Fillable Last Will and Testament Document for Pennsylvania

The Pennsylvania Last Will and Testament form serves as a crucial document for individuals looking to ensure their wishes regarding the distribution of their assets and care for their dependents are honored after their passing. This legal document allows a person, known as the testator, to appoint an executor tasked with managing the estate's affairs. Moreover, it provides the opportunity to specify guardians for any minor children or dependents, a key component for many families. In Pennsylvania, like in other states, there are specific requirements that must be met for a Last Will and Testament to be considered valid, including the need for it to be signed in the presence of witnesses. It is designed to offer peace of mind to the testator by laying out clear instructions for the handling of their estate, thereby minimizing potential disputes among heirs or beneficiaries. Thus, it stands as an essential tool for estate planning, reflecting the testator's final wishes and providing a guideline for loved ones and legal representatives to follow in the event of their death.

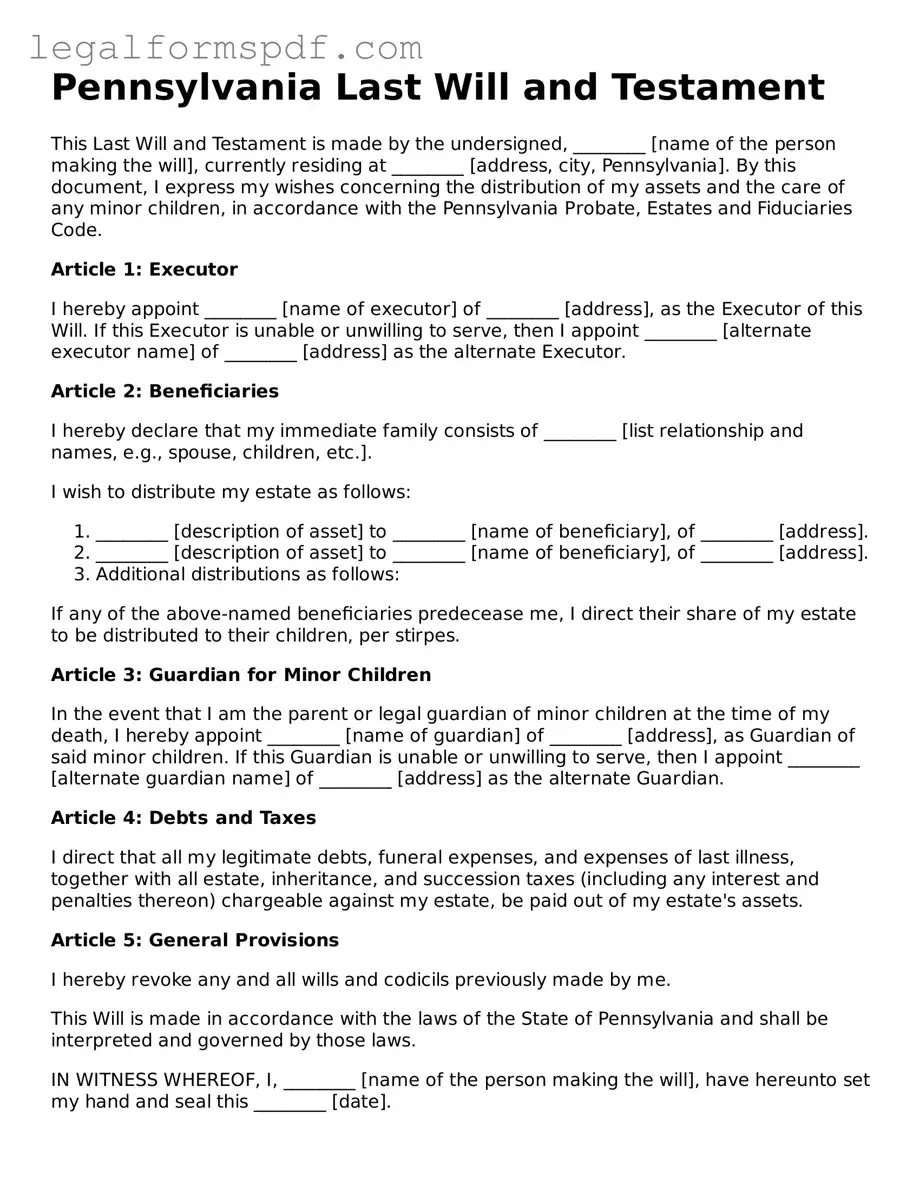

Document Example

Pennsylvania Last Will and Testament

This Last Will and Testament is made by the undersigned, ________ [name of the person making the will], currently residing at ________ [address, city, Pennsylvania]. By this document, I express my wishes concerning the distribution of my assets and the care of any minor children, in accordance with the Pennsylvania Probate, Estates and Fiduciaries Code.

Article 1: Executor

I hereby appoint ________ [name of executor] of ________ [address], as the Executor of this Will. If this Executor is unable or unwilling to serve, then I appoint ________ [alternate executor name] of ________ [address] as the alternate Executor.

Article 2: Beneficiaries

I hereby declare that my immediate family consists of ________ [list relationship and names, e.g., spouse, children, etc.].

I wish to distribute my estate as follows:

- ________ [description of asset] to ________ [name of beneficiary], of ________ [address].

- ________ [description of asset] to ________ [name of beneficiary], of ________ [address].

- Additional distributions as follows:

If any of the above-named beneficiaries predecease me, I direct their share of my estate to be distributed to their children, per stirpes.

Article 3: Guardian for Minor Children

In the event that I am the parent or legal guardian of minor children at the time of my death, I hereby appoint ________ [name of guardian] of ________ [address], as Guardian of said minor children. If this Guardian is unable or unwilling to serve, then I appoint ________ [alternate guardian name] of ________ [address] as the alternate Guardian.

Article 4: Debts and Taxes

I direct that all my legitimate debts, funeral expenses, and expenses of last illness, together with all estate, inheritance, and succession taxes (including any interest and penalties thereon) chargeable against my estate, be paid out of my estate's assets.

Article 5: General Provisions

I hereby revoke any and all wills and codicils previously made by me.

This Will is made in accordance with the laws of the State of Pennsylvania and shall be interpreted and governed by those laws.

IN WITNESS WHEREOF, I, ________ [name of the person making the will], have hereunto set my hand and seal this ________ [date].

Signature: ___________________________

Date: ________

Witness #1:

Name: ___________________________

Address: ___________________________

Signature: ___________________________

Date: ________

Witness #2:

Name: ___________________________

Address: ___________________________

Signature: ___________________________

Date: ________

This document was signed by ________ [name of the person making the will], the Testator, in the presence of the undersigned witnesses, who, in the presence of the Testator and each other, have hereunto subscribed our names this ________ [date]. The Testator declared this document to be his/her Last Will and Testament in our presence and appeared to us to be of sound mind and under no duress, fraud, or undue influence.

PDF Specifications

| Fact Number | Detail |

|---|---|

| 1 | The Pennsylvania Last Will and Testament must conform to the Pennsylvania Consolidated Statutes, Title 20, Chapters 25 and 27, governing wills and estate planning. |

| 2 | Individuals creating a Will in Pennsylvania, known as testators, must be at least 18 years old or legally married and must be of sound mind at the time of creating the document. |

| 3 | To be considered legally valid, the document must be signed by the testator in the presence of two witnesses, who must also sign the Will, attesting to the testator's declared mental state. |

| 4 | Witnesses to a Pennsylvania Will should not be beneficiaries to avoid conflicts of interest, although Pennsylvania law does not strictly disqualify beneficiary-witnesses. |

| 5 | The Will can dispose of the testator's real and personal property, including assets, cash, and other possessions, according to their wishes following their death. |

| 6 | Pennsylvania does not require wills to be notarized. However, a self-proving affidavit can be attached, requiring notarization, to simplify the probate process. |

| 7 | If a Will does not adhere to the statutory requirements, it may be declared invalid, in which case the estate would be distributed according to Pennsylvania intestacy laws. |

| 8 | It is recommended to regularly review and update the Last Will and Testament to reflect changes in the law, personal circumstances, and wishes regarding estate distribution. |

Instructions on Writing Pennsylvania Last Will and Testament

Creating a Last Will and Testament is a vital step in planning for the eventual distribution of your assets and the care of your loved ones after you pass away. The process requires careful attention to detail and clear direction to ensure your wishes are honored. The Pennsylvania Last Will and Testament form allows residents to specify how they want their possessions to be distributed, who will be the executor of their estate, and, if applicable, who will serve as guardian for their minor children. Below, you will find step-by-step instructions to help guide you through the process of filling out this important document.

- Begin by entering your full legal name at the top of the form to establish the document as your Last Will and Testament.

- Specify your city and county of residence to confirm the legal jurisdiction of the document.

- Appoint an executor for your estate by providing their full name and address. This person will be responsible for managing and distributing your assets according to the wishes outlined in your will.

- If you have minor children, appoint a guardian for them by listing the individual's full name and address. This step is crucial for parents, as it ensures your children will be cared for by someone you trust in the event of your passing.

- List all your assets, including property, and specify who you wish to inherit each asset. Be as detailed as possible to avoid any confusion or disputes among beneficiaries.

- If you are leaving specific items to certain individuals, such as family heirlooms or personal belongings, detail these bequests clearly to ensure each item goes to the intended recipient.

- Review the document carefully to ensure all information is accurate and reflects your wishes. Making any necessary revisions before finalizing the will is important.

- Sign the document in the presence of two witnesses. These witnesses must also sign the will, attesting that they observed you signing it and are of legal age and sound mind. Ensure that the witnesses are not beneficiaries in the will to avoid potential conflicts of interest.

- Date the document to establish when the will was executed. This date is important for legal purposes and can be critical in determining the validity of the will.

Once completed, keep the signed Last Will and Testament in a safe and accessible place. Inform your executor and a trusted family member or friend of its location to ensure your wishes are honored when the time comes. Remember, reviewing and updating your will periodically, especially after significant life changes such as marriage, divorce, the birth of a child, or the acquisition of substantial assets, is crucial to reflecting your current wishes and circumstances accurately.

Understanding Pennsylvania Last Will and Testament

What is a Last Will and Testament in Pennsylvania?

A Last Will and Testament in Pennsylvania is a legal document that allows an individual, known as the testator, to outline how they want their assets distributed, who will care for their minor children, and who will manage the estate until its final distribution upon their death. This document must comply with Pennsylvania state laws to be valid.

How can I make a Last Will and Testament valid in Pennsylvania?

To make a Last Will and Testament valid in Pennsylvania, the testator must be at least 18 years old and of sound mind. The will must be in writing and signed by the testator or by someone else in the testator’s presence and at their direction. Additionally, it requires the presence of at least two witnesses who must sign the will in the presence of the testator.

Do I need a lawyer to create a Last Will and Testament in Pennsylvania?

While it is not legally required to have a lawyer create a Last Will and Testament in Pennsylvania, it is highly recommended. A lawyer can help ensure that the will meets all state legal requirements, reflects the testator’s wishes accurately, and anticipates any legal challenges that could arise after the testator's death.

Can I change my Last Will and Testament after creating it in Pennsylvania?

Yes, you can change your Last Will and Testament at any time in Pennsylvania as long as you are of sound mind. This can be done by creating a new will that revokes the previous one or by making an amendment to the existing will, known as a codicil. Both changes need to be executed with the same formalities as the original will.

What happens if I die without a Last Will and Testament in Pennsylvania?

If you die without a Last Will and Testament in Pennsylvania, your estate will be distributed according to the state’s intestacy laws. Generally, this means that your assets will go to your closest relatives, starting with your spouse and children. If you have no living relatives by blood or marriage, your estate may escheat, or revert, to the state.

Common mistakes

Mistakes in completing a Last Will and Testament form in Pennsylvania can lead to significant confusion, delays, and even the potential for a will to be contested or considered invalid. Understanding these common pitfalls can help individuals ensure their final wishes are accurately documented and legally enforceable.

One common mistake is not adhering to the specific legal requirements of Pennsylvania law. For instance, Pennsylvania requires the will to be signed in the presence of two witnesses, who must also sign the document. These witnesses should not be beneficiaries of the will to avoid any appearance of a conflict of interest. Failing to meet these requirements can render the will invalid.

Another error involves unclear language or instructions. The language used in a will should be precise and unambiguous. Vague terms or conflicting instructions can lead to disputes among heirs, which may necessitate court intervention to resolve. This process can significantly delay the distribution of the estate and can also lead to outcomes that the decedent did not intend.

Many people also forget to update their will to reflect significant life changes. Marriages, divorces, births, deaths, and even substantial changes in assets should prompt a review and, if necessary, a revision of one's will. If these updates are not made, the will may not accurately reflect the individual's final wishes or current family structure, leading to potential legal challenges.

Failing to clearly identify beneficiaries is another mistake often seen in wills. It's crucial to be explicit about who the beneficiaries are, using full names and relationships, to prevent any confusion. Similarly, when naming an executor, it's important to choose someone who is both willing and able to undertake the responsibilities that come with this role, and to name an alternate in case the primary choice is unable or unwilling to serve.

A significant oversight is neglecting to consider digital assets. In today's digital age, many individuals have digital assets such as online accounts, social media, and digital currencies. It's important to include instructions on how to handle these assets in the will, though specific mechanisms for their management or transfer should also be considered and implemented.

Using a boilerplate or generic will form without customizing it to one's specific situation is another common error. Such forms may not account for the unique aspects of one's estate or family dynamics and might not be fully compliant with Pennsylvania law. It's beneficial to consult with a legal professional who can ensure the will is both personalized and compliant.

Lastly, some people mistakenly believe that a last will can cover all aspects of estate planning, neglecting tools like trusts that might be better suited for their needs. For example, a trust can provide for minor children or family members with special needs in ways a will alone cannot. Additionally, certain types of assets, such as life insurance or retirement accounts, are not governed by the will but by the beneficiary designations filed with the account.

By avoiding these common errors and consulting with a legal professional, individuals can create a comprehensive and valid Last Will and Testament that effectively communicates their final wishes and provides for the smooth distribution of their estate.

Documents used along the form

When you create a Last Will and Testament in Pennsylvania, it's just the first step in a comprehensive estate plan. While this document is crucial for outlining your wishes regarding your property, guardianship of minors, and your funeral arrangements, there are several other documents you should consider to ensure all aspects of your estate are covered. These additional documents can provide clarity, security, and ease for your loved ones during a difficult time. Below is a list of forms and documents often used alongside the Pennsylvania Last Will and Testament to create a full estate planning package.

- Advance Health Care Directive - This document, also known as a living will, allows you to state your wishes for medical treatment in scenarios where you are unable to communicate due to illness or incapacity. It can also designate a health care agent to make decisions on your behalf.

- Financial Power of Attorney - With this legal form, you can appoint someone you trust to manage your financial affairs. This can include paying bills, managing investments, and taking care of other financial matters, especially if you become incapacitated.

- Letter of Intent - While not a formal legal document, a letter of intent is helpful for providing additional information and personal wishes that don’t fit neatly into the Last Will and Testament. It can outline your desires for certain personal property, funeral arrangements, or even care for pets.

- Digital Assets Memorandum - This document can accompany your will to provide instructions and information about digital assets, like social media accounts, online banking, or a digital photo collection. It can specify who should access these assets and what should be done with them.

- Trust Documents - Depending on your estate planning needs, setting up a trust can be beneficial. Trust documents define how your assets should be managed and distributed, the roles of trustees, and the beneficiaries. Trusts are especially useful for avoiding probate or managing assets for minors.

- Funeral and Burial Instructions - Separate from a will or advance directive, these instructions can detail your specific wishes for your funeral and burial or cremation, including location, type of service, and handling of remains.

- Personal Property Memorandum - Some states allow this document to be included with your will, where you can list items of personal property and whom you wish to inherit them. It's more easily updated than a will and is useful for distributing sentimental items.

Ensuring you have a complete set of documents to complement your Pennsylvania Last Will and Testament is a crucial step in estate planning. Each document serves a unique purpose, offering peace of mind to both you and your loved ones by safeguarding not just your physical and financial assets, but also your personal wishes and health care preferences. Taking the time to create a thorough and well-rounded estate plan will help streamline the process for your executors and beneficiaries, making your wishes clear and easier to follow.

Similar forms

The Pennsylvania Last Will and Testament form shares similarities with the Living Will in that both documents deal with personal end-of-life decisions. While a Last Will and Testament outlines instructions for property distribution and the care of minor children after death, a Living Will specifies preferences regarding medical treatment when a person becomes incapacitated and cannot communicate their wishes. Both documents ensure a person's choices are respected, but they operate in different contexts.

Similar to the Last Will and Testament, a Trust document is used to manage a person's assets, but it comes into effect during their lifetime. The Trust can detail how assets should be used and distributed while the individual is alive and after their death, offering more control and flexibility over asset management. Unlike a Last Will, which goes through the probate process, a Trust can provide a smoother and sometimes private transition of assets.

The Health Care Power of Attorney, like the Last Will and Testament, allows an individual to make critical decisions in advance. This document appoints someone to make healthcare decisions on behalf of the individual if they are unable to do so. It differs from a Last Will in that it covers health care decisions only and is effective during the person's lifetime, not after their death.

Financial Power of Attorney shares the forward-thinking approach of the Last Will and Testament by allowing someone to manage financial affairs on another's behalf. This document becomes crucial if the individual becomes incapacitated. Unlike a Last Will, which becomes active after death, the Financial Power of Attorney is operational while the individual is alive but unable to manage their finances.

The Advance Directive is akin to the Last Will because it communicates a person's wishes concerning end-of-life care. It combines elements of a Living Will and Health Care Power of Attorney, detailing treatment preferences and appointing a health care agent. While the Last Will takes effect after death, the Advance Directive guides decisions made during the individual's life.

Executor Designation forms bear a resemblance to Last Wills as they both involve the appointment of an individual to carry out wishes stated in the document. While the Last Will names an executor to manage estate affairs after death, Executor Designation forms can be more specific or relate to particular aspects or assets within an estate, providing clear instructions for certain responsibilities.

The Property Deed Transfer document is related to the Last Will and Testament in the way it handles asset distribution. A Property Deed Transfer changes the ownership of property, and while it can be done while a person is living, a Last Will can dictate property transfer after the person's death. Both ensure the intentional passing of assets to chosen individuals or entities.

A Funeral Planning Declaration, much like a Last Will, outlines final wishes. While the Last Will may include instructions for asset distribution and care of dependents, a Funeral Planning Declaration specifies preferences for funeral arrangements and the handling of one's physical remains. It's a way to ease decision-making for loved ones during a difficult time.

Beneficiary Designations on accounts and policies directly complement the spirit of a Last Will by naming individuals or entities to receive assets such as life insurance proceeds, retirement accounts, and similar financial instruments upon the account holder's death. These designations typically bypass the probate process, much like aspects of a Trust, allowing for quicker distribution to beneficiaries.

Pet Trust documents have emerged as important legal tools for individuals looking to ensure their pets are cared for after their passing. Similar to a Last Will, which can include provisions for the care of minor children, a Pet Trust specifies arrangements for a pet’s care and maintenance, including the designation of a caregiver and financial provisions for the pet's needs. This reflects an acknowledgement of pets as valuable family members deserving of consideration in estate planning.

Dos and Don'ts

Creating a Last Will and Testament is a crucial step in planning for the future. In Pennsylvania, as elsewhere, it's important to take this task seriously to ensure your wishes are honored. To help guide you through this process, here's a list of things you should and shouldn't do when filling out your Last Will and Testament form.

What You Should Do:

- Read all instructions carefully before you begin to ensure you understand the steps involved in completing your will.

- Clearly identify your assets and to whom you wish to leave them to ensure there is no confusion about your intentions.

- Choose an executor whom you trust and who is capable of handling your estate's legal affairs after you pass away.

- Have witnesses present when you sign your will as required by Pennsylvania law to validate the document.

- Consider appointing a guardian for your minor children, if applicable, to ensure they are cared for by someone you trust.

- Review and update your will as necessary, especially after major life events such as marriage, divorce, birth of a child, or a significant change in assets.

- Ensure your will is stored in a safe place where your executor can access it when needed.

- Be specific about your wishes to prevent any potential disputes among family members or beneficiaries.

- Consider seeking legal advice if your estate is complex or if you have any questions about the legal requirements in Pennsylvania.

- Clearly date and sign your will in accordance with state laws to ensure it's legally valid.

What You Shouldn't Do:

- Don’t use vague language that could be open to interpretation or dispute.

- Don’t leave out important details such as the full names of beneficiaries or precise descriptions of assets.

- Don’t forget to designate alternates for your executor or beneficiaries in case your first choices are unable or unwilling to serve.

- Don’t sign your will without the required number of witnesses present, as it could be challenged on legal grounds.

- Don’t assume that verbal promises to family or friends will be honored without being explicitly stated in your will.

- Don’t fail to address guardianship for your minor children, leaving their care to be determined by the state.

- Don’t keep your will in a location where no one can find it after your death.

- Don’t ignore state-specific requirements, which can vary and affect the validity of your will.

- Don’t try to execute complex legal strategies within your will without professional advice, as this can lead to unintended consequences.

- Don’t neglect to review and revise your will regularly to reflect your current wishes and circumstances.

Misconceptions

When it comes to creating a Last Will and Testament in Pennsylvania, there are several misconceptions that people often hold. Understanding these misconceptions can provide clarity and ensure that the document accurately reflects one's wishes.

All your assets can be distributed through your Last Will and Testament. Many believe that a will can distribute all of their assets upon their passing. However, certain assets are not covered by a will. These include jointly owned property, life insurance proceeds, retirement accounts, and any assets held in a trust. These types of assets usually pass to the surviving co-owner or the named beneficiary, regardless of the will's instructions.

If you don't have a will, the state gets everything. This is a common fear, but it's not accurate. If a person dies without a will in Pennsylvania, they are considered to have died "intestate," and their assets are distributed according to state intestacy laws. Although the state's formula might not align with the person's wishes, the assets are distributed to the closest relatives, not to the state, unless there are no surviving kin, which is rare.

A handwritten will is not valid in Pennsylvania. Contrary to this belief, Pennsylvania does recognize handwritten (holographic) wills as long as they meet certain requirements. The key requirements include the necessity for the will to be entirely in the handwriting of the testator (the person making the will) and signed by the testator. However, ensuring it is correctly drafted to reflect one's wishes without ambiguity can be challenging, so it is typically advisable to seek professional assistance.

You need a lawyer to create a valid will in Pennsylvania. While it's true that seeking legal advice when creating a will can ensure that the document is accurate, comprehensive, and reflects your wishes, Pennsylvania law does not require a lawyer to draft a will. A person can create a valid will on their own as long as it meets the necessary legal requirements, including being of legal age, mentally competent, and the will being signed in front of witnesses. Nonetheless, due to the complexities involved in estate planning, consulting with a legal professional is often recommended.

Key takeaways

Filling out and effectively using the Pennsylvania Last Will and Testament form is an important step for ensuring your wishes are honored after your passing. Here are four key takeaways that can help make the process smoother and more effective:

- Understand all requirements: Pennsylvania law has specific requirements for a Last Will and Testament to be considered valid. These include the need for the person creating the will (testator) to be at least 18 years old and of sound mind, the presence of at least two witnesses during the signing, and that the will must be in writing. Familiarizing yourself with these requirements ahead of time can help avoid any issues later on.

- Be thorough in detailing your assets and their distribution: A clear and detailed description of your assets and how you wish them to be distributed can prevent disputes among beneficiaries. This includes listing out all personal property, real estate, bank accounts, and any other assets of value. Providing specific instructions on who gets what can help ensure your wishes are properly followed.

- Select a reliable executor: The executor of your will plays a crucial role in managing your estate after your death. It's vital to choose someone who is not only trustworthy but also capable of handling the responsibilities that come with the role. Consider discussing the duties with your chosen executor beforehand to ensure they are willing and able to take on the task.

- Consider consulting with a legal professional: While it is possible to fill out a Last Will and Testament on your own, consulting with a legal professional can provide you with peace of mind. An attorney can help ensure that your will is compliant with Pennsylvania law, and can also provide advice on more complex aspects of estate planning, such as setting up trusts or minimizing estate taxes.

More Last Will and Testament State Forms

Last Will and Testament Template Texas - It's a crucial element of estate planning, ensuring a person's legacy is honored and their assets are protected.

Georgia Last Will and Testament - Even if you do not have significant assets, a Last Will is important for making your final wishes known and legally recognized.

How to Make a Will in Illinois - For small business owners, a Last Will is vital for outlining succession plans, helping ensure the continuity or proper closure of the business.