Official Letter of Intent to Lease Commercial Property Document

Navigating the commercial real estate landscape requires a blend of sharp insight and steadfast preparation, especially when entrepreneurs set their sights on securing the perfect location for their ventures. Enter the Letter of Intent to Lease Commercial Property, a pivotal document that bridges initial negotiations and the drafting of a formal lease agreement. This precursor to a binding contract serves as a clear expression of interest from a potential lessee, outlining the conditions under which they would agree to lease a property from the lessor. The form encapsulates essential details such as the duration of the lease, proposed rent, and any specific terms or improvements requested by either party. By setting the stage for more detailed negotiations, it safeguards the interests of both lessees and lessors, ensuring clarity and a mutual understanding of the lease's potential framework. Engaging with this document attentively can significantly influence the trajectory of a business, positioning entrepreneurs to negotiate terms that align with their goals while providing landlords with a reliable indicator of serious intent.

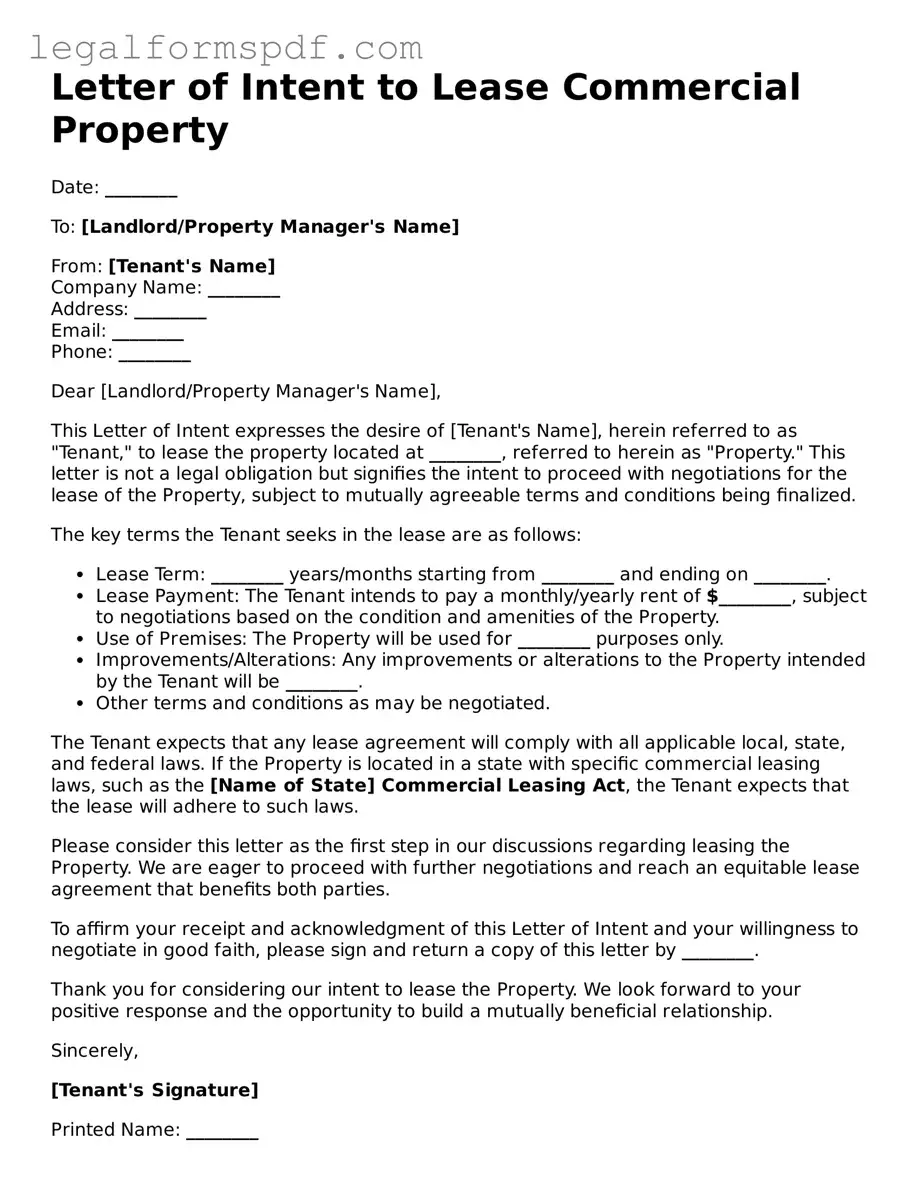

Document Example

Letter of Intent to Lease Commercial Property

Date: ________

To: [Landlord/Property Manager's Name]

From: [Tenant's Name]

Company Name: ________

Address: ________

Email: ________

Phone: ________

Dear [Landlord/Property Manager's Name],

This Letter of Intent expresses the desire of [Tenant's Name], herein referred to as "Tenant," to lease the property located at ________, referred to herein as "Property." This letter is not a legal obligation but signifies the intent to proceed with negotiations for the lease of the Property, subject to mutually agreeable terms and conditions being finalized.

The key terms the Tenant seeks in the lease are as follows:

- Lease Term: ________ years/months starting from ________ and ending on ________.

- Lease Payment: The Tenant intends to pay a monthly/yearly rent of $________, subject to negotiations based on the condition and amenities of the Property.

- Use of Premises: The Property will be used for ________ purposes only.

- Improvements/Alterations: Any improvements or alterations to the Property intended by the Tenant will be ________.

- Other terms and conditions as may be negotiated.

The Tenant expects that any lease agreement will comply with all applicable local, state, and federal laws. If the Property is located in a state with specific commercial leasing laws, such as the [Name of State] Commercial Leasing Act, the Tenant expects that the lease will adhere to such laws.

Please consider this letter as the first step in our discussions regarding leasing the Property. We are eager to proceed with further negotiations and reach an equitable lease agreement that benefits both parties.

To affirm your receipt and acknowledgment of this Letter of Intent and your willingness to negotiate in good faith, please sign and return a copy of this letter by ________.

Thank you for considering our intent to lease the Property. We look forward to your positive response and the opportunity to build a mutually beneficial relationship.

Sincerely,

[Tenant's Signature]

Printed Name: ________

Date: ________

Accepted by Landlord/Property Manager:

Signature: ________

Printed Name: ________

Date: ________

PDF Specifications

| Fact | Description |

|---|---|

| Purpose | The Letter of Intent to Lease Commercial Property is used by potential tenants to express their interest in leasing a commercial space, outlining the basic terms they wish to have in the official lease agreement. |

| Non-Binding Nature | Typically, this letter is non-binding, meaning it does not legally compel either party to finalize the lease agreement based on the terms discussed within the letter. |

| Negotiation Tool | This letter serves as a preliminary negotiation tool, allowing both tenant and landlord to agree on major terms before drafting the official lease document, saving both time and resources. |

| Governing Law | While the letter itself is generally non-binding, it should still be written with consideration to the leasing laws and regulations of the state where the property is located, as these laws will govern the subsequent official lease agreement. |

Instructions on Writing Letter of Intent to Lease Commercial Property

Filling out a Letter of Intent to Lease Commercial Property is a crucial step for anyone looking to lease space for their business. This document serves as a preliminary agreement between a potential tenant and the landlord, outlining the main terms that would later be detailed in the lease agreement. Understanding and accurately completing this form is essential to ensure both parties have a clear understanding of the intended lease terms before proceeding to the more binding lease agreement. Here is a straightforward guide to help you fill out this form accurately:

- Start by entering the date at the top of the form.

- Write the full names and addresses of both the potential tenant and the landlord in the spaces provided.

- Describe the property in detail, including its address and a brief description of the space to be leased.

- Specify the intended use of the leased property. Make sure this use complies with local zoning laws.

- List the terms of the lease, including the proposed start date, the length of the term, and any options for renewal.

- Indicate the proposed rent amount, including any provisions for rent increases, and state whether the rent includes utilities, property taxes, insurance, and maintenance costs.

- Detail any improvements or modifications to be made to the property by either the tenant or the landlord before or during the lease term.

- Outline the responsibilities for repairs and maintenance of the property.

- Discuss options for subleasing or assigning the lease and include any conditions or restrictions.

- Specify the security deposit and conditions for its return.

- Mention any contingencies that must be met before the lease is finalized, such as approval from a board or obtaining financing.

- Include a clause about the confidentiality of the negotiations and any details disclosed during discussions.

- Provide a space for both parties to sign and date the document, indicating their intent to enter into a lease based on the terms outlined.

After filling out the Letter of Intent, the next step involves a careful review by both parties and possibly their legal representatives. Any clarifications or adjustments needed should be addressed at this stage. Once mutually agreed upon, the Letter serves as a foundational document to draft the official lease agreement. It's important to remember that this Letter of Intent is not a binding contract to lease the property but rather a meaningful step towards finalizing the lease agreement. Thus, proceeding with integrity and due diligence during this phase lays a strong foundation for a successful landlord-tenant relationship.

Understanding Letter of Intent to Lease Commercial Property

What is a Letter of Intent to Lease Commercial Property?

A Letter of Intent to Lease Commercial Property is a document that outlines the preliminary agreements between a potential tenant and a landlord regarding the lease of commercial space. This letter typically includes key terms of the lease such as the rental amount, lease duration, and any specific conditions both parties want to negotiate prior to signing a formal lease agreement.

Is a Letter of Intent to Lease Commercial Property legally binding?

Generally, a Letter of Intent itself is not a legally binding document. It serves as a foundation for negotiations and can express a mutual commitment to proceed, but it usually specifically states that a binding agreement will only be made through a formal lease document. However, certain provisions within the letter, such as confidentiality clauses, can be binding.

What are the benefits of using a Letter of Intent to Lease Commercial Property?

This letter can streamline the leasing process by identifying and agreeing upon key terms early on, mitigating the risk of misunderstandings later. It helps both the landlord and the potential tenant to ensure their needs and expectations are clearly communicated and understood before investing time and resources into drafting a formal lease agreement.

What key information should be included in a Letter of Intent to Lease Commercial Property?

Essential information includes the names and contact information of both the potential tenant and the landlord, the address of the commercial property, the proposed lease term and start date, the rental amount and frequency of payments, any specific fit-out or modifications to be made to the property, and any conditions precedent to the execution of a formal lease.

Can either party withdraw from a Letter of Intent to Lease Commercial Property?

Yes, since the letter is generally not legally binding regarding the lease itself, either party can typically withdraw from the discussions without legal consequences. However, if the letter contains any binding provisions, those must still be honored, such as confidentiality agreements.

How does a Letter of Intent to Lease Commercial Property affect the negotiation process?

It lays a constructive groundwork for negotiations by clearly presenting the terms each party expects. This can lead to efficient discussions and can help avoid miscommunication by having a written record of what has been tentatively agreed upon. It shows a commitment to the deal, encouraging both parties to engage in good faith negotiations.

Should a lawyer review the Letter of Intent to Lease Commercial Property?

Having a lawyer review the letter before it is sent or signed is highly advisable. A lawyer can ensure that the letter accurately represents your interests and can advise on any potentially binding aspects of the letter to avoid unintended legal obligations. Additionally, a lawyer can help ensure that the letter aligns with local laws and regulations.

Common mistakes

One common mistake people make when filling out the Letter of Intent to Lease Commercial Property form is neglecting to review the document thoroughly before submission. This oversight can lead to inaccuracies or omissions that might weaken their position during negotiations. It's crucial to double-check all entries for correctness and completeness.

Another error involves not specifying the desired lease term and renewal options clearly. Tenants often underestimate the importance of outlining their lease duration preferences and the conditions under which they wish to renew. This vagueness can lead to misunderstandings and conflict later on.

Often, individuals fail to negotiate maintenance and repair responsibilities. Not delineating these responsibilities within the Letter of Intent can result in unexpected expenses and disputes. It's important to define who is responsible for what maintenance and repair work upfront.

A significant mistake is not clarifying the use of the property. Tenants should specify the intended use to ensure it aligns with zoning laws and the landlord's expectations. Failure to do so can lead to legal issues and potential eviction.

Many people overlook the importance of specifying improvement and modification terms. Without clear agreement on alterations to the property, tenants may find themselves unable to customize the space to their needs or facing hefty restoration fees upon lease termination.

Failure to inquire about and negotiate exclusivity clauses is another oversight. This clause prevents the landlord from leasing nearby premises to direct competitors. Without an exclusivity clause, businesses might find competing firms opening next door, significantly affecting their operations.

Not addressing subleasing and assignment rights within the Letter of Intent is a common error. These terms determine if and how a tenant can transfer their lease. Without clear rights, tenants may be stuck in an unsuitable space without the possibility of subletting or transferring the lease.

Ignoring the negotiation of signage rights can be a misstep. For many businesses, visibility is key to attracting customers. Failing to secure the right to install signage can severely limit a business's exposure and growth potential.

Last but not least, insufficient attention to the exit and termination clauses is a critical mistake. Tenants should understand under what conditions the lease can be terminated and what penalties, if any, apply. This foresight can save significant financial and legal headaches in the future.

Documents used along the form

When dealing with the lease of commercial property, a Letter of Intent is just the beginning. Various other forms and documents are typically used in conjunction to ensure clarity, legality, and the mutual agreement of all parties involved. These documents range from financial disclosures to detailed plans for the use of the property.

- Commercial Lease Agreement: This is the formal contract between the landlord and the tenant. It outlines the terms and conditions of the lease, including rent, duration, and the responsibilities of both parties, following the Letter of Intent.

- Personal Guarantee: Often used if the tenant is a small business or a startup, this document requires an individual (like the business owner) to guarantee the lease payments personally.

- Rent Roll: A document provided by the landlord, listing current tenants, lease start and end dates, and the rent amount. It offers insight into the property's existing rental situation.

- Property Inspection Report: This report documents the condition of the commercial property before the tenant moves in. It is crucial for noting any existing damages or issues to ensure that the tenant is not held responsible for them later.

- Estoppel Certificate: Requested from current tenants, this document confirms the terms of their leases and reveals any disputes or unusual agreements. It is especially useful in multi-tenant commercial properties.

- Build-Out Agreement: If the tenant plans to modify or improve the property, this agreement outlines what changes are permitted, who will pay for the improvements, and how they should be done.

Each of these documents serves a specific purpose in the process of leasing commercial property, providing protections and ensuring the expectations of both landlords and tenants are clearly defined and agreed upon. Together with the Letter of Intent, they create a comprehensive framework that supports a successful leasing arrangement.

Similar forms

The Letter of Intent to Lease Commercial Property is similar to a Residential Lease Agreement, which outlines the terms and conditions under which a residential property is leased. Both documents serve as preliminary agreements before a more detailed contract is drafted, establishing the fundamental terms like rent, duration, and the responsibilities of each party. However, the former focuses on commercial properties and might include terms related to commercial activities that are not present in residential agreements.

Comparable to a Commercial Lease Agreement, this document lays the groundwork for leasing terms specific to business properties. While a Letter of Intent is more of a proposal indicating a party's interest in entering a lease and setting the stage for negotiations, a Commercial Lease Agreement is a binding contract that specifies the detailed terms and conditions under which a tenant can use the commercial space. Both are crucial in the leasing process of commercial properties, albeit at different stages.

Similar in nature to a Real Estate Purchase Agreement, which details the terms of a property sale, the Letter of Intent for leasing shares the initial intention to enter into a formal agreement. Both documents are preliminary steps in their respective transactions, providing a framework that outlines key terms such as price for purchases, or lease term and rent for leases, yet neither constitutes a final, binding contract upon their execution.

A Memorandum of Understanding (MOU) also resembles the Letter of Intent to Lease Commercial Property. An MOU outlines the preliminary understanding between parties intending to work together on a project or within a partnership. While it is broader in scope and not limited to real estate, like the Letter of Intent, it serves as a non-binding agreement that precedes a more formal contract, documenting the parties' intentions and key terms agreed upon in principle.

The Letter of Intent to Lease Commercial Property shares similarities with a Commercial Sublease Agreement in that both involve the leasing of commercial property. However, a Sublease Agreement is used when an original tenant wants to rent out their leased premises to a new tenant. Both documents outline terms such as rent and lease duration, but the Letter of Intent precedes a primary lease agreement, while a Sublease Agreement operates under the terms of an existing lease.

A Property Management Agreement, while fundamentally different, shares the premise of detailing terms related to the use of property. This agreement is between a property owner and a management company or individual, specifying duties such as maintenance, tenant screening, and rent collection. The Letter of Intent to Lease, in contrast, sets the stage for an agreement between the property owner and potential tenant but similarly indicates an intention to enter a formal arrangement regarding the property's use.

Similar to an Option to Lease Agreement, which grants one party the exclusive right to lease property within a specified period, a Letter of Intent signifies the preliminary steps toward securing a lease. Both documents highlight the parties' initial agreement on key leasing terms before committing to a binding contract. However, the Option to Lease Agreement typically requires an upfront payment for the exclusive right, distinguishing it from the primarily non-financial Letter of Intent.

The Letter of Intent to Lease Commercial Property is akin to a Business Plan Proposal in that both are preparatory documents outlining proposed terms or actions. While a Business Plan Proposal lays out a company's strategy and objectives for achieving success, a Letter of Intent outlines the intentions of leasing a commercial space beneficial to the business's operation. Both serve as initial steps towards a larger goal, be it securing investment or leasing premises.

A Partnership Agreement, though primarily focused on the relationship between business partners and their obligations to each other, similarly precedes more significant commitments. Like the Letter of Intent, a Partnership Agreement might detail the preliminary understanding regarding the use of commercial property as part of the partners' business operations. Despite their different focuses, both documents are crucial for laying the groundwork for future operations and agreements.

Lastly, the Letter of Intent to Lease Commercial Property parallels a Tenant Improvement Allowance Letter, which is often part of lease negotiations, detailing funds provided by the landlord for improvements. Both documents are key in the early stages of a lease agreement, setting expectations and terms. However, the Tenant Improvement Allowance Letter specifically addresses the financial aspect of property modifications, while the Letter of Intent broadly covers intentions to lease and general terms.

Dos and Don'ts

When filling out the Letter of Intent to Lease Commercial Property form, it's important to approach the task with care and precision. This document serves as a crucial step in securing a commercial lease, outlining the terms and conditions that both the lessee and lessor will agree to follow. Below are some essential do's and don'ts to keep in mind:

- Do:

- Review the form thoroughly before starting. Ensure you understand each section to provide accurate and complete responses.

- Check for specific property requirements or clauses that could affect your business operations and negotiate accordingly.

- Include detailed information about the property, including address, square footage, and intended use, to avoid any confusion.

- Specify the lease terms, such as the length of the lease, renewal options, and any provisions for termination.

- Outline the financial aspects clearly, including rent, deposits, and any additional fees or charges.

- Consider enlisting the help of a real estate attorney or broker to review the document before submission, ensuring all terms are fair and legally sound.

- Don't:

- Leave any sections incomplete. An incomplete form could delay the leasing process or weaken your negotiating position.

- Assume that standard terms will apply. Always specify the details relevant to your agreement to avoid misinterpretations.

- Rush the process. Taking the time to negotiate and clarify terms can save you from potential problems down the line.

Remember, the Letter of Intent is not just a formality but a fundamental part of establishing a successful lease agreement. By following these guidelines, you can help ensure the process goes smoothly and fosters a positive relationship between you and the lessor.

Misconceptions

When dealing with commercial real estate, particularly the leasing aspect, individuals often encounter the Letter of Intent to Lease Commercial Property form. This document is prevalent in the preliminary stages of lease negotiations. However, several misconceptions surround its use and implications. Clarifying these misunderstandings can aid in navigating the complexities of commercial leases more effectively.

It serves as a legally binding agreement: A common misconception is that the Letter of Intent (LOI) is a legally binding contract. In reality, it is merely a preliminary agreement outlining the basic terms and understanding between the parties. It demonstrates mutual interest in proceeding but, typically, does not legally compel the parties to finalize the lease.

It replaces a lease agreement: Some individuals mistakenly believe an LOI can replace a formal lease agreement. An LOI is only intended to set the stage for formal lease negotiations and document creation. A comprehensive, legally binding lease agreement must still be drafted and signed by both parties to formalize the tenancy.

Details included are final and non-negotiable: Another misconception is that the terms outlined in the LOI are set in stone. On the contrary, the LOI serves as a starting point. Terms and conditions can still be negotiated and modified until the formal lease agreement is executed.

Any party can back out without consequences: While it's true that LOIs are generally not legally binding regarding lease commitments, backing out without a valid reason, after indicating intent, can sometimes lead to legal disputes, particularly if one party incurs costs based on the presumed agreement.

LOIs are only beneficial for tenants: This is incorrect. LOIs benefit both landlords and tenants by clarifying terms early in the negotiation process, thus saving time and reducing misunderstandings during the drafting of the formal lease agreement.

No need for professional advice when drafting an LOI: Given that the LOI sets the groundwork for the lease, professional advice from real estate attorneys or brokers can be invaluable in highlighting potential issues and ensuring that the LOI accurately reflects the party's interests and intentions.

All LOIs are the same: There is a wrong assumption that all LOIs follow a standard format. In reality, the content and format of an LOI can vary greatly depending on the property type, location, and negotiation terms. Customization to fit specific transactions is often necessary.

LOIs must include detailed legal clauses: While including some basic legal terms is common, an LOI does not typically delve into detailed legal specifications. That level of detail is reserved for the formal lease agreement. The LOI focuses on broad terms such as lease duration, rent amount, and property use.

There's no need to include an expiration date on the LOI: Failing to include an expiration date can lead to prolonged negotiations, which might disadvantage one or both parties. Setting a clear timeline encourages prompt decision-making and helps maintain the negotiation's momentum.

Clarifying these misconceptions about the Letter of Intent to Lease Commercial Property can facilitate smoother negotiations and better outcomes for both landlords and tenants. Understanding its role, limitations, and potential as a negotiation tool is crucial for successfully leasing commercial property.

Key takeaways

When it comes to leasing commercial property, a Letter of Intent (LOI) is a critical part of the negotiation process but it's not the final agreement. It serves as a foundation for a formal lease agreement by outlining the terms agreed upon by both the potential tenant and the landlord. Here are six key takeaways you should know about filling out and using the Letter of Intent to Lease Commercial Property form:

- Clarify Terms Early: The LOI helps both parties reach an understanding on major terms such as rent, lease duration, and property use restrictions before drafting the official lease. This clarity can help prevent misunderstandings later on.

- It's Not Legally Binding: Generally, the LOI is not a legally binding agreement to lease or rent the property, but parts of it, like confidentiality clauses, might be. Always treat it with the same seriousness as a formal contract.

- Details Matter: Include as much detail as possible in your LOI. The more specifics you cover, such as maintenance responsibilities and alteration permissions, the less room there will be for surprises during the lease term.

- Use it as a Negotiation Tool: The LOI sets the stage for negotiations. It provides a platform to discuss terms in a less formal setting before entering into a binding lease agreement. Don't hesitate to negotiate terms that are important to you.

- Professional Advice is Key: Consider consulting with a real estate attorney during the drafting and review of your LOI. They can offer valuable insights, ensuring your interests are well-protected and the terms are clearly defined.

- Keep a Record: Always keep a signed copy of the LOI for your records. Even though it's not a lease agreement, it can serve as important evidence of the discussions and preliminary agreements made between the parties.

Remember, a well-constructed LOI can pave the way for a smooth leasing process, establishing a clear understanding between the landlord and potential tenant. With careful attention to detail and proper professional guidance, you can navigate this initial stage with confidence, setting a positive tone for the business relationship.

Consider More Types of Letter of Intent to Lease Commercial Property Forms

Intention to Marry Within 90 Days of Entry - Acts as a written pledge of a couple's commitment to marry, important for various legal and immigration processes.