Official Loan Agreement Document

When individuals or entities decide to lend or borrow money, the Loan Agreement form becomes an essential document to outline the terms of the financial transaction. This document serves not only as a binding contract that specifies the amount of money being loaned and the repayment schedule, but it also details interest rates, collateral requirements, if any, and the consequences of failing to repay the loan as agreed. Furthermore, the agreement provides protections and assurances to both the lender and the borrower, ensuring that each party's interests are safeguarded. It may include clauses that address late payments, prepayment, and default conditions, thereby laying out a clear roadmap for both parties to follow. By clearly specifying the obligations and expectations of each party, the Loan Agreement form helps to prevent misunderstandings and disputes, making it a critical tool in any financial transaction involving a loan.

Loan Agreement Form Subtypes

Document Example

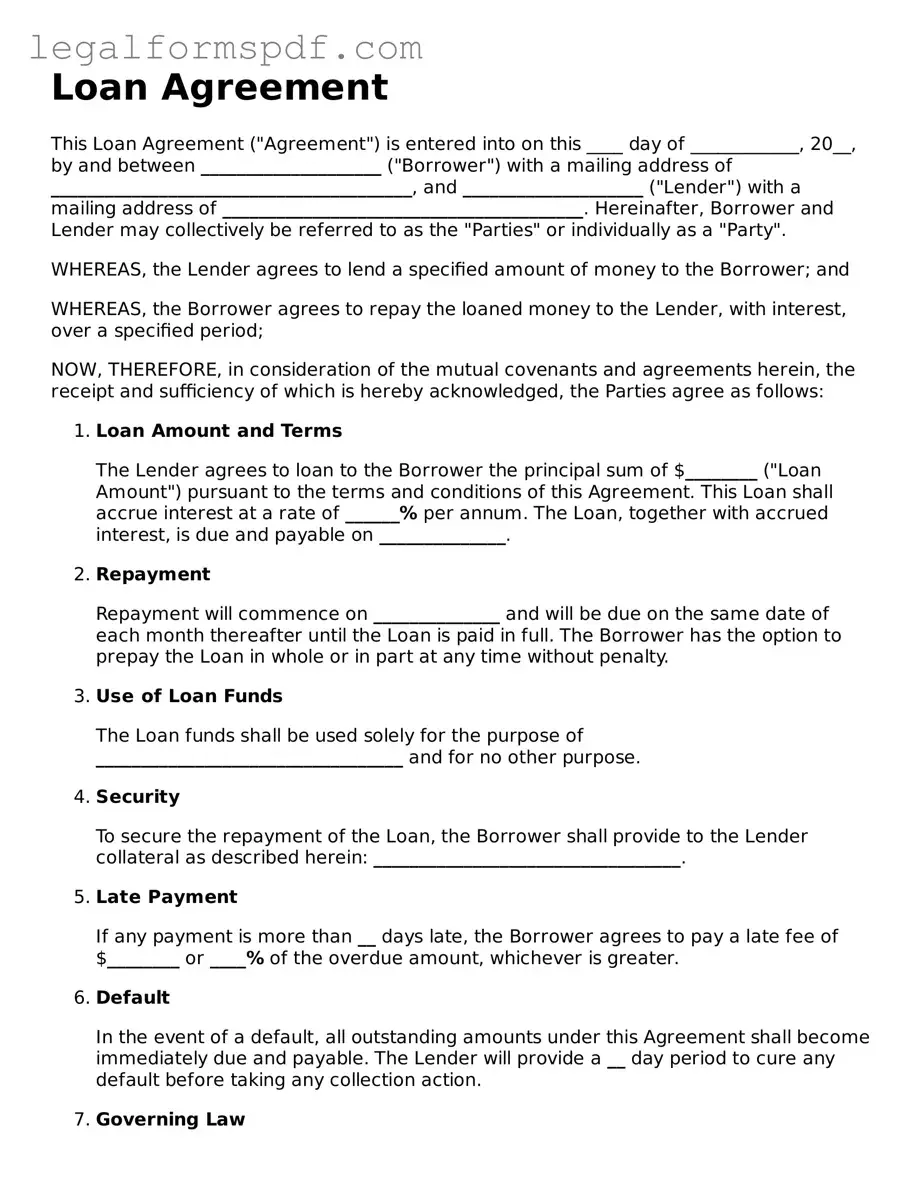

Loan Agreement

This Loan Agreement ("Agreement") is entered into on this ____ day of ____________, 20__, by and between ____________________ ("Borrower") with a mailing address of ________________________________________, and ____________________ ("Lender") with a mailing address of ________________________________________. Hereinafter, Borrower and Lender may collectively be referred to as the "Parties" or individually as a "Party".

WHEREAS, the Lender agrees to lend a specified amount of money to the Borrower; and

WHEREAS, the Borrower agrees to repay the loaned money to the Lender, with interest, over a specified period;

NOW, THEREFORE, in consideration of the mutual covenants and agreements herein, the receipt and sufficiency of which is hereby acknowledged, the Parties agree as follows:

- Loan Amount and Terms

The Lender agrees to loan to the Borrower the principal sum of $________ ("Loan Amount") pursuant to the terms and conditions of this Agreement. This Loan shall accrue interest at a rate of ______% per annum. The Loan, together with accrued interest, is due and payable on ______________.

- Repayment

Repayment will commence on ______________ and will be due on the same date of each month thereafter until the Loan is paid in full. The Borrower has the option to prepay the Loan in whole or in part at any time without penalty.

- Use of Loan Funds

The Loan funds shall be used solely for the purpose of __________________________________ and for no other purpose.

- Security

To secure the repayment of the Loan, the Borrower shall provide to the Lender collateral as described herein: __________________________________.

- Late Payment

If any payment is more than __ days late, the Borrower agrees to pay a late fee of $________ or ____% of the overdue amount, whichever is greater.

- Default

In the event of a default, all outstanding amounts under this Agreement shall become immediately due and payable. The Lender will provide a __ day period to cure any default before taking any collection action.

- Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of __________, without giving effect to any choice or conflict of law provision or rule.

- Amendment and Modification

This Agreement may only be amended or modified by a written document executed by both Parties.

- Notices

All notices and communications under this Agreement shall be in writing and sent to the Parties at their addresses mentioned above or at such other address as may be designated in writing.

- Entire Agreement

This document and any exhibits attached constitute the sole and entire Agreement between the Parties with respect to the subject matter contained herein, superseding all prior and contemporaneous understandings, agreements, representations, and warranties, both written and oral, with respect to such subject matter.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first above written.

Borrower's Signature: __________________________________________

Lender's Signature: ___________________________________________

Date: _________________

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition and Purpose | A Loan Agreement form is a legally binding document between a borrower and a lender that outlines the terms and conditions of a loan. |

| Key Components | This form typically includes details such as the loan amount, interest rate, repayment schedule, collateral, and any other terms agreed upon by the parties. |

| Governing Laws | The agreement is governed by state laws, which can vary significantly, affecting the interpretation, enforcement, and consequences of the contract's terms. |

| State-Specific Forms | Some states require specific forms or provisions to be included in the agreement to ensure compliance with local laws. |

| Importance of Precision | Careful drafting is critical to ensure that all parties' rights are protected and that the document is enforceable under the law. |

Instructions on Writing Loan Agreement

Filling out a loan agreement form is a critical step in formalizing the terms under which money will be borrowed and repaid. This document protects both parties by clearly outlining the loan amount, interest rate, repayment schedule, and any other conditions associated with the loan. It's important to complete this form carefully and thoroughly to avoid any misunderstandings or legal issues down the line. Here's how to fill out the loan agreement form step by step.

- Gather all necessary information beforehand, including the full names and contact details of both the lender and the borrower, the loan amount, interest rate, repayment schedule, and any collateral being offered.

- Start by filling in the date at the top of the form. This is the date on which the agreement is being entered into.

- Next, input the full legal names and addresses of both the lender and the borrower in their respective sections.

- Specify the principal amount of the loan. Write this amount in both words and figures to avoid any confusion.

- Detail the interest rate that will be applied to the loan and how it will be calculated, for example, annually.

- Outline the repayment schedule. Include how often payments will be made (monthly, quarterly), the amount of each payment, and when the first payment is due.

- If applicable, describe any collateral that is being used to secure the loan. Include a detailed description of the collateral and any registration numbers or identifiers if relevant.

- Include any other terms and conditions that have been agreed upon. This might involve late payment fees, conditions for loan forgiveness, or penalties for early repayment.

- Review the entered information carefully. Ensure all details are correct and that both parties understand and agree to the terms.

- Have both the lender and the borrower sign and date the form. Depending on your state laws, you may also need to have the signatures witnessed or notarized.

After completing the form, it's crucial to make copies for both parties. Store the original document in a safe place. This loan agreement will serve as a binding contract, ensuring that both the lender and the borrower are clear about their obligations and responsibilities. Remember, taking the time to fill out this form correctly can help prevent future disagreements and legal challenges.

Understanding Loan Agreement

What is a Loan Agreement?

A Loan Agreement is a legally binding contract between a borrower and a lender that outlines the terms and conditions of a loan. The agreement specifies the loan amount, interest rate, repayment schedule, and any other terms or conditions related to the borrowing and lending of the money.

Why do I need a Loan Agreement?

Creating a Loan Agreement helps protect both the lender and the borrower. For the lender, it secures the repayment of the loan and outlines legal recourse if the loan is not repaid. For the borrower, it ensures that the lender cannot arbitrarily change the terms of the loan, such as increasing the interest rate or demanding repayment sooner than agreed.

What should be included in a Loan Agreement?

A comprehensive Loan Agreement should include the following details: the amount of money being lent, interest rate, repayment schedule, any collateral securing the loan, provisions for default, the governing law, and signatures of both parties. It's also wise to include any agreed-upon penalties for late payments and the consequences of failing to repay the loan.

Can I write a Loan Agreement without a lawyer?

Yes, you can draft a Loan Agreement without legal assistance. However, it's important to use a detailed template that covers all legal bases and to make sure both parties fully understand and agree to the terms. For complex loans or large sums of money, consulting with a legal professional is recommended to ensure your agreement is enforceable and complies with state laws.

How is the interest rate determined in a Loan Agreement?

The interest rate in a Loan Agreement is typically agreed upon by the lender and borrower. It can be a fixed rate that remains constant throughout the term of the loan or a variable rate that changes with market conditions. The rate must be clearly stated in the agreement and comply with any applicable state usury laws to prevent it from being unlawfully high.

What happens if the borrower defaults on the Loan Agreement?

If the borrower defaults on the agreement by failing to make scheduled payments, the lender can enforce the terms of the agreement through legal action. This could involve seizing any collateral associated with the loan or obtaining a judgment against the borrower for the outstanding balance and possibly court costs and attorney's fees.

Can a Loan Agreement be modified?

Yes, a Loan Agreement can be modified if both the lender and the borrower agree to the changes. Any modifications should be made in writing, and both parties should sign the updated agreement. This helps to maintain clarity and avoid misunderstandings about the terms of the loan.

Is a Loan Agreement legally binding in all states?

Yes, a properly executed Loan Agreement is legally binding in all states. However, the specifics of enforceability and the legal processes available for dealing with disputes or defaults may vary by state. It's important to ensure that the agreement complies with the laws of the state governing the agreement, typically the state where the loan transaction takes place.

Common mistakes

One common mistake people make when filling out a Loan Agreement form is not clearly specifying the loan amount. The amount being borrowed is a critical piece of information and needs to be accurately recorded. Without this, the agreement can become ambiguous, leading to potential disputes about the exact financial obligations of the parties involved.

Another error frequently encountered is failing to outline the repayment terms in detail. This includes not only the timeline for repayments but also whether those payments include principal and interest, and if so, at what rate. Ambiguities in this area can result in disagreements regarding the expected payment amounts and the duration of the loan.

Incorrectly identifying the parties involved is also a common oversight. The full legal names of both the lender and the borrower need to be accurately included. This helps in legally identifying the parties and prevents any confusion regarding who has the rights and responsibilities under the agreement.

Many people forget to include the consequences of late payments or defaults within the agreement. Specifying penalties for late payments, or outlining the actions that can be taken in the event of a default, is essential for protecting the interests of both parties. Without these details, enforcing the terms of the loan can become challenging.

Omitting a clause related to amendment procedures is another oversight often seen in Loan Agreement forms. Circumstances may change, requiring adjustments to the agreement. Without a clear process for making amendments, altering the agreement to reflect new terms can become problematic.

Not clarifying the governing law is a mistake that can lead to uncertainty in the event of a dispute. It is crucial to specify which state or jurisdiction’s laws will govern the agreement, as this can significantly influence the interpretation and enforcement of the terms within the contract.

A common error is neglecting to consider the need for a witness or notary. Depending on the jurisdiction and the nature of the loan, having the signatures witnessed or notarized can add a layer of validity and protection against claims of forgery or coercion.

Overlooking the inclusion of a severability clause is also a notable mistake. This clause ensures that if one part of the agreement is found to be invalid or unenforceable, the remainder of the agreement still stands. Without this, the entire agreement could be jeopardized by one problematic clause.

Failing to detail what constitutes a breach of the agreement and the remedies for such a breach is another common shortfall. Clearly defining what actions or omissions would be considered a breach and what consequences would follow serves to safeguard both parties.

Last but not least, many individuals do not properly document the signing of the agreement. It’s essential to have a clear record of the date when the agreement was signed and by whom. This not only establishes the timeline of the agreement but also helps in confirming the parties' commitment to the terms laid out.

Documents used along the form

A Loan Agreement form is crucial when borrowing or lending money, as it outlines the terms and conditions of the loan, including the repayment schedule, interest rates, and the responsibilities of both parties. However, to fully protect both the borrower and lender, and to comply with legal requirements, several other forms and documents are often used in conjunction with a Loan Agreement form. These additional documents can enhance clarity, offer additional legal protection, and ensure that all aspects of the loan are thoroughly documented.

- Promissory Note: This document complements a Loan Agreement by providing a written promise from the borrower to pay back the loan amount plus any defined interest. It is a more simplified agreement that focuses on the repayment terms.

- Personal Guarantee: If the loan is to a business, a Personal Guarantee may be required from the business owner or a third party, guaranteeing the loan will be repaid. This document adds an additional layer of security for the lender.

- Security Agreement: This legal document gives the lender a security interest in a specified asset or property (collateral) that the borrower offers. If the loan is not repaid, the lender has the right to seize the collateral.

- Amortization Schedule: An Amortization Schedule outlines the detailed payment plan for the loan, showing both the principal and interest components of each payment throughout the term of the loan.

- Disclosure Statement: This is a detailed document that outlines all of the terms of the loan, including the annual interest rate, finance charge, amount financed, and total payments required. It’s particularly important for consumer protection.

- Prepayment Penalty Clause: This clause might be part of the Loan Agreement or a separate document; it specifies if there are any penalties for paying the loan off early, protecting the lender’s expected interest earnings.

- Default Provision: This outlines what constitutes a default on the loan, such as missing a payment or failing to maintain insurance on a collateral item, and the subsequent steps that will be taken.

- Cosigner Agreement: If there is a cosigner on the loan, this document outlines the cosigner’s responsibilities and liabilities. This is important because it ensures the cosigner understands their obligation to repay the loan if the primary borrower fails to do so.

Together, these documents form a comprehensive package that addresses different aspects of the loan process, from ensuring repayment to specifying actions in case of default. Not only do they provide a roadmap for the borrower and lender, but they also serve to protect the interests of both parties throughout the life of the loan. Ensuring these documents are properly completed and understood can prevent future misunderstandings and legal disputes, making for a smoother financial transaction for everyone involved.

Similar forms

A Promissory Note is a document similar to a Loan Agreement form, as it also outlines the terms under which money has been lent and the repayment obligations. However, a Promissory Note is generally more straightforward and less detailed than a Loan Agreement. It serves as a written promise from the borrower to pay back the lender a specific amount of money within a set period or on demand. While a Loan Agreement form typically includes detailed terms and conditions, such as the interest rate and repayment schedule, a Promissory Note might not be as comprehensive.

A Mortgage Agreement is another document closely related to a Loan Agreement, with its specific focus on real estate transactions. In essence, it outlines the borrower's promise to repay the loan used to purchase property and grants the lender a security interest in the property until the loan is fully repaid. Like a Loan Agreement form, it details the loan's terms, including the repayment schedule, interest rate, and actions in case of default. The primary difference is the Mortgage Agreement's collateral—the purchased property—which secures the loan.

Similarly, a Deed of Trust is often used in real estate transactions and shares similarities with a Loan Agreement form. This document involves three parties: the borrower, the lender, and a trustee, and it places the property title in trust with the trustee as security for the loan. Like a Loan Agreement, it specifies the terms under which the loan is provided and must be repaid. The primary difference lies in its use of a trustee, who holds the property's title until the loan is repaid in full.

An IOU (I Owe You) document represents a simple acknowledgment of debt, similar to a Loan Agreement form in its recognition of a financial obligation. However, it is far less formal and detailed, usually lacking comprehensive terms like repayment schedules, interest rates, and collateral agreements. An IOU simply records the borrower's obligation to repay a certain amount to the lender, making it similar in purpose but significantly less binding and detailed than a Loan Agreement.

A Line of Credit Agreement shares similarities with a Loan Agreement form by stipulating the terms under which a lender provides a specified amount of money that the borrower can draw upon as needed. Like a Loan Agreement, it includes details about the maximum amount available, the time frame for borrowing, repayment terms, and interest rates. The key difference is the flexibility a Line of Credit Agreement offers, allowing the borrower to take out varying amounts up to the maximum limit over a period, rather than a lump sum upfront.

A Credit Agreement, often used for establishing ongoing credit arrangements, similarly outlines the terms between a borrower and lender, detailing the loan amount, repayment structure, and interest rates, akin to a Loan Agreement form. It is typically more complex, covering various forms of credit facilities, repayment conditions, and covenants that the borrower must adhere to. Credit Agreements are often used in more significant financing transactions and offer a broader scope than the typically more straightforward Loan Agreement form.

Finally, a Business Loan Agreement is tailored specifically to the needs of businesses and shares the foundational attributes of a standard Loan Agreement form, detailing the loan terms, repayment schedule, interest rate, and collateral, if any. What sets a Business Loan Agreement apart is its focus on the needs of businesses, potentially including provisions related to the business's financial health, covenants, and specific conditions under which the loan must be used. This focus on business operations and objectives makes it distinct yet fundamentally similar to a Loan Agreement form.

Dos and Don'ts

When filling out a Loan Agreement form, it's crucial to ensure everything is documented correctly to protect all parties involved. Here are some guidelines to follow, divided into what you should and shouldn't do, to make the process smoother and more effective.

Do:Read the entire form carefully before you start filling it out to understand all the requirements and details.

Use clear, precise language to avoid any ambiguity. This includes specifying the loan amount, interest rate, repayment schedule, and any collateral involved.

Verify the accuracy of all names, addresses, and other personal information for both the lender and borrower. Errors can lead to legal complications.

Ensure that the terms and conditions of the loan are clear to both parties and that both agree on them. This promotes mutual understanding and agreement.

Sign and date the form in the presence of a witness or notary, depending on your state’s requirements. This step gives the document legal weight.

Keep a copy of the signed agreement for both the lender and the borrower. It serves as a receipt and evidence of the terms agreed upon.

Review the repayment terms to make sure they are realistic and fair, helping to prevent potential conflicts during the repayment period.

Rush through the process without fully understanding the terms. Misunderstandings can lead to disputes or legal issues.

Leave any sections blank. If a section does not apply, mark it as "N/A" (not applicable) to indicate it was considered but found irrelevant.

Forget to specify the jurisdiction or governing laws for the agreement. This is crucial in case of any legal disputes.

Overlook the need for a witness or notarization, as its absence can question the document's validity in some jurisdictions.

Ignore the importance of a detailed repayment schedule. It should include due dates, amounts, and where to send payments.

Agree to terms that are unfavorable or impossible to fulfill. It’s better to negotiate terms that are fair and manageable for both parties.

Fail to update the document if changes are agreed upon. Any modifications should be in writing and signed by both parties.

Misconceptions

When it comes to loan agreements, many people have misconceptions that can lead to misunderstandings or even legal trouble down the line. Here are ten common myths about loan agreement forms, debunked to help you navigate these vital documents more effectively:

All loan agreements are pretty much the same. This couldn't be further from the truth. Loan agreements can vary significantly depending on the lender, the borrower, the purpose of the loan, and the jurisdiction. Each agreement should be read thoroughly and understood before signing.

You don't need a loan agreement if you're borrowing from friends or family. Even if you're borrowing from someone you trust implicitly, a loan agreement is crucial. It helps clarify the terms and expectations for both parties, reducing the risk of misunderstandings or conflicts.

A verbal agreement is just as good as a written one. While verbal agreements can be legally binding, proving the terms of the agreement can be challenging if disputes arise. A written loan agreement provides clear evidence of the terms agreed upon by both parties.

If it's not in the loan agreement, it doesn't matter. Just because something isn't mentioned in the loan agreement doesn't mean it's irrelevant. All the terms and conditions of the loan should be explicitly stated in the agreement to avoid any future disputes.

Reading the loan agreement is unnecessary if you trust the lender. No matter how much you trust the lender, reading and understanding the loan agreement is crucial. It's essential to know what you're agreeing to, including any obligations, penalties, and the repayment schedule.

Loan agreements are too complicated to understand without a lawyer. While legal advice can be beneficial, especially for large or complex loans, many loan agreements are straightforward enough to be understood without a lawyer. Don't be afraid to ask questions if you encounter terms or clauses that aren't clear.

You can't negotiate the terms of a loan agreement. Before signing a loan agreement, you often have the opportunity to negotiate the terms. This could involve the interest rate, repayment schedule, or other clauses. Don't hesitate to discuss potential changes with the lender.

Signing a loan agreement means you agree to everything as is. Signing indicates that you agree to the terms at that moment, but amendments can be made later if both parties agree. It's possible to renegotiate terms if circumstances change, though it's easier to negotiate before signing.

A loan agreement only benefits the lender. A well-drafted loan agreement protects both the lender and the borrower. It clarifies the loan terms for the borrower and provides the lender with a means of recourse if the borrower fails to meet their obligations.

Electronic signatures aren't valid on loan agreements. In many jurisdictions, electronic signatures are legally binding and as valid as traditional handwritten signatures. They offer a convenient way to execute agreements without the need for physical documents.

Understanding these misconceptions and the truths behind them can help borrowers and lenders navigate the complexities of loan agreements with confidence.

Key takeaways

When diving into the world of loan agreements, it’s important to ensure clarity and protection for all parties involved. Here are key takeaways about filling out and using the Loan Agreement form:

Understand the purpose: A loan agreement is a legally binding document between a borrower and a lender, outlining the terms and conditions of the loan. It's not just a formality but a crucial step in safeguarding both sides’ interests.

Details matter: Be sure to include all relevant details in the loan agreement, such as the names of the parties, the loan amount, interest rate, repayment schedule, and any collateral involved. This prevents misunderstandings and disputes.

Interest rates: Clearly stating the interest rate is essential. Whether fixed or variable, knowing how interest is calculated helps both lender and borrower understand the total amount to be repaid.

Repayment plan specifics: The agreement should specify the repayment schedule, including due dates for payments and whether there are any grace periods allowed. This ensures that expectations are clear from the start.

Consider collateral: If the loan is to be secured with collateral, the details of the collateral should be explicitly mentioned. This includes identifying the collateral and outlining what happens in the event of a default.

Legal implications: Understand that loan agreements are not just informal deals but have legal implications. In the event of a dispute, the agreement can be used in a court of law to enforce terms.

Signatures: Ensure that all parties involved sign the agreement. A loan agreement is not considered valid without the signatures of the borrower and lender. This formalizes the commitment of all parties.

Seek professional advice: Lastly, consider seeking advice from a legal professional when drafting or signing a loan agreement. They can provide clarity on terms and protect your interests.

Keeping these key points in mind when dealing with a Loan Agreement form can significantly reduce potential problems and help maintain positive relationships between borrowers and lenders. It’s about ensuring fairness and security for everyone involved.

Other Templates

Bill of Sale for Gun Sale - This bill acts as a safeguard for both the seller and the buyer by documenting the transaction details, including the firearm’s condition and confirmation of the sale.

Affadavit of Domicile - This affidavit is often required by financial institutions to release the assets of the deceased to their beneficiaries.

Nursing Reference Example - Serves as a testament to a nurse's dedication, reliability, and ability to function effectively in high-pressure environments.