Fillable Transfer-on-Death Deed Document for Texas

In the realm of estate planning, individuals often seek methods to efficiently transfer assets to their heirs, bypassing the often lengthy and complex probate process. Within this context, Texas offers a convenient tool: the Transfer-on-Death (TOD) Deed form. This legal document allows property owners to designate a beneficiary who will inherit their real estate upon the owner's death, without the property having to go through probate. Unique in its simplicity and effectiveness, the TOD Deed form facilitates a smooth transition of property ownership, ensuring that a loved one or chosen heir directly receives real estate assets swiftly after the owner's passing. It represents a strategic approach for those looking to manage their estate with foresight and precision, providing peace of mind to property owners by ensuring their property will be distributed according to their wishes. As such, understanding the major aspects of this form, from its completion requirements to its potential limitations and impact on estate planning, is essential for anyone considering this option as part of their legacy planning.

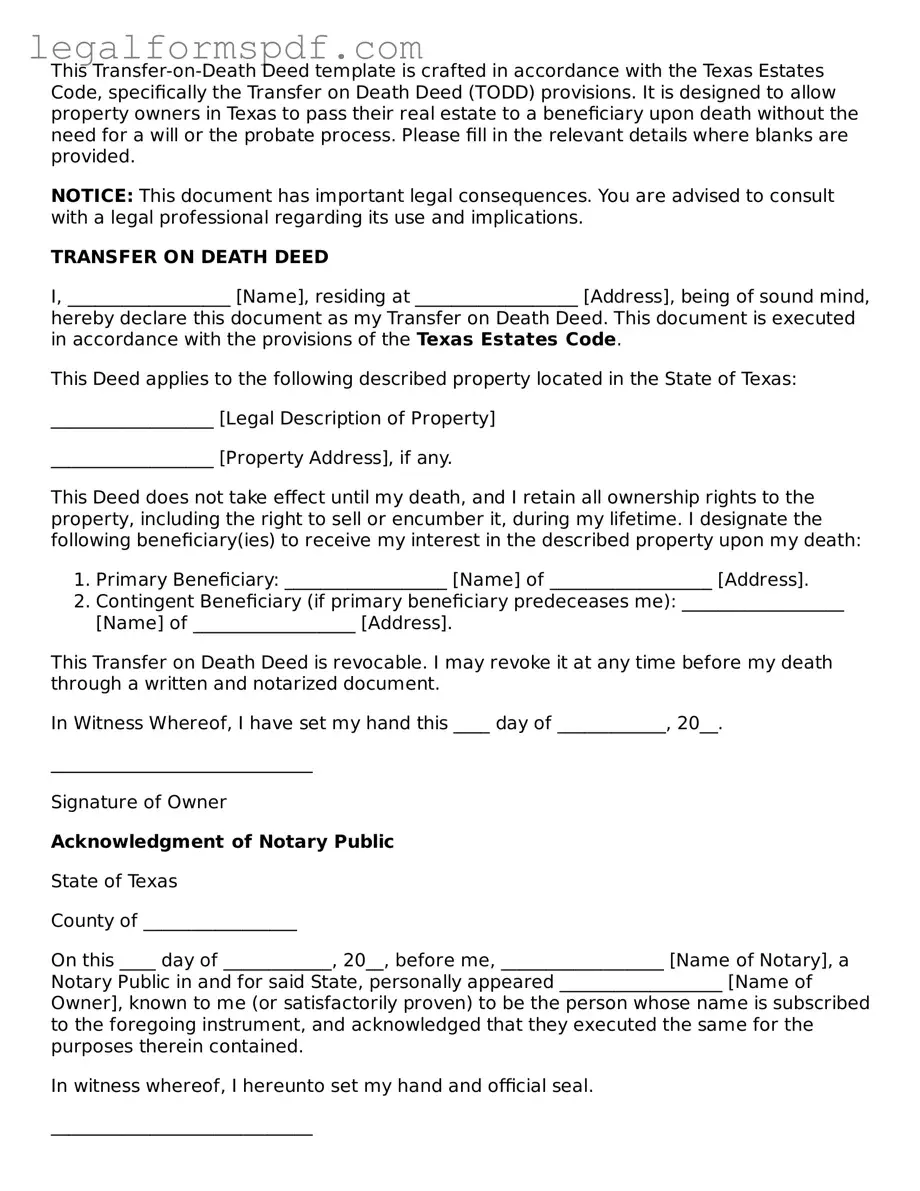

Document Example

This Transfer-on-Death Deed template is crafted in accordance with the Texas Estates Code, specifically the Transfer on Death Deed (TODD) provisions. It is designed to allow property owners in Texas to pass their real estate to a beneficiary upon death without the need for a will or the probate process. Please fill in the relevant details where blanks are provided.

NOTICE: This document has important legal consequences. You are advised to consult with a legal professional regarding its use and implications.

TRANSFER ON DEATH DEED

I, __________________ [Name], residing at __________________ [Address], being of sound mind, hereby declare this document as my Transfer on Death Deed. This document is executed in accordance with the provisions of the Texas Estates Code.

This Deed applies to the following described property located in the State of Texas:

__________________ [Legal Description of Property]

__________________ [Property Address], if any.

This Deed does not take effect until my death, and I retain all ownership rights to the property, including the right to sell or encumber it, during my lifetime. I designate the following beneficiary(ies) to receive my interest in the described property upon my death:

- Primary Beneficiary: __________________ [Name] of __________________ [Address].

- Contingent Beneficiary (if primary beneficiary predeceases me): __________________ [Name] of __________________ [Address].

This Transfer on Death Deed is revocable. I may revoke it at any time before my death through a written and notarized document.

In Witness Whereof, I have set my hand this ____ day of ____________, 20__.

_____________________________

Signature of Owner

Acknowledgment of Notary Public

State of Texas

County of _________________

On this ____ day of ____________, 20__, before me, __________________ [Name of Notary], a Notary Public in and for said State, personally appeared __________________ [Name of Owner], known to me (or satisfactorily proven) to be the person whose name is subscribed to the foregoing instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

_____________________________

Signature of Notary Public

My Commission Expires: _________________

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Transfer-on-Death Deed is governed by the Texas Estates Code, specifically sections 114.001 to 114.104, which allow for the non-probate transfer of real property. |

| Functionality | Allows property owners in Texas to designate a beneficiary to inherit property upon the owner’s death, bypassing the probate process. |

| Revocability | This deed is revocable, meaning the property owner can change the beneficiary or cancel the deed entirely at any time before their death. |

| No Immediate Transfer | The property remains in the owner’s control during their lifetime, with the transfer to the beneficiary occurring only upon the owner’s death. |

Instructions on Writing Texas Transfer-on-Death Deed

Once you've decided to manage your estate planning, completing a Texas Transfer-on-Death (TOD) Deed form is a step in the right direction for allowing your real estate to bypass probate and directly transfer to your beneficiaries upon your death. This simple form requires attention to detail to ensure your property is passed on according to your wishes. It's important to complete it accurately and fully understand what happens next. After filling out and properly executing the form, you must file it with the county clerk’s office where the property is located before your death. Doing so legally documents your intentions and makes the transfer process smoother for your designated beneficiaries.

- Gather all necessary information about the property, including its legal description and the address.

- Get a Transfer-on-Death Deed form, which is available online or from a local attorney.

- Fill in your name as the current property owner under the "Grantor" section.

- Write the full legal name(s) of your designated beneficiary or beneficiaries in the "Grantee Beneficiary" section. Ensure the names match their government-issued ID to avoid any confusion later.

- Provide the legal description of the property being transferred. This information can be found on your property deed, property tax statement, or by contacting your county recorder’s office.

- Sign and date the form in the presence of a notary public. Your signature must be notarized to validate the deed.

- Have the form recorded with the county clerk’s office in the county where the property is located. Recording fees will apply, and the amount varies by county.

Once the Transfer-on-Death Deed is correctly completed, signed, notarized, and filed, it legally indicates your intention to transfer the property directly to your named beneficiary upon your death, thereby eliminating the need for the property to go through probate. However, it's important to note that the deed can be revoked or changed at any time before your death, as long as the revocation or new deed is executed with the same formalities as the initial deed and properly recorded. Always consult with a legal advisor to ensure your estate planning documents align with your overall intentions and comply with current Texas laws.

Understanding Texas Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Texas?

A Transfer-on-Death Deed (TODD) is a legal document that allows individuals to transfer their real property to a named beneficiary upon their death, bypassing the probate process. This instrument is revocable, meaning the property owner can change their mind at any time before their death by executing a new TODD or by formally revoking it. It's a convenient tool to ensure a smooth transition of property ownership, without the complications or costs associated with probate court.

How can one create a Transfer-on-Death Deed in Texas?

To create a valid Transfer-on-Death Deed in Texas, the property owner must complete a form that meets the requirements set by Texas law. This includes providing a legal description of the property, naming one or more beneficiaries, and stating that the transfer of the property's ownership will occur upon the owner's death. The deed must be signed by the property owner in the presence of a notary public. After notarization, the document must be filed with the county clerk in the county where the property is located, before the property owner's death.

Is it possible to revoke a Transfer-on-Death Deed?

Yes, it is possible to revoke a Transfer-on-Death Deed at any time before the death of the property owner. Revocation can be achieved in one of three ways: executing a new TODD that explicitly revokes the prior deed or states contradictory terms, transferring the property to someone else during the owner’s lifetime which voids the TODD, or completing and notarizing a formal revocation form, and filing it with the county clerk. It is critical to ensure the revocation process is completed correctly to avoid any future legal challenges or confusion.

Can a Transfer-on-Death Deed be contested?

Like many estate planning tools, a Transfer-on-Death Deed can be contested. Grounds for contesting might include arguments that the property owner lacked the mental capacity to understand what they were signing, the presence of undue influence or coercion in making the TODD, or procedural flaws in how the deed was executed or recorded. Contesting a TODD requires legal action, typically initiated by potential heirs or other beneficiaries who feel they were unjustly omitted or adversely affected by the deed.

Are there any limitations or drawbacks to using a Transfer-on-Death Deed?

While Transfer-on-Death Deeds provide a straightforward method for transferring property, they do have limitations and potential drawbacks. For instance, they do not allow the property owner to specify conditions upon which the beneficiary receives the property; the transfer is outright upon death. Additionally, the deed does not protect the property from the owner's creditors. Debts, including mortgages or equity lines, may need to be satisfied before the beneficiary can take clear ownership. Moreover, TODDs can complicate matters if the beneficiary is a minor, leading to the need for a legal guardian or trust to manage the property until they reach adulthood.

Common mistakes

One common mistake made when filling out the Texas Transfer-on-Death (TOD) Deed form involves the incorrect or incomplete identification of the beneficiaries. Individuals often assume that first names alone are sufficient or mistakenly believe that describing the relationship (e.g., "my children") will clearly convey their intentions. However, for the TOD deed to function correctly upon the grantor's death, each beneficiary must be identified with specificity, including their full legal names. Failing to do so can lead to confusion, legal disputes, and potentially, the invalidation of the deed itself.

Another error involves misunderstanding the nature of the property that can be transferred using the TOD deed. Some individuals mistakenly believe that this form can be used to transfer all types of property, including vehicles and personal items. However, the Texas Transfer-on-Death Deed is specifically designed for real estate transactions. This includes houses, land, and certain types of buildings. Using a TOD deed to attempt to transfer non-real estate assets can lead to a nullification of the deed for those assets, leaving them subject to probate.

A further mistake is failing to properly execute the deed. The Texas TOD Deed requires not just the signature of the grantor but also notarization to be legally valid. It's not uncommon for individuals to overlook the notarization requirement or assume that a simple signature is sufficient. This oversight can render the deed invalid, forcing the estate through probate court despite the grantor's intentions to avoid such proceedings. Proper execution, including all necessary signatures and notarization, is crucial for the deed's validity.

Last but not least, many fail to recognize the importance of filing the deed with the county clerk's office in the county where the property is located. Simply completing and signing the deed, even with notarization, does not complete the process. For the deed to be effective and enforceable upon the grantor's death, it must be filed and recorded in the appropriate county office. Failure to do so means the transfer intent expressed in the TOD deed might not be honored, and the property may become part of the probate estate, contrary to the grantor's wishes. Ensuring that the deed is correctly filed is a critical final step in the process.

Documents used along the form

When planning for the future, the Texas Transfer-on-Death Deed is a valuable tool for managing your estate without the complexities of traditional probate. It's a simple way to pass on property to a beneficiary upon your passing. However, to ensure a comprehensive estate plan, several other forms and documents are often used alongside the Transfer-on-Death Deed. Each of these documents serves a unique purpose, contributing to the clarity and security of your estate plan.

- Last Will and Testament: This document outlines how you want your assets distributed and handles affairs that the Transfer-on-Death Deed does not cover. It can appoint guardians for minor children and specify wishes for personal items.

- Financial Power of Attorney: This grants a trusted person the authority to manage your financial affairs if you become incapacitated, ensuring that your finances are in order without the need for court intervention.

- Medical Power of Attorney: This allows you to designate someone to make healthcare decisions on your behalf if you're unable to do so, ensuring that your medical preferences are respected.

- Directive to Physicians (Living Will): It lets you state your wishes regarding end-of-life medical treatments, in case you become unable to communicate your healthcare desires in the future.

- Designation of Guardian in Advance: This specifies your preference for a guardian of your person and your estate should you become incapacitated and unable to make decisions for yourself.

- HIPAA Release Form: This form gives healthcare providers the permission to disclose your health information to designated individuals, making your medical information accessible to those making health decisions on your behalf.

- Declaration of Appointment of Guardian for My Children: If you have minor children, this document appoints a guardian for them in the event of your inability to care for them, ensuring they're cared for by someone you trust.

- Personal Property Memorandum: Often attached to your will, this allows for the distribution of personal property not specifically listed in the will, enabling you to leave items to beneficiaries without having to update your will for each item.

- Burial or Cremation Instructions: This document outlines your wishes regarding your final arrangements, such as burial or cremation preferences, relieving your loved ones from making these decisions during a difficult time.

An effective estate plan goes beyond drafting a Transfer-on-Death Deed. By incorporating these additional documents, you ensure a comprehensive coverage of your affairs, providing peace of mind and clarity for yourself and your loved ones. Remember, consulting with a professional can provide guidance tailored to your specific situation and needs, ensuring that your estate plan fully reflects your wishes.

Similar forms

The Texas Transfer-on-Death (TOD) Deed shares similarities with a Last Will and Testament, both serving as tools for directing the distribution of one's assets after death. While a Last Will encompasses a broader scope, including the nomination of an executor and guardians for minor children, the TOD Deed specifically allows property owners to name beneficiaries for their real estate, ensuring the property bypasses probate. The key difference lies in their scope and the probate process; a Last Will goes through probate, while a TOD Deed allows for direct transfer, avoiding probate entirely.

A Living Trust, much like the Texas Transfer-on-Death Deed, is designed to streamline the transfer of assets upon death and avoid probate. Property placed in a Living Trust can be transferred to beneficiaries without probate court involvement, similar to how real estate is transferred through a TOD Deed. However, the Living Trust offers more flexibility and control, allowing the grantor to include various types of assets, not just real estate, and to specify conditions under which beneficiaries can access these assets.

Joint Tenancy with Right of Survivorship (JTWROS) is another method of ensuring that property is passed on without the need for probate, akin to the Transfer-on-Death Deed. In a JTWROS, co-owners have equal shares of property with the stipulation that upon the death of one, the property's full ownership automatically transfers to the surviving co-owner(s). Unlike the TOD Deed, which only activates upon death and can name any beneficiary, JTWROS involves a legal relationship between living co-owners and does not allow for the naming of additional beneficiaries.

Beneficiary Designations on financial accounts and insurance policies serve a purpose similar to that of a Texas Transfer-on-Death Deed, but in the context of financial assets rather than real property. These designations allow the account or policy holder to name beneficiaries who will receive the assets directly upon the holder's death, bypassing the probate process. While the TOD Deed focuses on real estate, beneficiary designations apply to financial assets, both serving to streamline the transfer of assets to chosen beneficiaries outside of probate.

Dos and Don'ts

When preparing a Texas Transfer-on-Death Deed form, certain steps should be taken to ensure the process is carried out smoothly and effectively. Proper completion of this document allows property owners to pass on real estate to a beneficiary without the need for probate. Here are essential dos and don'ts to keep in mind:

Do:

- Review the Form Carefully: Ensure you fully understand every section before filling it out. This understanding is crucial for accurately conveying your intentions.

- Provide Accurate Information: Double-check details like property descriptions and beneficiary names for accuracy. Mistakes can lead to significant complications later on.

- Sign in the Presence of a Notary: Texas law requires the Transfer-on-Death Deed to be notarized to be valid. Ensure this step is not overlooked.

- Record the Completed Form: For the deed to be effective, it must be recorded with the county clerk's office in the county where the property is located, and this must be done before the property owner's death.

Don't:

- Delay Recording the Form: It is ineffective if not recorded before the property owner’s death. Prompt recording is essential.

- Forget to Consider All Legal Implications: Understand how a Transfer-on-Death Deed affects your overall estate plan and any potential impact on Medicaid eligibility or other benefits.

- Overlook the Need for Witness Signatures: While Texas might not require witnesses for this particular document, consulting with a legal professional to ensure all local requirements are met is wise.

- Assume It Overrules Previous Deeds: If there are previous conflicting deeds, it’s important to address those to ensure the Transfer-on-Death Deed's effectiveness.

Correctly preparing and recording a Transfer-on-Death Deed can securely and efficiently transfer property, bypassing the probate process. Paying close attention to the prescribed dos and don'ts can significantly smooth this process. If in doubt, consulting with a legal professional familiar with Texas estate law is advisable to navigate any complexities or concerns.

Misconceptions

The Texas Transfer-on-Death (TOD) Deed form is a useful legal tool, allowing homeowners to pass their property directly to a beneficiary upon their death without the need for probate. However, several misconceptions surround its use and implications. Here are nine common misunderstandings:

- It replaces a Will: Many think a TOD Deed can replace a will entirely. While a TOD Deed does transfer real property to a beneficiary outside of probate, it does not cover other assets or executor appointments. A comprehensive estate plan often includes both a will and a TOD Deed.

- It’s irrevocable: Some believe once a TOD Deed is signed, it cannot be changed. However, a property owner can revoke or change a TOD Deed at any time before their death.

- It avoids all taxes: A common misconception is that TOD Deeds allow beneficiaries to avoid paying taxes. Beneficiaries may still be responsible for estate or inheritance taxes, despite the streamlined transfer process.

- It’s only for the elderly: People often assume TOD Deeds are only for older adults. In reality, any homeowner can use a TOD Deed as part of their estate planning, regardless of age.

- It provides immediate effects: Some think that once a TOD Deed is executed, the beneficiary instantly gains rights to the property. In truth, the beneficiary’s interest only becomes effective upon the owner's death.

- It prevents creditors’ claims: There's a belief that TOD Deeds protect the property from creditors. However, creditors may still have claims against the property after the owner's death.

- It eliminates the need for probate: While it's true that a TOD Deed can avoid probate for the specific property it covers, it doesn’t eliminate the probate process for other assets not included in the deed.

- It’s complicated to create: Many homeowners are under the impression that creating a TOD Deed is complicated and requires extensive legal help. While legal advice is advisable, the process can be straightforward with the correct information.

- It conflicts with joint ownership: A widespread belief is that TOD Deeds cannot be used for property owned jointly. However, joint owners can execute TOD Deeds; the deed becomes effective after the death of the last surviving owner.

Understanding the true nature and limitations of Transfer-on-Death Deeds is crucial for effective estate planning. Homeowners should consider their entire estate plan and consult with a legal professional to ensure their real property and other assets are distributed according to their wishes.

Key takeaways

When dealing with the Texas Transfer-on-Death (TOD) Deed form, it's important to understand its purpose and how to use it correctly. This deed allows property owners to name a beneficiary who will inherit their property after their death, without the need for probate. Here are five key takeaways you should remember:

- The form must be completed accurately and in detail. This ensures the property is correctly transferred to the designated beneficiary without complications.

- It is essential for the property owner to sign the form in front of a notary public. This step legally acknowledges the owner’s intent to transfer the property upon their death.

- The TOD Deed must be filed with the county clerk’s office in the county where the property is located. Filing this document is necessary for it to be effective.

- Until the death of the property owner, they retain full control over the property. This means they can sell, lease, or otherwise dispose of the property during their lifetime.

- Revoking or changing a TOD Deed is possible, but it must be done according to Texas law to ensure the new deed overrides the previous one.

Understanding these key points will help ensure the process is handled correctly, making the transition smoother for the designated beneficiary after the property owner's death.

More Transfer-on-Death Deed State Forms

Avoiding Probate in California - This deed becomes active upon the property owner's death and immediately transfers ownership to the beneficiary named in the deed.

Transfer on Death Deed Form Ohio - Provides a straightforward method for property owners to control the future of their estate with minimum hassle.