Fillable Loan Agreement Document for Texas

When individuals or businesses in Texas decide to lend or borrow money, the Texas Loan Agreement form serves as a crucial document to outline the terms of the transaction. This form meticulously records the amount of money being lent, the repayment schedule, interest rates, collateral (if any), and the responsibilities of each party. Its importance cannot be understated as it provides a legal backbone to the financial transaction, ensuring both lender and borrower are protected under state laws. The form helps in preventing misunderstandings and disputes by clearly defining the expectations and obligations. Furthermore, it addresses various scenarios, such as late payments or defaults, making it comprehensive. Whether you are lending money to a friend or entering into a commercial loan, using the Texas Loan Agreement form is a step towards safeguarding your interests and ensuring that the agreement is recognized by law.

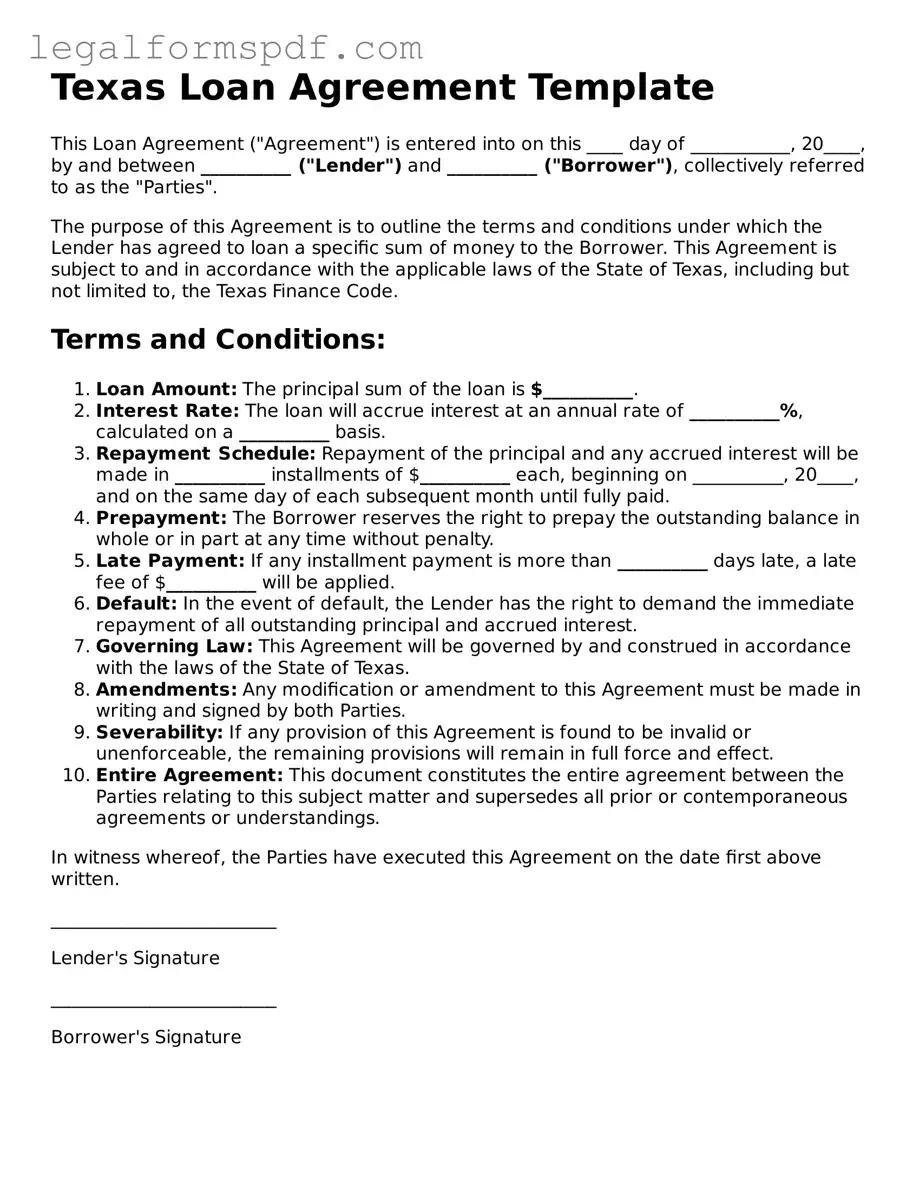

Document Example

Texas Loan Agreement Template

This Loan Agreement ("Agreement") is entered into on this ____ day of ___________, 20____, by and between __________ ("Lender") and __________ ("Borrower"), collectively referred to as the "Parties".

The purpose of this Agreement is to outline the terms and conditions under which the Lender has agreed to loan a specific sum of money to the Borrower. This Agreement is subject to and in accordance with the applicable laws of the State of Texas, including but not limited to, the Texas Finance Code.

Terms and Conditions:

- Loan Amount: The principal sum of the loan is $__________.

- Interest Rate: The loan will accrue interest at an annual rate of __________%, calculated on a __________ basis.

- Repayment Schedule: Repayment of the principal and any accrued interest will be made in __________ installments of $__________ each, beginning on __________, 20____, and on the same day of each subsequent month until fully paid.

- Prepayment: The Borrower reserves the right to prepay the outstanding balance in whole or in part at any time without penalty.

- Late Payment: If any installment payment is more than __________ days late, a late fee of $__________ will be applied.

- Default: In the event of default, the Lender has the right to demand the immediate repayment of all outstanding principal and accrued interest.

- Governing Law: This Agreement will be governed by and construed in accordance with the laws of the State of Texas.

- Amendments: Any modification or amendment to this Agreement must be made in writing and signed by both Parties.

- Severability: If any provision of this Agreement is found to be invalid or unenforceable, the remaining provisions will remain in full force and effect.

- Entire Agreement: This document constitutes the entire agreement between the Parties relating to this subject matter and supersedes all prior or contemporaneous agreements or understandings.

In witness whereof, the Parties have executed this Agreement on the date first above written.

_________________________

Lender's Signature

_________________________

Borrower's Signature

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Loan Agreement form is governed by the laws of the State of Texas, including but not limited to the Texas Finance Code, which outlines the state's regulations on lending practices and borrower protections. |

| Usury Limits | In Texas, the interest rates charged by lenders are subject to usury limits, which are designed to protect borrowers from exorbitant rates. These limits are specified in the Texas Finance Code, and exceptions depend on the nature of the lender and the loan. |

| Required Disclosures | Lenders in Texas are required to make certain disclosures to borrowers, including the annual percentage rate (APR), the terms of the loan, and any fees or charges. This ensures transparency and helps borrowers make informed decisions. |

| Default and Recovery | In the event of a default by the borrower, Texas law outlines specific procedures and remedies for lenders, including the right to repossess collateral or pursue legal action to recover the outstanding loan balance, subject to fair debt collection practices. |

Instructions on Writing Texas Loan Agreement

Filling out a Texas Loan Agreement form is a crucial step for both the lender and the borrower to ensure that the terms of the loan are clearly documented and legally binding. This process requires attention to detail and an understanding of the specific information that needs to be included to make the agreement enforceable. The following steps are designed to guide you through this process, ensuring that each party's rights are protected and obligations are clearly defined.

- Begin by filling out the date of the agreement at the top of the form. This date should reflect when the agreement is being entered into by both parties.

- Enter the full legal names and addresses of both the lender and the borrower in the respective fields. It's crucial to use the parties' legal names to ensure the enforceability of the agreement.

- Specify the principal amount of the loan. This is the amount of money being loaned before any interest or fees are applied.

- Detail the interest rate for the loan. This should be a yearly rate and must comply with the usury laws of Texas to avoid being considered illegal.

- Describe the terms of repayment. Include how often payments will be made (monthly, quarterly, etc.), the amount of each payment, and when the first payment is due. Additionally, specify the final payment date by which the loan must be repaid in full.

- Include any collateral that will secure the loan. If the loan is secured by collateral, describe the collateral in detail in the provided section.

- Outline any late fees or penalties for missed payments. This section should clearly state the consequences of late payments or defaults.

- Specify any prepayment terms. Some loans allow the borrower to pay off the loan early without penalty, while others may require a fee for early repayment.

- Both the lender and the borrower should read the entire agreement carefully. It's important that both parties fully understand and agree to the terms laid out in the document.

- Sign and date the form. The agreement must be signed by both the lender and the borrower to be legally binding. Include the print names of both parties below their signatures.

- If applicable, have the agreement notarized. While not always required, notarization can add an additional layer of legal validity to the document.

Once the Texas Loan Agreement form is fully completed and signed, it serves as a legal document that outlines the specifics of the loan between the lender and the borrower. Both parties should keep a copy of the agreement for their records. Following these steps ensures that the loan process is conducted fairly and transparently, with clear expectations for repayment and any potential issues addressed upfront.

Understanding Texas Loan Agreement

What is a Texas Loan Agreement form?

A Texas Loan Agreement form is a legally binding document between two parties - often a borrower and a lender - that outlines the terms and conditions of a loan. The form sets forth the details such as the loan amount, interest rate, repayment schedule, and any collateral involved. It serves to protect both the lender's interest and ensure the borrower knows their obligations.

Who needs to sign the Texas Loan Agreement form?

The Texas Loan Agreement form must be signed by the borrower and the lender. In some cases, if collateral is involved or if there are guarantors for the loan, they may also need to sign the agreement. It’s not just the signatures that matter; ensuring that all parties have a clear understanding of the terms is equally important.

Does the Texas Loan Agreement form need to be notarized?

While notarization is not a legal requirement for a Texas Loan Agreement to be considered valid, it can add an extra layer of authentication to the document. Notarization can help in the enforcement of the agreement, should any disputes arise. Yet, the focus should be on the completeness and accuracy of all agreed-upon terms.

Can I modify a Texas Loan Agreement form after it has been signed?

Yes, modifications can be made to a Texas Loan Agreement form after it has been signed, but any changes require the agreement of all parties involved. Modifications must be documented in writing and attached as amendments to the original agreement. This ensures that all changes are tracked and agreed upon, maintaining the integrity of the legal document.

What happens if the borrower defaults on the loan?

If the borrower defaults on the loan, the lender has the right to pursue legal action to recover the due amount. The specific actions that can be taken depend on the terms laid out in the Texas Loan Agreement form, including the possibility of seizing collateral if it was part of the agreement. Often, such situations are resolved through negotiation or restructuring of the loan's terms to avoid legal actions.

Is there a difference between a Texas Loan Agreement form and a promissory note?

Yes, there is a significant difference. A Texas Loan Agreement form is a comprehensive contract that includes detailed terms and conditions of the loan, such as repayment schedule, interest rates, and legal remedies in case of defaults. A promissory note, on the other hand, is a simpler document that outlines the borrower's promise to repay the loan. It may not include detailed terms like a loan agreement does.

How can I ensure my Texas Loan Agreement form is legally binding?

To ensure your Texas Loan Agreement form is legally binding, it should include all essential terms of the agreement, be signed by all parties involved, and ideally, be reviewed by a legal professional. Clarity, completeness, and conformity with Texas state laws are key to establish its enforceability.

Can the Texas Loan Agreement form be used for both secured and unsecured loans?

Yes, the Texas Loan Agreement form can be drafted to suit both secured and unsecured loans. The primary difference lies in whether or not collateral is offered by the borrower. For secured loans, details about the collateral and the conditions under which it can be seized by the lender in case of default are included. For unsecured loans, such terms are omitted as no collateral is involved.

Common mistakes

One common mistake people make when filling out the Texas Loan Agreement form is not providing complete personal information. This includes omitting contact details, such as phone numbers or email addresses, which can lead to delays in processing the agreement or difficulties in communication between the parties involved.

Another error is failing to specify the loan amount clearly. Some applicants write this crucial information in words but forget to include numerical figures, or vice versa, leading to confusion over the exact loan amount agreed upon. This lack of clarity can result in disputes or complications during the repayment phase.

Incorrectly stating the interest rate is also a frequent oversight. Individuals often enter the annual interest rate without specifying whether it is fixed or variable. This detail is vital for understanding how interest will accumulate over time and can significantly affect the borrower's repayment obligations.

Many people overlook the importance of detailing the repayment schedule. Without a clear repayment plan, including specific due dates and amounts for each installment, both parties may find themselves in disagreement about expectations, potentially leading to missed payments or breaches of the agreement.

Forgetting to include collateral, if applicable, is another common misstep. In secured loans, specifying what asset is being used as collateral and its condition is crucial. Failure to document this properly can cause issues if the lender needs to seize the asset due to nonpayment.

Not defining default terms is a critical error often found in these forms. The agreement should spell out what constitutes a default on the loan and the subsequent actions that can be taken by the lender. Without this, enforcing the agreement in the event of nonpayment becomes problematic.

Leaving signature lines blank or not having the document witnessed can invalidate the entire agreement. Texas law may require certain loan agreements to be signed in the presence of a witness or notarized to be legally binding.

Some individuals fail to keep or provide copies of the signed agreement to all parties. Each party should retain a copy for their records to ensure that there is no confusion about the terms of the loan or obligations of each party.

Omitting jurisdiction and governing law clauses is a subtler mistake that can have profound implications. These clauses determine which state's laws will apply to the agreement and where any disputes will be resolved. Without them, resolving legal issues can become more complicated and expensive.

Finally, a common mistake is not consulting with a legal professional before finalizing the loan agreement. While the temptation to save on legal fees might be strong, professional advice can help avoid the aforementioned pitfalls and tailor the agreement to meet specific needs and legal requirements.

Documents used along the form

When entering into a loan agreement in Texas, it's crucial to understand that this form is just one part of a collection of documents that ensure the process goes smoothly and all parties are protected. While the loan agreement outlines the terms and conditions of the loan itself, several other documents are commonly used in conjunction to provide additional details, secure the loan, or comply with legal requirements. Let's delve into some of these crucial documents that often accompany a Texas Loan Agreement form.

- Promissory Note: This is a crucial document that accompanies a loan agreement. It outlines the borrower's promise to repay the loan. It specifies the loan amount, interest rate, repayment schedule, and what happens in case of default. It's a more detailed document focusing on the repayment terms and provides a clear schedule and method for payments.

- Security Agreement: If the loan is secured, which means it's backed by collateral, a security agreement is necessary. This document specifies the assets that the borrower uses to secure the loan, such as property or goods. It clearly defines the rights of the lender to take possession of the collateral if the borrower fails to meet the terms of the loan agreement and promissory note.

- Guaranty: Often used in business loans or when the borrower’s creditworthiness is in question, a guaranty is an agreement by a third party to shoulder the responsibility of paying back the loan if the borrower defaults. This document provides an additional layer of security for the lender by ensuring another credible party guarantees the loan repayment.

- Amendment Agreement: Over the life of a loan, terms may need to be adjusted or updated, which is where an amendment agreement comes into play. This document outlines any changes made to the original loan agreement, ensuring that both parties legally acknowledge the adjustments. It's a testament to the fluid nature of financial agreements and the need for flexibility in long-term financial planning.

These documents work in concert to create a transparent, secure, and enforceable loan arrangement. Whether for personal loans, business financing, or other financial dealings, understanding the role and importance of each can make the loan process much smoother and more predictable for all parties involved. Navigating these documents may seem daunting at first, but each plays a vital role in protecting the interests of the borrower and the lender alike, making them indispensable parts of the lending process in Texas.

Similar forms

A Promissory Note is akin to a Texas Loan Agreement, serving as a written promise for the borrower to pay back a specified sum of money to the lender by a designated date. Both documents outline the loan amount, interest rate, repayment schedule, and any collateral. The primary difference lies in the level of detail; a Loan Agreement often includes more comprehensive terms and conditions, such as clauses related to default, governing law, and dispute resolution.

Mortgage Agreements share similarities with the Texas Loan Agreement, mainly in their function to secure a loan with real estate property. In both agreements, the borrower agrees to repay the borrowed amount under specified conditions. However, a Mortgage Agreement specifically ties the loan to a piece of real estate, granting the lender the right to foreclose on the property if the borrower defaults on the loan. This focus on real estate collateral is the main distinction from a general Loan Agreement.

A Deed of Trust, like a Texas Loan Agreement, is used in financing agreements involving real estate. It involves three parties: the borrower, the lender, and a trustee, who holds the property title until the loan is repaid. While a Loan Agreement outlines the terms under which money is borrowed, a Deed of Trust provides an additional layer of security for the lender by involving a trustee. The key difference lies in the involvement of this third party and the transfer of the property title to secure the loan.

A Line of Credit Agreement shares the foundational purpose with a Texas Loan Agreement, allowing a borrower access to a specific amount of funds over a set period. Both outline the terms for borrowing, including interest rates and repayment plans. Nonetheless, a Line of Credit Agreement differs in its flexibility, permitting the borrower to draw funds up to a predetermined limit as needed, which contrasts with the single lump sum provided under a typical Loan Agreement.

An Installment Agreement is closely related to a Texas Loan Agreement in its provision for a loan to be repaid over time through a series of scheduled payments. Both agreements detail payment schedules, interest rates, and the consequences of defaulting. The distinction often rests in the emphasis on regular, fixed payments in an Installment Agreement, specifically designed for the structured repayment of debt over time, which might not be as explicitly defined in a broader Loan Agreement.

Finally, a Personal Guarantee is a document often associated with a Texas Loan Agreement, especially when the borrower needs to provide additional assurance to the lender regarding the loan's repayment. A Personal Guarantee ensures that if the borrower fails to repay the loan, the guarantor will be responsible for fulfilling the debt. While not a loan document per se, it complements a Loan Agreement by offering the lender an extra layer of security, directly involving another individual or entity in the repayment obligation.

Dos and Don'ts

When filling out the Texas Loan Agreement form, it's critical to pay close attention to detail and follow best practices. The actions you take can have significant legal implications. Below are the five things you should do, as well as five things you should avoid to ensure the process is completed smoothly and effectively.

Five Things You Should Do

Ensure all parties' names and contact information are accurately filled out. This includes the lender, borrower, and any co-signers.

Clearly specify the loan amount and the interest rate. This should be spelled out in numerical and written form to avoid any confusion.

Detail the repayment schedule, including due dates, monthly payment amounts, and final payment date. Clarity here can prevent misunderstandings down the line.

Outline the terms for late payments, defaults, and prepayment options. Knowing the consequences and allowances ahead of time can guide behavior during the loan period.

Have the document reviewed by a legal professional. Even if you think you've completed everything correctly, legal nuances can make a big difference.

Five Things You Shouldn't Do

Don't leave any fields blank. If a section does not apply, fill it with "N/A" or "0" if it regards financials, to signify that it has been considered and intentionally left empty.

Avoid using vague language. Be as specific as possible to prevent any ambiguities that might lead to disputes in the future.

Do not forget to specify the governing state law, which in this case would be Texas. This is crucial for determining which state's laws will interpret the contract.

Resist the temptation to rush through the form without thoroughly reading every section and understanding its implications.

Do not fail to keep a signed copy of the agreement for your records. Each party should have an original or a photocopy of the signed document.

Misconceptions

Understanding the Texas Loan Agreement form is crucial for anyone entering into a lending arrangement in the state. However, there are several misconceptions that can lead to confusion. Here is a list of seven common misunderstandings and the realities behind them:

It's Only for Business Loans: Many believe that the Texas Loan Agreement form is exclusively for business-related lending. In reality, this versatile document can be used for a wide range of loans, including personal loans between family members or friends. It's designed to help any lender and borrower create a clear understanding of the loan terms.

Verbal Agreements Are Just as Binding: While Texas recognizes verbal contracts in some cases, relying on a verbal agreement for a loan can lead to significant misunderstandings and legal challenges. A written loan agreement clearly outlines each party's obligations and protections, reducing the risk of disputes.

One-Size-Fits-All: A common mistake is thinking that the form doesn't need customization. Each loan agreement should be tailored to the specific terms and conditions of the loan it represents, including the interest rate, repayment schedule, and any collateral involved.

No Need for Legal Review: Some parties skip having their loan agreement reviewed by a legal professional, believing that the form is sufficient on its own. However, consulting with a legal expert can ensure that the agreement complies with all applicable Texas laws and adequately protects all parties involved.

Only the Borrower Needs to Sign: This misconception can lead to a lack of enforceability. In Texas, as well as in other jurisdictions, it's critical for all parties involved in the loan agreement to sign the document, including co-signers or guarantors if applicable.

Not Necessary for Small Loans: No matter the size of the loan, a formal agreement is always recommended. It clarifies the terms and expectations for both parties, helping to prevent potential disputes over minor loans just as it does for larger amounts.

All Loan Agreements Are Public Record: There's a mistaken belief that once a loan agreement is signed, it becomes public record. In fact, these documents are private contracts between the lender and borrower. While related documents, like a mortgage filing, might be public, the loan agreement itself remains confidential unless a dispute leads to court action.

By understanding these misconceptions, individuals and businesses can better navigate the intricacies of loan agreements in Texas. Ensuring that a loan agreement is clear, customized, and legally sound can protect all parties involved and help prevent unnecessary complications.

Key takeaways

Filling out and using the Texas Loan Agreement form is a critical process that ensures the terms of a loan are clear, legally binding, and understood by all parties involved. Here are eight key takeaways to guide you through this important legal document.

- Thoroughly Review the Form: Before filling out the form, make sure to read it entirely to understand each section's purpose and requirements. This prevents errors and ensures you fully grasp the agreement's scope.

- Details Matter: Provide comprehensive details about the borrower and lender, including full names, addresses, and contact information. This clarity is vital for identification and communication.

- Loan Terms: Clearly state the loan amount, interest rate (if applicable), repayment schedule, and any other terms that define how the loan is to be repaid. Precise terms help avoid future disagreements.

- Collateral: If the loan is secured with collateral, describe it in detail in the agreement. This is crucial for secured loans, as it defines what assets are at risk if the loan is not repaid.

- Legal Clauses: Understand all legal clauses within the agreement, such as default conditions, dispute resolution methods, and prepayment penalties. These clauses protect both the lender and borrower's interests.

- Signature Requirements: Ensure that all parties involved sign the agreement. Signatures are necessary for the document to be legally binding. Witness or notary public signatures might also be required, depending on state laws.

- Keep Copies: After the agreement is signed, make sure all parties receive a copy of the document. Keeping a copy is essential for record-keeping and helps resolve any future issues.

- Consult Professionals: If you’re unsure about any aspect of the loan agreement, consulting with a legal or financial professional is prudent. Their expertise can guide you through complex terms and ensure your interests are protected.

By keeping these key takeaways in mind, you can navigate the Texas Loan Agreement form with confidence, ensuring a smooth and binding agreement between all parties.

More Loan Agreement State Forms

Promissory Note Template Florida Pdf - The agreement includes default terms, detailing the consequences and actions that can be taken if the borrower fails to repay.

Promissory Note Illinois - The document serves as a legal record to ensure both parties understand their obligations.