Official Mobile Home Purchase Agreement Document

Buying a mobile home involves a significant personal and financial commitment, making the Mobile Home Purchase Agreement form a critical document in the process. This comprehensive agreement lays out the terms and conditions of the sale, ensuring both the buyer and the seller are clear on every detail, from the purchase price to the closing date. It serves not only as a contract but also as a guide through the sometimes complex journey of purchasing a mobile home. By detailing the rights and responsibilities of each party, the form helps to prevent misunderstandings that could delay or derail the purchase. It includes information on any warranties offered, specifics about the home's condition, and any other agreements related to the sale, such as who handles certain expenses. The form is designed to protect all involved parties, providing a clear path to transferring ownership of the mobile home smoothly and efficiently.

Document Example

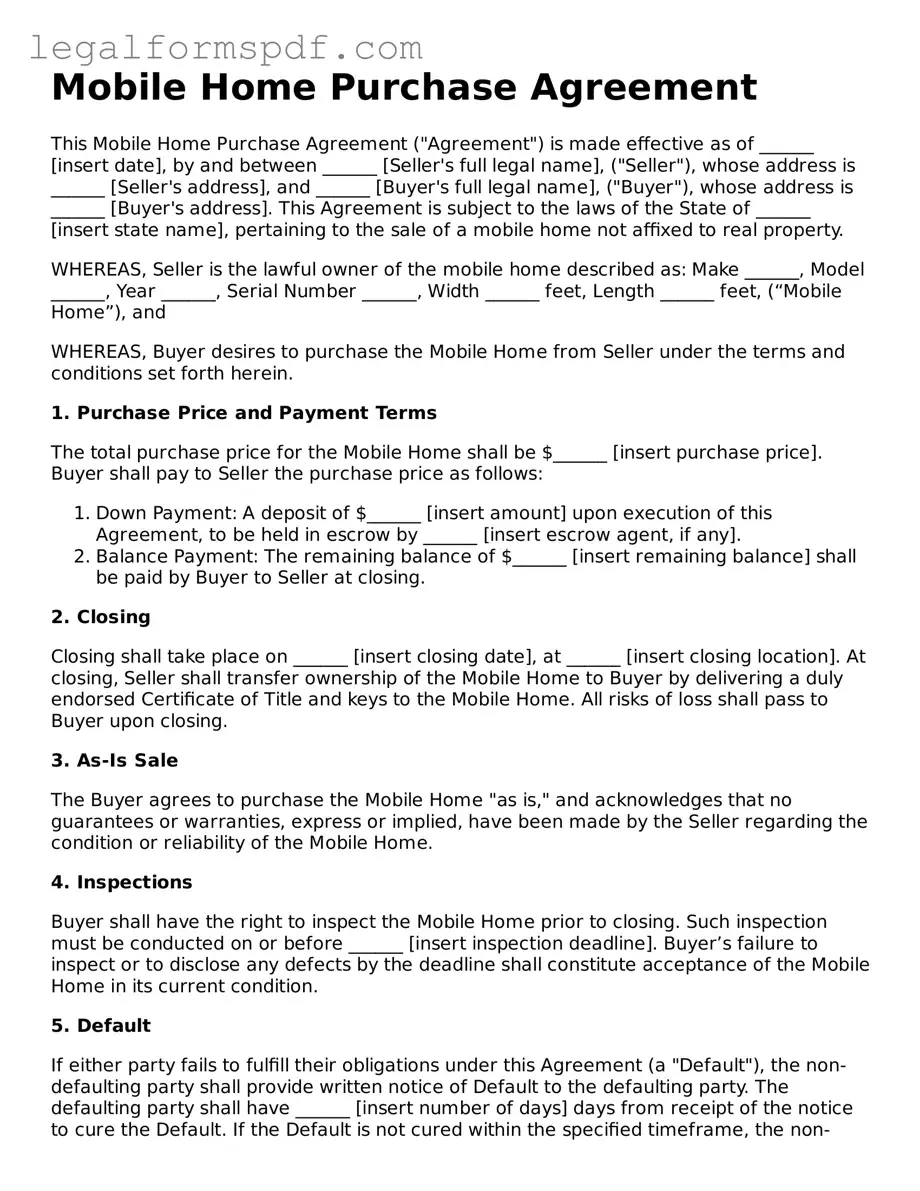

Mobile Home Purchase Agreement

This Mobile Home Purchase Agreement ("Agreement") is made effective as of ______ [insert date], by and between ______ [Seller's full legal name], ("Seller"), whose address is ______ [Seller's address], and ______ [Buyer's full legal name], ("Buyer"), whose address is ______ [Buyer's address]. This Agreement is subject to the laws of the State of ______ [insert state name], pertaining to the sale of a mobile home not affixed to real property.

WHEREAS, Seller is the lawful owner of the mobile home described as: Make ______, Model ______, Year ______, Serial Number ______, Width ______ feet, Length ______ feet, (“Mobile Home”), and

WHEREAS, Buyer desires to purchase the Mobile Home from Seller under the terms and conditions set forth herein.

1. Purchase Price and Payment TermsThe total purchase price for the Mobile Home shall be $______ [insert purchase price]. Buyer shall pay to Seller the purchase price as follows:

- Down Payment: A deposit of $______ [insert amount] upon execution of this Agreement, to be held in escrow by ______ [insert escrow agent, if any].

- Balance Payment: The remaining balance of $______ [insert remaining balance] shall be paid by Buyer to Seller at closing.

Closing shall take place on ______ [insert closing date], at ______ [insert closing location]. At closing, Seller shall transfer ownership of the Mobile Home to Buyer by delivering a duly endorsed Certificate of Title and keys to the Mobile Home. All risks of loss shall pass to Buyer upon closing.

3. As-Is SaleThe Buyer agrees to purchase the Mobile Home "as is," and acknowledges that no guarantees or warranties, express or implied, have been made by the Seller regarding the condition or reliability of the Mobile Home.

4. InspectionsBuyer shall have the right to inspect the Mobile Home prior to closing. Such inspection must be conducted on or before ______ [insert inspection deadline]. Buyer’s failure to inspect or to disclose any defects by the deadline shall constitute acceptance of the Mobile Home in its current condition.

5. DefaultIf either party fails to fulfill their obligations under this Agreement (a "Default"), the non-defaulting party shall provide written notice of Default to the defaulting party. The defaulting party shall have ______ [insert number of days] days from receipt of the notice to cure the Default. If the Default is not cured within the specified timeframe, the non-defaulting party reserves the right to terminate this Agreement and retain or recover, as applicable, the down payment as liquidated damages.

6. Governing LawThis Agreement shall be governed by and construed in accordance with the laws of the State of ______ [insert state name], without regard to its conflict of laws principles.

7. Entire AgreementThis Agreement constitutes the entire agreement between the parties regarding the purchase of the Mobile Home, and supersedes all previous agreements. No amendment, modification, or waiver of any provision of this Agreement shall be effective unless in writing and signed by both parties.

8. SignaturesIN WITNESS WHEREOF, the parties have executed this Mobile Home Purchase Agreement as of the date first mentioned above.

___________________________

[Seller's Signature]

[Seller's Printed Name]

Date: ______

___________________________

[Buyer's Signature]

[Buyer's Printed Name]

Date: ______

PDF Specifications

| Fact Number | Detail |

|---|---|

| 1 | A Mobile Home Purchase Agreement is a legal document that outlines the terms and conditions of the sale of a mobile home. |

| 2 | This agreement includes the names of the buyer and seller, the sale price, and a description of the mobile home. |

| 3 | The document often details any financing terms, including the down payment, interest rate, and repayment schedule, if applicable. |

| 4 | It may specify the responsibilities of the buyer and seller regarding home inspections, repairs, and warranties. |

| 5 | The agreement will include a provision for the transfer of title and the precise date of possession. |

| 6 | State-specific forms must comply with local laws governing mobile home sales, which vary significantly from one state to another. |

| 7 | In some states, the agreement must disclose whether the mobile home is affixed to the land and categorized as real property. |

| 8 | The agreement becomes legally binding once signed by both the buyer and the seller, obligating both parties to fulfill their respective duties as outlined. |

Instructions on Writing Mobile Home Purchase Agreement

Completing a Mobile Home Purchase Agreement form is a crucial step in the process of buying a mobile home. This document outlines the terms and conditions of the sale, ensuring both the buyer and seller are clear on the details of the transaction. It is important to approach this process with attention to detail to ensure all information is accurate and comprehensive, securing a smooth transition of ownership. After filling out the form, the next steps involve reviewing the agreement together with all parties involved, making any necessary adjustments, and signing the document to finalize the sale. Here are the steps to fill out the Mobile Home Purchase Agreement form.

- Identify the Parties: Start by writing the full legal names of both the buyer and the seller. Include any co-buyers or co-sellers if applicable.

- Description of the Mobile Home: Enter the make, model, year, and identifying number of the mobile home. Also, include the address of its current location.

- Price and Payment Terms: Specify the purchase price of the mobile home and outline the payment terms, such as down payment amount, financing details, and due dates for payments.

- Include Additional Property: List any additional property included in the sale, such as furniture or appliances.

- Disclosures: Note any disclosures related to the mobile home, including warranties, defects, or liens against the property.

- Closing and Possession Date: Determine the date when the purchase will be finalized (closing) and when the buyer will take possession of the mobile home.

- Signatures: Ensure all parties involved in the transaction sign and date the agreement. Provide spaces for witnesses’ signatures if required.

After filling out the Mobile Home Purchase Agreement form with detailed and accurate information, it is imperative for both parties to review the document thoroughly. This review process allows for the identification and correction of any discrepancies or misunderstandings. Following this, the parties involved should sign the agreement to mark their consent and agreement to the terms outlined. This signed document then serves as a legally binding contract that facilitates the fair and transparent sale of the mobile home.

Understanding Mobile Home Purchase Agreement

What is a Mobile Home Purchase Agreement?

A Mobile Home Purchase Agreement is a legal document that outlines the terms and conditions of the sale of a mobile home. This agreement includes details such as the purchase price, description of the mobile home, any warranties or disclosures, and the responsibilities of the buyer and seller.

Who needs to sign the Mobile Home Purchase Agreement?

Both the buyer and the seller of the mobile home need to sign the agreement. These signatures are required to make the document legally binding and to confirm that both parties agree to the terms and conditions outlined in the document.

Can I customize a Mobile Home Purchase Agreement for my specific needs?

Yes, a Mobile Home Purchase Agreement can be customized to fit the specific needs of the transaction. However, it's important to ensure that all modifications comply with local laws and regulations regarding mobile home sales.

What happens if I do not use a Mobile Home Purchase Agreement?

Not using a Mobile Home Purchase Agreement can lead to misunderstandings and disputes between the buyer and seller. The agreement provides a clear record of the sale, protects the rights of both parties, and clearly delineates the obligations and expectations.

Is a Mobile Home Purchase Agreement legally binding?

Yes, once signed by both the buyer and the seller, the Mobile Home Purchase Agreement becomes a legally binding contract. This means that both parties are legally obligated to fulfill their respective duties as outlined in the agreement.

Are there any specific disclosures that need to be included in the agreement?

Yes, certain disclosures may be required, depending on local laws. These can include disclosures about the condition of the mobile home, any existing liens against the property, and any other material facts that could affect the buyer's decision to purchase.

What should I do if the other party breaches the Mobile Home Purchase Agreement?

If the other party breaches the agreement, legal remedies may be available to you. It's recommended to seek legal advice to understand your options, which may include negotiating a settlement or pursuing legal action.

How long does the Mobile Home Purchase Agreement process take?

The length of the process can vary depending on several factors, including the negotiation process, obtaining financing (if necessary), and completing any required inspections. The timeline should be clearly outlined in the agreement itself.

Can I back out of a Mobile Home Purchase Agreement after signing?

Backing out of a Mobile Home Purchase Agreement after signing is generally not possible without facing legal consequences, unless the agreement contains specific provisions that allow for cancellation under certain conditions. It’s vital to thoroughly review the agreement and understand your commitments before signing.

Common mistakes

Filling out a Mobile Home Purchase Agreement requires careful attention to detail, yet many people make errors that can affect the outcome of the sale. One common mistake is not verifying the exact legal description of the property. This description is crucial because it ensures that the buyer and seller are clear about the specific parcel of land included in the sale, especially in a mobile home context where the land itself might not always be part of the transaction. Failing to get this right can lead to significant legal complications down the road.

Another frequent oversight is neglecting to confirm that all the necessary signatures are on the document. The excitement and stress of purchasing a mobile home can sometimes lead to hasty oversights, like missing signatures from co-owners or spouses. This omission can invalidate the entire agreement, leading to delays or, at worst, nullification of the sale. Ensuring every party required by law signs the agreement is paramount for its validity.

Incorrect or incomplete disclosures about the condition of the mobile home represent a serious mistake as well. Sellers are generally required to inform the buyer of any known issues or defects with the property. When these disclosures are not fully detailed, or worse, omitted, it not only misleads the buyer but can also expose the seller to legal liability for any undisclosed problems discovered after the sale.

Many buyers and sellers neglect to adequately specify the terms of the loan in the Purchase Agreement. This detail is critical when financing is involved. The agreement should clearly outline the loan amount, interest rate, repayment schedule, and any other conditions related to the financing. Ambiguities in these terms can lead to misunderstandings or disputes between the parties involved, potentially derailing the sale.

A common error made during this process is not setting a realistic closing date. The timeline for closing a mobile home sale can be affected by various factors, including financing approval, title searches, and inspections. Setting a closing date without allowing ample time for these steps can create unnecessary pressure on all parties and may result in delays.

Not allocating responsibilities for fees and closing costs is another mistake. The agreement should specify who is responsible for covering these expenses. Without clear terms, disputes can arise over who pays for title insurance, inspection fees, taxes, and other closing costs, possibly complicating or even halting the transaction.

Lastly, failing to include a contingency plan in the agreement is a critical oversight. Contingencies such as the sale being subject to financing approval or a satisfactory home inspection allow parties to back out under specific circumstances without penalty. Without these provisions, buyers and sellers may find themselves locked into a sale that no longer makes sense for them or facing financial penalties for withdrawing.

By being mindful of these common mistakes and taking the time to address each aspect carefully, parties involved in a mobile home purchase can ensure a smoother transaction and protect their interests throughout the process.

Documents used along the form

When purchasing a mobile home, a Mobile Home Purchase Agreement form is crucial; however, it's not the only document required to ensure a smooth transaction. Several other forms and documents play key support roles in this process. They ensure clarity, compliance, and security for all parties involved. The following list includes commonly used documents alongside the Mobile Home Purchase Agreement form.

- Title Certificate: This document proves the seller's legal ownership of the mobile home. It's essential to confirm that the seller has the right to sell the property and that there are no undisclosed liens or encumbrances on the home.

- Bill of Sale: Acting as a receipt for the transaction, the Bill of Sale details the mobile home's purchase price, the date of sale, and specifics about the mobile home, including make, model, year, and serial number. It provides proof of transfer from the seller to the buyer.

- Mobile Home Lot Lease Agreement: If the mobile home will reside in a mobile home park or on leased land, this agreement outlines the terms of the lot rental. It includes rent details, rules for the property, and responsibilities of both landlord and tenant.

- Disclosure Forms: Depending on the state, sellers may need to provide certain disclosure forms that report on the condition of the mobile home. These can include disclosures about any known problems, past repairs, or issues that could affect the home's value or livability.

Each of these documents plays a vital role in ensuring that the process of buying a mobile home is conducted legally and transparently. They help protect the interests of both buyer and seller, facilitating a fair and informed transaction. Always ensure that these additional forms and documents are properly filled out and filed to make the mobile home buying process as smooth as possible.

Similar forms

The Mobile Home Purchase Agreement form shares similarities with a Real Estate Purchase Agreement, primarily due to their foundation in property sales transactions. Both documents delineate the terms under which the sale and purchase of a property, whether mobile or stationary, will occur. This includes specifics like purchase price, down payment, financing terms, and any conditions or contingencies that must be met before the sale can finalize. The core purpose of both agreements is to legally bind the parties to the terms of the sale, ensuring that both the buyer and seller are protected under law.

Another document akin to the Mobile Home Purchase Agreement form is the Bill of Sale. Often used in the sale of personal property, the Bill of Sale serves as evidence that a transaction between a buyer and seller has occurred. Like its mobile home counterpart, it details the specifics of the sale such as the property being sold, the agreed-upon purchase price, and the identification of both parties involved. While a Bill of Sale is more commonly associated with vehicles or smaller items, its fundamental role in confirming a sale mirrors that of the Mobile Home Purchase Agreement.

The Lease Agreement also bears resemblance to the Mobile Home Purchase Agreement, though with a focus on rental instead of purchase. Similarities between the two documents include the identification of parties, description of the property, terms of the agreement, and any relevant conditions or rules. While one leads to ownership and the other to temporary possession, both are pivotal in establishing the rights and responsibilities of each party involved in the transaction.

Comparable to the Mobile Home Purchase Agreement, the Land Contract outlines the sale of a property directly from the seller to the buyer, often involving installment payments over time until the full purchase price is paid off. This agreement specifies the terms of payment, interest rates, and what happens in case of default. Both documents facilitate property transactions without the immediate full payment, but the Land Contract is unique in that the seller retains the title to the property until all payments have been made, contrasting with the immediate title transfer in most mobile home purchases.

Last but not least, the Conditional Sales Agreement shares features with the Mobile Home Purchase Agreement form, as it also governs the sale of goods under specific conditions. Both contracts include stipulations that must be fulfilled for the sale to complete, often including financing terms and other conditions precedent. The Conditional Sales Agreement, similar to the mobile home agreement, ensures that ownership is contingent upon the satisfaction of these conditions, thereby protecting the interests of the seller while also providing a structured path to ownership for the buyer.

Dos and Don'ts

When filling out the Mobile Home Purchase Agreement form, it's crucial to approach this process with attention to detail and a clear understanding of what is required. This document not only represents a significant financial transaction but also sets the terms for your future in your new home. Below are some essential dos and don'ts to consider:

- Do thoroughly review the entire form before you start filling it out. Understanding each section ahead of time helps prevent mistakes and ensures that you know what information is required.

- Do gather all necessary information ahead of time, such as your personal identification details, financial information, and any pertinent details about the mobile home, including its make, model, year, and serial number.

- Do use clear, legible handwriting if you are filling out the form by hand. Alternatively, if an electronic fill-out option is available, take advantage of it for a cleaner, more professional-looking document.

- Do ensure that all involved parties, including co-buyers or sellers, review the completed form before signing. This step is crucial for ensuring everyone agrees with the terms and understands their obligations.

- Do keep copies of the completed form for your records and for any other party involved in the transaction. Having this documentation is important for future reference or if any disputes arise.

- Don't leave any sections blank unless the form specifically instructs you to do so. If a section doesn't apply, consider writing "N/A" (not applicable) to indicate that the question was read but doesn't pertain to your situation.

- Don't rush through the process. Taking your time to accurately complete the form can prevent costly errors and misunderstandings later on.

Misconceptions

When it comes to buying a mobile home, the process can be as complicated and nuanced as purchasing any piece of real estate. A key component of this transaction is the Mobile Home Purchase Agreement, which lays out the terms and conditions of the sale. Despite its importance, various misconceptions persist about what this document entails and its implications for both buyers and sellers. Here's a look at four common myths:

- It's the same as a standard home purchase agreement

- All mobile home purchase agreements are identical

- The agreement doesn’t impact financing

- A verbal agreement is just as binding

One common misunderstanding is that the Mobile Home Purchase Agreement is interchangeable with standard home purchase agreements. Mobile homes, particularly those not attached to a permanent foundation, are often classified as personal property rather than real estate. This distinction means the purchase agreement for a mobile home may address issues not found in standard real estate transactions, such as transfer of title for the mobile home itself rather than the land it sits on, unless the mobile home is permanently affixed to the land and deemed real property.

Another myth is the belief that all Mobile Home Purchase Agreements are cast from the same mold. In reality, the details can vary significantly depending on state laws, whether the mobile home is new or used, and whether the sale includes the land. Buyers and sellers should ensure the agreement they use is tailored to their specific situation and complies with local regulations.

Some people might think that the specifics of a Mobile Home Purchase Agreement have little to no impact on financing. This is not the case, as lenders scrutinize the agreement closely. For instance, how the mobile home is classified (as personal property or real property) can affect loan options, interest rates, and loan terms. Moreover, lenders may require additional safeguards or documentation reflected in the purchase agreement before approving financing.

A particularly risky misconception is the belief that a verbal agreement to purchase a mobile home is as binding as a written contract. While verbal agreements can be legally enforceable in some contexts, the complexities and specific requirements involved in buying a mobile home—such as transfer of title and adherence to local codes—make a written and well-documented agreement crucial. Without it, proving the terms of the agreement or seeking recourse in case of a dispute becomes incredibly challenging, if not impossible.

Understanding these misconceptions about the Mobile Home Purchase Agreement is key to navigating the purchase process successfully. Buyers and sellers alike should seek proper legal guidance to ensure their rights are protected and their agreements are in compliance with all necessary laws and regulations.

Key takeaways

When engaging in the purchase of a mobile home, the Mobile Home Purchase Agreement form is crucial. This document not only formalizes the transaction between the buyer and seller but also offers vital protections for both parties. Here are key takeaways to ensure its effective use:

Accurate and Complete Information: It's paramount that all information filled out on the form be accurate and complete. This includes details pertaining to the buyer and seller, as well as the mobile home itself—such as make, model, year, and serial number. Errors or omissions can lead to disputes or legal complications.

Clarification of Terms: The agreement should clearly outline the terms of the sale, including the purchase price, payment schedule, and any conditions or contingencies that need to be met before the sale is finalized. This clarity helps prevent misunderstandings and provides a clear path forward for the transaction.

Disclosure of Condition: Sellers are often required to disclose the condition of the mobile home, including any known defects or issues that could affect the home’s value or livability. Buyers should ensure that this information is included in the agreement to avoid unexpected complications or expenses.

Seek Legal Advice: Given the legal nature of the Mobile Home Purchase Agreement, seeking advice from a legal professional can provide valuable insights. A lawyer can help review the agreement to ensure that it protects your interests and meets all legal requirements.

Other Templates

Furniture Purchase Agreement Template - For the seller, the Furniture Bill of Sale provides evidence that the item was sold "as is" or with a specific agreement, protecting against future claims.

Liability Release Waiver - For the document to be valid, it must be signed voluntarily and without any form of pressure or coercion.