Fillable Last Will and Testament Document for Illinois

Thinking about the future, especially in terms of after we're gone, can seem daunting, but it's an essential part of ensuring our wishes are respected and our loved ones are taken care of. In Illinois, the Last Will and Testament form serves as a vital tool in this process, offering individuals the opportunity to clearly outline how they want their estate divided and who will carry out these wishes. This legal document, when properly executed, stands as a powerful statement of one’s final intentions, covering everything from the distribution of assets to the appointment of guardians for minor children. The importance of having a Last Will and Testament in place cannot be overstated, as it not only provides peace of mind but also helps prevent potential disputes among family members. Navigating the specifics can be straightforward with the right information, ensuring that the form is completed in compliance with Illinois state laws. This includes understanding the requirements for legal witnesses, considering the implications of not having a will, and knowing how changes in life circumstances might affect its validity. Taking the time to prepare a Last Will and Testament is a wise investment in the future, anchoring a legacy in clarity and intention.

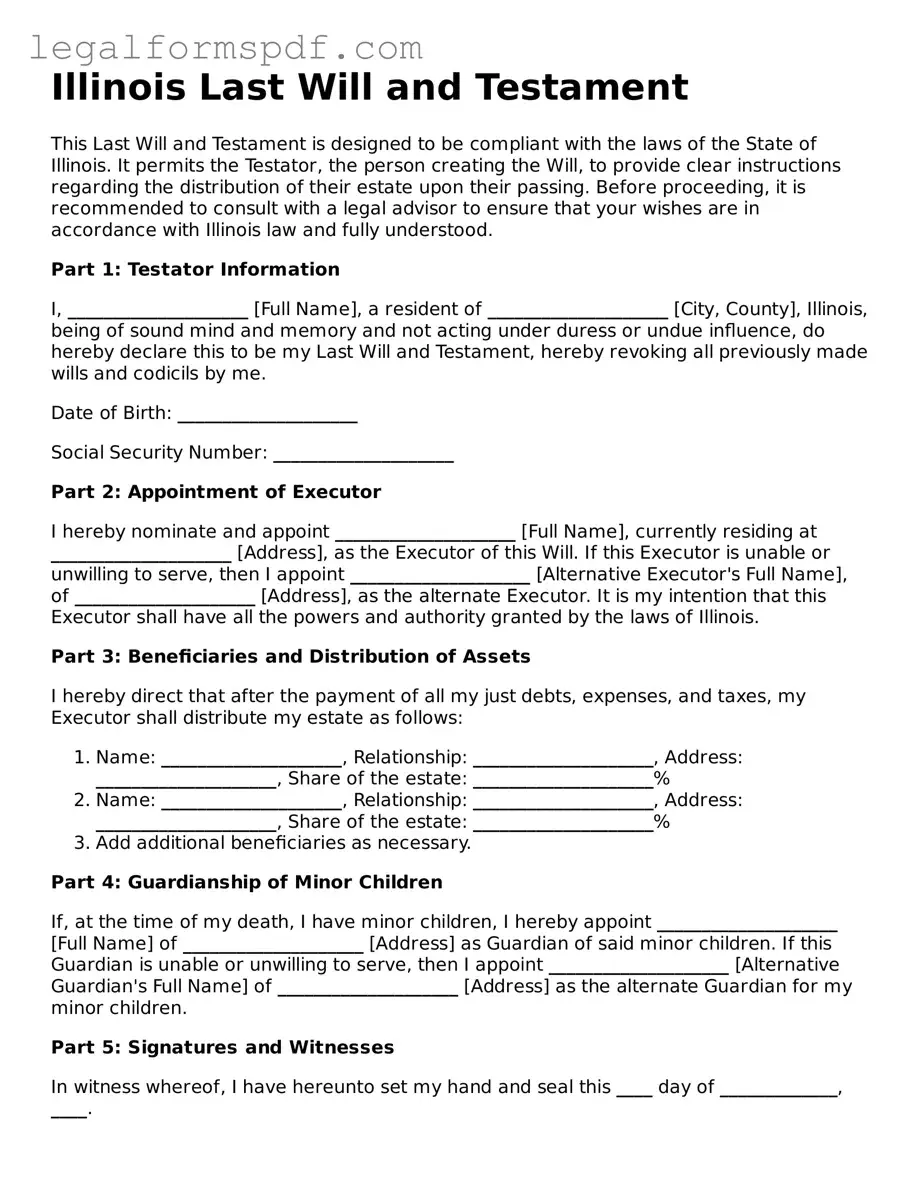

Document Example

Illinois Last Will and Testament

This Last Will and Testament is designed to be compliant with the laws of the State of Illinois. It permits the Testator, the person creating the Will, to provide clear instructions regarding the distribution of their estate upon their passing. Before proceeding, it is recommended to consult with a legal advisor to ensure that your wishes are in accordance with Illinois law and fully understood.

Part 1: Testator Information

I, ____________________ [Full Name], a resident of ____________________ [City, County], Illinois, being of sound mind and memory and not acting under duress or undue influence, do hereby declare this to be my Last Will and Testament, hereby revoking all previously made wills and codicils by me.

Date of Birth: ____________________

Social Security Number: ____________________

Part 2: Appointment of Executor

I hereby nominate and appoint ____________________ [Full Name], currently residing at ____________________ [Address], as the Executor of this Will. If this Executor is unable or unwilling to serve, then I appoint ____________________ [Alternative Executor's Full Name], of ____________________ [Address], as the alternate Executor. It is my intention that this Executor shall have all the powers and authority granted by the laws of Illinois.

Part 3: Beneficiaries and Distribution of Assets

I hereby direct that after the payment of all my just debts, expenses, and taxes, my Executor shall distribute my estate as follows:

- Name: ____________________, Relationship: ____________________, Address: ____________________, Share of the estate: ____________________%

- Name: ____________________, Relationship: ____________________, Address: ____________________, Share of the estate: ____________________%

- Add additional beneficiaries as necessary.

Part 4: Guardianship of Minor Children

If, at the time of my death, I have minor children, I hereby appoint ____________________ [Full Name] of ____________________ [Address] as Guardian of said minor children. If this Guardian is unable or unwilling to serve, then I appoint ____________________ [Alternative Guardian's Full Name] of ____________________ [Address] as the alternate Guardian for my minor children.

Part 5: Signatures and Witnesses

In witness whereof, I have hereunto set my hand and seal this ____ day of _____________, ____.

__________________________________

Signature of Testator

The above instrument, consisting of ____ pages, was signed in our presence by the Testator, and we, in the presence of the Testator and each other, have hereunto subscribed our names as witnesses this ____ day of _____________, ____.

Witness 1: Name: ____________________, Address: ____________________, Signature: ____________________

Witness 2: Name: ____________________, Address: ____________________, Signature: ____________________

Part 6: Notarization

This document was acknowledged before me on this ____ day of _____________, ____ by ____________________ [Full Name of Testator] as their Last Will and Testament, and by ____________________ [Full Name of Witness 1] and ____________________ [Full Name of Witness 2], in the presence of one another.

__________________________________

Notary Public Signature

My commission expires: ____________________

PDF Specifications

| Fact | Description |

|---|---|

| 1. Governing Law | The Illinois Last Will and Testament is governed by the Illinois Compiled Statutes, specifically 755 ILCS 5/4-1 which outlines who may make a will and the requirements for a will's validity. |

| 2. Age Requirement | In Illinois, the person creating a will (testator) must be at least 18 years old. |

| 3. Sound Mind Requirement | The testator must be of sound mind at the time of the will's creation. This means having the mental capacity to understand the extent of their estate and the legal effect of making a will. |

| 4. Signature Requirement | The will must be signed by the testator or by another person in the testator's presence and by the testator's direction. |

| 5. Witnesses | Illinois requires at least two credible witnesses to the signing of the will. These witnesses must also sign the will in the presence of the testator. |

| 6. Writing Requirement | The will must be in writing. Illinois does not recognize oral (nuncupative) wills as valid. |

| 7. Self-Proving Affidavits | While not required, Illinois allows for a self-proving affidavit to be attached to a will, making it easier to probate since it verifies the witnesses’ signatures and the authenticity of the will. |

| 8. Revocation | A will may be revoked by creating a new will or by physically destroying the original will (e.g., tearing, burning, or otherwise mutilating it). |

| 9. Amendments | Amendments to a will must be made through a codicil, which follows the same legal processes and requirements as creating a new will. |

| 10. Digital Assets | Illinois law allows for the inclusion of digital assets in a will, enabling the testator to designate who may access or control these assets after their death. |

Instructions on Writing Illinois Last Will and Testament

Creating a Last Will and Testament is a thoughtful way to ensure that your wishes are honored and your loved ones are provided for after your passing. In Illinois, this process can be straightforward if you follow the necessary steps. It's crucial to complete the form accurately, reflecting your final wishes for the distribution of your assets and the care of any dependents. This guide will walk you through each step required to fill out the Illinois Last Will and Testament form, aiming to make this important task as simple and stress-free as possible.

- Gather all necessary information, including a list of your assets (e.g., real estate, bank accounts, personal property), debts, and the names and addresses of beneficiaries and any guardians for minor children.

- Start by entering your full legal name and address in the designated sections at the top of the form to identify yourself as the testator (the person making the will).

- Appoint an executor for your will—the person responsible for carrying out the terms of the will. Include their full name and address. It's advisable to also name an alternate executor in case your first choice is unavailable or unwilling to serve.

- Specify the beneficiaries of your estate. For each beneficiary, provide their full name, address, and relationship to you. Clearly detail what assets or portion of your estate each beneficiary will receive.

- If you have minor children, nominate a guardian to care for them. Include the guardian’s full name and address. Consider appointing an alternate guardian as well.

- Outline the powers you wish to grant to your executor, tailoring them to suit your estate planning needs. Be as specific as possible to ensure your wishes are accurately executed.

- Sign and date the will in the presence of two witnesses. Illinois law requires your will to be witnessed by two individuals. These witnesses must be over the age of 18 and should not be beneficiaries in the will.

- Have the witnesses sign and date the will. They should also provide their addresses. This step is crucial as it validates the will.

- Consider having the will notarized to add an extra layer of legitimacy, although this is not a requirement in Illinois.

- Store the completed will in a safe, accessible place. Inform your executor and a trusted family member or friend of its location.

Completing your Illinois Last Will and Testament is a significant step in estate planning. It ensures your wishes are known and can greatly simplify the process for your loved ones after your passing. If you have complex assets or concerns, consulting with a legal professional who is familiar with Illinois laws can provide further guidance to ensure your will is legally sound and fully reflective of your wishes.

Understanding Illinois Last Will and Testament

What is a Last Will and Testament in Illinois?

A Last Will and Testament in Illinois is a legal document that allows an individual, known as the testator, to specify how their property and assets should be distributed after their death. It also lets them appoint an executor to manage the estate's affairs and can include guardianship arrangements for minor children.

How can I create a Last Will and Testament in Illinois?

To create a Last Will and Testament in Illinois, you must be at least 18 years old and of sound mind. The will must be written, signed by the testator, and witnessed by two or more individuals who are not beneficiaries of the will. It's recommended to consult with a legal professional to ensure the will complies with Illinois law and accurately reflects your wishes.

Does my Last Will and Testament need to be notarized in Illinois?

No, a Last Will and Testament in Illinois does not need to be notarized to be valid. However, it is advisable to have a "self-proving" affidavit, which is a sworn statement by the witnesses notarized, to make the probate process smoother and faster.

What happens if I die without a Last Will and Testament in Illinois?

If you die without a Last Will and Testament in Illinois, your assets will be distributed according to the state's intestacy laws. Typically, this means your closest relatives—starting with your spouse and children, if any—will inherit your assets. Without a will, you lose control over who receives your property after your death.

Can I change my Last Will and Testament after creating it?

Yes, you can change your Last Will and Testament at any time as long as you are of sound mind. This can be done by creating a new will that revokes the previous one or by making a codicil, which is an amendment to your existing will. Either way, the changes must meet the same legal requirements as the original will, including signatures and witnesses.

Can my Last Will and Testament be challenged in Illinois?

Yes, your Last Will and Testament can be challenged in Illinois courts. Grounds for a challenge include suspicions of fraud, undue influence, that the testator was not of sound mind when the will was created, or that the will was not executed properly according to Illinois law. Successfully contesting a will requires substantial evidence, and the process can be lengthy and complicated.

What can I include in my Last Will and Testament in Illinois?

In your Last Will and Testament in Illinois, you can include instructions on how your real and personal property should be distributed, name an executor for your estate, specify guardians for your minor children, and make financial arrangements for the care of your pets. You can also include funeral and burial instructions or any other personal wishes you have regarding your estate.

Is a handwritten Last Will and Testament valid in Illinois?

Yes, a handwritten Last Will and Testament, also known as a holographic will, can be valid in Illinois under specific conditions. It must be written entirely in the handwriting of the testator and signed by them. However, holographic wills are not recommended, as they are more susceptible to challenges and may not be comprehensive enough to cover all legal bases.

Common mistakes

One common mistake individuals make when filling out the Illinois Last Will and Testament form is failing to follow the state-specific requirements. Illinois law mandates certain formalities for a will to be considered valid. These include the necessity for the will to be in writing, the testator (the person creating the will) to be of sound mind, and the presence of witnesses during the signing process. Overlooking these guidelines can lead to a will being invalidated by a court, leaving the testator's assets to be distributed according to state intestacy laws, which may not align with their wishes.

Not specifying an executor is another oversight many commit. An executor is responsible for managing the estate in accordance with the will's instructions after the testator's death. Without naming a trusted individual or entity to fulfill this role, the court will appoint someone. This court-appointed executor may not handle the estate as the testator would have preferred, potentially causing conflicts among beneficiaries or delays in the distribution of assets.

People often neglect to include alternate beneficiaries in their will. Life's unpredictability means that a primary beneficiary may predecease the testator or choose to reject the inheritance. If there are no alternates named, the assets intended for the deceased or declining beneficiary could end up being distributed based on the state's default succession laws, which might not reflect the testator's original intentions.

Another significant error is not updating the will regularly. Events such as marriage, divorce, the birth of children or grandchildren, and significant changes in financial status can impact the relevance of a will's provisions. An outdated will may not accurately reflect the testator's current relationships or asset distribution wishes, leading to potential disputes among survivors.

Overlooking minor children's needs is a critical mistake made by some. Although it can be uncomfortable to contemplate, arrangements for the guardianship of minor children in the event of the testator's death should be clearly outlined in the will. Failure to do so leaves the decision up to the courts, which might not select the guardian the testator would have chosen.

Finally, a widespread error is attempting to include instructions in the will that dictate how to handle certain assets, such as life insurance policies or retirement accounts, which pass outside of the will via beneficiary designations. Not understanding that these assets are not governed by the will can lead to confusion and misguided expectations about the distribution of the estate.

Documents used along the form

When planning for the future, especially in terms of estate planning, preparing a Last Will and Testament is often the first step for many individuals in Illinois. This critical document ensures one's desires regarding the distribution of their estate and care for any minors are honored. However, a comprehensive approach often involves several other forms and documents that work in tandem with the Will to cover various aspects not addressed within the Will itself. The following list highlights seven such documents and provides a brief overview of each, offering a more robust framework for estate planning.

- Durable Power of Attorney: This form designates an individual to handle financial and legal decisions on behalf of the person creating the document, should they become unable to do so themselves due to illness or incapacitation.

- Healthcare Power of Attorney: Similar to the Durable Power of Attorney, this document appoints someone to make medical and healthcare-related decisions in the event that the original person is unable to make such decisions for themselves.

- Living Will: A Living Will specifies an individual's desires regarding medical treatment and life-sustaining measures in circumstances where they are no longer able to express informed consent.

- Trust Agreement: For those looking to avoid probate or manage their estate's privacy, establishing a Trust is often advisable. This document creates a legal entity to hold property and assets for the benefit of named beneficiaries.

- Beneficiary Designations: Often associated with specific assets like retirement accounts and life insurance policies, beneficiary designation forms override wills in dictating who will receive these assets upon the death of the account or policy holder.

- Transfer on Death Deed: This form allows for the direct transfer of real property to a designated beneficiary when the owner dies, bypassing the probate process.

- Letter of Intent: Although not a legal document, a Letter of Intent provides a personal touch, offering detailed instructions or wishes not suitably covered in a Will, such as funeral arrangements or the care of a pet.

While the Last Will and Testament form plays a pivotal role in estate planning, these additional documents collectively ensure that a person's health, assets, and personal wishes are comprehensively managed and respected. It's imperative for individuals to consult with a legal professional when preparing these documents to ensure that all legal requirements are met and that the documents are executed correctly. By doing so, individuals can provide themselves and their loved ones with peace of mind, knowing that their affairs are in order.

Similar forms

The Illinois Living Trust is a document that, much like the Last Will and Testament, outlines how an individual's assets should be distributed after their death. However, a living trust has the added benefit of allowing those assets to bypass the lengthy and often costly probate process. Both documents serve the purpose of asset distribution, but a living trust offers more privacy and efficiency in the process.

A Power of Attorney (POA) is another legal document similar to a Last Will in that it designates someone to make important decisions on behalf of the individual, but with a key difference. While a Last Will and Testament takes effect after death, a POA is operative during the individual's lifetime, especially if they become incapacitated and unable to make decisions for themselves.

An Advance Healthcare Directive allows an individual to outline their wishes regarding medical treatment and end-of-life care, somewhat akin to how a Last Will dictates asset distribution. Though serving different areas—healthcare decisions versus asset distribution—both documents ensure an individual’s specific desires are known and adhered to by others.

A Living Will, closely related to an Advance Healthcare Directive, specifies an individual's wishes for medical treatments and life-sustaining measures in terminal conditions. Like a Last Will and Testament, it communicates important decisions in advance, but focuses exclusively on healthcare, not asset distribution.

The Appointment of Guardian form, while not dealing with assets, is similar to a Last Will in that it allows an individual to designate a responsible party to care for their minor children or dependents after their death. Both documents enable an individual to make crucial family-related decisions in advance.

A Trust Amendment Form is used to make changes to an already established trust, a concept similar to a Codicil, which is an amendment to a Last Will and Testament. Both types of documents allow for updates and changes without the need to rewrite the entire original document.

A Digital Asset Will is a modern equivalent that deals explicitly with the management and distribution of one's digital assets, such as social media accounts, digital currencies, and online properties, after death. While targeting different assets than a traditional Last Will, both aim to manage and disburse property in accordance with the decedent’s wishes.

A Transfer-on-Death Deed allows property owners to name a beneficiary who will receive their property immediately upon the owner's death, bypassing probate similarly to how certain assets can be directly assigned to beneficiaries in a Last Will. Both documents provide mechanisms for direct transfer of assets, avoiding probate.

A Financial Affidavit is a sworn statement of an individual's income, expenses, assets, and liabilities. Though primarily used in divorce proceedings and child support determinations, it shares the Last Will's function of detailing personal financial information, albeit for different legal purposes.

A Personal Property Memorandum may accompany a Last Will and Testament, allowing an individual to specify who should receive personal possessions. Like a Last Will, it helps in dictating the distribution of one's estate, focusing on tangible personal items not necessarily covered in the main body of the Will.

Dos and Don'ts

Filling out the Illinois Last Will and Testament form is a crucial step in ensuring your wishes are honored. To make sure you do it correctly, here are several key dos and don'ts to follow:

Dos:Read the form carefully before you start filling it out. Understanding each section can help you provide accurate information.

Be clear and specific about who receives your property. Using precise names and descriptions avoids confusion later.

Choose an executor you trust. This person will be responsible for managing your estate and carrying out your will.

Sign your will in the presence of two witnesses. Illinois law requires this for your will to be valid.

Make sure your witnesses are people not named in your will. This helps ensure impartiality and avoids legal complications.

Consider getting your will notarized. While not required, it can add an extra layer of legal protection.

Keep your will in a safe place and let your executor know where it is. This ensures it can be found when needed.

Don't leave any sections blank. If a section doesn't apply, write "N/A" to clarify that you did not overlook it.

Don't try to make your will by yourself if you have a complex estate. Consulting with a professional can prevent mistakes.

Don't use vague language. Being clear and specific now can prevent disputes among your heirs later.

Don't forget to update your will after major life changes, such as marriage, divorce, the birth of a child, or the death of a beneficiary.

Don't let just anyone be your witness. Illinois law has specific requirements about who can witness a will.

Don't assume that your last will and testament can oversee the distribution of all your assets. Some assets, like insurance policies, are governed by their own beneficiary designations.

Don't keep updating your will informally. Always follow the proper legal procedure to ensure changes are valid and legally binding.

Misconceptions

When it comes to creating a Last Will and Testament in Illinois, there are plenty of misconceptions that can cloud judgment and decision-making. Understanding these can help ensure that one's final wishes are honored accurately and effectively.

Only for the Wealthy: Many believe that Wills are only for those with significant assets. However, anyone with personal belongings, no matter the size of their estate, can benefit from having a Will to specify how their assets should be distributed.

Too Young to Worry: Another misconception is that Wills are for older adults. Unfortunately, unforeseen circumstances can occur at any age, making it wise for adults of all ages to have a Will.

Oral Wills are Just as Good: In Illinois, an oral will, also known as a nuncupative will, is not recognized. A valid Will must be in writing and meet specific legal requirements to be enforceable.

Lawyer Required for Validity: Although having a lawyer can be helpful in ensuring that a Will is correctly drafted, one is not required for a Will to be valid in Illinois. However, without legal guidance, one might miss crucial details or fail to comply with state laws.

Online Templates are One-Size-Fits-All: Many assume that any online template will suffice. However, state-specific rules mean that a generic template might not comply with Illinois law, potentially rendering the Will invalid.

Wills Avoid Probate: A common misconception is that having a Will means avoiding probate. In reality, a Will goes through probate, allowing the court to oversee the Will’s execution and asset distribution.

Spouses Automatically Inherit Everything: While spouses do have rights to inheritance, the presence of a Will, especially one that specifies different desires, can alter the distribution of assets substantially.

Charitable Donations are Complicated: Some think it’s too complex to leave assets to a charity. In truth, including a charitable donation in a Will is quite straightforward and can be a meaningful way to leave a legacy.

Witnesses Aren’t Necessary: For a Will to be valid in Illinois, it must be signed by the testator (the person to whom the Will belongs) in the presence of at least two credible witnesses, who also sign the document.

Children Automatically Inherit Equally: Lastly, without a Will specifying how assets should be divided, state laws determine the distribution, which may not always result in an equal split among children or dependents.

Clearing up these misconceptions about the Illinois Last Will and Testament can empower individuals to take control of their estate planning, ensuring their wishes are legally recognized and properly executed.

Key takeaways

Creating a Last Will and Testament is a vital step in estate planning, allowing individuals to ensure their possessions are distributed according to their wishes upon their death. In Illinois, specific guidelines must be followed to ensure the document is legally binding and appropriately reflects the wishes of the individual (testator). Here are key takeaways to consider when filling out and using the Illinois Last Will and Testament form:

- The testator must be at least 18 years old and of sound mind at the time of creating the will to ensure it is valid under Illinois law.

- A Last Will and Testament in Illinois must be written, as oral wills are not recognized by the state.

- The document must be witnessed by at least two individuals who are not beneficiaries of the will to avoid conflicts of interest and ensure impartiality.

- Beneficiaries can include family members, friends, and organizations such as charities. The testator has the discretion to distribute their assets as they see fit.

- It is important to appoint an executor in the will, who will be responsible for managing the estate, distributing assets, and fulfilling the testator's wishes as outlined.

- Any properties jointly owned or accounts with designated beneficiaries (such as life insurance policies) are not covered by the will and will pass directly to the joint owner or named beneficiary.

- The Last Will and Testament can always be revised or revoked by the testator as long as they remain mentally competent.

- Keeping the will in a safe but accessible place is critical, and informing the executor or other trusted individual of its location can ensure it is found upon the testator's death.

Following these guidelines can significantly simplify the process of estate planning and provide peace of mind knowing that one's final wishes will be honored.

More Last Will and Testament State Forms

Georgia Last Will and Testament - It allows you to appoint a guardian for your minor children, giving you peace of mind about their care in your absence.

Free Will Forms Online - Creating this document ensures that your assets won't be distributed according to state laws but according to your own desires.

Is a Handwritten Will Legal in Nc - Can limit the inheritance of spouses in cases of divorce or separation.