Fillable Loan Agreement Document for California

In the world of finance, particularly within the borders of California, the significance of a thoroughly prepared Loan Agreement cannot be overstated. This document plays a pivotal role in delineating the terms under which money is lent and ensures clarity and protection for both the lender and the borrower. It encompasses various essential elements, including but not limited to, the amount of the loan, interest rates, repayment schedule, and the consequences of defaulting on the loan. Understanding and accurately completing this form is crucial for all parties involved to avoid potential legal disputes and to ensure that the agreement is enforceable under California law. The California Loan Agreement form is designed to meet specific state regulatory requirements, offering a structured framework for a wide range of lending transactions. Whether dealing with personal loans between individuals or more complex loans involving businesses, this form serves as an indispensable tool in securing a mutual understanding and formalizing the loan process.

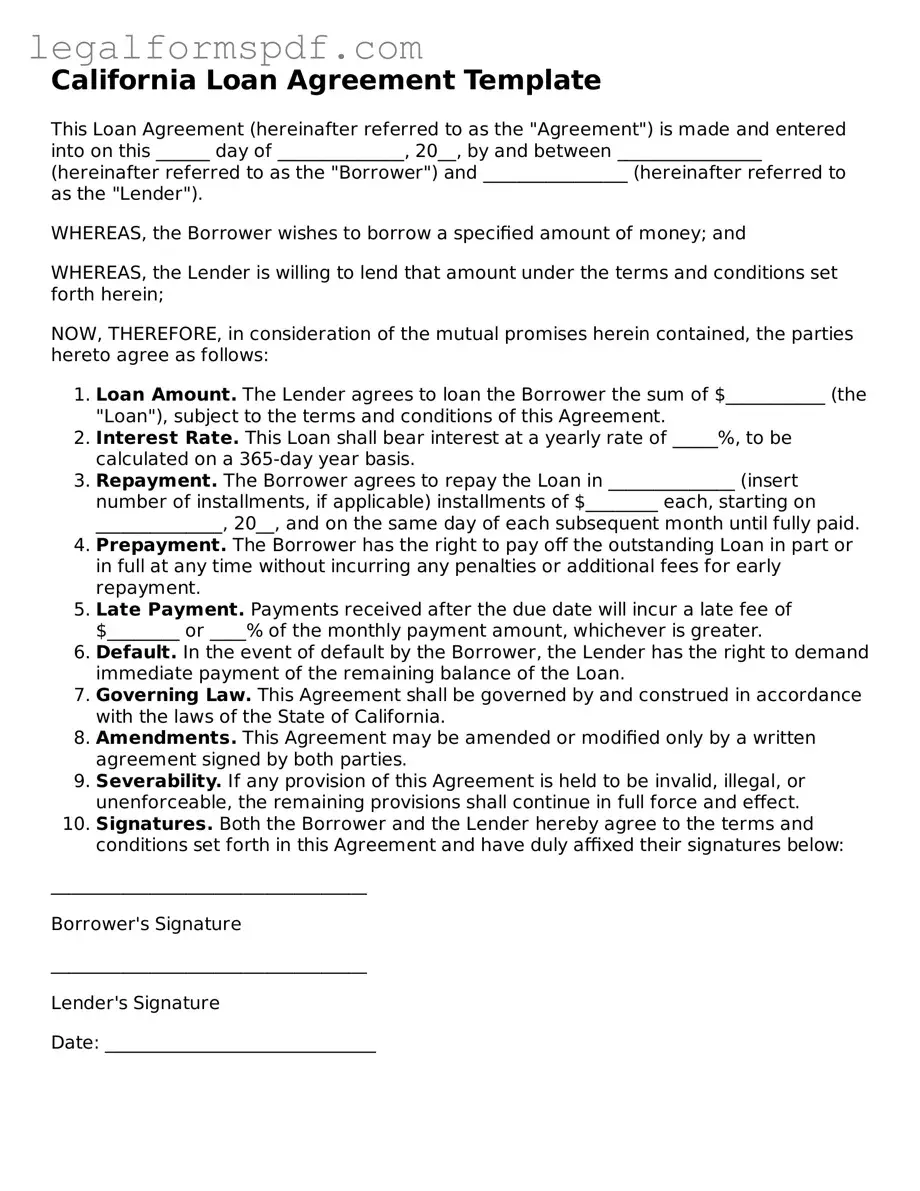

Document Example

California Loan Agreement Template

This Loan Agreement (hereinafter referred to as the "Agreement") is made and entered into on this ______ day of ______________, 20__, by and between ________________ (hereinafter referred to as the "Borrower") and ________________ (hereinafter referred to as the "Lender").

WHEREAS, the Borrower wishes to borrow a specified amount of money; and

WHEREAS, the Lender is willing to lend that amount under the terms and conditions set forth herein;

NOW, THEREFORE, in consideration of the mutual promises herein contained, the parties hereto agree as follows:

- Loan Amount. The Lender agrees to loan the Borrower the sum of $___________ (the "Loan"), subject to the terms and conditions of this Agreement.

- Interest Rate. This Loan shall bear interest at a yearly rate of _____%, to be calculated on a 365-day year basis.

- Repayment. The Borrower agrees to repay the Loan in ______________ (insert number of installments, if applicable) installments of $________ each, starting on ______________, 20__, and on the same day of each subsequent month until fully paid.

- Prepayment. The Borrower has the right to pay off the outstanding Loan in part or in full at any time without incurring any penalties or additional fees for early repayment.

- Late Payment. Payments received after the due date will incur a late fee of $________ or ____% of the monthly payment amount, whichever is greater.

- Default. In the event of default by the Borrower, the Lender has the right to demand immediate payment of the remaining balance of the Loan.

- Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of California.

- Amendments. This Agreement may be amended or modified only by a written agreement signed by both parties.

- Severability. If any provision of this Agreement is held to be invalid, illegal, or unenforceable, the remaining provisions shall continue in full force and effect.

- Signatures. Both the Borrower and the Lender hereby agree to the terms and conditions set forth in this Agreement and have duly affixed their signatures below:

___________________________________

Borrower's Signature

___________________________________

Lender's Signature

Date: ______________________________

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The California Loan Agreement is governed by the laws of the State of California. |

| Types of Loans Covered | It can be used for personal, commercial, real estate, and student loans. |

| Required Signatures | Both the borrower and the lender must sign the agreement for it to be valid. |

| Notarization | While not mandatory, notarizing the document can add a layer of legal protection. |

| Prepayment | The agreement can include terms for prepayment, allowing the borrower to pay off the loan early, possibly reducing interest. |

| Late Fees | Terms regarding late payment fees can be specified, including the amount and the grace period before they are applied. |

| Default and Remedies | It outlines the consequences of defaulting on the loan and the remedies available to the lender. |

Instructions on Writing California Loan Agreement

Filling out the California Loan Agreement form is a straightforward process but requires attention to detail. This form is a legally binding document between a borrower and a lender, involving the loaning of a certain amount of money under specified conditions. It's essential to provide accurate and clear information to avoid any potential disputes or misunderstandings. Follow the steps below to ensure the form is completed correctly.

- Begin by entering the date the agreement is being made at the top of the document. This establishes when the terms of the agreement come into effect.

- Write the full legal names and addresses of both the lender and the borrower in the designated sections. Confirm the accuracy to ensure both parties are correctly identified throughout the agreement.

- Specify the loan amount in numbers and words, ensuring both formats are consistent to avoid discrepancies.

- Detail the loan’s interest rate. This should be a clear annual rate, agreed upon by both parties. If applicable, provide information on whether the rate is fixed or variable and under what conditions it could change.

- Outline the repayment schedule, including the start date, frequency of payments (e.g., monthly), the amount of each payment, and when the loan must be paid in full. This section clarifies the borrower's obligations to repay the loan.

- Describe the purpose of the loan if it is required or relevant. Stating the purpose can sometimes offer protection to the lender by ensuring the borrowed funds are used as intended.

- Include any collateral that is being used to secure the loan. Collateral items should be described in detail, including their full value and any identification numbers or other distinguishing features.

- Input the governing state law, in this case, California. This indicates that the agreement is subject to the laws of California, regardless of where the parties are located.

- Both the borrower and lender must sign and print their names at the bottom of the form. Dates next to the signatures will confirm when each party signed the agreement.

- If applicable, have a witness sign and date the form as well. This can add an extra level of validation to the document, although not always required.

Once all steps are completed, it's crucial for both the borrower and the lender to keep a copy of the agreement for their records. This ensures that both parties have access to the agreed terms, which can be referred to in case any questions or issues arise during the term of the loan.

Understanding California Loan Agreement

What is a California Loan Agreement form?

A California Loan Agreement form is a legal document used between two parties - a lender and a borrower - within the state of California. This form outlines the terms of the loan, including the amount borrowed, the interest rate, repayment schedule, and any other relevant conditions agreed upon by both parties. It's designed to protect both the lender and the borrower by clearly defining their rights and responsibilities.

Why do I need a California Loan Agreement?

Having a California Loan Agreement is crucial whenever you're borrowing or lending money. It serves as a binding commitment that the borrower will repay the lender according to the terms agreed upon. For lenders, it offers a legal pathway to seek repayment if the borrower fails to meet their obligations. For borrowers, it ensures that the terms of the loan, such as the interest rate and repayment plan, cannot be changed without their consent, providing a layer of protection.

Can I write my own Loan Agreement in California, or do I need a lawyer?

While you can draft your own Loan Agreement in California, it's highly advisable to seek the guidance of a lawyer. A lawyer can help ensure that your agreement complies with all applicable state laws and adequately protects your interests. However, for simpler or smaller loans, you might use a standardized form or online template as a starting point, but having it reviewed by a legal professional is still recommended.

What information needs to be included in a California Loan Agreement?

A California Loan Agreement should contain the full names and contact information of the lender and borrower, the loan amount, the interest rate, repayment schedule, collateral (if any), and any other terms or conditions specific to the agreement. Signatures of both parties, along with the date of signing, should also be included to validate the agreement.

Is a notary required for a Loan Agreement in California?

While notarizing a Loan Agreement in California is not a legal requirement, it is a good practice. A notary public can help verify the identity of the parties signing the document, adding an extra layer of authentication to the agreement. This can be particularly useful if a dispute arises or if the document's validity is challenged in court.

How do I enforce a Loan Agreement in California?

Enforcing a Loan Agreement in California typically begins with trying to reach a resolution directly with the borrower. If that fails, you may need to initiate legal action. This involves filing a lawsuit in the appropriate court and proving the existence of the loan agreement, the terms of the agreement, and that the borrower has failed to comply with those terms. Winning a lawsuit may result in a judgment against the borrower, which can then be used to garnish wages or seize assets as repayment.

Can I charge any interest rate I want in a loan agreement?

No, California law limits the amount of interest that can be charged on a loan. The legal limits depend on several factors, including the type of loan, the amount, and whether the lender is licensed. Generally, for personal, family, or household purposes, the interest rate cannot exceed 10% per annum. Charging more than the lawful rate can lead to severe penalties, including the forfeiture of all interest or a claim by the borrower to recover twice the amount of interest paid.

What happens if the borrower can't repay the loan?

If a borrower fails to repay the loan as per the agreement, the lender has several options. They can negotiate a new repayment plan, demand full payment through a formal demand letter, or initiate legal proceedings to enforce the agreement. If collateral was part of the agreement, the lender might also have the right to seize the collateral to recover the owed amount.

Can modifications be made to a Loan Agreement after it's been signed?

Yes, modifications to a Loan Agreement can be made after it's been signed, but any changes must be agreed upon by both the lender and the borrower. These modifications should be documented in writing and signed by both parties, preferably with the same level of formality as the original agreement to ensure that they are legally binding.

Where can I find a template for a California Loan Agreement?

Templates for California Loan Agreements can be found online through legal services websites, state government resources, or by consulting with a legal professional. Bear in mind that while templates can provide a good starting point, it's important to customize the agreement to fit the specific terms of your loan and to ensure it complies with California law.

Common mistakes

One common mistake made by individuals when filling out the California Loan Agreement form is neglecting to provide detailed information about the loan terms. Specific details such as the interest rate, repayment schedule, and the loan's maturity date are crucial. The absence of these specifics can lead to misunderstandings between the parties involved, potentially leading to conflicts or legal disputes down the line.

Another area where errors occur is in the identification of the parties involved. Occasionally, individuals might provide incomplete names, misspellings, or fail to include the legal status of entities (such as Inc., LLC, etc.). This can create confusion about who is legally bound by the agreement, potentially complicating enforcement actions or the pursuit of legal remedies in the event of a breach.

Moreover, some people forget to specify the collateral (if any) securing the loan. Detailing what assets are being used as security for the loan is essential, particularly for secured loans. This omission could affect the lender's ability to recover the loaned amount if the borrower fails to make payments.

A frequent oversight is not outlining the procedures for amendment or termination of the agreement. Without a clear process for making changes or ending the loan agreement, parties may find themselves in a bind if circumstances change and the terms need adjusting. Including specific clauses for these situations can save both parties a considerable amount of time and legal fees.

Lastly, a critical mistake is failing to have the loan agreement witnessed or notarized, as required. While not all loan agreements need notarization, skipping this step when it is necessary can impact the document's legal enforceability. Ensuring that all legal formalities are observed is key to protecting the interests of both the lender and the borrower.

Documents used along the form

When navigating the complexities of financial transactions, such as those governed by the California Loan Agreement form, several other documents often come into play to ensure clarity, legality, and the protection of all parties involved. These supplementary documents provide additional detail, specify terms, or secure the agreement in a more comprehensive manner. Each serves a unique purpose, complementing the loan agreement to create a more robust legal framework around the loan transaction.

- Promissory Note: This document acts as a formal IOU and accompanies a loan agreement to detail the borrower's promise to repay the loan. It outlines the repayment schedule, interest rate, and what happens in case of default, providing clear terms for both the borrower and the lender.

- Personal Guarantee: Often used in conjunction with business loans, a personal guarantee is a commitment by an individual (usually a business owner or executive) to repay the loan personally if the business cannot. This provides an additional level of security to the lender.

- Security Agreement: When a loan is secured with collateral, a security agreement specifies the assets pledged as security. This document is crucial as it enumerates the rights of the lender to seize the collateral if the borrower fails to comply with the loan repayment terms.

- Deed of Trust/Mortgage: In real estate transactions, this document secures a loan by transferring legal title of the property to a trustee until the borrower repays the loan in full. This serves as protection for the lender that the borrower will honor the terms of the loan.

- Amendment Agreement: Over the life of a loan, terms may need to be revised due to changing circumstances. An amendment agreement is used to make any necessary adjustments to the original loan agreement, ensuring that all changes are documented and legally binding.

Considering and preparing additional documents as part of a loan transaction can not only protect the interests of all parties involved but also smooth the path for financial dealings by clearly outlining rights and responsibilities. These documents serve to bolster the foundational agreement provided by the California Loan Agreement form, creating a structured and secure framework for lending and borrowing. Understanding each document’s purpose and importance helps participants navigate through transactions with greater assurance and legal safety.

Similar forms

The Promissory Note is closely related to the California Loan Agreement form. Just like the Loan Agreement, a Promissory Note documents the borrower's promise to repay a sum of money to the lender. While the Loan Agreement often includes more detailed terms and conditions such as the interest rate, repayment schedule, and consequences of default, a Promissory Note typically focuses on the fundamental promise to repay the principal amount plus interest. Both serve as legally binding documents that establish a debtor-creditor relationship.

A Personal Guarantee is similar to the California Loan Agreement form in that both involve provisions to secure the repayment of a loan. In a Personal Guarantee, an individual (the guarantor) agrees to be responsible for the loan obligation if the primary borrower fails to repay. This is akin to certain clauses within a Loan Agreement that may require collateral or a guarantor as security. The main difference lies in the focus: Loan Agreements detail the relationship between the borrower and the lender, while Personal Guarantees emphasize the guarantor's commitment.

Mortgage Agreements share several similarities with the California Loan Agreement form, primarily in their function to secure a loan with property. A Mortgage Agreement involves a borrower pledging real estate as collateral for a loan, similar to how a Loan Agreement may secure a loan with collateral. Both documents outline the terms under which the money is borrowed, including repayment schedules, interest rates, and actions in case of default. However, Mortgage Agreements specifically deal with real estate transactions, whereas Loan Agreements can cover a broader range of collateral types.

A Deed of Trust, like the California Loan Agreement form, is used in some states as a means of securing a loan through property. It involves three parties: the borrower (trustor), the lender (beneficiary), and a trustee who holds the title to the property until the loan is repaid. This arrangement is somewhat comparable to the security interests detailed in Loan Agreements. However, the key difference is the involvement of a trustee in a Deed of Trust, who can foreclose on the property without court intervention if the borrower defaults.

A Line of Credit Agreement is akin to the California Loan Agreement form in that it establishes a borrower's ability to draw funds up to a specified limit over a set period. Both documents govern the terms of lending, including interest rates, repayment conditions, and what constitutes default. However, a Line of Credit Agreement allows for repeated borrowing within the agreed limit, offering more flexibility than the typically fixed loan amount in a Loan Agreement.

An Equipment Lease Agreement can be similar to a California Loan Agreement form when the lease is structured as a finance lease. In a finance lease, the lessee effectively borrows money to purchase the equipment, with the lease payments structured similarly to loan repayments. Like Loan Agreements, Equipment Lease Agreements cover interest rates, payment schedules, and default consequences. The distinction primarily lies in the ownership of the equipment; lessees may have the option to purchase the equipment at the lease's end.

Credit Sale Agreements resemble the California Loan Agreement form but are specifically related to transactions where goods are sold on credit. Both documents outline repayment obligations, including terms, interest rates, and the consequences of default. Credit Sale Agreements, however, are directly tied to the purchase of goods, with the repayment essentially financing the purchase. Unlike Loan Agreements, the primary purpose is the sale of goods rather than the provision of cash.

Dos and Don'ts

When filling out a California Loan Agreement form, it's crucial to pay attention to detail and to understand the responsibilities and rights both parties are agreeing to. Below are guidelines to aid individuals in correctly completing the form, ensuring a smooth and legally sound agreement.

Things You Should Do

- Read the entire form carefully before you start filling it out. Understanding every section will help prevent mistakes.

- Use clear, legible handwriting if you are filling out the form by hand. Alternatively, if an electronic fill-out option is available, use it to increase clarity.

- Include all necessary details, such as the full names and addresses of both the lender and borrower, the loan amount, the interest rate, repayment schedule, and any collateral involved.

- Check the specific requirements or provisions under California law that may apply to your loan agreement, ensuring the terms and conditions you set are legal and enforceable.

- Both parties should review the completed form before signing, verifying that all information is accurate and reflects the agreed-upon terms.

- Keep a signed copy of the loan agreement in a safe place. Both the lender and borrower should have a copy for their records.

Things You Shouldn't Do

- Don't leave any sections blank. If a section doesn't apply, write "N/A" (not applicable) to show that you didn't overlook it.

- Avoid using vague language. Be as specific as possible with loan terms, repayment schedules, and obligations.

- Don't forget to specify the governing state laws. Since this is a California Loan Agreement form, ensure that the agreement states that California law governs it.

- Do not sign the form without making sure you fully understand every term and condition. If needed, consult with a legal professional to clarify complex terms.

- Avoid rushing through the process. Taking the time to double-check details can prevent misunderstandings and legal complications later.

- Don't neglect to outline the procedure for amending the agreement, if necessary, to allow for adjustments in a straightforward and agreeable manner.

Misconceptions

When dealing with California Loan Agreement forms, it's easy to come across a fair share of misconceptions. These misconceptions can lead to confusion, making it challenging for individuals to navigate their way around these agreements accurately. Below, we debunk some of the most common misunderstandings.

The agreement doesn't need to be in writing to be enforceable. This is one of the most prevalent misconceptions. In California, for a loan agreement to be considered legally binding, it typically needs to be in writing, especially if the loan amount exceeds a certain threshold or if repayment is expected to take longer than a year. Relying on verbal agreements can lead to misunderstandings and legal disputes.

Interest rates can be as high as the lender decides. Actually, California has usury laws that limit the maximum amount of interest a lender can charge. These laws are put in place to protect borrowers from exorbitant interest rates. It's crucial for both lenders and borrowers to understand these limits to avoid unintentional violations of the law.

Only financial institutions can issue a legal loan agreement. This misconception often discourages individuals from lending or borrowing from private parties. In reality, private parties can enter into loan agreements as long as the document fulfills all legal requirements set by California laws. This flexibility facilitates personal loans between individuals, offering an alternative to traditional banking loans.

A loan agreement is only necessary for large loan amounts. Whether big or small, documenting the loan in a formal agreement is always a wise idea. This document not only provides legal protection for both parties but also outlines the terms and conditions of the loan, including repayment schedule, interest rates, and what happens if the borrower fails to repay the loan. Forgoing a written agreement for smaller loans can result in confusion and disputes down the line.

Key takeaways

When approaching the task of filling out and using the California Loan Agreement form, it's important to understand both its legal importance and practical considerations. This document serves as a binding agreement between the borrower and the lender, detailing the terms under which the loan will be provided and repaid. Here are key takeaways to consider:

- Accuracy is crucial. Every detail entered into the California Loan Agreement form must be accurate and truthful. This includes the names of the parties involved, the amount of the loan, the interest rate, repayment schedule, and any collateral securing the loan. Mistakes or inaccuracies can lead to disputes or legal challenges down the line.

- Understand the terms. Before signing, both the lender and borrower should fully understand the terms of the loan. This includes the interest rate, repayment schedule, and any consequences of late or missed payments. If there’s anything unclear, seeking clarification or legal advice is advisable.

- Keep it official. Once the California Loan Agreement form is completed and signed, it becomes a legally binding document. Ensure that all parties keep a signed copy of the agreement for their records. This document serves as evidence of the terms agreed upon and can be crucial in resolving any future disagreements.

- State laws matter. The California Loan Agreement form will be subject to California state laws governing loans, interest rates, and consumer protection. It’s important to be aware of these laws to ensure that the agreement complies with state legal requirements and to understand the rights and obligations of both parties under the law.

By paying close attention to these key takeaways when dealing with the California Loan Agreement form, parties can help ensure a smooth lending process, protect their interests, and avoid potential legal complications.

More Loan Agreement State Forms

Promissory Note Template Georgia - Includes a clause on indemnification, protecting the lender from losses due to borrower's actions.

Promissory Note Illinois - It may outline the conditions under which the lender can declare a default and demand immediate repayment.

Promissory Note Template Texas - A Loan Agreement form outlines the terms and conditions under which money is lent, specifying repayment schedules and interest rates.

Promissory Note Template Florida Pdf - Lastly, it often stipulates conditions under which information about the loan may be reported to credit bureaus, impacting the borrower's credit score.