Fillable Last Will and Testament Document for Georgia

When thinking about securing the future for your loved ones, the Georgia Last Will and Testament form stands out as a crucial document that should not be overlooked. This legally binding document provides an individual, also known as the testator, with the power to dictate the distribution of their assets and personal property following their passing. Beyond asset distribution, this document allows the testator to appoint an executor, who will be responsible for carrying out the wishes specified within the will. Moreover, for those with minor children, it offers a means to appoint guardians, ensuring their care and upbringing are managed according to the testator's desires. The creation of this document not only helps in minimizing potential disputes among surviving relatives but also ensures that your final wishes are respected and executed. Adhering to Georgia's specific legal requirements is essential when drafting a Last Will and Testament, as failing to do so can result in unnecessary complications and the potential for the will to be challenged in court. This form, therefore, represents not only a gesture of care and responsibility towards one's family and loved ones but also a legal tool designed to facilitate the orderly management of one’s affairs after death.

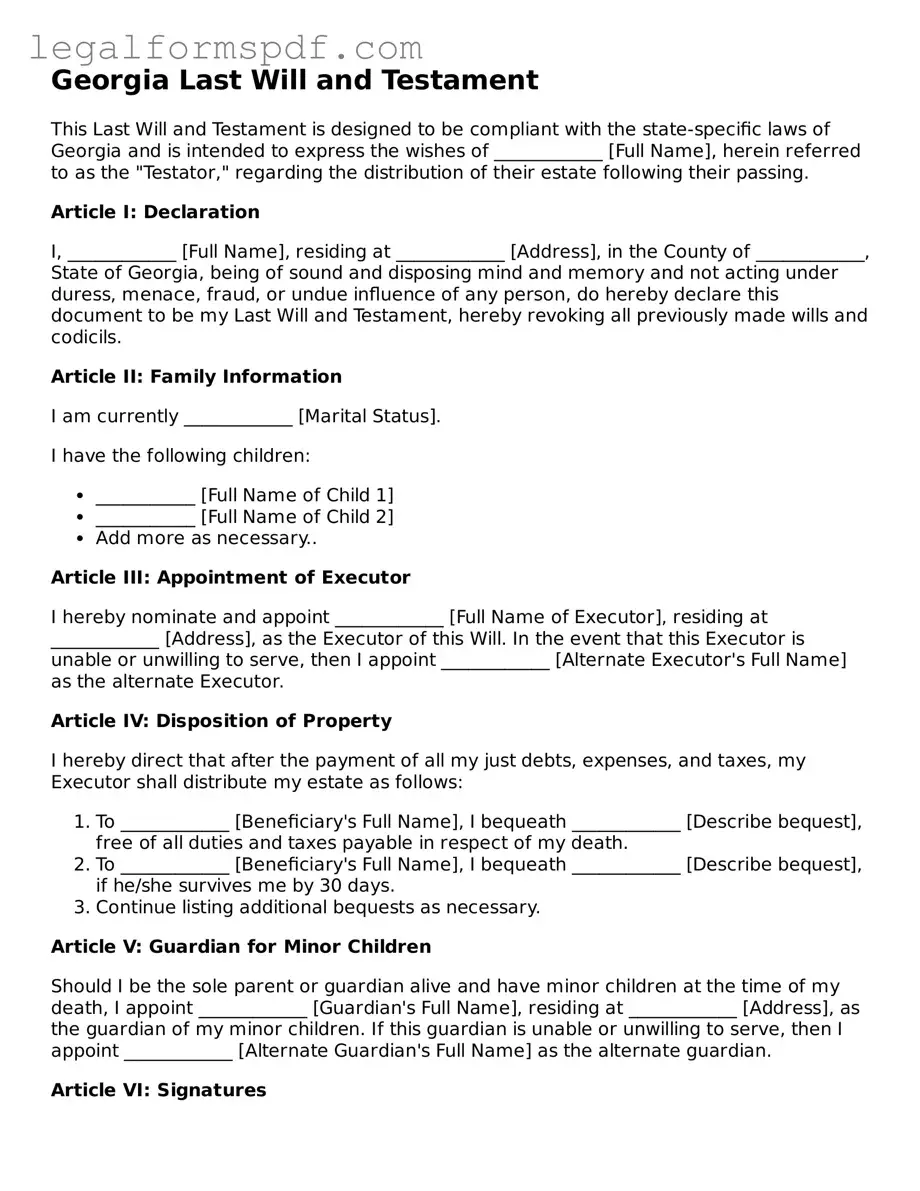

Document Example

Georgia Last Will and Testament

This Last Will and Testament is designed to be compliant with the state-specific laws of Georgia and is intended to express the wishes of ____________ [Full Name], herein referred to as the "Testator," regarding the distribution of their estate following their passing.

Article I: Declaration

I, ____________ [Full Name], residing at ____________ [Address], in the County of ____________, State of Georgia, being of sound and disposing mind and memory and not acting under duress, menace, fraud, or undue influence of any person, do hereby declare this document to be my Last Will and Testament, hereby revoking all previously made wills and codicils.

Article II: Family Information

I am currently ____________ [Marital Status].

I have the following children:

- ___________ [Full Name of Child 1]

- ___________ [Full Name of Child 2]

- Add more as necessary..

Article III: Appointment of Executor

I hereby nominate and appoint ____________ [Full Name of Executor], residing at ____________ [Address], as the Executor of this Will. In the event that this Executor is unable or unwilling to serve, then I appoint ____________ [Alternate Executor's Full Name] as the alternate Executor.

Article IV: Disposition of Property

I hereby direct that after the payment of all my just debts, expenses, and taxes, my Executor shall distribute my estate as follows:

- To ____________ [Beneficiary's Full Name], I bequeath ____________ [Describe bequest], free of all duties and taxes payable in respect of my death.

- To ____________ [Beneficiary's Full Name], I bequeath ____________ [Describe bequest], if he/she survives me by 30 days.

- Continue listing additional bequests as necessary.

Article V: Guardian for Minor Children

Should I be the sole parent or guardian alive and have minor children at the time of my death, I appoint ____________ [Guardian's Full Name], residing at ____________ [Address], as the guardian of my minor children. If this guardian is unable or unwilling to serve, then I appoint ____________ [Alternate Guardian's Full Name] as the alternate guardian.

Article VI: Signatures

This Will was signed on ____________ [Date], at ____________ [Location, City, State], by the Testator as and for his/her Last Will and Testament, in the presence of us, who, at his/her request, in his/her presence, and in the presence of each other, have subscribed our names as witnesses thereto.

Testator's Signature: _______________

Testator's Name (Printed): _______________

Witness #1 Signature: _______________

Witness #1 Name (Printed): _______________

Witness #1 Address: _______________

Witness #2 Signature: _______________

Witness #2 Name (Printed): _______________

Witness #2 Address: _______________

Article VII: Additional Provisions

Any provision of this Will deemed invalid or unenforceable shall not affect other provisions that can be given effect without the invalid provision.

Verification

This document, and all its provisions, are declared by the undersigned Testator to be his/her Georgia Last Will and Testament, in the presence of the witnesses who signed below in the Testator's presence and in the presence of each other.

Dated this ______ day of _______________, 20___.

______________________

Testator's Signature

______________________

Witness #1 Signature

______________________

Witness #2 Signature

This Last Will and Testament was executed as and declared by the Testator to be the Testator's Last Will and Testament, and we, in the Testator's presence and at the Testator's request, and in the presence of each other, have hereunto subscribed our names as witnesses on the date written above.

PDF Specifications

| Fact Name | Detail |

|---|---|

| Legal Requirements for Validity | The person making the will (testator) must be at least 14 years old and of sound mind. The will must be in writing and signed by the testator or by another person at the testator’s direction and in their presence. It also needs to be witnessed by at least two individuals who are not beneficiaries of the will. |

| Governing Law | The Georgia Probate Code, specifically Title 53 of the Official Code of Georgia Annotated (O.C.G.A.), governs the creation, validity, and execution of Last Will and Testament forms in Georgia. |

| Holographic Wills | Georgia recognizes holographic wills (wills that are handwritten by the testator) only if they meet the standard legal requirements for wills, including being witnessed as required by Georgia law. |

| Nuncupative Wills | Georgia allows nuncupative (oral) wills only under very specific circumstances, such as by a member of the armed forces while in actual military service during a time of war or a person engaged in maritime service. These wills have strict limitations regarding the value of property that can be disposed of and require a certain number of witnesses. |

| Revocation | A will in Georgia can be revoked by the testator by creating a new will that explicitly states it revokes the previous will or by performing a physical act of destruction on the will, such as tearing, burning, or otherwise destroying it intending to revoke it. |

Instructions on Writing Georgia Last Will and Testament

Creating a Last Will and Testament is a significant step in planning for the future. It outlines how you wish your assets to be distributed after your passing and can help ensure your loved ones are cared for according to your wishes. The process of filling out the Georgia Last Will and Testament form may seem daunting, but by following clear, step-by-step instructions, it can be completed with confidence. This document allows you to express your final wishes clearly and can alleviate potential stress for your family during a difficult time.

- Start by entering your full legal name and address, establishing you as the testator of the will.

- Appoint an executor who will be responsible for administering your estate according to the will's instructions. Include their full name and relationship to you.

- Designate a guardian for your minor children (if applicable) and provide the guardian's full name and relationship to the children.

- List all your assets, including real estate, bank accounts, securities, and personal property you wish to distribute.

- For each asset listed, specify the beneficiary or beneficiaries who will receive the asset upon your passing. Include their full names and relationships to you.

- If you have specific wishes for the distribution of personal items, such as family heirlooms or sentimental possessions, detail these instructions clearly.

- Should you wish to disinherit a potential heir or clarify why certain individuals are receiving different portions of your estate, provide a clear explanation.

- Review any additional directives you’d like to include, such as funeral arrangements or charitable donations, and document these wishes.

- Thoroughly read through the entire document to ensure all information is accurate and reflects your final wishes.

- Sign and date the Will in the presence of at least two witnesses, who must also sign and print their names, acknowledging they witnessed the act. Their addresses should also be included.

- Consider having the Will notarized to add an extra layer of legal validation, although this is not a requirement in Georgia.

Once completed, it is essential to store your Last Will and Testament in a safe place and let your executor or a trusted family member know where it can be found. Although it is a complex task, laying out your wishes clearly can provide peace of mind and certainty for your future and the well-being of your loved ones.

Understanding Georgia Last Will and Testament

What is a Last Will and Testament in Georgia?

A Last Will and Testament is a legal document that outlines how a person's property and assets will be distributed after their death in the state of Georgia. It allows the person creating the will, known as the testator, to specify beneficiaries for their belongings, appoint guardians for minor children, and designate an executor to manage the estate.

How do I create a Last Will and Testament in Georgia?

To create a Last Will and Testament in Georgia, the testator must draft a document that includes their final wishes regarding their estate, the appointment of an executor, guardianship of minor children, and any specific legacies. The document must be signed by the testator in the presence of at least two witnesses who are not beneficiaries of the will. All parties must sign the document to make it legally binding.

Are there any specific requirements for a Will to be valid in Georgia?

Yes, for a Will to be valid in Georgia, the testator must be at least 14 years old and of sound mind at the time of drafting. The Will must be in writing and signed by the testator or by another person under the testator's direction and in their presence. It must also be witnessed by at least two individuals who are at least 14 years of age, who are not beneficiaries, and who sign the document in the presence of the testator.

Can I name an executor for my estate in my Will?

Yes, you can and should name an executor in your Will. The executor is responsible for managing your estate, including paying off any debts and taxes and distributing assets as specified in your Will. Choosing someone trustworthy and capable of handling these responsibilities is crucial. If no executor is named, the court will appoint one, which may not align with your preferences.

What happens if I die without a Will in Georgia?

If you die without a Will in Georgia, your estate will be distributed according to the state's intestacy laws. Generally, this means your close relatives, such as your spouse and children, will inherit your assets. If you have no living family members, your estate may become property of the state. Dying without a Will can complicate the distribution process and may result in your wishes not being followed.

Can I change my Will after creating it?

Yes, you can change your Will at any time as long as you are of sound mind. To make changes, you can either add a supplement to your existing Will, known as a codicil, or create a new Will. Both methods require the same formalities as drafting a new Will, including signatures and witnesses. It's advisable to consult with a legal professional to ensure your changes are valid and effectively reflect your wishes.

Should I have a lawyer review my Will?

While not strictly necessary, having a lawyer review your Will can provide valuable insight and ensure that your document meets all legal requirements and accurately reflects your wishes. An attorney can also advise on complex situations, such as providing for a family member with special needs or structuring large estates to minimize taxes.

How do I ensure my Will is safe and secure?

Keep your Will in a safe, secure location and inform your executor or a trusted family member of its whereabouts. Some individuals choose to keep their Will in a safe deposit box or with an attorney. Ensure that it can be easily accessed by your executor after your death. Avoiding places where it could be damaged by fire or water is also wise.

What should I do if my circumstances change?

If your circumstances change, such as through marriage, divorce, the birth of a child, or the acquisition of significant assets, it's important to update your Will. These life events can significantly impact how you wish to distribute your estate. Revising your Will to reflect your current situation ensures that your final wishes are honored.

Common mistakes

When people set out to fill out a Last Will and Testament in Georgia, it's common for them to make mistakes that may lead to unintended consequences. One common mistake is not adhering to the specific legal requirements for the document to be considered valid. In Georgia, for instance, the will must be signed in the presence of two witnesses, who must also sign the will. If this step isn’t executed correctly, it could void the entire document.

Another error is assuming that all assets can be distributed via a will. Certain assets, such as those held in joint tenancy or designated to be passed on to a named beneficiary (like life insurance policies or retirement accounts), aren’t governed by the directives of a will. This misunderstanding can lead to confusion among beneficiaries about the distribution of assets.

Frequently, individuals neglect to clearly identify their beneficiaries, which can lead to disputes among potential heirs. It's crucial to be specific about who is to receive what, rather than making general statements that can be interpreted in multiple ways. Similarly, failing to appoint an executor, or selecting someone without the capability or willingness to perform the duties required, can cause significant issues in the administration of the estate.

Some people make the mistake of not considering the need for alternates for beneficiaries and executors. Life is unpredictable. If a beneficiary or executor passes away before the testator (the person who made the will) or is unable or unwilling to serve, having no alternate arrangements can complicate matters.

Another common oversight is not updating the will periodically. As life situations change—marriages, divorces, births, deaths—it's essential to update the document to reflect these changes. A will that does not account for these life changes may not fulfil the testator's final wishes.

A critical error is attempting to impose conditions on gifts that are either illegal or simply impossible to enforce. For instance, willing money to someone under the condition that they marry within a year can create legal headaches and may not be enforceable.

Underestimating the importance of clarity and specificity is another mistake. Ambiguities in a will can lead to prolonged legal battles among heirs. Every asset and its intended beneficiary should be identified as clearly as possible.

Incorrectly signing the document or not in accordance with state laws is a severe error. For a will to be valid in Georgia, specific signing procedures must be followed. For example, using an electronic signature when a handwritten one is required would invalidate the will.

People sometimes wrongly assume that once a will is created, it doesn't need to be reviewed by a professional. Seeking the advice of an estate lawyer can ensure that the will is valid and all legal bases are covered. This step can prevent mistakes that might make the will invalid or not reflective of the testator's true intentions.

Lastly, the failure to inform the executor or close family members of where the will is stored is more common than one might think. If the will cannot be found upon the testator's death, it is as if it never existed. Ensuring that the executor knows the location of the will and that it is accessible is crucial for carrying out the testator’s last wishes.

Documents used along the form

When preparing a Last Will and Testament in Georgia, several other documents are often used in conjunction to ensure a comprehensive estate plan. These ancillary forms help address a variety of legal, financial, and personal matters that a Last Will alone cannot fully encompass. Below is a list of documents that are frequently used alongside a Georgia Last Will and Testament.

- Advance Directive for Health Care: This document allows individuals to specify their preferences for medical treatment and end-of-life care. It also lets them appoint a health care agent to make decisions on their behalf if they are unable to do so.

- Power of Attorney: This form grants another individual the authority to make legal and financial decisions on behalf of the person creating the document. Powers of attorney can be durable, meaning they remain in effect even if the person becomes incapacitated.

- Living Will: Often included within an Advance Directive for Health Care, a living will outlines specific wishes regarding medical treatment, particularly life-sustaining measures, in case of terminal illness or incapacitation.

- Trust Agreement: A legal arrangement where assets are held by one party for the benefit of another. Trusts can help manage assets during the grantor's lifetime and distribute property upon their death, often bypassing the probate process.

- Funeral Directive: This document provides instructions for one's funeral and burial wishes, helping to ensure their final arrangements are carried out according to their desires.

- Designation of Guardian for Minor Children: For individuals with minor children, this document nominates a guardian to take responsibility for the children's care in the event of the parents' incapacity or death.

- Financial Inventory: Though not a formal legal document, maintaining a comprehensive list of personal assets, liabilities, accounts, and important contacts can be invaluable in estate planning and administration.

Creating a comprehensive estate plan often requires more than just a Last Will and Testament. By including these additional documents, individuals in Georgia can ensure a more thorough approach to end-of-life planning, covering a range of legal, financial, and personal decisions. It is advisable to consult with legal professionals to determine the specific needs and legal requirements for each individual's situation.

Similar forms

The Georgia Last Will and Testament form, pivotal for stating one's final wishes regarding the distribution of assets and the care of any minor children, bears similarities to several other legal documents. One such document is the Living Will. This document, essentially a directive for healthcare, enables individuals to outline their preferences for medical treatment and care in scenarios where they are unable to communicate due to severe illness or incapacitation. Both the Last Will and Testament and the Living Will express personal wishes legally; however, their focuses differ—estate and asset management for the former and healthcare directives for the latter.

The Trust is another document related to the Last Will and Testament, as it also deals with the management and distribution of one’s assets. While a Will becomes effective only after one's death, a Trust can be operational during the individual's lifetime, after death, or both. The Trust can offer more control over the assets and might help avoid the lengthy probate process, unlike a Last Will and Testament that undergoes probate court review before asset distribution.

A Financial Power of Attorney is a legal instrument granting someone authority to handle your financial affairs, which could include paying bills, managing investments, or making sales of property. This similarity to a Last Will and Testament lies in its function of designating another individual to manage one's affairs. The main difference is in its operative time; the Financial Power of Attorney is active during the person's life, whereas the Last Will and Testament takes effect posthumously.

Similarly, a Healthcare Power of Attorney allows for the appointment of another person to make healthcare decisions on one's behalf when incapacitated. It aligns with the Last Will’s principle of appointing others to act in one’s stead, though it is specific to medical decisions rather than the broad scope of personal estate management found in a Last Will and Testament.

A Designation of Guardian for Minor Children is specifically focused on appointing a guardian for one’s children in the event of the parents' untimely death or incapacitation, a concern also addressed within a Last Will and Testament. This document is critical for parents wishing to ensure their children's care and upbringing according to their preferences, similarly aiming to secure a responsible and trusted individual’s oversight, as does a Last Will in its clauses concerning minors.

An Advance Directive is a combination of a Living Will and a Healthcare Power of Attorney. It not only stipulates preferences for medical treatment and procedures but also designates an individual to make healthcare decisions. This comprehensive approach to future incapacitation or end-of-life care mirrors the Last Will and Testament’s comprehensive approach to posthumous affairs, although focusing on healthcare rather than estate distribution.

An Ethical Will, though not a legal document, is akin to a Last Will and Testament in its personal nature and its use as a tool for communicating one’s values, beliefs, life’s lessons, and hopes for the future. It complements the Last Will by providing a non-material legacy, highlighting the importance of passing on ethical and emotional values in addition to physical assets.

Finally, a Digital Asset Will, an emerging concept, directs the management of one’s digital presence after death, including social media profiles, digital assets, and online accounts. It shares with the Last Will and Testament the goal of managing one's estate, although focusing specifically on digital rather than physical or financial assets, underscoring the modern need to address one’s digital footprint in estate planning.

Dos and Don'ts

Creating a Last Will and Testament is a significant step in planning for the future. It ensures that your wishes regarding the distribution of your assets and the care of any dependents are clearly documented and legally enforceable. In the state of Georgia, as in elsewhere, adhering to specific guidelines and avoiding common pitfalls can streamline the process, making it easier for your loved ones to honor your intentions after you're gone. Here are some do's and don'ts to consider when filling out a Georgia Last Will and Testament form.

Do:- Review Georgia's legal requirements: Ensure your will complies with Georgia laws, including the necessary signatures and witnessing procedures.

- Be clear and specific: Clearly identify your beneficiaries and specify what assets each should receive. Ambiguity can lead to disputes and legal challenges.

- Choose an executor you trust: This person will manage your estate and ensure your wishes are carried out. Make sure they are willing and able to take on this responsibility.

- Include a guardian for minor children: If applicable, naming a guardian ensures that your children will be cared for by someone you trust.

- Sign and date the document in front of witnesses: For a will to be valid in Georgia, it must be signed by you and witnessed by at least two individuals who are not beneficiaries.

- Keep the document in a safe place: Inform your executor or a trusted individual of where your will is stored to ensure it can be found when needed.

- Use vague language: Ambiguities in your will can lead to disputes between beneficiaries and may result in parts of your will being interpreted by a court.

- Forget to update your will: Life changes, such as marriage, divorce, the birth of children, or the acquisition of significant assets, may necessitate updates to your will.

- Fail to consider digital assets: In today's digital age, it's also wise to make arrangements for your digital assets, including social media accounts and digital currencies.

- Leave out alternate beneficiaries: Designating alternate beneficiaries can prevent your assets from passing in ways you wouldn't have wanted in the event a primary beneficiary predeceases you.

- Rely solely on a handwritten will: While "holographic" wills (entirely written by hand) can be legal, they are more prone to challenges and complications.

- Ignore tax implications: Certain aspects of your will, such as the distribution of large assets, can have significant tax implications for your beneficiaries.

Misconceptions

When discussing the Last Will and Testament form in Georgia, several misconceptions commonly arise. It is crucial to understand the truth behind these misunderstandings to ensure that one's final wishes are properly documented and legally enforceable. Here are nine common myths and the realities that dispel them:

- Oral wills are just as valid as written ones: In Georgia, for a will to be legally binding, it must typically be a written document. Oral wills, known as nuncupative wills, have very limited legal acceptance and are subject to stringent requirements.

- Wills must be notarized to be valid: Georgia law does not require a will to be notarized for it to be valid. However, a will can be made "self-proving" through notarization, which can expedite the probate process.

- A will automatically overrides other legal documents: Certain documents, such as life insurance or retirement account beneficiary designations, typically override provisions in a will. It's crucial to ensure all such documents are updated and consistent with one's will.

- You only need a will if you have substantial assets: A will is essential for anyone who wishes to have a say in the distribution of their assets, regardless of size or value. It also allows individuals to designate guardians for minor children.

- Once written, a will is final: Wills can be updated or entirely rewritten at any time before death, as long as the individual is legally competent to do so.

- Spouses are automatically entitled to inherit everything: Without a will stating otherwise, Georgia law divides assets among a spouse and children or other relatives, depending on the family situation.

- Wills can only be contested for lack of mental capacity: Wills in Georgia can be contested on various grounds, including undue influence, fraud, or improper execution, not just for questions concerning the mental capacity of the deceased.

- All assets go through probate: Certain assets, such as those with designated beneficiaries or jointly owned assets, may pass outside of probate and are not governed by the will.

- Creating a will is a complicated and costly process: While it's advisable to consult with an attorney to ensure a will is properly drafted, the process does not have to be overly complex or expensive. Resources are available to help individuals understand their options and make informed decisions.

Correcting these misconceptions is the first step towards establishing a comprehensive estate plan that aligns with an individual's wishes and complies with Georgia law.

Key takeaways

The Georgia Last Will and Testament form is a critical document that allows individuals to dictate the distribution of their assets and property after their death. Understanding its components and the requirements for its execution can ensure that an individual’s final wishes are honored. Below are key takeaways for properly filling out and utilizing this important document:

- Completing the Georgia Last Will and Testament requires the testator (the person making the will) to be at least 18 years old and mentally competent. This ensures that the individual has the legal capacity to make sound decisions regarding their estate.

- The will must be written clearly, outlining how the testator's assets and property should be distributed. These instructions should be explicit to prevent any misinterpretation.

- It is vital for the testator to appoint an executor in their will. This person will be responsible for managing the estate, paying off any debts, and ensuring that the assets are distributed according to the will.

- Two witnesses are required to observe the signing of the will. They must also sign the document, attesting to the testator's mental state and the voluntary nature of their actions. This is crucial to ensure that the will is legally binding.

- Although not mandatory, notarizing the will can add an extra layer of validity. A notarized will can expedite the probate process, although Georgia law does not require a will to be notarized for it to be considered valid.

- Regularly updating the will is advisable, especially after significant life events such as marriage, divorce, the birth of a child, or the acquisition of significant assets. This ensures that the document reflects the testator’s current wishes and circumstances.

- Securely storing the will is paramount. The executor, or at least a trusted individual, should know its location. It’s also beneficial to keep copies in secure places, but the original document is required for the probate process.

By adhering to these takeaways, individuals can ensure that their Last Will and Testament accurately reflects their wishes and provides clear instructions for the distribution of their assets. This not only offers peace of mind but also helps to mitigate potential disputes among heirs and beneficiaries.

More Last Will and Testament State Forms

Free Will Forms Online - It’s particularly important for individuals with complex family situations, such as blended families, to have a will.

New York State Will Template - A Last Will and Testament is a key element in protecting the future of one’s family and ensuring that personal and financial wishes are respected.

Last Will and Testament Template Texas - For parents, it's a vital tool to ensure their children's future security and to appoint trusted caregivers.

How to Make a Will in Illinois - Understanding that a Last Will is a flexible document is essential; it can always be revisited and revised to reflect an individual's changing life and priorities.