Fillable Last Will and Testament Document for North Carolina

Creating a Last Will and Testament is a critical step for residents of North Carolina who wish to ensure their wishes are respected regarding the distribution of their assets after their passing. This legal document, tailored specifically to the regulations and requirements of North Carolina, allows individuals to outline how their property, whether it's real estate, personal belongings, or financial assets, should be handed down to family, friends, or charitable organizations. It also lets people choose an executor who will oversee the process of distributing assets and managing the estate according to the directive laid out in the will. For those with minor children, the document provides an opportunity to appoint a guardian, ensuring their minors are cared for by a trusted adult. By completing this form, North Carolinians can avoid the complexities and delays that often accompany the probate process when there is no will in place, thus giving them peace of mind knowing that their final wishes will be honored. Furthermore, the North Carolina Last Will and Testament form is designed to be straightforward, simplifying the process of creating a legally binding document that adheres to state-specific nuances and legal requirements.

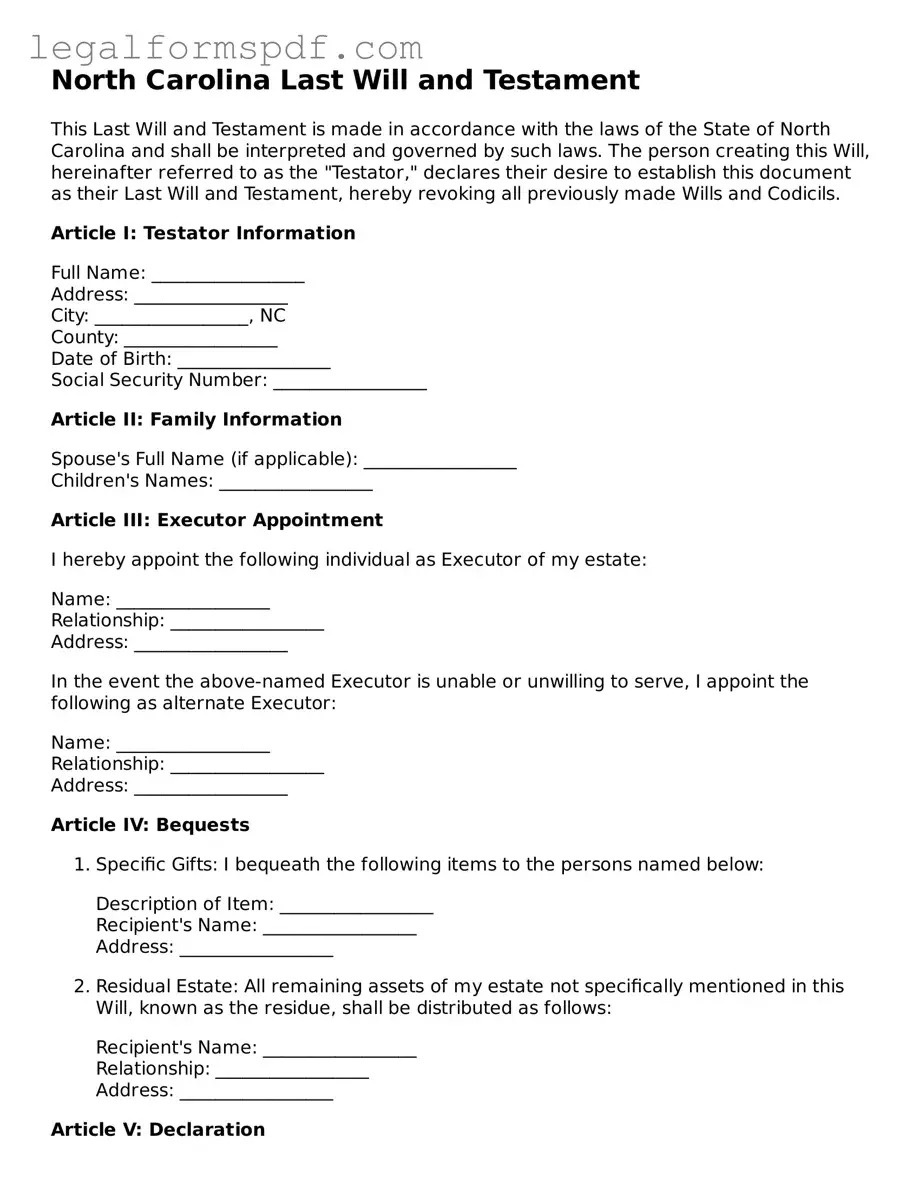

Document Example

North Carolina Last Will and Testament

This Last Will and Testament is made in accordance with the laws of the State of North Carolina and shall be interpreted and governed by such laws. The person creating this Will, hereinafter referred to as the "Testator," declares their desire to establish this document as their Last Will and Testament, hereby revoking all previously made Wills and Codicils.

Article I: Testator Information

Full Name: _________________

Address: _________________

City: _________________, NC

County: _________________

Date of Birth: _________________

Social Security Number: _________________

Article II: Family Information

Spouse's Full Name (if applicable): _________________

Children's Names: _________________

Article III: Executor Appointment

I hereby appoint the following individual as Executor of my estate:

Name: _________________

Relationship: _________________

Address: _________________

In the event the above-named Executor is unable or unwilling to serve, I appoint the following as alternate Executor:

Name: _________________

Relationship: _________________

Address: _________________

Article IV: Bequests

- Specific Gifts: I bequeath the following items to the persons named below:

- Residual Estate: All remaining assets of my estate not specifically mentioned in this Will, known as the residue, shall be distributed as follows:

Description of Item: _________________

Recipient's Name: _________________

Address: _________________

Recipient's Name: _________________

Relationship: _________________

Address: _________________

Article V: Declaration

I, _________________, the Testator, declare under penalty of perjury under the laws of the State of North Carolina that this is my Last Will and Testament and that I sign it willingly, that I execute it as my free and voluntary act for the expressed purposes herein stated, and that I am of sound mind and under no constraint or undue influence.

Date and Signature

Date: _________________

Testator's Signature: _________________

Printed Name: _________________

Witnesses

This Will was signed in our presence by the Testator, declaring it to be their Last Will and Testament. We, in the Testator’s presence and at the Testator’s request, and in the presence of each other, have hereunto subscribed our names as witnesses.

Witness 1 Signature: _________________

Printed Name: _________________

Address: _________________

Witness 2 Signature: _________________

Printed Name: _________________

Address: _________________

PDF Specifications

| Fact Name | Description |

|---|---|

| Legal Requirement for Wills | In North Carolina, the person creating a will (testator) must be at least 18 years old and of sound mind. |

| Witness Requirement | A will must be signed by at least two competent witnesses, who are present at the same time to witness the testator signing the will or acknowledging the will. |

| Holographic Wills | North Carolina recognizes holographic wills, which are wills entirely handwritten and signed by the testator, without the need for witnesses. |

| Governing Laws | The North Carolina General Statutes, Chapter 31, specifically governs the requirements and validity of Last Will and Testaments in the state. |

Instructions on Writing North Carolina Last Will and Testament

Filling out a Last Will and Testament is a critical step for individuals in North Carolina who wish to ensure their property and assets are distributed according to their wishes upon their passing. This document allows individuals to specify beneficiaries for their estate, appoint an executor to manage the estate's affairs, and, if applicable, nominate guardians for any minor children. The process requires attention to detail and accuracy to ensure the document reflects the individual's desires and complies with North Carolina laws. Here are the steps needed to fill out a North Carolina Last Will and Testament form:

- Collect all necessary information: Before starting, gather necessary details such as full names and addresses of beneficiaries, specifics of assets, and the name of the person you wish to appoint as your executor.

- Start by entering your full name and address: At the beginning of the form, specify your name and the address where you currently live, to identify yourself as the testator (the person making the will).

- Appointment of Executor: Designate an individual whom you trust to carry out the instructions in your will. Include the executor's full name and address.

- Designation of Guardians: If you have minor children, nominate a guardian for them, and provide the guardian's full details. This step is crucial to ensure your children are cared for by someone you trust in the event you can no longer do so.

- Detail the distribution of your assets: Specify how you wish to distribute your assets, listing specific items and the names of their respective beneficiaries. Be as clear and detailed as possible to avoid confusion.

- Signatures: Sign and date the will in the presence of two witnesses, who are not beneficiaries of the will. These witnesses must also sign and date the document, affirming they witnessed your signature.

- Notarization (Optional): While not a requirement in North Carolina, having your will notarized can add an extra layer of validity. If you choose to do so, a notary public must witness the signing and notarize the document.

After completing these steps, your Last Will and Testament should accurately reflect your wishes regarding the distribution of your estate. To ensure it remains valid and enforceable, keep the document in a safe, but accessible place, and inform your executor of its location. It's also wise to review and, if necessary, update your will regularly or after major life events such as marriage, divorce, the birth of a child, or significant changes in your financial situation.

Understanding North Carolina Last Will and Testament

What is a Last Will and Testament?

A Last Will and Testament is a legal document that allows you to express your wishes regarding the distribution of your property and the care of any minor children after your death.

Do I need a Last Will and Testament in North Carolina?

While not legally required, having a Last Will and Testament is strongly advised. It ensures your property is distributed according to your wishes and provides clear instructions for the care of minor children, if applicable.

How can I make a Last Will and Testament in North Carolina?

To create a valid Last Will and Testament in North Carolina, you must be at least 18 years old and of sound mind. The document must be in writing, signed by you, and witnessed by at least two people who are present at the same time and understand that the document is your will.

Can I write my own Last Will and Testament in North Carolina?

Yes, you can write your own Last Will and Testament in North Carolina. However, to ensure it is valid and meets all legal requirements, it is advisable to consult with a legal professional.

What should be included in a Last Will and Testament?

A Last Will and Testament should include your full name and address, a declaration that the document is your will, the names of beneficiaries and their relationship to you, specific bequests, the name of an executor, the name of a guardian for any minor children, and any other instructions or wishes you have.

Do I need a lawyer to make a Last Will and Testament in North Carolina?

While you are not required to have a lawyer to create a Last Will and Testament in North Carolina, consulting one can help ensure your will complies with state law, accurately reflects your wishes, and considers all legal implications.

What happens if I die without a Last Will and Testament in North Carolina?

If you die without a Last Will and Testament in North Carolina, your property will be distributed according to the state's intestacy laws. These laws may not distribute your property in the way you would have chosen.

Can a Last Will and Testament in North Carolina be changed?

Yes, a Last Will and Testament in North Carolina can be changed as long as you are alive and of sound mind. Changes are typically made through a codicil, which is an amendment to your will, or by creating a new will.

How do I select an executor for my Last Will and Testament?

When choosing an executor, select someone you trust to handle your affairs after you're gone. This can be a family member, friend, or professional. It's important they are willing and able to serve in this role. You may also name a secondary executor as a backup.

What should I do with my Last Will and Testament after signing it?

After signing your Last Will and Testament, keep it in a safe place, such as a fireproof safe or safety deposit box. Inform your executor or a trusted family member of its location to ensure it can be easily found after your death.

Common mistakes

When filling out a Last Will and Testament form in North Carolina, many individuals make mistakes that could have lasting consequences on the distribution of their estate. One common error is neglecting to designate an executor or failing to choose an alternate executor. The executor plays a critical role in managing and distributing the assets of an estate. Without a clearly named executor or an alternate in case the primary executor cannot serve, the courts may need to appoint one, potentially delaying the process and adding unnecessary complications.

Another significant oversight is not specifying guardians for minor children. This is particularly crucial for parents with dependents under the age of 18. Should something happen to both parents without a clear guardian outlined in the will, the decision is left to the court, which may not align with the deceased's wishes. Clearly designating a guardian and an alternate ensures that the children's care is entrusted to someone the parents have chosen.

Many individuals also fail to provide clear instructions for the distribution of specific assets. This vagueness can lead to disputes among beneficiaries. It’s essential to be specific about who gets what, especially when it comes to items of sentimental or significant value. By being precise in detailing the distribution of assets, it can help prevent conflict and ensure that wishes are followed.

Not properly signing or witnessing the document is another prevalent mistake. In North Carolina, a will must be signed in the presence of two competent witnesses, who must also sign the will in the presence of the creator and each other. Overlooking this requirement can render the will invalid, disregarding the decedent's final wishes and defaulting to state laws to distribute the estate.

A further error includes the omission of a residuary clause. This clause addresses the distribution of any remaining assets not specifically mentioned in the will. Without this, any unassigned assets could become subject to intestate succession laws, possibly countering the decedent's intentions for those assets.

Some people mistakenly believe that a will covers all aspects of their estate, neglecting to consider non-probate assets like life insurance policies or retirement accounts. These assets typically pass to named beneficiaries outside of the will, and failing to coordinate these designations with the overall estate plan can lead to unforeseen outcomes.

Last, but not least, individuals often neglect to update their will to reflect major life changes such as marriage, divorce, the birth of children, or the death of a beneficiary. An outdated will can lead to assets being distributed in ways that no longer align with the testator's desires or intentions. It is crucial to review and, if necessary, revise a will when significant life events occur to ensure it accurately reflects current wishes.

Avoiding these common mistakes can help ensure that a Last Will and Testament in North Carolina accurately reflects the wishes of the person creating the will, and can make the administration of the estate smoother and more in line with intended outcomes.

Documents used along the form

Preparing a Last Will and Testament is a significant step in managing one's estate, ensuring that personal wishes are honored following one’s passing. In North Carolina, alongside the Last Will and Testament, several other key documents are commonly used to fully articulate one’s desires regarding their estate, health, and financial affairs. These documents play vital roles in comprehensive estate planning, offering clarity, and peace of mind for both the individual and their loved ones.

- Durable Power of Attorney: This document enables an individual to appoint someone they trust to manage their financial affairs either immediately or in the event they become incapacitated.

- Health Care Power of Attorney: It allows an individual to appoint a trusted person to make healthcare decisions on their behalf should they become unable to communicate their wishes directly.

- Living Will: Also known as an advance directive, it outlines a person's wishes regarding the types of medical treatment they want to receive or refuse, particularly in end-of-life situations.

- Trust Agreement: Trusts are established to provide legal protection for the trustor's assets, to ensure those assets are distributed according to the trustor's wishes, and sometimes to avoid or minimize estate taxes and probate.

- Beneficiary Designations: Often used with retirement accounts and life insurance policies, these designations specify who will receive the assets in these accounts upon the account holder's death.

- Tangible Personal Property List: This document complements a will by listing items of personal property (jewelry, art, collectibles) and their intended recipients.

- Letter of Intent: A document that provides additional personal instructions and desires that aren't formally covered in the will, such as funeral arrangements or specific bequests.

- Digital Asset Trust: This relatively new type of document gives instructions and authority for managing digital assets, including social media accounts, digital files, and cryptocurrencies.

- Guardianship Designation: In the case of parents with minor children, this document specifies the chosen guardian for their children in the event of the parents' untimely demise.

Together with a Last Will and Testament, these documents form the backbone of a solid estate plan. Creating a comprehensive estate plan is not merely about distributing assets; it's about making decisions today that will protect one's interests and those of loved ones in the future. Everyone’s situation is unique, so it’s advisable to consult with a legal professional to ensure your estate planning needs are fully met, tailored to your specific circumstances and in compliance with North Carolina laws.

Similar forms

The North Carolina Last Will and Testament form is similar to a Living Will in that both documents allow individuals to outline their wishes regarding personal decisions. A Last Will and Testament directs the distribution of an individual's property after death, whereas a Living Will specifies medical care preferences in case the individual becomes incapacitated and cannot express wishes themselves. Both documents serve to communicate the individual's decisions ahead of time, ensuring that personal choices are respected.

Comparable to a Last Will and Testament, a Trust Agreement is another estate planning tool that specifies how an individual's assets should be managed and distributed. However, a Trust Agreement, unlike a Last Will, goes into effect during the individual's lifetime and can continue after death. Both documents help manage an individual's assets, but a Trust also offers privacy since it does not go through public probate like a Last Will.

Similarly, a Durable Power of Attorney is an estate planning document that, like a Last Will and Testament, can affect control over an individual’s affairs. It allows someone to appoint an agent to manage their financial and legal affairs while they are alive, possibly if they become incapacitated. Unlike a Last Will, which takes effect after death, a Durable Power of Attorney operates during the individual’s lifetime, ceasing upon their death.

A Health Care Proxy shares similarities with a Last Will and Testament as it is a preemptive legal document designed to outline a person’s wishes regarding health decisions, akin to how a Last Will outlines wishes for asset distribution post-mortem. A Health Care Proxy specifically activates when the individual cannot make decisions due to incapacity, focusing on health care decisions rather than the distribution of possessions.

An Advance Directive, similar to a Last Will and Testament, is a document that allows individuals to state their wishes concerning medical treatment and care in advance. While a Last Will provides instructions for after the individual's death, an Advance Directive covers decisions about the individual’s own health care while still alive, especially in situations where they cannot make decisions for themselves. Both documents guide future actions based on the individual's stated wishes.

The Executor's Deed, while distinct in purpose, bears resemblance to a Last Will and Testament by being involved in the process of managing and transferring assets after an individual's death. This deed allows the executor, appointed in the Last Will, to transfer property to the beneficiaries. It is a key tool in executing the instructions laid out in a Last Will, serving to legalize the transfer of real property as directed by the deceased.

A Beneficiary Designation, often used with retirement accounts or life insurance policies, is akin to a Last Will and Testament in that it dictates how specific assets will be distributed upon the account holder's death. Unlike a Last Will, which can cover a wide range of assets, a Beneficiary Designation is specific to the account or policy it accompanies but directly ensures the intended transfer of those assets without the necessity of probate.

A Letter of Instruction is an informal document that, like a Last Will and Testament, provides guidance and wishes regarding an individual's estate. However, it doesn't have the legal authority of a Last Will. It can include wishes about funeral arrangements or how specific items should be distributed, offering a complementary piece to the more formal Last Will by covering aspects not typically included or appropriate in a legal will.

Dos and Don'ts

Creating a Last Will and Testament is a responsible step towards ensuring your wishes are honored after you pass away. When filling out the North Carolina Last Will and Testament form, there are specific do's and don'ts to keep in mind. This guidance will help you avoid common mistakes and ensure your document is legally binding and clear in its intent.

- Do thoroughly read through the entire form before you begin to fill it out. Understanding the structure and requirements can help you prepare the necessary information.

- Do use clear and concise language to avoid any ambiguity. Your wishes should be easily understood by anyone who reads your will.

- Do have the document witnessed as required by North Carolina law. Typically, this means having two individuals witness you signing your will. These individuals should not be beneficiaries in the will to avoid potential conflicts of interest.

- Do consider having your will notarized. In North Carolina, a will that is notarized can be a "self-proving" will, which can simplify the probate process.

- Do review and update your will regularly, especially after significant life events such as marriage, divorce, the birth of a child, or the acquisition of substantial assets.

- Don't use vague terms when identifying people or assets. Clearly specify the full names of individuals and detailed descriptions of properties or accounts.

- Don't attempt to use the will to handle matters not typically covered by a Last Will and Testament, such as instructions for your funeral or arrangements for a living trust.

- Don't forget to sign and date the will. An unsigned will is not enforceable under North Carolina law.

By following these guidelines, you can ensure that your Last Will and Testament reflects your wishes accurately and complies with North Carolina laws. If you're uncertain about any part of the process, consulting with a legal professional specializing in estate planning can provide clarification and peace of mind.

Misconceptions

When discussing Last Will and Testament forms, particularly those for North Carolina, there are several common misconceptions. Many people misunderstand the requirements, effectiveness, and legal standards associated with these crucial documents. Dispelling these myths is essential for ensuring one's final wishes are legally recognized and properly executed.

- Online Forms are Always Valid: A widespread misconception is that any Last Will and Testament form downloaded from the internet will automatically be valid in North Carolina. For a will to be legally binding in North Carolina, it must meet specific requirements, such as being signed by the testator (the person making the will) in the presence of two witnesses. Simply filling out an online form without following these legal formalities can result in an invalid will.

- No Need for Witnesses if Notarized: Another common mistake is the belief that a will does not need to be witnessed if it is notarized. In North Carolina, while notarization can lend additional credibility to the document, the law still requires the presence of two competent witnesses to the signing of the will. Notarization alone does not substitute for this requirement.

- Oral Wills are Just as Good: Some people think that oral wills, also known as "nuncupative" wills, hold the same weight as written wills. In North Carolina, oral wills are only recognized in very limited circumstances, such as by a member of the armed forces while in active service. For the general public, a written will is necessary for it to be considered valid and enforceable.

- Wills Only Distribute Personal Property: It's a common belief that Last Will and Testament forms are solely for the distribution of personal items, like jewelry or family heirlooms. However, in North Carolina, a will can dictate the distribution of all kinds of property, including real estate, bank accounts, and other assets. It's a legal tool that covers a broad range of property types, not just personal belongings.

Key takeaways

Preparing a Last Will and Testament is a significant step in managing your affairs and ensuring your wishes are honored. For those residing in North Carolina, understanding the nuances of filling out and using the state's specific form is crucial. Below are some key takeaways to guide you through this process:

- Legal Requirements: In North Carolina, the person making the will (testator) must be at least 18 years old and of sound mind. The will must be in writing and signed by the testator or by another person in the testator’s presence and under the testator’s direction. Moreover, it must be witnessed by at least two competent witnesses who are present during the signing.

- Choice of Executor: Naming a reliable executor is essential. This individual will manage your estate's distribution according to your will. Their powers and duties can range from paying off debts to distributing assets, so choose someone who is both trustworthy and capable.

- Specificity in Bequests: Be as specific as possible when detailing your bequests (gifts of property). Whether it’s personal belongings, monetary assets, or real estate, clear instructions can prevent misunderstandings and legal challenges among beneficiaries.

- Naming Guardians for Minor Children: If you have minor children, naming a guardian in your will is of paramount importance. This ensures your children are cared for by the individual(s) you trust most in the event of your passing. Without such a designation, the court will make this decision on your behalf.

- Regular Updates: Life changes such as marriage, divorce, births, and deaths can affect your will. Regular updates ensure your will reflects your current wishes and circumstances. Failing to update your will can lead to the distribution of your estate in a manner that no longer aligns with your desires.

- Seek Professional Advice: While filling out the North Carolina Last Will and Testament form may seem straightforward, consulting with a legal professional can offer invaluable peace of mind. An expert can provide guidance tailored to your specific situation, helping to avoid common pitfalls that could otherwise undermine your will’s validity or the distribution of your estate.

In conclusion, taking the time to properly prepare and update your Last Will and Testament in North Carolina not only protects your assets but also provides clear guidance to your loved ones after you're gone. By adhering to the legal requirements and carefully considering your decisions regarding executors, guardians, and bequests, you can help ensure your final wishes are honored exactly as you intended.

More Last Will and Testament State Forms

Free Last Will and Testament Ohio - A safeguard for a person's belongings, ensuring they are given to the appointed heirs or organizations.

How to Make a Will in Illinois - It's crucial for individuals with dependents or significant assets to have a Last Will to ensure their loved ones are provided for as intended.

Last Will and Testament Form Pennsylvania - An arrangement that can bypass the lengthy and public process of probate if properly constructed.