributions, profit and loss distribution, management structure, voting rights of members, rules for meetings and decision-making, provisions for adding or removing members, and dissolution terms. Tailoring the content to match your LLC's specific needs and operations is essential.

How does an Operating Agreement protect the members of an LLC?

An Operating Agreement offers protection by clearly defining each member's rights and responsibilities, thus minimizing misunderstandings. Furthermore, it distinguishes your business entity and personal assets, offering a veil of protection against personal liability for business debts. Operating agreements also provide stability and predictability for how disputes and changes in ownership are handled.

Does the Operating Agreement need to be filed with the state of Florida?

No, the Operating Agreement is an internal document and does not need to be filed with the Florida Division of Corporations. However, having it accessible is essential for reference during legal or financial assessments, and you must ensure all members have a copy.

Can an Operating Agreement be modified after it has been created?

Absolutely. An Operating Agreement isn't set in stone. As your business evolves, your agreement may need updates to reflect changes in operations, membership, or management structure. It's wise to include provisions within your Operating Agreement on how amendments can be made, typically requiring a majority vote or consensus among members.

What happens if my LLC does not have an Operating Agreement in Florida?

Without an Operating Agreement, your LLC would be governed by default state laws, which may not suit your business model or member preferences. This lack of customization can lead to inefficiencies and increased potential for member disputes. Though not having one isn't against the law, it's a missed opportunity for clarity, efficiency, and protection.

Are there any templates or resources to help create a Florida Operating Agreement?

Yes, numerous online resources offer templates and guides specifically designed for drafting Florida LLC Operating Agreements. These templates can serve as a good starting point. Still, it's crucial to customize the document to reflect your business accurately. For complex structures or specific legal concerns, consulting with a legal professional is advisable to ensure your Operating Agreement fully covers all necessary areas.

Common mistakes

Filling out the Florida Operating Agreement form can often be seen as a straightforward task, but a careful approach is essential to avoid common mistakes. One prevalent error is the omission of key details. Parties may neglect to include vital information such as the full legal names of all members, the company's official name, and precise contributions of each member. This lack of detail can lead to ambiguity, which in the realm of legal agreements, is a breeding ground for disputes.

Another mistake is failing to clearly outline the decision-making processes. The Operating Agreement serves as the backbone of how decisions are made within the company, including daily operations and major business moves. When these processes are not explicitly stated, it leaves room for misinterpretation and potential conflict among members.

Often, individuals make the error of not properly addressing the allocation of profits and losses. It's crucial that the agreement specifies how these will be divided among members. Without this clarity, members may have unrealistic expectations which can lead to friction. This specification must be fair and reflective of each member’s input to avoid future financial misunderstandings.

Another common pitfall is ignoring the procedures for adding or removing members. Businesses evolve, and so do their ownership structures. An Operating Agreement that doesn't specify how members can join or exit the company can create legal headaches down the line. This oversight can severely complicate transitions, affecting not only the departing or joining members but the company's operations as a whole.

A mistake that can have significant implications is not planning for disputes. No matter how aligned members may seem, disagreements are inevitable. An Operating Agreement lacking a clear dispute resolution mechanism is a missed opportunity to preemptively address how conflicts are managed, leaving the company vulnerable to prolonged and costly disputes.

Last but not least, failing to update the document when necessary can lead to operational and legal challenges. As the business grows and changes, so should its Operating Agreement. This document is not meant to be static. Companies that neglect to regularly review and amend their Operating Agreement as needed find that the document does not accurately represent their current operations or member agreements, leading to a misalignment between practice and policy.

Documents used along the form

When setting up a business in Florida, particularly an LLC, a Florida Operating Agreement is a fundamental document. However, this agreement does not stand alone. Several other forms and documents are often needed to fully establish legal and operational foundations for businesses in Florida. Here is a look at some of these critical documents.

- Articles of Organization: This is the primary document required to formally register the LLC with the State of Florida. It outlines basic information about the LLC, including its name, principal address, registered agent, and sometimes the names of its members and managers.

- Employer Identification Number (EIN): Issued by the IRS, an EIN is essentially a Social Security number for the business. It is necessary for tax purposes, hiring employees, and opening a business bank account.

- Annual Reports: Florida law requires LLCs to file an annual report with the Florida Department of State. This report keeps the company's information, such as office address and current management, updated on the public record.

- Operating Licenses and Permits: Depending on the type of business and its location, various local, state, and federal licenses or permits may be necessary to operate legally. These may include occupational permits, sales tax permits, or health department permits.

While the Florida Operating Agreement is a crucial document for establishing the rights and responsibilities of the LLC's members, it's just one part of the documentation needed. Incorporating these additional forms and documents ensures that a business is compliant with state and federal regulations, setting a firm foundation for operational success.

Similar forms

The Florida Operating Agreement form, used to outline the structure and operating procedures of a limited liability company (LLC) within the state of Florida, shares similarities with various other legal documents that also set forth governance structures and operational guidelines. One such document is the Partnership Agreement. Like an Operating Agreement, a Partnership Agreement outlines the roles, responsibilities, and profit distribution among partners in a business venture. However, it is primarily used in general partnerships and limited partnerships, distinguishing it from the LLC-specific Operating Agreement.

Another comparable document is the Bylaws of a corporation. Bylaws serve a similar function for corporations as the Operating Agreement does for LLCs, laying out the rules and procedures for internal governance. While Operating Agreements are more flexible and tailored to the specific needs of the LLC members, Bylaws tend to be more formalized, reflecting the structured nature of corporations and their requirements under state laws.

The Shareholder Agreement shares some commonalities with the Operating Agreement, particularly in defining the relationship among the business entity's owners, their rights, and obligations. Used by corporations, a Shareholder Agreement covers topics such as share ownership, voting rights, and dividend distribution, paralleling how an Operating Agreement might stipulate member interests and voting procedures in an LLC.

An Investment Agreement, often used when new funds are injected into a company, bears resemblance to an Operating Agreement in that it specifies the terms of the investment, including the roles and expectations of the investors and the company. While an Investment Agreement focuses on the conditions surrounding financial contributions and returns, an Operating Agreement may also detail members’ capital contributions to the LLC.

The Employment Agreement, while primarily concerning the relationship between employers and employees, parallels the Operating Agreement in its detailed outlining of roles, responsibilities, and terms of engagement. Both documents serve to clarify expectations and obligations, ensuring all parties are aligned, though they do so in different contexts and with different parties.

The Confidentiality Agreement or Non-Disclosure Agreement (NDA) is similar to certain provisions that might be found in an Operating Agreement, particularly in protecting sensitive information. While an NDA specifically prohibits disclosure of confidential information, Operating Agreements may contain clauses regarding the handling of internal information and member confidentiality.

The Non-Compete Agreement, often a standalone agreement or a clause within another agreement, restricts individuals from entering into competition against their own company for a certain period and in specific geographical areas. These provisions can also be incorporated within Operating Agreements to protect the LLC’s interests, mirroring the restrictive purpose of a Non-Compete Agreement.

The Commercial Lease Agreement, used for renting business properties, and an Operating Agreement, while serving different functions, both detail terms and conditions that govern a relationship – one between a landlord and a tenant, and the other among LLC members. Each document specifies rights, responsibilities, and expectations to avoid misunderstandings and disputes.

Finally, the Business Plan, though not a legal document, is akin to an Operating Agreement in its function to outline the strategic direction of a business. A Business Plan projects future operations, growth, and objectives, while an Operating Agreement establishes the framework within which those objectives will be pursued, offering a detailed agreement that complements the broader visions outlined in a Business Plan.

Dos and Don'ts

When filling out the Florida Operating Agreement form, it's important to approach the task with meticulous attention to detail and an understanding of the implications of the information you provide. This document is a key element in establishing the operational, financial, and managerial framework of a Limited Liability Company (LLC) in Florida. Below are eight do's and don'ts to consider for a smooth and accurate completion of the form:

- Do review Florida's specific requirements for an LLC Operating Agreement. State regulations can vary, and it's crucial to ensure your document complies with local laws.

- Do include all relevant parties in the discussion when drafting the agreement. Every member’s rights and responsibilities should be clearly outlined and understood by all.

- Do be clear and precise in defining the terms of distribution of profits and losses. This clarity can prevent future disputes among members.

- Do decide on a dispute resolution mechanism and include it in the agreement. Having a predetermined method can simplify conflict resolution.

- Don't leave any sections incomplete. An incomplete agreement can lead to ambiguity and legal challenges.

- Don't use ambiguous language. Clear and straightforward terms reduce the chances of misunderstandings and litigation.

- Don't forget to update the agreement as the business evolves. Changes in membership, management structure, or business operations should be reflected in the agreement.

- Don't overlook the importance of having each member review and sign the agreement. This formalizes the consensus and can provide legal protection.

Misconceptions

When it comes to operating agreements for limited liability companies (LLCs) in Florida, several misconceptions can lead business owners astray. Clearing up these misunderstandings is crucial for ensuring your LLC is on solid legal footing. Here's a look at five common misconceptions about the Florida Operating Agreement form:

- It's not required by law. Many believe that Florida law doesn't require LLCs to have an Operating Agreement. While it's true that Florida doesn't mandate these agreements be filed with the state, having one is still crucial. It outlines the ownership structure, operational procedures, and solves potential disputes among members, offering crucial legal protection.

- One size fits all. Another common misconception is that a generic, one-size-fits-all form will suffice. Every LLC has unique needs, and its Operating Agreement should reflect that. Tailoring the document to fit your specific business scenario can prevent numerous problems down the line.

- Only multi-member LLCs need one. Even if your LLC has just one member, drafting an Operating Agreement is important. It helps reinforce your legal protection by clearly separating your personal assets from the business's liabilities, which is essential for safeguarding personal finances.

- It's solely an internal document. While the Operating Agreement isn't filed with the state, suggesting it's merely for personal use, it has significant external applications. For example, banks often require seeing it before opening business accounts or issuing loans. Potential investors or partners also typically request to review it before making commitments.

- It's unchangeable once signed. Some might think that once an Operating Agreement is signed, it's set in stone. However, as your business grows and evolves, so too can your Operating Agreement. It's actually designed to be amended, with the consent of all members, to reflect changes in the company's operations or ownership structure.

Addressing these misconceptions head-on can help ensure your Florida LLC is better protected and more successful. Crafting a thorough and tailored Operating Agreement is a step that shouldn't be overlooked.

Key takeaways

An Operating Agreement is a fundamental document for any Florida Limited Liability Company (LLC). It outlines the business's financial and functional decisions including rules, regulations, and provisions. The purpose is to govern the internal operations of the business in a way that suits the specific needs of the business owners. Here are six key takeaways about filling out and using the Florida Operating Agreement form:

- Customization is Key: Each LLC is unique, and the Operating Agreement should reflect this. It should be tailored to fit the specific arrangements and expectations of the members. Generic templates may not cover all the necessary details relevant to your business.

- Legal Protection: While not legally required in Florida, having an Operating Agreement can provide legal protection for the members. It helps ensure that courts will respect your personal liability protection by showing that your LLC operates with proper governance and documentation.

- Define Financial and Management Structure: Clearly outline the division of profits and losses, the process for making business decisions, and the responsibilities of members and managers. This clarity can prevent conflicts among members by setting clear expectations.

- Flexibility in Rules: The Operating Agreement allows LLC members to set their own rules for the company, within the bounds of the law. This can include provisions for adding or removing members, how meetings are held, and how business decisions are made, offering a level of flexibility not always found in corporate statutes.

- Updating the Agreement: As the business grows or changes, the Operating Agreement should be updated to reflect these changes. Regularly reviewing and updating the document ensures that it remains relevant and effective in governing the business.

- Execution and Storage: Once completed, the Operating Agreement should be signed by all members of the LLC. Keep a signed copy with your business records and ensure each member has a copy. This document may need to be presented to financial institutions or in legal proceedings, so it's important that it's easily accessible.

In conclusion, while the Florida Operating Agreement form is not mandated by law, its importance cannot be overstated. It acts as a safeguard for members, provides legal recognition, and serves as a blueprint for the operation and management of an LLC. Taking the time to draft a comprehensive Operating Agreement can save time, money, and confusion, ensuring the smooth operation of the LLC over the long term.

More Operating Agreement State Forms

Nys Llc - Safeguards the LLC's interests by detailing procedures for handling member exits or deaths.

Llc Operating Agreement Michigan - This document can help prevent disputes among members by providing written guidelines for conflict resolution.

How to Make an Operating Agreement - Not legally required in all states, but highly recommended, as it provides clarity and legal protection for your LLC’s operational proceedings.

Does Llc Need Operating Agreement - By laying out the exit strategies for members, it prepares the LLC for potential changes in membership without upheaval.