Fillable Last Will and Testament Document for New York

A Last Will and Testament form is a critical document for anyone living in New York or indeed anywhere, as it outlines one's final wishes regarding the distribution of their assets, care of any minor children, and any specific final instructions one may have upon their passing. It's a powerful tool that ensures your wishes are known and considered legally binding once properly executed in accordance with New York State law. For residents of New York, creating a Last Will and Testament involves understanding the specifics of state laws to ensure the document is valid. This includes requirements such as the testator's legal capacity, the presence of witnesses during signing, and the clear declaration that the document is indeed the testator's will. Different aspects, such as choosing an executor to administer the estate, the inclusion of a residuary clause to cover any remaining assets not specifically mentioned, and considerations for any charitable donations or special instructions, should be thoroughly considered when drafting this document. It stands not just as a statement of one’s final wishes but as an essential component of estate planning that can significantly ease the process for loved ones during a time of loss.

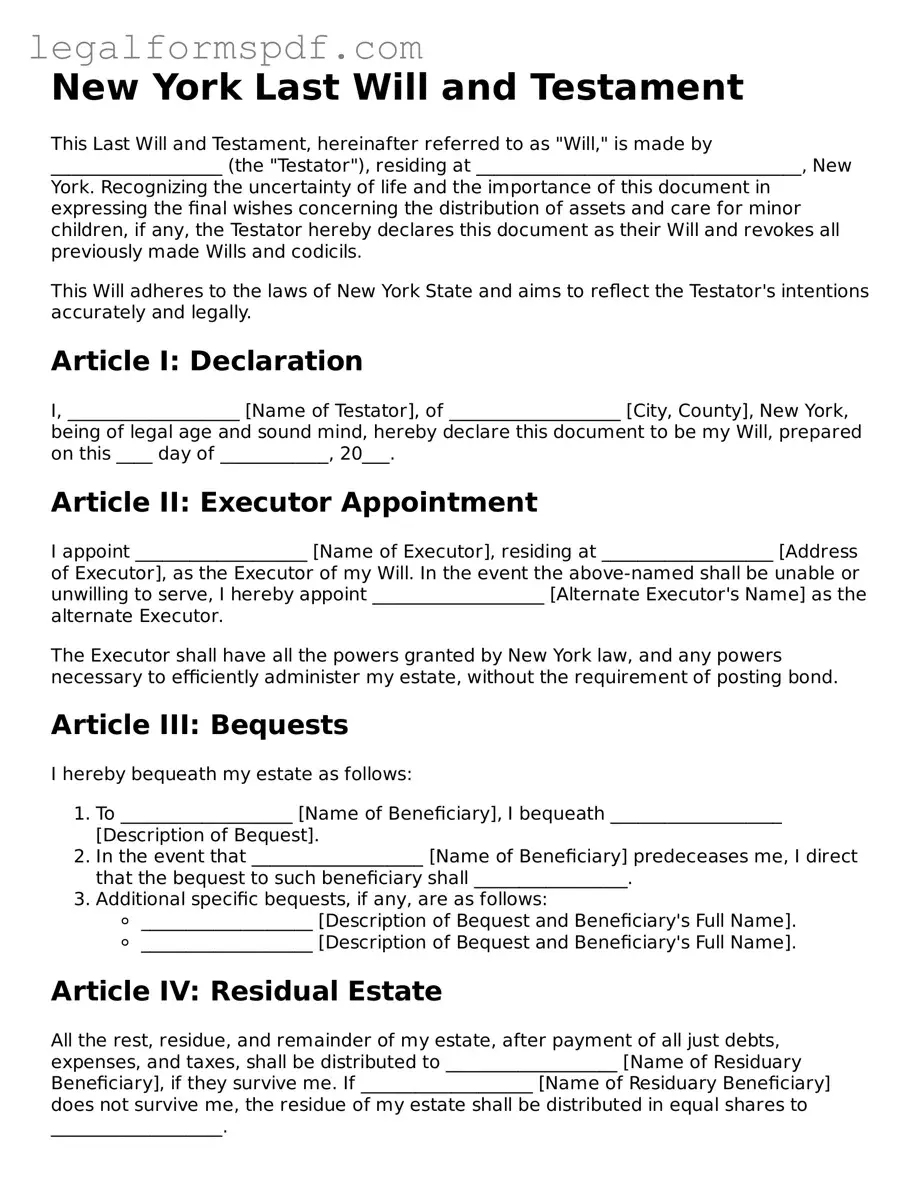

Document Example

New York Last Will and Testament

This Last Will and Testament, hereinafter referred to as "Will," is made by ___________________ (the "Testator"), residing at ____________________________________, New York. Recognizing the uncertainty of life and the importance of this document in expressing the final wishes concerning the distribution of assets and care for minor children, if any, the Testator hereby declares this document as their Will and revokes all previously made Wills and codicils.

This Will adheres to the laws of New York State and aims to reflect the Testator's intentions accurately and legally.

Article I: Declaration

I, ___________________ [Name of Testator], of ___________________ [City, County], New York, being of legal age and sound mind, hereby declare this document to be my Will, prepared on this ____ day of ____________, 20___.

Article II: Executor Appointment

I appoint ___________________ [Name of Executor], residing at ___________________ [Address of Executor], as the Executor of my Will. In the event the above-named shall be unable or unwilling to serve, I hereby appoint ___________________ [Alternate Executor's Name] as the alternate Executor.

The Executor shall have all the powers granted by New York law, and any powers necessary to efficiently administer my estate, without the requirement of posting bond.

Article III: Bequests

I hereby bequeath my estate as follows:

- To ___________________ [Name of Beneficiary], I bequeath ___________________ [Description of Bequest].

- In the event that ___________________ [Name of Beneficiary] predeceases me, I direct that the bequest to such beneficiary shall _________________.

- Additional specific bequests, if any, are as follows:

- ___________________ [Description of Bequest and Beneficiary's Full Name].

- ___________________ [Description of Bequest and Beneficiary's Full Name].

Article IV: Residual Estate

All the rest, residue, and remainder of my estate, after payment of all just debts, expenses, and taxes, shall be distributed to ___________________ [Name of Residuary Beneficiary], if they survive me. If ___________________ [Name of Residuary Beneficiary] does not survive me, the residue of my estate shall be distributed in equal shares to ___________________.

Article V: Guardian Appointment for Minor Children

If I am the parent or legal guardian of minor children at the time of my passing, I appoint ___________________ [Name of Guardian] as the guardian of said minor children. Should the aforementioned guardian be unable or unwilling to serve, I name ___________________ [Name of Alternate Guardian] as the alternate guardian.

Article VI: Signatures

This Will shall be executed on the ____ day of ______________, 20__, in the presence of witnesses, who shall witness and affirm this document as my Will.

___________________ [Signature of Testator]

Witnessed by:

- ___________________ [Signature of Witness #1]

- ___________________ [Signature of Witness #2]

This Will was signed in the presence of the Testator and the Testator has signed or acknowledged this Will in our presence. We now, at the Testator's request and in the Testator's presence and in the presence of each other, subscribe our names as witnesses. We declare under penalty of perjury that the Testator appears to be of sound mind and under no duress, fraud, or undue influence.

IN WITNESS WHEREOF, we have hereunto subscribed our names.

Date: ___________________

Witness #1 Name: ___________________

Address: ___________________

Witness #2 Name: ___________________

Address: ___________________

PDF Specifications

| Fact Name | Description |

|---|---|

| State-Specific Requirements | New York Estates, Powers, and Trusts Law (EPTL) Section 3-2.1 outlines the specific requirements for a valid Last Will and Testament in New York State. |

| Age Requirement | The individual creating the Will (testator) must be at least 18 years old. |

| Witness Requirement | The Will must be signed by at least two witnesses within 30 days of each other, who also must attest the testator's signature in their presence. |

| Self-Proving Affidavit Option | A self-proving affidavit can be attached to the Will, which can help speed up the probate process. This needs to be signed by the witnesses, typically in front of a notary public. |

Instructions on Writing New York Last Will and Testament

Preparing a Last Will and Testament is a critical step in managing your affairs and ensuring your assets are distributed according to your wishes after you pass away. The process of filling out a New York Last Will and Testament form requires attention to detail and accuracy to reflect your intentions clearly. This document must be completed in compliance with New York state laws to be legally binding. Follow the steps below to correctly fill out your New York Last Will and Testament.

- Begin by inserting your full legal name and address, establishing yourself as the maker of the will.

- Appoint an executor, the person you trust to carry out the instructions of your will. Include their full name and relationship to you.

- Designate a guardian for any minor children or dependents in your care, ensuring they are cared for by someone you trust in your absence.

- List all your assets, including properties, bank accounts, investments, and personal items of value that you wish to bequeath.

- Specify the beneficiaries, clearly stating the name of each individual or organization and what they will receive. Be as clear and precise as possible to avoid confusion or disputes.

- If you wish, include any special instructions or wishes you have regarding your assets or burial and memorial arrangements.

- Review the entire document to ensure there are no errors or omissions that could lead to your will being contested or not carried out as you intended.

- Sign and date the form in the presence of two witnesses, who are not beneficiaries, who also need to sign and date the document, acknowledging they witnessed your signature. This is crucial for the will to be legally valid.

- Consider having the document notarized if required or to add an extra layer of legal protection, though this step is not mandatory in New York.

- Store the completed will in a safe, accessible place and inform your executor and a trusted family member or friend of its location.

Filling out your Last Will and Testament is a straightforward process that plays a fundamental role in estate planning. By taking the time to carefully complete each step, you ensure that your assets are distributed according to your wishes, providing peace of mind for yourself and your loved ones.

Understanding New York Last Will and Testament

What is a Last Will and Testament in New York?

A Last Will and Testament in New York is a legal document that allows you to express your wishes regarding the distribution of your assets and the care of any minor children after your death. It names an executor, the person you designate to carry out your instructions, manage your estate, and oversee the distribution of your assets to the beneficiaries you have named.

Do I need a lawyer to create a Last Will and Testament in New York?

While it's not a requirement to have a lawyer to create a Last Will and Testament in New York, consulting with a lawyer can be beneficial. A lawyer can ensure that your will complies with New York law, reflects your wishes accurately, and offers advice on how to minimize potential estate taxes. However, if your estate is fairly straightforward, you might use a template or online will-making service.

What are the legal requirements for a Last Will and Testament in New York?

In New York, the person making the will (the testator) must be at least 18 years old and of sound mind. The will must be written, signed by the testator, and witnessed by at least two people who are not beneficiaries in the will. The witnesses must sign the will in the presence of the testator and each other.

Can I change my Last Will and Testament once it's been created?

Yes, you can change your Last Will and Testament anytime during your life as long as you are mentally competent. Changes are usually made through a formal amendment called a codicil, which must meet the same legal requirements as the original will for it to be valid. Alternatively, creating a new will and revoking the old one is another way to make changes.

What happens if I die without a Last Will and Testament in New York?

If you die without a Last Will and Testament in New York, your estate will be distributed according to the state's intestacy laws. Typically, this means your assets will be divided among your closest relatives, starting with your spouse and children, then parents, and further extended family, in a predetermined order. This might not align with your wishes, which is why having a will is important.

Are digital or electronic wills legal in New York?

As of my last knowledge update in 2023, New York does not recognize digital or electronic wills as legally binding. A will must be a physical document, handwritten or typed, signed by the testator and witnesses to be considered valid.

How can I ensure that my Last Will and Testament is found after my death?

Inform a trusted family member or friend, your executor, or your attorney where your Last Will and Testament is located. Some people choose to keep their will in a safe deposit box or with their attorney, but it's important to ensure that the executor has access to the will upon your death.

Does my Last Will and Testament need to be notarized in New York?

No, your Last Will and Testament does not need to be notarized in New York for it to be legal. However, New York allows you to make your will "self-proving" by having it notarized, which can simplify probate, the legal process through which your will is validated by the court.

What can I do if someone contests my will in New York?

When a will is contested in New York, the probate process becomes more complicated, and the court will evaluate the challenge's merits. Common reasons for contesting a will include claims of undue influence, fraud, or that the testator was not of sound mind. Having a lawyer who understands estate law can be crucial in defending the will's validity.

Is a handwritten, or "holographic," will valid in New York?

In New York, a holographic will (a will entirely handwritten and signed by the testator) is typically not considered valid unless made by members of the armed forces during wartime or by mariners at sea. For most residents, a will must meet the formal requirements outlined above to be legally binding.

Common mistakes

One common mistake when filling out the New York Last Will and Testament form is not adhering to signature requirements. New York law requires the will to be signed in the presence of at least two witnesses, who also need to sign the document. Failing to meet this criteria can render the will invalid, often leading to unintended distribution of assets.

Another error is neglecting to name an executor or naming one without an alternate. The executor plays a crucial role in managing the estate, and without a clear appointment, the court may end up selecting someone the decedent might not have chosen. Moreover, if the primary executor is unable to serve and no alternate is named, this can lead to delays and additional court involvement.

Improperly addressing the allocation of personal property can also cause issues. Many individuals forget to detail how personal items should be distributed, leading to potential disputes among heirs. It's beneficial to be as specific as possible about who receives what to avoid confusion and ensure wishes are honored.

Some individuals make the mistake of not updating their will after significant life changes, such as marriage, divorce, the birth of a child, or the death of a beneficiary. These events can drastically affect the relevance and execution of the will, potentially disqualifying it if it seems outdated or doesn't account for current relationships and assets.

Failure to declare a guardian for minor children is another oversight. Without this appointment, the state may determine who will care for the children, possibly choosing someone who may not align with the deceased’s wishes. Clearly stating a preferred guardian in the will is crucial for the well-being of minor children.

Another common mistake is including instructions for assets that will bypass the will, such as life insurance or retirement accounts. Since these assets typically transfer to named beneficiaries upon death, including them in a will can create confusion and complicate the estate process.

Using unclear or ambiguous language is also problematic. Legal documents require precision, and vague terms or unclear instructions can lead to misinterpretation and contesting of the will. Being concise and clear in expressing wishes is paramount to ensure they are correctly understood and followed.

Lastly, an error often made is not having the will reviewed by a legal professional. While many individuals use templates or online services to create their wills, consulting with an attorney can identify and rectify potential issues, ensuring the document complies with New York law and truly reflects the individual’s intentions.

Documents used along the form

When preparing a Last Will and Testament in New York, it is often part of a larger estate planning strategy. Alongside a will, there are several key documents that ensure a person's wishes are fully honored both in life and death. These documents complement a will by covering aspects of care and decision-making not addressed directly within the will itself. Here's a list of other forms and documents frequently used in conjunction with a New York Last Will and Testament to provide a comprehensive estate plan.

- Power of Attorney: This authorizes another person to make financial decisions and handle financial matters on one’s behalf.

- Health Care Proxy: Similar to a Power of Attorney but specific to health care decisions. It allows someone to make medical decisions for you if you are unable to do so yourself.

- Living Will: Outlines your preferences for medical care, such as life support and resuscitation, if you are unable to communicate your wishes directly.

- Revocable Living Trust: Enables you to maintain control over your assets during your lifetime and specifies how those assets should be distributed upon your death. This can help bypass the probate process.

- Beneficiary Designations: Forms that specify who will receive assets like life insurance policies and retirement accounts, which pass outside of the will.

- Digital Asset Memorandum: Specifies how digital assets such as social media accounts and digital files should be handled after one’s death.

- Memorial Instructions: Often not a legal document, but provides guidance on one’s preferences for funeral arrangements and other final wishes.

Together, these documents form a robust estate plan that addresses a wide range of personal, financial, and medical concerns. While the Last Will and Testament focuses on the distribution of assets and guardianship arrangements, the additional documents ensure that your wishes are respected in other equally important areas. It's advisable to work with a legal professional familiar with New York laws to ensure that your estate plan fully protects your interests and those of your loved ones.

Similar forms

The New York Last Will and Testament form is akin to a Living Will, primarily in its focus on personal preferences and directives. Whereas a Last Will outlines instructions for after someone's death, a Living Will applies while they are still alive but incapacitated. Both documents capture the individual’s desires - one for post-mortem asset distribution and the other for medical treatment preferences, thus ensuring that their wishes are known and respected at different stages of life.

Similar to a Power of Attorney document, the New York Last Will and Testament also nominates individuals to perform certain actions on behalf of the testator. However, while a Power of Attorney typically takes effect during the testator's lifetime, granting someone the authority to make decisions about finances or health, a Last Will activates upon the testator’s death, designating executors to manage estate affairs and ensure asset distribution according to the will.

Trust documents share a similarity with the New York Last Will in their purpose to manage and distribute assets, although they operate differently. Trusts can take effect during a person's life or after their death, offering more flexibility and control over when and how assets are distributed. They often bypass the probate process, unlike a will, providing a smoother transition of assets to beneficiaries without court intervention.

The Healthcare Proxy is another document related to the Last Will, with both appointing someone to make crucial decisions on the drafter’s behalf. While the Last Will designates executors for estate decisions, a Healthcare Proxy names a proxy to make healthcare decisions if the individual becomes unable to do so themselves, highlighting each document's role in safeguarding the drafter's preferences in different scenarios.

Advance Directives bear resemblance to the Last Will in that they guide future actions based on the individual’s specifications, particularly in healthcare contexts. Advance Directives can encompass both Living Wills and Healthcare Proxies, focusing on end-of-life care and medical preferences. Similarly, a Last Will directs the distribution and care of the individual’s estate and dependents after death, ensuring their wishes are adhered to in personal and medical matters alike.

The Beneficiary Designation form frequently used for retirement accounts or life insurance policies is akin to the Last Will in dictating the distribution of specific assets. Instead of addressing an entire estate, a Beneficiary Designation targets specific assets, bypassing the probate process directly to named beneficiaries. The Last Will encompasses a broader range of assets but shares the crucial function of ensuring assets are transferred as intended.

A Codicil to a Will closely relates to the original Last Will and Testament, as it serves to modify, add to, or revoke provisions within the will without requiring the drafting of a new document entirely. It allows for adjustments to reflect changes in the testator's wishes, assets, or beneficiaries, ensuring the Last Will remains aligned with the testator’s current intentions.

The Guardianship Nomination is often included within or associated with a Last Will, highlighting another similarity. This nomination specifies the individual’s choice for a guardian to care for minor children or dependents if the testator is deceased, ensuring that the care and custody of dependents are managed according to the testator’s preferences.

Lastly, the Ethical Will, while not a legal document, complements the Last Will and Testament by conveying personal values, life lessons, and desires to future generations. Unlike the legally binding nature of a Last Will, an Ethical Will is a heartfelt expression meant to accompany the testamentary directions with personal reflections, often serving as a moral legacy alongside material inheritances.

Dos and Don'ts

Creating a Last Will and Testament is a critical step in ensuring your estate is handled according to your wishes after you pass away. In New York, as in other states, there are specific do's and don'ts one should follow when filling out these forms to ensure they are valid and reflect your intentions clearly. Below are essential guidelines to consider.

What You Should Do

- Be clear and precise in detailing your assets and to whom they should go. Ambiguity can lead to disputes and legal challenges, potentially causing your wishes not to be honored as you had intended.

- Choose a reliable executor. This person will manage your estate and ensure your will is executed as you described. Their reliability and capability are crucial in the smooth administration of your estate.

- Sign your will in the presence of witnesses. New York law requires the presence of at least two witnesses during the signing of your will who are not beneficiaries of the will. This step is vital for the legality of the document.

- Consult with a legal professional to ensure your will complies with New York law and covers all legal bases, especially if you have a complex estate or unique wishes.

- Review and update your will as necessary. Life changes such as marriage, divorce, the birth of children, or the acquisition of significant assets can affect your estate planning needs.

What You Shouldn't Do

- Don’t use vague language. Unclear instructions can lead to misinterpretation and conflict among your heirs, potentially resulting in your true intentions not being fulfilled.

- Don’t forget to date and sign the will. A will without a date or signature can be deemed invalid, as these elements are crucial for establishing the document's legitimacy and your final intentions.

- Don’t neglect the selection of guardians if you have minor children. Failing to specify this in your will can result in the court deciding who will care for your children, potentially against your wishes.

- Don’t rely solely on a DIY will writing kit without consulting a professional. Each estate situation is unique, and a professional can offer personalized advice that ensures your will is valid and comprehensive.

- Don’t leave your will in an inaccessible place. If your executor or loved ones cannot find your will or do not know it exists, your wishes may not be carried out. It’s important to inform your executor or a trusted individual of its location.

Misconceptions

Many people have misconceptions about creating a Last Will and Testament, especially in New York. Understanding the truth behind these misconceptions can help ensure that your wishes are accurately documented and legally upheld. Below are six common misunderstandings:

Only the Wealthy Need a Will: A common misconception is that only those with significant assets need a Last Will and Testament. In reality, this legal document is crucial for anyone who wishes to have control over the distribution of their assets, no matter the size. It's also vital for appointing a guardian for minor children.

Everything Goes to Your Spouse Automatically: Many believe that in the absence of a will, everything automatically transfers to their spouse. However, without a will, New York's intestacy laws dictate the distribution of your assets, which may result in a portion of your estate going to your children, parents, or other relatives, not just your spouse.

A Will Covers All Your Assets: Some think that once they create a will, all their assets are covered. This isn't true. Certain assets, such as those held in jointly owned property, retirement accounts, and life insurance policies with named beneficiaries, pass outside of the will. Therefore, it's important to consider these exceptions when planning your estate.

My Will from Another State is Valid in New York: While it's true that New York may recognize out-of-state wills, it's essential to understand that state laws vary. An out-of-state will may not meet New York's specific legal requirements, potentially complicating the probate process. It's advisable to create a will that adheres to New York's laws.

Creating a Will is a One Time Task: Many people think that once they create their will, they don't need to revisit it. Life changes, such as marriage, divorce, the birth of children, or the acquisition of significant assets, warrant a review and possibly an update to ensure that your will reflects your current wishes.

You Don't Need a Lawyer to Create a Will: While it's possible to create a will without a lawyer's help, doing so can sometimes lead to mistakes and omissions. Professional legal guidance ensures that your will complies with New York law and accurately reflects your intentions, potentially saving your beneficiaries time, money, and stress.

Correcting these misconceptions can lead to a deeper understanding of the importance and complexity of creating a Last Will and Testament. Taking the time to ensure that this vital document is accurately prepared and reflects your current wishes can save your loved ones unnecessary complications during an already difficult time.

Key takeaways

Creating a Last Will and Testament is a responsible step in managing your affairs and ensuring that your wishes are honored. Here are key takeaways for filling out and using the New York Last Will and Testament form:

Legal Requirements: To ensure your Last Will is legally binding in New York, it's necessary to follow state law requirements. You must be 18 years or older and of sound mind. The Will must be written, and you must sign it in the presence of at least two witnesses, who also need to sign the document.

Choosing an Executor: Select an executor whom you trust to manage your estate after your passing. This person will be responsible for distributing your assets according to your wishes, as stated in your Will. It's also wise to name an alternate executor, in case your first choice is unable to serve.

Specificity in Bequests: Clearly identify to whom you wish to leave your assets. This includes not only the names of individuals, organizations, or charities but also clear descriptions of any property or specific items you are bequeathing to them.

Guardianship: If you have minor children, you should name a guardian in your Will. This is the person who will take care of your children if you and the other parent pass away before the children reach adulthood. Consider discussing this responsibility with the individuals you choose before naming them in your Will.

Review and Update: Life changes, such as marriage, divorce, the birth of children, or the acquisition of significant assets, may require updates to your Will. Regularly reviewing and updating your Will ensures that it always reflects your current wishes and circumstances.

Adhering to these guidelines will help ensure that your New York Last Will and Testament accurately expresses your intentions and is deemed valid under state laws. As circumstances and laws can change, it may be helpful to consult with a legal professional to provide guidance specific to your situation.

More Last Will and Testament State Forms

Last Will and Testament Form Pennsylvania - A basis for legal proceedings in probate court, ensuring a smoother transition of assets.

How to Make a Will in Illinois - Legal professionals often recommend reviewing a Last Will periodically, especially after significant life events to ensure it still reflects current wishes.