Fillable Transfer-on-Death Deed Document for Pennsylvania

In Pennsylvania, navigating the path of estate planning and ensuring that one's assets are distributed according to their wishes after passing can be a complex process. A crucial component in simplifying this process is the Transfer-on-Death (TOD) Deed form. This legal document allows property owners to designate a beneficiary who will inherit their property, bypassing the often lengthy and expensive probate process. The beauty of the TOD Deed lies in its ability to offer peace of mind and financial security to both the property owner and their chosen beneficiaries, ensuring a seamless transfer of assets at what can be a very challenging time. It’s important to understand the specific requirements and implications of this form, including who can be named as a beneficiary, how it affects the property titles, and the steps needed to execute it properly. Tailored guidance can also help in addressing any concerns regarding its impact on one’s overall estate plan. With careful consideration and planning, the TOD Deed can be a powerful tool in one’s estate planning arsenal.

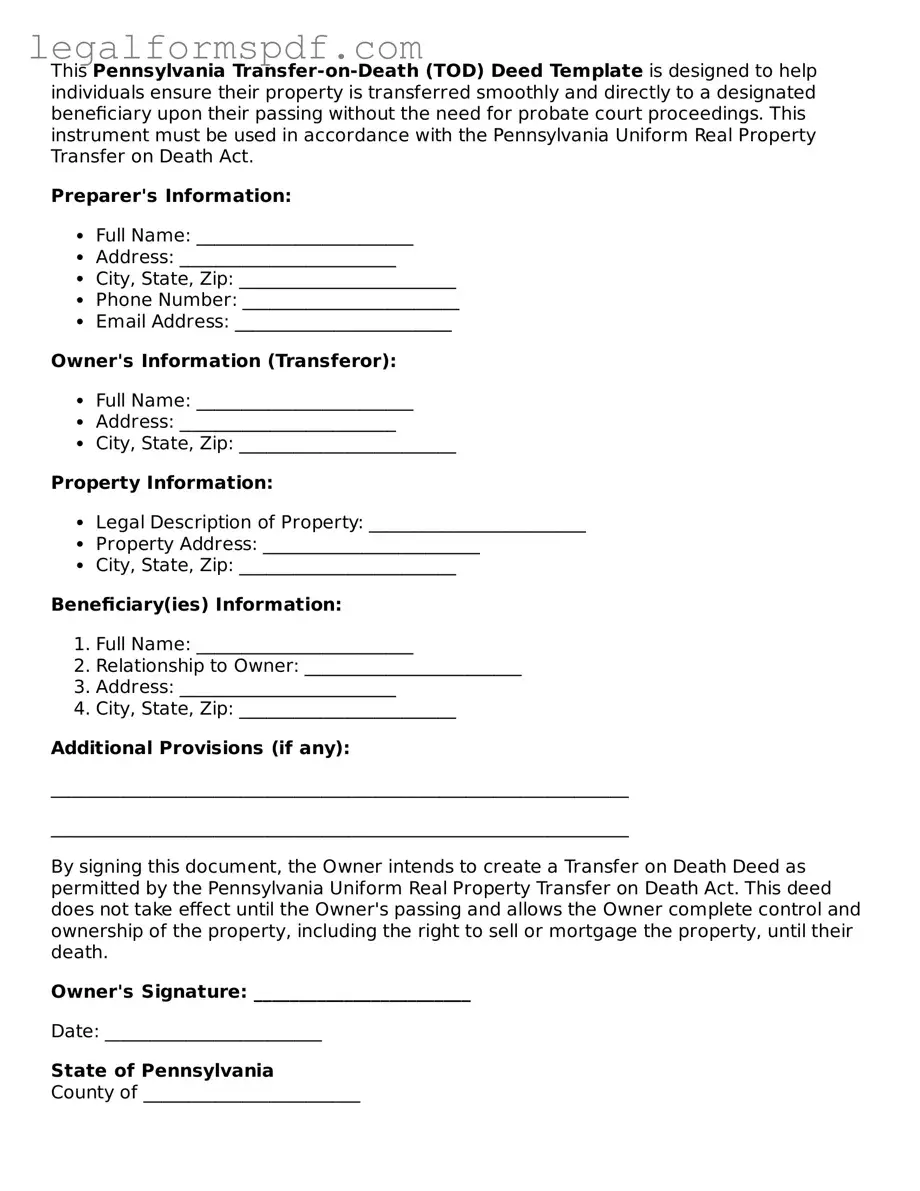

Document Example

This Pennsylvania Transfer-on-Death (TOD) Deed Template is designed to help individuals ensure their property is transferred smoothly and directly to a designated beneficiary upon their passing without the need for probate court proceedings. This instrument must be used in accordance with the Pennsylvania Uniform Real Property Transfer on Death Act.

Preparer's Information:

- Full Name: ________________________

- Address: ________________________

- City, State, Zip: ________________________

- Phone Number: ________________________

- Email Address: ________________________

Owner's Information (Transferor):

- Full Name: ________________________

- Address: ________________________

- City, State, Zip: ________________________

Property Information:

- Legal Description of Property: ________________________

- Property Address: ________________________

- City, State, Zip: ________________________

Beneficiary(ies) Information:

- Full Name: ________________________

- Relationship to Owner: ________________________

- Address: ________________________

- City, State, Zip: ________________________

Additional Provisions (if any):

________________________________________________________________

________________________________________________________________

By signing this document, the Owner intends to create a Transfer on Death Deed as permitted by the Pennsylvania Uniform Real Property Transfer on Death Act. This deed does not take effect until the Owner's passing and allows the Owner complete control and ownership of the property, including the right to sell or mortgage the property, until their death.

Owner's Signature: ________________________

Date: ________________________

State of Pennsylvania

County of ________________________

This document was acknowledged before me on (date) ___________ by (name of owner) ________________________, who is personally known to me or has produced identification.

Notary's Signature: ________________________

Notary Public, State of Pennsylvania

My commission expires: ___________

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death (TOD) Deed allows property owners in Pennsylvania to pass their real estate to a beneficiary without the need for probate upon their death. |

| Governing Law | The Pennsylvania General Assembly authorizes TOD Deeds under specific conditions, governed by the Pennsylvania Consolidated Statutes. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries, including individuals, trusts, or organizations, to inherit their real estate directly. |

| Revocability | The TOD Deed is revocable; the property owner can alter or cancel it at any time before their death, without the beneficiary's consent. |

| Effectiveness | The deed only becomes effective upon the death of the property owner, ensuring they retain full control over the property during their lifetime. |

| Requirements for Validity | To be valid, the TOD Deed must be signed, witnessed, notarized, and recorded in the county where the property is located, following Pennsylvania law. |

Instructions on Writing Pennsylvania Transfer-on-Death Deed

When planning for the future, it's crucial to understand every tool available for estate planning. One such tool is the Transfer-on-Death (TOD) deed, particularly useful in Pennsylvania. This document allows property owners to designate a beneficiary who will inherit their property without the need for probate court proceedings. The process of filling out a TOD deed is straightforward, but it's important to follow each step carefully to ensure the deed is legally binding. Below are the steps to complete the Pennsylvania Transfer-on-Death Deed form.

- Begin by gathering all necessary information about the property. This includes the legal description of the property, its address, and any identifying number, such as a parcel number.

- Identify the current owner of the property. This is the person or persons who will be signing the deed, transferring the property upon their death.

- Choose a beneficiary or beneficiaries. These are the individuals or organizations that will receive the property upon the death of the current owner. Make sure to have their full legal names, addresses, and a clear understanding of how they are to take ownership (e.g., equally, in shares).

- Obtain a Transfer-on-Death Deed form specific to Pennsylvania. This form can usually be found online through legal services or at a local attorney's office. Ensure it meets all Pennsylvania legal requirements.

- Fill out the form with the gathered information. Make sure to enter all details accurately, especially the legal description of the property and the names of the beneficiaries.

- Review the deed. It's wise to have a legal professional review the form to ensure it's been completed correctly and complies with Pennsylvania law.

- Sign the deed in front of a notary. Pennsylvania law requires the current owner(s) to sign the Transfer-on-Death Deed in the presence of a notary public to make it legally binding.

- Record the completed deed with the county recorder's office. The office’s location is where the property is situated. There might be a recording fee, which varies by county.

Once the above steps are completed, the Transfer-on-Death Deed will be in effect. It's important to remember that this deed can be revoked or changed as long as the property owner is alive. To do this, the owner would follow a similar process, either creating a new TOD deed or completing a form that revokes the existing deed. Taking the time to carefully fill out and file a Transfer-on-Death Deed can offer peace of mind, knowing that the property will be transferred according to the owner's wishes without the need for a lengthy probate process.

Understanding Pennsylvania Transfer-on-Death Deed

What is a Transfer-on-Death (TOD) Deed in Pennsylvania?

A Transfer-on-Death (TOD) Deed in Pennsylvania is a legal document that allows the owner of a property to directly transfer the property to a designated beneficiary upon their death, without the need for the property to go through probate court. This can simplify the process of transferring property upon death, making it faster and less costly for the beneficiary.

Who can create a TOD Deed in Pennsylvania?

Any property owner in Pennsylvania who has the legal capacity to own and manage property can create a TOD Deed. This typically means the individual must be of sound mind and at least 18 years old. It’s important for the property owner to clearly identify themselves and the beneficiaries in the deed, ensuring there are no discrepancies or misunderstandings.

How do I file a TOD Deed in Pennsylvania?

To file a TOD Deed in Pennsylvania, the property owner must complete the deed with accurate details, including the legal description of the property and the full name of the beneficiary. The deed must then be signed by the property owner in the presence of a notary public. After notarization, the deed should be filed with the appropriate county recorder's office in the county where the property is located. Filing fees may vary by county.

Can I change or revoke a TOD Deed after it's been filed?

Yes, a TOD Deed in Pennsylvania is revocable. This means that the property owner can change their mind at any time before they pass away. To revoke a TOD Deed, the owner must either create and file a new deed that explicitly revokes the TOD Deed or sells or gifts the property to someone else, which automatically cancels the deed. It's crucial to file any revocation or new deed with the county recorder's office to ensure the change is legally recognized.

What happens to the property if the designated beneficiary predeceases the property owner?

If the designated beneficiary on a TOD Deed in Pennsylvania passes away before the property owner, the transfer on death deed becomes void. In such cases, the property will be handled according to the property owner’s will or, if there isn’t one, by the state’s intestacy laws, which govern inheritance in the absence of a will. Property owners can avoid this issue by naming alternate beneficiaries when creating the TOD Deed.

Common mistakes

Filling out the Pennsylvania Transfer-on-Death (TOD) Deed form can be a straightforward way for individuals to manage their estate planning. However, some common mistakes can complicate what should be a smooth transfer of their property to their beneficiaries upon their passing. One critical error is the failure to provide the correct legal description of the property. This description is not just the address; it must include the exact legal definition used in property records, which often involves metes and bounds or lot numbers from a plat.

Another mistake involves not correctly identifying the beneficiaries. It's essential to list the full legal names of the beneficiaries and specify their relationship to the grantor. Should there be any changes, such as a beneficiary's legal name changing due to marriage or divorce, the document may not accurately reflect the grantor's wish for who should inherit the property. Furthermore, the form must be completed with careful attention to the details of each beneficiary's portion of interest if there's more than one beneficiary. Ambiguities in this area can lead to disputes among beneficiaries.

Many individuals also overlook the witness and notarization requirements. Pennsylvania law requires that a TOD Deed be both witnessed and notarized to be valid. This ensures that the deed is legally binding and records the grantor's intent without duress or coercion. Failing to follow these steps can result in the TOD Deed being considered invalid, negating the advantages of this estate planning tool.

Furthermore, some individuals mistakenly believe that once the TOD Deed is filled out and filed, it does not need to be revisited. Life circumstances and relationships change, so updating the TOD Deed to reflect new beneficiaries or to remove ones no longer intended to inherit is crucial. Without these updates, the property could pass to an unintended individual, contrary to the grantor's final wishes.

A common error is neglecting to file the completed TOD Deed with the county recorder's office. A TOD Deed that is not properly filed before the grantor's death does not legally transfer the property to the named beneficiaries. The property could then become part of the probate estate, defeating one of the main purposes of utilizing a TOD Deed.

Lastly, people often misunderstand the effects of a TOD Deed on their estate's tax obligations. While a TOD Deed can bypass probate, it does not remove the property from the estate for tax purposes. Ensuring that one's estate plan is coherent and accounts for potential tax implications is essential. Consulting with an estate planning attorney can help to clarify these aspects and provide peace of mind.

Documents used along the form

When arranging future estate plans, particularly in Pennsylvania, employing a Transfer-on-Death Deed is a forward-thinking step that ensures a property's seamless transition to a beneficiary upon the owner's demise, without the need for probate court proceedings. However, this deed is just one part of a comprehensive estate planning toolkit. A variety of other forms and documents often accompany the Transfer-on-Death Deed to create a full estate plan that addresses all facets of an individual's assets and desires. Understanding these additional documents can provide a robust framework for ensuring one's estate planning is thorough and reflects their wishes accurately.

- Last Will and Testament: This crucial document outlines how the property and assets not covered by the Transfer-on-Death Deed or other beneficiary designations should be distributed. It also names an executor to manage the estate's affairs.

- Financial Power of Attorney: This form designates an individual to make financial decisions on behalf of the person creating the form, should they become incapacitated. It ensures that financial matters, including those not directly related to the estate, can be handled efficiently.

- Healthcare Power of Attorney: Similar to the Financial Power of Attorney, this document appoints someone to make healthcare decisions if the individual is unable to do so themselves, ensuring that healthcare preferences are respected.

- Living Will: Also known as an advance healthcare directive, this document outlines the person’s wishes regarding end-of-life care. It provides guidance to healthcare providers and loved ones about treatment preferences in scenarios where the individual cannot communicate their desires.

- Revocable Living Trust: This flexible trust can be altered or revoked during the individual's lifetime. It provides a means to manage assets while alive and specifies how these should be distributed upon death, potentially bypassing probate for assets held in the trust.

- Beneficiary Designations: For assets like retirement accounts and life insurance policies, beneficiary designations directly transfer these assets to named beneficiaries upon death, independent of the will or probate process.

- Property Inventory: Though not a legal document, a comprehensive inventory of property and assets can be invaluable in estate planning. It ensures nothing is overlooked and can assist the executor or trustee in the management and distribution of the estate.

These documents, along with the Pennsylvania Transfer-on-Death Deed, can provide a well-rounded approach to estate planning. They collectively help in managing and distributing an individual's assets according to their wishes, while minimizing the administrative burden on loved ones during a difficult time. It's advisable to consult with legal professionals specializing in estate planning to ensure that all documents are correctly executed and reflect the latest state laws and regulations. This ensures that one's final wishes are honored and provides peace of mind to both the individual and their beneficiaries.

Similar forms

The Pennsylvania Transfer-on-Death (TOD) Deed is often compared to a Last Will and Testament, given both documents' roles in estate planning. A Last Will and Testament allows an individual to specify how they wish their assets to be distributed upon their death, as does the TOD Deed, but specifically with real estate. However, the key distinction is that the property transfer via a TOD Deed occurs automatically upon the grantor's death, bypassing probate, which is not the case with assets distributed under a will.

Similar to a Beneficiary Designation, which commonly applies to financial accounts or life insurance policies, the TOD Deed enables an individual to name one or more beneficiaries who will receive the property directly upon the owner’s death. Both tools allow for a straightforward transfer of assets outside of the probate process. The primary difference lies in the types of assets they control—financial assets versus real estate, respectively.

A Joint Tenancy Agreement shares common ground with the TOD Deed as both involve the transfer of property rights upon death. With a Joint Tenancy, the property automatically passes to the surviving owner(s) without the need for probate. Though similar in effect—bypassing probate—the TOD Deed specifically designates a beneficiary who is not necessarily the joint owner during the grantor's lifetime, offering flexibility in planning estate transfers.

Living Trusts are another estate planning tool akin to TOD Deeds. Like a TOD Deed, a Living Trust allows property to be passed to beneficiaries without going through probate. However, Living Trusts provide greater control over the assets, allowing the grantor to specify terms under which assets are managed or distributed, which is not an option with the more straightforward TOD Deed.

The Durable Power of Attorney (POA) for Property shares some conceptual similarities with the TOD Deed, in that both concern the control and administration of an individual’s property. However, a POA for Property designates an agent to manage the grantor's affairs while they're alive, possibly including the sale of property, unlike the TOD Deed, which only comes into effect upon the grantor's death.

The Revocable Transfer-on-Death Deed, closely related to the standard TOD Deed, allows property owners to retain the right to sell or change the designated beneficiary during their lifetime, much like the Pennsylvania TOD Deed. The key difference in some jurisdictions is that the "revocable" aspect is emphasized to clarify that the deed can be altered as long as the grantor is alive and competent.

Finally, an Advance Directive is somewhat parallel to a TOD Deed in its future-oriented planning. An Advance Directive typically covers personal care and health decisions in the event of incapacitation, reflecting the proactive aspect of a TOD Deed which concerns the disposition of property after death. Though their scopes differ—health decisions versus property transfer—both documents enable individuals to make crucial decisions in advance.

Dos and Don'ts

When it comes to filling out the Pennsylvania Transfer-on-Death (TOD) Deed form, it's important to proceed with caution and clarity. This document allows property owners to pass on real estate to a beneficiary without going through probate court. Below are nine tips, split between things you should and shouldn't do, to help ensure the process is smooth and successful.

What You Should Do:

- Review the form carefully to understand all its requirements and implications.

- Consult with an estate attorney to ensure the TOD deed aligns with your overall estate planning goals.

- Clearly identify the beneficiary or beneficiaries, using their full legal names to avoid any confusion.

- Provide precise property descriptions. This typically means using the legal description of the property, not just its address.

- Sign the form in the presence of a notary public to ensure it is legally valid and binding.

What You Shouldn't Do:

- Don’t rush. Take your time to fill out the form accurately, avoiding any mistakes that could cause legal issues in the future.

- Don’t use vague language when naming beneficiaries or describing property. Be as specific as possible to avoid any ambiguity.

- Don’t forget to file the deed with your county recorder’s office. An unrecorded TOD deed might not be effective.

- Don’t ignore your state’s specific requirements or updates to the law that may affect TOD deeds. Laws can change, and it’s crucial to make sure your deed is compliant with current regulations.

Misconceptions

In Pennsylvania, the concept of a Transfer-on-Death (TOD) deed allows property owners to pass real estate directly to a beneficiary upon their death without the need for probate. While this tool can be beneficial under the right circumstances, there are several misconceptions surrounding its use and implications. Below are nine of these common misunderstandings:

- Any property can be transferred using a TOD deed. It’s important to note that not all types of property can be transferred with a TOD deed. Only certain types of real estate are eligible, and the property must be located in a jurisdiction that recognizes TOD deeds under its laws.

- TOD deeds avoid taxes. While a TOD deed can help avoid the probate process, it does not exempt the beneficiary from potential estate, inheritance, or property taxes associated with inheriting the property.

- The beneficiary cannot be changed once a TOD deed is recorded. Property owners retain the right to change the designated beneficiary on a TOD deed at any time before their death, as long as the change complies with state laws and the deed’s requirements.

- A TOD deed takes effect immediately upon recording. The TOD deed only takes effect upon the death of the property owner. Until that time, the owner retains full control and ownership of the property, including the right to sell or refinance.

- Creating a TOD deed is complicated and requires a lawyer. While legal advice is beneficial, especially for complex estates, creating a TOD deed can be straightforward. It requires completion of the appropriate form, meeting state-specific requirements, and recording the deed with the local land records office.

- TOD deeds override wills. If there is a conflict between a TOD deed and a will, the TOD deed generally takes precedence for the specific property designated. However, this does not mean TOD deeds are a substitute for a will, which covers a broader range of estate planning concerns.

- Jointly owned property cannot be transferred via a TOD deed. Property owned in joint tenancy or as tenants by the entirety may be eligible for transfer by a TOD deed, depending on state law and the terms of the deed. However, specific rules apply to these types of ownership, and they should be carefully considered.

- Beneficiaries inherit the property debt-free. Beneficiaries inherit the property subject to any existing mortgages, liens, or other encumbrances. It is a misconception that these debts are wiped clean upon the property owner’s death.

- There is no need to notify the beneficiary in advance. While not strictly a legal requirement, it is advisable to inform the beneficiary of the TOD deed. This advance notice can help avoid surprises and ensure the beneficiary is prepared to assume responsibility for the property.

Understanding the facts about Transfer-on-Death deeds in Pennsylvania can help property owners make informed decisions about estate planning and ensure their wishes are carried out as intended.

Key takeaways

The Pennsylvania Transfer-on-Death (TOD) Deed form allows property owners to automatically transfer their property to a named beneficiary upon the owner's death, bypassing the probate process. Understanding how to properly fill out and utilize this document is crucial for ensuring a smooth and efficient transfer of property. Here are six key takeaways:

- Eligibility: Before using a TOD deed, confirm that the property is eligible under Pennsylvania law. Not all types of property can be transferred using this method.

- Complete Information: Ensure all required information is accurately provided on the form. This includes the legal description of the property, the current owner’s full name, and the beneficiary’s full name and contact information.

- Witness and Notarization: For a TOD deed to be valid, it must be signed in the presence of a notary public. Pennsylvania may also require witnesses; consult local laws to comply with witness requirements.

- Filing: After notarization, the TOD deed must be filed with the county recorder’s office where the property is located. Failure to record the deed could render it ineffective.

- Revocation: A TOD deed can be revoked by the owner at any time before death, as long as the revocation is executed with the same formalities as the original deed. Filing a new deed with different terms or a formal declaration of revocation are common methods.

- Impact on Estate Planning: Integrating a TOD deed into your estate plan can simplify the transfer of your property, but it should be coordinated with your overall estate planning strategy. It may affect eligibility for Medicaid and other benefits, so consultation with an estate planning attorney is advised.

Proper use of the Pennsylvania Transfer-on-Death Deed form can create a seamless transition of real estate to a beneficiary without the need for probate court proceedings. However, attention to detail and compliance with state laws are essential for executing this document effectively.

More Transfer-on-Death Deed State Forms

How to Transfer Land Ownership - This option is not available in all states, so it's essential to check local laws before proceeding.

Transfer on Death Deed Form Florida - It's a legally recognized means of transferring property, ensuring that a homeowner's last wishes are honored without unnecessary complications.

Transfer on Death Deed Form Ohio - Functional tool for bypassing the complexities and delays commonly associated with the transfer of property after death.

Tod Deed Georgia - This form is beneficial for those looking to leave their home or other property to a loved one in the most straightforward manner possible.