Fillable Land Purchase Agreement Document for California

Embarking on the journey to buy land in California can be an exciting yet complex process, fraught with details that demand careful attention. At the heart of this transaction is the California Land Purchase Agreement form, a crucial document that lays out the terms and conditions of the sale. This form covers everything from the purchase price to the obligations of both the buyer and the seller, making it the blueprint for the entire transaction. Not only does it specify the rights and responsibilities of each party, but it also outlines the contingency plans in case things don't go as expected, such as provisions for financing, inspections, and the resolution of any disputes that arise. For those navigating this process for the first time, the form acts as a guiding light, ensuring that all legal requirements are met and that the transaction proceeds as smoothly as possible. It is a testament to the importance of due diligence and clear communication in the realm of real estate transactions, serving as a protective barrier against misunderstandings and legal complications. Understanding the nuances of the California Land Purchase Agreement form is not just recommended; it's essential for anyone looking to secure their piece of the Golden State.

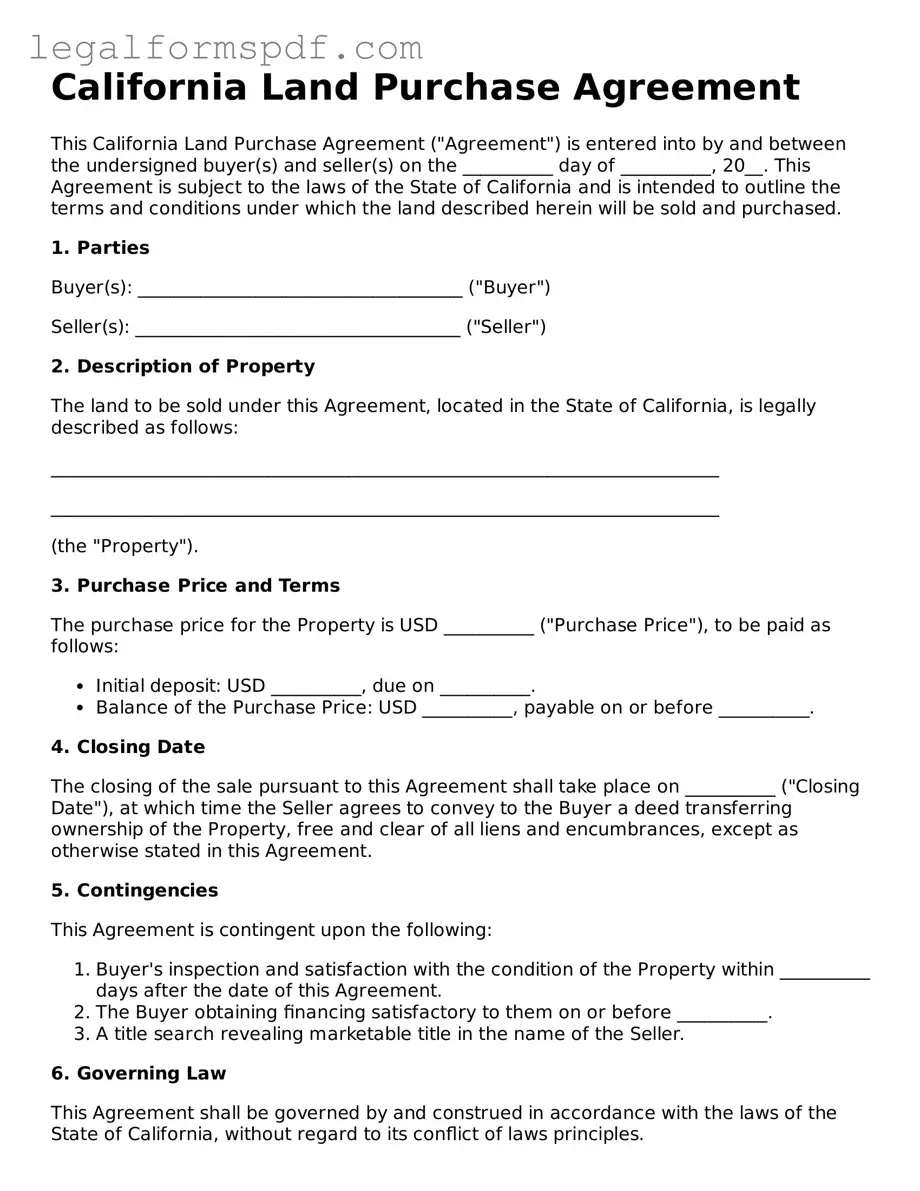

Document Example

California Land Purchase Agreement

This California Land Purchase Agreement ("Agreement") is entered into by and between the undersigned buyer(s) and seller(s) on the __________ day of __________, 20__. This Agreement is subject to the laws of the State of California and is intended to outline the terms and conditions under which the land described herein will be sold and purchased.

1. Parties

Buyer(s): ____________________________________ ("Buyer")

Seller(s): ____________________________________ ("Seller")

2. Description of Property

The land to be sold under this Agreement, located in the State of California, is legally described as follows:

__________________________________________________________________________

__________________________________________________________________________

(the "Property").

3. Purchase Price and Terms

The purchase price for the Property is USD __________ ("Purchase Price"), to be paid as follows:

- Initial deposit: USD __________, due on __________.

- Balance of the Purchase Price: USD __________, payable on or before __________.

4. Closing Date

The closing of the sale pursuant to this Agreement shall take place on __________ ("Closing Date"), at which time the Seller agrees to convey to the Buyer a deed transferring ownership of the Property, free and clear of all liens and encumbrances, except as otherwise stated in this Agreement.

5. Contingencies

This Agreement is contingent upon the following:

- Buyer's inspection and satisfaction with the condition of the Property within __________ days after the date of this Agreement.

- The Buyer obtaining financing satisfactory to them on or before __________.

- A title search revealing marketable title in the name of the Seller.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of California, without regard to its conflict of laws principles.

7. Signatures

This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same document. In witness whereof, the parties have executed this Agreement as of the first date written above.

Buyer's Signature: ___________________________ Date: __________

Seller's Signature: ___________________________ Date: __________

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | Specifies the terms and conditions under which a piece of real estate in California will be bought or sold. |

| Governing Law | Governed by California real estate law and requires adherence to state-specific disclosure requirements. |

| Components | Includes details such as the purchase price, deposit amount, description of the property, and any contingencies that must be satisfied before the sale is finalized. |

| Mandatory Disclosures | In California, sellers must complete specific disclosures about the property's condition, including any known hazards or defects. |

Instructions on Writing California Land Purchase Agreement

When parties decide to buy or sell a piece of land in California, they will need to complete a Land Purchase Agreement. This document is crucial as it outlines the terms of the deal, including the purchase price, the description of the property, and any contingencies that must be met before the sale is finalized. Filling out the agreement accurately is important to ensure a smooth transaction and to protect both the buyer and the seller's interests.

Steps to Fill Out the California Land Purchase Agreement Form:

- Begin by entering the date of the agreement at the top of the form.

- Write the full names and addresses of both the buyer and the seller in the designated sections.

- Describe the property in detail, including its legal description and physical address. This part may require attaching additional documents for a comprehensive description.

- Specify the purchase price of the land in the section provided. This should include the initial deposit amount and how the remainder of the purchase price will be paid.

- Detail any contingencies that must be satisfied before the transaction can be completed. These may include inspections, financing, and approvals from local government or homeowners' associations.

- Outline the closing date and location where the final transaction will take place.

- Specify who will be responsible for the closing costs and how these costs will be allocated between the buyer and the seller.

- Include any additional terms or conditions that are relevant to the sale of the property. This could cover issues like zoning restrictions or environmental considerations.

- Both the buyer and the seller must sign and date the form at the bottom, confirming their agreement to the terms outlined.

- It's recommended to have the signatures notarized to add an extra layer of legal protection.

After completing the form, the next step involves ensuring that all contingencies are met and preparing for the closing process. This may include final inspections, obtaining financing, and having legal representatives review the agreement. The closing then finalizes the transaction, transferring the ownership of the land from the seller to the buyer. Throughout this process, it's crucial to keep open lines of communication between all parties involved to address any issues that may arise.

Understanding California Land Purchase Agreement

What exactly is a California Land Purchase Agreement?

A California Land Purchase Agreement is a legally binding document used in real estate transactions that outlines the terms and conditions of the sale and purchase of land within the state of California. This comprehensive form details the agreed-upon purchase price, any contingencies (such as financing or inspection), the responsibilities of both the buyer and seller leading up to the closing, and any other specific agreements pertinent to the sale. It ensures that both parties are clear on their obligations and helps protect their rights throughout the transaction.

Who needs to sign the California Land Purchase Agreement?

Both the buyer and the seller are required to sign the California Land Purchase Agreement for it to be considered valid and enforceable. In some cases, additional parties such as guarantors or corporate officers (if the buying or selling entity is a corporation) may also need to affix their signatures. It's crucial for all signatures to be accompanied by the date of signing to confirm the agreement was mutually accepted at a specific time.

Are there any contingencies I should be aware of in a California Land Purchase Agreement?

Yes, contingencies are common in these agreements and serve as conditions that must be met for the transaction to proceed. Common contingencies include the ability of the buyer to obtain financing, successful completion of inspections (such as soil tests, environmental assessments, and surveys), and the requirement that the land is free of liens or disputes. These contingencies protect the buyer by allowing them to withdraw from the contract under specific circumstances without penalty, provided they do so within the agreed-upon time frame.

What happens if either party wants to back out of the agreement?

If either party wishes to back out of a California Land Purchase Agreement, the consequences will depend on the terms outlined in the agreement itself and whether any contingencies allow for such action without penalty. Generally, if the buyer backs out without just cause or beyond contingency allowances, they may forfeit any earnest money deposited. Conversely, if the seller reneges on the agreement, they might be required to return the earnest money and could face additional legal ramifications. Therefore, it's important to fully understand the agreement's provisions before signing.

Common mistakes

Filling out a California Land Purchase Agreement form is a crucial step in buying property, but it's easy to make mistakes that could affect the transaction. One common error is not checking the legal description of the property. This description is essential for identifying the exact boundaries and size of the land being purchased. Overlooking or inaccurately recording this information can lead to disputes over what was actually bought and sold.

Another mistake is failing to specify the terms of the deposit. Buyers typically put down a deposit to show their commitment to the purchase. However, the agreement must clearly state the amount, timing, and conditions under which the deposit is refundable. Without this detail, disagreements could arise over the return of these funds if the deal falls through.

People often overlook the importance of specifying contingencies in the agreement. Contingencies are conditions that must be met for the purchase to proceed, such as obtaining financing or passing a property inspection. Not including these conditions, or not being clear about their specifics, can trap a buyer in a deal they can no longer complete or afford.

Misunderstanding closing costs and who is responsible for them is another common error. The agreement should outline which party is responsible for costs such as title insurance, escrow fees, and transfer taxes. Misallocations can lead to unexpected financial burdens at the closing of the sale.

Another frequently seen mistake is failing to include a specific closing date or agreeing on a timeline that is unrealistic. This oversight can cause logistical and financial complications, particularly if one party is under the impression that the transfer of ownership will occur sooner or later than is feasible.

Ignoring the need for disclosures or inaccurately completing them is a significant error. Sellers are legally required to disclose certain information about the property's condition and history. Failure to include these disclosures, or providing incorrect information, can lead to legal repercussions and the potential undoing of the sale.

Lastly, not seeking professional advice when filling out the agreement is a risk. Real estate transactions involve complex legal and financial details. Without the guidance of a professional, parties may inadvertently agree to terms that are unfavorable or legally problematic. Consulting with a real estate lawyer can prevent many of these mistakes and ensure that the agreement accurately reflects the intentions and protections for both the buyer and seller.

Documents used along the form

The process of buying land in California involves several documents beyond the Land Purchase Agreement. These forms and documents play critical roles at different stages of the transaction, ensuring that both the buyer's and seller's interests are safeguarded, and legal requirements are met. Highlighting four key documents commonly used alongside the Land Purchase Agreement will provide a clearer understanding of their importance in the overall process.

- Disclosure Statements: Sellers are required to provide buyers with disclosure statements, which contain vital information about the land's condition, and any known issues that could affect its value or usability. These disclosures are legally mandated and help buyers make informed decisions.

- Title Report: This document provides a detailed history of the property's ownership and highlights any encumbrances, liens, or easements that may exist. A title report ensures that the seller has the legal right to sell the property and that the buyer is aware of any potential restrictions.

- Escrow Instructions: Typically drafted by the escrow company once both parties sign the Land Purchase Agreement, these instructions detail the escrow process, outline the obligations of each party, and specify the documents and funds required for the transaction to be completed. Escrow instructions act as a roadmap for the closing process.

- Loan Documents: If the purchase involves financing, the buyer will need to sign various loan documents. These include the promissory note, which is a commitment to repay the borrowed amount, and a deed of trust, which secures the loan with the purchased property. These documents are essential for buyers utilizing loans to understand their rights and obligations under the loan agreement.

Understanding these documents and how they complement the Land Purchase Agreement is crucial for a smooth and legally sound transaction. Each document serves a specific purpose, ensuring that the process is transparent, and the rights of both parties are protected. Buyers and sellers are advised to review these documents carefully and consult with legal professionals if they have any questions or concerns.

Similar forms

The Real Estate Purchase Agreement is closely related to the California Land Purchase Agreement, sharing similar objectives in outlining the terms and conditions of a property sale. This document not only specifies the price and conditions of the sale but also includes detailed information about the property, financing details, and closing procedures. The comprehensive nature of this agreement ensures both the buyer and the seller are fully aware of their rights and obligations, facilitating a smooth transaction.

The Residential Lease Agreement, another document akin to the California Land Purchase Agreement, focuses on the rental of property rather than the sale. It details the terms under which a property is leased, including rent, duration, and tenant and landlord responsibilities. Although it serves a different purpose, it shares the essence of formalizing an agreement between two parties over the use of real estate.

A Deed of Trust is also similar to the California Land Purchase Agreement in the context of financing a property purchase. It involves a borrower, a lender, and a trustee, securing the property as collateral for a loan. It outlines the legal framework that allows the lender to proceed with foreclosure if the borrower defaults on the loan, providing a legal pathway to enforce the agreement akin to the purchase agreement's enforcement mechanisms.

The Seller's Disclosure Statement bears similarities to the California Land Purchase Agreement, as it is an essential document in most real estate transactions. This statement provides the buyer with important information about the property's condition, including any known defects or issues that could affect the property's value or desirability. It plays a crucial role in ensuring transparency and honesty in the transaction, principles that are central to both documents.

An Escrow Agreement aligns closely with the purchase agreement, acting as a neutral third party document that holds assets or documents until the specified conditions of a transaction are met. Like the California Land Purchase Agreement, it involves detailed instructions agreed upon by the buyer and seller, ensuring that both parties' interests are protected during the transaction process.

The Option to Purchase Real Estate is a document that grants an individual the right to buy a property at a specified price within a certain time frame, sharing similarities with the Land Purchase Agreement in providing a legal framework for real estate transactions. While it does not obligate the holder to buy, it locks in the potential for a sale under agreed-upon terms, reflecting the binding nature of agreements in real estate dealings.

A Title Insurance Policy can be related to the California Land Purchase Agreement through its role in protecting the buyer and lender from losses resulting from disputes over property ownership. It assures that the title to the property is free from defects that were not known at the time of sale, paralleling the Agreement's role in detailing the terms of the property's transfer to mitigate future conflicts.

Lastly, the Quitclaim Deed, though distinct in its application, shares a connection with the Land Purchase Agreement. It is a legal document used to transfer interest in real property from one party to another without providing any warranties regarding the title. It simplifies the process of transferring ownership, echoing the Purchase Agreement's fundamental purpose of facilitating changes in property ownership under specific terms and conditions.

Dos and Don'ts

When navigating the California Land Purchase Agreement, precision and attention to detail are key. Missteps can lead to delays, legal issues, or the downfall of the entire transaction. To guide you through this critical process, here's a succinct list of dos and don'ts.

Do:- Review the entire form carefully before you start filling it out. Understanding every section ensures that you don’t overlook essential details.

- Use clear, legible handwriting if filling out the form by hand, or opt for a typed document for maximum clarity. This prevents misunderstandings or processing delays caused by illegible text.

- Verify all numerical information, including prices, dimensions, and dates. Accuracy here is crucial for the legal and financial aspects of the agreement.

- Consult a real estate lawyer if there’s any part of the agreement that you don’t understand. A professional’s insight can safeguard you against potential legal complications.

- Ensure all parties involved in the transaction sign the agreement, and keep copies for your records. This step is essential for the document to be legally binding.

- Include any agreed-upon contingencies in the agreement. These might include a successful inspection or the ability of the buyer to secure financing.

- Rush through the process. Taking the time to double-check every detail can prevent costly errors.

- Skip over any sections or fields that you think might not apply. If in doubt, seek clarification to ensure every part of the form is appropriately addressed.

- Make assumptions about verbal agreements. If it’s not written in the purchase agreement, it’s not legally enforceable.

- Forget to specify who pays for closing costs, taxes, and other financial responsibilities. These terms should be clearly outlined in the agreement to avoid future disputes.

- Overlook the importance of a professional inspection. Even if the land appears to be in good condition, an inspection can reveal issues that could affect the value or usability of the property.

- Ignore local zoning laws and restrictions. These can dramatically impact what the buyer can do with the property, so ensure you have all the necessary information before completing the agreement.

Misconceptions

There are several misconceptions about the California Land Purchase Agreement form that often confuse both buyers and sellers. Addressing these misunderstandings can help clarify the process and expectations for all parties involved.

It's Just a Standard Form: Many people think that the California Land Purchase Agreement form is a simple, standard document with no room for negotiation. This is not true. Various terms including price, closing dates, contingencies, and more can be customized to fit the needs of both parties.

It's Only About Price: While price is a crucial element, the Agreement covers more than just the cost of the land. It includes terms about inspections, disclosures, and other conditions that must be met before the sale concludes, making it a comprehensive guide to the transaction, not just a price tag.

Verbal Agreements Suffice: Some believe that verbal agreements or handshake deals can enforce terms in the land purchase process. However, in California, real estate agreements must be in writing to be legally binding. Relying on verbal agreements can lead to significant legal complications.

It's Final and Cannot Be Changed: Another misconception is that once the Agreement is signed, its terms are set in stone. In reality, amendments can be made if both parties agree. Changes to the contract, such as extending closing dates or altering terms, are common as long as both parties consent in writing.

It Guarantees the Sale Will Close: Signing the Agreement does not guarantee that the sale will close. Various contingencies, like financing approval, inspections, and appraisals, need to be satisfied. If these conditions are not met, the agreement may be terminated or renegotiated.

No Attorney Review is Needed: Some parties assume that since the form is standardized, attorney review is unnecessary. This is not advisable. An attorney can provide valuable insight on the terms of the agreement, ensuring that one's rights are protected and that the document complies with all relevant laws.

It Only Affects Buyers and Sellers: While the Agreement primarily concerns the buyer and seller, its terms can also impact other parties, such as lenders, title companies, and real estate agents. The conditions may dictate specific actions or approvals required from these entities before the transaction can proceed.

Key takeaways

When engaging in the process of acquiring land in California, utilizing the California Land Purchase Agreement form is a pivotal step. This document, serving as the legal foundation for the transaction, mandates thorough understanding and precise filling to safeguard the interests of all parties involved. Below are key takeaways to ensure that the use of this form is both effective and proficient.

- The Complete Identification of Parties involved is crucial. This means full legal names, including middle names or initials if applicable, should be accurately listed to avoid any ambiguity regarding the transaction participants.

- Accurately Describe the Property. The legal description of the property being purchased, including its address, parcel number, and any legal boundaries, must be clearly outlined to prevent disputes concerning the land in question.

- Understanding the “As-Is” Clause is essential. This clause indicates that the buyer is purchasing the property in its current state, acknowledging any faults or issues that exist at the time of sale.

- Financing Terms should be detailed. If the purchase involves financing, the agreement must specify the terms, including loan amounts, interest rates, and repayment schedules, to ensure clarity for both parties.

- Disclosure Requirements must be met. California law requires sellers to disclose certain information about the property, including any known defects or hazards, to the buyer in a timely manner.

- Include any Contingencies that must be resolved before the sale can proceed. Common contingencies include the buyer obtaining financing, the sale of their current home, or satisfactory property inspections.

- The Closing Date and Costs should be explicitly stated. This includes who is responsible for covering various costs associated with the purchase, such as title insurance, escrow fees, and transfer taxes, as well as the finalized date when the property will change hands.

- Ensure that Legal Compliance is addressed. This includes zoning laws, building codes, and other local, state, and federal regulations that may impact the use and transfer of the property.

- Signatures of All Parties are mandatory. The agreement must be signed by all parties involved to be legally binding. Witness signatures or notarization may also be required, depending on local laws.

- Consultation with a Real Estate Attorney is advisable. Before finalizing the agreement, it’s wise for both the buyer and seller to seek legal advice to ensure their rights and obligations are fully understood and protected.

Navigating through the use of the California Land Purchase Agreement form is a complex process that requires attention to detail and an understanding of legal obligations. By following these key takeaways, parties can engage in real estate transactions with greater confidence and security, ensuring a smooth transfer of property ownership.

More Land Purchase Agreement State Forms

Land Contract Michigan - Details the responsibilities of both parties in a land transaction to ensure a clear transfer of title.