Fillable Last Will and Testament Document for California

In California, the process of planning for one's estate after passing involves the creation of a Last Will and Testament, a document that holds significant power and responsibility. This legal instrument allows individuals, commonly referred to as testators, to outline precisely how they wish their property, assets, and personal belongings to be distributed among chosen beneficiaries. Apart from ensuring that one’s final wishes are honored, this document plays a crucial role in minimizing disputes among heirs, thereby streamlining the probate process — a court-supervised procedure to validate the will and oversee the distribution of the estate. California law has specific requirements for a Last Will and Testament to be considered valid, including the age and mental capacity of the testator, as well as the necessity for the document to be signed in the presence of witnesses. Moreover, while many might consider drafting a will to be a task for the wealthier segments of society, it stands as an essential step for anyone seeking to safeguard their legacy and provide clear instructions for the handling of their affairs, regardless of the size of their estate. Understanding the critical features and legal stipulations of the California Last Will and Testament form can empower individuals to make informed decisions, ensuring their peace of mind and the well-being of their loved ones.

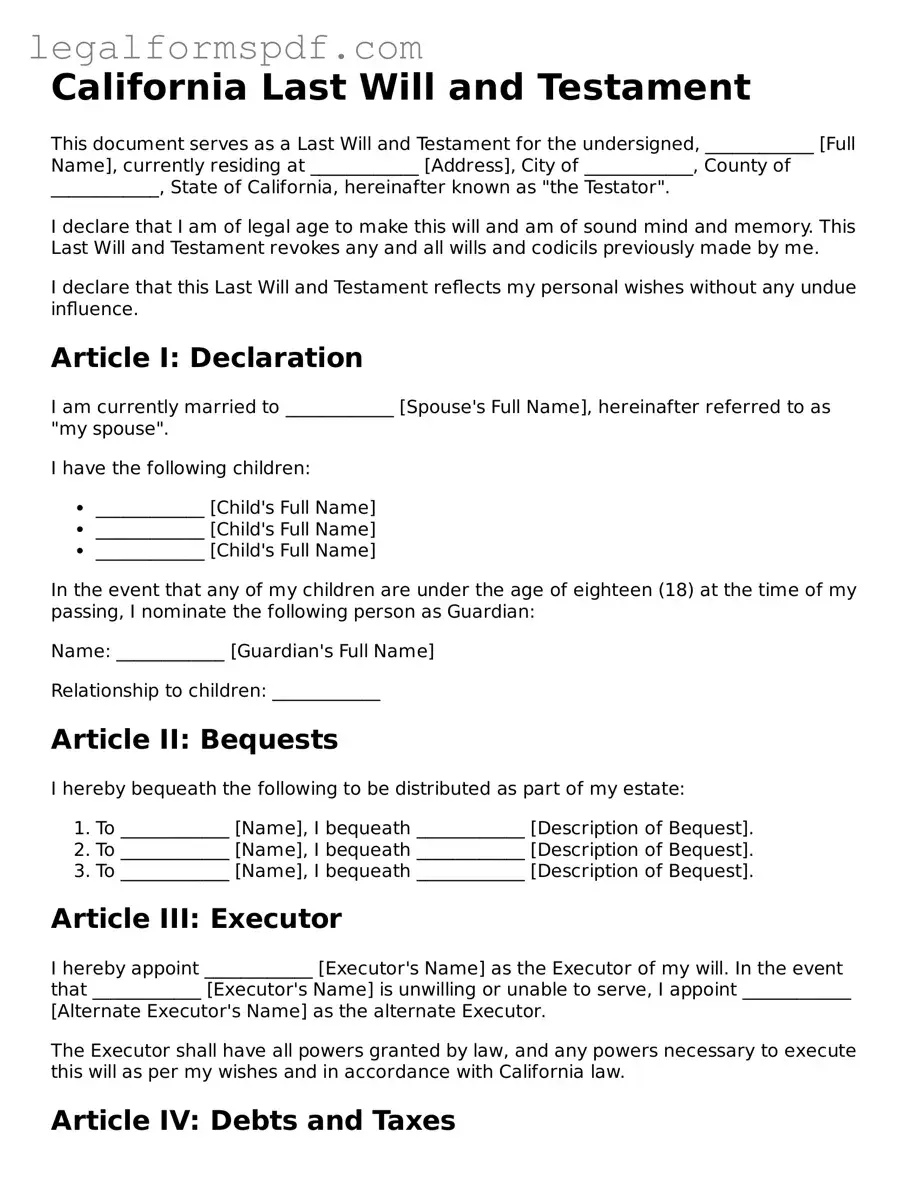

Document Example

California Last Will and Testament

This document serves as a Last Will and Testament for the undersigned, ____________ [Full Name], currently residing at ____________ [Address], City of ____________, County of ____________, State of California, hereinafter known as "the Testator".

I declare that I am of legal age to make this will and am of sound mind and memory. This Last Will and Testament revokes any and all wills and codicils previously made by me.

I declare that this Last Will and Testament reflects my personal wishes without any undue influence.

Article I: Declaration

I am currently married to ____________ [Spouse's Full Name], hereinafter referred to as "my spouse".

I have the following children:

- ____________ [Child's Full Name]

- ____________ [Child's Full Name]

- ____________ [Child's Full Name]

In the event that any of my children are under the age of eighteen (18) at the time of my passing, I nominate the following person as Guardian:

Name: ____________ [Guardian's Full Name]

Relationship to children: ____________

Article II: Bequests

I hereby bequeath the following to be distributed as part of my estate:

- To ____________ [Name], I bequeath ____________ [Description of Bequest].

- To ____________ [Name], I bequeath ____________ [Description of Bequest].

- To ____________ [Name], I bequeath ____________ [Description of Bequest].

Article III: Executor

I hereby appoint ____________ [Executor's Name] as the Executor of my will. In the event that ____________ [Executor's Name] is unwilling or unable to serve, I appoint ____________ [Alternate Executor's Name] as the alternate Executor.

The Executor shall have all powers granted by law, and any powers necessary to execute this will as per my wishes and in accordance with California law.

Article IV: Debts and Taxes

I direct that all my just debts, funeral expenses, and expenses of last illness be paid as soon as practicable after my passing.

It is my intention that any taxes or duties payable in respect of any property or money passing under this will shall be paid out of my estate and not by the respective beneficiaries.

Article V: General Provisions

All references in this will to the "estate", "my estate", or "the estate" shall include any real, personal, or mixed property that I may own at the time of my passing.

This Last Will and Testament is made in accordance with the laws of the State of California and shall be interpreted accordingly. Any part of this will found to be invalid will not affect the remaining parts.

IN WITNESS WHEREOF, I, ____________ [Full Name], the Testator, have to this will, set my hand this ____ day of ____________, 20__.

Testator's Signature: ___________________________

Date: _______________

Witness #1

Name: ___________________________

Signature: _______________________

Date: _______________

Witness #2

Name: ___________________________

Signature: _______________________

Date: _______________

PDF Specifications

| Fact | Detail |

|---|---|

| Definition | A Last Will and Testament is a legal document that expresses a person's wishes regarding the distribution of their property and the care of any minor children upon their death. |

| Governing Law | In California, the Probate Code sections 6100-6806 govern the creation and execution of Wills. |

| Age Requirement | The individual creating the Will (Testator) must be at least 18 years old. |

| Capacity Requirement | The Testator must be of sound mind, meaning they understand the nature of the Will, their relations to those mentioned in the Will, and their property. |

| Writing Requirement | A California Last Will and Testament must be in writing to be considered valid. |

| Witness Requirement | It must be signed by at least two individuals who have witnessed the Testator signing the Will or the Testator’s acknowledgment of the signature or the Will. |

| Holographic Wills | California recognizes holographic Wills, which are handwritten by the Testator and do not necessarily need to be witnessed if the material provisions and the Testator’s signature are in the Testator’s handwriting. |

| Self-Proving Affidavit | A self-proving affidavit is not required in California, but it can speed up probate because it verifies the Will's validity, often without the need for witness testimony. |

| Revocation | A Will can be revoked by the Testator by creating a new Will or by physically destroying the previous one with the intent to revoke it. |

Instructions on Writing California Last Will and Testament

Creating a Last Will and Testament is a thoughtful way to ensure your wishes are honored and your loved ones are taken care of after your passing. This document allows you to clearly lay out how you'd like your assets to be distributed and can help avoid any potential disputes among family members or beneficiaries. If you're residing in California and ready to prepare your will, here's how you can fill out the California Last Will and Testament form. Note that while this guide aims to make the process smoother, consulting with a legal professional can provide personalized advice and peace of mind.

- Gather all necessary information, including the full names and addresses of beneficiaries, details of your assets, and who you wish to appoint as the executor of your will.

- On the top of the document, enter your full legal name and address to establish your identity as the testator (the person creating the will).

- Appoint your executor by providing their full name and address. This person will be responsible for managing and distributing your estate according to the will's instructions.

- Detail the beneficiaries of your will. Clearly state the name of each beneficiary, their relationship to you, and what you are bequeathing to them. If you wish to leave specific items or amounts of money to individuals, outline this clearly.

- If you have minor children, specify a guardian for them in the event of your passing. Include the guardian’s full name and address.

- Review all sections of the will to ensure that all information is accurate and reflects your wishes. Pay particular attention to names, addresses, and the specifics of your bequests.

- Sign and date the document in the presence of two witnesses. These witnesses must also sign, affirming they saw you sign the will and deem you of sound mind to do so. The witnesses should be people who are not named as beneficiaries in the will.

- Consider storing the will in a safe and accessible place. Let your executor know where the will is stored, so it can be easily found when needed.

Completing your Last Will and Testament is a significant step in planning for the future. It's not only about protecting your assets but also about making things easier for those you care about. By following these steps, you can rest assured that your final wishes will be understood and acted upon in California. Remember, laws can change, and each situation is unique, so it's wise to review your will periodically and consult with a legal expert if you have any questions or changes to make.

Understanding California Last Will and Testament

What is a California Last Will and Testament?

A California Last Will and Testament is a legal document that allows an individual, known as the testator, to designate how their assets and property will be distributed after their death. It outlines the wishes of the testator regarding who receives their assets, the appointment of an executor to manage the estate, and can also include guardianship preferences for minor children.

Who can create a Last Will and Testament in California?

In California, any person over the age of 18 who is of sound mind can create a Last Will and Testament. Being of "sound mind" generally means that the individual understands the nature of the will, knows the nature and extent of their property, and is aware of the people who are the natural beneficiaries of their estate.

Does a California Last Will and Testament need to be notarized?

No, a Last Will and Testament in California does not need to be notarized to be legally valid. However, it must be signed by the testator and by at least two witnesses who are present at the same time and understand that the document being signed is the testator's will. These witnesses cannot be beneficiaries of the will.

Can I update my Last Will after it's been created?

Yes, a Last Will and Testament can be updated at any time before the testator's death. This is often done through a codicil, which is an amendment to the will that needs to be executed with the same formality as the original will. Alternatively, the testator can create a new will that revokes and replaces the previous one.

What happens if I die without a Last Will and Testament in California?

If you die without a Last Will and Testament in California, your estate will be distributed according to the state's intestacy laws. These laws dictate a default distribution plan, which often grants your closest relatives—such as your spouse, children, or parents—the inheritance. This may not align with your personal wishes for your estate, highlighting the importance of having a will.

Common mistakes

Creating a Last Will and Testament is a critical step in managing one's affairs and ensuring wishes are honored after passing. In California, as elsewhere, individuals often make mistakes when filling out this crucial document. These mistakes can create complications, delay the distribution of the estate, or even lead to litigation among heirs.

One common mistake is not adhering to California's legal requirements for a will to be considered valid. For instance, it's essential that the will be signed in the presence of two witnesses, who also must sign the document themselves. These witnesses should not be beneficiaries of the will to avoid potential conflicts of interest or challenges to the will’s validity.

Another frequent error is failing to be specific enough when designating heirs and assigning assets. Vague language can lead to disputes among potential heirs and may require legal intervention to interpret the deceased's intentions. This can significantly delay the distribution of the estate and lead to additional expenses that reduce the inheritance for the beneficiaries.

Some individuals neglect to name an executor or name someone without ensuring they’re willing and able to take on the responsibility. This role is crucial as the executor will manage the estate, including paying debts and distributing assets in accordance with the will. A reluctant or incapable executor can hinder the efficient execution of these duties.

Failing to update the will is another oversight. Major life events such as marriage, divorce, the birth of children, or the death of a named heir or executor should prompt a review and, if necessary, a revision of the will to reflect current wishes and circumstances.

Incomplete or incorrect descriptions of assets can also create issues. For assets to be distributed as wished, they must be identified clearly and accurately. Without precise descriptions, the intended recipients may not receive what the decedent wanted them to have.

Some individuals mistakenly believe that a will can cover all types of assets. However, certain assets, like those held in joint tenancy or designated to pass to a named beneficiary such as life insurance policies or retirement accounts, are not covered by a will. Misunderstanding which assets can be included can lead to mistaken assumptions about the distribution of the estate.

Lastly, attempting to impose conditions on beneficiaries that are either impossible, illegal, or based on personal beliefs (e.g., requiring marriage within a certain faith or the attainment of a specific educational degree) can lead to parts of the will being invalidated. Ensuring that all conditions are legally enforceable and reasonably achievable is crucial for the will to be executed as intended.

Understanding and avoiding these common mistakes can help ensure that a Last Will and Testament in California accurately reflects one's wishes and can be executed smoothly, providing peace of mind to both the individual and their loved ones.

Documents used along the form

When preparing a Last Will and Testament in California, it's crucial to understand that this document is part of a broader estate planning process. Various other documents often accompany the Last Will to ensure a comprehensive approach to estate planning. These documents can further clarify your wishes, protect your assets, and provide for your loved ones. Below is a list of forms and documents frequently used alongside the California Last Will and Testament form.

- Advance Health Care Directive - This document outlines your wishes regarding medical treatment if you become unable to communicate your decisions due to illness or incapacity. It combines a living will and a durable power of attorney for health care.

- Financial Power of Attorney - It allows you to appoint someone you trust to manage your financial affairs. This can include paying bills, managing investments, and handling other financial matters if you are unable to do so yourself.

- Living Trust - A living trust helps manage your property during your lifetime and distribute it after your death. It can help avoid the potentially lengthy and costly probate process.

- Guardianship Designation - This is crucial if you have minor children or dependents. It allows you to appoint a guardian to care for them if you are unable to do so.

- Beneficiary Designations - Certain assets, such as life insurance policies and retirement accounts, allow you to designate beneficiaries. These designations take precedence over instructions in a will or trust.

- Digital Asset Instruction - This document provides instructions and authority for someone to manage your digital assets, including social media accounts, digital photos, and online banking, after your death.

- Personal Property Memorandum - Linked to your will, this document allows you to list items of personal property and designate who will receive each item. This can help prevent disputes among heirs.

- Funeral Instructions - Although not legally binding in all states, including these instructions can help your loved ones know your wishes regarding your funeral arrangements and the disposition of your remains.

- Letter of Intent - This document provides additional guidance and personal messages to your executors and beneficiaries. It can outline your wishes for specific assets or provide explanations for the decisions made in your will.

Incorporating these documents into your estate plan can provide a well-rounded approach to planning for the future. Each plays a significant role in ensuring your wishes are respected and your loved ones are cared for, making the estate administration process as smooth as possible. Consulting with a legal professional can help tailor these documents to your specific needs, ensuring a comprehensive estate plan that aligns with California laws.

Similar forms

The Living Trust is similar to the California Last Will and Testament in that it manages the allocation of an individual's property after their death. However, a Living Trust offers the advantage of avoiding probate, which can lead to a faster distribution of assets to beneficiaries. It provides specific instructions for asset management and distribution, similar to a will, but allows for a more seamless transition of assets.

A Power of Attorney document shares some similarities with the Last Will and Testament, as it designates someone to make decisions on behalf of the creator. While a Last Will and Testament becomes effective upon death, a Power of Attorney is operational during the individual’s lifetime, specifically when they are unable to make decisions for themselves due to incapacity or other reasons.

Advance Health Care Directive is somewhat akin to the Last Will and Testament since it outlines a person’s wishes regarding medical treatment if they become unable to communicate those preferences. Although it focuses on healthcare decisions rather than asset distribution, both documents ensure a person's wishes are honored, one at the end of life and the other after death.

The Financial Inventory Statement, while not a directive for after death, is related to a Last Will and Testament because it lists an individual's assets, liabilities, and other financial information. This document can be invaluable in estate planning and is often used alongside a will to provide a comprehensive overview of what will be distributed upon death.

A Beneficiary Designation form directly complements a Last Will and Testament as it names who will receive assets like life insurance proceeds, retirement accounts, and other financial instruments upon the owner's death. While both documents specify asset distribution, beneficiary designations typically bypass the will and probate process.

The Digital Asset Inventory is particularly relevant in modern estate planning, akin to a Last Will and Testament, but for one's digital presence. This document lists all digital assets and accounts, such as email, social media, and online banking information, offering clear instructions on handling these assets posthumously, similar to how physical assets are dealt with in a will.

A Letter of Intent for a Will serves a similar purpose to the California Last Will and Testament by providing additional context or specific wishes not formally outlined in the will. This document is not legally binding but can guide executors and beneficiaries, offering insights into the deceased’s personal thoughts and wishes regarding their estate.

The Guardianship Nomination, much like a Last Will and Testament, allows an individual to appoint someone to care for their minor children or dependents in the event of their death. It is a crucial document for parents and guardians, ensuring that their children are cared for by a trusted individual, in line with their wishes, should they be unable to do so themselves.

Dos and Don'ts

When drafting a California Last Will and Testament, careful attention to detail is crucial. This ensures your final wishes are respected and effectively communicated. Here are essential dos and don'ts to consider during the process:

- Do thoroughly review California's legal requirements for wills to ensure yours is valid. Understanding these specifications ensures your will stands firm legally.

- Do clearly identify your assets and how they should be distributed. Specificity can prevent misunderstandings and ensure your wishes are followed accurately.

- Do choose an executor you trust. This person will manage your estate's affairs, making it crucial they’re both capable and reliable.

- Don't use ambiguous language that might lead to interpretations you didn't intend. Clarity in your instructions prevents potential disputes among beneficiaries.

- Don't forget to sign and date your will in the presence of two witnesses, as required by California law. An unsigned will risks being considered invalid.

- Don't overlook the importance of updating your will as life circumstances change. Regular revisions ensure your document reflects your current wishes and situation.

Misconceptions

When thinking about creating a Last Will and Testament in California, many people come across information that might not be entirely accurate. Understanding and dispelling these misconceptions can ensure that individuals make well-informed decisions regarding their estate planning. Here are five common misconceptions about the California Last Will and Testament form:

- A Last Will and Testament can avoid probate. A widespread misconception is that having a Last Will and Testament allows the estate to bypass the probate process. In reality, the will directs the probate court on how to distribute the deceased's assets. The process of proving the will's validity still occurs in probate court.

- Spouses are automatically granted everything. People often believe that if they pass away without a will, their spouse will automatically inherit everything. While California's laws of intestate succession do provide significant protections for spouses, not all assets may go to them, especially if there are children from outside the marriage or designated beneficiaries on certain accounts.

- Oral wills are legally binding in California. Another common misunderstanding is the legality of oral wills. In California, for a will to be considered valid, it generally needs to be written and comply with specific statutory requirements, such as being signed by the testator and witnessed by at least two individuals.

- You can disinherit your spouse completely. Many believe that one can entirely disinherit their spouse through their Last Will and Testament. However, California law provides certain protections for spouses, such as the right to claim a portion of the estate under the community property laws, regardless of the will's provisions.

- Only elderly or wealthy individuals need a Last Will and Testament. This misconception leads many younger or less wealthy individuals to postpone estate planning. In reality, anyone who has assets, minor children, or wishes to specify their desires for after their death should consider creating a Last Will and Testament. It ensures that a person's wishes are followed and can make the administration of their estate much smoother for their loved ones.

Key takeaways

The California Last Will and Testament form is an essential legal document that allows individuals to specify how their possessions and assets are to be distributed after their death. Understanding the key aspects of filling out and properly using this form is crucial for ensuring that one's final wishes are honored. Here are nine key takeaways to consider:

- The individual creating the Will, known as the testator, must be at least 18 years old and of sound mind at the time of making the document to ensure it is valid.

- Clearly listing the assets and specifying the beneficiaries for each ensures that the testator's wishes are understood and can be executed without ambiguity.

- The Will must be in writing. While California recognizes holographic (handwritten) Wills, having a typed and formally witnessed document can help avoid potential disputes.

- For a Will to be considered valid in California, it requires the signatures of at least two witnesses. These witnesses must not stand to inherit anything from the Will to avoid conflicts of interest.

- Including a self-proving affidavit with the Will can expedite the probate process, as it serves as proof that the Will was signed under the legally required conditions.

- Designating an executor in the Will is critical. This person will be responsible for managing the estate, paying any debts or taxes, and distributing assets as specified in the Will.

- Regularly updating the Will is necessary to reflect changes in the testator’s life and relationships, such as marriage, divorce, the birth of children or grandchildren, or acquiring significant assets or liabilities.

- Understanding the difference between probate and non-probate assets is important. Some assets, like those held in a trust, life insurance proceeds, or jointly owned property, may not be covered by the Last Will and Testament.

- Consulting with a legal professional is advisable to ensure the Will complies with California laws and fully captures the testator’s intentions. This can also provide clarity and peace of mind for both the testator and the beneficiaries.

More Last Will and Testament State Forms

Last Will and Testament Form Pennsylvania - A mechanism to prevent unnecessary legal disputes and preserve family harmony.

Free Last Will and Testament Ohio - A crucial step in estate planning that offers guidance and instructions for asset allocation after one's passing.

Is a Handwritten Will Legal in Nc - May be used to disinherit individuals or to leave unequal shares to heirs.