Fillable Transfer-on-Death Deed Document for Ohio

In the scenic state of Ohio, property owners have a valuable tool at their disposal that simplifies the process of passing real estate to their heirs without the need for a lengthy probate process. This tool, known as the Transfer-on-Death (TOD) Deed form, allows for a seamless transition of property ownership from one generation to the next. For many, the attractiveness of this legal document lies in its ability to offer a clear path for real estate to be transferred directly to a designated beneficiary upon the death of the property owner. Essential elements of this form include the property owner's clear declaration of intent, the specification of the beneficiary or beneficiaries, and adherence to Ohio's legal stipulations regarding the execution and recording of such deeds. Not only does the TOD Deed form streamline the process of transferring property rights, but it also significantly alleviates the emotional and financial strain often associated with estate planning and probate court proceedings. Consequently, understanding the major aspects of this form is crucial for any Ohio property owner considering their legacy and the future of their estate.

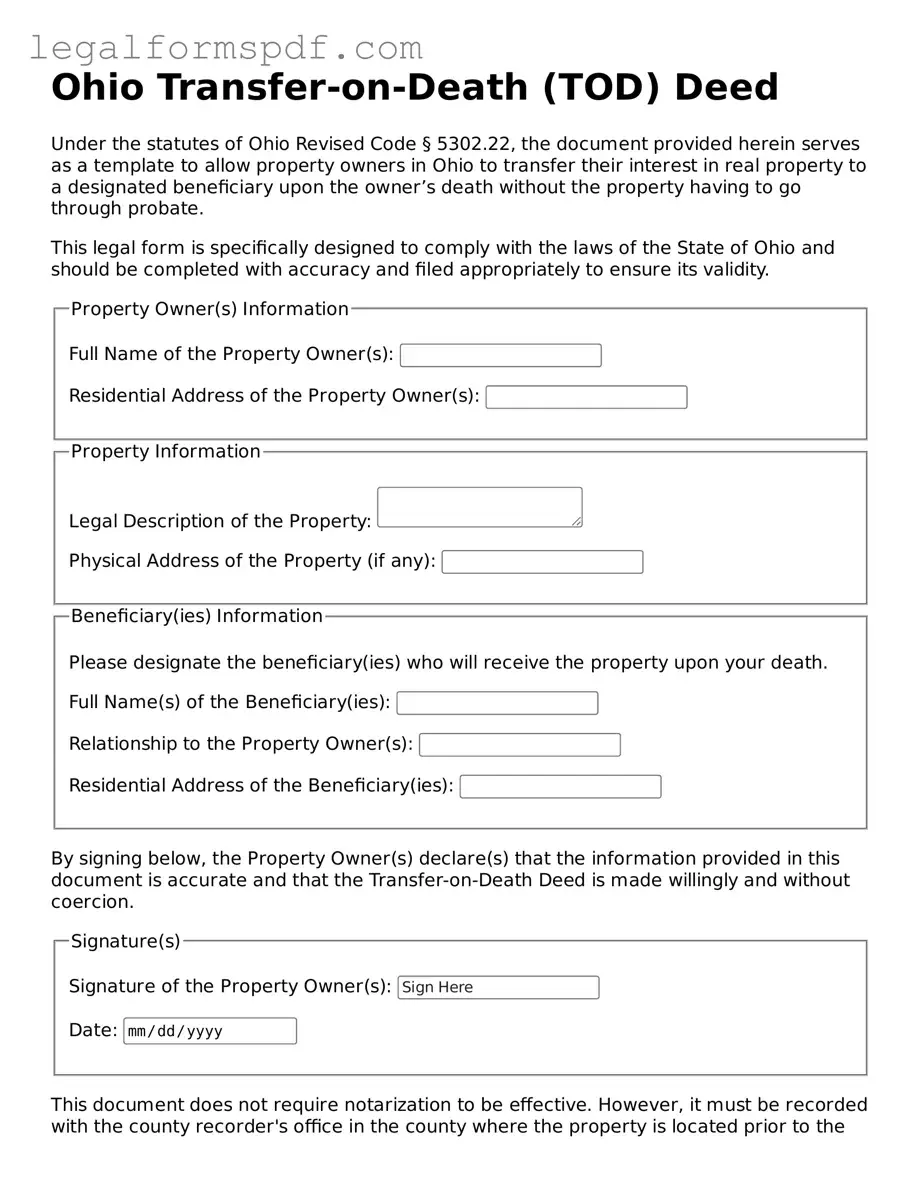

Document Example

Ohio Transfer-on-Death (TOD) Deed

Under the statutes of Ohio Revised Code § 5302.22, the document provided herein serves as a template to allow property owners in Ohio to transfer their interest in real property to a designated beneficiary upon the owner’s death without the property having to go through probate.

This legal form is specifically designed to comply with the laws of the State of Ohio and should be completed with accuracy and filed appropriately to ensure its validity.

This document does not require notarization to be effective. However, it must be recorded with the county recorder's office in the county where the property is located prior to the owner's death to be legally binding and effective.

For legal advice or assistance preparing this document, please consult with a lawyer licensed to practice in the State of Ohio.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | A Transfer-on-Death (TOD) Deed allows property owners in Ohio to pass their real estate to a designated beneficiary upon their death, without the property having to go through probate court. |

| Governing Law | Ohio Revised Code Section 5302.22 is the governing law for Transfer-on-Death Deeds in Ohio. |

| Eligibility | Any individual who owns real property in Ohio and is of legal age can execute a TOD Deed. |

| Property Types | Most types of real property, including single-family homes, condominiums, and certain types of agricultural land, can be transferred using a TOD Deed. |

| Revocability | The property owner can revoke the TOD Deed at any time before their death, as long as the revocation complies with Ohio law. |

| Beneficiary Designations | Owners can name one or more beneficiaries, including individuals, trusts, or organizations, to inherit the property. |

| Joint Ownership | Owners of property held in joint tenancy or as tenants in common may each use a TOD Deed to designate beneficiaries for their share of the property. |

| Effect on Probate | The use of a TOD Deed allows the property to bypass the probate process, facilitating a smoother and more direct transfer to the beneficiary upon the owner’s death. |

Instructions on Writing Ohio Transfer-on-Death Deed

When preparing to complete an Ohio Transfer-on-Death (TOD) Deed form, it's essential to follow each step carefully to ensure it accurately reflects your wishes. This document allows property owners to designate a beneficiary to inherit their property upon their death, bypassing the probate process. It's a forward-looking step that ensures your real estate is transferred smoothly and quickly to your designated beneficiary. Below are the detailed steps needed to fill out the form correctly.

- Begin by reading the form thoroughly to familiarize yourself with its requirements and instructions. Understanding every section is crucial before you start entering information.

- Enter the preparer's information at the top of the form. This includes the name and address of the person completing the document.

- Below the preparer's information, indicate who will receive the recorded deed by providing the name and address of the designated recipient.

- In the "After Recording Return to" section, write the name and address of the individual where the deed should be sent after it is recorded.

- Fill in the "Consideration" section with the amount of money being exchanged for the property, if applicable. If there's no monetary exchange, a nominal value such as $1.00 can be stated to satisfy legal requirements.

- Provide the legal description of the property in the designated space. This description should match the one used in your current property deed to avoid discrepancies. You may need to consult your original deed or contact a legal professional to ensure accuracy.

- About halfway through the document, you will find the "Transfer on Death Designation Affidavit." In this section, clearly print your name as the current property owner.

- List the name(s) of your designated beneficiary(ies) in the section provided. Be sure to include their full legal names to avoid any confusion in the future.

- Sign the document in the presence of a notary public. The notary will need to fill in their section, confirming your identity and your signing of the document.

- Finally, file the completed and notarized TOD Deed form with your county's Recorder's Office to make it official. There may be a filing fee, so it's wise to check with the Recorder’s Office beforehand.

Once you have completed these steps, your property's transfer-on-death deed will be on record. This act ensures your property is swiftly transferred to your designated beneficiary without the need for probate court involvement. It's a powerful tool for estate planning that provides peace of mind for both you and your beneficiary. If you have any doubts or need further assistance, consider seeking advice from a professional who specializes in estate planning or real estate matters. They can offer guidance tailored to your situation.

Understanding Ohio Transfer-on-Death Deed

What is a Transfer-on-Death (TOD) Deed in Ohio?

A Transfer-on-Death (TOD) deed in Ohio allows property owners to pass on real estate to a beneficiary upon their death without the need for probate court proceedings. This type of deed is a simple estate planning tool that permits the direct transfer of the property to the named beneficiary, who will automatically assume ownership when the current owner passes away.

Who can use a TOD deed in Ohio?

Almost any property owner in Ohio can use a TOD deed. This includes individuals who own residential homes, certain types of commercial properties, and even vacant land. To execute a TOD deed, the property owner must be of sound mind and competent to make such decisions. Moreover, the property must be located in Ohio.

How do you create a TOD Deed in Ohio?

Creating a TOD deed in Ohio involves several key steps. Firstly, the deed must be properly drafted to include the legal description of the property, the name of the beneficiary, and must clearly state the intention to transfer the property upon death. The property owner must then sign the deed in the presence of a notary public. Finally, the completed deed must be filed with the county recorder’s office in the county where the property is located before the owner's death.

Can you change your mind after recording a TOD deed?

Yes, a property owner can change their mind after recording a TOD deed. To revoke or change the beneficiary, the owner must execute a new deed that either revokes the previous TOD deed or names a new beneficiary. This new deed must also be notarized and recorded with the county recorder’s office to be effective.

What happens to the mortgage on the property when it transfers via a TOD deed?

When a property with an outstanding mortgage is transferred via a TOD deed, the beneficiary inherits the property along with the mortgage. The beneficiary becomes responsible for continuing the mortgage payments. If the mortgage isn't maintained, the lender may proceed with foreclosure on the property.

Are there any limitations to what can be transferred with a TOD Deed in Ohio?

Yes, there are some limitations. A TOD deed can only be used for real estate and cannot be used to transfer personal property, such as vehicles or household goods. Furthermore, TOD deeds are not applicable for properties held in joint tenancy or as community property with right of survivorship. It's crucial to consider these limitations and consult with a legal professional when planning your estate.

Common mistakes

One common mistake people make when filling out the Ohio Transfer-on-Death (TOD) Deed form is not properly identifying all current owners of the property in question. It's crucial that every person who holds a legal interest in the property is listed. This ensures the deed recognizes all owners' intentions to transfer the property upon their passing.

Another error involves incorrectly describing the property. An accurate and complete description is necessary for the deed to be valid. This typically means including the address, parcel number, and any other legal descriptions that identify the property uniquely and precisely. Without this clarity, the transfer could be delayed or invalidated.

Often, individuals fail to designate a beneficiary correctly. The TOD deed requires the beneficiary’s full legal name and their relationship to the property owner(s). This designation must be clear to prevent any confusion about the rightful recipient of the property upon the owner's death.

Also, overlooking the requirement to have the deed signed in the presence of a notary public is a frequent oversite. The TOD deed must be notarized to be legally binding. This formal witnessing confirms the identity of the signers and their understanding and agreement to the deed’s terms.

Not including relevant additional documents is another common mistake. Depending on specific situations or local requirements, additional paperwork, such as a death certificate or proof of ownership, may need to accompany the TOD deed. Ensuring all necessary documents are attached is crucial for the deed's effective processing.

Failure to file the deed with the county recorder’s office is a significant error, as well. After it is notarized, the TOD deed must be recorded to be effective. This step makes the deed a matter of public record and officially transfers the ownership rights upon the owner's death.

Individuals sometimes mistakenly believe that creating a TOD deed automatically overrides a will or other estate plans. However, discrepancies between these documents can lead to confusion and legal challenges. It's essential to understand how the TOD deed interacts with other aspects of an estate plan.

Lastly, a frequent misunderstanding is that the TOD deed removes the property from the estate for debt settlement purposes. In reality, the property may still be subject to claims by creditors even after the transfer has occurred. Understanding the implications of the TOD deed on the estate's obligations is critical.

Documents used along the form

In Ohio, the Transfer-on-Death (TOD) Deed form serves as a critical tool for estate planning, helping individuals to pass property to beneficiaries without the need for probate proceedings upon the death of the property owner. However, to ensure a well-rounded and effective estate plan, several other forms and documents should be considered in conjunction with the TOD Deed. The use of these documents can provide a more comprehensive approach to managing one's assets and wishes after death.

- Last Will and Testament - A document that outlines how a person's assets and affairs should be handled after their death. While the TOD Deed covers specific property, a will can address other assets and specify guardians for minor children.

- Financial Power of Attorney - Authorizes someone else to manage financial matters on the individual’s behalf, useful in situations where the individual becomes incapacitated before death.

- Health Care Power of Attorney - Allows an individual to designate another person to make medical decisions for them if they are unable to do so.

- Living Will - Specifies a person's wishes regarding medical treatment in case they become unable to communicate their desires due to illness or incapacity.

- Revocable Living Trust - A trust that can be amended or revoked by the creator during their lifetime. It can hold assets during the owner's life, controlling their distribution upon death, often used in tandem with a TOD deed for comprehensive estate planning.

- Designation of Beneficiary Form - Used with retirement accounts, life insurance policies, and other financial accounts to designate beneficiaries, ensuring these assets transfer directly to said beneficiaries outside of probate.

- Real Estate Affidavit - Required in some cases after the death of a property owner to prove ownership and clear title, especially when not all assets were effectively transferred by TOD deeds or other means.

- Property Appraisal Report - Sometimes necessary for tax purposes or to inform the probate court of the property's value when transferring ownership through a TOD deed or inheritance.

Together, these documents form the backbone of a robust estate plan, working in concert with the Ohio Transfer-on-Death Deed to ensure a person's assets are distributed according to their wishes, while minimizing the legal and emotional burden on their loved ones. Properly executed and maintained, these forms can assure a smoother transition of assets and help avoid potential disputes or confusion among beneficiaries.

Similar forms

The Ohio Transfer-on-Death (TOD) Deed form shares similarities with a Last Will and Testament in that both are used to dictate the distribution of an individual's assets upon their death. While a Last Will covers a broad spectrum of assets and requires probate to be effective, a TOD deed specifically addresses the transfer of real estate and bypasses the probate process, directly transferring property ownership to a designated beneficiary upon the death of the owner.

Similar to a Living Trust, the TOD deed allows property owners to manage their real estate during their lifetime and ensure its transfer upon their death. Both instruments avoid probate; however, a Living Trust encompasses a broader range of assets and involves a more complex setup, including the appointment of a trustee to manage the trust's assets.

A Joint Tenancy with Right of Survivorship deed is another document that parallels the TOD deed, as it also allows real estate to pass directly to the surviving owners without probate. The fundamental difference lies in the joint tenancy's immediate creation of shared ownership upon execution of the deed, while a TOD deed retains full ownership with the original owner until their death.

Beneficiary Designations on financial accounts, such as retirement accounts and life insurance policies, operate on the same principle as TOD deeds by naming a beneficiary to whom the assets will transfer upon the account holder's death. Though beneficiary designations apply to financial assets as opposed to real property, both methods bypass the probate process, ensuring a smoother and quicker transfer of assets.

The Durable Power of Attorney (DPOA) for finances and the TOD deed both involve planning for the future handling of one's assets. While a DPOA grants an agent the authority to manage the principal’s financial affairs during their lifetime, including potentially transferring property, a TOD deed specifies the transfer of property upon death, without the need for the deed holder to take any actions during the owner's lifetime.

A Lady Bird Deed, available in some states, is closely related to the TOD deed as it enables property owners to retain control over their property during their lifetime, including the right to sell or mortgage, and automatically transfer it to a beneficiary upon death without probate. Despite their similarities, the Lady Bird Deed offers the unique feature of allowing the property owner to retain the right to sell or change the beneficiary without the beneficiary’s consent.

Lastly, a Revocable Transfer on Death Deed, similar to Ohio's TOD deed, permits property owners to name one or more beneficiaries to inherit property automatically upon the owner’s death, avoiding probate. Both documents allow the owner to change beneficiaries or revoke the deed entirely at any time before death, providing flexibility and control over the future of their property.

Dos and Don'ts

When completing the Ohio Transfer-on-Death (TOD) Deed form, it is essential to ensure the document is filled out correctly to fulfill its intended purpose without complications. Here are guidelines to adhere to:

Do:

Include the full legal description of the property. The accuracy of this description is critical for the deed to be valid.

Clearly state the name(s) of the beneficiary(ies). Be specific to avoid any ambiguity regarding the intended recipient(s) of the property upon the owner's death.

Sign the deed in the presence of a notary. Ohio law requires that the document be notarized to be legally binding.

Keep the deed updated. If circumstances change, such as the owner's relationship with the beneficiary or if the property is sold, the deed should be revised accordingly.

Record the deed with the county recorder’s office. Once signed and notarized, the deed must be officially recorded to be effective.

Don't:

Forget to specify each beneficiary's share if the property is to be shared. Without clear instructions, the division of the property might not reflect the owner’s wishes.

Omit any co-owners from the deed. All owners should be included to ensure the deed is valid and enforceable.

Assume the deed overrides a will. If there are discrepancies between the TOD deed and the owner's will, specific legal rules determine which document takes precedence.

Leave out any attachments if the legal description doesn’t fit. Attachments should be clearly marked and securely attached to the deed.

Ignore legal advice. Consulting with a legal professional can prevent common mistakes and ensure the deed accomplishes the owner's objectives.

Misconceptions

The Ohio Transfer-on-Death (TOD) deed form allows homeowners to name beneficiaries who will receive their property upon the homeowner's death, bypassing the probate process. Despite its benefits, there are several misconceptions surrounding its use and implications. Understanding these misconceptions is crucial for property owners considering this estate planning tool.

- Misconception 1: A Transfer-on-Death Deed is Complicated to Create

Many believe that creating a TOD deed is a complex and daunting task, requiring extensive legal knowledge or the assistance of a lawyer. However, Ohio law provides clear guidelines for creating a TOD deed, making it accessible for most homeowners. While consulting with an estate planning attorney is advisable to ensure all legal requirements are met, the process is generally straightforward for those who choose to proceed on their own.

- Misconception 2: The Beneficiary Gains Immediate Control Over the Property

Another common misconception is that naming someone as a beneficiary on a TOD deed gives them immediate rights or control over the property. In reality, the beneficiary's interest only becomes effective upon the death of the current owner. Until that time, the owner retains full control over the property, including the right to sell or mortgage it without the beneficiary's consent.

- Misconception 3: A Transfer-on-Death Deed Overrides a Will

Some people mistakenly believe that a TOD deed will override the provisions of a will in regard to the property in question. However, a TOD deed takes precedence over a will for the specific asset it covers. This means if a property is designated to a beneficiary through a TOD deed, that designation cannot be changed by a will. It's important to align your TOD deed with your overall estate plan to avoid unintended consequences.

- Misconception 4: Transfer-on-Death Deeds Avoid All Types of Taxes

While it's true that a TOD deed can help avoid the costs and delays associated with probate, it does not necessarily exempt an estate from all types of taxes. For instance, inheritance tax or estate tax implications may still apply, depending on the overall value of the estate and the specific laws in place at the time of the owner's death. Therefore, it's wise to consult with an estate planning professional to understand the tax implications of a TOD deed in your specific situation.

Key takeaways

When considering the Ohio Transfer-on-Death (TOD) Deed form, it's important to understand its purpose and how to properly fill it out to ensure your property is transferred smoothly upon your passing. Here are key takeaways to guide you through this process:

- The Ohio Transfer-on-Death Deed form allows property owners to name one or more beneficiaries who will receive their property automatically upon the owner's death, bypassing the probate process.

- It's essential to provide clear and accurate information about the property and the beneficiary(ies). Mistakes can complicate or invalidate the transfer process.

- The form must be signed in the presence of a notary public to be valid. This formal step ensures that the document is legally recognized.

- After notarization, the Transfer-on-Death Deed must be recorded with the county recorder's office in the county where the property is located. If this step is skipped, the deed will not be effective.

- Updating the TOD Deed may be necessary if circumstances change, such as the death of a beneficiary or a change in the property owner's intentions. This requires completing a new deed.

Understanding these key points can help property owners in Ohio make informed decisions about managing their assets and ensuring their wishes are honored without the need for probate court involvement.

More Transfer-on-Death Deed State Forms

How to Avoid Probate in Pennsylvania - By filling out a Transfer-on-Death Deed, the property owner can maintain control over the property until their death, with the deed only taking effect thereafter.

Transfer on Death Deed Form Florida - This form allows for the direct transfer of the property to a designated beneficiary, offering a clear path to follow for estate distribution.

Todi Illinois - It serves as a peace-of-mind tool for property owners, knowing they have planned for their property's future distribution.