Official Employee Loan Agreement Document

In today's fast-paced work environment, the provision of financial assistance by an employer to their employees has become an increasingly common practice. Whether it's for covering unexpected expenses or helping to secure a major purchase, such support can significantly improve an employee's well-being and loyalty to the company. However, to ensure that these transactions are conducted fairly and transparently for both parties, an Employee Loan Agreement form is essential. This critical document lays the groundwork for the loan, detailing the amount borrowed, the repayment schedule, interest rates, if applicable, and the consequences of non-repayment. It serves as a binding contract that protects the interests of the employer while providing clear terms to the employee. The inclusion of provisions for contingencies, such as early repayment options or what happens if an employee leaves the company, makes this agreement a comprehensive tool for managing employer-provided loans. Therefore, understanding the major components and implications of the Employee Loan Agreement form is crucial for any employer considering extending financial assistance to their employees.

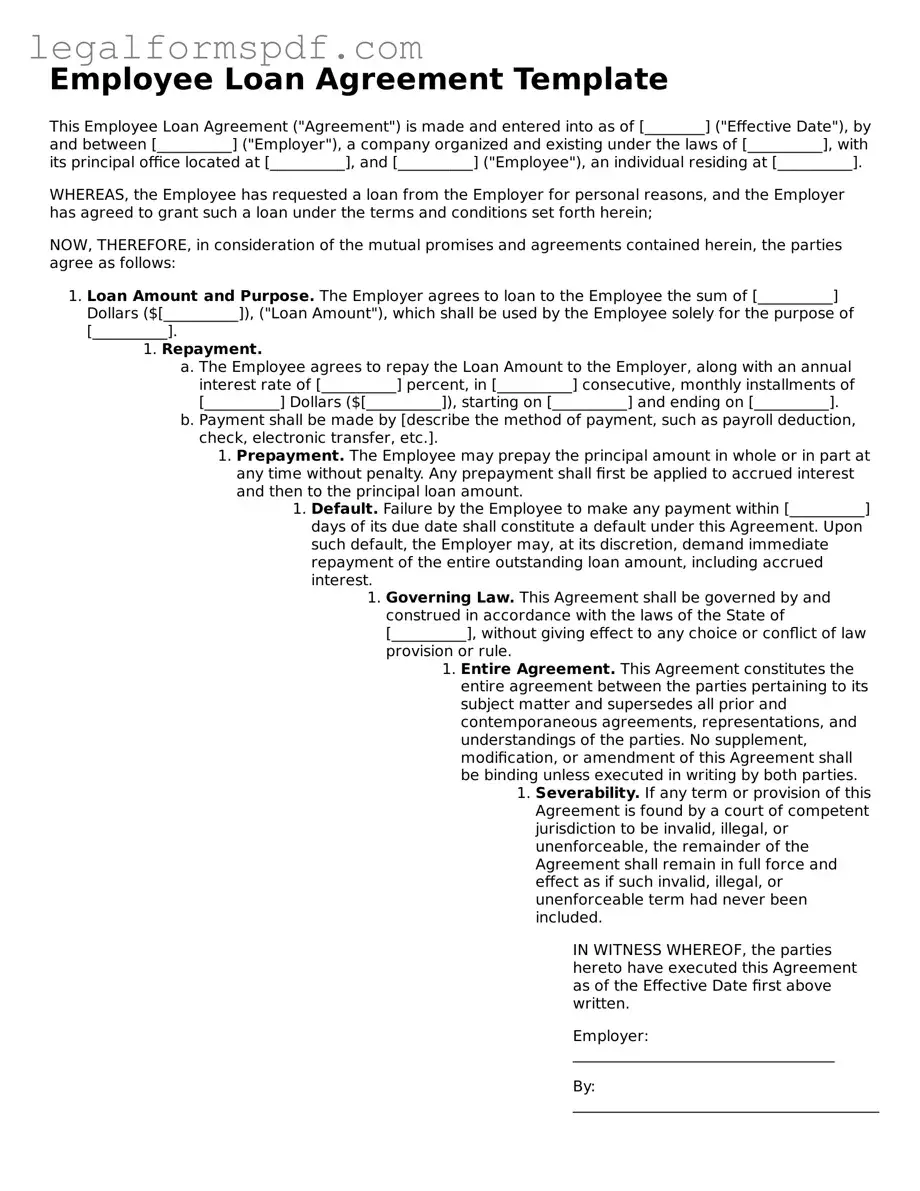

Document Example

Employee Loan Agreement Template

This Employee Loan Agreement ("Agreement") is made and entered into as of [________] ("Effective Date"), by and between [__________] ("Employer"), a company organized and existing under the laws of [__________], with its principal office located at [__________], and [__________] ("Employee"), an individual residing at [__________].

WHEREAS, the Employee has requested a loan from the Employer for personal reasons, and the Employer has agreed to grant such a loan under the terms and conditions set forth herein;

NOW, THEREFORE, in consideration of the mutual promises and agreements contained herein, the parties agree as follows:

- Loan Amount and Purpose. The Employer agrees to loan to the Employee the sum of [__________] Dollars ($[__________]), ("Loan Amount"), which shall be used by the Employee solely for the purpose of [__________].

- Repayment.

- The Employee agrees to repay the Loan Amount to the Employer, along with an annual interest rate of [__________] percent, in [__________] consecutive, monthly installments of [__________] Dollars ($[__________]), starting on [__________] and ending on [__________].

- Payment shall be made by [describe the method of payment, such as payroll deduction, check, electronic transfer, etc.].

- Prepayment. The Employee may prepay the principal amount in whole or in part at any time without penalty. Any prepayment shall first be applied to accrued interest and then to the principal loan amount.

- Default. Failure by the Employee to make any payment within [__________] days of its due date shall constitute a default under this Agreement. Upon such default, the Employer may, at its discretion, demand immediate repayment of the entire outstanding loan amount, including accrued interest.

- Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of [__________], without giving effect to any choice or conflict of law provision or rule.

- Entire Agreement. This Agreement constitutes the entire agreement between the parties pertaining to its subject matter and supersedes all prior and contemporaneous agreements, representations, and understandings of the parties. No supplement, modification, or amendment of this Agreement shall be binding unless executed in writing by both parties.

- Severability. If any term or provision of this Agreement is found by a court of competent jurisdiction to be invalid, illegal, or unenforceable, the remainder of the Agreement shall remain in full force and effect as if such invalid, illegal, or unenforceable term had never been included.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the Effective Date first above written.

Employer: ___________________________________

By: _________________________________________

Title: ______________________________________

Date: _______________________________________

Employee: ___________________________________

By: _________________________________________

Date: _______________________________________

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Employee Loan Agreement form is used when an employee borrows money from their employer. |

| Components | This form typically includes the loan amount, repayment schedule, interest rate (if applicable), and the consequences of non-repayment. |

| Governing Law | State-specific laws may govern the agreement to ensure compliance with local legal requirements. |

| Benefit to Employee | An Employee Loan Agreement can provide financial assistance to an employee at potentially more favorable terms than external lenders. |

| Benefit to Employer | Offering loans can improve employer-employee relationships, potentially leading to increased loyalty and retention. |

Instructions on Writing Employee Loan Agreement

Filling out an Employee Loan Agreement form is a crucial step in formalizing the agreement between an employer and an employee regarding a loan. This process ensures clarity, legal compliance, and a mutual understanding of the terms and conditions of the loan. The following steps are designed to guide you smoothly through the process, making sure each party is well-informed and agreement terms are clearly laid out. Before you begin, gather all necessary information, including loan amount, repayment schedule, interest rate (if applicable), and any collateral involved. This preparation will streamline the filling process and help avoid any potential issues.

- Start by entering the date on which the agreement is being made at the top of the form.

- Fill in the full legal names of the employer and the employee in their respective fields to clearly identify both parties involved.

- Specify the loan amount in words and then in parentheses, write the amount in numerical figures to eliminate any confusion about the loan size.

- Describe the purpose of the loan in detail to ensure both parties agree on why the loan is being provided.

- Indicate the repayment terms, including the repayment schedule (monthly, bi-weekly, etc.), the amount of each payment, and the total number of payments. If there's an interest rate, include it in this section.

- If applicable, detail any collateral that is being used to secure the loan. This section should clearly describe the collateral and state its condition and estimated value.

- Outline any consequences of default on the loan. This includes procedures for late payments, potential penalties, or actions that will be taken if the loan is not repaid according to the agreed terms.

- Provide spaces for both the employer and the employee to sign and date the agreement, which formally acknowledges their understanding and acceptance of the loan's terms.

- Lastly, include a section for a witness or notary public to sign and date the agreement, if required by state law, to add an additional level of authenticity and legal compliance.

Once all steps are completed and the form is fully filled out, both parties should receive a copy for their records. This ensures that the employer and the employee have accessible documentation of the agreement, protecting the interests of both sides. For added security, it might also be beneficial to consider filing this document in a secure location or with a legal entity, if deemed necessary. Moving forward, adhere to the terms outlined in the document and maintain open communication to manage the loan effectively.

Understanding Employee Loan Agreement

What is an Employee Loan Agreement?

An Employee Loan Agreement is a formal document that outlines the terms and conditions under which an employer lends money to an employee. This agreement specifies the loan amount, interest rate (if any), repayment schedule, and any other conditions related to the loan. It serves to protect both the employer's interests by ensuring repayment and the employee's interests by clearly stating the terms of the loan.

Why should an Employee Loan Agreement be used?

An Employee Loan Agreement is used to create a legal obligation and formalize the loan process between an employer and an employee. It helps in avoiding misunderstandings or disputes by clearly defining the loan terms. Additionally, in the event of non-repayment, it provides a legal framework for the employer to recover the loaned amount. This agreement also reassures the employee that the terms of the loan will not be arbitrarily changed.

What key elements should be included in an Employee Loan Agreement?

An effective Employee Loan Agreement should include several key elements:

- The full names and contact information of both the employer and the employee.

- The total loan amount being provided.

- The purpose of the loan, if necessary.

- Details of the interest rate, if applicable.

- A clear repayment schedule, including due dates and the amount of each payment.

- Consequences for late payments or default.

- Any other terms or conditions both parties have agreed upon.

Can interest be charged on an employee loan, and if so, how is it calculated?

Yes, employers can charge interest on loans provided to employees, but the rate must comply with relevant state and federal laws to avoid being considered usurious or excessively high. Interest can be calculated using a simple interest formula (interest = principal x rate x time) or any other method agreed upon by both parties. It's crucial that the interest rate and calculation method are clearly specified in the Employee Loan Agreement to avoid any confusion.

What happens if an employee leaves the company before repaying the loan?

The terms for this scenario should be specifically addressed within the Employee Loan Agreement. Typically, the agreement will stipulate that any outstanding balance becomes immediately due upon termination of employment. However, repayment terms can vary, such as deducting the remaining balance from final paycheck(s) or arranging for alternative repayment options. It's important for both parties to agree on and understand the procedure for such situations.

Is a witness or notarization required for an Employee Loan Agreement to be legally binding?

While having a witness or notarization can add an extra layer of verifiability, it is not generally required for an Employee Loan Agreement to be legally binding. The most critical aspect is that both parties have a clear understanding of the terms and signify their agreement by signing the document. However, the requirements can vary by state, so it's advisable to check local laws or consult with a legal professional to ensure the agreement meets all legal criteria for enforceability.

Common mistakes

When individuals tackle filling out an Employee Loan Agreement form, it's not uncommon to stumble over certain pitfalls. These documents, crucial for both the employer and the employee, need precise and thoughtful handling. A common mistake is overlooking the necessity of clear, detailed terms. Without specifying repayment schedule, interest rates, and deadlines, confusion can easily ensue, leading to potential disputes. Precisely articulating every term ensures both parties fully understand their commitments, minimizing risks of misunderstandings.

Another notable misstep is neglecting to outline the consequences of a default. It should be crystal clear what happens if the employee fails to meet the repayment terms. This isn't about expecting the worst but preparing for all scenarios. Without this, enforcing the agreement or managing missed payments becomes fraught with difficulty.

Many also fail to include a clause that addresses what happens should the employee leave the company, whether through resignation, termination, or retirement. This omission can lead to ambiguity regarding the loan's status in such events. Incorporating provisions for these situations protects both the lender and borrower by setting expectations for loan repayment in the event of the borrower's departure from the company.

Ignoring the need for a witness or notary is another common mistake. Having a third party witness the signing of the agreement adds a layer of legal protection and authenticity. This step can prove invaluable if the agreement is later disputed.

Some individuals forget to keep a copy of the signed agreement for their records. This document serves as evidence of the terms agreed upon by both parties and is crucial for resolving any future disputes. Ensuring that both the employer and employee retain a copy is essential for transparency and security.

Last but not least, a frequent oversight is not checking the legality of the loan agreement under state laws. Laws governing employee loans can vary significantly from one state to another. Failing to ensure that the agreement complies with state-specific regulations can render it unenforceable or lead to legal complications. Understanding and adhering to local laws is paramount for the agreement’s validity and enforceability.

Documents used along the form

When setting up an Employee Loan Agreement, it's not just about the agreement itself. Various forms and documents often accompany this key form to ensure clarity, compliance, and proper record-keeping throughout the loan's lifecycle. These documents range from those that establish the terms of the loan to those that detail repayment plans. Here's a closer look at eight critical forms and documents often used alongside an Employee Loan Agreement.

- Promissory Note: This is a written promise from the employee to pay back the borrowed amount under agreed terms. Unlike the loan agreement, a promissory note may not detail collateral but clearly outlines the loan amount, interest rate, repayment schedule, and what happens in case of default.

- Loan Repayment Schedule: This document outlines the specific dates and amounts for each loan payment. It helps both the employer and employee keep track of payments due and ensures transparency in the repayment process.

- Amortization Schedule: For loans with interest, an amortization schedule shows how each payment is divided into principal and interest over the life of the loan. This detailed breakdown helps the employee see how the loan balance decreases over time.

- Salary Deduction Authorization: If the repayment method involves deductions from the employee's salary, this form is crucial. It authorizes the employer to deduct loan payments directly from the employee's paycheck, detailing the deduction amount and frequency.

- Loan Modification Agreement: Should the terms of the original loan agreement change, this document outlines the modifications made. Common changes include extending the loan term, changing the interest rate, or adjusting payment amounts.

- Release of Loan Agreement: Once the loan is fully repaid, this document serves as proof of the loan's settlement. It releases the employee from further obligations and formally closes out the loan agreement.

- Confidentiality Agreement: This ensures that the terms of the loan, along with any personal or financial information disclosed during the process, remain confidential between the employer and employee.

- Default Notice: In the event the employee fails to make a scheduled repayment or otherwise breaches the loan agreement's terms, this document formally notifies them of the default and the potential consequences.

Together, these documents form a comprehensive framework that supports the Employee Loan Agreement, safeguarding both the employer and employee's interests. They ensure that the loan process is transparent, fair, and adheres to agreed-upon terms, which helps in maintaining a positive working relationship throughout the repayment period and beyond.

Similar forms

An Employee Loan Agreement form is similar to a Promissory Note in that both are legally binding agreements requiring the borrower to repay a loan according to the terms specified within the document. While an Employee Loan Agreement is specifically between an employer and employee, a Promissory Note can be between any two parties. Both documents outline the loan amount, repayment schedule, interest rate, and consequences for non-repayment, ensuring clear expectations and legal accountability for both parties involved.

Similar to an Employee Loan Agreement is a Personal Loan Agreement. This type of agreement also lays out the terms and conditions under which money is lent, though it is typically between individuals, such as friends or family members. Like an Employee Loan Agreement, a Personal Loan Agreement includes details about the loan amount, repayment terms, interest rate, and the responsibilities of each party. However, the latter is not limited to the context of an employment relationship.

An Employee Loan Agreement shares similarities with an Employment Contract, although they serve different purposes. An Employment Contract specifies the terms of the employment relationship, including duties, salary, and duration, while an Employee Loan Agreement focuses on the specifics of a loan provided by the employer to the employee. Both documents, however, are essential in defining the expectations and obligations of each party within the context of employment, contributing to a clear and structured professional relationship.

Lastly, the Employee Loan Agreement is akin to a Mortgage Agreement in the sense that both involve a loan that is to be repaid over time with interest. In a Mortgage Agreement, the loan is specifically for purchasing property, and the property itself serves as collateral. In contrast, an Employee Loan Agreement may not necessarily involve collateral and is more flexible in terms of purpose. Despite these differences, both documents are critical for detailing the repayment plan and ensuring legal enforceability of the loan terms.

Dos and Don'ts

Filling out an Employee Loan Agreement form is an important task that requires attention to detail and a clear understanding of the agreement you are entering into. Here are several dos and don'ts to keep in mind when completing this form to ensure the process goes smoothly and effectively:

- Do read the entire agreement carefully before filling it out. Understanding every section and term is crucial to know what you are agreeing to.

- Do fill out the form accurately. Provide factual and up-to-date information to avoid any potential issues or misunderstandings.

- Do thoroughly check for any spelling or grammatical errors, especially in sections that require personal information or financial details.

- Do ask for clarification if any part of the agreement is unclear. It's better to seek assistance than to make assumptions about what is required.

- Don't rush through the form. Take your time to ensure that all information provided is correct and complete.

- Don't leave any sections blank unless instructed. If a section does not apply, consider writing 'N/A' to indicate this clearly.

- Don't forget to sign and date the form where required. An unsigned agreement may not be legally binding.

- Don't hesitate to make a copy of the completed form for your records before submitting it. Having a personal copy can be useful for future reference.

Misconceptions

When it comes to an Employee Loan Agreement, people often have misconceptions about what it involves, its purpose, and how it's regulated. Here are eight common misunderstandings clarified to help both employers and employees navigate these agreements better:

Only large corporations can offer employee loans. Many believe that employee loans are exclusive to large companies. However, businesses of all sizes have the ability to offer loans to their employees. This flexibility supports a diverse range of businesses in providing financial assistance to their workforce.

Employee Loan Agreements are informal. Some may think these agreements are casual or unenforceable verbal agreements. On the contrary, an Employee Loan Agreement is a formal contract that outlines specific terms and conditions, such as repayment schedules, interest rates, and what happens in the event of default. This formality protects both the employer and the employee.

Interest rates on employee loans are always low or nonexistent. While it’s true that employee loans can have lower interest rates compared to commercial loans, they're not automatically low or interest-free. The terms, including the interest rate, are determined by the agreement between the employer and the employee.

There's no need for documentation or witnesses. Proper documentation is crucial for ensuring the legality and clarity of the loan terms. Without a written agreement, misunderstandings and disputes are more likely. Witnesses or notarization can also add an extra layer of legal validity to the document.

An Employee Loan Agreement can compel an employee to stay with the company. Some believe that by accepting a loan, an employee is legally obligated to remain within the company for a certain period. Although repayment terms can be tied to employment, they cannot force an employee to stay against their will. Such situations are more about financial obligations than employment bondage.

Offering loans to employees is universally beneficial. While offering loans can be a great benefit, it's not suitable for all businesses or employees. Employers need to consider their ability to offer loans without jeopardizing business finances. Likewise, employees should consider their ability to repay the loan without putting undue strain on their financial well-being.

Any dispute over the loan agreement automatically leads to termination of employment. Disagreements or disputes over the terms or repayment of a loan don't necessarily result in the termination of employment. Resolutions can often be found through mediation or adjustments to the repayment schedule. However, serious breaches of the agreement may have employment consequences, depending on the terms set out in the Employee Loan Agreement.

Employee loans don’t need to comply with state laws. Actually, employee loans must comply with all applicable state and federal laws, including those related to interest rates (usury laws) and tax implications. Compliance ensures that the loan agreement is both fair and legal, providing protection to both parties involved.

Understanding these aspects of Employee Loan Agreements can help employers and employees make informed decisions, ensuring that loans are a benefit, not a burden or source of conflict. Both parties are encouraged to seek legal counsel to understand the full implications and responsibilities tied to these agreements.

Key takeaways

When it comes to navigating the process of an Employee Loan Agreement, it is essential to approach the task with due diligence and understanding. This agreement not only outlines the terms of a loan provided by an employer to an employee but also serves as a legal document that protects the interests of both parties. Here are key takeaways to consider:

- Accuracy is paramount. When filling out the Employee Loan Agreement, ensure that all information provided is accurate and complete. This includes personal details, loan amount, repayment schedule, and interest rates, if applicable. Inaccurate or incomplete forms can lead to misunderstandings or legal complications down the line.

- Understand the terms. Before any party signs the agreement, it's crucial that both the employer and employee fully understand the terms laid out in the document. This includes the obligations of the employee to repay the loan under the agreed-upon conditions and the consequences of failing to meet these obligations.

- Keep a signed copy. Once the Employee Loan Agreement is filled out and signed by both parties, ensure that both the employer and the employee retain a copy of the document. This serves as a record of the agreement and can be crucial for resolving any disputes that may arise in the future.

- Privacy matters. The individual handling the Employee Loan Agreement must treat all information contained within with confidentiality. The details of the loan, including the amount and the existence of the loan itself, should not be disclosed to unauthorized parties, respecting the privacy of the employee.

In summary, the Employee Loan Agreement is a significant document that requires careful attention to detail. By ensuring accuracy, understanding the terms, securing signed copies, and maintaining privacy, both employers and employees can foster a relationship built on trust and mutual respect.