Fillable Last Will and Testament Document for Florida

When thinking about the future and the eventual passing of one's assets to loved ones, the Florida Last Will and Testament form plays a pivotal role. This legal document, unique to the state of Florida, is designed to ensure that a person’s final wishes concerning the distribution of their personal property, real estate, and other assets are respected and carried out according to their preferences. Not only does it specify how and to whom assets should be distributed, but it also allows the individual, known as the testator, to name an executor who will manage the estate until its final disbursement. For parents of minor children, the form provides an opportunity to appoint guardians, ensuring their children are cared for by trusted individuals in the event of the parents' untimely demise. Understanding and completing this form correctly is essential, as it can prevent potential disputes among surviving relatives and ensure that the testator's wishes are honored, thus providing peace of mind to all involved. The state of Florida has specific requirements and statutes that govern the creation and validation of this document, emphasizing the importance of adhering to legal standards to make the Last Will and Testament enforceable.

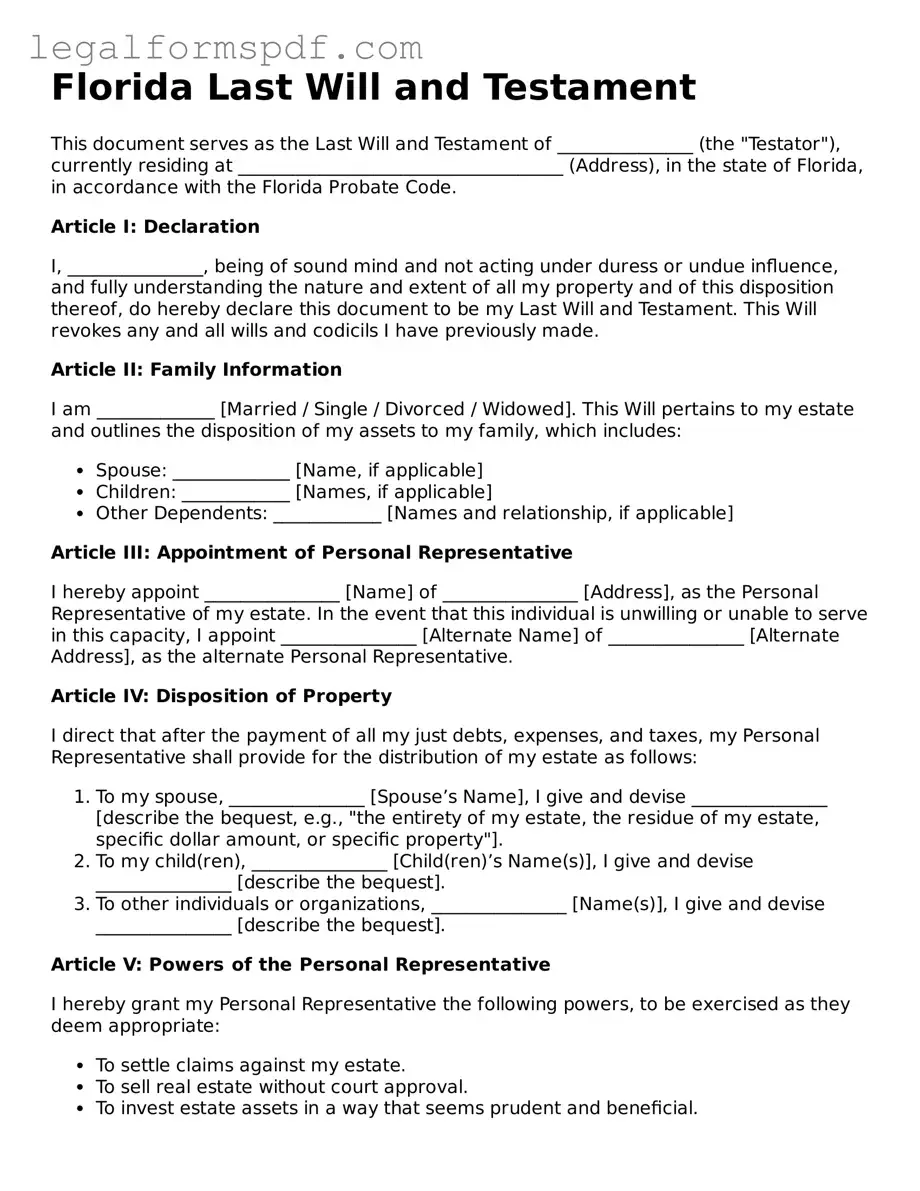

Document Example

Florida Last Will and Testament

This document serves as the Last Will and Testament of _______________ (the "Testator"), currently residing at ____________________________________ (Address), in the state of Florida, in accordance with the Florida Probate Code.

Article I: Declaration

I, _______________, being of sound mind and not acting under duress or undue influence, and fully understanding the nature and extent of all my property and of this disposition thereof, do hereby declare this document to be my Last Will and Testament. This Will revokes any and all wills and codicils I have previously made.

Article II: Family Information

I am _____________ [Married / Single / Divorced / Widowed]. This Will pertains to my estate and outlines the disposition of my assets to my family, which includes:

- Spouse: _____________ [Name, if applicable]

- Children: ____________ [Names, if applicable]

- Other Dependents: ____________ [Names and relationship, if applicable]

Article III: Appointment of Personal Representative

I hereby appoint _______________ [Name] of _______________ [Address], as the Personal Representative of my estate. In the event that this individual is unwilling or unable to serve in this capacity, I appoint _______________ [Alternate Name] of _______________ [Alternate Address], as the alternate Personal Representative.

Article IV: Disposition of Property

I direct that after the payment of all my just debts, expenses, and taxes, my Personal Representative shall provide for the distribution of my estate as follows:

- To my spouse, _______________ [Spouse’s Name], I give and devise _______________ [describe the bequest, e.g., "the entirety of my estate, the residue of my estate, specific dollar amount, or specific property"].

- To my child(ren), _______________ [Child(ren)’s Name(s)], I give and devise _______________ [describe the bequest].

- To other individuals or organizations, _______________ [Name(s)], I give and devise _______________ [describe the bequest].

Article V: Powers of the Personal Representative

I hereby grant my Personal Representative the following powers, to be exercised as they deem appropriate:

- To settle claims against my estate.

- To sell real estate without court approval.

- To invest estate assets in a way that seems prudent and beneficial.

Article VI: Guardian for Minor Children

In the unfortunate event that I am the surviving parent and my children are under 18 at the time of my passing, I nominate _______________ [Name] of _______________ [Address], as guardian of my children. If this nominee is unable or unwilling to serve, I nominate _______________ [Alternate Name] of _______________ [Alternate Address], as the alternate guardian.

Article VII: Signatures

This Will was signed on _______________ [Date], at _______________ [Location], by _______________ [Testator’s Name] as the Testator, and by the following witnesses, who in the presence of the Testator and each other, at the Testator’s request, have hereunto subscribed our names:

- Witness 1: _______________ [Print Name] _______ [Signature] _______ [Date]

- Witness 2: _______________ [Print Name] _______ [Signature] _______ [Date]

The foregoing instrument was acknowledged before me this ___________ [Date], by _______________ [Testator’s Name], who is personally known to me or who has produced _______________ [Type of Identification] as identification and who did not take an oath.

Notary Public: _______________ [Print Name]

Signature of Notary: __________________

Commission expires: _______________

PDF Specifications

| Fact | Description |

|---|---|

| Legal Requirement | Must be in writing to be considered valid under Florida law. |

| Age Requirement | The person creating the will (testator) must be at least 18 years old or an emancipated minor. |

| Witness Requirement | The will must be signed by at least two witnesses who must be present at the same time. |

| Self-Proving Affidavit | A self-proving affidavit can speed up probate but is not required. It must be signed by the testator and witnesses, making the will easier to prove in court. |

| Governing Laws | Governed by the Florida Probate Code, primarily found in Chapters 731 through 735 of the Florida Statutes. |

Instructions on Writing Florida Last Will and Testament

Creating a Last Will and Testament is an important step in planning for the future. It ensures your assets are distributed according to your wishes and can help minimize disagreements among surviving family members. In Florida, filling out a Last Will and Testament form requires attention to detail and an understanding of your assets and how you wish to distribute them. Follow these steps carefully to complete your form correctly. This document, once properly filled out and signed, acts as a legal guide for handling your estate after your death.

- Start by clearly printing your full legal name at the top of the form. This identifies you as the creator of the will.

- Next, list your current address, including city, state, and zip code, to further establish your identity.

- Declare your mental state and understanding that you are creating this document as your Last Will and Testament, revoking any previous wills or codicils. This is usually a standard statement provided in the form.

- Appoint an executor, the person you trust to carry out the instructions of your will. Include their full name and relationship to you. It’s also wise to appoint an alternate executor in case your first choice is unable or unwilling to serve.

- Detail the distribution of your assets. Specify which of your belongings go to which beneficiaries. These can include family members, friends, or organizations. Be as clear as possible to avoid any confusion.

- If you have minor children, appoint a guardian for them in the will. This is someone who will look after your children should you and the other parent pass away.

- List any specific funeral or burial wishes you have. While not mandatory, this can be helpful for your family members in their time of grief.

- Review the document to ensure all information is accurate and reflects your wishes. Mistakes could lead to misinterpretation of your intentions.

- Date and sign the will in front of two witnesses. Under Florida law, these witnesses must be present at the same time, watch you sign the will, and then sign it themselves as witnesses. The witnesses should not be beneficiaries of the will to avoid potential conflicts of interest.

- Consider having the will notarized to strengthen its validity. In Florida, a notarized will can streamline the probate process, although it's not a requirement.

Once completed, store your Last Will and Testament in a safe place and inform your executor or a close family member of its location. It’s also advisable to keep a copy in a secure yet accessible place, so it can be easily found when needed. Remember, this document can be updated as your circumstances change, so review it periodically and make any necessary adjustments.

Understanding Florida Last Will and Testament

What is a Last Will and Testament in Florida?

A Last Will and Testament in Florida is a legal document that allows an individual, known as the testator, to specify how they would like their assets to be distributed after their death. This document can also be used to appoint a guardian for minor children and to designate an executor who will manage the estate until its final distribution.

Do I need a lawyer to create a Last Will and Testament in Florida?

While it is not required to have a lawyer to create a Last Will and Testament in Florida, consulting with a legal professional can ensure that the will is valid and effectively carries out your wishes. Florida law has specific requirements for a will to be considered valid, such as being in writing, signed by the testator, and witnessed by at least two individuals who are present at the same time.

Can I change my Last Will and Testament after it’s been created?

Yes, a Last Will and Testament can be changed at any time before the testator's death. This is typically done through a codicil, which is a separate document that outlines changes or additions to the original will. Like the original will, a codicil must also meet Florida's legal requirements to be valid.

What happens if I die without a Last Will and Testament in Florida?

If a person dies without a Last Will and Testament in Florida, they are considered to have died "intestate." This means their assets will be distributed according to Florida's intestacy laws rather than their own wishes. Typically, the estate would be divided among surviving family members, such as a spouse, children, parents, or siblings, in a manner defined by state law.

Common mistakes

In preparing a Last Will and Testament, many individuals overlook the importance of designating an alternate executor. The primary role of the executor is to manage and distribute the assets of the estate according to the wishes of the deceased. However, if the first choice for the executor is unable or unwilling to serve, having an alternate named can prevent delays and complications in the probate process. This oversight can lead to the court appointing someone not chosen by the deceased, potentially complicating the estate's administration.

Another common mistake is the failure to include a residuary clause in the will. This clause covers any property that is not specifically mentioned elsewhere in the document. Without it, any assets not explicitly listed could be distributed according to state law rather than the deceased's wishes. This can result in unintended beneficiaries receiving assets, undermining the primary intentions of the will.

Sometimes, individuals fail to properly witness the will, as required by Florida law. For a Last Will and Testament to be legally valid, it must be signed in the presence of two witnesses, who then must also sign the document. Failure to adhere to this requirement can lead to the will being declared invalid, and the estate being distributed according to state intestacy laws, rather than the deceased's wishes.

Not updating the will is a mistake many make after significant life changes such as marriage, divorce, the birth of a child, or the acquisition of significant assets. These events can dramatically affect how one would like their estate to be distributed. An outdated will may not accurately reflect the current wishes or familial relationships of the deceased, potentially leading to disputes among surviving relatives.

Failing to clearly identify beneficiaries is another error. Generic descriptions or not using full legal names can lead to confusion and potential disputes among heirs. It's crucial to be as specific as possible when naming beneficiaries to ensure the right individuals receive the intended portions of the estate.

Some individuals mistakenly believe that a will can dictate the distribution of all types of assets. However, certain assets such as life insurance proceeds, retirement accounts, and jointly held property often pass outside of the will, directly to a named beneficiary or surviving co-owner. Not understanding these distinctions can lead to false assumptions about how property will be distributed.

Additionally, overlooking the need to plan for potential taxes and debts can be problematic. The estate may be responsible for outstanding debts and taxes before any distribution to beneficiaries. Not considering these obligations can result in beneficiaries receiving less than intended or specified in the will.

Finally, attempting to impose conditions on gifts in a manner that is not legally enforceable is a mistake. While it's natural to want to control how and when assets are used, some conditions can be deemed unenforceable, leading to portions of the will being invalidated. For example, requiring a beneficiary to marry or adopt a particular religion to receive a gift is likely unenforceable.

Documents used along the form

When preparing a Last Will and Testament in Florida, it's important to consider other documents that may be needed to fully ensure your affairs are in order. These complementary documents can help protect your assets, specify your healthcare wishes, and provide clear instructions for managing your estate. Below is a list of additional forms and documents often used alongside the Florida Last Will and Testament.

- Durable Power of Attorney: This document allows you to appoint someone to manage your financial affairs if you become incapacitated.

- Living Will: Also known as an advance directive, it specifies your wishes regarding medical treatment if you're unable to communicate them yourself.

- Designation of Health Care Surrogate: This form appoints someone to make healthcare decisions on your behalf if you're unable to do so.

- Declaration Naming Pre-Need Guardian: Allows you to choose a guardian for yourself in the event of incapacitation, and for your minor children, if applicable.

- Revocable Living Trust: Helps manage and protect your assets while you're alive and allows for an easier transfer of assets upon your death.

- Bank Account POD Form: “Payable on Death” form designates beneficiaries for your bank accounts, ensuring the funds in the account bypass probate.

- Life Insurance Policies: Not a form per se, but critical documents to have in order, specifying beneficiaries and making sure they align with your will.

- Digital Asset Management Plan: Specifies how your digital assets (social media, online accounts, etc.) should be handled after your passing.

- Funeral and Burial Instructions: Though not legally binding in all areas, this document states your wishes for your funeral and burial, relieving your loved ones of the burden of making these decisions during a difficult time.

Each of these documents plays a unique role in estate planning, complementing your Last Will and Testament in Florida. They work together to ensure your wishes are honored in various scenarios, not just after your death. It's advisable to consult with a legal professional to ensure all documents are correctly filled out and filed, providing thorough protection and peace of mind for you and your loved ones.

Similar forms

The Florida Trust Agreement shares similarities with the Last Will and Testament, primarily in its purpose of managing and distributing a person’s assets after their death. Both documents provide instructions for asset allocation but differ in that a Trust can also come into effect during the grantor's lifetime, offering privacy and potentially avoiding probate.

A Living Will, like the Last Will and Testament, is a legal document that sets forth an individual's preferences for medical care, specifically end-of-life decisions. While the Last Will and Testament deals with the distribution of assets posthumously, a Living Will takes effect when the individual is alive but incapacitated, guiding healthcare providers and loved ones in making medical decisions.

The Power of Attorney (POA) serves a similar function to the Last Will and Testament by delegating authority, but does so for different circumstances and timeframes. The POA allows an individual to appoint an agent to manage their affairs while they are alive, particularly if they become unable to do so themselves, whereas the Last Will activates only after death.

The Health Care Surrogate Designation is akin to the Last Will and Testament in that it appoints someone to act on another’s behalf. This document specifically allows the designation of a surrogate to make healthcare decisions if the individual becomes unable to make them, contrasting with the Last Will’s focus on posthumous asset distribution.

A Testamentary Trust within a Last Will and Testament acts similarly to the broader document by specifying asset distribution after death. However, this trust specifically outlines the management and distribution of assets for beneficiaries, such as minors, within the Will, setting stipulations for age or conditions under which beneficiaries receive assets.

The Durable Power of Attorney for Finances parallels the Last Will in allowing an individual to designate another to handle their financial affairs. Unlike the Last Will which activates on death, this document is effective during the individual’s lifetime, providing for financial management in cases of incapacitation.

An Advance Directive, like the Last Will and Testament, provides instructions for future scenarios. These directives encompass living wills and health care power of attorney, combining instructions for medical care preferences with appointing a health care agent, thus addressing aspects both prior to and similar to those after death covered by a Last Will.

The Preneed Guardian Declaration, while distinct, has objectives similar to those of a Last Will and Testament by allowing individuals to plan for future incapacity. It enables the appointment of a guardian in advance, effectively addressing the care of the person or their assets in situations not covered by death, where a Last Will would then take precedence.

The Revocable Living Trust is closely related to the Last Will and Testament, as it manages the distribution of an individual’s estate. However, it differs by avoiding probate, and its terms can be changed during the grantor's lifetime. While the Last Will takes effect after death, a Revocable Living Trust can manage assets during the grantor's life and after death, providing a seamless transition.

Finally, a Joint Ownership Agreement shares the purpose of managing assets with the Last Will and Testament by stipulating the ownership and rights of multiple parties over shared property. Although it primarily governs how property is managed while all owners are alive, it can include provisions for the distribution of a deceased partner’s interest, complementing or circumventing the need for directives in a Last Will.

Dos and Don'ts

Preparing a Last Will and Testament is a significant step in planning for the future. Below are some key do's and don'ts to consider when filling out the Florida Last Will and Testament form to ensure it accurately reflects your wishes and complies with Florida law.

Do's:- Do ensure the will is properly witnessed. In Florida, you must have at least two witnesses sign your will, and these witnesses must be present during the signing process and observe each other sign.

- Do be clear and specific about your beneficiaries and what they are to receive. This helps prevent any confusion or disputes among those you leave behind.

- Do choose a reliable and trustworthy executor. This person will be responsible for managing and distributing your estate according to your wishes as stated in your will.

- Do keep your will in a safe and accessible place. Inform your executor or a close family member of its location to ensure it can be found when needed.

- Do review and update your will as needed. Life changes such as marriage, divorce, the birth of a child, or the purchase of a major asset should prompt a review of your will.

- Do consider seeking legal advice. Consulting with an attorney who specializes in estate planning can ensure that your will complies with Florida law and that your wishes are clearly stated.

- Do be aware of the requirements for a self-proving affidavit. This affidavit can simplify the probate process but must be signed in the presence of a notary and witnesses.

- Don't leave any sections of the form blank. If a section does not apply, it's better to write "N/A" or "None" than to leave it empty, which could lead to unnecessary confusion.

- Don't attempt to make changes to the will by hand after it's been signed and witnessed. Handwritten changes may not be recognized by the court and could invalidate the entire document.

- Don't neglect to be specific about the distribution of your personal belongings, financial assets, and real estate. Vagueness can lead to conflicts among your beneficiaries.

- Don't forget to name a guardian for your minor children, if applicable. Without your direction, the court will decide who will care for your children.

- Don't use a generic will form if your situation is complex. High-value estates, businesses, or unique family dynamics may require a more tailored document.

- Don't fail to sign and date the will in accordance with Florida law. The validity of your will depends on complying with state-specific signing requirements.

- Don't keep your intentions a secret from your family or heirs. While the details of your will are personal, discussing your wishes can prevent surprises and conflict later on.

Misconceptions

When it comes to creating a Last Will and Testament in Florida, several misconceptions often cloud people's understanding. It's crucial to set the record straight, ensuring individuals can make informed decisions. Here's a look at seven common myths and the realities behind them:

Myth 1: You don't need a will if you don't have a lot of assets. Many believe that wills are only for the wealthy. In reality, a will is crucial for anyone who wishes to have a say in how their possessions, no matter how modest, are distributed after their death.

Myth 2: Your spouse automatically gets everything. While spouses do inherit a significant portion under Florida law, without a will, other close relatives may also have a claim to your estate. A will ensures your wishes are clearly spelled out.

Myth 3: You can leave anything to anyone. Florida law includes certain protections for spouses and minor children, ensuring they are not completely disinherited. This means there are limits to how you can distribute your assets.

Myth 4: Once you write your will, you never have to update it. Life changes such as marriage, divorce, and the birth of children can greatly affect your will's provisions. Regular updates ensure your will reflects your current wishes.

Myth 5: A handwritten will is just as valid as a formal document. While handwritten, or "holographic," wills can be legal in some places, Florida law generally requires a will to be typed and witnessed to be considered valid.

Myth 6: You don't need a lawyer to create a will. Technically true, but drafting a will without legal guidance can lead to mistakes and ambiguities. Consulting a lawyer ensures your will complies with Florida laws and fully captures your intentions.

Myth 7: Your debts die with you. Unfortunately, your debts may need to be settled out of your estate before any distribution to heirs. However, certain protections are available for spouses and homestead property.

Understanding these misconceptions can avoid potential pitfalls and ensure your final wishes are respected. A Last Will and Testament is a powerful tool, not just for asset distribution but also for articulating your wishes regarding the care of minors, the handling of business affairs, and more. Engaging with the process thoughtfully and with the right guidance ensures your legacy is as you envision it.

Key takeaways

Creating a Last Will and Testament is a crucial step in ensuring your wishes are honored after your passing. When filling out and using the Florida Last Will and Testament form, there are several key takeaways to keep in mind to ensure the process is completed efficiently and accurately.

- Understand Florida law: Before you start filling out your Last Will and Testament, it’s important to familiarize yourself with Florida's specific requirements for wills to be considered valid.

- Clearly identify yourself: Make sure to clearly print your full legal name and address to help affirm the will's credibility and make it easier for the executor to carry out your wishes.

- Appoint a reliable executor: The executor is responsible for managing your estate according to your will’s instructions. Choose someone who is trustworthy, willing, and able to take on this responsibility.

- Be specific about beneficiaries: Clearly specify who your beneficiaries are (e.g., full names) and what you wish to leave to each to prevent any confusion or disputes among family members or other parties.

- Assign guardians for minor children: If you have minor children, it’s critical to appoint a guardian for them in your will, ensuring they are cared for by someone you trust in the event of your untimely death.

- Detail your assets: Provide a detailed list of your assets (property, bank accounts, personal possessions) and specify how you want them distributed. This precision helps prevent potential disputes and ensures your assets are distributed according to your wishes.

- Consider creating a self-proving affidavit: Although not required, a self-proving affidavit can speed up the probate process since it verifies the authenticity of your will without requiring your witnesses to testify in court.

- Sign the will in the presence of witnesses: In Florida, you must sign your will in the presence of two witnesses, who must also sign the document. This is a critical step for the will to be considered legally valid.

- Store your will safely: Once completed, store your Last Will and Testament in a safe, secure, and accessible place. Make sure your executor knows where to find it when the time comes.

- Review and update regularly: Life changes such as marriage, divorce, births, and deaths can affect your will. Review and update it regularly to ensure it accurately reflects your wishes.

Following these guidelines will help streamline the process of creating a Last Will and Testament in Florida, ensuring that your wishes are honored and your loved ones are provided for according to your intentions.

More Last Will and Testament State Forms

Free Last Will and Testament Ohio - An essential legal framework that dictates the exact manner in which an estate's assets are to be distributed.

Making Will - It offers peace of mind, knowing that personal affairs are in order, and loved ones will be cared for according to specific desires.