Fillable Employment Verification Document for Ohio

In the state of Ohio, employers and employees must navigate through various documentations and regulations that are essential for employment processes. Key among these documents is the Ohio Employment Verification form, a critical piece of paperwork instrumental in confirming the eligibility of individuals for employment within the jurisdiction. This form serves as a cornerstone for ensuring that all workers meet the necessary legal requirements to work, thereby helping employers comply with state and federal laws. It encompasses information on the employee's identity and their authorization to work in the United States, touching base with broader national employment verification standards. The completion and retention of this document are not just formalities but integral components of the hiring process, safeguarding both the employer and the employee against potential legal pitfalls. Understanding its significance, guidelines for accurately filling it out, and its role in the broader scheme of employment practices is essential for anyone involved in the hiring process in Ohio.

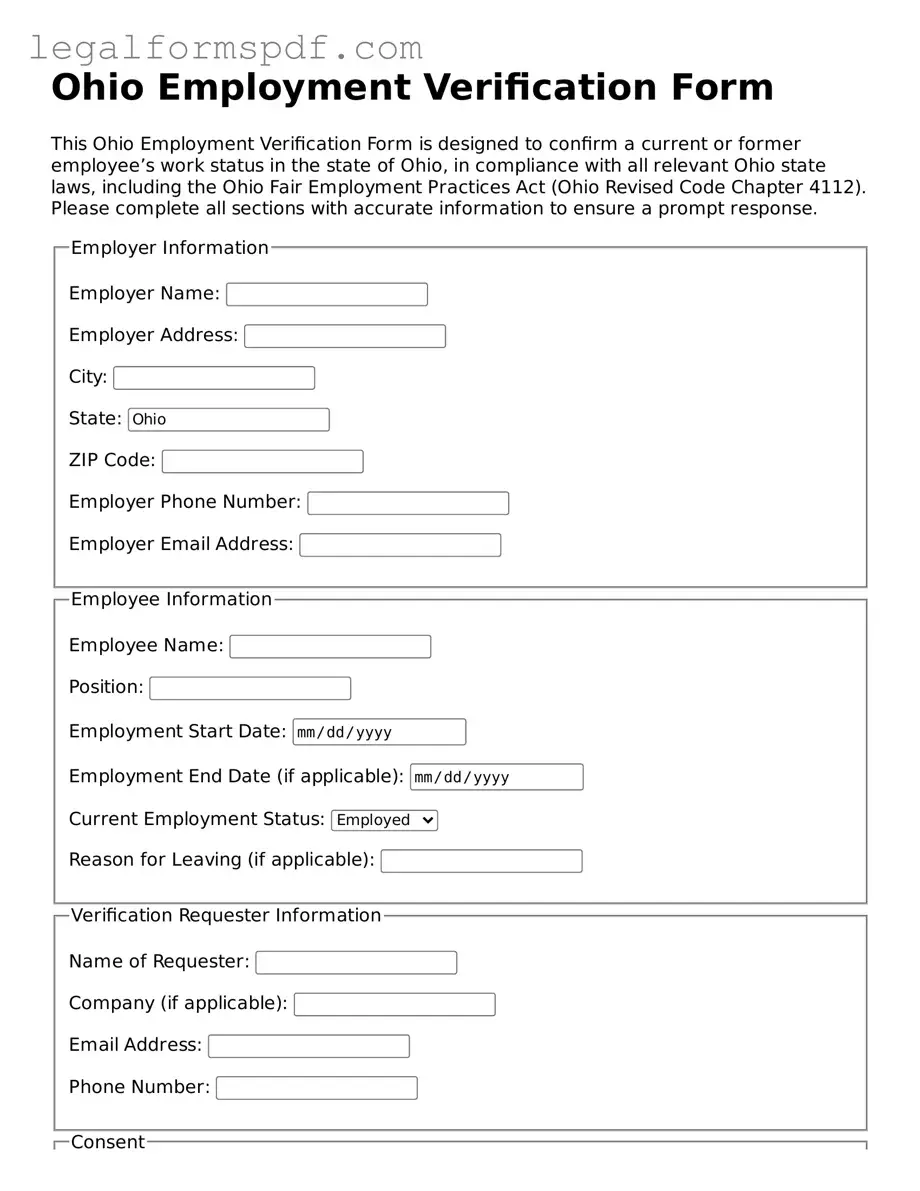

Document Example

Ohio Employment Verification Form

This Ohio Employment Verification Form is designed to confirm a current or former employee’s work status in the state of Ohio, in compliance with all relevant Ohio state laws, including the Ohio Fair Employment Practices Act (Ohio Revised Code Chapter 4112). Please complete all sections with accurate information to ensure a prompt response.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | To verify the employment eligibility and identity of newly hired employees in Ohio. |

| Governing Laws | Mainly governed by the federal Immigration Reform and Control Act (IRCA) and related Ohio state laws. |

| Use Requirement | Mandatory for all Ohio employers to complete and retain for each individual they hire for employment in the United States. |

| Form Retention | Employers must keep the completed form on file for three years after the date of hire or one year after employment ends, whichever is later. |

| Electronic Submission | While the form can be stored electronically, it must meet the regulations set by the Department of Homeland Security. |

| Penalties for Non-compliance | Failing to comply can result in penalties including fines and, in severe cases, criminal charges. |

Instructions on Writing Ohio Employment Verification

When it comes the time to verify employment in Ohio, filling out the Employment Verification form is a necessary step in the process. This document serves as a formal request and confirmation of an individual's employment status, history, and potentially their income with a company or organization within the state. To make this task as straightforward as possible, it's important to follow a clear, step-by-step approach to completing the form. Properly filled forms ensure quick processing and eliminate the need for corrections or resubmissions, which can delay the verification process. Below are the detailed steps to fill out the Ohio Employment Verification form accurately.

- Start by providing the employee's information in the designated section. This includes the employee's full name, social security number (SSN), and the dates of employment you are requesting verification for.

- Next, fill in the employer's details. This should include the name of the company, the address (both physical and mailing if different), the employer identification number (EIN), and the contact information of the person completing the form.

- In the section provided, specify the type of information you are requesting. This could range from verifying employment status (current or past), job title, salary information, to dates of employment. Ensure you check the appropriate boxes to facilitate a clear request.

- If the verification is for a specific purpose, such as a loan application or housing assistance, indicate this in the relevant section. Providing context can help expedite the verification process.

- It’s important to obtain and include the employee's consent on the form, as employment verification involves sharing personal information. There should be a section for the employee to sign, indicating they authorize the release of the information requested.

- Before submitting the form, review all the information entered for accuracy. Any incorrect information can result in delays. Also, make sure all required signatures are on the document.

- Finally, submit the completed form to the designated recipient, which could be the employer’s human resources department or a third-party verifier, depending on the purpose of the verification.

Once the form has been submitted, it's a matter of waiting for the response. Depending on the organization's procedures, this can take anywhere from a few days to a couple of weeks. It's important to submit the request well in advance of when the information is needed to avoid any potential delays. The verification process is a crucial step for many transactions and applications, so ensuring the form is filled out accurately and completely is key to a smooth and efficient process.

Understanding Ohio Employment Verification

What is the Ohio Employment Verification form?

The Ohio Employment Verification form is a document used by employers in the state of Ohio to verify the employment eligibility of their employees. It ensures that all employees have the legal right to work in the United States in compliance with state and federal laws. This form is part of the hiring process and helps in verifying the identity and employment authorization of individuals employed in Ohio.

When should the Ohio Employment Verification form be completed?

This form should be completed at the start of an individual's employment. It is crucial to have this form filled out and signed before or on the first day of work. Completing the form timely ensures compliance with the laws and regulations governing employment verification in Ohio.

Who is responsible for completing the Ohio Employment Verification form?

Both the employer and the employee have responsibilities in completing the Ohio Employment Verification form. The employee must provide valid identification and work authorization documents. The employer is responsible for examining the documents provided by the employee to ensure they are genuine and relate to the person presenting them, and then completing their portion of the form based on this information.

What types of documents are needed to complete the form?

A variety of documents can be used to complete the form, which are typically categorized into List A, List B, and List C documents. List A documents prove both identity and employment authorization (e.g., a U.S. passport). List B documents solely prove identity (e.g., a driver's license), and List C documents solely prove employment authorization (e.g., a Social Security card). Employees must provide one document from List A or one document from both List B and List C.

What happens if the Ohio Employment Verification form is not completed?

If the form is not completed, it can lead to various legal issues for employers, including fines and penalties. It's crucial for employers to comply with all employment verification requirements to avoid legal consequences and to ensure a lawful workforce.

How should the Ohio Employment Verification form be stored?

Employers should store the completed Ohio Employment Verification form in a secure and confidential manner. It's recommended to keep the form separate from other personnel files to protect the sensitive information it contains. These forms should be retained for three years after the date of hire or one year after the date employment ends, whichever is later.

Common mistakes

When filling out the Ohio Employment Verification form, one common mistake is neglecting to double-check the accuracy of personal information. It seems straightforward, but applicants often rush through filling in their details, leading to typos in names, addresses, or social security numbers. Such errors can cause unnecessary delays in the verification process.

Another frequent oversight is failing to provide complete employment history. Some individuals might list only their most recent job, forgetting that the form asks for a comprehensive employment background. This incomplete information can result in the need for further clarification, slowing down the employment verification.

A significant error is ignoring the instructions on how to complete the form correctly. Each section of the form comes with specific directions that should be followed to the letter. However, applicants sometimes overlook these instructions, leading to incorrectly filled forms that can't be processed as intended, thus stalling their application.

People often underestimate the importance of consistency in the information they provide. For instance, if the dates of employment or job titles do not match the records available to an employer, this can raise questions about the applicant's credibility. Ensuring that all information is consistent across the board can help avoid such issues.

Not signing the form is another common mistake. This might seem like a minor oversight, but an unsigned form is usually considered incomplete and can't be processed. It's crucial to check that all the required signatures are in place before submitting the form.

Misinterpreting the term "employment verification" can also lead to errors. Some individuals might think it only pertains to their most current or notable position, but it actually encompasses all employment history. This misunderstanding can lead to the omission of relevant employment information.

Overlooking the need for accurate contact information for past employers is another pitfall. If the contact details provided for verification purposes are outdated or incorrect, it can significantly delay the verification process. Ensuring that all contact information is current and correct is essential for a smooth verification process.

Lastly, a common error is failing to review the form for completeness before submission. In the rush to complete the application, it's easy to miss entire sections or required fields. Taking a moment to review the form in its entirety can save time and frustration by avoiding the need for resubmission due to incomplete information.

Documents used along the form

When processing the Ohio Employment Verification form, several additional documents often are required to complete the employment process adequately. These documents can vary based on the specific needs of the role, the employer, and any legal requirements that must be met. Below is a list of common documents that are frequently used in conjunction with the Ohio Employment Verification form.

- W-4 Form: This is a tax form used by employers to determine the correct amount of federal income tax to withhold from an employee's paycheck. It considers the employee's financial situation and allowances.

- I-9 Form: Employers use the I-9 form to verify an employee's identity and eligibility to work in the United States. This document requires identification and employment authorization documents.

- State Tax Withholding Form: Similar to the W-4 form but for state taxes, this document indicates how much state income tax an employer should withhold from the employee's wages.

- Direct Deposit Authorization Form: This form is used by employees to authorize direct deposit of their paycheck into their bank account.

- Employee Handbook Acknowledgment Form: Employers provide this form to employees to confirm they have received, read, and agreed to adhere to the policies outlined in the company’s employee handbook.

- Background Check Authorization Form: This document is used to obtain the employee's permission to perform a background check, which may be necessary for certain positions.

- Employment Application Form: Typically completed at the start of the hiring process, this form collects comprehensive information about the candidate, including their education, employment history, and references.

- Job Description Document: A detailed description of the position, including roles, responsibilities, and qualifications required, which helps ensure both employer and employee understand the expectations.

- Confidentiality Agreement: A legal document that an employee signs agreeing not to disclose any confidential information obtained during their employment.

Each of these documents plays a vital role in comprehensively establishing the employment relationship and ensuring compliance with various legal requirements and company policies. It's important for employers to accurately complete and retain these documents as part of their personnel records.

Similar forms

The Ohio Employment Verification form is similar to the Federal I-9 Employment Eligibility Verification form, primarily in its purpose. Both documents are used by employers to verify an employee's eligibility to work in the United States. They require the employee to present documents that establish their identity and eligibility to work, although the specific types of acceptable documents may vary.

Another document resembling the Ohio Employment Verification form is the W-4 form, used for determining federal income tax withholding. While serving a different function—focusing on tax rather than employment eligibility—both forms are mandatory for new hires and assist in establishing the formal employment relationship between an employer and an employee. They ensure compliance with federal and state regulations from the outset of employment.

The Background Check Authorization form also shares similarities with the Ohio Employment Verification form since both are integral to the pre-employment process. While the Employment Verification form confirms eligibility to work in terms of legal status, the Background Check Authorization form helps employers vet candidates' backgrounds to ensure they are suitable for the position, highlighting a concern for security and compliance.

Similarly, the Direct Deposit Authorization form is used in conjunction with the Ohio Employment Verification form as part of new hire paperwork. While the Direct Deposit Authorization form collects banking information from the employee to facilitate electronic pay deposits, both forms are necessary for the administrative setup of a new employee, ensuring they are work-ready and can be paid for their services.

The Ohio New Hire Reporting form is another document closely related to the Employment Verification form. Required by the state, the New Hire Reporting form aids in tracking employment and supports the enforcement of child support orders. Although serving different purposes, both forms must be completed by employers for each new employee, emphasizing the employer's legal responsibilities during the hiring process.

Last, the Employee's Withholding Certificate for Local Taxes in Ohio serves a similar role by collecting information pertinent to local tax withholding. Like the Employment Verification form, it is a critical step in aligning the employment setup with local legal requirements, ensuring the correct amount of taxes are withheld and remitted to the appropriate local authorities, thereby maintaining regulatory compliance.

Dos and Don'ts

When completing the Ohio Employment Verification form, accuracy and attention to detail are paramount. The following guidelines are intended to assist individuals in the process, ensuring the form is filled out correctly and efficiently. By adhering to these directives, applicants can avoid common mistakes and enhance the credibility of their submission.

Do:

- Read the instructions carefully before you start filling out the form to ensure you understand the requirements.

- Use black or blue ink if the form is to be completed by hand, as these colors are preferred for clarity and photocopying.

- Provide accurate information for all fields required on the form to verify employment comprehensively.

- Double-check the spellings of names, addresses, and other details to avoid any errors.

- Make sure dates are filled in correctly, including the format specified by the form (e.g., MM/DD/YYYY).

- Sign and date the form if a signature is required, as this validates the information you've provided.

- Keep a copy of the completed form for your records, in case verification or follow-up is needed.

- Contact the HR department or your employer if you're unsure about the specifics they require on the form.

- Submit the form within the deadline provided to ensure timely processing.

- Use clear, legible handwriting if the form is not being filled out electronically to prevent misinterpretation.

Don't:

- Leave any required fields blank; if a section does not apply, mark it as "N/A" (not applicable).

- Use correction fluid or tape; if you make an error, start over with a new form to maintain its neatness.

- Rush through the form, as this may lead to mistakes or omissions.

- Guess on dates or employment details; verify this information before submitting the form.

- Ignore fields that are marked as optional but could provide important context or clarity about your employment.

- Alter the form's structure or questions, as this could invalidate the document.

- Overlook the necessity to get consent from a current or previous employer if the form requests sensitive information.

- Forget to check the form for updates or revisions that may have been made since you last filled it out.

- Submit the form without making sure all sections are completed as per the instructions.

- Underestimate the importance of providing a way for the verifier to contact you in case of questions or additional information needs.

Misconceptions

Many people have misunderstandings about the Ohio Employment Verification form. Shedding light on these misconceptions can help employers and employees ensure they are fulfilling their legal obligations correctly.

Only applicable to certain businesses: It's a common belief that the Ohio Employment Verification form is only needed for certain types of businesses. In reality, any employer in Ohio that hires an employee must complete this form, regardless of the business type or size.

It's the same as the I-9 Form: Another misconception is that the Ohio Employment Verification form and the federal I-9 Employment Eligibility Verification form are the same. While both forms serve to verify an employee's eligibility to work in the United States, they are indeed separate documents and both must be completed where applicable.

Once submitted, no further action is required: Some believe that once the Employment Verification form is filled out and submitted, no further action is required. In fact, employers need to keep the completed forms on file for a certain period and be prepared to present them if requested by relevant authorities.

There is no deadline for completion: Contrary to this belief, there is a strict timeframe within which the Ohio Employment Verification form must be completed. Typically, this must be done by the employee's first day of work. Failure to comply can result in legal complications for the employer.

Digital submissions are not allowed: In today's digital age, there's a misconception that the Ohio Employment Verification form must be completed on paper. However, digital completion and storage of the form are permissible as long as they meet the state's legal requirements for document retention.

Addressing these misconceptions is essential for maintaining compliance with Ohio's employment verification laws. Employers and employees alike should ensure they understand the requirements to avoid potential legal issues.

Key takeaways

Completing the Ohio Employment Verification form is a fundamental step in the hiring process for employers in the state of Ohio. This document serves as proof that employees are authorized to work in the United States, ensuring compliance with state and federal regulations. The following key takeaways highlight the essential aspects of filling out and utilizing this important form:

- Before starting the process, employers should ensure they have the latest version of the Ohio Employment Verification form. State and federal regulations may change, which can lead to updates in the form’s content and format.

- Accuracy is paramount when filling out the form. Employers must carefully enter all required information, including the employee’s name, social security number, birth date, and employment authorization details.

- The form requires the employer to attest to the employee’s work authorization in the United States. This involves examining and verifying documents that the employee presents from an approved list, which can include passports, birth certificates, or other government-issued identification.

- Timeliness plays a critical role in the submission of the Ohio Employment Verification form. Employers should complete and retain the form no later than the third business day after the employee begins work for pay.

- Retention of the completed form is a critical aspect of compliance. Employers must keep the form on file for three years after the date of hire or one year after employment ends, whichever is later.

- The information provided on the form should be treated with confidentiality to protect employee privacy. Access to these forms should be limited to authorized personnel.

- In the event of government audits or inspections, employers must be prepared to present Ohio Employment Verification forms promptly. This underscores the importance of organized record-keeping.

- Failure to comply with the Ohio Employment Verification requirements can lead to legal ramifications, including penalties and fines for employers. It is crucial for businesses to understand their obligations under the law and to adhere strictly to these requirements.

By paying close attention to these key takeaways, employers in Ohio can navigate the employment verification process with confidence, ensuring that they remain compliant with legal standards while safeguarding the rights and privacy of their employees.

More Employment Verification State Forms

Employment History Verification - Often required for professional or industry-specific memberships or associations that have employment prerequisites.

Employee Verification Letter Template - It often requires the employer's signature or company seal to verify its authenticity.

Texas Employment Comfirmation Letter - While digital submissions are becoming more common, the importance of secure handling remains paramount to protect sensitive information.