Fillable Loan Agreement Document for Florida

When entering into a borrowing arrangement in Florida, it's crucial to have clear, written documentation of the terms and conditions. This is where the Florida Loan Agreement form becomes indispensable. It serves as a formal record, meticulously outlining the loan's amount, repayment schedule, interest rate, and any collateral requirement. The form is designed to protect both the borrower and lender by ensuring there is a mutual understanding of the loan's obligations and the consequences of failing to meet those obligations. It acts as a legal safeguard, providing a framework for recourse in case of disputes. Moreover, the Florida Loan Agreement form is adaptable, catering to both personal and business loans, making it a versatile tool in a variety of financial transactions. Its comprehensive nature ensures that all aspects of the loan are covered, making it a key document for any lending or borrowing activity in the state.

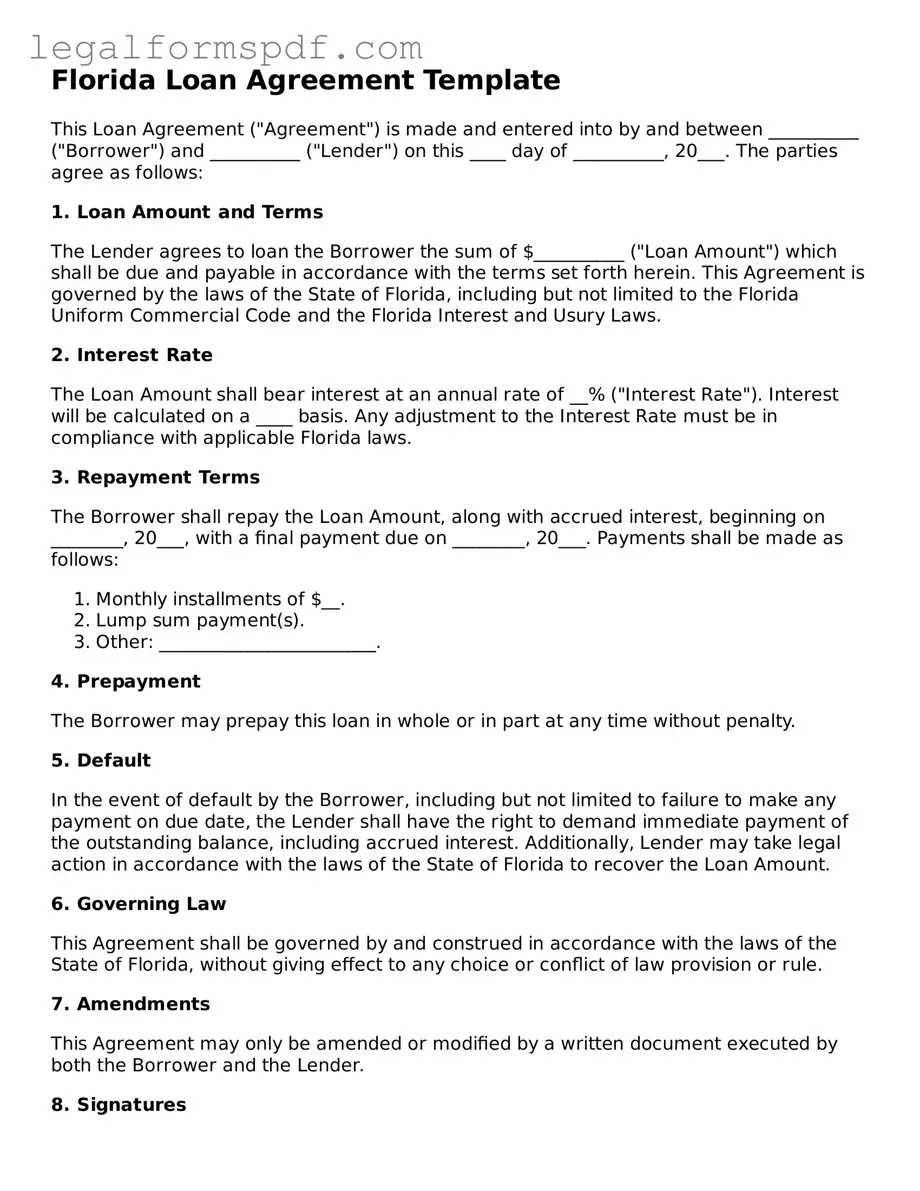

Document Example

Florida Loan Agreement Template

This Loan Agreement ("Agreement") is made and entered into by and between __________ ("Borrower") and __________ ("Lender") on this ____ day of __________, 20___. The parties agree as follows:

1. Loan Amount and Terms

The Lender agrees to loan the Borrower the sum of $__________ ("Loan Amount") which shall be due and payable in accordance with the terms set forth herein. This Agreement is governed by the laws of the State of Florida, including but not limited to the Florida Uniform Commercial Code and the Florida Interest and Usury Laws.

2. Interest Rate

The Loan Amount shall bear interest at an annual rate of __% ("Interest Rate"). Interest will be calculated on a ____ basis. Any adjustment to the Interest Rate must be in compliance with applicable Florida laws.

3. Repayment Terms

The Borrower shall repay the Loan Amount, along with accrued interest, beginning on ________, 20___, with a final payment due on ________, 20___. Payments shall be made as follows:

- Monthly installments of $__.

- Lump sum payment(s).

- Other: ________________________.

4. Prepayment

The Borrower may prepay this loan in whole or in part at any time without penalty.

5. Default

In the event of default by the Borrower, including but not limited to failure to make any payment on due date, the Lender shall have the right to demand immediate payment of the outstanding balance, including accrued interest. Additionally, Lender may take legal action in accordance with the laws of the State of Florida to recover the Loan Amount.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Florida, without giving effect to any choice or conflict of law provision or rule.

7. Amendments

This Agreement may only be amended or modified by a written document executed by both the Borrower and the Lender.

8. Signatures

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

_____________________________________

Borrower's Signature

_____________________________________

Borrower's Printed Name

_____________________________________

Lender's Signature

_____________________________________

Lender's Printed Name

PDF Specifications

| Fact Number | Detail |

|---|---|

| 1 | Florida Loan Agreement forms must comply with Florida state laws, including but not limited to the Florida Commercial Code and Usury laws. |

| 2 | The interest rates on loans in Florida are governed by the state's Usury laws, which set maximum allowable rates. |

| 3 | Written agreements are highly recommended for loans in Florida to provide clear terms and protect both parties. |

| 4 | Florida Loan Agreements must include the amount of the loan, interest rate, repayment schedule, and the parties' information. |

| 5 | Security or collateral may be required for a loan, and specifics should be outlined in the Florida Loan Agreement. |

| 6 | In cases of default, Florida laws dictate the remedies and processes lenders may pursue, which should be addressed in the loan agreement. |

| 7 | Any amendments to the loan agreement need to be in writing and agreed upon by all parties involved. |

| 8 | Florida Loan Agreements can be secured or unsecured, with secured loans requiring collateral. |

| 9 | The governing law clause in a Florida Loan Agreement indicates that any disputes under the agreement will be resolved under the laws of the State of Florida. |

Instructions on Writing Florida Loan Agreement

Filling out the Florida Loan Agreement form is a crucial step in formalizing the terms and conditions of a loan between two parties. This document specifies the amount of money borrowed, the interest rate, repayment schedule, and the consequences of failing to meet these terms. It's essential to complete this form accurately to ensure protection for both the lender and the borrower throughout the loan period. After completing the form, both parties should review it carefully before signing. It's recommended to keep copies of the signed agreement for personal records.

- Start by entering the date on which the loan agreement is being made at the top of the form.

- Fill in the full names and addresses of both the lender and the borrower in the designated sections.

- Specify the total amount of money being loaned in the section labeled "Loan Amount."

- Detail the loan's interest rate per annum in the section provided for this purpose.

- Describe the repayment schedule, including the number of payments, the amount of each payment, and the due date for the first payment. Make sure to specify the frequency of payments (e.g., monthly).

- Include any agreed upon collateral in the section titled "Collateral." Describe the collateral in detail.

- Outline the actions that will be taken if the borrower fails to make payments on time under the "Default" section. This includes any late fees or legal actions.

- Go through the "Governing Law" section, where the agreement specifies that Florida laws govern the loan agreement.

- Review the section regarding amendments. This typically requires that any changes to the agreement must be in writing and signed by both parties.

- Check the part about notices, indicating how communications about the loan should be sent between the borrower and lender.

- Fill in any additional clauses or provisions specific to the loan agreement in the section labeled "Miscellaneous."

- Both the lender and borrower should sign and date the bottom of the form. Include printed names beneath signatures for clarity.

Once signed, this document becomes a binding agreement that ensures both parties adhere to the outlined terms. It's a vital step in maintaining transparency and accountability in financial transactions between individuals or entities. Always consult with a legal professional if there are any uncertainties before finalizing the agreement.

Understanding Florida Loan Agreement

What is a Florida Loan Agreement Form?

A Florida Loan Agreement Form is a legal document used between two parties — the lender and the borrower — in the state of Florida. This form outlines the terms and conditions under which the loan is provided, including the loan amount, interest rate, repayment schedule, and any other relevant details that govern the financial transaction.

Why do I need a Florida Loan Agreement Form?

Having a comprehensive loan agreement in place is crucial because it legally protects both the lender and the borrower. It ensures that both parties have a clear understanding of their obligations. This form helps prevent misunderstandings and disputes by detailing the expectations and responsibilities of each party involved in the loan process.

What must be included in a Florida Loan Agreement Form?

A typical Florida Loan Agreement Form should include the names and contact information of the lender and the borrower, the amount of money being loaned, the interest rate, repayment terms and schedule, collateral information (if any), and any other terms agreed upon by both parties. It also usually includes provisions for what happens in case of a default.

Who needs to sign the Florida Loan Agreement Form?

Both the lender and the borrower must sign the Florida Loan Agreement Form to acknowledge their understanding and acceptance of its terms. Depending on the loan’s complexity and amount, it may also be advisable to have witnesses sign or to get the document notarized to add an additional layer of authenticity.

Is a witness or notarization required for a Florida Loan Agreement Form?

While not always legally required, having a witness or notarization can provide added legal protection and credibility to the agreement. This step helps to affirm that the signatures on the document are genuine and can reduce the likelihood of disputes about the validity of the agreement.

How can I ensure my Florida Loan Agreement Form is legally binding?

To ensure the form is legally binding, make sure it includes all necessary information and is clear, detailed, and without ambiguity. Both parties should review the document thoroughly before signing. It’s also a good practice to consult with a legal professional to verify that the agreement complies with Florida laws and regulations.

Can the terms of a Florida Loan Agreement Form be modified?

Yes, the terms of a Florida Loan Agreement Form can be modified, but any changes should be agreed upon by both the lender and the borrower. Once agreed, the modifications should be documented in writing and, ideally, added to the original agreement form as an amendment. Both parties should then sign or initial the changes to acknowledge and accept them.

What happens if a party violates the terms of the Florida Loan Agreement Form?

If a party violates the terms of the agreement, the other party has the right to pursue legal action to enforce the agreement or seek damages. The specific consequences or remedies for breach of the agreement should be outlined in the form itself, providing a clear course of action for resolving disputes.

Common mistakes

Filling out a Florida Loan Agreement form requires attention to detail and an understanding of what is needed for the agreement to be legally binding and clear to all parties involved. One common mistake is not providing detailed information about the involved parties. It's crucial to include full legal names, addresses, and contact information of both the borrower and the lender. This omission can lead to confusion or disputes about who is obligated under the agreement.

Another error often made is not specifying the loan amount clearly. The document should state unequivocally the total amount of money being loaned. When the amount is not precisely cited, it may lead to disagreements or legal issues about the obligations of the borrower, including the exact amount that needs to be repaid.

Interest rates are another area where mistakes are frequently made. Either the agreement fails to mention the interest rate, or it's not clearly defined whether the rate is fixed or variable. This lack of clarity can result in disputes over the amount of interest accruing over the life of the loan. It's important to spell out the interest rate explicitly and describe how it will be applied to the principal amount.

The terms of repayment are also often inadequately detailed. The agreement should clearly outline repayment schedule, including the due dates and the amount of each payment. Without this information, enforcing the repayment terms can become problematic, and the lender may find it difficult to hold the borrower accountable for missed or incomplete payments.

Missing signatures are a fundamental yet common mistake. For the loan agreement to be enforceable, it must be signed by all parties involved. Sometimes, individuals neglect to have the document signed, or they miss a signature page, rendering the agreement legally void or contestable.

Not including a clause on the governing law is another oversight. Loan agreements should specify which state's laws will govern the agreement. Without this information, there can be uncertainty and confusion over legal jurisdiction in the event of a dispute. For agreements in Florida, explicitly stating that Florida law applies is essential for clarity and enforceability.

Lastly, individuals often forget to add provisions for amendments or updates to the agreement. Over the life of a loan, circumstances may change, necessitating modifications to the original terms. Without a process for making these amendments, both parties may find themselves in a difficult position, unable to adapt the agreement to new conditions without breaching the original terms.

Documents used along the form

When entering into a loan agreement in Florida, various other forms and documents might be needed to ensure everything is thoroughly documented and legally compliant. These additional documents help protect both the borrower and lender's interests, providing clear guidelines and expectations for the loan. Below is a list of documents often used alongside the Florida Loan Agreement form, each serving its unique purpose in the loan process.

- Promissory Note: A promissory note is crucial as it outlines the borrower's promise to pay back the loan according to the terms agreed upon. This document specifies the loan amount, interest rate, and repayment schedule.

- Mortgage Agreement or Deed of Trust: When the loan is secured with real property, a mortgage agreement or deed of trust is used to lien the property to the lender as security for the loan.

- Guaranty: A guaranty is often needed if there's a third party guarantor who promises to repay the loan if the original borrower fails to do so.

- Amendment Agreement: If parties want to change any terms of the original loan agreement, an amendment agreement is required to document these changes.

- Release of Loan Agreement: Once the loan is fully repaid, a release of loan agreement is often issued to formally relieve the borrower from any further obligations.

- Loan Modification Agreement: This document is used when terms of the original loan, such as interest rate, payment schedule, or loan amount, are modified.

- Prepayment Agreement: To document terms regarding the early repayment of the loan, a prepayment agreement can be used. It specifies if any penalties apply for prepayment.

- Subordination Agreement: In situations where the borrower has or will have multiple loans, a subordination agreement establishes the priority of claims on the borrower's assets.

- Security Agreement: For loans secured against personal property (as opposed to real estate), a security agreement details the property being used as collateral.

- UCC-1 Financing Statement: Often filed with the state's UCC office, this document is used to publicly declare the lender's interest in the borrower's personal property used as collateral.

Gathering and correctly executing these documents can be quite a process, but doing so is essential to ensure a smooth and legally sound lending experience. Whether you are the lender or the borrower, understanding the purpose and requirements of each document will help protect your rights and interests throughout the loan term. Seeking professional advice for complex transactions or if any doubts arise is always a sound strategy.

Similar forms

The Florida Loan Agreement form shares similarities with the Promissory Note, as both serve as binding legal documents outlining the specifics of a loan between parties. While a loan agreement is comprehensive, detailing the responsibilities of each party, the repayment schedule, interest rates, and the consequences of default, a promissory note is a more streamlined document. It typically covers the amount borrowed, the interest rate if applicable, and the repayment terms. Essentially, both documents are pledges by the borrower to repay the lender, but the loan agreement delves into greater detail and broader legal protections.

Mortgage Agreements are another type of document closely related to the Florida Loan Agreement, particularly when the loan involves real estate. Like loan agreements, mortgage agreements specify the loan details, repayment plan, and actions in case of default. However, mortgage agreements go a step further by using the purchased property as collateral, securing the loan. If the borrower fails to meet the repayment terms, the lender has the right to foreclose on the property. Although they serve different purposes, both documents are vital in real estate transactions, ensuring clarity and legal recourse for the involved parties.

Lines of Credit Agreements also share similarities with the Florida Loan Agreement, mainly in how they describe the terms under which money is borrowed. However, unlike a traditional loan agreement that provides a lump sum of money upfront, a line of credit agreement offers the borrower access to a predetermined amount of funds that can be drawn upon as needed. This agreement outlines the maximum amount available, interest rates, and the period during which the line of credit can be accessed. Both types of agreements set forth repayment obligations and interest terms, but lines of credit offer more flexibility in borrowing and repayment.

Lastly, the Deed of Trust is another document with parallels to the Florida Loan Agreement, especially in transactions involving real estate. This document also includes terms of a loan and delineates a trustee's role, holding the property's title as security for the loan. The key difference lies in the parties involved; a deed of trust involves a borrower, lender, and a trustee, whereas a loan agreement typically involves only a borrower and lender. Upon the loan's fulfillment, the trustee transfers the property title to the borrower. While both secure the loan with real property, their structures and the roles of involved parties differ significantly.

Dos and Don'ts

When it comes to filling out a Florida Loan Agreement form, it's crucial to approach this task with care and attention to detail. To help you navigate this process smoothly, here are six dos and don'ts to keep in mind:

Do:- Review the entire form before you start: This helps you understand what information you need and ensures you have all the necessary details on hand.

- Use clear, precise language: Avoid any ambiguity to ensure that all parties have a clear understanding of the terms of the loan.

- Check for accuracy: Double-check all figures, such as the loan amount, interest rate, repayment schedule, and any fees to prevent any misunderstandings or legal issues down the line.

- Leave any sections incomplete: If a section doesn't apply to your situation, indicate this with “N/A” (not applicable) instead of leaving it blank. This shows that you haven't overlooked it.

- Forget to specify the governing law: Indicate that the agreement is governed by the laws of Florida. This is crucial for ensuring that any legal disputes will be handled under Florida law.

- Rush through the process: Take your time to thoroughly review the agreement before signing. Ensuring that both parties agree to all terms can prevent potential disputes.

Misconceptions

When it comes to loan agreements in Florida, there are several misconceptions that can lead to confusion. Understanding these common myths can help ensure that individuals are better informed when entering into a loan agreement within the state.

All loan agreements in Florida must be in writing to be valid. While it's true that having a written loan agreement can provide clarity and serve as tangible evidence of the terms agreed upon, not all loans need to be in writing to be enforceable. For small loans or informal agreements between friends or family, a verbal agreement can still be legally binding, although proving the terms can be more challenging.

Interest rates can be as high as the parties agree upon. Florida law places limitations on the amount of interest that can be charged in a loan agreement. The state has usury laws that cap interest rates to prevent lenders from imposing excessively high charges. Therefore, even if both parties agree, the interest rate cannot exceed the legal limit.

A notary must witness signing the Florida Loan Agreement form. While having a notary witness the signing of a loan agreement adds a level of formalization and can be very helpful in verifying the authenticity of the document, it is not a legal requirement for the agreement to be enforceable. It's beneficial, especially for significant loans, but not mandatory.

The borrower always secures loan agreements with collateral. This is not necessarily true. Whether a loan is secured with collateral depends on the agreement between the lender and the borrower. Secured loans require collateral, which means the borrower pledges an asset like a house or car that the lender can seize if the loan is not repaid. Unsecured loans, however, do not involve collateral and are often based on the borrower’s creditworthiness.

Loan agreements are only for large amounts of money. Loan agreements can be for any amount of money, not just large sums. They are versatile documents that can cater to various lending and borrowing needs, including small loans between friends or family members. The key is to ensure the terms of the loan are clearly outlined, regardless of the amount.

Key takeaways

Filling out and utilizing the Florida Loan Agreement form is a detailed process that requires attention to ensure both parties—the lender and the borrower—are clear on the terms of the agreement. Here are key takeaways to remember when dealing with this important document:

Understand All Terms Clearly: Both parties must comprehensively understand the terms set forth in the agreement. This understanding includes the loan amount, interest rate, repayment schedule, and any conditions that may affect these terms.

Accurate Information is Crucial: Providing accurate details when filling out the form is critical. This accuracy encompasses personal information, loan amounts, interest rates, and any collateral securing the loan.

Legal Compliance: The agreement must comply with Florida state laws regarding loans between parties. This compliance ensures that the agreement is enforceable in a court of law if needed.

Consequences of Default: The agreement should clearly outline the consequences if the borrower defaults on the loan. These may include late fees, legal action, and seizure of collateral.

Signatures Are Essential: The agreement must be signed by both parties to be legally binding. Witness signatures or a notary public may also be required to further validate the document.

Keep Records: Both the lender and the borrower should keep copies of the loan agreement. This record-keeping is essential for reference in case of disputes or for financial record-keeping.

Adhering to these guidelines when dealing with the Florida Loan Agreement form will help ensure a clear, lawful, and enforceable agreement between the lender and the borrower. It is advisable to review the document carefully and consult with a legal professional if there are any uncertainties or questions about the agreement's terms and conditions.

More Loan Agreement State Forms

Promissory Note Template Texas - It delineates conditions under which borrower information may be shared with third parties, respecting privacy laws.

Promissory Note Template Georgia - Establishes the loan amount, interest type (fixed or variable), and the frequency of repayments.

New York Promissory Note - May include a co-signer clause, adding an additional layer of security for the lender.