Fillable Employment Verification Document for Texas

In the state of Texas, employers and employees alike navigate a landscape rich with opportunities and regulatory requirements. Central to this environment is the Texas Employment Verification form, a crucial document designed to confirm the eligibility of individuals to work within the United States. This form serves not only as a compliance measure but as a bridge between job seekers and the fulfillment of their employment aspirations. It meticulously verifies an employee's identity and legal authorization to work, embodying the intersection of federal law and workplace accountability. As such, it plays a pivotal role in the hiring process, ensuring that both employers and potential employees adhere to the legal standards set forth. The importance of accurately completing this form cannot be overstated, as it safeguards businesses from potential legal challenges and upholds the integrity of the Texas workforce.

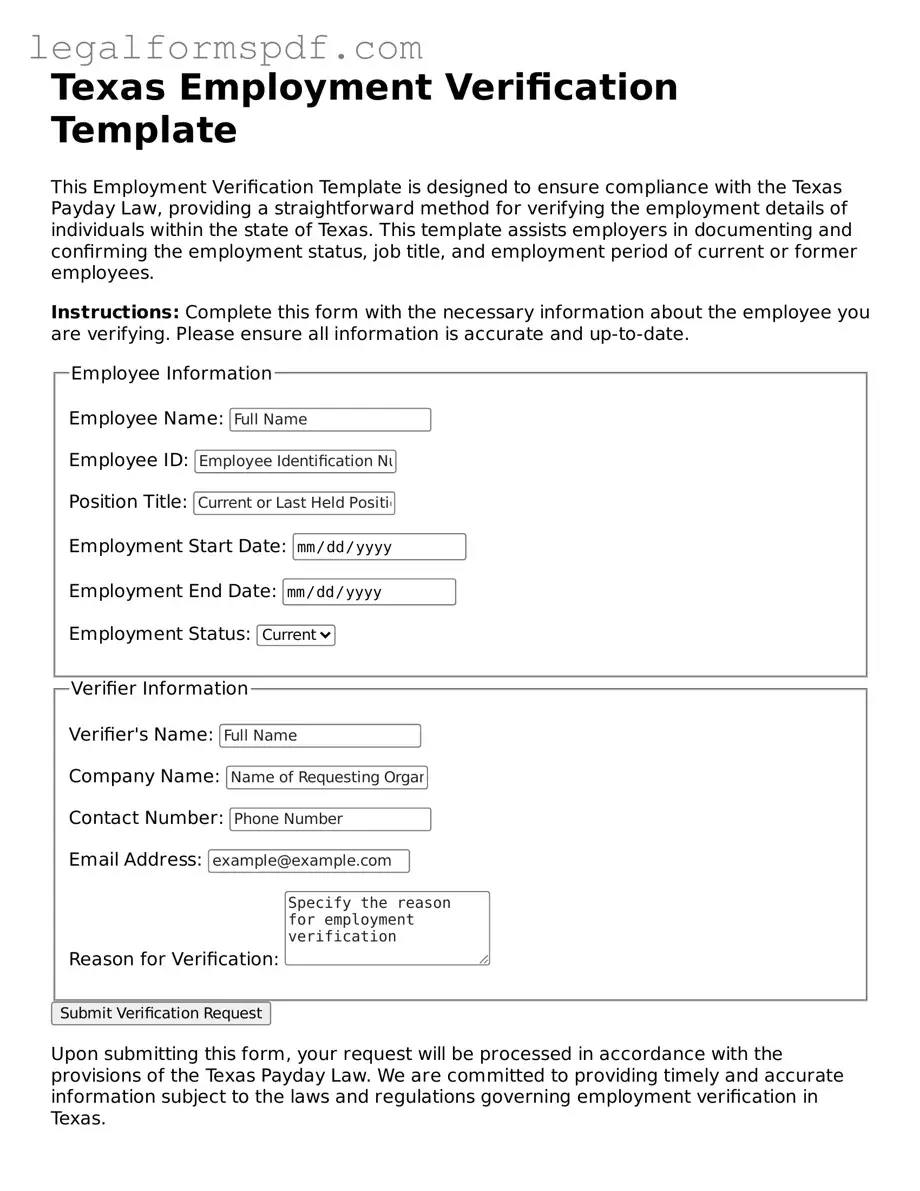

Document Example

Texas Employment Verification Template

This Employment Verification Template is designed to ensure compliance with the Texas Payday Law, providing a straightforward method for verifying the employment details of individuals within the state of Texas. This template assists employers in documenting and confirming the employment status, job title, and employment period of current or former employees.

Instructions: Complete this form with the necessary information about the employee you are verifying. Please ensure all information is accurate and up-to-date.

Upon submitting this form, your request will be processed in accordance with the provisions of the Texas Payday Law. We are committed to providing timely and accurate information subject to the laws and regulations governing employment verification in Texas.

For any inquiries or further assistance, please contact [Your Company's Support Information] or refer to the Texas Workforce Commission for more details on employment verification procedures.

PDF Specifications

| Fact | Detail |

|---|---|

| 1. Purpose | Used to verify the employment eligibility of individuals employed in Texas. |

| 2. Required by Law | Employers in Texas are obligated to adhere to the federal Immigration Reform and Control Act (IRCA) of 1986, which mandates employment verification. |

| 3. Form I-9 | While not a Texas-specific form, Form I-9 is the standard federal document for employment verification, used in Texas and nationwide. |

| 4. State-Specific Regulations | Texas does not have a mandatory state-specific employment verification form but enforces the use of E-Verify for state agencies and certain contractors. |

| 5. E-Verify | A web-based system that compares information from an employee's I-9 to data from U.S. Department of Homeland Security and Social Security Administration records. |

| 6. Legislative Requirement | Since September 1, 2015, Texas law (H.B. 11) requires state agencies and public universities to use E-Verify for all new employees. |

| 7. Penalties for Non-Compliance | Employers failing to verify employment eligibility can face both federal and state penalties, including fines and, in severe cases, criminal charges. |

| 8. Record Keeping | Employers are required to keep I-9 forms (or any state equivalent if used) for three years after the date of hire or one year after the date of termination, whichever is later. |

| 9. Privacy Concerns | Employers must ensure the confidentiality of the information submitted during the verification process and protect it from unauthorized access. |

| 10. Self-Audit | Employers are encouraged to conduct regular audits of their employment verification processes to ensure compliance with all applicable laws and regulations. |

Instructions on Writing Texas Employment Verification

Once an individual or company completes the Texas Employment Verification Form, it marks an important step in ensuring compliance with state employment laws. This form verifies the employment eligibility of a new hire in Texas. Strict adherence to the instructions for filling out the form is crucial for the accuracy and legality of the employment verification process. After the submission of this form, the Texas Workforce Commission reviews the provided information to confirm the employment eligibility status of the new employee. It's essential to follow each step meticulously to avoid any delays or issues in the verification process.

- Gather all necessary information, including the employee's full name, Social Security Number (SSN), and employment start date.

- Access the Texas Employment Verification Form online through the Texas Workforce Commission's official website or obtain a paper copy from the Human Resources department.

- Complete the "Employer Information" section. Here, enter your company's full legal name, address, and contact information. Include an EIN (Employer Identification Number) if applicable.

- Fill in the "Employee Information" section with the employee's full legal name, SSN, address, and the position they are being hired for.

- Check the appropriate box in the "Employment Eligibility Verification" section to indicate whether the employee is eligible for employment based on the documents they presented. These documents are typically a form of identification and an eligibility document such as a birth certificate or passport.

- Ensure the "Declaration by Employer" section is read carefully. This part requires the employer's attestation to the accuracy of the information provided and to the fact that the necessary documents were examined.

- Sign and date the form in the designated "Employer's Signature" area. This signature must be from an authorized representative of the company.

- Provide the completed form to the new employee for them to review, sign, and date in the "Employee's Declaration" section.

- Keep a copy of the completed Texas Employment Verification Form for your records.

- Submit the original completed form to the Texas Workforce Commission as directed on the form. Submission methods may include mail, fax, or email, depending on the instructions provided.

Following the submission, the Texas Workforce Commission will take the necessary steps to verify the employment eligibility of the employee. This process is crucial for maintaining compliance with state laws and regulations. Employers should ensure they follow up on the verification process and keep informed of any additional information or documentation required. Timeliness and accuracy in filling out and submitting the Texas Employment Verification Form are paramount to avoid potential legal challenges or penalties.

Understanding Texas Employment Verification

What is the purpose of the Texas Employment Verification form?

This form serves as a tool for employers in Texas to verify the employment eligibility of their hires. It's a step to ensure that every employee has the legal right to work in the United States, aligning with both federal and state regulations.

Who needs to complete the Texas Employment Verification form?

Employers in Texas are required to fill out this form for each new employee, whether they are citizens or non-citizens, to verify their employment eligibility within the United States.

When should the Texas Employment Verification form be submitted?

It must be completed and retained by the employer after hiring a new employee. However, it's not typically submitted to a state agency unless specifically requested during an audit or investigation.

What information is needed to fill out the form?

To complete the form, employers need information from the employee such as their full name, date of birth, Social Security Number (if applicable), employment start date, and proof of eligibility to work in the U.S., such as a passport, birth certificate, or green card.

What happens if an employer fails to complete the Texas Employment Verification form for an employee?

Failing to complete and retain the form for each employee can result in penalties for the employer. These penalties might include fines and, in severe cases, legal action, depending on the nature of the violation and its severity.

Where can employers find the Texas Employment Verification form?

Employers can access the form online through the Texas Workforce Commission's website or request a paper copy from the same. It’s important for employers to use the most current version of the form to ensure compliance with existing employment verification laws.

Common mistakes

When completing the Texas Employment Verification form, individuals often navigate through several common pitfalls. One of the most frequently made mistakes is not checking for accuracy in the information provided. Whether rushing through the process or overlooking fine details, incorrect data entry can lead to delays or the outright rejection of the application. Details such as dates of employment, job titles, and personal information must be double-checked for precision.

Another error frequently encountered is the omission of required fields. It's not uncommon for individuals to skip over sections they might consider irrelevant or overlook entirely. However, every field in the Texas Employment Verification form is placed there for a reason, and leaving sections blank can signal incomplete verification to employers, possibly complicating or halting the hiring process.

A lack of proper documentation is also a significant hurdle. The form requires specific documents to verify employment history thoroughly. Failing to attach or provide accurate supporting documents, such as pay stubs or W-2 forms, may result in the need for further clarification or verification, slowing down what could have been an expedient process.

Submitting the form without the necessary signatures is another common oversight. Both the employee and the employer, or their authorized representatives, need to sign the form to attest to the accuracy of the information provided. An unsigned form is often considered invalid and can lead to delays in processing.

Many individuals also fall into the trap of using outdated forms. State requirements and forms can be updated or revised. Using an older version of the Texas Employment Verification form may mean missing new fields or not complying with current verification standards, thus causing unnecessary obstacles in employment verification.

Improper formatting can cause trouble as well. The form must be filled out clearly and legibly. Handwritten forms are prone to errors if the handwriting is difficult to read. When possible, typing the information can help avoid this mistake and ensure the data is understood by anyone who reviews it.

Submitting the form to the wrong department or organization is an error that can lead to significant delays. It's vital to confirm the correct submission address or electronic portal for the Texas Employment Verification form. Misdirected forms can get lost or take additional time to reroute to the appropriate place.

Lastly, assuming that filling out the form is the final step in the employment verification process can lead to issues. In some cases, further information or additional steps may be required. Staying proactive and in communication with the employer or agency handling the employment verification can help smooth out any potential bumps in the process.

Documents used along the form

In the field of employment, particularly within the state of Texas, navigating the requirements and paperwork can be a daunting task for employers and employees alike. Among various forms, the Texas Employment Verification form stands out as a crucial document, designed to ascertain the employment eligibility of new hires. However, this form is rarely completed in isolation. It often goes hand in hand with other essential documents and forms, ensuring compliance with legal standards and enhancing the hiring process. Each document serves a specific purpose, contributing to a comprehensive understanding of the employee's eligibility, background, and qualifications.

- Form I-9, Employment Eligibility Verification: A federal requirement, this form is used to verify the identity and legal authorization to work of all paid employees in the United States. It is complementary to the state's employment verification efforts, requiring similar but more extensive information.

- W-4 Form, Employee’s Withholding Certificate: This IRS form is used by employees to indicate their tax withholding preferences. It helps employers calculate and withhold the correct amount of federal income tax from their paychecks.

- Work Opportunity Tax Credit (WOTC) Pre-Screening Notice and Certification Request: Employers fill out this form before or on the day employment is offered. It is used for identifying eligibility for a federal tax credit when hiring from specific groups that have significant barriers to employment.

- Direct Deposit Authorization Form: Though not a legal requirement, this form is widely used to smoothly transition new hires into the payroll system, allowing for the electronic transfer of their salary directly into their chosen bank account.

- State New Hire Reporting Form: Required by law in Texas, this form helps in locating parents who owe child support. Employers must report every new employee to a state directory within 20 days of their hire date.

- Employee Handbook Acknowledgment Form: This is a document through which an employee acknowledges having received, read, and understood the company's employee handbook. It often covers policies, procedures, and expectations in detail.

- Emergency Contact Information Form: Although simple, it is a critical form where employees provide contact information for use in any emergency. It fosters a safer workplace environment and preparedness.

The landscape of employment documentation is intricate and requires careful navigation. While the Texas Employment Verification form serves as a fundamental starting point, the supplementary documents listed contribute to a robust framework for onboarding new employees. Each plays a unique role in ensuring legal compliance, financial accuracy, and safety in the workplace. Together, they embody the comprehensive diligence necessary when bringing new talent into an organization.

Similar forms

The Texas Employment Verification form shares similarities with the I-9 Employment Eligibility Verification form used across the United States. Both forms serve the primary purpose of verifying the legal employment eligibility of individuals within the country. Employers are required to complete these forms to confirm that their employees are authorized to work legally in the U.S., ensuring compliance with federal law.

Another document akin to the Texas Employment Verification form is the W-4 form, which is utilized for tax withholding purposes. While the W-4 form is principally used by employees to indicate their tax situation to their employers, it similarly requires personal identity verification as part of the employment process. This shared aspect underscores the importance of accurate employee information in both tax and employment eligibility processes.

The Direct Deposit Authorization form, often used by employers to process employees' paychecks electronically, also parallels the Texas Employment Verification form in its requirement for verified personal information. Though its primary function is to instruct banks on the transfer of funds, the accuracy of the employee's personal details is crucial, akin to the emphasis on valid information in employment verification.

The Background Check Authorization form parallels the Texas Employment Verification form in terms of the necessity for consent and personal information accuracy. This form is utilized by employers to legally conduct a background check on potential employees, ensuring their suitability for the position. The emphasis on accuracy and legality of information is a shared focal point between these documents.

Similar to the Texas Employment Verification form, the Health Insurance Portability and Accountability Act (HIPAA) Authorization form also deals with sensitive personal information. Though its primary concern is the release of medical information, the meticulous care in handling personal identities aligns with the employment verification process's attention to legal and accurate documentation.

The Non-Disclosure Agreement (NDA) can also be compared to the Texas Employment Verification form in terms of its legal implications for employment. NDAs are crucial for protecting proprietary information upon the commencement of employment. The seriousness with which personal and confidential information is handled in both documents highlights the importance of integrity and accuracy in the employment context.

Employment contracts bear resemblance to the Texas Employment Verification form because they formalize the employment relationship between an employer and an employee. Like the verification form, employment contracts require detailed personal information and serve as legal documentation that binds both parties to certain terms and conditions, emphasizing the legalities involved in employment.

The Occupational Safety and Health Administration (OSHA) Form 300, which logs work-related injuries and illnesses, shares a connection with the Texas Employment Verification form in its role within employment. Both documents are regulatory in nature, ensuring that employment practices comply with federal and state laws for the protection and fairness of employees.

Finally, the Employee Handbook Acknowledgment form, which employees sign to indicate their understanding and agreement to comply with their employer’s policies, corresponds with the Texas Employment Verification form by spotlighting the legal acknowledgments made by employees. Both types of documents are crucial in establishing clear expectations and legal obedience as part of the employment process.

Dos and Don'ts

Filling out the Texas Employment Verification form is a critical step in affirming an employee's eligibility to work within the state. Below are key practices to ensure this process is both accurate and compliant with legal standards. The list is divided into actions you should take and those you should avoid to help simplify the process.

What You Should Do

- Review the form in its entirety before beginning to ensure you understand the requirements.

- Provide accurate and complete information for each field requested on the form to prevent delays or legal issues.

- Use a black or blue ink pen if filling out the form by hand, as these colors are generally required for official documents.

- Keep a copy of the completed form for your records, as it may be required for future reference or in the case of a legal dispute.

- Submit the form by the deadline, if applicable, to ensure compliance with Texas employment laws.

What You Shouldn't Do

- Do not leave any required fields blank; if a section does not apply, mark it as "N/A" to indicate this.

- Do not use correction fluid or tape; if you make a mistake, start over on a new form to maintain legibility and ensure the document's integrity.

- Do not guess on dates or other factual information; verify all details for accuracy before submission.

- Do not disregard the form's instructions for submission, such as sending it to the correct department or including any required additional documentation.

- Do not ignore requests for additional information from the reviewing body, as failing to respond can result in processing delays or non-compliance.

Misconceptions

When it comes to navigating employment verification requirements in Texas, misunderstandings can create confusion for both employers and employees. Let's dispel some common misconceptions about the Texas Employment Verification form to ensure everyone is on the same page.

Only Texas residents need to be verified: This is incorrect. All employees working in Texas, regardless of whether they are Texas residents, need to undergo employment verification. This ensures compliance with both federal and state laws regarding work eligibility in the United States.

It's a one-time process: Employment verification is not just a one-off process. Employers are required to reverify an employee's work eligibility in certain situations, such as the expiration of work authorization documents. Keeping records up to date is crucial for maintaining compliance with employment laws.

Employers can fill out the form based on assumptions: This is a risky misconception. Employers must complete the employment verification form based on documents presented by the employee, not on assumptions or past experiences with similar employees. This approach avoids discrimination and non-compliance penalties.

The Texas Employment Verification form is all that's needed: In reality, the I-9 form, mandated by the federal government, is the primary document used for employment verification in Texas and across the United States. The Texas Employment Verification form may refer to additional state-specific documentation requirements or verifications, but it does not replace the I-9 form.

Small businesses are exempt: Size doesn't matter when it comes to the law on employment verification. All employers, regardless of the number of employees, must comply with employment verification requirements, including the completion of the I-9 form for each employee.

Digital copies of documents are sufficient for verification: Although digital versions of documents might be convenient, employers are required to examine original documents when completing the I-9 form. This helps to ensure the authenticity of the documents and compliance with verification requirements.

The form must be submitted to the government: The completed I-9 form does not need to be submitted to any government agency upon completion. However, it must be retained by the employer and produced upon request for inspection by authorized federal officials.

Only HR needs to understand the verification process: While HR often leads the process, understanding employment verification is important across management levels. Training and awareness can help prevent inadvertent non-compliance due to misunderstandings.

There are no deadlines for completion: This could not be further from the truth. The I-9 form must be completed within three business days of the employee's first day of work for pay. Timeliness is critical to comply with legal requirements and avoid penalties.

Penalties are only for knowingly hiring unauthorized workers: Employers can also face penalties for procedural non-compliance, such as failing to properly complete, retain, or produce I-9 forms when requested. Understanding and adhering to verification requirements is essential to avoid penalties.

Clearing up these misconceptions is the first step toward ensuring that both employers and employees understand their obligations and rights under the law. Compliance is not just about following rules; it's about contributing to a fair and lawful working environment for everyone.

Key takeaways

When filling out and using the Texas Employment Verification form, there are several key takeaways to keep in mind. These points ensure that the form is completed accurately and aligns with the requirements set by Texas law. Understanding these points can help both employers and employees navigate the verification process smoothly.

- Accuracy is crucial: Every piece of information provided on the form must be true and accurate to the best of your knowledge. Incorrect information can lead to legal complications.

- Complete all required sections: Do not leave any required fields blank. Incomplete forms may be rejected or cause delays in the employment verification process.

- Employer identification: Employers must fill in their full name, address, and contact information. This ensures there's a record of which business is making the verification request.

- Employee details: The form requires comprehensive information about the employee, including legal name, date of birth, and employment dates. Ensuring these details are accurate is essential for confirming employment history.

- Signature is mandatory: Both the employer and the employee are required to sign the form. Electronic signatures may be accepted, but it's important to check current guidelines.

- Confidentiality: The information on the form is private. Handle it with the same level of confidentiality as other personal employee information.

- Keep a copy: It's advisable for both the employer and the employee to keep a copy of the completed form for their records. The document can serve as proof of employment verification if any disputes arise in the future.

- Timely submission: Submit the completed form within the timeframe specified by the requesting party. Delayed submissions can impact employment opportunities or compliance status.

Following these guidelines can simplify the employment verification process in Texas. It ensures the form is filled out correctly, submitted on time, and handled with the necessary level of care and confidentiality.

More Employment Verification State Forms

Employment History Verification - Can be used by employees to provide evidence of their employment history and professional accomplishments.

Map:iiifgpdoof0= Ohio State - Aids in the process of verifying an individual's employment for various verification purposes.

Employee Verification Letter Template - It serves as an official document to verify an individual's current or previous job details as provided by their employer.