Official Investment Letter of Intent Document

When stepping into the world of investments, one of the pivotal documents encountered is the Investment Letter of Intent form. This document, at its core, serves as a cornerstone in clarifying the intentions of parties on the brink of a financial endeavor. It outlines the preliminary understanding between an investor and a company, or between two investors, before final agreements are inked. By doing so, it lays down the expectations, terms, and conditions of the proposed investment, making it clear to all involved the direction in which they are heading. Crucially, it also identifies the due diligence processes, timelines, and confidentiality agreements that will govern the period leading up to the final investment. This form is not legally binding in terms of the investment itself but holds significance in establishing a formal negotiation phase, often acting as a safeguard against misunderstandings and setting the foundation for a smooth investment process.

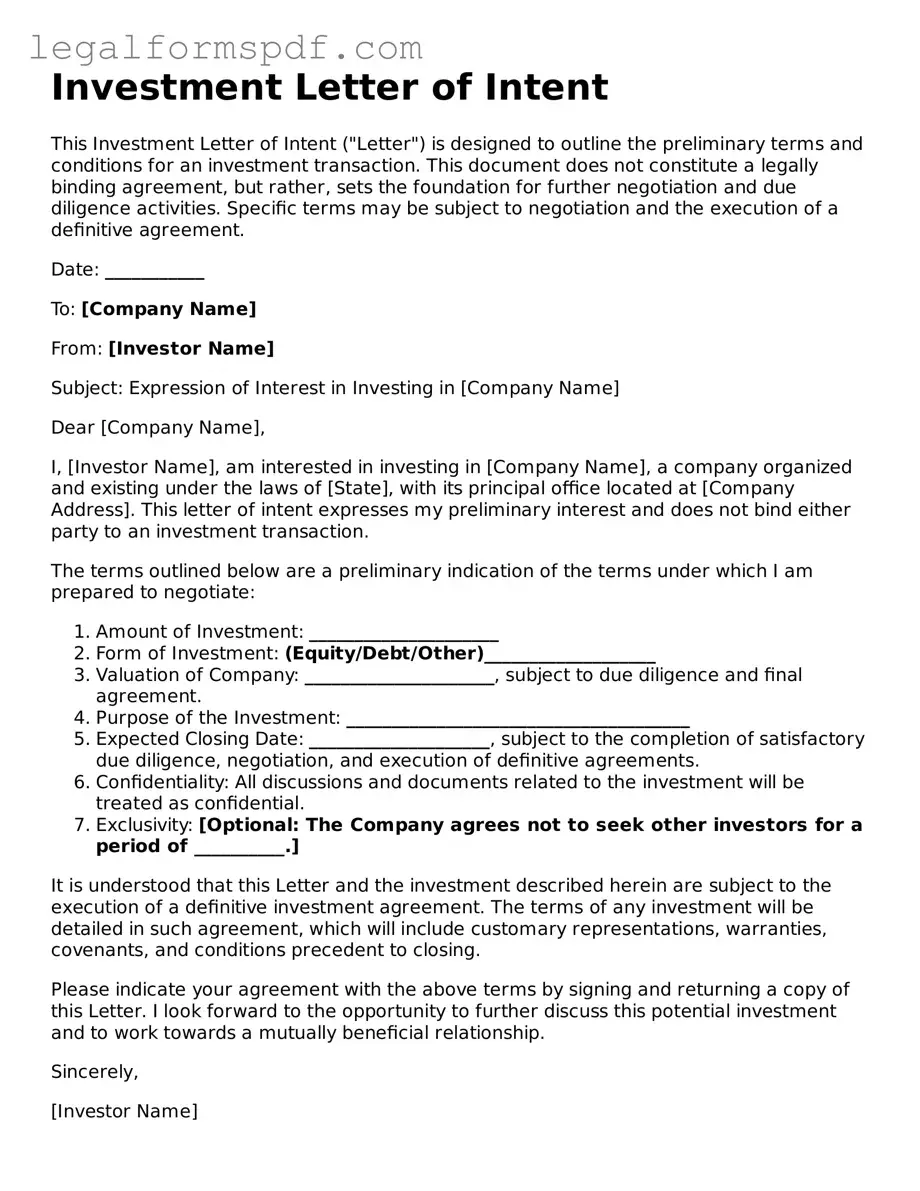

Document Example

Investment Letter of Intent

This Investment Letter of Intent ("Letter") is designed to outline the preliminary terms and conditions for an investment transaction. This document does not constitute a legally binding agreement, but rather, sets the foundation for further negotiation and due diligence activities. Specific terms may be subject to negotiation and the execution of a definitive agreement.

Date: ___________

To: [Company Name]

From: [Investor Name]

Subject: Expression of Interest in Investing in [Company Name]

Dear [Company Name],

I, [Investor Name], am interested in investing in [Company Name], a company organized and existing under the laws of [State], with its principal office located at [Company Address]. This letter of intent expresses my preliminary interest and does not bind either party to an investment transaction.

The terms outlined below are a preliminary indication of the terms under which I am prepared to negotiate:

- Amount of Investment: _____________________

- Form of Investment: (Equity/Debt/Other)___________________

- Valuation of Company: _____________________, subject to due diligence and final agreement.

- Purpose of the Investment: ______________________________________

- Expected Closing Date: ____________________, subject to the completion of satisfactory due diligence, negotiation, and execution of definitive agreements.

- Confidentiality: All discussions and documents related to the investment will be treated as confidential.

- Exclusivity: [Optional: The Company agrees not to seek other investors for a period of __________.]

It is understood that this Letter and the investment described herein are subject to the execution of a definitive investment agreement. The terms of any investment will be detailed in such agreement, which will include customary representations, warranties, covenants, and conditions precedent to closing.

Please indicate your agreement with the above terms by signing and returning a copy of this Letter. I look forward to the opportunity to further discuss this potential investment and to work towards a mutually beneficial relationship.

Sincerely,

[Investor Name]

[Investor Contact Information]

Agreed and Accepted:

[Company Name]

By: ____________________________________

Title: __________________________________

Date: ___________________________________

PDF Specifications

| Name of Fact | Detail |

|---|---|

| Purpose | Indicates a party's intention to invest in a business or project. |

| Non-Binding Nature | Generally, it is not legally binding except for certain provisions such as confidentiality. |

| Key Components | Includes investment amount, terms, conditions, and any preconditions for the investment. |

| Drafting Time | Can save time and costs in the negotiation process by clarifying terms early. |

| Negotiation Tool | Serves as a basis for further negotiation and due diligence. |

| Expiration Date | Often contains an expiration date by which the agreement must be finalized. |

| Governing Law | Subject to the laws of the state in which the investment is made, and this varies for state-specific forms. |

| Confidentiality Clauses | May include clauses that bind the parties to confidentiality regarding the investment details. |

Instructions on Writing Investment Letter of Intent

Upon deciding to embark on a new investment journey, an Investment Letter of Intent (LOI) form is a crucial step in formalizing the preliminary agreements between the investor and the party receiving the investment. This document serves as a foundation for understanding and agreement, outlining the basic terms and conditions both parties intend to follow. Completing this form accurately is essential to ensuring a smooth process as you move forward. Following the outlined steps meticulously will help in crafting an LOI that effectively communicates your intentions and lays the groundwork for the subsequent legal documentation and negotiations that will follow this initial phase.

- Start by including the date at the top of the document. This marks when the letter of intent is being drafted and gives a reference point for the timeframe of the negotiation process.

- Enter the full legal name and address of both the investor and the recipient. These details are critical for identifying the parties involved and ensuring the LOI's applicability to the intended entities.

- Specify the type of investment being made. Clarify whether it is a monetary investment, asset contribution, stock purchase, or any other form of investment, providing a clear understanding of what is being offered.

- Detail the amount of the investment. Include currency denominations to avoid any confusion, especially in international dealings.

- Outline the intended use of the investment. This section sets expectations about how the recipient plans to apply the funds or resources provided.

- Agree upon and stipulate the timeframe for the investment. Mention specific dates or milestones that highlight when the investment will begin and any conditions for its continuance or completion.

- Include any conditions precedent that need to be met before the investment is finalized. These might include due diligence requirements, regulatory approvals, or any other specific contingencies directly impacting the investment agreement.

- Clarify the confidentiality and exclusivity terms. This part clearly states the expectations for privacy regarding the investment discussions and any agreements on exclusivity during the negotiation phase.

- Detail the governing law that will preside over the agreement. Identifying the legal jurisdiction upfront helps in managing expectations and outlining the legal framework that will resolve any disputes.

- Close the LOI with a section for signatures from both parties. It's essential to have the document signed by authorized representatives to validate the intentions expressed in the letter.

After completing the Investment Letter of Intent, the document should be thoroughly reviewed by all parties involved. It's advisable to consult with legal counsel to ensure that the LOI accurately reflects the preliminary agreements and does not inadvertently bind the parties to terms not fully agreed upon. The next steps typically involve deeper due diligence and the drafting of definitive agreements based on the terms outlined in the LOI. This meticulous approach helps in safeguarding the interests of both the investor and the recipient, paving the way for a successful partnership.

Understanding Investment Letter of Intent

What is an Investment Letter of Intent?

An Investment Letter of Intent (LOI) is a formal document that outlines the preliminary agreements between two parties concerning a potential investment. This document is not legally binding but indicates a serious commitment from both the investor and the recipient towards a financial undertaking. It typically includes key details such as the investment amount, the structure of the investment, and any conditions that must be met before finalizing the agreement.

Why is an Investment Letter of Intent important?

An LOI is important because it lays the foundation for negotiations between the investor and the entity seeking investment. It helps both parties to clarify and formalize their intentions and expectations. This process can significantly streamline and speed up the investment negotiations by addressing major deal points early in the discussions.

What should be included in an Investment Letter of Intent?

An effective LOI should include specific details about the proposed investment, such as the amount of money being considered, the type of investment (e.g., stock purchase, asset acquisition), the timeline for the investment, any conditions precedent to the investment, and the confidentiality of the negotiations. Additionally, it should outline any due diligence processes and mention any exclusivity period during which the parties cannot negotiate with others.

Is an Investment Letter of Intent legally binding?

Generally, an Investment Letter of Intent is not legally binding regarding the commitment to proceed with the investment. However, certain provisions within the LOI, like confidentiality and exclusivity, can be legally binding. It's crucial for both parties to carefully review these terms to understand their obligations fully.

How does an Investment Letter of Intent differ from a Term Sheet?

While both an LOI and a Term Sheet outline the terms of a potential investment, they serve different purposes. A Term Sheet is often used in venture capital transactions and provides a snapshot of the proposed terms but does not usually detail the negotiation process. An LOI, on the other hand, is more comprehensive and is typically used in more complex transactions. It not only includes the tentative agreement terms but also covers the process leading to a final agreement.

Can negotiations continue after an Investment Letter of Intent is signed?

Yes, negotiations can and often do continue after an LOI is signed. The LOI signifies that both parties have a serious intention to continue discussions in good faith. However, since the document is generally not binding regarding the investment itself, both parties can negotiate terms and make changes before finalizing the investment through a definitive agreement.

What happens if a deal falls through after signing an Investment Letter of Intent?

If a deal falls through after an LOI is signed, the consequences for both parties are typically limited to those areas of the LOI that were legally binding, such as confidentiality or exclusivity clauses. Since the document does not usually bind the parties to complete the investment, neither side is generally obligated to proceed if terms cannot be agreed upon or if either party decides to withdraw from the negotiations.

Common mistakes

When filling out an Investment Letter of Intent (LOI), which signifies the preliminary commitment between two parties before a formal agreement is finalized, individuals often rush through the process, leading to potential oversights and errors. This document sets the groundwork for the investment and, if not handled properly, can lead to misunderstandings or legal disputes down the line. Recognizing the common mistakes made during this process is crucial for anyone looking to navigate their investments wisely.

One common misstep is the failure to specify the terms and conditions in clear, unambiguous language. The clarity of an LOI is paramount, as it outlines the basic structure of the deal. Ambiguous terms can lead to conflicting interpretations, which might complicate or even derail future negotiations. It is essential to articulate the intentions, expectations, and obligations of both parties explicitly to prevent any misinterpretations.

Another oversight is neglecting to define the timeframe for the investment deal. An LOI should always include the timeline for when the agreement will be finalized and when the actual investment will commence. This omission can create uncertainty and impede the investment process. Additionally, not having a defined timeline can leave parties without recourse in the event of delays or changes in circumstances, potentially jeopardizing the investment.

Many individuals also mistakenly treat the LOI as a casual document rather than a precursor to a legally binding agreement. This underestimation can lead to a lack of due diligence, such as failing to conduct a thorough background check on the other party or not consulting with a legal professional before signing. It’s vital to approach the LOI with the same seriousness as one would a final investment agreement to avoid future complications.

Some fail to include a confidentiality clause, which is a critical oversight. In the investment world, safeguarding sensitive information is paramount. A confidentiality clause ensures that all discussions and shared documents remain private. Without it, there's nothing legally preventing the other party from disclosing or leveraging your information inappropriately.

A frequent error is not clearly delineating the obligations and contributions of each party. Whether it's financial commitments, resources, or services, an LOI should specify what each party is bringing to the table. This lack of clarity can lead to disputes over who is responsible for what, slowing down or even voiding the investment process.

Omitting a dispute resolution clause is another critical mistake. While no one enters into an investment expecting disputes, they can and do arise. Such a clause outlines the steps for resolving disagreements, such as mediation or arbitration, helping prevent costly and time-consuming litigation.

Failing to include a condition that makes the agreement subject to due diligence is a notable error as well. This oversight can lock parties into an agreement before they have fully vetted the opportunity or the other party, potentially leading to regrettable investments. Due diligence is a key step in ensuring that the investment is sound and that all parties have accurately represented their positions.

Avoiding these errors when drafting an Investment Letter of Intent can significantly increase the chances of a successful and mutually beneficial agreement. While the excitement of a potential investment can be thrilling, maintaining attention to detail and considering the potential long-term implications of the LOI are paramount. It’s always recommended to seek legal advice to ensure that the document reflects the deal accurately and protects the interests of all parties involved.

Documents used along the form

When companies or investors are on the verge of entering into significant transactions, a well-drafted Investment Letter of Intent (LOI) plays a pivotal role in outlining the preliminary terms of the investment. However, finalizing such agreements usually requires more than just an LOI. A suite of supporting documents often accompanies the LOI to ensure that all aspects of the investment are thoroughly documented and legally sound. These additional forms and documents are crucial for due diligence, compliance, and to establish the terms of the relationship between the parties involved.

- Confidentiality Agreement: Often executed alongside or before the Investment LOI, a Confidentiality Agreement ensures that all sensitive information exchanged during negotiations remains private between the involved parties. It protects the interests and secrets of both investors and companies throughout the investment process.

- Due Diligence Checklist: This document outlines all the information and documents that the investor needs to review before finalizing the investment. It includes financial records, legal contracts, and other crucial documents, ensuring that the investor can make an informed decision.

- Term Sheet: Although similar to the LOI, a Term Sheet provides a more detailed summary of the terms of the investment. It is more concise and focuses on the financial and legal aspects of the proposed agreement.

- Subscription Agreement: This is a direct agreement where the investor commits to buying a specific number of securities at a predetermined price, officially becoming a shareholder or partner in the company.

- Shareholders' Agreement: For investments resulting in shared ownership or changes in existing ownership, a Shareholders' Agreement outlines the rights and obligations of all parties. It includes provisions for the management of the company, distribution of profits, and dispute resolution.

- Corporate Resolutions: These documents are necessary when the investment involves significant decisions that need to be approved by the company’s board of directors or shareholders, such as issuing new shares or changing corporate bylaws.

Each of these documents plays a vital role in the investment process, safeguarding both parties' interests and ensuring the investment proceeds smoothly from initial intent to final execution. By carefully preparing and reviewing these documents, investors and companies can achieve a mutually beneficial agreement, laying a strong foundation for a successful partnership.

Similar forms

An Investment Term Sheet is quite similar to an Investment Letter of Intent as both outline the preliminary agreement terms between investors and the company before finalizing the investment. While a Letter of Intent includes a broader intention to invest, the Term Sheet goes into more detail about the investment’s terms and conditions, such as the valuation of the company, the amount of investment, and any specific conditions tied to the investment.

A Memorandum of Understanding (MOU) shares similarities with an Investment Letter of Intent because it also signifies a mutual agreement on the intent to enter into a formal agreement. An MOU is more flexible and can be used in various agreements, not just investments. It outlines the expectations and responsibilities of all parties before drafting a formal contract, serving as a foundation for the forthcoming detailed agreement.

Non-Disclosure Agreements (NDAs) are crucial in the initial stages of investment discussions, akin to an Investment Letter of Intent. NDAs protect sensitive information shared during the negotiation and due diligence process. While the Letter of Intent indicates a willingness to proceed under certain terms, the NDA ensures that all disclosed financials, strategies, and intellectual property remain confidential among the parties involved.

A Purchase Agreement often follows an Investment Letter of Intent in business transactions, especially when dealing with the acquisition of assets or shares. This document is detailed, outlining the specific terms, conditions, prices, and warranties related to the sale. Whereas the Letter of Intent signals the preliminary commitment to such transactions, the Purchase Agreement finalizes the deal, incorporating the detailed terms agreed upon.

Shareholder Agreements are also akin to an Investment Letter of Intent when new investments are made. This document specifies the rights and obligations of shareholders, including how the company is managed and how disputes are resolved. While a Letter of Intent suggests an initial pledge to invest, the Shareholder Agreement establishes the ongoing relationship and operational dynamics among investors post-investment.

Partnership Agreements resemble an Investment Letter of Intent as they lay the groundwork for a formal arrangement amongst parties seeking to embark on a business venture together. Both documents serve as a prelude to more definitive agreements and set forth the basic framework of the partnership or investment, including roles, investment amounts, and profit distribution, yet the Partnership Agreement delves deeper into the operational aspects of the partnership.

The Heads of Agreement document has similarities with an Investment Letter of Intent in its function as a precursor to a formal agreement. It captures the key points of a deal in its infancy, intended to guide the drafting of final agreements. Though less formal than a contract, it signifies a seriousness to proceed, akin to the commitment shown by an Investment Letter of Intent.

Letters of Interest, although generally broader and less specific than an Investment Letter of Intent, serve a similar purpose in expressing a party’s preliminary interest in pursuing a deal or project. This document can be utilized in various contexts, from job applications to real estate development proposals, providing a broad indication of intent without delving into the specifics of the contemplated agreement.

Finally, the Confidentiality Letter often accompanies or precedes an Investment Letter of Intent, emphasizing the importance of maintaining the confidentiality of negotiations and information exchange during the investment discussion process. While it specifically addresses the non-disclosure of information, its usage complements the Letter of Intent by safeguarding sensitive data during preliminary discussions.

Dos and Don'ts

Filling out an Investment Letter of Intent (LOI) is a pivotal step in the negotiation process for potential investments. This document, while not always legally binding in its entirety, sets the framework for the investment relationship and outlines key terms and understandings. It's crucial to approach this task with diligence and caution. Here are essential dos and don'ts to consider:

Things You Should Do

- Review the form carefully: Ensure you understand every aspect of the form before filling it out. Misunderstandings or misinterpretations can lead to incorrect information being provided, which could affect the investment negotiations negatively.

- Provide accurate and complete information: The integrity of an Investment Letter of Intent is crucial. Ensure all information provided is accurate, complete, and truthful to the best of your knowledge. This includes financial details, investment terms, and any other pertinent data.

- Consult with professionals: Seek advice from legal and financial professionals before submitting the LOI. Their expertise can help ensure that your interests are protected and that you have not overlooked any critical details.

- Use clear and concise language: Ambiguity can lead to misunderstandings and disputes. Make sure that the language used in the LOI is clear, precise, and unequivocal, leaving no room for misinterpretation.

- Keep a copy for your records: After submitting the LOI, it's important to retain a copy for your records. This document will serve as a reference point throughout subsequent negotiations and transactions.

Things You Shouldn't Do

- Do not overlook the non-binding clause: Most LOIs include a non-binding clause regarding specific negotiations or terms, except for certain sections such as confidentiality. It's crucial not to treat the LOI as a final agreement but as a step towards a binding contract.

- Do not rush the process: Take your time when preparing and reviewing the LOI. Rushing through the document can lead to oversights that might complicate or jeopardize the investment process.

- Do not ignore discrepancies: If there are discrepancies between your discussions and the LOI, do not ignore them. Address these issues immediately to ensure the document accurately reflects the agreed terms.

- Do not forget to discuss termination conditions: While it might seem negative to discuss the end of a relationship before it has fully begun, understanding and agreeing on termination conditions within the LOI can save considerable difficulties later.

- Do not sign without understanding every term: Finally, do not sign the LOI unless you completely understand every term and condition. Signing a document without full comprehension can lead to legal and financial consequences.

Misconceptions

The Investment Letter of Intent (LOI) is crucial in the investment process, yet misunderstandings about its content and significance are common. This document seeks to clarify some of the most prevalent misconceptions, providing clarity to investors and businesses alike.

It's Legally Binding: One major misconception is that an Investment LOI is entirely legally binding. In reality, while certain sections like confidentiality agreements may hold legal weight, the LOI as a whole is largely a foundation for negotiation, detailing the terms and intentions but not cementing them into a binding contract.

All Sections Are Equally Important: Another misunderstanding is that every section within an LOI carries equal weight. However, the significance of sections can vary, and some parts are more about setting expectations rather than establishing firm agreements. It’s crucial to recognize which sections are fundamental and which are more flexible.

It's Just a Formality: Some people might perceive the LOI as merely a procedural step without much significance. This is far from the truth. An LOI sets the stage for the investment process, outlining the basic structure of the deal. It's a critical document that guides the negotiations and preparations for the final agreement.

It Commits Both Parties to a Deal: There’s a common belief that once an LOI is signed, both parties are committed to going through with the deal. This is not accurate. An LOI primarily expresses a serious intent to explore a business arrangement, but either party can typically back out if the terms are not finalized to mutual satisfaction in the subsequent definitive agreements.

Understanding these misconceptions is vital for any party involved in the investment process. Recognizing the true role and implications of an Investment Letter of Intent can help in navigating negotiations more effectively, ensuring that both investors and businesses are properly aligned in their expectations and commitments.

Key takeaways

An Investment Letter of Intent (LOI) is a formal document that outlines the preliminary terms and conditions between two parties before they enter into a detailed investment agreement. While it is not legally binding in the same way as the final agreement, it serves as an important step in the process of negotiation and investment. Here are key takeaways to consider when filling out and using an Investment Letter of Intent:

- Clarity is key: Ensure that all the terms, conditions, and expectations are clearly defined in the LOI to avoid misunderstandings or conflicts later in the investment process.

- Specify the parties involved: Clearly identify all parties involved in the investment, including investors, beneficiaries, and other stakeholders, to ensure there is no ambiguity.

- Outline the investment details: The LOI should specify the amount to be invested, the form of the investment (such as cash, property, or shares), and any conditions or performance metrics tied to the investment.

- Include a confidentiality clause: It is often beneficial to include a clause that protects sensitive information shared between the parties during the negotiation and due diligence processes.

- Set a timeline: Establishing a clear timeline for when the due diligence must be completed and when the final investment agreement will be executed helps keep the process on track.

- Non-binding nature: Make it clear that the LOI is not a legally binding contract to commit the investment but a step towards drafting the final agreement. Exceptions to this should be clearly stated, such as confidentiality and exclusivity clauses.

- Dispute resolution: Include a section that outlines how any disputes during the negotiation phase will be resolved to minimize conflicts.

- Termination conditions: It’s wise to specify under what conditions the LOI can be terminated by either party, giving a clear exit strategy should negotiations break down or due diligence reveal unsatisfactory results.

Remember, while an Investment Letter of Intent is an initial step, it sets the tone for the investment relationship. Taking the time to carefully draft and review this document can help ensure a smoother negotiation process and clarity for all parties involved in the investment.

Consider More Types of Investment Letter of Intent Forms

Intention to Marry Within 90 Days of Entry - This form is a stepping stone for partners from different countries to start their life together, proving their serious intent to marry.

Notice of Intent to Homeschool - Parents might need to submit this letter annually, depending on the regulations within their specific state or locality.