Fillable Marital Separation Agreement Document for North Carolina

In North Carolina, a Marital Separation Agreement serves as a critical legal document for couples considering separation. This form solidifies the terms of their separation, covering a wide range of topics that influence both parties' futures. Key aspects that the form addresses include the division of assets and debts, child custody and support arrangements, alimony, and any other relevant details tailored to the couple’s unique circumstances. By laying the groundwork for these essential topics, the agreement aims to prevent disputes and ensure a smoother transition into this new phase of life. It not only outlines the responsibilities and rights of each spouse but also paves the way for an amicable divorce process, should the couple choose to pursue it later on. The North Carolina Marital Separation Agreement form is therefore an indispensable tool for those navigating the complexities of separation, providing a structured approach to managing the dissolution of marital ties.

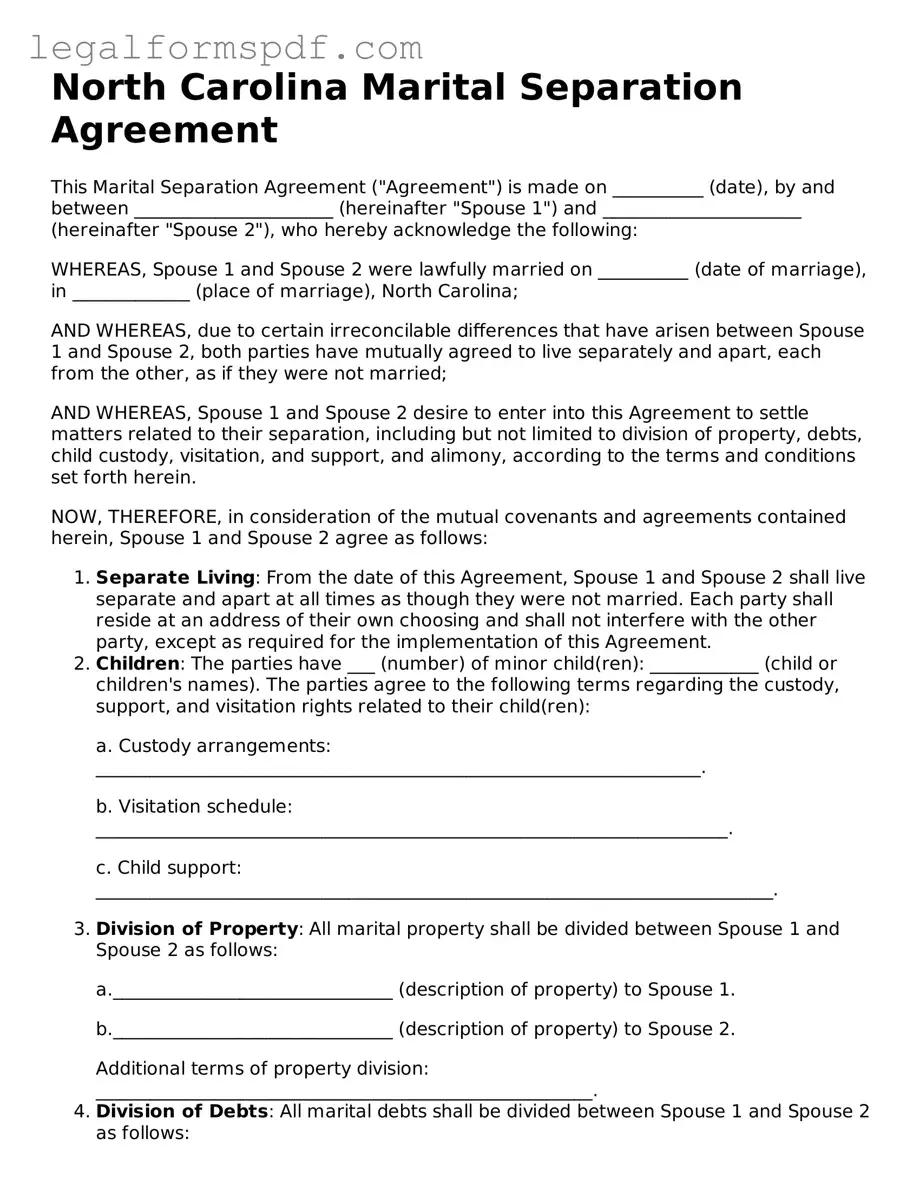

Document Example

North Carolina Marital Separation Agreement

This Marital Separation Agreement ("Agreement") is made on __________ (date), by and between ______________________ (hereinafter "Spouse 1") and ______________________ (hereinafter "Spouse 2"), who hereby acknowledge the following:

WHEREAS, Spouse 1 and Spouse 2 were lawfully married on __________ (date of marriage), in _____________ (place of marriage), North Carolina;

AND WHEREAS, due to certain irreconcilable differences that have arisen between Spouse 1 and Spouse 2, both parties have mutually agreed to live separately and apart, each from the other, as if they were not married;

AND WHEREAS, Spouse 1 and Spouse 2 desire to enter into this Agreement to settle matters related to their separation, including but not limited to division of property, debts, child custody, visitation, and support, and alimony, according to the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the mutual covenants and agreements contained herein, Spouse 1 and Spouse 2 agree as follows:

- Separate Living: From the date of this Agreement, Spouse 1 and Spouse 2 shall live separate and apart at all times as though they were not married. Each party shall reside at an address of their own choosing and shall not interfere with the other party, except as required for the implementation of this Agreement.

- Children: The parties have ___ (number) of minor child(ren): ____________ (child or children's names). The parties agree to the following terms regarding the custody, support, and visitation rights related to their child(ren):

a. Custody arrangements: ___________________________________________________________________.

b. Visitation schedule: ______________________________________________________________________.

c. Child support: ___________________________________________________________________________.

- Division of Property: All marital property shall be divided between Spouse 1 and Spouse 2 as follows:

a._______________________________ (description of property) to Spouse 1.

b._______________________________ (description of property) to Spouse 2.

Additional terms of property division: _______________________________________________________. - Division of Debts: All marital debts shall be divided between Spouse 1 and Spouse 2 as follows:

a._______________________________ (description of debt) to Spouse 1.

b._______________________________ (description of debt) to Spouse 2.

Additional terms of debt division: ___________________________________________________________. - Alimony: Considering the circumstances of the marriage and separation, the issue of alimony is settled as follows:

__________________________________________________________________________________.

- Amendments and Governing Law: This Agreement may only be amended, modified, or supplemented by an agreement in writing signed by both parties. This Agreement shall be governed by and construed in accordance with the laws of the State of North Carolina, without giving effect to any choice or conflict of law provision or rule.

- Entire Agreement: This Agreement constitutes the entire agreement between Spouse 1 and Spouse 2 pertaining to the subject matter contained herein and supersedes all prior and contemporaneous agreements, representations, and understandings of the parties.

In WITNESS WHEREOF, the Parties have executed this Agreement on the date first above written.

__________________________________________________________

Signature of Spouse 1Signature of Spouse 2

__________________________________________________________

Printed Name of Spouse 1Printed Name of Spouse 2

Date: __________

PDF Specifications

| Fact Number | Description |

|---|---|

| 1 | The North Carolina Marital Separation Agreement is a contract between spouses who are separating but not yet divorcing. |

| 2 | This agreement outlines the division of property, debt responsibilities, and may include alimony and child support terms. |

| 3 | To be valid, both parties must enter into the agreement voluntarily, with full disclosure of their financial situations. |

| 4 | The Agreement is governed by the laws of the State of North Carolina, including the North Carolina General Statutes (NCGS). |

| 5 | While not required, having the Agreement notarized can add a level of formality and enforceability. |

| 6 | It serves as a crucial document in the process of a legal separation and precedes the filing of a divorce decree. |

| 7 | Amendments to the Agreement must be made in writing and signed by both parties, ensuring ongoing fairness and agreement. |

Instructions on Writing North Carolina Marital Separation Agreement

In North Carolina, the process of legally documenting a separation between spouses involves several critical steps. This formal separation sets the stage for the resolution of various issues such as asset division, alimony, child support, and custody arrangements, laying a clear groundwork for potential divorce proceedings. Handling this document with care and precision is paramount to ensuring that the terms of the separation are clear, fair, and legally binding. Below are straightforward steps to assist in the completion of the North Carolina Marital Separation Agreement form.

- Gather all necessary financial documents and information pertaining to marital assets, debts, income, and expenses. This will ensure accuracy in filling out the form.

- Start by entering the full legal names of both parties involved in the separation at the top of the form where indicated.

- Specify the date of marriage and the date of separation, as this establishes the timeframe of the marital union and its cessation.

- Detail the arrangements for any minor children from the marriage, including custody arrangements, visitation schedules, and child support obligations. If applicable, attach a separate parenting plan document.

- Outline the division of any marital property, including but not limited to homes, vehicles, investment accounts, and personal property. Be as specific as possible to prevent future disputes.

- Address the allocation of debts incurred during the marriage, specifying who will be responsible for each debt.

- If applicable, document the terms of spousal support or alimony, including the amount, frequency, and duration of payments.

- Include any additional agreements made between the parties regarding health insurance, tax filings, or other relevant matters.

- Both parties should carefully review the agreement to ensure that all information is accurate and that the terms are fair and mutually agreeable.

- After reviewing, both parties must sign and date the agreement in the presence of a notary public to validate the document.

- Finally, file the completed and notarized agreement with the appropriate North Carolina court to make it legally binding.

It is highly recommended to seek the advice of a legal professional before finalizing the Marital Separation Agreement. This will help guarantee that the document is properly completed and meets all legal requirements, ensuring that the interests of both parties are adequately protected. Moving forward, this agreement will serve as the foundation for any future divorce proceedings, making it a critical step in the process of separation.

Understanding North Carolina Marital Separation Agreement

What is a North Carolina Marital Separation Agreement?

A North Carolina Marital Separation Agreement is a legal document that outlines the terms agreed upon by a married couple in the event of their separation. These terms often cover important issues such as alimony, child custody, child support, and the division of property. Once signed, it serves to organize the responsibilities and rights of each party during the separation period.

Is a Marital Separation Agreement legally required in North Carolina?

No, a Marital Separation Agreement is not legally required in North Carolina. However, it is highly recommended as it provides a clear and enforceable outline of the terms between the separating parties. It can help avoid misunderstandings and legal disputes down the line.

Does signing a Marital Separation Agreement mean I am legally divorced?

No, signing a Marital Separation Agreement does not mean you are legally divorced. In North Carolina, legal divorce is only granted after at least one year and one day of separation. The agreement simply outlines the terms of the separation prior to a divorce being finalized.

Can we modify the Marital Separation Agreement after signing it?

Yes, the Marital Separation Agreement can be modified after it is signed, but both parties must agree to the changes. Any modifications should be made in writing and ideally done with legal assistance to ensure the changes are legally binding.

What happens if we reconcile after signing a Marital Separation Agreement?

If a couple decides to reconcile after signing a Marital Separation Agreement, they can choose to nullify the agreement. It's advisable to have a written document that confirms the nullification of the agreement to avoid any future legal disputes.

How do we file a Marital Separation Agreement in North Carolina?

To file a Marital Separation Agreement in North Carolina, it's not obligatory to file the agreement with the court for it to be effective. However, if you wish to make it part of a divorce judgment in the future, you should present it to the court during the divorce proceedings. Legal advice is recommended to ensure the process meets all legal requirements.

What should be included in a Marital Separation Agreement?

A Marital Separation Agreement should detail all aspects of the couple's separation, including but not limited to alimony, division of marital property, child custody and visitation arrangements, child support, and insurance matters. Including these details ensures that both parties are clear on their rights and responsibilities and helps to prevent conflicts.

Common mistakes

When couples in North Carolina decide to separate, they often choose to draft a Marital Separation Agreement. This document outlines the terms of their separation, including property division, child custody, and support. However, mistakes during its completion can lead to misunderstandings, legal disputes, and potential delays in the separation process. One common mistake is failing to adequately describe the property and debts. Parties sometimes list these items in vague terms, omitting details such as account numbers or legal descriptions of real estate. This lack of specificity can create confusion and conflict when the time comes to divide assets.

Another issue arises when individuals overlook the importance of addressing future changes in income or living circumstances. They might not include provisions that allow for adjustments to child support or alimony based on significant changes in financial situations. Without such provisions, modifying the agreement in the future could require returning to court, which is both time-consuming and costly.

People also frequently underestimate the value of seeking legal advice before signing the agreement. They believe that they can handle everything themselves to save costs. However, misunderstandings about legal rights and obligations can lead to an agreement that is unfair or does not meet their needs. Consulting with a lawyer can help ensure that the agreement is balanced, complies with North Carolina law, and protects both parties’ interests.

Underestimating the importance of a thorough review and negotiation process is another mistake. Sometimes, in the desire to expedite the separation, one or both parties might rush through the agreement without fully considering the terms. This haste can result in agreements that are regretted later. It’s important for both parties to take the time to review all clauses, negotiate terms if necessary, and ensure that the agreement accurately reflects their intentions.

Lastly, failing to properly execute the agreement ranks among the common pitfalls. In North Carolina, certain formalities must be observed for a Marital Separation Agreement to be legally binding. These might include having the document notarized or witnessed. Neglecting these formalities can render the agreement invalid, which would significantly complicate matters if disputes were to arise later. Ensuring correct execution is crucial for the enforceability of the agreement.

Documents used along the form

When couples decide to separate in North Carolina, a Marital Separation Agreement is a crucial step in outlining the terms of their separation. This contract sets forth how the couple wishes to handle matters such as property division, debt allocation, and if applicable, spousal support. However, this agreement does not stand alone when navigating the complex process of separation and divorce. There are other important documents and forms that are often utilized in conjunction with a Marital Separation Agreement to ensure a thorough and legally sound separation process. These auxiliary documents play vital roles in addressing various aspects of the separation, ranging from financial obligations to parental responsibilities.

- Financial Affidavit: This form provides a detailed account of an individual’s financial situation, including income, expenses, assets, and liabilities. It is essential for accurately determining spousal support and property division.

- Child Custody and Visitation Agreement: For couples with children, this document outlines the custody arrangement and visitation schedule. It focuses on the well-being of the children and ensures their needs are met during and after the separation.

- Child Support Agreement: This agreement specifies the amount and frequency of child support payments. It often follows state guidelines to ensure that the financial needs of the children are adequately covered.

- Property Settlement Agreement: While the Marital Separation Agreement may cover property division, a separate Property Settlement Agreement can provide a more detailed arrangement for the division of both assets and debts.

- Alimony Agreement: This document specifies the terms of spousal support, including the amount, duration, and conditions under which alimony will be paid.

- Domestic Violence Protective Order: If domestic violence is a concern, this legal order protects the victim from further harm by legally restricting the abuser’s actions.

- Name Change Forms: If one party wishes to change their name post-separation or divorce, these forms facilitate the legal process of altering one’s name with the state.

Collectively, these documents complement the Marital Separation Agreement by addressing all aspects of a couple’s legal separation in North Carolina. They ensure that both parties have a clear understanding and agreement on financial matters, parental responsibilities, and personal safety. This comprehensive approach helps to mitigate potential conflicts and promotes a smoother transition during what can be a challenging time. When utilized effectively, these forms can pave the way for a respectful and amicable separation or divorce process.

Similar forms

A Marital Separation Agreement, specifically in the context of North Carolina, closely mirrors a Property Settlement Agreement. Both are utilized when couples decide to live apart and need to divide their assets and debts. The key similarity lies in their primary function: to document how personal and real property, along with debts, will be divided. However, the Marital Separation Agreement also typically addresses issues related to alimony, child support, and custody, making it a bit more comprehensive.

The Marital Separation Agreement is somewhat analogous to a Prenuptial Agreement, albeit serving a different stage in a relationship. While a Prenuptial Agreement sets the terms for asset division and obligations before marriage, a Marital Separation Agreement does so after marital discord but before divorce. Both serve to clearly outline the expectations and agreements between partners in respect to their finances, assets, and sometimes, responsibilities towards children.

Similar to a Custody Agreement, the Marital Separation Agreement in North Carolina may include detailed arrangements about the care, custody, and support of children. The focus is on establishing a plan that serves the best interests of the children, delineating custody schedules, decision-making authority, and financial support in the wake of parents living separately.

Another document similar to the Marital Separation Agreement is a Postnuptial Agreement. This type of agreement is made after a couple gets married to detail how assets and liabilities would be handled in the event of separation or divorce. Both documents allow couples to negotiate and finalize how their financial and family matters will be dealt with, should their marriage not work out.

The Marital Separation Agreement closely relates to a Separation and Property Settlement Agreement, which is often used interchangeably in some jurisdictions. Both outline the division of marital property, debt responsibilities, and may include alimony and child support provisions. The primary purpose is to settle these crucial matters without needing a court's intervention.

Comparable to a Debt Settlement Agreement, the Marital Separation Agreement encompasses aspects related to the division and settlement of debts. While a Debt Settlement Agreement focuses solely on negotiating and agreeing upon how debts will be paid off, a Marital Separation Agreement includes this as part of a broader document, alongside dividing assets and addressing family support responsibilities.

Somewhat akin to a Child Support Agreement, parts of the Marital Separation Agreement dedicate attention to outlining how child support will be managed. Both aim to ensure that financial provisions for the children are fair, adequate, and in accordance with state guidelines, albeit the Marital Separation Agreement encompasses this within a larger framework of marital separation clauses.

The Safe Houses Agreement parallels the Marital Separation Agreement in efforts to outline arrangements for living situations post-separation. Though not a widely recognized term, Safe Houses Agreements typically address immediate housing and safety concerns in volatile situations. Meanwhile, Marital Separation Agreements cover living arrangements more broadly, often including who will reside in the marital home, under what conditions, and for how long.

Similar in nature to an Alimony Agreement, portions of a Marital Separation Agreement may stipulate the conditions under which one party provides financial support to the other. This comparison emphasizes the segment of the agreement dedicated to ensuring that parties are adequately supported financially after separation, often until divorce proceedings finalize or as long as agreed upon by the parties.

Lastly, the Marital Separation Agreement bears resemblances to a Maintenance Agreement in some respects. While a Maintenance Agreement typically refers to contractual agreements for the provision of services or upkeep of property, in the context of marital separation, it might parallel discussions around who maintains health insurance, life insurance, and the upkeep of any joint properties until assets are fully divided or sold.

Dos and Don'ts

When navigating through the intricacies of filling out the North Carolina Marital Separation Agreement form, individuals must adhere to certain guidelines to ensure a smooth and legally sound process. Below are essential do's and don'ts that can serve as a roadmap during this crucial phase.

- Do gather all necessary financial documents before starting. This preparation will make filling out the financial details in the agreement more accurate and straightforward.

- Do consider consulting with a legal expert. Understanding your rights and obligations under North Carolina law can be crucial in drafting a fair and enforceable agreement.

- Do use clear and concise language. Avoid legal jargon when possible to ensure both parties fully understand the terms of the agreement.

- Do review the form for specific requirements unique to North Carolina. State-specific details, such as division of marital property, child custody, and support details, must comply with local laws.

- Do include provisions for resolving potential future disputes. Outline methods for dealing with disagreements that might arise after the agreement is in effect.

- Don't rush through the process. Take your time to consider all aspects of your separation, including assets, debts, and the welfare of any children involved.

- Don't sign the agreement without fully understanding every term and condition. Once signed, it becomes a legally binding contract.

- Don't leave any sections blank. If a section does not apply, indicate with "N/A" (not applicable) or "0" (zero) to show that it has been considered and intentionally left blank.

- Don't forget to have the agreement notarized. A notary public must witness the signing of the document to validate its authenticity, a requirement for legal enforcement in most cases.

By following these guidelines, individuals can better navigate the process of completing the North Carolina Marital Separation Agreement form. This not only ensures clarity and fairness but also adheres to legal standards that protect both parties involved.

Misconceptions

Understanding the nuances of the North Carolina Marital Separation Agreement form is essential for individuals navigating through the complexities of separation and divorce. However, several misconceptions often cloud the judgment and expectations of those involved. Here, we aim to clarify some of these misunderstandings.

It’s just a simple form. Many believe that filling out the North Carolina Marital Separation Agreement is as easy as completing any everyday form. However, this document requires careful consideration of legal rights, financial implications, and future responsibilities. Its completion demands thoughtfulness and, often, legal counsel.

Once signed, it cannot be changed. Another misconception is that the agreement is set in stone once both parties sign it. In reality, modifications can be made if both parties agree to the changes and those changes are properly documented and filed with the court.

It covers child custody and support issues. People often think the Marital Separation Agreement encompasses agreements about child custody and support. While it can address these issues, specific forms and proceedings usually handle child custody and support matters, which must comply with North Carolina law.

Legal assistance is not necessary. There’s a common belief that one can execute the Marital Separation Agreement without any legal help. While it’s possible, seeking legal advice is highly recommended to ensure that the agreement is fair, comprehensive, and legally binding.

Any agreement will be approved by the court. The assumption that courts automatically approve any Marital Separation Agreement is misguided. The court reviews the agreement to ensure it's in compliance with the law and that its terms are fair and reasonable.

It immediately leads to divorce. Some individuals misunderstand that executing a Marital Separation Agreement is synonymous with being legally divorced. In fact, it is a precursor to divorce proceedings but does not, by itself, dissolve the marriage.

All assets and debts are split 50/50. The myth that everything is divided equally is widespread but inaccurate. North Carolina law operates under the principles of equitable distribution, meaning assets and debts are divided in a way that is fair, which may not always be equal.

Separation agreements are only for the wealthy. The belief that separation agreements are exclusively beneficial for those with substantial assets is incorrect. They serve to protect the rights and outline the responsibilities of both parties, regardless of their financial status.

A separation agreement is the same as a divorce decree. Lastly, equating a separation agreement with a divorce decree is a mistake. The separation agreement is a contract between spouses outlining the terms of their separation, whereas a divorce decree is a court order officially ending the marriage.

Dispel these misconceptions to navigate your separation with clarity and confidence, ensuring that decisions are made on accurate understandings and facts.

Key takeaways

Filling out and using the North Carolina Marital Separation Agreement form is a critical step for couples who are choosing to live apart without formally ending their marriage. This agreement outlines the terms of their separation, covering various aspects of their current and future lives apart. The following key takeaways are vital for individuals navigating this legal process:

- Accuracy is paramount: When completing the Marital Separation Agreement, it's essential to provide accurate and detailed information about assets, debts, and personal details. Errors or omissions can lead to delays in the agreement's approval or issues with enforceability.

- Consideration of all relevant areas is necessary: The agreement should comprehensively cover all areas relevant to the couple's situation, including but not limited to child custody and support, division of property, alimony, and any other financial arrangements. This broad scope ensures that all aspects of the separation are legally addressed.

- Legal advice is invaluable: Consulting with a legal professional who understands North Carolina's laws regarding marital separation can provide crucial guidance. They can ensure the agreement's terms are fair, legal, and in the best interest of both parties.

- Signing requirements must be adhered to: For the Marital Separation Agreement to be recognized as legally binding in North Carolina, it must be signed by both parties. Furthermore, the signatures typically need to be notarized to certify the document's authenticity and the signees' identities.

- Amendments are possible: Life circumstances can change, necessitating modifications to the Marital Separation Agreement. Both parties must agree to any changes, and the amendments should be made in writing, signed, and notarized, similar to the original agreement.

Adhering to these key points can streamline the process of completing and using the North Carolina Marital Separation Agreement, ensuring that it meets the legal criteria and adequately addresses the needs and intentions of both parties during their separation.

More Marital Separation Agreement State Forms

Texas Separation Agreement - This form can significantly reduce the time and emotional toll involved in dissolving a marriage, facilitating a smoother transition for everyone involved.

Legal Separation in Georgia With Child - Creating a Marital Separation Agreement can help in establishing a clear pathway for future divorce proceedings, making the process more straightforward.