Fillable Loan Agreement Document for New York

Securing a loan in New York entails a comprehensive process where both lenders and borrowers must mutually agree on the terms and conditions that govern the transaction. This process is encapsulated within a New York Loan Agreement form, an essential document that clearly outlines the amount of money being borrowed, the interest rate applied, repayment schedules, and what happens in the event of a default. Constructing a well-drafted loan agreement is crucial as it legally binds both parties and protects their interests throughout the duration of the loan. Moreover, the form also details the obligations of each party, any collateral involved, and includes specific provisions applicable under New York state laws. Whether it's for personal loans, business ventures, or other financial agreements, understanding every segment of this form ensures a smooth lending process, minimizes potential disputes, and outlines a clear path for repayment. It’s not just a formality but a strategic step in securing financial transactions within the legal framework of New York, making it indispensable for lenders and borrowers alike.

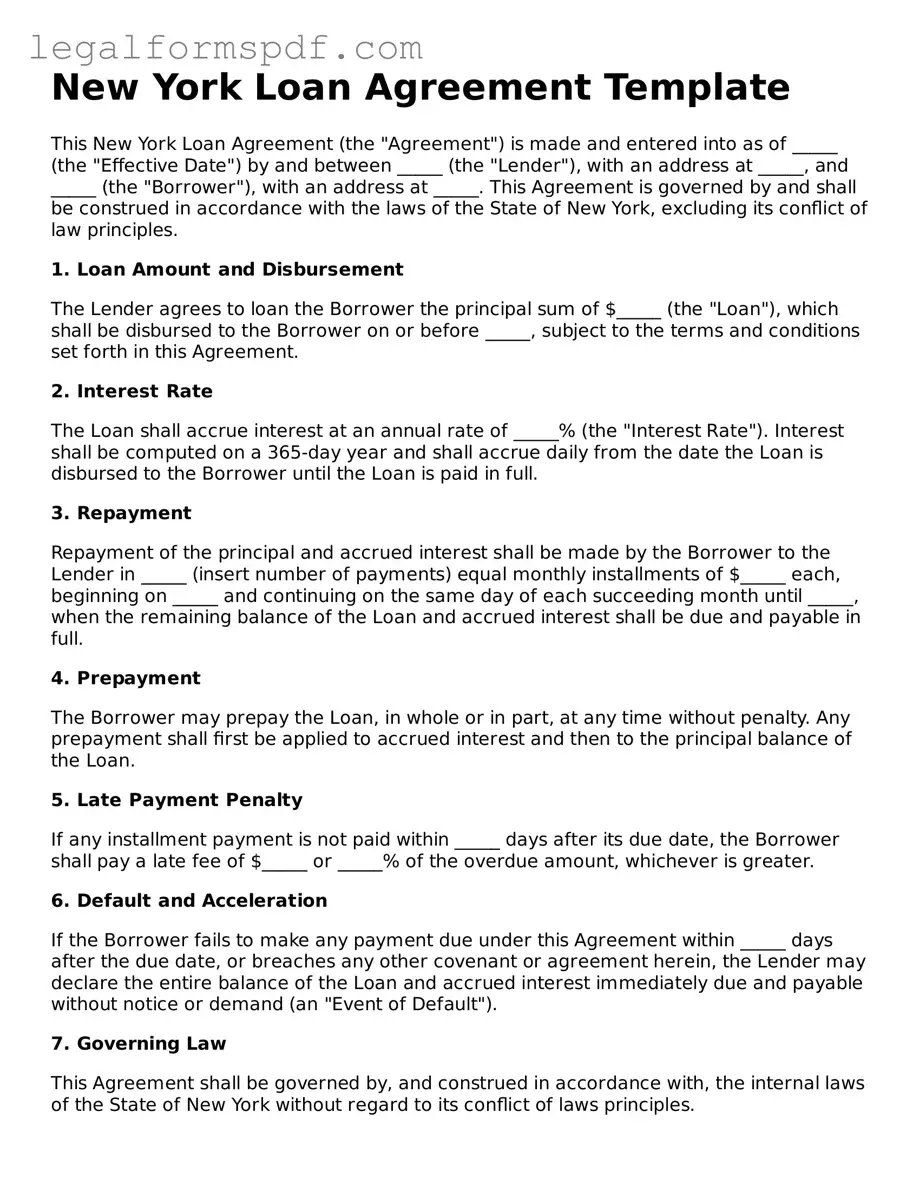

Document Example

New York Loan Agreement Template

This New York Loan Agreement (the "Agreement") is made and entered into as of _____ (the "Effective Date") by and between _____ (the "Lender"), with an address at _____, and _____ (the "Borrower"), with an address at _____. This Agreement is governed by and shall be construed in accordance with the laws of the State of New York, excluding its conflict of law principles.

1. Loan Amount and Disbursement

The Lender agrees to loan the Borrower the principal sum of $_____ (the "Loan"), which shall be disbursed to the Borrower on or before _____, subject to the terms and conditions set forth in this Agreement.

2. Interest Rate

The Loan shall accrue interest at an annual rate of _____% (the "Interest Rate"). Interest shall be computed on a 365-day year and shall accrue daily from the date the Loan is disbursed to the Borrower until the Loan is paid in full.

3. Repayment

Repayment of the principal and accrued interest shall be made by the Borrower to the Lender in _____ (insert number of payments) equal monthly installments of $_____ each, beginning on _____ and continuing on the same day of each succeeding month until _____, when the remaining balance of the Loan and accrued interest shall be due and payable in full.

4. Prepayment

The Borrower may prepay the Loan, in whole or in part, at any time without penalty. Any prepayment shall first be applied to accrued interest and then to the principal balance of the Loan.

5. Late Payment Penalty

If any installment payment is not paid within _____ days after its due date, the Borrower shall pay a late fee of $_____ or _____% of the overdue amount, whichever is greater.

6. Default and Acceleration

If the Borrower fails to make any payment due under this Agreement within _____ days after the due date, or breaches any other covenant or agreement herein, the Lender may declare the entire balance of the Loan and accrued interest immediately due and payable without notice or demand (an "Event of Default").

7. Governing Law

This Agreement shall be governed by, and construed in accordance with, the internal laws of the State of New York without regard to its conflict of laws principles.

8. Amendments

This Agreement may only be amended, modified, or supplemented by an agreement in writing signed by each party hereto.

9. Notices

All notices, requests, demands, and other communications hereunder shall be in writing and shall be deemed to have been duly given if delivered personally or sent by registered or certified mail (postage prepaid, return receipt requested) to the parties at the above addresses or at such other address as either party may specify in writing.

10. Entire Agreement

This Agreement contains the entire understanding between the parties with respect to the subject matter hereof and supersedes all prior and contemporaneous agreements and understandings, oral or written, relating to such subject matter.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the Effective Date.

__________________________________

Lender: _____

__________________________________

Borrower: _____

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The New York Loan Agreement is governed by the laws of the State of New York, irrespective of the borrower's location. |

| Form Purpose | This form is used to document the terms and conditions under which a loan is provided by a lender to a borrower in New York. |

| Key Components | The agreement includes parts such as loan amount, interest rate, repayment schedule, collateral (if any), and provisions for default. |

| Critical Terms | Terms like 'Principal', 'Interest', and 'Maturity Date' are clearly defined to avoid ambiguity and ensure mutual understanding. |

| Interest Rate Compliance | Interest rates contained in the agreement must comply with New York's usury laws to ensure they are not illegally high. |

| Prepayment | The agreement may specify conditions for prepayment, allowing the borrower to pay off the loan early potentially with or without a penalty. |

| Default and Remedies | Specifies what constitutes default and the legal remedies available to the lender, including acceleration of repayment. |

| Secured vs. Unsecured | Clarifies whether the loan is secured by collateral or unsecured, which affects the remedies available in case of default. |

| Signature Requirement | Both parties must sign the agreement, making it a legally binding contract enforceable in a court of law. |

| Notarization | Notarization is not mandatory but may be required based on the loan amount or the presence of collateral. |

Instructions on Writing New York Loan Agreement

Filling out a loan agreement form is an essential step when borrowing or lending money in New York, ensuring that the terms of the agreement are clearly documented and binding for both parties involved. This process doesn’t have to be daunting. With a clear outline and understanding of the necessary information, you can confidently complete the form. Here, you will find a straightforward guide to navigate through each section of the New York Loan Agreement form, designed to protect both the borrower's and lender's interests while adhering to the state's legal requirements.

- Start by entering the date the agreement is being made at the top of the form.

- Fill in the full legal names of the borrower and lender, ensuring accuracy to avoid any misunderstandings or legal issues.

- Specify the loan amount in words and then in numbers to confirm the total money being loaned.

- Detail the loan repayment terms, including the repayment schedule, the interest rate agreed upon, and the final due date for the loan to be fully repaid.

- Document any collateral that the borrower is offering against the loan, if applicable. Clearly describe the collateral to ensure both parties understand what is at stake if the loan is not repaid.

- Include a section on late fees and penalties for overdue payments to ensure there is a clear understanding of the consequences of late repayment.

- Outline the governing law which indicates that the agreement will be governed by the laws of the State of New York, regardless of where the parties are located.

- Both parties should review the entire agreement carefully to ensure that all the terms are understood and accurate.

- Have the borrower and lender sign and date the agreement in the presence of a witness or notary, if required. This step legally binds both parties to the terms of the agreement.

- Finally, keep a copy of the agreement for both the borrower and the lender for record-keeping and as proof of the terms agreed upon should any disputes arise.

By carefully following these steps, all parties involved can ensure that the loan agreement is filled out correctly and comprehensively. This careful attention to detail will help protect everyone's interests and provide a clear framework for the repayment of the loan, offering peace of mind throughout the duration of the agreement.

Understanding New York Loan Agreement

What is a New York Loan Agreement Form?

A New York Loan Agreement Form is a legal document that outlines the terms and conditions under which a loan is provided. It is a binding agreement between the borrower, who is receiving the funds, and the lender, who is providing the funds. The document typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral securing the loan. It serves to protect both parties' interests by clearly defining their rights and obligations.

Why do I need a Loan Agreement Form in New York?

In New York, having a Loan Agreement Form is crucial when lending or borrowing money. It legalizes the transaction, making it enforceable in a court of law should any disputes arise. This form also provides a clear record of the loan, ensuring there is no misunderstanding about the terms. It is particularly important in New York due to the state's specific legal requirements and protections for both lenders and borrowers.

What information should be included in a New York Loan Agreement Form?

A comprehensive New York Loan Agreement Form should include the following key information: the names and contact details of the lender and borrower, the loan amount, the interest rate, repayment schedule, details of any collateral, provisions for late payments, and a clause on default and its consequences. Including governing law and dispute resolution clauses to clarify how disagreements will be handled is also advisable.

How can I make my New York Loan Agreement Form legally binding?

To ensure your New York Loan Agreement Form is legally binding, both the borrower and lender must sign the document. It is highly recommended to have the signatures witnessed by a neutral third party or notarized to add an extra layer of authenticity. Additionally, ensuring that the agreement complies with New York state laws regarding loans and interest rates will help in enforcing the agreement, if necessary.

Can I modify a New York Loan Agreement Form after it has been signed?

Yes, a New York Loan Agreement Form can be modified after it has been signed, but any amendments must be agreed upon by both parties. The modifications should be documented in writing and attached to the original agreement. Both the borrower and the lender should then sign the amendment. For record-keeping and legal purposes, ensuring that any changes are clearly documented and agreed upon is important.

What should I do if the borrower or lender breaches the New York Loan Agreement Form?

If either party breaches the New York Loan Agreement Form, the other party should first refer to the agreement's clauses on default and dispute resolution. It's often beneficial to attempt to resolve the issue through direct communication or mediation. If this fails, the aggrieved party may need to seek legal recourse. Consulting with a legal professional experienced in New York's lending laws can provide guidance on the best steps to take following a breach of the agreement.

Common mistakes

When preparing to fill out a New York Loan Agreement form, individuals often approach the process with diligence and a sense of urgency. However, despite the best intentions, common mistakes can emerge, leading to potential complications down the line. Understanding these pitfalls is the first step toward ensuring the creation of a clear, legally binding agreement that serves the interests of all parties involved.

One prevalent mistake is neglecting to provide comprehensive details about the parties involved. This includes failing to list full legal names, addresses, and contact information. Such an oversight can lead to ambiguity regarding who is precisely obligated under the terms of the agreement. For an agreement to be enforceable, clarity is paramount. It is essential to confirm that every piece of information is accurate and complete, establishing a solid foundation for the legal document.

Another area where errors frequently occur is in the description of the loan terms. Ambiguities or omissions regarding the loan amount, interest rate, repayment schedule, and maturity date can render an agreement confusing or even disputable. It is critical to articulate these elements with precision. Detailing these terms explicitly ensures both parties have a mutual understanding of the obligations, such as when payments are due and how much interest will accrue over the loan's lifetime. This approach minimizes misunderstandings and provides a clear pathway forward.

Failing to specify the collateral, if applicable, is a significant misstep in some loan agreements. Collateral serves as the lender's security, guaranteeing the borrower's commitment to repay the loan. Neglecting to clearly describe the collateral, or failing to state that the loan is unsecured if that is the case, can lead to disputes and complications in enforcing the agreement should repayment issues arise. Accurate and detailed descriptions of any collateral underscore the seriousness and the obligations of the loan agreement.

Lastly, a common oversight is not including provisions for default and remedies. It's an uncomfortable aspect to consider, but specifying what constitutes default, the notifications required, and the recourse available to the lender is crucial. This section sets out the steps to be taken should the borrower fail to meet their repayment obligations, offering protection and a predefined resolution pathway for the lender. A well-drafted default clause promotes accountability and provides both parties with peace of mind.

By avoiding these common mistakes, individuals can create strong, enforceable New York Loan Agreements. It's about ensuring protection, clarity, and mutual respect for the parties involved, building a foundation for a successful financial relationship. A meticulously prepared agreement is not just a legal requirement; it's a testament to the professionalism and due diligence of the parties involved.

Documents used along the form

When working on a New York Loan Agreement, there are several key documents that are usually used alongside it to ensure everything goes smoothly. These documents help clarify the terms of the loan, secure the loan, and comply with local laws. Here’s a rundown of other forms and documents that are commonly used together with a New York Loan Agreement.

- Promissory Note: This is a promise in writing made by the borrower to pay back a specified sum to the lender by a certain date. It outlines the repayment details clearly.

- Mortgage Agreement or Deed of Trust: This secures the loan by using real estate as collateral. It ensures that if the loan isn't repaid, the lender can foreclose on the property.

- Guaranty: This document is a promise by a third party (the guarantor) to repay the loan if the original borrower fails to do so. It provides an additional layer of security for the lender.

- Loan Amortization Schedule: This outlines how the loan will be repaid over time, including the division of payments between principal and interest, and the balance after each payment.

- UCC-1 Financing Statement: For loans involving personal property as collateral, this document is filed with the state to publicly declare the lender's interest in the borrower's property.

- Personal Financial Statement: This document provides a snapshot of the borrower's financial health, including assets, liabilities, income, and expenses, giving the lender insight into the borrower’s ability to repay the loan.

- Compliance Agreement: This ensures that the borrower agrees to comply with all relevant laws and regulations, including those specific to New York, during the term of the loan.

Together, these documents form a comprehensive framework that supports the Loan Agreement. They provide clarity, security, and legal compliance, which protects both the borrower and the lender throughout the duration of the loan. Having all the necessary paperwork in order can make the lending process much smoother and reduce the risk for everyone involved.

Similar forms

The New York Loan Agreement form shares many similarities with the Promissory Note. Both documents serve as legally binding agreements between two parties regarding the borrowing and repayment of money. The Promissory Note, like the Loan Agreement, outlines the amount borrowed, the interest rate (if applicable), and the repayment schedule. However, the Loan Agreement often provides more comprehensive details, including clauses about the legal recourse in case of default and specific conditions under which the loan must be repaid.

Mortgage Agreements are also akin to the New York Loan Agreement form, particularly when the borrowed funds are used for purchasing real estate. In essence, a Mortgage Agreement secures the loan with the property being purchased, specifying that the lender has the right to take possession of the property if the borrower fails to repay the loan according to the agreed terms. Both documents detail the loan amount, interest rate, repayment period, and obligations of the borrower, yet the Mortgage Agreement places a specific focus on the real estate aspect.

Another related document is the Personal Guarantee. This form is often used alongside a New York Loan Agreement when the borrower does not have sufficient credit history or collateral to secure a loan. By signing a Personal Guarantee, a third party agrees to repay the loan if the original borrower defaults. This similarity lies in the mitigation of risk for the lender, with both documents outlining conditions under which someone is obligated to pay back the borrowed funds. However, the Personal Guarantee specifically extends the repayment obligation beyond the initial borrower to another individual or entity.

Lastly, the Deed of Trust shares elements with the New York Loan Agreement, particularly in transactions involving real estate. Like a Mortgage Agreement, a Deed of Trust is used to secure a loan with real property. It involves three parties: the borrower (trustor), the lender (beneficiary), and a neutral third party (trustee) who holds the property title until the loan is repaid. Both the Deed of Trust and the Loan Agreement specify loan details such as the amount, interest rate, and repayment terms. The primary distinction is the involvement of a trustee, who has the authority to sell the property if the borrower defaults, making the foreclosure process generally quicker than with a traditional mortgage.

Dos and Don'ts

When filling out the New York Loan Agreement form, certain practices should be followed to ensure the process goes smoothly and to avoid common pitfalls. Adhering to these guidelines will help to establish a clear, enforceable loan agreement that protects the interests of all parties involved. Below are essential do's and don'ts to consider.

Do:

- Provide complete and accurate information for all parties involved, including full legal names, addresses, and contact details.

- Clearly specify the loan amount in words and figures to prevent any confusion regarding the total sum being borrowed.

- Define the repayment terms concisely, including the installment amounts, due dates, and any interest rates applied, ensuring they comply with New York State's legal requirements.

- Include a clause about the governing law, affirming that the agreement adheres to the regulations of the State of New York, to ensure jurisdiction is established.

- Ensure both the borrower and lender sign the agreement in the presence of a witness or notary to validate its authenticity and enforceability.

Don't:

- Leave any fields blank; if a section does not apply, fill it with "N/A" to indicate it has been reviewed but is not applicable—this prevents unauthorized alterations after signing.

- Use vague or ambiguous language that could be interpreted in multiple ways; specificity is key to a clear understanding between all parties.

- Forget to include a clause that addresses late payments or defaults, detailing any penalties or measures that will be taken in such events.

- Omit details about any collateral securing the loan, if applicable, as this is crucial for a secured loan agreement.

- Finalize the document without having all parties review it thoroughly; encourage questions and clarifications to avoid misunderstandings or disputes in the future.

Misconceptions

When it comes to loan agreements in New York, misunderstandings can lead to confusion, potential legal issues, and may even impact the relationship between the lender and borrower. Here are four common misconceptions about the New York Loan Agreement form:

One size fits all: A widespread misconception is that a standard New York Loan Agreement form can suit every type of loan transaction. In reality, loan agreements need to be tailored to the specifics of each deal. Factors such as the loan amount, repayment schedule, interest rates, and collateral (if any) vary significantly and must be clearly outlined in the agreement to protect the interests of all parties involved.

Verbal agreements are just as good: While New York recognizes oral contracts in some cases, relying on a verbal agreement for a loan can lead to significant risks. Misunderstandings about the terms, difficulty in enforcing the agreement, and the challenge of proving the agreement's existence in court are potential pitfalls. A written loan agreement form provides a clear, enforceable record of the loan's terms and conditions.

Only the borrower needs to understand the agreement: Both the lender and the borrower must fully understand and agree to the terms of the loan agreement. It is crucial for the lender to ensure that the borrower has read, understood, and acknowledged all aspects of the loan agreement to avoid future disputes or misunderstandings. Both parties should consider their rights and obligations under the agreement before signing.

A lawyer is not necessary to draft a loan agreement: While it's true that individuals can draft a loan agreement without legal assistance, consulting with a lawyer can prevent legal issues down the line. A lawyer can help tailor the agreement to meet specific needs, ensure compliance with New York law, and identify potential issues that may not be apparent to those not versed in legal nuances. Seeking professional advice can safeguard against unforeseen complications.

Key takeaways

When navigating the complexities of the New York Loan Agreement form, it's essential to approach the process with attention to detail and a thorough understanding of what the document entails. This agreement is not just a formal necessity; it's a safeguard for both the lender and borrower, outlining the terms under which money or property is lent. Below are key takeaways to ensure that the agreement serves its purpose effectively, protecting all parties involved.

- Accurate Information: Before filling out the form, gather all necessary details about the loan. This includes the names and addresses of the lender and borrower, the amount of the loan, repayment schedule, interest rates, and any collateral involved. Accuracy in this step is crucial to avoid misunderstandings or legal complications down the road.

- Understand the Terms: Both the lender and the borrower should thoroughly review and understand the terms of the loan agreement. This encompasses the repayment schedule, interest rates, late fees, and consequences of default. If any term is unclear, seeking clarification or legal advice is advisable before signing.

- State-specific Provisions: New York State may have specific provisions or requirements related to loan agreements. This can include caps on interest rates (to avoid usury), legal language requirements, or additional disclosures. Ensuring the loan agreement complies with state laws is vital for its enforceability.

- Signatures: A New York Loan Agreement must be signed by both the lender and the borrower to be legally binding. Witnesses or notarization may also be required, depending on the loan amount or as an added measure of legal precaution. Confirming what is needed for your particular agreement guarantees its validity.

- Keep Records: After the loan agreement is fully executed, both parties should keep a copy of the document. This serves as proof of the terms agreed upon should any disputes arise. It's also useful for tax purposes, financial planning, and as a record of liabilities or assets for both individuals and businesses.

Filling out and using the New York Loan Agreement form is a responsibility that carries legal weight. It's a step that solidifies the commitment of both parties to adhere to the agreed-upon terms, making it essential to approach this task with diligence and care. By keeping these key takeaways in mind, lenders and borrowers can navigate the process more effectively, ensuring protection and clarity for all involved.

More Loan Agreement State Forms

Promissory Note Template Florida Pdf - The Loan Agreement form can be customized to include various loan types, such as personal, business, or mortgage loans.

Promissory Note Template Georgia - Features a severability clause ensuring the rest of the agreement remains valid even if one part is invalidated.

Promissory Note Illinois - Crucial for lenders as it provides legal recourse in case of non-payment.