Fillable Loan Agreement Document for Georgia

In the realm of financial agreements, precision and clarity stand paramount, especially when navigating through the intricacies of lending and borrowing. The Georgia Loan Agreement form serves as a critical tool in this process, fostering a well-structured and legally sound foundation for transactions between lenders and borrowers within the state of Georgia. This document intricately outlines the terms, conditions, and obligations that all parties must adhere to, ensuring a mutual understanding and setting a clear path for the execution of the loan. It addresses vital components such as the loan amount, interest rates, repayment schedules, and any collateral involved, alongside provisions for default and remedies. Crafted to comply with Georgia's specific legal requirements, this form not only minimizes the potential for disputes but also provides a robust framework for enforcing the agreement's terms should issues arise. As such, individuals and entities engaged in lending or borrowing in Georgia find this form indispensable for securing their financial transactions and protecting their interests.

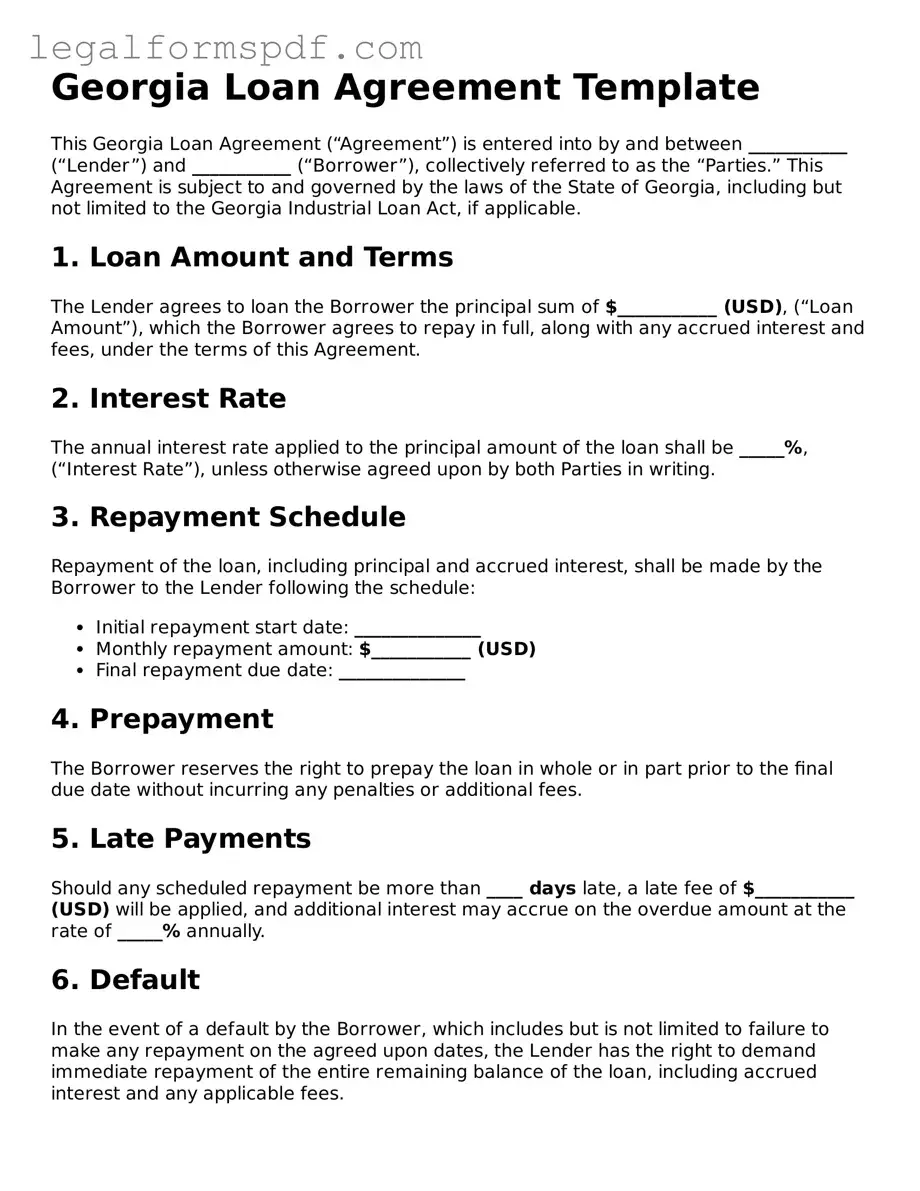

Document Example

Georgia Loan Agreement Template

This Georgia Loan Agreement (“Agreement”) is entered into by and between ___________ (“Lender”) and ___________ (“Borrower”), collectively referred to as the “Parties.” This Agreement is subject to and governed by the laws of the State of Georgia, including but not limited to the Georgia Industrial Loan Act, if applicable.

1. Loan Amount and Terms

The Lender agrees to loan the Borrower the principal sum of $___________ (USD), (“Loan Amount”), which the Borrower agrees to repay in full, along with any accrued interest and fees, under the terms of this Agreement.

2. Interest Rate

The annual interest rate applied to the principal amount of the loan shall be _____%, (“Interest Rate”), unless otherwise agreed upon by both Parties in writing.

3. Repayment Schedule

Repayment of the loan, including principal and accrued interest, shall be made by the Borrower to the Lender following the schedule:

- Initial repayment start date: ______________

- Monthly repayment amount: $___________ (USD)

- Final repayment due date: ______________

4. Prepayment

The Borrower reserves the right to prepay the loan in whole or in part prior to the final due date without incurring any penalties or additional fees.

5. Late Payments

Should any scheduled repayment be more than ____ days late, a late fee of $___________ (USD) will be applied, and additional interest may accrue on the overdue amount at the rate of _____% annually.

6. Default

In the event of a default by the Borrower, which includes but is not limited to failure to make any repayment on the agreed upon dates, the Lender has the right to demand immediate repayment of the entire remaining balance of the loan, including accrued interest and any applicable fees.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Georgia.

8. Consent to Jurisdiction

The Parties hereby consent to the exclusive jurisdiction of the state and federal courts located within Georgia for the resolution of any disputes arising out of or relating to this Agreement.

9. Amendments

Any amendments to this Agreement must be made in writing and signed by both Parties.

10. Notices

All notices or communications related to this Agreement shall be in writing and sent to the Parties at their respective addresses mentioned at the beginning of this document or to any other address as either Party may have specified in writing.

11. Severability

Should any provision of this Agreement be held to be invalid or unenforceable, the remaining provisions shall remain in full force and effect.

12. Entire Agreement

This document constitutes the entire Agreement between the Parties regarding the subject matter herein and supersedes all prior agreements or understandings, whether written or oral.

13. Signatures

This Agreement is effective as of the date of the latest signature below and is executed by the Parties as follows:

Lender's Signature: _____________________ Date: ___________

Borrower's Signature: ____________________ Date: ___________

PDF Specifications

| Fact Number | Fact Description |

|---|---|

| 1 | The Georgia Loan Agreement form is governed by the laws of the State of Georgia. |

| 2 | It outlines the obligations and rights of both the borrower and lender. |

| 3 | Interest rates on loans detailed in the agreement must comply with Georgia's usury laws. |

| 4 | The form should include detailed information on the loan amount, interest rate, repayment schedule, and any collateral involved. |

| 5 | Late fees and consequences of defaulting on the loan should be clearly stated in the agreement. |

| 6 | Both the borrower and the lender must sign the agreement for it to be legally binding. |

| 7 | Witnesses or a notary public may be required to legitimize the signatures, depending on the loan's complexity and size. |

| 8 | The agreement can be used for both secured and unsecured loans. |

| 9 | If the loan is secured, the agreement needs to detail the collateral that will be used to secure the loan. |

Instructions on Writing Georgia Loan Agreement

When it comes to managing finances, securing a loan can be a significant step. In Georgia, like in many places, a Loan Agreement form is the foundational document for this transaction. This form outlines the terms and conditions of a loan between two parties: the borrower and the lender. Completing it correctly is crucial to ensure the legality of the agreement and to protect the interests of both parties. Here's a straightforward guide to help you fill out the Georgia Loan Agreement form properly.

- Start by entering the full legal names of both the borrower and the lender. These are the parties involved in the loan agreement.

- Specify the loan amount in US dollars. Make sure this is the exact amount agreed upon by both parties.

- Detail the loan repayment terms. This includes the repayment schedule, which can be monthly, quarterly, or as agreed upon. Include the date by when the loan should be fully repaid.

- Describe the interest rate applicable to the loan. This should be a yearly rate, also known as the annual percentage rate (APR).

- Include any collateral that the borrower is offering as security for the loan, if applicable. Clearly describe the collateral and state its value.

- Outline the conditions under which the loan must be repaid immediately, also known as the acceleration clause. This could be due to late payments or other breaches of the agreement.

- Specify any legal fees that will be paid and by whom, in case of a dispute regarding the loan agreement that requires legal action.

- Include a severability clause. This ensures that if one part of the agreement is found to be unlawful, the remainder of the agreement still stands.

- Sign and date the agreement. Both the borrower and the lender must sign the form. It's also a good idea to have the signatures witnessed or notarized for additional legal validation.

Once you've completed these steps, you've prepared a comprehensive Loan Agreement that lays the foundation for a clear financial transaction. Ensure that both parties receive a copy of the signed agreement for their records. Remember, this form is a binding contract; it's important that each party understands every aspect of the agreement before signing. If there's any confusion or if either party is unsure about the terms, it's wise to consult with a legal professional. This helps in avoiding any potential disputes and in ensuring that the agreement is fair and legal for everyone involved.

Understanding Georgia Loan Agreement

What is a Georgia Loan Agreement Form?

A Georgia Loan Agreement Form is a legal document that outlines the terms and conditions between a lender and a borrower. It includes details such as the amount of money loaned, the repayment schedule, interest rates, and any collateral involved. This form is essential for ensuring that both parties understand their rights and responsibilities in the lending process.

Who needs to sign the Georgia Loan Agreement Form?

The Georgia Loan Agreement Form must be signed by both the lender and the borrower to be legally binding. In some cases, witnesses or a notary public may also need to sign the form to further authenticate the agreement.

Is a lawyer required to prepare a Georgia Loan Agreement Form?

While it is not required to have a lawyer prepare a Georgia Loan Agreement Form, it is highly recommended. A lawyer can ensure that the document complies with all state laws and properly protects the interests of both parties. However, individuals may choose to prepare the form themselves or use a legal document preparer.

Can the terms of the Loan Agreement be changed after it is signed?

Yes, the terms of the Loan Agreement can be changed after it is signed, but any amendments must be agreed upon by both the lender and the borrower. These changes should be documented in writing and appended to the original agreement to maintain clarity and legality.

What happens if the borrower fails to repay the loan as agreed?

If the borrower fails to repay the loan as outlined in the agreement, the lender has the right to take legal action to recover the owed amount. Depending on the terms of the agreement, this might include taking possession of any collateral listed or suing for the outstanding debt. The specific remedies available will depend on the terms of the agreement and Georgia state laws.

Common mistakes

Filling out a Georgia Loan Agreement form requires attention to detail and an understanding of what is legally required. One common mistake is not providing complete information about the parties involved. This includes not only their full legal names but also addresses and contact information. It's crucial for identifying the lender and borrower legally and clearly, ensuring there are no ambiguities about who is obligated to fulfill the terms of the agreement.

Another oversight is failing to specify the loan amount clearly. This should be stated in numerals and written out in words to prevent any misunderstanding about the total amount being borrowed. Misrepresentation, even accidentally, can lead to disputes or legal challenges down the line. Ensuring accuracy here provides a clear basis for the agreement's obligations.

Often, individuals neglect to detail the terms of repayment accurately. This includes not only the due date or dates but also the payment method and any conditions related to early or late payments. Such clarity prevents confusion and potential conflicts over repayment expectations. Moreover, articulating whether the loan is secured or unsecured, and if secured, describing the collateral, is essential. Many forget this step, leaving the legal standing of the loan uncertain if there's a default.

Interest rates are another critical component that is sometimes incorrectly recorded. Not specifying whether the interest rate is fixed or variable, along with neglecting to detail how it is calculated and applied, can lead to substantial differences in the total amount owed. Incorrect or vague interest rate information undermines the financial clarity the document is supposed to provide.

Failure to include a clause about what happens in the event of a default is a major oversight. This should clearly state the consequences if the borrower fails to meet the terms, such as late fees or the acceleration of the repayment schedule. Without this information, enforcing the agreement in case of non-compliance becomes more complicated.

Many individuals also overlook the necessity of including a governing law clause. This specifies which state's laws will be used to interpret the agreement. For Georgia Loan Agreements, it's important to state that Georgia law applies, ensuring that both parties have clear expectations about the legal framework governing their agreement.

Not setting forth any amendment or modification procedures is another common mistake. This leaves the agreement rigid and unable to accommodate changes without creating an entirely new document. Establishing a method for both parties to agree to modifications provides flexibility and can save time and legal expenses in the future.

Likewise, forgetting to specify how notices should be delivered under the agreement, whether by email, postal mail, or another method, can lead to communication failures. It is critical to have a predefined process for how legal notices and communications are to be sent and acknowledged by both parties.

One of the most critical errors made is not having the agreement signed by both parties in the presence of a witness or notary. This step authenticates the document, making it more enforceable in court should any disputes arise. An unsigned or improperly witnessed agreement could be deemed void or unenforceable.

Finally, failing to include a severability clause is a mistake. This clause ensures that if one part of the agreement is found to be invalid, the rest of the document remains effective. Without it, the entire agreement could be jeopardized by a single legal flaw. It's a safeguard against the agreement being nullified due to issues with a specific section.

Documents used along the form

In financial transactions, the paperwork is crucial, especially when it comes to loans in Georgia. Alongside the main Loan Agreement form, several other documents often play significant roles. These documents ensure both parties involved - the borrower and the lender - are protected and fully informed. Understanding these can help navigate the complexities of loan agreements more smoothly.

- Promissory Note: This document complements the loan agreement by specifying the promise of the borrower to pay back the borrowed amount. It outlines the amount of money borrowed, the interest rate, and the repayment schedule in detail.

- Personal Guarantee: Often used in business loans, this assures the lender that the borrower (or a third party, usually associated with the borrower) guarantees the loan. It's a pledge to cover the loan if the primary borrower fails to repay.

- Security Agreement: This document is vital if the loan is secured against collateral. It lists the assets or property pledged by the borrower as security for the loan, detailing what the lender can seize if the loan is not repaid.

- Amortization Schedule: This document provides a detailed schedule of payments throughout the life of the loan. It breaks down each payment into principal and interest components, showing the borrower exactly how each payment reduces the loan balance over time.

- Disclosure Statement: Required by federal law, this document offers the borrower all the critical details about the loan, such as the annual percentage rate (APR), total costs, and any other charges. It ensures transparency in lending practices.

Each of these documents plays a pivotal role in ensuring the loan process is transparent, fair, and legally binding. They help in setting clear expectations and responsibilities, which can significantly reduce potential misunderstandings or disputes between the borrower and lender. Whether you're getting a personal loan, a business loan, or any other type of loan, being familiar with these documents can be incredibly helpful.

Similar forms

The Georgia Loan Agreement form shares similarities with a Promissory Note, as both documents are used to outline the details of a loan between two parties. In a Promissory Note, the borrower agrees to pay back the lender under specified conditions, much like in a loan agreement. However, the loan agreement often contains more comprehensive details regarding the repayment schedule, interest rates, and consequences of default.

Another related document is the Personal Guarantee. In transactions where there is a higher risk to the lender, a personal guarantee might be required as part of the loan agreement. This document makes a third party (often a company executive or business owner) personally liable for the debt if the original borrower fails to pay. Both documents ensure the loan's repayment, but the personal guarantee adds an extra layer of security for the lender.

The Mortgage Agreement is also akin to the Georgia Loan Agreement form when the loan in question is used to purchase real estate. This agreement secures the loan by the property itself, offering the lender collateral. While both agreements serve to document the details of a loan, the Mortgage Agreement is specifically tied to real estate transactions and includes terms regarding foreclosure in case of non-payment.

Similarly, the Deed of Trust is related to the Georgia Loan Agreement when real estate transactions are involved. Like a Mortgage Agreement, a Deed of Trust involves a trustee, typically a title company, which holds the property's title until the loan is paid off. Both documents are used to secure a loan with real property, but the involvement of a third-party trustee is a unique feature of the Deed of Trust.

The Business Loan Agreement is another document that closely mirrors the Georgia Loan Agreement form, specifically tailored for business financing. This agreement outlines the loan's terms for businesses, including the loan amount, interest rate, payment schedule, and collateral, if any. Both agreements serve to detail the borrower-lender relationship, though the Business Loan Agreement is specifically designed for commercial loans.

A Line of Credit Agreement is similar to a loan agreement in that it establishes terms between a lender and a borrower. However, unlike a loan agreement that provides a lump sum of money upfront, a line of credit offers the borrower access to funds up to a specified limit as needed. Both documents regulate the borrowing terms but differ in the flexibility and availability of the funds.

The Student Loan Agreement is specifically designed for educational loans and shares common ground with the Georgia Loan Agreement form in setting forth the terms under which money is borrowed. It includes details on the loan amount, interest rate, deferment options, and repayment schedule. Though both aim to outline the terms of a loan, the Student Loan Agreement focuses on funding education and often includes provisions for deferment and forgiveness not typically found in other loan agreements.

Lastly, the Lease Agreement, while primarily associated with the rental of property, resembles a loan agreement in aspects of its structure and purpose. It stipulates terms under which one party agrees to rent property owned by another party, involving regular payments akin to loan repayments. Although their primary purposes diverge - one being for the use of property and the other for borrowing money - the essence of establishing a payment agreement under specified conditions links these documents.

Dos and Don'ts

When filling out a Georgia Loan Agreement form, it's crucial to approach the task with accuracy and clarity. Here's a straightforward guide on what you should and shouldn't do to ensure the process goes smoothly.

Do:

- Read the entire form carefully before starting to fill it out. Understanding every section will help prevent mistakes and misunderstandings.

- Use a black or blue pen if filling out the form by hand. These colors are universally accepted and ensure legibility.

- Provide accurate information for every field. Double-check figures, dates, and spelling to ensure there are no errors.

- Include all required attachments. Some sections might require additional documentation. Make sure these are complete and attached where necessary.

- Sign and date the form in the designated areas. Your signature is a critical component, validating the entire agreement.

- Keep a copy of the signed agreement for your records. It's important to have personal documentation of the contract.

Don't:

- Leave any sections blank. If a section does not apply, mark it as "N/A" (not applicable) rather than leaving it empty.

- Use correction fluid or tape. Mistakes should be neatly crossed out, and the correct information should be written in. Using correction fluid can raise questions about the integrity of the document.

- Rush through the form without understanding each part. This can lead to errors that might complicate or invalidate the agreement.

- Sign the form without reviewing it one last time. Once you sign, it signifies your agreement to all terms, so a final review is crucial.

- Forget to provide required identification or documentation that substantiates the information on the form. Missing documents can delay or nullify the contract.

- Ignore the specific instructions or guidelines provided by the lender. These instructions are intended to clarify the process and ensure compliance with Georgia laws.

Misconceptions

Understanding the Georgia Loan Agreement form is crucial for anyone involved in lending or borrowing money in Georgia. However, several misconceptions can lead to confusion or legal missteps. Let's clarify some of the most common misunderstandings to ensure parties are well-informed.

It's Just Standard Paperwork: Many individuals assume the Georgia Loan Agreement form is a mere formality without legal weight. In reality, this document is a legally binding contract that outlines the terms and conditions agreed upon by the lender and borrower. Its contents can be enforced by law, making it far from "just paperwork."

One Size Fits All: The misconception that a single template can suit every loan situation is widespread. Although templates can serve as a starting point, the Georgia Loan Agreement should be tailored to address the specific terms of each loan, including interest rates, repayment schedules, and collateral, if applicable.

Legal Representation Isn't Necessary: Some believe that you don't need an attorney to draft or review a Georgia Loan Agreement. While legal counsel is not a requirement for the agreement to be valid, having an attorney can help ensure the document complies with relevant laws and that the rights and obligations of both parties are clearly defined and protected.

It Only Benefits the Lender: This form is often thought to primarily protect the lender's interests. However, a well-constructed Georgia Loan Agreement also safeguards the borrower by specifying the terms of the loan, including the interest rate and repayment schedule, thereby preventing any future misunderstandings or unexpected demands from the lender.

Oral Agreements Are Just as Good: While verbal contracts can be legally binding, proving their existence and terms is significantly more challenging than with written agreements. The Georgia Loan Agreement form provides a tangible record of the loan's terms, making it easier to enforce and less susceptible to disputes.

No Need to Update or Review: Loan agreements are not set in stone. Circumstances change, necessitating updates or reviews of the agreement. Reliance on the original terms without consideration for changing financial situations, interest rates, or laws can lead to problems. Regular reviews ensure the agreement remains fair and legal.

It's All About the Money: While a loan agreement certainly details the financial aspects, it also includes clauses that cover dispute resolution, jurisdiction for legal matters, and what happens if either party fails to meet their obligations. These non-financial clauses are crucial for the overall effectiveness and enforceability of the agreement.

Signing Without Reading: Unfortunately, it's not uncommon for people to sign the Georgia Loan Agreement form without fully reading or understanding it. This can lead to surprise clauses, such as prepayment penalties or hidden fees. Always read and clearly understand each clause of any agreement before signing.

Clarifying these misconceptions ensures that all parties involved in a loan transaction are informed and can make the best decisions based on accurate information. Whether you're the lender or the borrower, always approach the Georgia Loan Agreement with the seriousness and attention it deserves.

Key takeaways

Filling out and using the Georgia Loan Agreement form is a process that requires attention to detail and an understanding of what is legally binding between a borrower and a lender within the state of Georgia. Below are key takeaways to assist both parties in navigating through the agreement process effectively:

- Understanding the Terms: It's crucial for both the borrower and the lender to thoroughly understand and agree upon the terms outlined in the loan agreement, including the loan amount, interest rate, repayment schedule, and any collateral securing the loan. This mutual understanding helps prevent disputes during the loan period.

- Completeness is Key: Every field in the Georgia Loan Agreement form should be filled out completely to ensure that there are no ambiguities. Missing information can lead to misunderstandings or legal issues down the line, making it important that both parties review the form in its entirety before signing.

- Legally Binding: Once signed by both parties, the Georgia Loan Agreement becomes a legally binding document. This means that both the borrower and the lender are legally obligated to adhere to the terms of the agreement. Non-compliance by either party can result in legal ramifications.

- Witnesses and Notarization: While not always mandatory, having the loan agreement witnessed or notarized can add an extra layer of legal protection and authenticity to the agreement. This process can help in the verification of the signatures in case of any disputes.

- Consultation with Legal Professionals: Before finalizing the loan agreement, it might be beneficial for both parties to consult with legal professionals. Lawyers can provide valuable insights, ensure the agreement complies with Georgia laws, and tailor the document to meet the specific needs of both the borrower and the lender.

By keeping these key takeaways in mind, both borrowers and lenders can facilitate a smoother loan agreement process, ensuring that all legal and financial responsibilities are clearly defined and understood.

More Loan Agreement State Forms

Promissory Note Template California - Governing law clause indicates which state's laws will interpret the agreement’s terms and enforcement.

New York Promissory Note - Specifies the loan amount, interest rate, repayment schedule, and maturity date, providing a clear financial roadmap.

Promissory Note Illinois - Outlines the process and potential charges for loan servicing or processing fees.