Official Operating Agreement Document

Embarking on a new business venture brings with it a cascade of decisions, responsibilities, and legal considerations, especially when it involves forming a limited liability company (LLC). At the heart of these considerations is the Operating Agreement, a crucial document that outlines how the business will be run. This agreement plays a key role in defining the financial and functional decisions of the business, including provisions for governance, allocation of profits and losses, and procedures for resolving disputes. More than just a formal requirement, this bespoke document acts as a safeguard for all members, ensuring clarity and fairness in the management and operation of the LLC. By setting clear expectations and responsibilities, it provides a strong foundation for business operations, offering peace of mind and a blueprint for success. With its importance in mind, it's essential to approach the creation of an Operating Agreement with care, ensuring it is thorough, fair, and reflective of the goals and values of the business and its members.

State-specific Information for Operating Agreement Forms

Operating Agreement Form Subtypes

Document Example

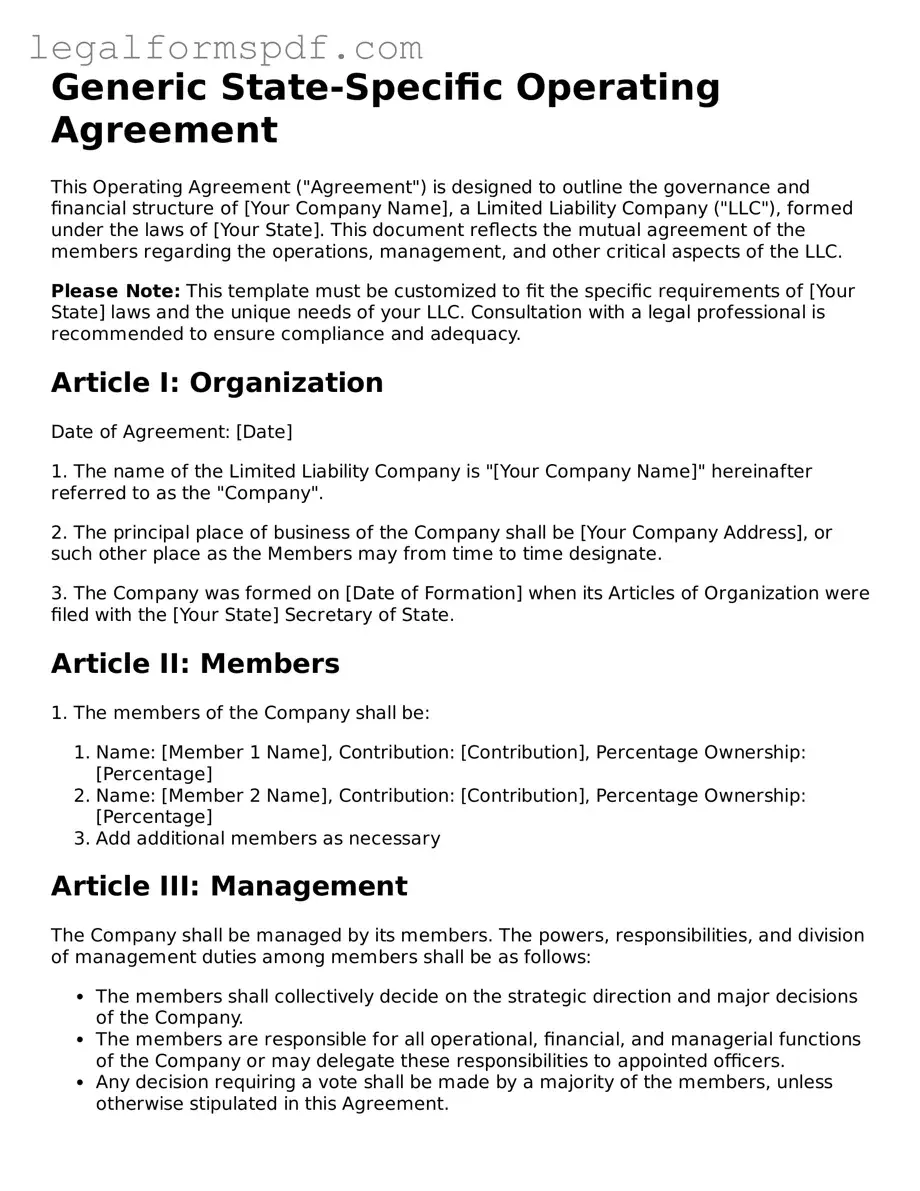

Generic State-Specific Operating Agreement

This Operating Agreement ("Agreement") is designed to outline the governance and financial structure of [Your Company Name], a Limited Liability Company ("LLC"), formed under the laws of [Your State]. This document reflects the mutual agreement of the members regarding the operations, management, and other critical aspects of the LLC.

Please Note: This template must be customized to fit the specific requirements of [Your State] laws and the unique needs of your LLC. Consultation with a legal professional is recommended to ensure compliance and adequacy.

Article I: Organization

Date of Agreement: [Date]

1. The name of the Limited Liability Company is "[Your Company Name]" hereinafter referred to as the "Company".

2. The principal place of business of the Company shall be [Your Company Address], or such other place as the Members may from time to time designate.

3. The Company was formed on [Date of Formation] when its Articles of Organization were filed with the [Your State] Secretary of State.

Article II: Members

1. The members of the Company shall be:

- Name: [Member 1 Name], Contribution: [Contribution], Percentage Ownership: [Percentage]

- Name: [Member 2 Name], Contribution: [Contribution], Percentage Ownership: [Percentage]

- Add additional members as necessary

Article III: Management

The Company shall be managed by its members. The powers, responsibilities, and division of management duties among members shall be as follows:

- The members shall collectively decide on the strategic direction and major decisions of the Company.

- The members are responsible for all operational, financial, and managerial functions of the Company or may delegate these responsibilities to appointed officers.

- Any decision requiring a vote shall be made by a majority of the members, unless otherwise stipulated in this Agreement.

Article IV: Capital Contributions

Members have contributed capital to the Company as documented above in Article II. The procedure for making additional contributions shall be determined by a majority vote of the members.

Article V: Distributions

Distributions of profit and losses shall be made proportionally to the members' percentage ownership in the Company annually or at other intervals as decided by the members.

Article VI: Changes to the Agreement

Any changes to this Agreement must be made in writing and signed by all members of the Company.

Article VII: Dissolution

The Company may be dissolved upon the agreement of a majority of the members. Upon dissolution, the assets of the Company shall be distributed according to the members' percentage ownership after all debts and liabilities have been settled.

Article VIII: Governing Law

This Agreement and the operation of the Company are subject to the laws of [Your State].

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the latest date written below.

Member Signatures:

- [Member 1 Name], Date: [Date]

- [Member 2 Name], Date: [Date]

- Add additional member signatures as necessary

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Operating Agreement outlines the internal operating procedures, financial decisions, and responsibilities of the members of a Limited Liability Company (LLC). |

| Legally Binding Document | Though not always required by law, an Operating Agreement is a legally binding document among LLC members once signed. |

| Flexibility | This form is highly customizable to suit the specific needs and preferences of the LLC members, making each agreement unique. |

| Governing Law(s) | The Operating Agreement is governed by the state in which the LLC is registered. Each state has its own set of laws that can affect the contents of the agreement. |

| Protection of Personal Assets | An Operating Agreement can help reinforce the legal distinction between an LLC's operations and the personal assets of its members, offering increased protection against personal liability. |

Instructions on Writing Operating Agreement

An Operating Agreement is a critical document for any LLC, governing the business's inner workings and outlining the rights and responsibilities of its members. This document ensures that all members are on the same page regarding the business operation and can help prevent conflicts down the line. Completing this form might seem daunting at first, but with a step-by-step guide, you can navigate the process with confidence. Here's how to fill out the Operating Agreement form efficiently.

- Start by gathering all necessary information about your LLC, including the official business name, address, and the names and addresses of all members.

- Identify the principal place of business where your LLC will operate. This will be the primary location for official business activities.

- Determine how your LLC will be managed. You'll need to decide whether it will be member-managed or manager-managed and indicate this in the agreement.

- Outline the capital contributions of each member. This includes how much each member will contribute to start the business and how additional contributions will be handled.

- Describe how profits and losses will be distributed among members. Typically, this is based on the percentage of the business each member owns.

- Detail the process for adding or removing members to ensure the continuity of the business in case of membership changes.

- Clarify the decision-making process. This includes how decisions are made within the LLC, such as voting rights and minimum votes required for certain actions.

- Specify any limitations on members' authority to bind the LLC. This is important for clarifying who can enter into contracts and other legal obligations on behalf of the business.

- Include a dispute resolution clause. This outlines how disputes among members will be handled, potentially avoiding costly litigation.

- Have all members review the completed Operating Agreement to ensure accuracy and understanding. It's crucial that all members agree on the terms laid out in this document.

- Finally, ensure all members sign the Operating Agreement. While not always required by law, having a signed agreement on file is a best practice for protecting the members and the business.

Once the Operating Agreement is fully completed and signed, it's important to keep it in a safe yet accessible place. Members should have copies, and an extra copy should be stored with your business records. Though it's not typically filed with the state, this document plays a vital role in guiding your LLC's operations and settling any future disputes. Regularly review and update the agreement as your business grows and changes to reflect new circumstances and decisions.

Understanding Operating Agreement

What is an Operating Agreement?

An Operating Agreement is a key document used by Limited Liability Companies (LLCs) that outlines the business' financial and functional decisions including rules, regulations, and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners. It can cover everything from the allocation of profits and losses, to management structure, to the procedures for adding or removing members. It acts as a guide for how the business is to be operated.

Why is having an Operating Agreement important?

Having an Operating Agreement is critical as it ensures that all business owners are on the same page regarding the company's operating procedures and helps avoid future conflicts. Furthermore, although not all states require LLCs to have an Operating Agreement, it provides an extra layer of protection for your business's limited liability status. By clearly defining the business's structure and operations, it can also be instrumental in demonstrating to courts and creditors that your LLC is a separate business entity.

What typically goes into an Operating Agreement?

An Operating Agreement generally includes sections on the percentage of interests of each member, the rights and responsibilities of members, the allocation of profits and losses, management structure, voting power, rules for meetings and votes, guidelines for buying out or adding members, and dissolution procedures for winding down the business. It's tailored to fit the business's needs, so it can include other terms as seen fit by the members.

Can an Operating Agreement be changed?

Yes, an Operating Agreement can be changed. This flexibility is one of the benefits of an LLC. To amend an Operating Agreement, members usually need to vote on the changes according to the rules established in the original agreement. This may vary depending on the specific terms outlined in the agreement regarding amendments. It is crucial that any amendments are documented in writing and agreed upon by all members, reflecting the consensus and changes accurately to maintain clarity and avoid future disagreements.

Common mistakes

One common mistake individuals make when completing an Operating Agreement form is not clearly defining the roles and responsibilities of each member. This can lead to confusion and conflict, as members may have different expectations about their contributions and decision-making authority within the company. It's crucial for the agreement to spell out each person's duties, powers, and obligations to ensure smooth operation and minimize disagreements.

Another oversight occurs when the agreement fails to specify the process for adding or removing members. Without a clear procedure in place, transitioning members in or out of the company can become complicated and contentious. This section should detail how new members can join, the circumstances under which a member may leave, and the steps for formally recognizing these changes within the business structure.

Often, people neglect to outline the distribution of profits and losses. This omission can lead to disputes among members about how much of the company's earnings each person is entitled to and how losses are to be shared. By clearly stating the formula or percentages for distributing profits and losses, members can set expectations and reduce potential conflicts.

A crucial detail frequently overlooked in Operating Agreements is the decision-making process. An effective agreement should delineate how decisions are made, including what constitutes a majority and how votes are counted. This clarity helps prevent stalemates and ensures that the company can make decisions efficiently.

Dispute resolution mechanisms are sometimes absent from Operating Agreements. Conflicts can arise in any business venture, and having a predetermined method for resolving disagreements can save time, money, and relationships. Whether through mediation, arbitration, or another method, establishing a process for addressing disputes is important for maintaining harmony within the company.

Failure to include a dissolution plan is another common mistake. While it may be uncomfortable to consider the end of the business, having a strategy for winding down operations can alleviate complications if the company decides to cease operations. This plan should address aspects such as asset distribution, handling of remaining debts, and the formal steps for dissolving the company.

Some individuals mistakenly omit a clause on amending the Operating Agreement. As businesses evolve, the agreement may need updates or modifications. Including a section on how to make these changes ensures that the document remains relevant and reflective of the company's current practices and agreements among members.

Not properly defining the fiscal year for the business is a detail often overlooked. This can cause confusion when it comes to financial planning, tax filings, and revenue tracking. The Operating Agreement should specify the start and end dates of the fiscal year to align with accounting practices and legal requirements.

Last but not least, overlooking the need for signatures is a surprisingly common mistake. For an Operating Agreement to be effective and enforceable, all members must sign the document. This formalizes the agreement and signifies each member's understanding and acceptance of its terms. Ensuring that the document is properly executed by all parties is essential for its validity.

Documents used along the form

An Operating Agreement is a fundamental document for Limited Liability Companies (LLCs), structuring the operations and management of the business. It is, however, just one component of the documentation required for a smoothly functioning LLC. There are other forms and documents that are often used in conjunction with an Operating Agreement to ensure compliance with state laws, financial organization, and the protection of the business. These documents range from initial registration forms to those necessary for ongoing compliance and operational management.

- Articles of Organization: This is the primary document required to register an LLC with the state. It outlines basic information about the LLC, such as the business name, address, and the names of its members.

- Employer Identification Number (EIN) Application: An EIN, assigned by the IRS, is necessary for an LLC to open a bank account, hire employees, and pay taxes. The application for an EIN is a crucial step following the drafting of an Operating Agreement.

- Membership Certificates: These certify ownership interest in the LLC, similar to stock certificates in a corporation. They are physical evidence of each member's ownership percentage.

- Meeting Minutes: While not always legally required, keeping a record of LLC meetings and decisions is a best practice for maintaining proper documentation and upholding the Operating Agreement's procedures.

- Amendment(s) to the Operating Agreement: As a business evolves, its Operating Agreement may need changes. Amendment forms ensure that any modifications are documented and acknowledged by all members.

- Annual Reports: Many states require LLCs to submit an annual report, which is a document that updates the state on the LLC's current information, such as contact information and business activities.

Together with the Operating Agreement, these documents create a comprehensive groundwork for the legal and operational framework of an LLC. From the establishment phase with the Articles of Organization and EIN application to the ongoing maintenance via Meeting Minutes and Annual Reports, these documents support an LLC's compliance, clarity in operations, and evidence of the members' rights and responsibilities. Advisably, LLC members should be familiar with both the requirements and benefits of each of these documents to safeguard their business and personal interests.

Similar forms

The Operating Agreement form, used primarily by Limited Liability Companies (LLCs), shares similarities with the Bylaws document utilized by corporations. Both serve as the internal rulebooks for the entity, outlining the governance structure, operational processes, and the roles and responsibilities of the entity's members or directors. Whereas the Operating Agreement is tailored for the flexible structure of an LLC, bylaws cater to the more rigid corporate framework, focusing on the board of directors, shareholder meetings, and voting procedures. This delineation allows each entity type to function within its designed legal and procedural bounds.

Similar to the Operating Agreement, a Partnership Agreement outlines the operational structure and financial arrangements between partners in a business partnership. It covers profit sharing, decision-making processes, and the resolution of disputes among partners. Both documents function as foundational agreements that dictate the internal workings and management of the respective business entities. However, the Operating Agreement is specific to LLCs, providing a customized framework that acknowledges the unique blend of corporation-like liability with partnership-like flexibility, whereas the Partnership Agreement is exclusively used by partnerships without the corporate shield of limited liability.

Shareholder Agreements, like Operating Agreements, set forth the rights, responsibilities, and relationships of the business's owners. In a corporation, the Shareholder Agreement details the specifics of share ownership, including transfer restrictions, buy-sell provisions, and voting rights, mirroring the way an Operating Agreement might regulate membership changes, profit distributions, and member voting in an LLC. The key distinction lies in their application to different legal entities, with Shareholder Agreements being pertinent to corporations and the Operating Agreement to LLCs, reflecting each entity’s unique legal structure and ownership mechanisms.

An Employment Agreement bridges the employee-employer relationship, akin to how an Operating Agreement sets the stage for members' interactions within an LLC. Although an Employment Agreement specifically addresses terms of employment, compensation, duties, and confidentiality for individual employees, parallels can be drawn to the Operating Agreement’s role in defining the scope of work, distribution of profits, and operational roles of members. Both agreements aim to clarify expectations and responsibilities, but they do so at different levels within the business hierarchy.

The Buy-Sell Agreement, often a component of broader business agreements, focuses on the conditions under which a member's interest in a company may be bought or sold, such as in the event of death, disability, or retirement. This concept mirrors aspects of the Operating Agreement, particularly in delineating the process for transferring membership interests and managing changes in ownership. While a Buy-Sell Agreement can be a standalone document or part of a larger agreement in any business entity, its principles of ownership transition are embedded within the Operating Agreement of an LLC, ensuring continuity and stability of the business.

A Non-Disclosure Agreement (NDA) shares the premise of protecting sensitive information with an Operating Agreement, although the latter encompasses a broader operational scope. NDAs explicitly prevent the unauthorized sharing of proprietary information, a concern also addressed in Operating Agreements through confidentiality clauses. These clauses safeguard the LLC’s trade secrets, business processes, and client information from being disclosed by members. The differentiation lies in the NDA’s singular focus on confidentiality versus the Operating Agreement’s comprehensive governance of the LLC’s entirety, including but not limited to information protection.

Dos and Don'ts

An Operating Agreement is a pivotal document for any Limited Liability Company (LLC). It outlines the financial and functional decisions of a business, including rules, regulations, and provisions. The goal of this agreement is to govern the internal operations of the business in a way that suits the specific needs of the business owners. When it's time to fill out this crucial form, there are specific dos and don’ts to keep in mind to ensure its effectiveness and legality.

Things You Should Do:

- Review State Requirements: Before anything else, investigate your state's specific requirements for Operating Agreements. Some states have mandatory clauses that must be included.

- Clarify Member Roles and Responsibilities: Clearly define each member’s role, responsibilities, and the percentage of ownership. This clarity helps in managing expectations and responsibilities within the LLC.

- Detail the Financial Structures: Be meticulous in detailing the distribution of profits and losses. Specifying the financial interests of each member prevents conflicts down the line.

- Plan for the Future: Include provisions for adding or removing members, and spell out the process for dissolving the LLC if necessary. Planning for the future can save a lot of headaches.

- Seek Legal Advice: Consult with a legal professional to ensure that your Operating Agreement is comprehensive and compliant with state laws and regulations.

- Review and Update Regularly: As your business evolves, so should your Operating Agreement. Make it a point to review and update it regularly to reflect any changes in the business structure or member roles.

Things You Shouldn’t Do:

- Use Generic Templates Without Customization: While templates can be a good starting point, merely filling in the blanks without considering your specific business needs can lead to problems down the road.

- Overlook Important Details: Skipping over critical details or leaving sections incomplete can render your Operating Agreement ineffective or legally void.

- Ignore State Laws: Each state has its own laws governing LLCs. Failing to align your Operating Agreement with these laws can result in legal complications.

- Forget to Include Dispute Resolution Methods: Conflicts can arise in any business. Not having a predefined method for resolving disputes can lead to drawn-out and costly legal battles.

- Leave Out Any Member Information: Every member’s contribution and role should be acknowledged in the agreement. Omitting this information can create ambiguity and conflicts.

- Fail to Have All Members Sign: An Operating Agreement is only valid if all parties agree to it. Ensure every member signs the document to make it legally binding.

By following these guidelines, you can create an Operating Agreement that not only meets legal standards but also lays a solid foundation for your business’s internal operations. Remember, this document is essentially a blueprint for how your LLC will run; it’s worth the time to do it right.

Misconceptions

An Operating Agreement is a crucial document for any LLC (Limited Liability Company), yet there are several common misconceptions about its nature and purpose. Below are seven of these misconceptions, clarified to improve understanding and ensure that businesses can better navigate their legal landscapes.

- Only multi-member LLCs need an Operating Agreement. Even single-member LLCs benefit from having an Operating Agreement. This document provides clarity on the business structure and operations which can be important for legal protection and financial institutions.

- Operating Agreements are the same in every state. While many states have similar requirements for what an Operating Agreement should contain, each state has its own specific laws that may require different information or stipulations in the Agreement.

- A generic template is sufficient. While templates can provide a starting point, every LLC is unique. Customizing the Operating Agreement to match the specific needs and operations of the business ensures that all aspects of the LLC are properly addressed.

- An Operating Agreement is not legally required. While not all states require an Operating Agreement, having one is still crucial. It not only helps in managing the internal operations of the LLC but can also be required by banks or other entities.

- Operating Agreements do not need to be updated. As a business evolves, so too should its Operating Agreement. Regularly updating the document to reflect changes in ownership, operations, or state laws is important for maintaining its relevance and effectiveness.

- An Operating Agreement is only for internal use. Although primarily an internal document, Operating Agreements can also be important in legal situations, such as disputes between members or with third parties. They can also be requested by lenders or investors.

- The creation of an Operating Agreement can be indefinitely postponed. Delaying the drafting of an Operating Agreement can lead to problems, especially if disputes arise among members. It's best to create this document early in the formation of the LLC to ensure a clear understanding of member roles, responsibilities, and expectations.

Key takeaways

An Operating Agreement is a crucial document for any LLC, detailing the management structure, financial arrangements, and operating procedures. Understanding how to effectively fill out and utilize this document can ensure your business operates smoothly and is prepared for future challenges. Here are four key takeaways to consider:

- Detail the Ownership Structure Clearly: It's essential to outline each member's ownership percentage accurately. This clarity helps prevent disputes among members and provides a clear framework for distributing profits and losses. Precise definitions set a solid foundation for the business relationship.

- Define Member Roles and Responsibilities: In the Operating Agreement, each member’s responsibilities, powers, and duties should be clearly defined. This definition helps in managing expectations and ensures smooth day-to-day operations. When everyone knows their role, the business can operate more efficiently.

- Outline the Financial and Management Structure: The agreement should detail the financial arrangements, including capital contributions, distributions, and how profits and losses will be allocated. Additionally, clearly stating whether the LLC will be member-managed or manager-managed guides decision-making processes and operational control.

- Plan for the Future: Include provisions for adding or removing members, resolving disputes, and dissolving the LLC. Preparing for these eventualities in advance can save time, legal expenses, and heartache later on. By foreseeing potential changes and challenges, you can ensure the longevity and flexibility of the business structure.

Properly filling out and understanding your LLC’s Operating Agreement is not just about legal compliance; it's about laying the groundwork for your business's success. A well-thought-out agreement can be the difference between a smooth-running operation and a chaotic one.

Other Templates

Eagle Scout Recommendation Letter Sample - Clarifies the expectations for the content and depth of the recommendations, supporting a quality review process.

Affadavit of Domicile - Legal advisors often recommend completing this document as early as possible in the estate administration process.