Fillable Last Will and Testament Document for Texas

Ensuring that personal wishes regarding the distribution of assets and the care of minor children are respected after one’s passing is of paramount importance. In Texas, creating a Last Will and Testament is a critical step in this process. This legal document provides individuals with the power to designate heirs, specify asset distribution, appoint guardians for minor children, and even nominate executors to manage estate affairs. Texas laws offer a unique framework for these documents, emphasizing the importance of adhering to state-specific rules to ensure the will's validity. From the necessity of witnesses to the acknowledgment requirements that solidify the document's legality, understanding each aspect of the Texas Last Will and Testament form is essential. This introductory exploration will delve into the major components of this form, offering insight into how Texans can ensure their final wishes are fully recognized and effectively executed under the law.

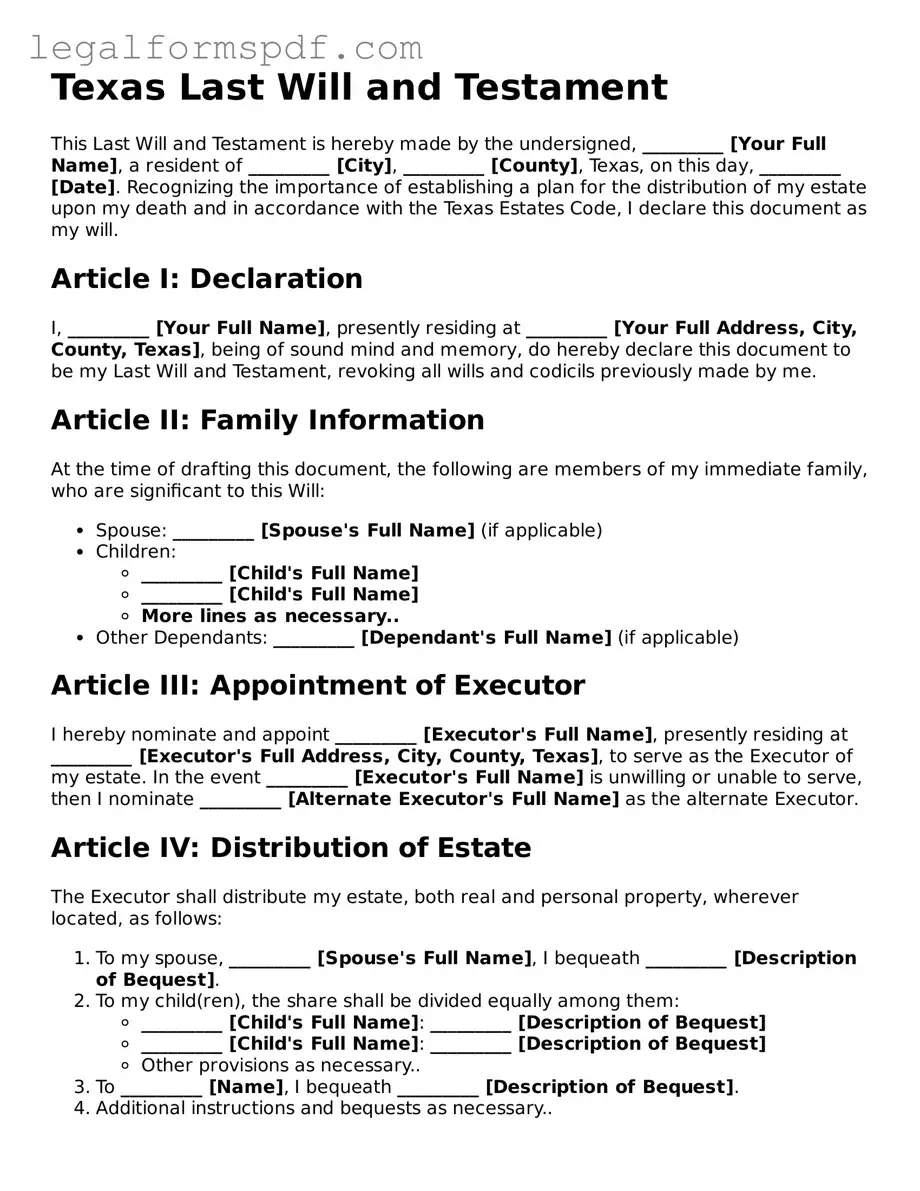

Document Example

Texas Last Will and Testament

This Last Will and Testament is hereby made by the undersigned, _________ [Your Full Name], a resident of _________ [City], _________ [County], Texas, on this day, _________ [Date]. Recognizing the importance of establishing a plan for the distribution of my estate upon my death and in accordance with the Texas Estates Code, I declare this document as my will.

Article I: Declaration

I, _________ [Your Full Name], presently residing at _________ [Your Full Address, City, County, Texas], being of sound mind and memory, do hereby declare this document to be my Last Will and Testament, revoking all wills and codicils previously made by me.

Article II: Family Information

At the time of drafting this document, the following are members of my immediate family, who are significant to this Will:

- Spouse: _________ [Spouse's Full Name] (if applicable)

- Children:

- _________ [Child's Full Name]

- _________ [Child's Full Name]

- More lines as necessary..

- Other Dependants: _________ [Dependant's Full Name] (if applicable)

Article III: Appointment of Executor

I hereby nominate and appoint _________ [Executor's Full Name], presently residing at _________ [Executor's Full Address, City, County, Texas], to serve as the Executor of my estate. In the event _________ [Executor's Full Name] is unwilling or unable to serve, then I nominate _________ [Alternate Executor's Full Name] as the alternate Executor.

Article IV: Distribution of Estate

The Executor shall distribute my estate, both real and personal property, wherever located, as follows:

- To my spouse, _________ [Spouse's Full Name], I bequeath _________ [Description of Bequest].

- To my child(ren), the share shall be divided equally among them:

- _________ [Child's Full Name]: _________ [Description of Bequest]

- _________ [Child's Full Name]: _________ [Description of Bequest]

- Other provisions as necessary..

- To _________ [Name], I bequeath _________ [Description of Bequest].

- Additional instructions and bequests as necessary..

Article V: Guardian of Minor Children

In the event I am the sole parent or guardian of minor children at the time of my death, I hereby appoint _________ [Guardian's Full Name], residing at _________ [Guardian's Full Address, City, County, Texas], as the guardian of my minor children. Should _________ [Guardian's Full Name] be unwilling or unable to serve, I then appoint _________ [Alternate Guardian's Full Name] as the alternate guardian.

Article VI: Signatures

This Last Will and Testament was signed in the presence of witnesses, who in my presence and in the presence of each other, have hereunto subscribed our names:

_________________________

[Your Full Name], Testator

Witness #1: _________________________

Name: _________ [Witness #1 Full Name]

Witness #2: _________________________

Name: _________ [Witness #2 Full Name]

Article VII: Affidavit of Witnesses

The undersigned, being duly sworn, declare(s) that the foregoing instrument was signed in their respective presence by _________ [Your Full Name], the testator, who declared it to be his/her Last Will and Testament. Further, at the Testator's request and in his/her presence and in the presence of each other, the undersigned have hereunto subscribed our names as witnesses on the date last above written.

Witness #1 Signature: _________________________

Date: ______

Witness #2 Signature: _________________________

Date: ______

PDF Specifications

| Fact | Detail |

|---|---|

| 1. Applicable Law | The Texas Estates Code governs the creation and interpretation of Last Will and Testament documents in Texas. |

| 2. Age Requirement | In Texas, an individual must be 18 years or older, or legally married, or a member of the armed forces, in order to create a Last Will and Testament. |

| 3. Witnesses Requirement | A Last Will and Testament in Texas must be signed by at least two credible witnesses over the age of 14 who are not beneficiaries in the will. |

| 4. Notarization | Notarization is not required for a will to be valid in Texas, but a will can be made "self-proved" with a notarized affidavit, which can expedite the probate process. |

| 5. Holographic Wills | Texas recognizes holographic wills, which are wills that are handwritten and signed by the testator, without the requirement of witnesses. |

| 6. Oral Wills | Oral (nuncupative) wills are only recognized in Texas under very specific circumstances, such as by a member of the armed forces active in duty. |

| 7. Revocation | A Last Will and Testament in Texas can be revoked by creating a new will, by physically destroying the old will with the intent to revoke, or through a legal declaration of revocation. |

| 8. Divorce or Marriage | In Texas, divorce generally revokes any gifts or fiduciary appointments in favor of the ex-spouse, but marriage after the creation of a will does not automatically update or annul the will. |

| 9. Digital Assets | The Texas Estates Code has provisions that allow for the management and transfer of digital assets, such as social media accounts and electronic communications, in a Last Will and Testament. |

Instructions on Writing Texas Last Will and Testament

Creating a Last Will and Testament is a crucial step in managing your estate and ensuring your wishes are honored after your passing. In Texas, the process has been streamlined to help residents easily delineate their desires concerning their assets, the care of their minor children, and any other final wishes. This document, once completed and properly executed, serves as a legal declaration of how you want your estate to be handled. Here, we provide a straightforward guide to filling out a Texas Last Will and Testament form.

- Begin by entering your full legal name and address, establishing your identity as the testator (the person making the will).

- Designate an executor, the individual you trust to carry out the instructions in your will. Include their full name and address. If you wish, appoint an alternate executor in case the primary executor is unable or unwilling to serve.

- Specify the beneficiaries, those who will receive your assets. For each beneficiary, include their full name, relationship to you, and the specific bequests or portions of your estate they will receive.

- Detail any specific gifts, such as cherished possessions, family heirlooms, or monetary donations to organizations, making sure to clearly identify the recipient and the item or amount to be given.

- If you have minor children, appoint a guardian for them in the event of your demise before they reach adulthood. Include the full name and address of your chosen guardian.

- Provide instructions for your pets’ care, if applicable, designating a caregiver and allocating funds for their maintenance, if desired.

- Outline how debts, expenses, and taxes should be paid from your estate, clarifying any particular instructions or wishes regarding these financial obligations.

- Special instructions for the distribution of the remainder of your estate or residuary estate, if there are assets not specifically accounted for in preceding sections.

- Review the form to ensure all information is accurate and reflects your wishes. It's advisable to consult with an attorney to confirm that the document meets all legal requirements and effectively represents your intentions.

- Sign and date the will in the presence of at least two witnesses, who are not beneficiaries, and who must also sign and date the document, attesting to your capacity and voluntariness in making the will. Their full names and addresses should be clearly printed or typed.

- In Texas, it's recommended, though not required, to complete a self-proving affidavit, which can expedite the probate process. This requires notarization and signatures from both you and the witnesses.

Filling out a Last Will and Testament form is a responsible action to ensure your estate is distributed according to your wishes. It's an affirming step in planning for the future, protecting your loved ones, and making your final wishes known. Remember, laws and guidelines can vary, so seeking legal advice is always recommended to address individual circumstances and ensure all requirements are met. Properly completing and executing this document gives peace of mind to you and your heirs, ensuring a smoother transition during a challenging time.

Understanding Texas Last Will and Testament

What is a Last Will and Testament?

A Last Will and Testament is a legal document that allows a person, known as the testator, to designate how their assets should be distributed upon their death. It specifies who will inherit the property, money, and personal items of the testator. Additionally, it can outline plans for the care of minor children.

Do I need a lawyer to create a Last Will and Testament in Texas?

No, in Texas, you do not need a lawyer to create a valid Last Will and Testament. However, consulting with a legal professional can provide clarity and ensure that the will complies with Texas state laws, thereby safeguarding your wishes.

What are the legal requirements for a Last Will and Testament to be valid in Texas?

In Texas, the person creating the will must be at least 18 years old, must be of sound mind, and the will must be in writing. The will must also be signed by the testator (or by someone else in the testator's presence and under their direction) and witnessed by at least two individuals over the age of 14 who are present at the same time and see the testator or acknowledge the testator's signature.

Can I make a digital or electronic will in Texas?

As of the last update, Texas recognizes electronic wills if they meet specific criteria, such as being executed with the same formalities as traditional paper wills, including the requirement for witnesses. It's essential to stay updated on current laws, as regulations regarding electronic wills can evolve.

What happens if I die without a Last Will and Testament in Texas?

If you die without a Last Will and Testament in Texas, your assets will be distributed according to state "intestacy" laws. Typically, this means your closest relatives—such as your spouse, children, or parents—will inherit your assets, which might not align with your wishes.

Can I change my Last Will and Testament after creating it?

Yes, you can change your Last Will and Testament at any time while you are still of sound mind. To do so, you can either create a new will or add an amendment, known as a codicil, to your existing will. Any changes must follow Texas legal formalities to be valid.

Do I need to have my Last Will and Testament notarized in Texas?

No, Texas does not require your Last Will and Testament to be notarized to be valid. However, having your will notarized can speed up the probate process since a notarized will is presumed to be "self-proving," helping to expedite its acceptance by the court.

How do I revoke or cancel my Last Will and Testament?

You can revoke or cancel your Last Will and Testament by either creating a new will that states it revokes all previous wills or by physically destroying the previous will (e.g., tearing, burning, or otherwise mutilating it) with the intent to revoke it.

What is a "self-proving" affidavit, and do I need one in Texas?

A "self-proving" affidavit is a sworn statement by the witnesses to a will, made in front of a notary, that affirms the will was properly executed. While not required in Texas, including one can simplify and expedite the probate process by potentially eliminating the need for your witnesses to testify in court about the validity of the will.

Can I leave property to anyone I choose in my Last Will and Testament?

Yes, in Texas, you can generally leave your property to anyone you choose. However, there are laws to protect spouses and minor children from being completely disinherited. Consultation with a legal advisor can help ensure your will adheres to these laws while still respecting your wishes.

Common mistakes

Filling out a Texas Last Will and Testament requires careful attention to detail. One common mistake is not adhering strictly to state-specific requirements. Texas law mandates certain formalities for a will to be considered valid, including the need for it to be in writing, signed by the testator, and witnessed by at least two individuals over the age of 14. Overlooking these requirements can result in a will being declared invalid.

Another frequent error is failing to clearly identify beneficiaries. It is crucial that each beneficiary is named explicitly, and their relationship to the testator is made clear. Ambiguity in the designation of heirs can lead to disputes among potential beneficiaries, which might necessitate legal intervention to resolve.

Many people also make the mistake of not updating their will to reflect significant life changes, such as marriage, divorce, the birth of a child, or the death of a named beneficiary. An outdated will can distribute one's estate in a manner that no longer aligns with their wishes or current family structure, potentially causing unintended harm or exclusion to loved ones.

Ignoring the appointment of an executor is another common oversight. An executor plays a crucial role in administering the estate according to the wishes outlined in the will. Failure to appoint an executor, or choosing someone who lacks the ability, willingness, or understanding to fulfill these duties adequately, can complicate the probate process significantly.

Another mistake lies in the improper witness selection. Witnesses must not only meet the age requirement but also be considered competent. Additionally, they should not be beneficiaries in the will, as this could raise questions about the will's validity due to potential conflicts of interest.

Some individuals also make the error of not being specific enough about the division of property. Vague instructions can lead to disputes among heirs and beneficiaries, potentially leading to a court having to make decisions that might not align with the testator's intentions.

Moreover, using ambiguous language is a pitfall that can make the will difficult to interpret and execute as intended. Clarity and precision in the language used can prevent misinterpretation and ensure that the testator's wishes are carried out accurately.

A common technical mistake is failing to sign the will in the presence of the required witnesses, or not having the witnesses sign in the presence of each other and the testator. This step is crucial for the will's validity and is strictly required by Texas law.

Forgetting to include a residuary clause is another oversight. This clause covers any property that wasn't explicitly mentioned in the will, ensuring that it is distributed according to the testator's general wishes rather than falling under Texas's intestate succession laws.

Finally, a significant misstep people often make is attempting to make handwritten changes to a will after it has been executed. Amendments, known as codicils, must meet the same formal requirements as the original will to be legally valid. Failing to adhere to this can render the changes invalid, potentially undermining the testator’s final intentions.

Documents used along the form

When preparing a Last Will and Testament in Texas, it's important to consider other documents that may support or complement your will. These documents can help ensure your wishes are honored in both life and death, addressing financial, medical, and personal decisions. Here are ten common forms and documents that are often used alongside a Texas Last Will and Testament.

- Advance Directive: This document allows you to outline your preferences for medical treatment in case you become unable to communicate your wishes due to illness or incapacity.

- Durable Power of Attorney for Healthcare: This assigns a trusted person to make healthcare decisions on your behalf if you're unable to do so yourself.

- Medical Information Release: This form authorizes the disclosure of your health information to designated individuals.

- Durable Financial Power of Attorney: It grants someone you trust the authority to manage your financial affairs if you are incapacitated or otherwise unable to do so.

- Declaration of Guardian in the Event of Later Incapacity or Need of Guardian: This document names the individual you wish to serve as your guardian should you become mentally incapacitated and unable to make decisions for yourself.

- Appointment of Agent to Control Disposition of Remains: This form allows you to designate who will have the authority to make decisions about the disposition of your body after death, including decisions about burial, cremation, and funeral arrangements.

- Trust Agreement: A legal arrangement that can be used to manage your assets during your lifetime and distribute them after your death, often used to avoid probate, reduce estate taxes, or manage inheritance for minors or special needs family members.

- Certificate of Trust Existence and Authority: This document verifies the existence of a trust and outlines the powers granted to the trustee, often required by financial institutions when the trust is involved in transactions.

- List of Important Documents and Asset Inventory: A comprehensive list detailing where your important documents are stored, alongside an inventory of your assets, can be incredibly helpful for your executor and beneficiaries.

- Letter of Intent: A non-binding document that provides additional guidance and wishes that aren’t legally covered in the will, such as personal property distribution and funeral preferences.

While a Last Will and Testament is crucial for ensuring your estate is handled according to your wishes, these accompanying documents can provide comprehensive guidance to your loved ones and legal representatives. They address a range of decisions, from financial and medical to personal preferences, thus offering peace of mind to both you and your family. It's advisable to consult with a legal professional to ensure all documents are correctly prepared and reflect your current wishes.

Similar forms

The Texas Living Will, also known as an Advance Directive, shares similarities with the Last Will and Testament, primarily because both documents allow individuals to outline their preferences and instructions for the future. While a Last Will and Testament specifies how a person's estate should be distributed after their death, a Living Will focuses on healthcare decisions, including end-of-life care and life-sustaining treatments, should the individual become unable to communicate their wishes.

A Trust is another document with close ties to the Last Will and Testament. Both serve to manage and distribute an individual's assets, but they do so in different ways. A Trust usually comes into effect during the grantor's lifetime and can continue after their death, offering more privacy and potentially avoiding probate, while a Last Will and Testament comes into effect only after the person's death and must go through the probate process.

The Durable Power of Attorney for Finances is a document that, like the Last Will and Testament, deals with an individual's assets and financial responsibilities. However, it is effective during the person's life, allowing someone else to manage their financial affairs if they become unable to do so themselves. Unlike a Last Will and Testament, which operates after death, the Durable Power of Attorney becomes void once the person passes away.

Medical Power of Attorney designates someone to make healthcare decisions on behalf of the individual in the event they are incapacitated, similar to how the Last Will and Testament appoints executors and beneficiaries for estate management and asset distribution. While the Medical Power of Attorney is in force during the individual's lifetime, the Last Will and Testament becomes effective upon death.

The Declaration of Guardian in Advance allows an individual to select a guardian for themselves and their estate in the event of incapacitation, somewhat akin to the Last Will and Testament which also involves selecting individuals to carry out certain responsibilities after one's death. The main difference is the timing of when these documents come into effect—upon incapacitation for the Declaration of Guardian and after death for the Last Will and Testament.

A Beneficiary Designation is often used in conjunction with retirement accounts, life insurance policies, and other financial instruments, designating who will receive the assets upon the account holder's death. This document parallels the Last Will and Testament in its role of assigning assets to specific heirs, although Beneficiary Designations typically bypass the probate process and are not part of the estate governed by the Last Will.

The Digital Assets Will is a newer type of document that specifies how one's online accounts and digital assets should be handled after death. This form complements the Last Will and Testament by covering assets not traditionally considered physical or financial, such as social media profiles or digital music libraries. It ensures that digital assets are managed according to the deceased's wishes.

The Codicil to a Will serves to amend or make additions to an existing Last Will and Testament without the need to draft a new will entirely. This document highlights the dynamic nature of estate planning, allowing for adjustments to be made as circumstances change. Both the Codicil and the original Last Will operate under the same principles, guiding posthumous asset distribution.

An Appointment of Agent to Control Disposition of Remains is a document specifying who has the authority to make decisions regarding a person's body after death, including funeral arrangements and the final resting place. This document complements the Last Will and Testament by covering an area not typically addressed in the will, focusing on the physical body rather than the estate.

Finally, a Memorandum of Personal Property is a more informal document that can accompany a Last Will and Testament, allowing individuals to specify recipients for certain items of personal property. Though not legally binding in some jurisdictions, it works in tandem with the Last Will to ensure personal belongings are distributed as wished. This flexibility allows for easier updates without the need to alter the will itself.

Dos and Don'ts

Creating a Last Will and Testament is a significant step in planning for the future. In Texas, as elsewhere, it's essential to approach this task with care and due diligence to ensure that your wishes are clearly understood and legally binding. Here are some dos and don'ts to consider when filling out the Texas Last Will and Testament form:

Do:- Read instructions carefully: Before you start, make sure you fully understand each section of the form to avoid any mistakes that could potentially make your will invalid.

- Be clear and concise: Use simple, straightforward language to describe your wishes. Ambiguity can lead to disputes among your heirs.

- Appoint a trusted executor: Choose someone reliable and capable to manage your estate after you're gone. This person will play a crucial role in ensuring your will is executed according to your wishes.

- Sign in the presence of witnesses: Texas law requires your will to be signed in the presence of at least two credible witnesses who are not beneficiaries.

- Keep it in a safe place: Store your will in a secure location and let your executor and a close family member or friend know where it is.

- Review and update regularly: Life changes such as marriage, divorce, births, and deaths can affect your will. Review and update it as necessary to reflect your current wishes.

- Seek professional advice: Consider consulting with a legal professional to ensure your will complies with Texas law and fully captures your intentions.

- Procrastinate: Don't wait for the "right" time to make your will. The future is unpredictable, and it's crucial to have your affairs in order sooner rather than later.

- Use ambiguous language: Avoid vague terms that could be open to interpretation. Be as specific as possible to minimize the chances of disputes.

- Forget to name a guardian for minor children: If you have children under 18, clearly state who you wish to take care of them in your absence.

- Overlook digital assets: Digital assets like social media accounts, online banking, and cryptocurrencies should also be included in your will.

- Rely solely on a template: While a template can be a good starting point, it might not cover all aspects of your unique situation. Tailor your will to fit your specific needs.

- Sign without witnesses: Signing your will without the required witnesses can render it invalid in Texas. Ensure this crucial step is not overlooked.

- Leave it accessible to the wrong people: While it's important to keep your will in a safe place, make sure that only the right individuals know where it is and can access it when the time comes.

Misconceptions

Many people have misconceptions about the Texas Last Will and Testament form, which can lead to errors in drafting and executing this important document. Here are some common misunderstandings and clarifications:

It must be notarized to be valid: In Texas, a Last Will and Testament does not need to be notarized to be valid. However, it must be signed by the person making the will (the testator) in the presence of two witnesses, who also sign the will.

Oral wills are not recognized: Texas recognizes oral wills (also known as nuncupative wills) under specific, narrow circumstances, mainly when the testator is in imminent peril of death and unable to create a written will. However, the requirements for an oral will to be valid are stringent, and it can only dispose of personal property, not real estate.

All property can be distributed through a will: Certain types of property, such as jointly-owned property or assets with designated beneficiaries (like life insurance or retirement accounts), do not pass through a will and are instead distributed according to the terms of the ownership agreement or beneficiary designation.

A handwritten will is not valid: Texas recognizes handwritten (holographic) wills, provided that the entire will is in the testator's handwriting and signed by the testator. Such wills do not need witness signatures to be valid but proving their authenticity in court can be more challenging.

If you die without a will, the state takes everything: If someone dies intestate (without a will), their property is distributed among their relatives according to Texas intestacy laws. The state only receives the estate if there are no legally recognized heirs.

A will avoids probate: Having a will does not bypass the probate process. The will must still be proved valid in a probate court, and the estate will be distributed according to the will under the supervision of the court. However, a well-drafted will can make the probate process smoother and quicker.

You only need a will if you're wealthy: A will is beneficial for anyone who wishes to designate how their property should be distributed upon their death, regardless of the size of the estate. It can also nominate guardians for minor children and make other important arrangements.

Once written, a will is final: A will can be updated or completely revoked by the testator at any time before their death, as long as they are legally competent. This flexibility allows for changes in circumstances, such as new family members, changes in marital status, or shifts in the estate composition.

Key takeaways

When preparing a Texas Last Will and Testament, many significant factors must be considered to ensure that your estate is handled according to your wishes after you pass away. This document is a powerful tool that allows you to dictate who receives your property and assets, appoint an executor to oversee your estate's distribution, and can also allow you to name guardians for any minor children. Here are four key takeaways to keep in mind:

- Completeness is crucial. Every section of the Texas Last Will and Testament form should be thoroughly completed to avoid any potential ambiguities. Incomplete documents can lead to disputes among heirs or may even result in the will being contested in court, which can greatly delay the distribution of assets.

- Witness requirements. Texas law requires that your Last Will and Testament be signed in the presence of at least two credible witnesses over the age of 14. These witnesses must also sign the will, attesting that they witnessed your signature. It’s important that these witnesses are not beneficiaries in the will to avoid any appearance of conflict of interest.

- Consider a self-proving affidavit. Although not required, adding a self-proving affidavit to your will can streamline the probate process. This affidavit is signed by you and your witnesses before a notary public, which then eliminates the need for your witnesses to physically appear in court to validate your will after your death.

- Keep it updated. Life changes such as marriage, divorce, the birth of a child, or the acquisition of significant assets should prompt a review and, if necessary, revisions to your Last Will and Testament. Keeping your will updated ensures that it accurately reflects your final wishes and circumstances.

By considering these key points, individuals can create a comprehensive and effective Texas Last Will and Testament, providing peace of mind and clarity for the future. Remember, while you can complete this form yourself, consulting with a legal professional can help ensure that all legal requirements are met and that your estate is distributed according to your wishes.

More Last Will and Testament State Forms

Is a Handwritten Will Legal in Nc - Facilitates the distribution of assets to stepchildren or non-related beneficiaries.

Free Last Will and Testament Ohio - A guide for executors and beneficiaries, clarifying the deceased’s intentions for asset distribution.

Georgia Last Will and Testament - By delineating your wishes in a Will, you protect your estate from mismanagement and ensure that your assets are distributed as you intended.