Official Letter of Intent to Purchase Business Document

When embarking on the critical journey of acquiring a business, one essential step often undertaken is the drafting and delivery of a Letter of Intent to Purchase Business. This preliminary document serves several vital functions in the business acquisition process. It outlines the basic terms of the deal between the buyer and the seller, ensuring both parties are on the same page regarding aspects such as the anticipated purchase price, payment terms, due diligence period, and any conditions precedent to the closing of the transaction. Besides laying the groundwork for negotiations, this letter also acts as a formal indication of the buyer's serious interest in proceeding with the acquisition, allowing for the allocation of resources towards diligent review and negotiation of final agreements. Importantly, while it highlights the buyer's intent to purchase, it typically does not bind either party to proceed with the transaction, thus providing a structured yet flexible framework within which both parties can operate as they move closer to a definitive agreement.

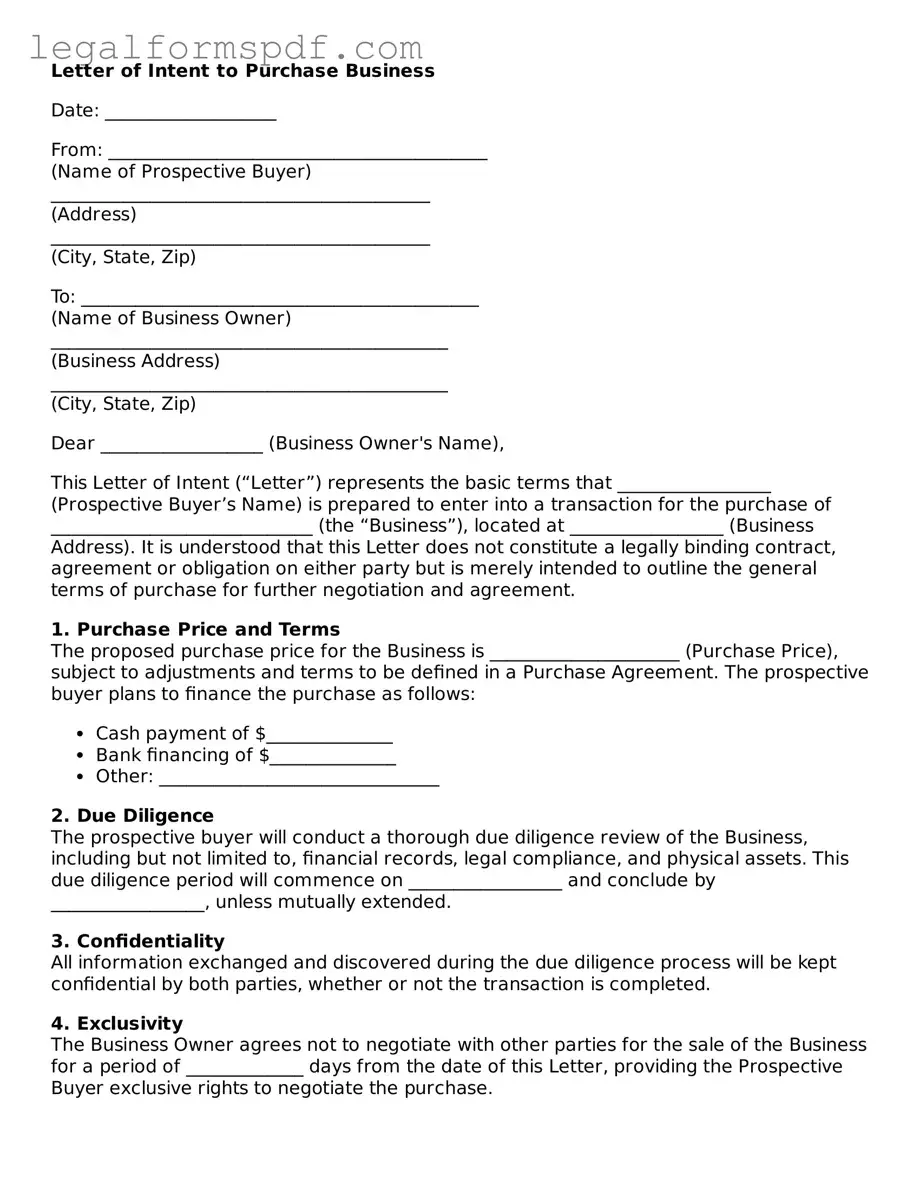

Document Example

Letter of Intent to Purchase Business

Date: ___________________

From: __________________________________________

(Name of Prospective Buyer)

__________________________________________

(Address)

__________________________________________

(City, State, Zip)

To: ____________________________________________

(Name of Business Owner)

____________________________________________

(Business Address)

____________________________________________

(City, State, Zip)

Dear __________________ (Business Owner's Name),

This Letter of Intent (“Letter”) represents the basic terms that _________________ (Prospective Buyer’s Name) is prepared to enter into a transaction for the purchase of _____________________________ (the “Business”), located at _________________ (Business Address). It is understood that this Letter does not constitute a legally binding contract, agreement or obligation on either party but is merely intended to outline the general terms of purchase for further negotiation and agreement.

1. Purchase Price and Terms

The proposed purchase price for the Business is _____________________ (Purchase Price), subject to adjustments and terms to be defined in a Purchase Agreement. The prospective buyer plans to finance the purchase as follows:

- Cash payment of $______________

- Bank financing of $______________

- Other: _______________________________

2. Due Diligence

The prospective buyer will conduct a thorough due diligence review of the Business, including but not limited to, financial records, legal compliance, and physical assets. This due diligence period will commence on _________________ and conclude by _________________, unless mutually extended.

3. Confidentiality

All information exchanged and discovered during the due diligence process will be kept confidential by both parties, whether or not the transaction is completed.

4. Exclusivity

The Business Owner agrees not to negotiate with other parties for the sale of the Business for a period of _____________ days from the date of this Letter, providing the Prospective Buyer exclusive rights to negotiate the purchase.

5. Governing Law

This Letter of Intent shall be governed by the laws of the State in which the Business is located, specifically _________________ Law.

We acknowledge that this Letter is not a legally binding contract for sale but is an expression of intent to negotiate terms of sale in good faith. The parties agree to negotiate the definitive Purchase Agreement in accordance with the terms outlined in this Letter. This Letter constitutes the entire understanding between the parties and supersedes all prior discussions and agreements.

Sincerely,

_________________________________

(Signature of Prospective Buyer)

_________________________________

(Printed Name of Prospective Buyer)

Date: ___________________

PDF Specifications

| Fact Number | Description |

|---|---|

| 1 | It signifies the buyer's intention to enter into negotiations to purchase a business. |

| 2 | Typically non-binding, except for provisions like confidentiality and exclusivity. |

| 3 | Includes key terms of the deal such as purchase price, payment terms, and closing date. |

| 4 | May include conditions precedent, such as obtaining financing or satisfactory due diligence results. |

| 5 | Serves as a basis for drafting the definitive purchase agreement. |

| 6 | Governing laws will vary by state; it is vital to understand local regulations affecting the transaction. |

| 7 | It is a crucial document in the M&A process, setting the stage for formal negotiations. |

Instructions on Writing Letter of Intent to Purchase Business

Completing a Letter of Intent to Purchase Business is a significant first step in the process of buying a business. This document serves as a formal proposal to express your interest and outline the preliminary terms of the purchase. It's crucial to fill out this form carefully and accurately to ensure all parties have a clear understanding of the intentions and terms from the outset. This guide will help you step by step through the process, focusing on ensuring that the form accurately reflects your intentions and outlines the initial framework for the purchase agreement that will follow. After this letter is submitted and accepted by the other party, the detailed negotiations and due diligence phase will begin, eventually leading to the final purchase agreement.

Here are the steps you need to follow to fill out the Letter of Intent to Purchase Business form:

- Begin with the date at the top of the document. This marks when the letter is being submitted, which can be important for various deadlines and negotiation timelines.

- Address the letter to the current owner or representative of the business. Ensure that you have the correct name and address for formal correspondence.

- Introduce yourself and your intention by stating your desire to purchase the business. Be clear and concise in your opening statements.

- Detail the proposed purchase price and the structure of the transaction (whether it will be an asset purchase, a stock purchase, etc.). This section should be as specific as possible.

- Outline the terms of payment you are proposing. This includes down payment details, whether there will be seller financing, and the timing of payments.

- Describe any contingencies that must be fulfilled before the purchase is finalized. Common contingencies include successful due diligence, obtaining financing, and any regulatory approvals that might be necessary.

- Mention the targeted closing date for the purchase. While this date may change during negotiations, setting an initial target is helpful for planning purposes.

- Include a clause about confidentiality, stating that the details of the letter and subsequent negotiations should not be disclosed to third parties without mutual consent.

- State the expiration date of the letter of intent. This creates a timeframe for the initial negotiations to take place and indicates your desire to move forward promptly.

- End with a section for your signature and printed name, evidencing your commitment to the proposed terms at this stage of the purchase process.

After you have completed and submitted the Letter of Intent to Purchase Business, the ball is in the court of the business owner or their representative. They will review your proposal, and if they find it acceptable, they will signify their agreement by signing the document or engaging in further negotiations to fine-tune the terms. This is a critical phase where both parties will closely examine the terms and work towards an agreement that satisfies everyone. Remember, the Letter of Intent is not binding in terms of finalizing the sale, but it does signify a serious intention to proceed under the proposed terms. Therefore, careful preparation and clear communication are key to a successful transition to the next stages of purchasing a business.

Understanding Letter of Intent to Purchase Business

What is a Letter of Intent to Purchase Business?

A Letter of Intent to Purchase Business is a document used by a prospective buyer to express their intention to buy a particular business. This letter outlines the basic terms of the purchase agreement, including price, terms of payment, and any conditions that must be met before the final purchase. Though not legally binding in terms of the sale itself, it sets the stage for formal negotiations and due diligence before finalizing the transaction.

When should I use a Letter of Intent to Purchase Business?

This letter should be used when you have identified a business that you are seriously interested in buying and wish to enter into formal discussions with the seller. It is a preliminary step that allows both parties to agree on the main terms before investing time and resources into the due diligence and legal processes required to complete the sale.

Is a Letter of Intent legally binding?

Generally, a Letter of Intent itself is not legally binding in terms of obligating either party to complete the sale. However, certain provisions within it, such as confidentiality agreements and exclusivity arrangements, can be binding. It's important to clearly specify which parts of the letter are intended to be binding.

What key elements should be included in a Letter of Intent to Purchase Business?

Key elements include the proposed purchase price, payment terms, due diligence requirements, any conditions precedent to completing the transaction, confidentiality clauses, and an exclusivity period during which the seller cannot entertain offers from other prospective buyers. Additionally, the letter should outline the expected timeline for negotiation, due diligence, and closing the transaction.

How does a Letter of Intent differ from a Purchase Agreement?

A Letter of Intent is a preliminary document that outlines the basic terms and intentions of both parties to engage in a transaction. It is not a definitive agreement but rather a roadmap to negotiation. A Purchase Agreement, on the other hand, is a detailed and legally binding contract that finalizes the terms of the sale, including all obligations, representations, warranties, and conditions of the sale.

Can I back out of a Letter of Intent to Purchase Business?

Since a Letter of Intent is generally not legally binding regarding the sale's completion, parties can typically back out without legal consequences. However, if the letter contains binding provisions, such as confidentiality agreements, those aspects must still be honored. It's crucial to understand what you're agreeing to before signing a Letter of Intent.

What happens after a Letter of Intent is signed?

After signing, the buyer typically begins the due diligence process to verify the business's financials, operations, legal standing, and other critical aspects. Both parties might also start negotiating the final Purchase Agreement based on the terms outlined in the Letter of Intent. This phase continues until either a Purchase Agreement is signed, or either party decides not to proceed with the transaction.

Do I need a lawyer to draft or review a Letter of Intent to Purchase Business?

While not strictly necessary, it's highly advisable to have a lawyer experienced in business transactions review or draft your Letter of Intent. This step ensures that the letter accurately reflects your intentions, protects your interests with proper legal language, and includes necessary binding provisions like confidentiality clauses.

Are there any risks associated with using a Letter of Intent to Purchase Business?

Yes, there are potential risks. For example, if not properly drafted, the Letter of Intent could unintentionally bind you to certain terms or conditions, limiting your ability to negotiate or back out of the transaction. Additionally, the exclusivity period could prevent you from exploring other potentially better opportunities. Thus, it's crucial to approach the Letter of Intent process with clear intentions and, ideally, legal counsel.

Common mistakes

When embarking on the journey of purchasing a business, individuals often encounter the Letter of Intent to Purchase Business form - a critical step in the negotiation process. Unfortunately, mistakes in this process can set the tone for future challenges. One common mistake is failing to clearly define the terms of the purchase. This involves omitting essential details such as the purchase price, payment method, and any contingencies that could affect the transaction. Without these specifics, misunderstandings can arise, potentially derailing the agreement.

Another error lies in neglecting to specify the assets and liabilities included in the sale. Prospective buyers sometimes assume that all assets and liabilities are automatically transferred with the business, but this is not always the case. It's vital to explicitly list what is being acquired to avoid disputes and ensure a smooth transition of ownership.

Confidentiality is a cornerstone of business transactions, yet individuals often forget to include a confidentiality clause in the Letter of Intent. This oversight can lead to sensitive information leaking, which might compromise the transaction or damage the business's reputation. A confidentiality clause helps protect both parties' interests and maintains the integrity of the negotiation process.

Likewise, not setting a clear timeline for the transaction is a mistake that can lead to prolonged negotiations and lost opportunities. Stakeholders should agree on a reasonable timetable for due diligence, financing, and closing the deal to keep the process moving forward efficiently.

Some individuals mistakenly treat the Letter of Intent as a binding agreement, not realizing it's typically non-binding. This confusion can lead to premature commitments or a misunderstanding of the negotiation's flexibility. It's essential to understand which parts, if any, are legally binding, like confidentiality agreements or exclusivity periods.

Failing to consult with legal and financial advisors when drafting the Letter of Intent is another common pitfall. Professionals can offer invaluable insights and ensure that the document protects your interests and complies with relevant laws. This guidance is crucial for navigating the complexities of business transactions successfully.

Individuals sometimes omit dispute resolution mechanisms from the Letter of Intent. Including terms for mediation or arbitration can save time and money by providing a framework to resolve potential disagreements without resorting to litigation.

Overlooking the requirement for a due diligence period is also a significant mistake. Due diligence allows the buyer to thoroughly evaluate the business's operations, finances, and legal standings. Neglecting to allocate time for this process can lead to unwelcome surprises after the transaction has been completed.

Another error involves not being prepared for exclusivity demands. Sellers may require that buyers refrain from negotiating the purchase of other businesses for a certain period. Understanding and negotiating these terms can prevent being locked into an unfavourable position.

Last but not least, failing to plan for the aftermath of the transaction can lead to operational disruptions. It's important for the Letter of Intent to include, or at least consider, the integration process and how the transition of ownership will be managed to ensure the business continues to run smoothly.

Avoiding these mistakes when filling out the Letter of Intent to Purchase Business form can pave the way for a more successful transaction. Attention to detail, thorough planning, and professional advice are key components of this crucial first step in acquiring a business.

Documents used along the form

Entering into the world of business acquisitions can be both exhilarating and daunting. A Letter of Intent to Purchase Business is just the starting point, laying out the preliminary agreements between a buyer and a seller. However, it's important to understand that this document is typically accompanied by other critical forms and documents. These additional documents help to further define the terms, provide detailed evaluations, and ensure that the legal aspects of the transaction are thoroughly covered. Let’s look at four such forms and documents that are often used in conjunction with a Letter of Intent to Purchase Business.

- Confidentiality Agreement: This document is crucial for protecting sensitive information. When a potential buyer starts looking into a business, they are given access to confidential and proprietary information. A Confidentiality Agreement ensures that this information is not disclosed to others, safeguarding the business’s trade secrets and other confidential data.

- Due Diligence Checklist: Due diligence is the comprehensive appraisal of a business by a prospective buyer, especially to establish its assets and liabilities and evaluate its commercial potential. A Due Diligence Checklist helps the buyer to systematically review all the significant aspects of the business, from financial records to legal obligations, ensuring a thorough evaluation before proceeding with the purchase.

- Asset Purchase Agreement: Moving from intent to actual purchase requires a detailed contract, and an Asset Purchase Agreement serves this purpose. It lists all the assets being bought, including but not limited to tangible assets like inventory and equipment, and intangible assets like customer lists and intellectual property. This agreement details the terms and conditions of the sale, warranties, and indemnifications.

- Non-Compete Agreement: Often, sellers are asked to sign a Non-Compete Agreement to prevent them from starting a new, competing business within a certain geographic area for a specified period. This helps protect the buyer’s investment in the newly acquired business by reducing direct competition.

The journey from expressing an initial interest with a Letter of Intent to Purchase Business to finally sealing the deal involves numerous steps and requires multiple documents. Each document plays a specific role in ensuring that both parties’ interests are protected and that the transaction proceeds as smoothly as possible. By understanding and properly utilizing these documents, buyers and sellers can navigate the complex process of business acquisitions with greater ease and confidence.

Similar forms

The Letter of Intent to Purchase Business is closely related to a Memorandum of Understanding (MOU). Both documents serve as preliminary agreements before a final deal is struck, outlining the basic terms and understanding between parties. An MOU, like the Letter of Intent, is often non-binding and used to signal the intention of both parties to move forward in good faith. It lays the groundwork for further negotiation and formal agreement, providing a clear framework within which parties aim to finalize their deal.

Similarly, the Terms Sheet (or Term Sheet) shares a number of characteristics with the Letter of Intent. This document outlines the terms and conditions under which an investment will be made. It acts as a blueprint for later legal documentation, covering key financial and legal points of the deal. While a Term Sheet is common in venture capital and private equity deals, its function to summarize the main points of a business agreement mirrors the role of a Letter of Intent in business acquisition processes.

A Purchase Agreement stands as another closely related document, though it is typically more binding and detailed than a Letter of Intent to Purchase Business. It includes comprehensive terms of the sale, including payment details, warranties, and representations. While the Letter of Intent signifies the parties' initial agreement and intention to proceed, a Purchase Agreement finalizes the transaction, outlining the specific obligations and rights of each party.

The Confidentiality Agreement, or Non-disclosure Agreement (NDA), often accompanies or precedes a Letter of Intent in business transactions. This legal document ensures that any confidential information exchanged during negotiations remains secure. An NDA safeguards the interests of both parties, allowing them to discuss the intricacies of the deal openly, which is crucial for the due diligence process following a Letter of Intent.

Due Diligence Checklist documents are integral to the process initiated by a Letter of Intent to Purchase Business. This checklist outlines all the necessary information and documents needed for a comprehensive evaluation of the business in question. It ensures that the buyer performs a thorough investigation into the business’s legal, financial, and operational standing, informed by the initial agreement to pursue a transaction outlined in the Letter of Intent.

The Partnership Agreement shares common ground with the Letter of Intent to Purchase Business when the purchase involves entering into a partnership. This document formalizes the agreement between partners, detailing the responsibilities, profit-sharing, and decision-making processes. While a Letter of Intent marks the beginning of negotiations towards such an agreement, the Partnership Agreement cements the terms of the partnership itself.

An Employment Agreement may also follow a Letter of Intent, particularly in scenarios where key employees of the business being acquired are offered new contracts. This document outlines the terms of employment, including duties, compensation, and confidentiality requirements. It becomes relevant after the Letter of Intent when the acquisition strategy involves retaining critical staff under new terms.

The Share Purchase Agreement (SPA) is akin to a Letter of Intent where the acquisition involves buying shares in a company rather than the company itself. This legally binding document details the share sale, including the number of shares to be sold, price, and conditions of the sale. The Letter of Intent often precedes an SPA, outlining the initial terms and intention to purchase shares, which is then followed by the SPA to finalize the transaction.

A Franchise Agreement is relevant in situations where a Letter of Intent to Purchase Business involves a franchised business. This agreement details the franchisor's terms, allowing the franchisee to operate under the brand. It addresses aspects such as royalties, marketing obligations, and territory rights. A Letter of Intent might precede such arrangements, indicating a party’s interest in acquiring a franchise before moving on to the detailed terms within a Franchise Agreement.

Finally, an Asset Purchase Agreement shares similarities with the Letter of Intent, specifically when the transaction involves buying assets rather than the entire business. This document details the specific assets being purchased, such as equipment, inventory, and intellectual property, and the terms of their transfer. It follows the Letter of Intent, which initially outlines the buyer's intention to acquire certain assets from the business.

Dos and Don'ts

When filling out the Letter of Intent to Purchase Business form, there are several do's and don'ts to keep in mind to ensure the process is smooth and legally sound. Below are ten key points to consider:

Do:- Review the form thoroughly before filling it out to understand each section and what information is required.

- Be clear and concise in your language to avoid any misunderstandings or ambiguities.

- Include all relevant details about the purchase, such as the purchase price, payment terms, and any conditions or contingencies.

- Use formal language and a professional tone throughout the letter to reflect the seriousness of your intent.

- Proofread the completed form carefully for any spelling or grammatical errors, and to ensure all information is accurate and complete.

- Rush through the process without paying attention to the specifics of the agreement or the accuracy of the information provided.

- Leave any sections blank unless they are explicitly stated as optional. Incomplete information could lead to misunderstandings or legal complications.

- Make assumptions about any terms or conditions. If something is unclear, seek clarification before proceeding.

- Use vague language that could be open to interpretation. Be specific about dates, numbers, and other crucial details.

- Sign the letter without legal review, especially if the transaction involves significant amounts of money or complex terms. It's always wise to have a legal expert look over any contractual documents before finalizing them.

Misconceptions

When exploring the acquisition of a business, many individuals encounter misconceptions regarding the Letter of Intent to Purchase Business. Understanding these common misunderstandings can prevent potential mistakes and ensure a smoother transaction process. Here are nine misconceptions:

It's Legally Binding: People often believe that this letter is a legally binding agreement to purchase. In reality, it primarily serves as an expression of intent, not an enforceable contract.

All Terms are Final: Another misconception is that the terms outlined in the letter are final. However, these terms are subject to change as due diligence is performed and negotiations continue.

No Need for a Lawyer: Many assume that drafting this letter doesn’t require legal assistance. It's advisable to consult with a lawyer to ensure your interests are protected and to navigate any legal complexities.

It's Merely a Formality: Some consider the letter to be just a formality without much practical importance. On the contrary, it sets the framework for the transaction and can significantly influence negotiations.

Details Don't Matter as Much: There's a belief that details can be ironed out later, making precision in the letter less critical. Detailed terms in the letter can prevent misunderstands and guide the subsequent transaction process more smoothly.

Diligence Period is Fixed: The assumption that the diligence period specified in the letter is set in stone is incorrect. This period can be extended if both parties agree, based on findings or negotiations.

Exclusive Negotiation Rights are Assumed: Many believe that once the letter is signed, the seller cannot negotiate with other potential buyers. Unless explicitly stated, sellers may continue discussions with others.

Only Large Businesses Need It: There's a notion that only large businesses or transactions need a letter of intent. Businesses of any size can benefit from the clarity and direction it provides in the purchase process.

Template Use is Adequate: Finally, the idea that a generic template is sufficient can lead to problems. Tailoring the letter to the specific transaction's needs is crucial for clear communication and protecting both parties' interests.

Dispelling these misconceptions helps all parties involved understand the significance and correct usage of a Letter of Intent to Purchase Business. It’s a critical step in conducting business transactions that requires careful consideration and, often, legal guidance.

Key takeaways

When considering the acquisition of a business, the Letter of Intent to Purchase Business form serves as a foundational document to formally express your interest and outline the preliminary terms of the deal. Below are key takeaways to ensure the document is filled out correctly and serves its intended purpose effectively:

- Clarification of Intent: The Letter of Intent (LOI) should clearly state that it is not a binding agreement to purchase but a statement of intent to negotiate in good faith. It's important to outline this to avoid any legal misunderstandings.

- Detail Specific Terms: It should include key terms of the deal such as the proposed purchase price, the structure of the transaction (e.g., assets or shares), and any other critical elements like payment terms, non-compete clauses, and conditions precedent to closing.

- Confidentiality Clause: Both parties often share sensitive information during negotiations. A confidentiality clause protects this information from being disclosed to third parties.

- Exclusivity Agreement: This clause can prevent the seller from shopping the business around to other prospective buyers for a specified period. It allows the potential buyer time to conduct due diligence without competition.

- Due Diligence Process: The LOI should outline the scope and timeline of the due diligence process, giving the buyer a clear path to assess the business’s financial health, legal standing, and operational efficiency.

- Termination Provision: Including conditions under which either party can walk away from the negotiations without penalty is crucial. This could be tied to findings during due diligence or failure to agree on final terms.

- Advisory Involvement: It's advisable to involve legal and financial advisors in drafting the LOI to ensure that it accurately reflects the terms discussed and protects the rights and interests of the party drafting the letter.

Properly executing a Letter of Intent to Purchase Business is a critical step in the acquisition process. It sets the tone for negotiations and lays the groundwork for a successful transaction. By being detailed, clear, and structured in your approach, you can navigate this phase with confidence, knowing that both parties have a mutual understanding of the deal's proposed terms and conditions.

Consider More Types of Letter of Intent to Purchase Business Forms

Intent to Lease Form - This document sets the stage for lease negotiations by detailing a prospective tenant’s desired terms for occupying a property.

Intention to Marry Within 90 Days of Entry - A formal declaration used by betrothed couples to signal their intention to marry, particularly in the context of immigration.