Fillable Last Will and Testament Document for Ohio

In the heart of America, Ohio stands as a beacon for those aiming to secure their legacy through the decisive act of drafting a Last Will and Testament. This vital legal document, a cornerstone in estate planning, serves as the final word of an individual regarding the distribution of their possessions and the guardianship of their dependents after passing away. Ohio's specific regulations around the formulation of this document ensure that the resident's wishes are clearly understood and legally upheld. The form itself, while straightforward, requires careful consideration of its components, including designating beneficiaries, appointing an executor, and, if necessary, naming a guardian for minor children. Understanding the significance of each section and its potential impact on loved ones is paramount. Additionally, the state mandates surrounding the signing process, which include the necessity for witnesses or a notary, further underscore the importance of adherence to legal protocols to guarantee the will's validity. Ultimately, navigating the complexities of the Ohio Last Will and Testament form not only provides peace of mind for the individual drafting it but also acts as a protective measure for their family's future, ensuring that their final wishes are honored and conflicts potentially mitigated.

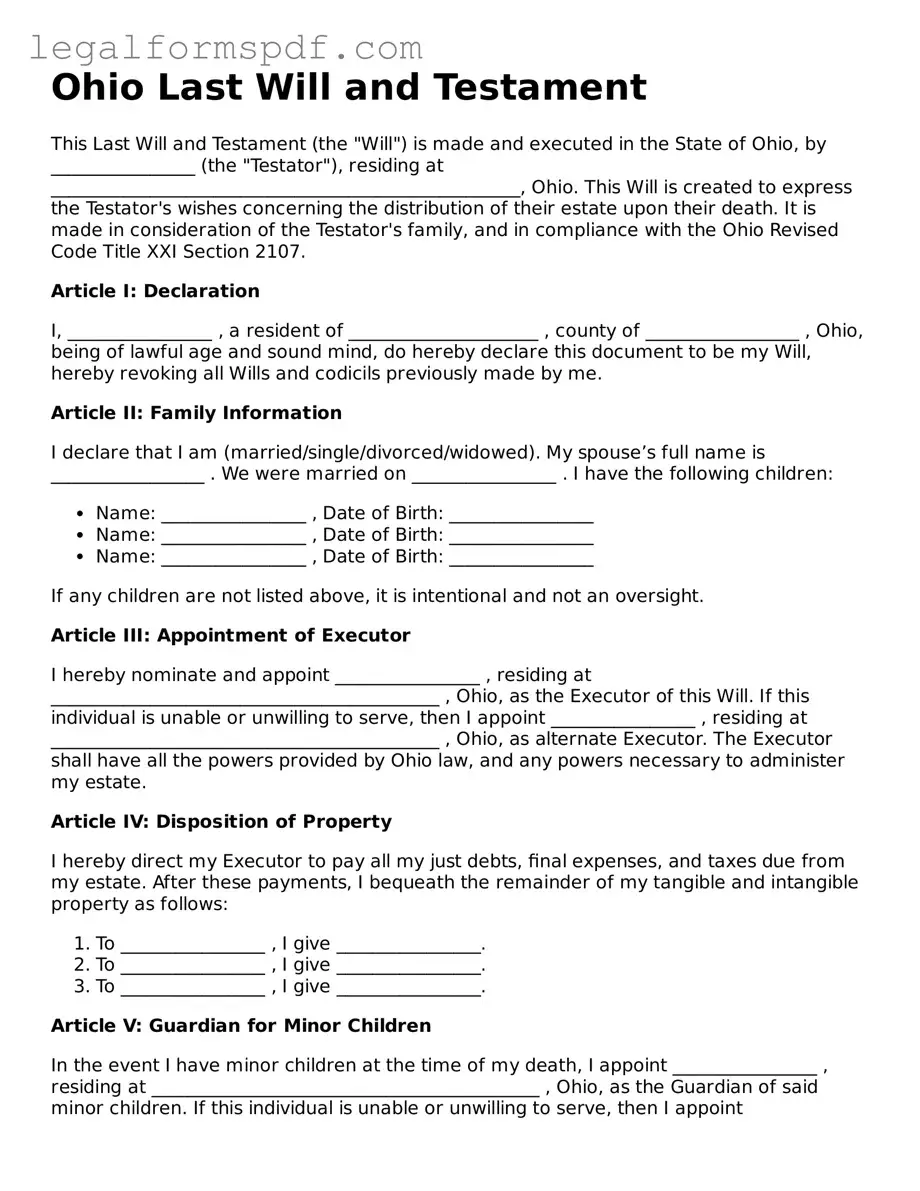

Document Example

Ohio Last Will and Testament

This Last Will and Testament (the "Will") is made and executed in the State of Ohio, by ________________ (the "Testator"), residing at ____________________________________________________, Ohio. This Will is created to express the Testator's wishes concerning the distribution of their estate upon their death. It is made in consideration of the Testator's family, and in compliance with the Ohio Revised Code Title XXI Section 2107.

Article I: Declaration

I, ________________ , a resident of _____________________ , county of _________________ , Ohio, being of lawful age and sound mind, do hereby declare this document to be my Will, hereby revoking all Wills and codicils previously made by me.

Article II: Family Information

I declare that I am (married/single/divorced/widowed). My spouse’s full name is _________________ . We were married on ________________ . I have the following children:

- Name: ________________ , Date of Birth: ________________

- Name: ________________ , Date of Birth: ________________

- Name: ________________ , Date of Birth: ________________

If any children are not listed above, it is intentional and not an oversight.

Article III: Appointment of Executor

I hereby nominate and appoint ________________ , residing at ___________________________________________ , Ohio, as the Executor of this Will. If this individual is unable or unwilling to serve, then I appoint ________________ , residing at ___________________________________________ , Ohio, as alternate Executor. The Executor shall have all the powers provided by Ohio law, and any powers necessary to administer my estate.

Article IV: Disposition of Property

I hereby direct my Executor to pay all my just debts, final expenses, and taxes due from my estate. After these payments, I bequeath the remainder of my tangible and intangible property as follows:

- To ________________ , I give ________________.

- To ________________ , I give ________________.

- To ________________ , I give ________________.

Article V: Guardian for Minor Children

In the event I have minor children at the time of my death, I appoint ________________ , residing at ___________________________________________ , Ohio, as the Guardian of said minor children. If this individual is unable or unwilling to serve, then I appoint ________________ , residing at ___________________________________________ , Ohio, as alternate Guardian.

Article VI: Personal Representative for Health Care

I appoint ________________ as my Personal Representative to make all necessary health care decisions on my behalf in accordance with Ohio's Living Will Declaration laws, in the event that I am unable to communicate my wishes directly.

Article VII: Signing

This Will was signed in the city of ____________________, Ohio, on the __________ day of ________________ , 20____ by the Testator, who declared it to be his/her Last Will and Testament in the presence of us, who, in his/her presence and at his/her request, and in the presence of each other, have hereunto subscribed our names as witnesses. The Testator appears to be of sound mind and under no duress or undue influence.

Testator's Signature: ___________________________

Date: ________________

Witness #1 signature: ___________________________

Printed Name: ________________

Address: ______________________________________

Witness #2 signature: ___________________________

Printed Name: ________________

Address: ______________________________________

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | Ohio Revised Code Section 2107 |

| Age Requirement | 18 years or older |

| Sound Mind Requirement | Must be of sound mind and capable of making decisions |

| Writing Requirement | Must be in writing to be legally binding |

| Signature Requirement | The will must be signed by the maker or at the maker's direction |

| Witness Requirement | Must be witnessed by two disinterested parties |

| Holographic Will Status | Not recognized unless it meets certain legal criteria |

| Nuncupative (Oral) Will Status | Limited recognition and only under specific circumstances |

| Self-Proved Will Provision | An affidavit can make a will self-proving to streamline probate |

Instructions on Writing Ohio Last Will and Testament

Creating a Last Will and Testament is a critical step in planning for the distribution of your estate (assets, property, and possessions) after you pass away. This document ensures that your wishes are understood and followed by those you leave behind. The state of Ohio has specific requirements for drafting a valid will, so it’s important to follow the guidelines closely to ensure your will is legally binding. Here are the steps you'll need to take to fill out the Ohio Last Will and Testament form properly.

- Begin by clearly identifying yourself: Start with your full legal name, residence, and any other identifying information that the form requests to establish your identity.

- Appointment of Executor: Choose an individual you trust to execute the terms of your will. Identify this person by full name and relationship to you, ensuring they are willing and able to take on this responsibility.

- Appointment of Guardians: If you have minor children or dependents, select a guardian to care for them should you pass away before they reach legal adulthood. State the guardian's full name and their relationship to your children or dependents.

- List your beneficiaries: Name every person or organization you wish to inherit your assets. Use their full names and specify their relationship to you or reason for inclusion.

- Allocate your assets: Clearly describe how you want your estate divided among the named beneficiaries. Include specific items or percentages of your estate to avoid any ambiguity.

- Signatures: Ohio law requires that you sign your will in the presence of two non-beneficiary witnesses, who must also sign the document. Ensure this process is completed correctly to validate your will.

- Notarization (Optional): While Ohio does not require your will to be notarized, doing so can help affirm its validity and may simplify the probate process.

Once you've completed these steps, you’ll have a completed Ohio Last Will and Testament. It's advisable to keep the original document in a safe, accessible place and inform your executor or close family member of its location. Regularly review and update your will to reflect any major life changes, such as marriage, divorce, the birth of a child, or a significant change in assets, to ensure it always reflects your current wishes.

Understanding Ohio Last Will and Testament

What is an Ohio Last Will and Testament?

An Ohio Last Will and Testament is a legal document that allows an individual, known as the testator, to specify how their possessions, property, and guardianship of minor children should be handled upon their passing. This document ensures that the testator’s final wishes are recognized and followed in the state of Ohio.

Who can create an Ohio Last Will and Testament?

In Ohio, any person over the age of 18 who is of sound mind and not under undue influence or duress can create a Last Will and Testament. This means the individual must fully understand the nature of the document they are creating and the implications of its contents.

Does an Ohio Last Will need to be notarized or witnessed?

While notarization is not strictly required for an Ohio Last Will and Testament to be legally valid, the will must be signed in the presence of at least two disinterested witnesses. These witnesses should not be beneficiaries of the will and must also sign the document, attesting to the testator’s soundness of mind and voluntary signing of the will.

What happens if someone dies without a Last Will in Ohio?

If a person dies without a Last Will in Ohio, their assets are distributed according to the state's intestacy laws. This typically means that the deceased's possessions and property are allocated to their closest relatives, beginning with spouses and children, and then extending outward to more distant relatives if necessary. This process may not reflect the deceased’s wishes and can lead to disputes among survivors.

Can an Ohio Last Will be changed or revoked?

Yes, an individual can change or revoke their Ohio Last Will at any time while they are still alive and of sound mind. To make changes, one can either add an amendment to the existing will, known as a codicil, which must be executed with the same formalities as the original will, or create a new will that states it revokes all previous wills and codicils.

How should an Ohio Last Will be stored?

It is crucial to store an Ohio Last Will in a safe and accessible place where the executor or personal representative can find it upon the testator's death. Many choose to keep their will in a fireproof safe, safety deposit box, or with an attorney. It’s advisable to inform the executor or a trusted family member of the will’s location to ensure it can be easily located when needed.

Common mistakes

One common mistake individuals make when filling out the Ohio Last Will and Testament form is failing to ensure that it is properly witnessed. Ohio law requires the presence of at least two disinterested witnesses to sign the document for it to be legally binding. Witnesses should not be beneficiaries of the will to avoid any conflict of interest. This oversight can lead to questions about the will's validity.

Another error is not being specific enough about the distribution of assets. Many individuals make the mistake of mentioning only general categories or being vague about who should receive what. This lack of specificity can cause disputes among heirs and may result in the distribution of assets in a manner not intended by the will maker.

A third mistake is neglecting to name an executor or not choosing an appropriate executor. The executor plays a crucial role in managing and distributing the estate according to the will's instructions. When no executor is named, or if the appointed person is not capable of handling the estate affairs effectively, the probate court will have to appoint someone, which can complicate and delay the process.

Some people also overlook the necessity to update their will. Life changes, such as marriage, divorce, the birth of children, or the death of a beneficiary, can significantly impact the relevance and effectiveness of a will. An outdated will may not reflect the current wishes of the individual, leading to unintentional outcomes.

Failing to include a residuary clause is another common oversight. This clause covers any assets not specifically mentioned elsewhere in the will. Without this clause, unspecified assets could become subject to Ohio's intestacy laws, potentially distributing them in a way the decedent did not intend.

Individuals often underestimate the need to clearly identify beneficiaries. Using vague descriptions or not using full legal names can create confusion and disputes among potential heirs. Clarity in identifying who is to inherit is paramount to ensuring that the will maker's wishes are honored.

Another misstep is attempting to address matters in the will that would be better handled through other legal means. For instance, certain types of property, like those held in joint tenancy or designated beneficiary accounts, do not pass through wills. Trying to bequeath these assets through a will can create unnecessary confusion and conflict.

Lastly, some individuals mistakenly believe they don't need a professional's guidance when drafting their Ohio Last Will and Testament. Although DIY will kits and online resources are available, they cannot replace the personalized advice and expertise of a licensed attorney. Without professional guidance, it's easy to make errors that could invalidate the will or lead to disputes among heirs.

Documents used along the form

Preparing a Last Will and Testament in Ohio is a significant step in ensuring your assets and loved ones are taken care of according to your wishes after you pass away. To complement this critical document and strengthen your estate plan, several other forms and documents are commonly utilized. These additional documents can provide clarity, security, and peace of mind for you and those you care about.

- Living Will Declaration: This document spells out your preferences regarding medical treatment if you become unable to communicate your wishes due to a severe health condition. It acts as a directive to physicians and family members about end-of-life care, such as life support and resuscitation efforts.

- Health Care Power of Attorney: It allows you to appoint someone to make medical decisions on your behalf if you're incapacitated and unable to do so yourself. This person, known as your health care agent, will ensure that your medical treatment preferences are respected.

- Financial Power of Attorney: This form grants a trusted individual the authority to handle your financial affairs. This could include managing, selling, or purchasing assets and handling your day-to-day financial matters. It becomes particularly useful if you become incapacitated and unable to make those decisions on your own.

- Living Trust: A living trust is an estate planning tool that helps manage your assets during your lifetime and distribute them after your death, often without the need for probate. You can name yourself as the trustee, maintaining control over your assets while you're alive and specifying a successor trustee to manage them after your passing.

Together with the Last Will and Testament, these documents form a comprehensive estate plan that addresses not only the distribution of your assets but also your care and financial management if you cannot make decisions for yourself. Estate planning can feel overwhelming, but taking it one step at a time and understanding the purpose of each document can make the process more manageable.

Similar forms

The Ohio Last Will and Testament form shares similarities with the Living Will, primarily in its function as a directive for personal preferences. Both documents are legal instruments that allow an individual to outline their wishes regarding personal decisions, with the Last Will and Testament focusing on the distribution of assets posthumously and the Living Will focusing on healthcare preferences in the event of incapacitation. Both serve as preemptive statements of an individual's choices, aimed at guiding families and courts when the person can no longer communicate their wishes due to death or incapacitation.

Similarly, the Durable Power of Attorney (DPOA) is akin to a Last Will and Testament as it grants someone else the authority to make decisions on an individual's behalf. Where a Last Will and Testament activates posthumously, detailing wishes for property distribution and care of dependents, a DPOA becomes effective during the grantor's lifetime, permitting an agent to make financial, legal, and sometimes healthcare decisions. Hence, both documents are preventive, ensuring that an individual's affairs are managed according to their wishes either in life or death.

Comparable to the Last Will and Testament, a Trust document outlines the management and distribution of an individual's assets. Trusts, like Wills, can specify asset distribution among beneficiaries but offer additional benefits such as avoiding probate court and providing more control over when and how beneficiaries receive their inheritance. The key difference lies in the Trust becoming effective during the creator's lifetime, whereas a Will takes effect after death.

The Healthcare Power of Attorney parallels the Last Will and Testament in its preparation for future incapacity. While the Last Will addresses financial affairs and property distribution after death, a Healthcare Power of Attorney appoints an agent to make healthcare decisions on the grantor's behalf if they become unable to. It reflects similar foresight in planning for circumstances where the principal cannot express their wishes.

An Advance Directive is another document related to the Last Will and Testament, combining aspects of a Living Will and a Healthcare Power of Attorney. It ensures a person's healthcare preferences are known and adhered to if they're incapacitated, complementing a Last Will's role of ensuring a person's property and dependent care wishes are followed after death.

The Financial Power of Attorney shares the preventive aspect of the Last Will and Testament, focusing, however, on financial and property matters during the individual's lifetime. By appointing an agent to handle financial decisions, it mirrors the Last Will's aim to manage and distribute assets according to the individual’s wishes, operating before the person's death as opposed to afterwards.

The Beneficiary Designations commonly found in insurance policies and retirement accounts also resemble aspects of the Last Will and Testament. These designations allow an individual to name who will receive benefits directly, bypassing the probate process similar to a Last Will. Though these designations are more narrowly focused, they work alongside Wills in forming a comprehensive estate plan.

Last but not least, the Transfer on Death Deed (TODD) serves a similar estate planning function as the Last Will, albeit for real estate. It allows property owners to name beneficiaries for their real estate, effective upon their death, thus avoiding probate like a Trust. While a TODD applies solely to real estate, a Will is more encompassing, addressing a broader scope of assets and personal matters.

Dos and Don'ts

When filling out the Ohio Last Will and Testament form, it's important to be mindful of the steps that should be taken to ensure it's completed accurately and effectively. Below are several dos and don'ts to consider:

Do:- Review Ohio state laws: Familiarize yourself with the specific requirements for Last Wills in Ohio. This includes understanding the necessary witness procedures and other legality aspects.

- Be clear and concise: Use clear language to specify your wishes. Avoid ambiguity to ensure your intentions are understood.

- Appoint a reliable executor: Choose someone you trust to carry out the provisions of your will. This person should be responsible and trustworthy.

- Sign in front of witnesses: Ohio law requires your Last Will to be signed in the presence of witnesses. Make sure they are legally qualified to act as witnesses.

- Keep it in a safe place: Once signed, store your Last Will in a secure location where your executor can access it when needed.

- Regularly update it: Life changes such as marriage, divorce, or the birth of a child can affect your Last Will. Update it to reflect any major life changes.

- Consult with a legal professional: Consider seeking advice from a lawyer to ensure your Last Will complies with Ohio law and accurately reflects your wishes.

- Use vague language: Avoid leaving any part of your Last Will open to interpretation. Be specific about your wishes and the distribution of your assets.

- Forget to name a guardian for minor children: If you have minor children, be sure to appoint a guardian in your will. This is crucial for their care should something happen to you.

- Sign without witnesses: Your Last Will must be signed in the presence of witnesses to be legally valid in Ohio. Signing it alone can make it invalid.

- Leave out important assets: Make sure all significant assets are included in your Last Will. This helps prevent potential disputes among heirs.

- Rely solely on a will for complex estate planning: Consider other estate planning tools, such as trusts, for more complex situations or to provide more specific directives.

- Fail to consider digital assets: In today’s digital age, don’t overlook including instructions on how to handle your digital assets, such as social media accounts and digital files.

- Delay making a will: Don’t put off creating your Last Will. It’s an important part of planning for the future and ensuring your wishes are respected.

Misconceptions

When it comes to preparing a Last Will and Testament in Ohio, there are several misconceptions that can lead to confusion and missteps. Understanding the truth behind these common misunderstandings is crucial for ensuring your wishes are honored and your estate is handled according to your intentions.

A lawyer is required to draft a Last Will and Testament in Ohio. While legal advice can be beneficial, especially for complex estates, Ohio law does not mandate the use of a lawyer to create a valid will. Individuals can prepare their own will, provided it meets Ohio's legal requirements, including being over 18, of sound mind, and having the will signed by two disinterested witnesses.

Oral wills are legally binding in Ohio. In reality, for a will to be recognized as legally valid in Ohio, it must be in writing. While some states may recognize oral wills under very specific conditions, Ohio requires a written document that is signed and witnessed according to state laws.

Ohio law automatically divides your property equally among your children. This misconception overlooks the importance of specifying your wishes in a will. Without a will, Ohio's intestacy laws come into play, which may not distribute your assets in a way you would have chosen. Creating a will allows you to detail exactly how you want your estate to be divided among your beneficiaries.

A Last Will and Testament in Ohio can also designate a guardian for my minor children. This is actually true and not a misconception. A will is not only a tool for distributing your property but also an important way to make known your wishes regarding who should care for your minor children should you pass away.

Once created, a will in Ohio does not need to be updated. People's circumstances and relationships change over time, which can affect how they want their estate to be handled. It's advisable to review and possibly update your will after major life events such as marriage, divorce, the birth of a child, or significant changes in your financial situation to ensure it still reflects your current wishes.

Key takeaways

Creating a Last Will and Testament is a crucial step in ensuring your assets are distributed according to your wishes after your passing. When it comes to filling out and using an Ohio Last Will and Testament form, understanding the legal requirements and best practices can streamline the process, making it less daunting. Here are five key takeaways to guide you through this essential task:

- Legal Requirements: Ohio law mandates that the person creating the will, known as the testator, be at least 18 years old and of sound mind. The document must be written, signed by the testator, and witnessed by at least two individuals who are not beneficiaries in the will and are at least 18 years old. These witnesses must sign the will in the presence of the testator and each other, affirming the testator's declaration of the document as their last will.

- Specificity is Key: To avoid ambiguity and potential disputes among heirs, clearly identify all beneficiaries and specify the assets each is to receive. If certain assets are not mentioned or if beneficiaries are not clearly named, the distribution of these assets may be determined by state laws, potentially against the testator's wishes. Precise descriptions of property and clear identification of individuals are imperative.

- Choosing an Executor: The executor is responsible for managing the estate, settling debts, and distributing assets as outlined in the will. It's important to choose someone who is both willing and capable of fulfilling these duties. The named executor should be someone you trust implicitly, such as a close family member or friend, or a professional like an attorney or accountant. Remember, an executor can decline the role, so having an alternate is wise.

- Regular Updates: Life changes—such as marriages, divorces, births, and deaths—can affect your last will and testament. Review and update your will as these changes occur to ensure it reflects your current wishes. Failing to update your will could result in the distribution of your assets in a manner that no longer aligns with your intentions.

- Seeking Professional Help: While templates and online resources can provide a starting point, consulting with a legal professional who is knowledgeable about Ohio wills and estate planning laws is invaluable. They can offer personalized advice, ensure your will complies with Ohio laws, and help you address complex issues such as the appointment of guardians for minor children or the setup of trusts. This step can prevent mistakes that might invalidate the document or cause disputes among heirs.

Properly filling out and using an Ohio Last Will and Testament form isn't just a legal procedure; it's a critical component of estate planning that can ensure your assets are distributed according to your wishes, safeguarding your legacy and providing clarity and support to your loved ones during a difficult time.

More Last Will and Testament State Forms

Last Will and Testament Template Texas - Regularly reviewing and updating a Last Will is important, especially after major life events like marriage or the birth of a child.

New York State Will Template - By naming an executor, the document ensures that there is a trusted individual in charge of final affairs.

Georgia Last Will and Testament - It simplifies the legal process for your family, reducing the burden on them during a time of grieving and adjustment.