Fillable Last Will and Testament Document for Michigan

In the state of Michigan, a Last Will and Testament form serves as a crucial legal document that allows individuals to specify how their estates should be managed and distributed upon their demise. This form not only enables people to appoint an executor who will oversee the disbursement of their assets but also allows them to make clear directives about who should inherit their property, money, and personal items. Moreover, for those with minor children, the form offers a means to nominate guardians, ensuring their welfare is protected according to the wishes of the parent or guardian. Given its significance, the process of creating a Last Will and Testament in Michigan adheres to strict legal requirements, including the necessity for the document to be signed in the presence of witnesses to ensure its validity. The Michigan Last Will and Testament form is an essential tool for individuals seeking peace of mind and the assurance that their instructions for their estate and the care of their children will be honored.

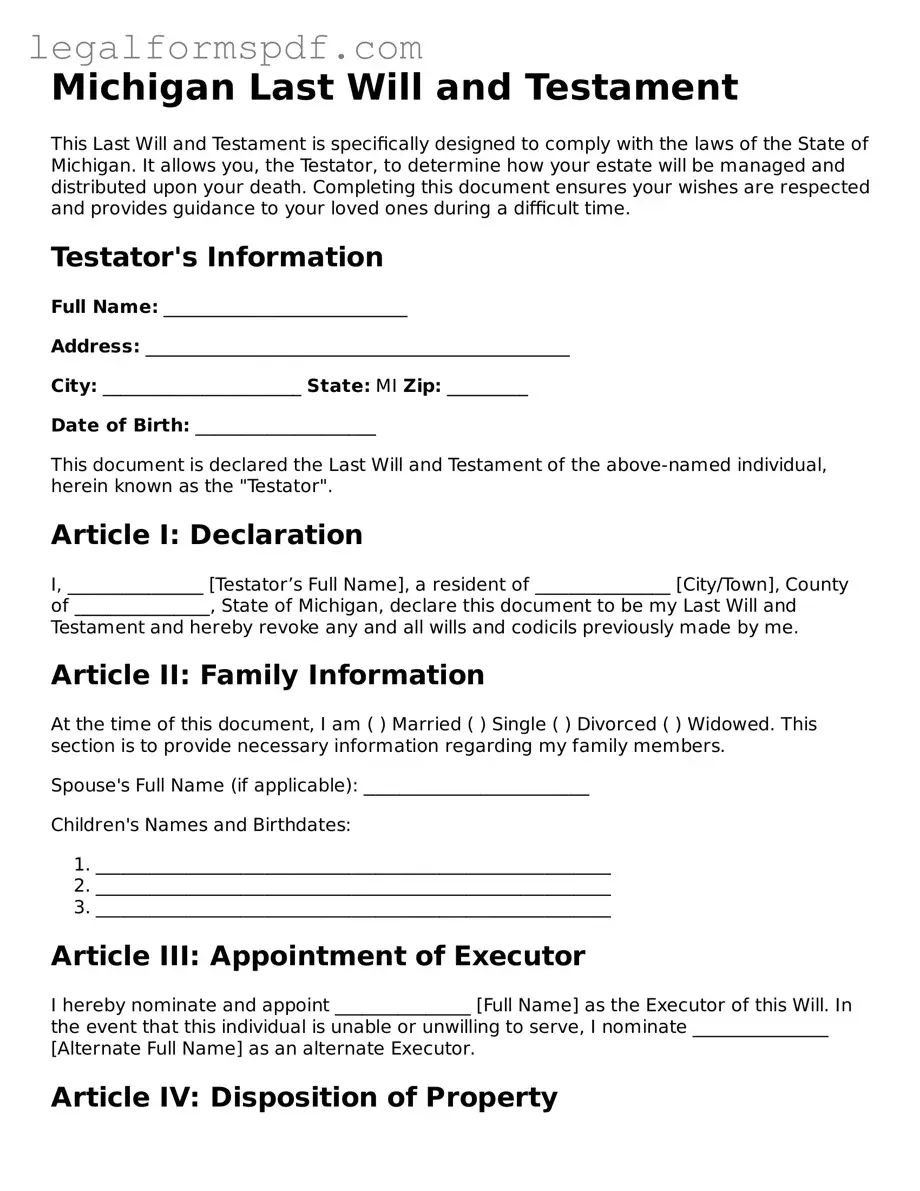

Document Example

Michigan Last Will and Testament

This Last Will and Testament is specifically designed to comply with the laws of the State of Michigan. It allows you, the Testator, to determine how your estate will be managed and distributed upon your death. Completing this document ensures your wishes are respected and provides guidance to your loved ones during a difficult time.

Testator's Information

Full Name: ___________________________

Address: _______________________________________________

City: ______________________ State: MI Zip: _________

Date of Birth: ____________________

This document is declared the Last Will and Testament of the above-named individual, herein known as the "Testator".

Article I: Declaration

I, _______________ [Testator’s Full Name], a resident of _______________ [City/Town], County of _______________, State of Michigan, declare this document to be my Last Will and Testament and hereby revoke any and all wills and codicils previously made by me.

Article II: Family Information

At the time of this document, I am ( ) Married ( ) Single ( ) Divorced ( ) Widowed. This section is to provide necessary information regarding my family members.

Spouse's Full Name (if applicable): _________________________

Children's Names and Birthdates:

- _________________________________________________________

- _________________________________________________________

- _________________________________________________________

Article III: Appointment of Executor

I hereby nominate and appoint _______________ [Full Name] as the Executor of this Will. In the event that this individual is unable or unwilling to serve, I nominate _______________ [Alternate Full Name] as an alternate Executor.

Article IV: Disposition of Property

I direct that my tangible personal property be distributed as follows:

- Item: ____________, Beneficiary: ____________

- Item: ____________, Beneficiary: ____________

- Item: ____________, Beneficiary: ____________

For any part of my estate not effectively disposed of by this will, I give, devise, and bequeath it to _______________ [Name of Beneficiary], residing at _______________.

Article V: Guardianship

Should I be the parent or legal guardian of minor or dependent children at the time of my death, I appoint _______________ [Name of Guardian] to act as their legal guardian, with the powers authorized by the law of the State of Michigan.

Article VI: Signatures

This Will was declared to be the Last Will and Testament of the Testator in our presence, who in their presence and in the presence of each other, all being present at the same time, have hereunto subscribed our names as witnesses on this ______ day of ____________, 20__.

Testator's Signature: ___________________________

Witness #1 Signature: ___________________________

Name: ___________________________________________

Address: _________________________________________

Witness #2 Signature: ___________________________

Name: ___________________________________________

Address: _________________________________________

Notarization

This document was acknowledged before me on _____________ [date] by __________________ [Testator’s Name], who is personally known to me or who has produced _______________________________ [type of identification] as identification.

Notary Public Signature: ___________________________

My commission expires: ________________________

PDF Specifications

| Fact | Detail |

|---|---|

| Governing Law | Michigan Estates and Protected Individuals Code (EPIC), specifically MCL 700.2502 |

| Age Requirement | Must be at least 18 years old |

| Capacity Requirement | Must be of sound mind |

| Signature Requirement | Must be signed by the testator or in the testator’s name by some other individual in the testator’s conscious presence and by the testator’s direction |

| Witness Requirement | Must be signed by at least two witnesses who observed the signing or the testator’s acknowledgment of the signature or of the will |

| Notarization | Not required for validity but a will can be made “self-proving” with a notarized affidavit |

| Holographic Wills | Recognized if signed and the material portions are in the testator’s handwriting, dated, and clearly intended as the testator’s will |

Instructions on Writing Michigan Last Will and Testament

Creating a Last Will and Testament is a significant step in planning for the future. It's a document that allows you to distribute your property, name an executor, and make clear decisions about your estate after your passing. While the task might seem daunting, filling out the Michigan Last Will and Testament form is straightforward if you approach it step by step. Below, you'll find a guide to help you through this process, ensuring your wishes are properly documented and legally sound.

- Gather necessary information: Before starting, collect all relevant details such as your full name, address, a list of your assets (including property, bank accounts, and personal belongings), and the names and addresses of your beneficiaries.

- Choose an executor: Decide who will manage your estate after you're gone. Make sure it's someone you trust to carry out your wishes as outlined in your will.

- Select beneficiaries: Clearly identify who will inherit your assets. You can leave specific items to certain people or divide your assets among multiple beneficiaries.

- Appoint a guardian for minor children: If you have minor children, choose a guardian for them in the event of your untimely death. This decision should not be taken lightly, as this individual will be responsible for your children's upbringing.

- Detail your assets and their distribution: Be as specific as possible when listing your assets and who you want to inherit them. This can include everything from your home to sentimental items.

- Sign the will: For the will to be legally valid in Michigan, you must sign it in the presence of two witnesses. These witnesses will also need to sign the will, confirming they observed you signing it. Choosing witnesses who stand to inherit nothing from the will can help prevent potential conflicts of interest.

- Store the will safely: Once the will is completed and signed, keep it in a safe place where your executor can easily access it when needed. Consider letting a trusted family member, attorney, or financial advisor know where it's located.

By following these steps, you'll create a Last Will and Testament that clearly communicates your wishes. Remember, it's beneficial to review and possibly update your will periodically, especially after significant life changes such as marriage, divorce, the birth of a child, or a substantial change in assets. This ensures that your estate plan always reflects your current wishes and circumstances.

Understanding Michigan Last Will and Testament

What are the legal requirements for a Last Will and Testament in Michigan?

In Michigan, the person creating the will (known as the testator) must be at least 18 years old and of sound mind at the time of drafting the document. The will must be in writing, and the testator must sign it in the presence of two witnesses. These witnesses, who must be at least 18 years old and of sound mind, also need to sign the will, affirming they observed the testator's signature or acknowledgment of the signature. It's important to note that witnesses should not be beneficiaries in the will to avoid conflicts of interest.

Can a Michigan Last Will and Testament be changed or revoked?

Yes, a Last Will and Testament in Michigan can be altered or revoked by the testator at any time, as long as they remain of sound mind. This can be done by creating a new will that explicitly states the intention to revoke the previous one or by physically destroying the previous will with the intention of revoking it. Additionally, certain life events like marriage, divorce, or the birth of a child can automatically invalidate or affect portions of the will, unless it explicitly states otherwise.

What happens if someone dies without a Last Will and Testament in Michigan?

If a person dies without a Last Will and Testament in Michigan, they are considered to have died "intestate." This means that the state laws will determine how their estate is distributed. Typically, the estate will be divided among the surviving spouse, children, or other family members, according to the intestacy succession laws of Michigan. This process may not always reflect the deceased's wishes, which is why having a well-drafted will is crucial.

Are digital or electronic wills valid in Michigan?

As of the most recent information available, Michigan law requires wills to be in writing and physically signed. Consequently, digital or electronic wills are not recognized as valid. This includes wills that are written on a computer, tablet, or another digital device, even if they are printed and signed later. It's vital to adhere to the specific formalities for will execution to ensure its validity and to prevent it from being contested in probate court.

Common mistakes

Filling out a Last Will and Testament form in Michigan seems straightforward, yet many people inadvertently make errors that can complicate their final wishes. One common mistake is not properly witnessing the document. Michigan law requires two witnesses to observe the signing of the will. These witnesses must be disinterested parties, meaning they do not stand to gain from the will. Individuals often choose close family members or beneficiaries as witnesses, which can challenge the validity of the will.

Another area where errors occur is in the specificity of bequests. When individuals fail to clearly identify their property or the recipients, it leads to ambiguity and potential disputes among heirs. It's crucial to be as specific as possible when describing both the property being bequeathed and who will receive it. General statements like "jewelry to my niece" can cause confusion if there are multiple nieces or pieces of jewelry.

A critical oversight many people make is not updating their will. Life events such as marriages, divorces, births, and deaths can drastically change one's intentions for their estate. However, many fail to revise their will to reflect these changes. This can result in outdated wishes being executed, potentially contradicting the deceased's actual final desires.

Lastly, a significant mistake is trying to address complex legal matters without professional advice. The desire to avoid legal fees may lead individuals to draft wills on their own. While this is legally permissible, it often results in documents that do not fully comply with Michigan laws or fail to take advantage of tax benefits and other legal strategies. Consulting with an attorney can ensure that a will is both legally sound and fully reflects the individual's intentions.

Documents used along the form

When preparing a Last Will and Testament in Michigan, several additional forms and documents often come into play to ensure a comprehensive estate plan. These documents are critical for detailing one’s wishes beyond the disposal of assets, addressing health care decisions, and ensuring the efficient management of one’s affairs in various situations. Below is a list of these essential forms and documents that frequently accompany the Last Will and Testament, each serving a distinct but complementary purpose.

- Living Will: This document specifies an individual's preferences regarding medical treatment in scenarios where they are unable to make decisions due to incapacitation. It guides loved ones and healthcare providers on whether to administer life-sustaining treatments.

- Durable Power of Attorney for Healthcare: This grants another person the authority to make healthcare decisions on one’s behalf when they are incapacitated. It works in tandem with a living will but covers a broader range of health care decisions.

- Durable Power of Attorney for Finances: This allows an individual to designate another person to manage their financial affairs. This could include paying bills, managing investments, and other financial actions, effective when the individual is unable to do so themselves.

- Designation of Patient Advocate: Similar to a durable power of attorney for healthcare, this designates someone to make decisions about medical treatment but also includes decisions about mental health care. It’s unique to Michigan and takes effect upon the person’s incapacity.

- Funeral Declaration: This document outlines an individual’s wishes for their funeral arrangements, including the type of ceremony, burial or cremation preferences, and any specific instructions for services or memorials.

- Trust Agreement: Often used in conjunction with a will, a trust agreement can help manage an individual's assets while they are alive and distribute them after death. Trusts can be tailored to specific needs, such as avoiding probate or managing assets for minor children.

- Beneficiary Designations: Completing beneficiary designations on accounts like life insurance policies, retirement accounts, and annuities ensures these assets are transferred directly to designated individuals or entities upon death, bypassing the will and probate process.

- Letter of Intent: This document provides an informal, personal explanation of the will. It can include the rationale behind decisions made in the will or give instructions not covered elsewhere, like a guardian’s responsibilities for minor children.

Each document serves to cover different aspects of an individual’s personal, health, and financial wishes, providing a fuller estate planning picture when used alongside a Last Will and Testament. Together, they ensure that a wide range of scenarios are anticipated and accounted for, offering peace of mind to the individual and clarity for their loved ones. It’s essential to work with legal professionals to ensure that each document is properly executed and valid under Michigan law, fitting into an overarching strategy tailored to individual needs and circumstances.

Similar forms

A Trust is closely related to a Last Will and Testament in that it also specifies how your assets should be managed and distributed after your death. The difference lies in the level of control and privacy it offers. With a trust, assets can be transferred to beneficiaries without going through probate, the legal process that verifies a will. This not only ensures a smoother transition but also keeps the distribution private, unlike a will, which becomes a public document once it enters probate.

A Living Will bears similarity to a Last Will and Testament because it expresses your wishes regarding medical treatment if you become unable to communicate those wishes yourself. While a Last Will dictates what happens after your death, a Living Will focuses on your preferences for end-of-life care. It might include your stance on life support or resuscitation efforts, ensuring that your medical care aligns with your values and desires during critical moments.

A Power of Attorney (POA) is similar to a Last Will and Testament in its function of appointing someone to act on your behalf. However, the scope and timing of their powers are different. A POA grants another person the authority to make decisions for you, typically while you are still alive but incapacitated. This could cover a broad range of decisions including financial, legal, or health-related matters. In contrast, a will activates only after your death, directing the distribution of your assets as you have specified.

The Beneficiary Designations on accounts like retirement plans or life insurance policies share similarities with a Last Will and Testament, as both specify your wishes for who will receive your assets. Beneficiary designations, however, bypass the will and probate process entirely. They allow for direct transfer of specific assets to the named beneficiaries upon your death, ensuring these assets are not tied up in the legal process of probate. This makes beneficiary designations an efficient tool for asset distribution, akin to the role of a will but more streamlined for certain types of assets.

Dos and Don'ts

Creating a Last Will and Testament is a significant step in planning for the future. It ensures that your assets are distributed according to your wishes and provides clarity and comfort for your loved ones. When filling out the Michigan Last Will and Testament form, it's important to adhere to certain guidelines to ensure that your document is valid and reflects your intentions. Here are essential dos and don'ts to consider:

Dos:

Review Michigan's legal requirements for a will to ensure understanding and compliance. These include being of legal age and sound mind, and having the will signed by witnesses.

Be thorough and clear when detailing the distribution of your assets. Specify names, relationships, and clear descriptions of each item or asset you are bequeathing.

Choose an executor you trust. This person will be responsible for managing your estate according to the will’s instructions.

Select a guardian for your minor children, if applicable, to ensure they are cared for by someone you trust in the event of your absence.

Have the will signed by at least two witnesses who are not beneficiaries in the will to avoid conflicts of interest.

Consider the need for a notary. While not always legally required, notarizing the will can add an extra layer of validation.

Don'ts:

Don't leave any sections blank. If a section does not apply, write “N/A” to indicate this and avoid confusion or manipulation.

Don't attempt to modify the will by hand after it has been signed and witnessed. Any changes could void the document or create legal challenges.

Don't forget to update the will as life circumstances change, such as marriage, divorce, the birth of a child, or the acquisition of significant assets.

Don't choose an executor or guardian without discussing the responsibilities with them first. Ensure they are willing and able to take on the role.

Don't use vague language that could lead to interpretation variances. Be as precise as possible in your wording.

Don't keep your will in a place where it cannot be found. Inform the executor and a trusted family member or friend of its location.

Misconceptions

Creating a Last Will and Testament in Michigan is an important step in planning for the future. However, there are several misconceptions about the process and the form itself that can lead to confusion. Here are nine common misunderstandings:

It has to be complicated. Many people believe that creating a Last Will and Testament must be a complex process, involving difficult legal language. In reality, Michigan law allows for the document to be straightforward, ensuring that one's wishes are clearly stated and understood.

A lawyer is necessary for it to be valid. While legal advice can be beneficial, particularly for complex estates, Michigan residents can create and finalize a Last Will and Testament without a lawyer, as long as it meets state requirements.

It only deals with financial assets. A common misconception is that a Last Will and Testament only covers the distribution of money and property. However, it can also name guardians for minor children, express funeral wishes, and more.

Oral wills are just as good as written ones. In Michigan, oral wills (also known as "nuncupative" wills) have very limited legal standing and are subject to strict conditions. A written and properly executed will is far more reliable and broadly accepted.

It's only for the elderly or ill. Many people put off writing a Last Will and Testament, thinking it's not necessary until later in life. However, life is unpredictable, and having a will is wise for any adult, regardless of age or health status.

A copied form from the internet is good enough. While downloadable forms can provide a useful starting point, each person's situation is unique. A generic form may not adequately cover one's specific needs or comply with all Michigan legal requirements.

It covers all assets. Certain assets, such as those held in joint tenancy or with designated beneficiaries (like life insurance policies or retirement accounts), pass outside of a will. It's important to consider these in estate planning but understand they're not governed by the will.

Once it's done, it never needs to be updated. Life changes—such as marriage, divorce, the birth of a child, or significant changes in financial situation—can make it necessary to update one's Last Will and Testament to reflect current wishes and circumstances.

It avoids probate court. Having a Last Will and Testament does not mean one's estate will bypass probate court in Michigan. The will needs to go through probate to be validated, though it can make the process smoother and faster by clearly outlining the deceased's wishes.

Key takeaways

Filling out and using the Michigan Last Will and Testament form effectively is crucial for ensuring your wishes are honored after your passing. It requires attention to detail and an understanding of your assets and desires for their distribution. Here are key takeaways to guide you through this process:

- Be clear and specific: When detailing how your assets should be distributed, clarity is key. Avoid vague language that could lead to misinterpretation or disputes among beneficiaries.

- Choose an executor wisely: Your executor is responsible for carrying out the instructions in your will. Select someone you trust, who is organized, and capable of managing this responsibility.

- Consider a guardian for minor children: If you have minor children, you should nominate a guardian in your will. This ensures that someone you trust will care for your children if you cannot.

- Sign in front of witnesses: Michigan law requires that you sign your will in front of two witnesses. These witnesses must also sign the will, affirming that they watched you sign it in their presence.

- Keep your will safe: Once your will is complete and properly signed, store it in a safe place. Inform your executor or a trusted family member of its location.

- Review and update regularly: Life changes such as marriage, divorce, the birth of children, or the acquisition of significant assets should prompt a review of your will. This ensures it always reflects your current wishes.

- Understand Michigan's laws: Familiarize yourself with Michigan's laws regarding wills to ensure yours is valid. This includes understanding the requirements for a will to be considered legally binding in the state.

- Consider legal advice: While filling out a will form might seem straightforward, consulting with a legal professional ensures that your will complies with state laws and your assets are distributed according to your wishes.

Creating a Last Will and Testament is a step towards peace of mind, knowing your affairs are in order. With careful planning and consideration, you can ensure your legacy is preserved according to your wishes.

More Last Will and Testament State Forms

Is a Handwritten Will Legal in Nc - Includes appointments of executors responsible for managing the estate's distribution.

New York State Will Template - This document enables a person to designate beneficiaries for their assets, ensuring that their possessions are distributed according to their wishes.

Making Will - This document can include instructions not just for financial assets, but also personal effects, heirlooms, and even messages to loved ones.