Official LLC Share Purchase Agreement Document

An LLC Share Purchase Agreement form is an instrumental document in navigating the complexities of buying and selling membership interests in a Limited Liability Company (LLC). It serves as a formal contract that clearly outlines the terms, conditions, and obligations of both the buyer and the seller involved in the transaction. This essential legal document meticulously details the purchase price, payment methods, warranties, and representations of all parties, in addition to conditions precedent to the closing of the transaction. Furthermore, it addresses the allocation of profits and losses, management of the LLC following the transaction, and any rights to first refusal. The agreement is paramount in ensuring that the sale complies with applicable state laws, thereby securing a smooth transfer of membership interests with minimized risk of future disputes. By capturing the entire agreement in writing, both parties obtain a tangible record that can help prevent misunderstandings and provide a clear path for resolution should questions or concerns arise post-sale.

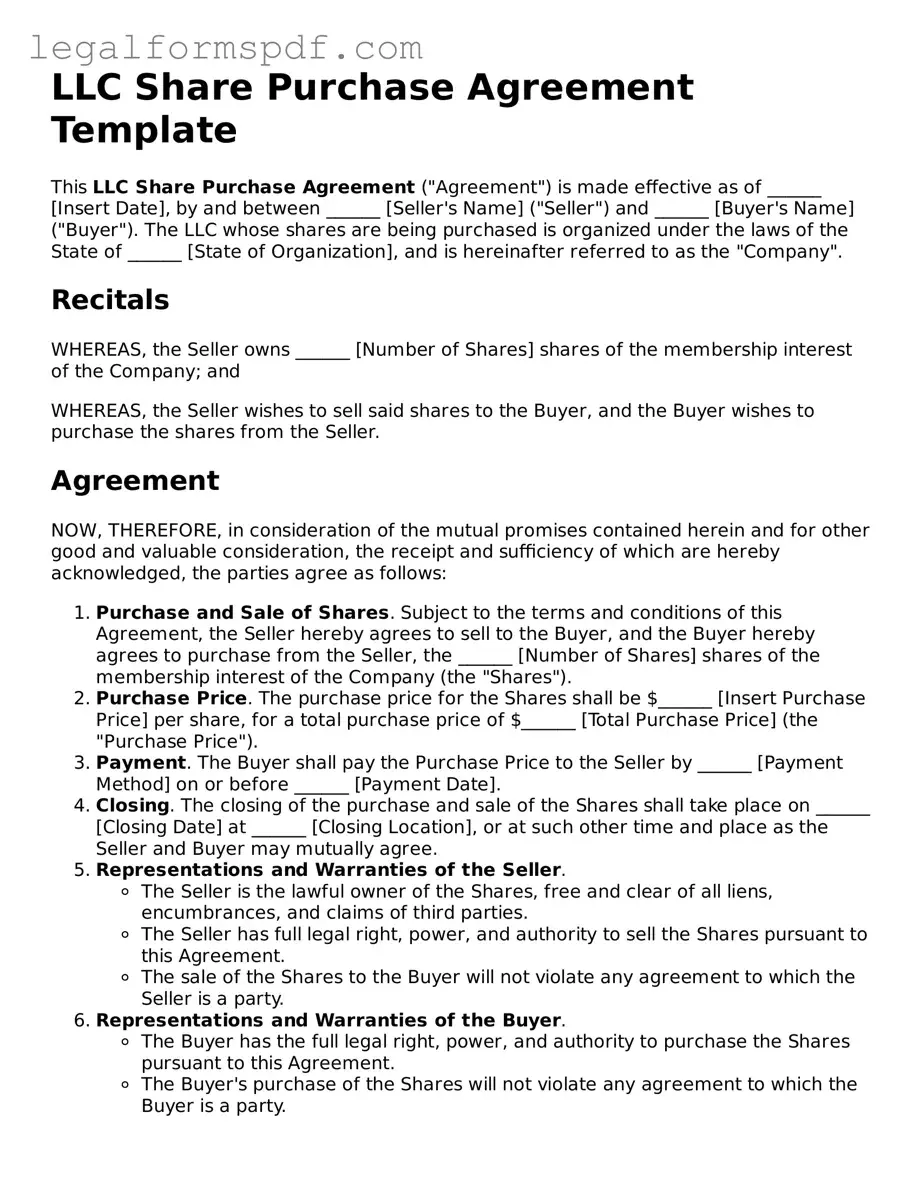

Document Example

LLC Share Purchase Agreement Template

This LLC Share Purchase Agreement ("Agreement") is made effective as of ______ [Insert Date], by and between ______ [Seller's Name] ("Seller") and ______ [Buyer's Name] ("Buyer"). The LLC whose shares are being purchased is organized under the laws of the State of ______ [State of Organization], and is hereinafter referred to as the "Company".

Recitals

WHEREAS, the Seller owns ______ [Number of Shares] shares of the membership interest of the Company; and

WHEREAS, the Seller wishes to sell said shares to the Buyer, and the Buyer wishes to purchase the shares from the Seller.

Agreement

NOW, THEREFORE, in consideration of the mutual promises contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

- Purchase and Sale of Shares. Subject to the terms and conditions of this Agreement, the Seller hereby agrees to sell to the Buyer, and the Buyer hereby agrees to purchase from the Seller, the ______ [Number of Shares] shares of the membership interest of the Company (the "Shares").

- Purchase Price. The purchase price for the Shares shall be $______ [Insert Purchase Price] per share, for a total purchase price of $______ [Total Purchase Price] (the "Purchase Price").

- Payment. The Buyer shall pay the Purchase Price to the Seller by ______ [Payment Method] on or before ______ [Payment Date].

- Closing. The closing of the purchase and sale of the Shares shall take place on ______ [Closing Date] at ______ [Closing Location], or at such other time and place as the Seller and Buyer may mutually agree.

- Representations and Warranties of the Seller.

- The Seller is the lawful owner of the Shares, free and clear of all liens, encumbrances, and claims of third parties.

- The Seller has full legal right, power, and authority to sell the Shares pursuant to this Agreement.

- The sale of the Shares to the Buyer will not violate any agreement to which the Seller is a party.

- Representations and Warranties of the Buyer.

- The Buyer has the full legal right, power, and authority to purchase the Shares pursuant to this Agreement.

- The Buyer's purchase of the Shares will not violate any agreement to which the Buyer is a party.

- Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of ______ [Governing State], without regard to its conflict of laws principles.

- Amendment. This Agreement may only be amended, modified, or supplemented by an agreement in writing signed by both parties hereto.

- Entire Agreement. This Agreement constitutes the entire agreement between the parties concerning the subject matter hereof and supersedes all previous agreements and understandings, whether oral or written, between the parties with respect to such subject matter.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first written above.

SELLER: ______ [Seller's Signature] ______ [Print Name]

BUYER: ______ [Buyer's Signature] ______ [Print Name]

PDF Specifications

| Fact Number | Description |

|---|---|

| 1 | An LLC Share Purchase Agreement is a legal document used when an individual or entity agrees to buy shares in a Limited Liability Company. |

| 2 | This agreement outlines the terms and conditions of the sale, including the purchase price, payment method, and any representations or warranties. |

| 3 | It ensures that all parties have a clear understanding of their rights and obligations regarding the transfer of ownership. |

| 4 | The form is crucial for maintaining accurate records of ownership and for the protection of both the buyer's and seller's interests. |

| 5 | State-specific laws govern the agreement, and it must comply with these regulations to ensure its legality and enforceability. |

| 6 | It often contains confidentiality clauses to protect sensitive information disclosed during the transaction process. |

| 7 | Due diligence is recommended for both parties to verify the accuracy of disclosed information and the legitimacy of the shares in question. |

| 8 | The document typically requires the acknowledgment of all LLC members to prevent disputes and ensure a unanimous agreement on the share transfer. |

| 9 | Amending the official member roster of the LLC to reflect the new ownership post-transaction is an essential step following the agreement. |

Instructions on Writing LLC Share Purchase Agreement

An LLC Share Purchase Agreement is a vital document that facilitates the sale and transfer of ownership interest in a limited liability company (LLC) from one party to another. This document ensures that all terms of the sale are clearly outlined and agreed upon by both parties, protecting the rights and interests of everyone involved. Filling out this form properly is crucial for the smooth execution of the transaction. Follow the steps below to accurately complete the LLC Share Purchase Agreement form.

- Start by entering the date of the agreement at the top of the form. Make sure to use the current date or the date when both parties have agreed to execute the sale.

- Input the full legal names and addresses of both the seller and the buyer in the respective sections provided. This identification is crucial for the legality of the document.

- Describe in detail the LLC ownership interest being sold. This section should include the percentage of membership interest, any specific units of interest, if applicable, and the name of the LLC to which the interest belongs.

- List the purchase price for the LLC share being sold. Clearly state the amount in words and then in numbers to ensure there is no confusion regarding the sale amount.

- Specify the terms of payment. This includes how the payment will be made (e.g., cash, check, wire transfer), any installment plans if applicable, and the due dates for such payments.

- Include any representations and warranties made by the seller regarding the LLC and its business operations. This section is meant to provide assurance to the buyer about the state of the business being entered into.

- Outline any covenants or agreements that pertain to the sale. These can range from non-compete clauses to the seller's obligation to assist in the transition period after the sale.

- Provide space for any conditions precedent to the sale, such as the buyer's satisfactory review of the LLC's financial statements or any required approvals from regulatory bodies.

- Detail the closing date and location where the final sale will be executed and the LLC share officially transferred from the seller to the buyer.

- Include sections for both parties to sign and date the agreement. It's also prudent to have space for witness signatures, even if not required, to add an extra layer of validity to the document.

After completing these steps, review the entire document to ensure all information is accurate and reflects the agreement between the buyer and seller. It's advisable for both parties to seek legal review of the agreement before signing to avoid any future disputes or misunderstandings. Finally, execute the agreement by having both parties sign and date where indicated, making the transaction official.

Understanding LLC Share Purchase Agreement

What is an LLC Share Purchase Agreement?

An LLC Share Purchase Agreement is a legally binding document used when an individual or entity decides to buy shares in a Limited Liability Company (LLC). This agreement outlines the terms of the purchase, including the number of shares being bought, the price per share, and any representations and warranties made by both the buyer and the seller. It's a crucial step in ensuring that both parties understand their rights and obligations during the transaction.

Why do I need an LLC Share Purchase Agreement?

Having an LLC Share Purchase Agreement in place provides a clear framework for the transaction, helping to prevent misunderstandings and disputes between the buyer and the seller. It ensures that both parties are aware of the specifics of the deal, such as payment details, transfer of ownership, and any conditions that must be met before the sale can be completed. Additionally, it protects the interests of both parties by clearly stating what will happen should either side fail to fulfill their obligations.

What should be included in an LLC Share Purchase Agreement?

The agreement should include details such as the identity of the buyer and seller, the number of shares to be purchased, the price per share, payment terms, any representations and warranties by the buyer and seller, conditions precedent to the closing of the sale, and the effective date of the agreement. It may also cover any restrictions on the sale of shares, confidentiality obligations, and dispute resolution mechanisms. Ensuring that the agreement is comprehensive and tailored to the specific transaction is crucial.

How is the price per share determined in an LLC Share Purchase Agreement?

The price per share can be determined through various methods, including negotiation between the buyer and the seller, valuation of the LLC by a financial expert, or a formula set out within the LLC's operating agreement. The chosen method should be agreed upon by both parties and clearly documented in the Share Purchase Agreement to avoid any confusion.

Can I modify an LLC Share Purchase Agreement after it's been signed?

Modifications to an LLC Share Purchase Agreement after it has been signed require the consent of both the buyer and the seller. Any changes should be made in writing and attached as amendments to the original agreement. It’s important to keep detailed records of any modifications to ensure clarity and legal compliance.

What happens if either party breaches the agreement?

In the event of a breach, the course of action will depend on the terms stipulated in the agreement itself. Common remedies include requiring the breaching party to fulfill their obligations, payment of damages to the non-breaching party, or termination of the agreement. The agreement may also outline specific dispute resolution mechanisms, such as arbitration or mediation, to handle conflicts.

Do I need a lawyer to draft an LLC Share Purchase Agreement?

While it's possible to draft an LLC Share Purchase Agreement without a lawyer, seeking professional legal advice is highly recommended. This ensures that the agreement is legally sound, reflects the intentions of both parties accurately, and adheres to state and federal laws. A lawyer can also help identify and address any potential issues before they arise, offering peace of mind and potentially saving time and money in the long run.

Common mistakes

One common mistake made during the completion of an LLC Share Purchase Agreement is the failure to accurately define the terms used within the document. This oversight can lead to ambiguity and misunderstandings between the parties involved. It's crucial that every term, especially those pertaining to the financial aspects and the responsibilities of each party, is clearly defined and understood by all stakeholders. A lack of clarity can result in disputes and legal challenges down the line.

Another error involves neglecting to verify the authority of the signatories. It is imperative to ensure that individuals signing the agreement on behalf of the LLC or the purchasing party have the proper authorization. Without such verification, the legitimacy of the agreement can be called into question. This step is often overlooked in the eagerness to finalize the transaction but can have significant legal implications.

Inadequate due diligence is a critical mistake during this process. Parties often fail to thoroughly investigate the financial health and legal standing of the LLC whose shares are being purchased. This oversight can lead to unforeseen liabilities and complications. Conducting comprehensive due diligence before finalizing the agreement can save significant time and resources by identifying potential issues early.

A further common mistake is not specifying the dispute resolution mechanism within the agreement. Disagreements or misunderstandings can arise after the transaction has been completed. Without a predefined method for resolving these disputes, parties may find themselves in prolonged and costly legal battles. Including a dispute resolution clause that outlines whether arbitration or mediation will be used can provide a clear path forward in the event of a disagreement.

Lastly, an error often made is failing to include a comprehensive list of representations and warranties. This section provides assurances from the seller to the buyer about the state of the LLC and its shares at the time of purchase. Omitting detailed representations and warranties can leave the buyer unprotected against potential misrepresentations or omissions by the seller. Ensuring that this section is comprehensive and meticulously detailed is crucial for the protection of all parties involved.

Documents used along the form

When parties come together to buy and sell shares of a limited liability company (LLC), they use a variety of forms and documents alongside the LLC Share Purchase Agreement to make sure the transaction is clearly understood and legally sound. These documents provide a framework for the agreement, outline the responsibilities of each party, and ensure compliance with state and federal laws. Let's explore some of these crucial documents used in such transactions.

- Operating Agreement: This document outlines the LLC's operating procedures, ownership percentages, and profit distribution among members. It's essential in transactions involving share purchases to ensure new shareholders understand the company's management structure and operational policies.

- Bill of Sale: This document serves as proof of the transaction and transfer of ownership. It details the specific shares being sold, the sale price, and the transfer date, providing a clear record of the purchase.

- Non-Disclosure Agreement (NDA): Often used in share purchase transactions to protect sensitive company information. It ensures that the buyer cannot disclose confidential information learned during the transaction process.

- Escrow Agreement: In transactions where the share transfer and payment are not simultaneous, an escrow agreement is used to protect both parties. It holds the payment in trust until all conditions of the sale are met.

- Due Diligence Request List: This is a comprehensive list of documents and information the buyer requests to review before completing the purchase. It typically includes financial records, contracts, and compliance documents of the LLC.

- Member Consent Form: In many LLCs, the sale or transfer of shares requires the approval of existing members. This form documents their consent to the share sale and the addition of a new member.

- Warranties and Representations Statement: Both the buyer and seller provide statements asserting that all the information provided is true to the best of their knowledge. This document helps protect against fraud and misrepresentation.

Each document plays a vital role in ensuring the share purchase transaction is conducted fairly and legally. Buyers and sellers should understand these documents completely before proceeding with a sale. Consulting with legal professionals can provide clarification and help avoid potential legal issues down the road.

Similar forms

The LLC Share Purchase Agreement is similar to a Stock Purchase Agreement, in that both documents outline the terms and conditions under which ownership stakes in a company are bought and sold. However, the key difference lies in the type of ownership interest that is being transferred. An LLC Share Purchase Agreement deals specifically with the membership interests in a Limited Liability Company, while a Stock Purchase Agreement pertains to the shares of a corporation. Both agreements serve to protect the interests of both the buyer and the seller, ensuring that the transfer is legally binding and conforms to the agreed-upon terms.

Similar to an Asset Purchase Agreement, an LLC Share Purchase Agreement focuses on the transfer of ownership. While an Asset Purchase Agreement involves the sale of a company's assets, including tangible and intangible items, an LLC Share Purchase Agreement exclusively concerns the transfer of membership interest in the company. Both types of agreements are crucial in business transactions and require detailed information about what is being bought or sold, alongside conditions that protect both parties involved.

The Membership Interest Purchase Agreement is a document that closely mirrors the LLC Share Purchase Agreement, as both are used in the context of Limited Liability Companies. These agreements facilitate the sale and transfer of a member's interest in the LLC. The distinction primarily lies in the terminology and the specific structure of the interest being transferred, but fundamentally, both documents serve to ensure a smooth transition of ownership rights and responsibilities within an LLC.

An Agreement of Sale and Purchase of Shares has a broad resemblance to the LLC Share Purchase Agreement, as it is another form of agreement used when buying and selling ownership in a business entity. The main difference is that an Agreement of Sale and Purchase of Shares can apply to various types of business structures, including corporations and partnerships, whereas an LLC Share Purchase Agreement is exclusively for Limited Liability Companies. Each document outlines the transaction details, including the purchase price and the terms of the sale, to provide a clear framework for the transfer of ownership.

Business Purchase Agreements share similarities with LLC Share Purchase Agreements because they both involve the buying and selling of a business or a portion of a business. The LLC Share Purchase Agreement is more specific, focusing on the sale of membership interests in an LLC, while a Business Purchase Agreement could involve the purchase of a whole business, including its assets, liabilities, and operations. Despite these differences, both agreements are fundamental in ensuring the legality and smooth execution of the transaction.

A Buy-Sell Agreement, often used in business succession planning, has parallels to an LLC Share Purchase Agreement in ensuring the orderly transfer of business ownership. However, a Buy-Sell Agreement is typically established among business owners at the inception of their partnership or sometime during the business's lifecycle, setting the terms under which ownership interest can be sold or must be sold, such as in the event of a member's death, divorce, or desire to exit the business. This preemptive agreement contrasts with an LLC Share Purchase Agreement, which is executed at the time of an actual sale or transfer.

Merger Agreements bear a resemblance to LLC Share Purchase Agreements in that they both pertain to the combining or acquiring of business entities. An LLC Share Purchase Agreement might be used when one entity is purchasing the membership interests of another entity, often as part of a strategic acquisition. On the other hand, a Merger Agreement involves the fusion of two entities into one, where at least one company may cease to exist in its previous form. Despite the structural differences in the transactions, both documents facilitate the expansion or consolidation of business interests.

The Subscription Agreement is somewhat related to the LLC Share Purchase Agreement because it also deals with investment in a company. Specifically, a Subscription Agreement is used when a person or entity agrees to purchase stock from a company, often before it is made available to the public. While this agreement commonly applies to corporations, the fundamental concept of acquiring ownership interests is akin to that of purchasing membership interests in an LLC through a Share Purchase Agreement.

Lastly, a Shareholder Agreement shares similarities with an LLC Share Purchase Agreement as it pertains to the governance of a company's shareholders (or members, in the case of an LLC). Though not a document for transferring ownership like the LLC Share Purchase Agreement, it establishes the rights and obligations of the shareholders, potentially impacting the sale and transfer of shares by dictating conditions under which shares can be sold. Both documents are critical for delineating the framework within which owners and members operate, though they serve different purposes in the context of business operations and transitions.

Dos and Don'ts

Filling out an LLC Share Purchase Agreement is an important step in the process of buying or selling shares within a Limited Liability Company (LLC). This document, crucial for the transaction, ensures that all parties are clear about the terms of the share transfer. Below are lists of things you should and should not do when completing this form.

Things You Should Do:

Review the LLC's operating agreement. Before filling out the Share Purchase Agreement, understanding any provisions the LLC's operating agreement might have regarding the sale or transfer of shares is essential.

Gather all necessary information. Ensure you have all the required details, such as the number of shares being bought or sold, the per-share price, and the identities of the buyer and seller.

Be clear and precise. When describing the terms of the sale, such as payment schedules, responsibilities of both parties, and any representations or warranties, clarity and precision prevent misunderstandings.

Seek legal advice. Consulting with a lawyer can help ensure that the agreement complies with state laws and that your interests are protected.

Include a confidentiality clause. This clause protects sensitive information about the business from being disclosed to unauthorized individuals.

Get the agreement reviewed by all parties involved. Before finalizing, every party involved should review the document to ensure it accurately reflects their understanding.

Things You Shouldn't Do:

Don't rush the process. Taking the time to thoroughly understand and correctly fill out the agreement prevents issues later on.

Don't leave blanks. Ensure all fields in the agreement are filled out to avoid ambiguity that could lead to disputes.

Don't ignore state-specific laws. State laws can vary significantly when it comes to LLCs and share transfers, so it's crucial to be compliant with them.

Don't forget to specify dispute resolution methods. In case of a disagreement or breach of the agreement, having a predetermined method for resolution can save time and legal expenses.

Don't use unclear language. Ambiguous terms can lead to different interpretations, so it's important to use clear, straightforward language.

Don't overlook signatures. An agreement isn't complete without the signatures of all parties involved, making it legally binding.

Misconceptions

When entrepreneurs and business owners decide to buy or sell membership interests in a Limited Liability Company (LLC), they often encounter the LLC Share Purchase Agreement. This legal document is crucial for outlining the terms of the deal, ensuring both parties are protected throughout the process. However, there are several misconceptions about this agreement that can lead to confusion or even legal issues down the road. Let's clear up some of these misunderstandings:

It's Just a Formality: This couldn't be further from the truth. The LLC Share Purchase Agreement is a critical document that outlines every aspect of the purchase, including the price, payment terms, and any representations and warranties. It serves as the roadmap for the transaction and provides legal protection for both parties.

One Size Fits All: Each LLC is unique, and so is each share purchase transaction. Using a generic template without customizing it to the specific deal and the laws of the state where the LLC is organized can overlook critical elements and lead to disputes.

It's Only Necessary for Large Transactions: No matter the size of the transaction, a Share Purchase Agreement is essential. It ensures clarity and protects the interests of both the buyer and the seller, avoiding misunderstandings that could lead to legal disputes regardless of the deal's size.

Legal Representation Isn't Necessary: While the internet offers various legal documents, consulting with a lawyer who has experience in LLC transactions is vital. They can help tailor the agreement to your specific needs and ensure that all legal bases are covered, avoiding potential pitfalls.

It Only Covers the Exchange of Shares: The agreement does more than merely outline the share exchange. It also includes provisions for due diligence, representations and warranties, indemnities, and how disputes will be resolved. These clauses are crucial for a smooth transition and for protecting the parties’ interests.

Verbal Agreements Are Sufficient: While some deals may be discussed verbally, a written LLC Share Purchase Agreement is legally binding and ensures that all terms of the deal are clearly documented and enforceable. Relying on verbal agreements can lead to misunderstandings and legal complications.

The Agreement Is Final: It's not uncommon for negotiations to continue after the initial agreement is drafted. Terms may be revised based on due diligence findings or changes in circumstances. Until both parties sign the document, it's not set in stone.

You Can't Back Out Once It's Signed: Certain provisions can be included that allow a party to legally withdraw from the deal under specific conditions, such as failure to meet due diligence criteria or breach of representations and warranties. Understanding these conditions and having clear termination provisions is crucial.

In conclusion, the LLC Share Purchase Agreement is a complex but necessary document that requires careful attention to detail and an understanding of the legal and financial implications of the transaction. By debunking these misconceptions, buyers and sellers can better protect their interests and facilitate a smoother transaction process.

Key takeaways

When a business transaction involves buying or selling shares in a Limited Liability Company (LLC), a vital piece entails accurately completing an LLC Share Purchase Agreement. This document not only serves as a legal record of the sale but also outlines the terms, conditions, and responsibilities of all parties involved. Below are key takeaways to consider for effectively filling out and utilizing this form:

- Understand the terms: Before anything else, make sure you fully grasp every condition and provision within the agreement. This understanding is crucial in ensuring that your interests are protected.

- Detail the parties involved: Clearly identify all the parties involved in the transaction, including the buyer, seller, and the LLC whose shares are being traded. Accurate identification helps in avoiding future disputes.

- Specify the share details: The agreement must include specific details about the shares being sold, such as the number of shares, type of shares, and the price per share. Precision here is key to a clear understanding of what is being bought and sold.

- Include payment terms: Outline how and when the payment will be made for the shares. Whether it’s a lump sum or an installment plan, these details help prevent misunderstandings about financial obligations.

- Address representations and warranties: Both the buyer and the seller make certain promises related to the sale, like the legality of the shares and the financial status of the LLC. These assurances build trust between the parties.

- Include confidentiality clauses: Protect sensitive information with confidentiality clauses. It ensures that non-public details about the transaction or the LLC remain secure.

- Outline dispute resolution methods: In case disagreements arise from the agreement, having a predefined mechanism for resolving disputes can save both time and money.

- State the governing law: Specifying the state law that will govern the agreement helps in clarifying which legal jurisdiction’s rules should be followed if legal issues occur.

- Signatures are crucial: The agreement becomes legally binding once all parties have signed it. Never underestimate the importance of this step.

- Seek professional advice: Given the legal and financial implications of an LLC Share Purchase Agreement, consulting with a lawyer or a financial advisor ensures that your interests are safeguarded and the document complies with all applicable laws.

Completing an LLC Share Purchase Agreement with accuracy and care not only facilitates a smoother transaction but also significantly reduces the risk of future legal complications. Keep these takeaways in mind to navigate the process with confidence.

Other Templates

Private Car Sale Contract With Monthly Payments - It outlines the terms and conditions under which the borrower agrees to repay the lender for the vehicle.

Single Member Llc Operating Agreement Template - Helps in resolving disputes and making decisions efficiently by referring to the pre-established rules and procedures.

Non Compete Agreement Template Free - Details the legal recourse and potential damages for violating the terms of the agreement, aiming to deter breach of contract.