Official Last Will and Testament Document

Many of us may not like to think about it, but planning for the future and what happens after we're gone is important. One crucial step in this planning process is creating a Last Will and Testament. This legal document serves as a guide for how an individual's assets and affairs should be handled after their death. It outlines who should inherit assets, who should take care of any minor children, and even how one wishes for certain personal items to be distributed. Additionally, a Last Will and Testament can appoint someone the individual trusts to ensure that their last wishes are carried out correctly, this person is known as the executor. Creating this document might seem daunting, but it's a fundamental way to ensure that one's wishes are respected and that loved ones are provided for in the best possible way. The importance of this form lies not only in the distribution of assets but in providing peace of mind and clarity during a time that will be difficult for those left behind.

State-specific Information for Last Will and Testament Forms

Last Will and Testament Form Subtypes

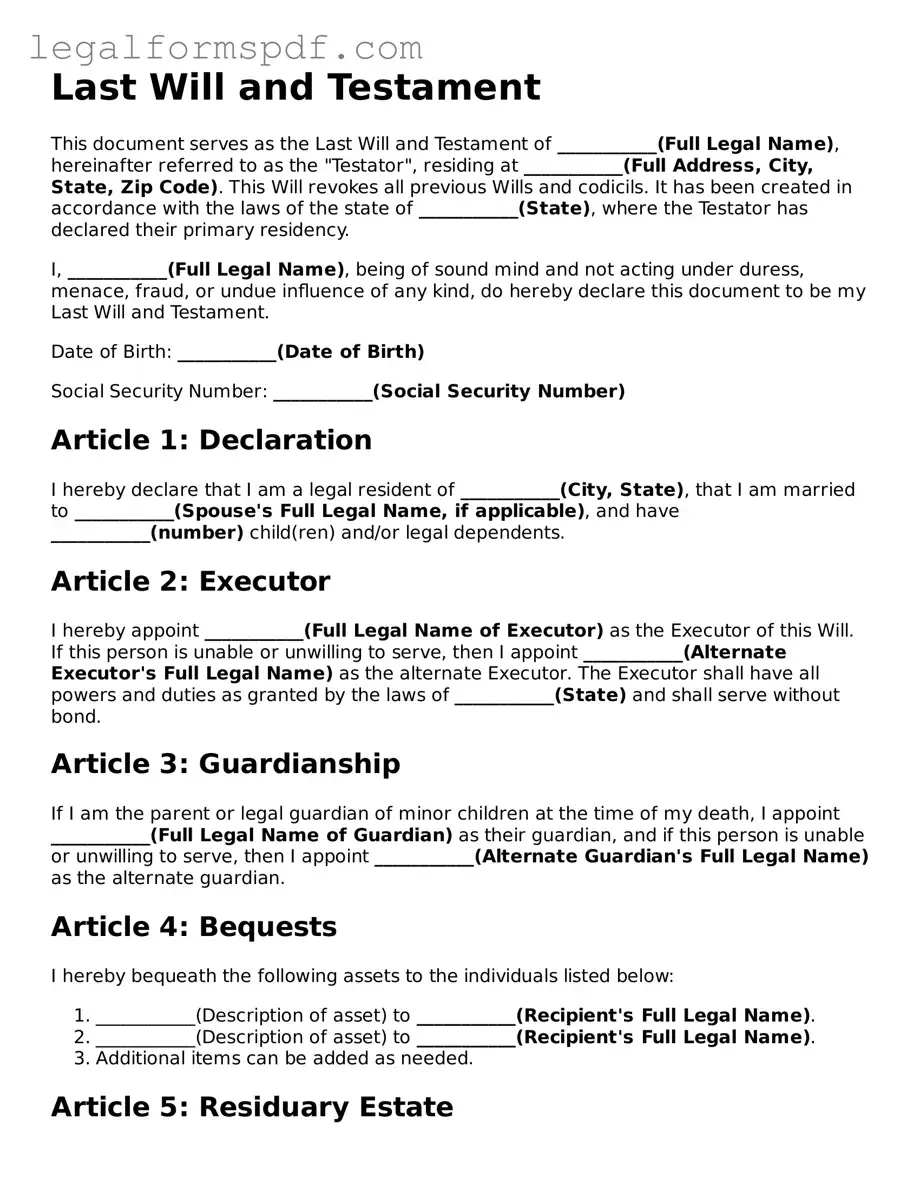

Document Example

Last Will and Testament

This document serves as the Last Will and Testament of ___________(Full Legal Name), hereinafter referred to as the "Testator", residing at ___________(Full Address, City, State, Zip Code). This Will revokes all previous Wills and codicils. It has been created in accordance with the laws of the state of ___________(State), where the Testator has declared their primary residency.

I, ___________(Full Legal Name), being of sound mind and not acting under duress, menace, fraud, or undue influence of any kind, do hereby declare this document to be my Last Will and Testament.

Date of Birth: ___________(Date of Birth)

Social Security Number: ___________(Social Security Number)

Article 1: Declaration

I hereby declare that I am a legal resident of ___________(City, State), that I am married to ___________(Spouse's Full Legal Name, if applicable), and have ___________(number) child(ren) and/or legal dependents.

Article 2: Executor

I hereby appoint ___________(Full Legal Name of Executor) as the Executor of this Will. If this person is unable or unwilling to serve, then I appoint ___________(Alternate Executor's Full Legal Name) as the alternate Executor. The Executor shall have all powers and duties as granted by the laws of ___________(State) and shall serve without bond.

Article 3: Guardianship

If I am the parent or legal guardian of minor children at the time of my death, I appoint ___________(Full Legal Name of Guardian) as their guardian, and if this person is unable or unwilling to serve, then I appoint ___________(Alternate Guardian's Full Legal Name) as the alternate guardian.

Article 4: Bequests

I hereby bequeath the following assets to the individuals listed below:

- ___________(Description of asset) to ___________(Recipient's Full Legal Name).

- ___________(Description of asset) to ___________(Recipient's Full Legal Name).

- Additional items can be added as needed.

Article 5: Residuary Estate

All the rest, residue, and remainder of my estate, not otherwise disposed of by this Will, shall be distributed to ___________(Recipient's Full Legal Name). If this recipient is deceased, the residuary estate shall pass to ___________(Alternate Recipient's Full Legal Name).

Article 6: Taxes and Expenses

All my lawful debts, funeral expenses, and expenses of last illness shall be paid from my estate before any distribution is made.

Article 7: Severability

If any part of this Will is ruled invalid, illegal, or unenforceable by a court, the remaining parts shall be unimpaired and remain in effect.

Signing

In witness whereof, I have hereunto set my hand and seal this ___________(Date).

_____________________(Signature of Testator)

Witnessed this day of ___________(Date) by:

- ___________(Witness 1 Full Legal Name), residing at ___________(Witness 1 Address)

- ___________(Witness 2 Full Legal Name), residing at ___________(Witness 2 Address)

Notary Public:

State of ___________(State)

County of ___________(County)

On ___________(Date), before me, ___________(Notary's Full Legal Name) personally appeared ___________(Full Legal Name of Testator), personally known to me (or proved to me on the oath of ___________(credible witness) or through __(type of identification)__) to be the person whose name is subscribed to the within instrument, and acknowledged to me that he/she executed the same in his/her authorized capacity, and that by his/her signature on the instrument, the person, or the entity upon behalf of which the person acted, executed the instrument.

Witness my hand and official seal:

_____________________(Signature of Notary Public)

Seal:

PDF Specifications

| Fact | Description |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines an individual's wishes regarding the distribution of their assets and care of minor children after death. |

| Requirements | Generally includes being of legal age (usually 18 or older), being of sound mind, and having the will signed in the presence of witnesses. |

| Witnesses | Most states require at least two witnesses to sign the will, who are not beneficiaries, to validate its authenticity. |

| Revocation | The document can be revoked or modified by the creator at any time before death, provided they are of sound mind. |

| Executor | An executor is named within the document to manage the estate's distribution according to the will's instructions. |

| Guardianship | If the deceased has minor children, the will can specify a preferred guardian for them, although final decisions are made by a court. |

| State Specificity | Laws governing Last Wills and Testaments vary by state, affecting form requirements, execution, and validity. |

| Probate Process | After death, the will is usually submitted to probate court to begin the process of asset distribution and debt settlement. |

Instructions on Writing Last Will and Testament

Completing a Last Will and Testament form is a thoughtful process that ensures your assets are distributed according to your wishes after you pass away. This document serves as a clear instruction set for the distribution of your estate, including property, financial assets, and personal items, to your designated beneficiaries. It is essential to approach this task with attention to detail to ensure all your preferences are accurately reflected. Here are step-by-step instructions for completing the form.

- Gather all necessary information, including the full names and addresses of your beneficiaries, a comprehensive list of your assets, and the details of your chosen executor.

- Begin by entering your full name and address at the top of the document to establish your identity as the testator (the person making the will).

- Appoint an executor by writing the name and contact details of the person you trust to carry out your will’s instructions. An executor is responsible for managing your estate, paying off any debts, and distributing your assets to your beneficiaries.

- Designate guardians for any minor children or dependents, ensuring you have discussed this responsibility with them beforehand.

- List all beneficiaries next, including their full names, addresses, and the specific assets you wish to leave to each. Be as clear as possible to avoid ambiguity.

- Provide instructions for dividing your assets. If certain items or properties are meant for specific individuals, mention these clearly. For shared assets, specify how you want them divided.

- Consider adding a residuary clause to cover any assets not specifically mentioned elsewhere in your will. This clause can direct the remaining portion of your estate to a particular beneficiary or divide it among several beneficiaries.

- Sign the document in the presence of witnesses. The number of witnesses required can vary by state, but generally, two or three unbiased individuals who are not beneficiaries should witness your signature and then sign the document themselves.

- Store the completed form in a safe place and inform your executor of its location. It’s also wise to keep a digital copy in a secure, accessible location.

By following these steps, you can create a Last Will and Testament that clearly expresses your final wishes and helps ensure that your estate is distributed according to your preferences. It’s advisable to consult with a legal professional to confirm that your will complies with state laws and fully captures your intentions.

Understanding Last Will and Testament

What is a Last Will and Testament?

A Last Will and Testament is a legal document that allows you to express your wishes regarding the distribution of your assets, the care of any minor children, and the execution of your estate after your death. It specifies who will inherit your property, who will be responsible for managing your estate (the executor), and, if applicable, who will take guardianship of your minor children.

Why do I need a Last Will and Testament?

Having a Last Will and Testament ensures that your assets are distributed according to your wishes after you pass away. Without one, state laws will determine how your assets are divided, which might not align with your desires. It also allows you to appoint a guardian for your minor children, providing you peace of mind about their well-being in your absence.

How do I make a Last Will and Testament legally binding?

To make a Last Will and Testament legally binding, it must be written in accordance with state laws, which typically require the will to be signed by the person making the will (the testator) in the presence of at least two witnesses. Some states may also require the document to be notarized. It is essential to consult local laws to ensure all legal requirements are met.

Can I change my Last Will and Testament after creating it?

Yes, you can change your Last Will and Testament anytime during your lifetime, provided you are of sound mind. This can be done by amending the existing will through a document called a codicil or by creating a new will. Both methods require the same formalities as the original will to be considered valid.

What should be included in a Last Will and Testament?

A comprehensive Last Will and Testament should include identification of the testator, a declaration that the document is your will, the appointment of an executor, instructions for asset distribution, the nomination of guardians for minor children if applicable, and any specific funeral arrangements. It might also include provisions for charitable donations or the establishment of trusts.

Who can serve as a witness to a Last Will and Testament?

Witnesses to a Last Will and Testament should be competent adults who do not stand to benefit from the will. This means they should not be heirs or related to any of the beneficiaries in a way that could affect their impartiality. The exact requirements for witnesses can vary by state, so it's important to understand local laws.

What happens if I die without a Last Will and Testament?

If you die without a Last Will and Testament, you are considered to have died "intestate." This means that state laws will determine the distribution of your assets and the guardianship of your minor children. These laws may not reflect your personal wishes or provide the best outcomes for your loved ones, which is why having a will is critical.

Can a Last Will and Testament reduce estate taxes?

While a Last Will and Testament itself doesn't directly reduce estate taxes, it allows for planning that can minimize the tax burden on your estate. By distributing assets in certain ways, creating trusts, or making charitable donations, you can potentially reduce the amount of your estate subject to taxes. Consulting with a financial advisor or tax expert can help you understand the best options for your situation.

Is a lawyer required to create a Last Will and Testament?

While you are not legally required to use a lawyer to create a Last Will and Testament, consulting with one who specializes in estate planning can be beneficial. They can provide valuable advice on complex situations and ensure that the will complies with state laws. For more straightforward estates, using reliable online templates or software might suffice, but it's always advisable to have the final document reviewed by an expert.

Common mistakes

One common mistake made when filling out a Last Will and Testament form is not providing clear details about the distribution of assets. Many individuals tend to write general statements of intent without specifying who receives what or how much. This lack of clarity can lead to disputes among beneficiaries, potentially resulting in lengthy legal battles that can drain the estate's resources.

Another frequent error is neglecting to update the will after significant life changes. Life events such as marriages, divorces, births, and deaths can drastically change a person's intentions for their estate. However, if the will is not updated accordingly, it may not reflect the current wishes of the testator, which can lead to unintended consequences for the distribution of the estate.

Failing to choose an appropriate executor is also a crucial oversight. The executor of a will has significant responsibilities, including distributing assets, paying debts, and ensuring the will's instructions are followed. Selecting someone who is untrustworthy, unwilling, or unable to perform these duties can cause unnecessary complications and delays in the administration of the estate.

A technical but essential mistake is forgetting to have the will properly witnessed. Most jurisdictions require that a will be signed in the presence of witnesses to be legally valid. These witnesses must be adults who are not beneficiaries of the will, ensuring there is no conflict of interest. Overlooking this step can render the entire document invalid, leaving the estate to be distributed according to the state's default laws on intestacy.

Lastly, many individuals attempt to include instructions for the distribution of assets that cannot be legally transferred through a will. Certain types of property, such as jointly owned property or assets in a trust, pass outside of the will. Including these in the will can create confusion and potentially conflict, as these assets are governed by different legal mechanisms. It is crucial for individuals to understand which assets can be included in a will to avoid this mistake.

Documents used along the form

The Last Will and Testament form is a crucial component of estate planning, serving as a foundational document that outlines an individual's wishes regarding the distribution of their assets upon death. However, it is typically not the only document needed to fully express one’s end-of-life wishes and manage estate affairs. Various other legal documents often accompany a Last Will and Testament, each serving a distinct purpose in ensuring a comprehensive approach to estate planning. Let’s explore five such documents that are commonly used in conjunction with a Last Will and Testament.

- Durable Power of Attorney - This document allows an individual, known as the principal, to appoint someone else, referred to as an agent or attorney-in-fact, to make decisions on their behalf. This is crucial in situations where the principal cannot make decisions due to incapacity. The "durable" aspect means it remains in effect even if the principal becomes incapacitated.

- Health Care Proxy (or Medical Power of Attorney) - Similar to a Durable Power of Attorney, a Health Care Proxy appoints an agent to make health care decisions for the principal if they are unable to do so themselves. This document ensures that someone the principal trusts is making decisions about their medical care according to their wishes.

- Living Will - A Living Will is a document that outlines an individual’s preferences regarding end-of-life care. It comes into play if the individual is unable to communicate their desires directly. This document can specify wishes regarding life-prolonging medical treatments, pain management, and other important considerations.

- Revocable Living Trust - This tool allows an individual to manage their assets during their lifetime and specify how these assets should be distributed upon their death. A significant advantage is that assets placed in a revocable living trust can bypass the probate process, potentially saving time and money, and maintaining privacy.

- Beneficiary Designations - Though not a stand-alone document like the others, beneficiary designations are critical in ensuring specific assets such as retirement accounts and life insurance policies go to the intended beneficiaries without being subject to the probate process. It is essential to ensure that these designations are up to date and align with the wishes laid out in the Last Will and Testament and other estate documents.

Together with the Last Will and Testament, these documents form a comprehensive estate plan that addresses not only the distribution of assets post-death but also crucial decisions during one's life, particularly in situations of incapacity. Properly executed and maintained, these documents can provide reassurance to individuals and their families that their wishes will be respected and that provisions are in place for their care and the care of their loved ones. Engaging with legal professionals to create and review these documents can ensure that they accurately reflect an individual's wishes and are executed according to current laws.

Similar forms

A Living Will is closely related to a Last Will and Testament as it expresses an individual's preferences regarding medical treatment should they become unable to communicate their decisions. Both documents ensure a person's intentions are respected; a Last Will and Testament pertains to the disposition of one's estate after death, while a Living Will addresses healthcare decisions during one's lifetime.

Trust documents share similarities with the Last Will and Testament, as they both deal with the management and distribution of assets. A Trust can be established to take effect during a person's lifetime or after their death, providing a mechanism for asset management that can avoid probate, whereas a Last Will and Testament becomes effective only after one’s death and typically requires probate to execute the deceased's wishes.

Power of Attorney (POA) documents, much like a Last Will and Testament, enable an individual to make critical financial and legal decisions on another’s behalf. While a Last Will and Testament is enacted after death, a POA is effective during the principal's lifetime, granting an agent authority to act in a wide range of legal and financial matters.

Healthcare Proxy forms are similar to the Last Will and Testament in that they appoint another person to make decisions on behalf of the individual, should they become incapacitated. While the Last Will and Testament deals with estate matters after death, a Healthcare Proxy focuses on medical decisions, ensuring the person's healthcare wishes are followed when they can't communicate them on their own.

Beneficiary Designations, often found in life insurance policies, retirement accounts, and other financial products, are similar to the directives in a Last Will and Testament because they specify who will receive assets upon the owner’s death. Unlike a Last Will and Testament, which covers a wide range of assets, beneficiary designations apply specifically to financial accounts and insurance policies.

A Codicil shares a direct relationship with a Last Will and Testament, as it is essentially an amendment or addition made to an existing Will. It allows for changes or updates to be made without the need to draft a new Will entirely, ensuring that the individual's current wishes are accurately reflected as circumstances change over time.

The Advance Healthcare Directive, like a Last Will and Testament, prepares for future scenarios, specifically regarding healthcare preferences and end-of-life care. This document details an individual’s wishes concerning medical treatments they wish to accept or refuse, complementing a Last Will by addressing healthcare decisions rather than asset distribution.

Durable Financial Power of Attorney documents enable individuals to appoint an agent to manage their financial affairs, echoing the Last Will and Testament's purpose of delegating authority. This type of POA remains in effect even if the principal becomes incapacitated, ensuring that financial matters are handled according to the principal’s preferences.

A Letter of Intent is a document that, although not legally binding, is similar to a Last Will and Testament in that it can provide specific instructions, wishes, or explanations to accompany formal legal documents. Often used in estate planning, it can detail how assets should be managed or distributed, offering clarity and personal insights that a Last Will and Testament might not explicitly convey.

Finally, a Revocable Living Trust has parallels with the Last Will and Testament as it details how an individual’s assets should be handled and distributed upon their death. However, it has the added benefit of avoiding probate, allowing for a more straightforward transfer of assets to beneficiaries, which can be both time-saving and cost-efficient.

Dos and Don'ts

When filling out a Last Will and Testament form, it is important to follow guidelines that ensure the document is legally binding and reflects your wishes accurately. Below are lists of dos and don'ts to consider during this critical process.

Things You Should Do:

- Ensure that you are of sound mind and not under any duress or undue influence when making your Last Will and Testament. This helps guarantee that the document is a true reflection of your desires.

- Be detailed in specifying your beneficiaries and what assets they are to receive. Clarification helps prevent potential disputes between family members or other beneficiaries after your passing.

- Have the Last Will and Testament properly witnessed according to the laws of your state. This typically means having at least two witnesses who are not beneficiaries sign the document in your presence.

- Consider appointing an executor who you trust to carry out the terms of your will efficiently and according to your wishes. This individual will play a critical role in managing your estate.

Things You Shouldn't Do:

- Do not fill out the Last Will and Testament without fully understanding its terms and the implications of each clause. If something is not clear, seeking clarification from a legal professional is advisable.

- Do not leave any sections of the form blank. Incomplete information can lead to confusion or misinterpretation of your wishes.

- Avoid making alterations or cross-outs on the form after it has been signed and witnessed, as this can void certain sections or necessitate that the entire document be re-executed.

- Do not fail to update your Last Will and Testament as your circumstances change. This includes changes in marital status, the birth of children, acquisition or disposal of significant assets, or the death of a named beneficiary.

Misconceptions

When it comes to planning for the future, creating a Last Will and Testament is an important step that many people consider. However, there are numerous misconceptions about what a Last Will and Testament can and cannot do. Clarifying these misunderstandings can empower individuals to make informed decisions and ensure their wishes are properly executed after their departure.

Only the rich need a Last Will and Testament. A common misconception is that Last Wills are only for the wealthy. However, regardless of the size of one's estate, a Last Will serves as a fundamental tool to direct the distribution of assets, specify guardians for minor children, and appoint executors.

A Last Will avoids probate. Many believe that having a Last Will means their estate will not go through probate. While a Last Will provides instructions for how an estate should be handled, it does not bypass the probate process. In fact, the will becomes a public document through probate, which determines the will’s validity and administers the estate's distribution.

Verbal Wills are just as good as written ones. While some jurisdictions may recognize oral wills under very specific conditions, the vast majority do not. A formal, written Last Will and Testament, usually witnessed and notarized, is the most effective way to ensure one's wishes are honored.

Once written, it does not need to be updated. Life’s circumstances change, such as births, deaths, marriages, and divorces. These and other significant events can necessitate updates to a Last Will to reflect current wishes and relationships. Failing to update a will can lead to unintended consequences regarding asset distribution.

A Last Will can dictate the terms for a funeral. While individuals may include their funeral preferences in their Last Will, these details are often not seen until after the funeral has taken place. It’s more effective to communicate these wishes separately to loved ones or through a pre-arranged plan with a funeral home.

Understanding the facts about Last Wills and Testaments enables individuals to plan effectively for the future, ensuring their assets and loved ones are taken care of according to their wishes. It’s a critical step in estate planning that shouldn’t be overlooked or misinterpreted based on common misconceptions.

Key takeaways

When it comes to preparing a Last Will and Testament, understanding the process and requirements is crucial for ensuring your wishes are honored after you pass away. Below are five key takeaways that everyone should know when filling out and using this important document.

- Accuracy is key: Ensure all information is accurate and clearly stated. Mistakes or ambiguity can lead to disputes or the will being contested.

- Witness requirements: A Last Will and Testament must be signed in the presence of witnesses. The number of witnesses required can vary by state, so it’s important to know the requirements in your jurisdiction.

- Keep it updated: Life changes such as marriage, divorce, the birth of children, or the acquisition of significant assets should prompt a review and, if necessary, an update to your will to reflect your current wishes.

- Select an executor wisely: The executor of your will is responsible for managing your estate and carrying out your wishes as outlined in your will. Choose someone who is responsible and in a position to take on this task.

- Legalization: In some states, notarization is required for a will to be considered valid. Even if not required, notarization can add an extra layer of legitimacy to the document.

Lastly, while a Last Will and Testament can often be created without the immediate assistance of a lawyer, consulting with legal counsel can ensure that your estate is planned accurately and complies with state laws. This can provide peace of mind to you and your loved ones that your wishes will be honored.

Other Templates

Application Form Rental - Initiates the verification process by which landlords determine if applicants meet the leasing conditions for a property.

Share Purchase Agreement Template - By specifying dispute resolution mechanisms, the agreement prepares both parties for handling potential conflicts without resorting to litigation immediately.