Fillable Transfer-on-Death Deed Document for North Carolina

Planning your estate involves deciding what will happen to your assets after you pass away. In North Carolina, the Transfer-on-Death (TOD) Deed form presents a straightforward method for homeowners to ensure their property goes directly to a named beneficiary without the need for probate court proceedings. This legal document allows you to keep full control of your property until your death; you can revoke or change the beneficiary at any time before you pass away. The process for using a TOD deed in North Carolina is governed by specific state laws, which dictate how the form must be filled out, signed, and recorded to be effective. By allowing property to bypass the often lengthy and expensive probate process, the TOD deed simplifies the transfer of real property, making it an appealing option for many. However, understanding its implications, including potential tax consequences and how it fits into the broader context of your estate plan, is crucial for making an informed decision.

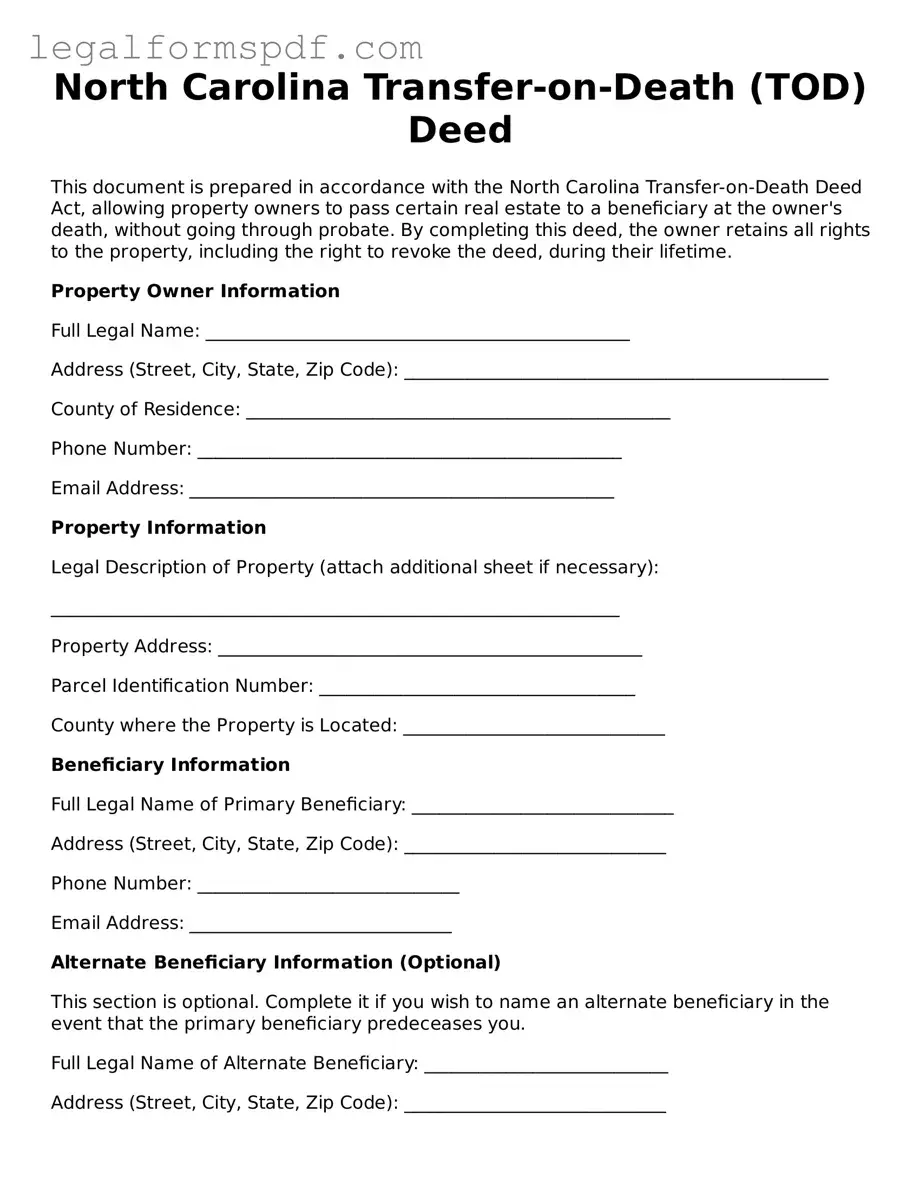

Document Example

North Carolina Transfer-on-Death (TOD) Deed

This document is prepared in accordance with the North Carolina Transfer-on-Death Deed Act, allowing property owners to pass certain real estate to a beneficiary at the owner's death, without going through probate. By completing this deed, the owner retains all rights to the property, including the right to revoke the deed, during their lifetime.

Property Owner Information

Full Legal Name: _______________________________________________

Address (Street, City, State, Zip Code): _______________________________________________

County of Residence: _______________________________________________

Phone Number: _______________________________________________

Email Address: _______________________________________________

Property Information

Legal Description of Property (attach additional sheet if necessary):

_______________________________________________________________

Property Address: _______________________________________________

Parcel Identification Number: ___________________________________

County where the Property is Located: _____________________________

Beneficiary Information

Full Legal Name of Primary Beneficiary: _____________________________

Address (Street, City, State, Zip Code): _____________________________

Phone Number: _____________________________

Email Address: _____________________________

Alternate Beneficiary Information (Optional)

This section is optional. Complete it if you wish to name an alternate beneficiary in the event that the primary beneficiary predeceases you.

Full Legal Name of Alternate Beneficiary: ___________________________

Address (Street, City, State, Zip Code): _____________________________

Phone Number: _____________________________

Email Address: _____________________________

Additional Provisions

If there are any specific conditions or limitations you wish to apply to this Transfer-on-Death Deed, list them here (attach additional sheets if necessary):

_______________________________________________________________

Execution

This Transfer-on-Death deed must be signed in the presence of a notary public and recorded with the county recorder's office in the county where the property is located before the owner's death.

______________________________________

Signature of Property Owner

______________________________________

Print Name of Property Owner

State of North Carolina

County of ________________

This document was acknowledged before me on (date) _______________ by (name of property owner) ____________________________________.

______________________________________

Signature of Notary Public

My commission expires: _______________

Recording

After completion and notarization, this deed must be filed with the recorder's office in the county where the property is located. It is the responsibility of the property owner or their legal representative to ensure proper filing.

PDF Specifications

| Fact | Detail |

|---|---|

| Governing Law | North Carolina General Statutes, Chapter 64, Article 4 |

| Form Purpose | Allows property owners to transfer property upon their death without the need for probate. |

| Property Types | Can be used for real estate only. |

| Revocability | The deed is revocable during the owner's lifetime. |

| Grantee Requirements | The beneficiary must survive the owner to inherit the property. |

| Necessary Information | Owner's details, legal description of the property, and beneficiary's details. |

| Witness Requirement | Requires signature by two witnesses for validity. |

| Notarization | The deed must be notarized to be valid. |

| Filing Requirement | Must be filed with the county recorder's office where the property is located before the owner's death. |

| Effect on Probate | Helps to avoid the property going through probate upon the owner's death. |

Instructions on Writing North Carolina Transfer-on-Death Deed

Completing a Transfer-on-Death (TOD) deed can be an efficient way to pass on property upon death without the need for a will or going through probate. This document allows the property owner to directly transfer ownership of their real estate to a designated beneficiary once they pass away. It's important to approach this document with clarity and ensure all required information is accurately provided to uphold its validity and effectiveness in transferring property according to the owner's wishes.

Here’s a step-by-step guide on how to fill out the North Carolina Transfer-on-Death Deed form:

- Identify the Grantor(s): Enter the name(s) of the current property owner(s) as the Grantor(s). This includes anyone currently holding title to the property.

- Specify the Grantee Beneficiary(ies): Clearly write the name(s) of the person(s) or entity you wish to transfer the property to upon your death, known as the Grantee Beneficiary(ies).

- Legal Description of the Property: Include the full legal description of the property as recorded in your county's land records. This description can often be found on your deed, property tax bill, or by contacting your county's land records office.

- Prepare the Acknowledgement: The deed must be acknowledged before a notary public. This means that the Grantor(s) must sign the deed in the presence of a notary.

- Witness Requirements: North Carolina law requires the presence of two witnesses in addition to the notary public. Ensure these witnesses are present to observe your (the Grantor's) signature and sign the deed themselves.

- Signature(s) of the Grantor(s): All Grantor(s) must sign the deed. Ensure this is done in the presence of the notary and the required witnesses.

- Notarization: The notary public will fill out the notarization section, confirming the identity of the Grantor(s) and witnessing the signatures.

- File the Deed: After the deed is properly completed and notarized, file it with the register of deeds in the county where the property is located. There may be a filing fee required.

After these steps have been completed, the Transfer-on-Death Deed will be effective, allowing for the direct transfer of the property to the designated beneficiary upon the death of the Grantor(s) without needing to go through probate court. This can significantly ease the transition of assets and ensure that the property is transferred according to the owner's wishes with minimal complications.

Understanding North Carolina Transfer-on-Death Deed

What is a Transfer-on-Death (TOD) Deed in North Carolina?

A Transfer-on-Death Deed is a legal document that allows property owners in North Carolina to pass on their real estate to a beneficiary upon their death without the need for the property to go through probate. This type of deed lets the property owner retain full control over the property during their lifetime, meaning they can sell or mortgage the property or revoke the deed without the beneficiary's consent.

How does one create a TOD Deed in North Carolina?

To create a Transfer-on-Death Deed, the property owner must complete a specific form that complies with North Carolina laws. This form must include the legal description of the property, the name of the beneficiary, and must be signed by the property owner in the presence of a notary public. After it's signed and notarized, the deed must be recorded with the Register of Deeds office in the county where the property is located, before the owner's death, to be effective.

Can a TOD Deed be revoked?

Yes, a Transfer-on-Death Deed can be revoked at any time before the owner's death. The revocation process involves preparing and recording a document that expressly revokes the deed, or by executing a new TOD deed that states the previous one is revoked. Additionally, selling or transferring the property to someone else will also automatically revoke the TOD deed, as it can only apply to property the owner still holds at their death.

What happens to the property when the owner passes away?

Upon the death of the property owner, the named beneficiary or beneficiaries automatically become the new owners of the property, subject to any debts or liens on the property. The beneficiary must provide a certified copy of the death certificate to the Register of Deeds to have the property title officially transferred to their name, bypassing the probate process. This streamlined transfer helps avoid the often lengthy and costly probate procedure.

Are there any limitations on what can be transferred using a TOD Deed in North Carolina?

In North Carolina, a Transfer-on-Death Deed can be used for real estate including homes and land. However, it cannot be used to transfer personal property, such as vehicles or furniture, or for assets that already have a designated beneficiary, like life insurance or retirement accounts. Also, if the property is owned as joint tenants with right of survivorship, the TOD deed would only be effective after the death of the last surviving owner.

Does a beneficiary need to accept the TOD Deed?

Yes, to formally accept the property, the beneficiary must survive the owner and take steps to record the transfer after the owner’s death. If a beneficiary chooses not to accept the property, they can disclaim their interest, which means they can formally refuse to accept the property, and it would then pass as if they predeceased the owner. This process involves filing a specific document called a Disclaimer of Interest with the Register of Deeds.

Common mistakes

One common mistake made when filling out the North Carolina Transfer-on-Death (TOD) Deed form is the failure to accurately identify the property. The deed requires a precise description of the real estate, including its address and any identifying parcel numbers. Without this detailed information, the document may not be legally effective, potentially leaving the property in limbo upon the owner's death. It's crucial to ensure all information matches exactly what's on the property's current deed to avoid complications.

Another area where people falter is not properly listing the beneficiaries. The Transfer-on-Death deed allows property owners to name individuals or entities to whom the property should pass upon their death, bypassing the often lengthy probate process. However, if beneficiaries are not clearly named, with full legal names and accurately described relationships, it can lead to disputes and delays. It's equally important to periodically review and update this information, especially after major life events such as a marriage or the death of a named beneficiary.

Incorrectly executing the deed is also a common error. In North Carolina, for a TOD deed to be valid, it must be signed by the property owner in the presence of a notary. If this process is not followed precisely, including having the notarization properly documented, the TOD deed may not be considered valid. This oversight can unintentionally invalidate the document, forcing the property into the probate process and negating the benefits of having a TOD deed in the first place.

Lastly, neglecting to file the TOD deed with the appropriate county office is a critical mistake. After the deed is correctly filled out and notarized, it must be filed with the Register of Deeds in the county where the property is located. Failure to do this before the property owner's death means the deed doesn't take effect, and the property will likely go through probate. Timely filing ensures that the transfer intention is recorded and acknowledged by the state, providing peace of mind to the property owner and the beneficiaries.

Documents used along the form

When planning for the future, many individuals opt for a Transfer-on-Death (TOD) deed in North Carolina. This legal document allows property owners to pass down real estate to beneficiaries without the need for probate. While the TOD deed plays a crucial role in estate planning, there are additional documents that can complement its effectiveness and ensure a smoother transition of assets. Here are five commonly used forms and documents that often accompany a Transfer-on-Death Deed form:

- Last Will and Testament: This document outlines an individual's wishes regarding how their assets, including personal property and financial assets, should be distributed upon their death. It also appoints an executor to manage the estate's distribution.

- Power of Attorney: A Power of Attorney grants another person the authority to make legal and financial decisions on behalf of the individual creating the document. This can be particularly useful in managing the individual's affairs if they become incapacitated.

- Living Trust: Similar to a TOD deed, a Living Trust allows individuals to manage their assets during their lifetime and specify how these should be distributed after their death. It offers the advantage of avoiding probate for all assets held in the trust.

- Health Care Power of Attorney: This document appoints someone to make healthcare decisions for the individual, should they become unable to make those decisions themselves. It is essential for ensuring that the individual's healthcare wishes are followed.

- Advance Directive (Living Will): An Advance Directive specifies an individual's preferences regarding end-of-life care. It complements the Health Care Power of Attorney by providing detailed instructions on medical treatments and interventions the individual wishes to accept or refuse.

Each of these documents serves an essential role in comprehensive estate planning. By considering the inclusion of these forms alongside a Transfer-on-Death Deed, individuals can provide clear directives regarding their assets and healthcare wishes, thereby easing the transition for their beneficiaries and loved ones.

Similar forms

The North Carolina Transfer-on-Death (TOD) Deed form shares similarities with a Last Will and Testament in that both documents deal with the distribution of an individual's assets upon their death. However, whereas a Last Will and Testament goes into effect after death and requires probate to legally transfer assets, a TOD deed can transfer the designated property automatically without the need for probate.

Comparable to a Joint Tenancy Agreement, the TOD Deed allows property to bypass the probate process upon the owner's death. In both instances, ownership of the property is transferred directly to the surviving owner or beneficiary. A key difference, however, lies in the fact that a Joint Tenancy Agreement involves ownership by two or more parties simultaneously, whereas a TOD deed involves a future transfer upon the death of the property owner.

A Beneficiary Designation, commonly used for life insurance policies or retirement accounts, resembles a TOD Deed since both designate a beneficiary to receive an asset upon the death of the owner. However, a TOD deed is specifically designed for real property, whereas beneficiary designations are generally utilized for financial assets and accounts.

The Durable Power of Attorney (POA) for Property closely relates to a TOD deed because both involve arrangements concerning an individual’s assets. Nonetheless, a Durable POA allows another person to manage or make decisions about the property during the owner's lifetime, especially if they become incapacitated, unlike a TOD deed, which only applies after the property owner's death.

Similar to a Trust Agreement, the TOD Deed offers a mechanism for transferring property upon the owner's death outside of probate. Both can specify beneficiaries and provide for a transfer of assets. However, a Trust can also provide detailed instructions for managing the property before and after the owner's death, offering a level of control and flexibility not available with a TOD deed, which is solely concerned with the transfer of property upon death.

Likewise, the Healthcare Directive or Living Will bears resemblance in its preparatory nature, securing arrangements for an individual's preferences in the event of incapacitation or death. While a Healthcare Directive focuses on medical decisions and end-of-life care, a TOD Deed focuses on the transfer of real property upon death without the need for probate.

A Revocable Living Trust aligns with the goals of a TOD Deed by facilitating the transfer of assets upon the grantor's death outside of probate. However, a Revocable Living Trust covers a broader spectrum of assets and allows for detailed instructions on how those assets are managed and distributed before and after death, which differs from the singular focus of transferring real property provided by a TOD Deed.

Finally, a General Warranty Deed is used to transfer real property from a seller to a buyer but differs from a TOD Deed in timing and purpose. While a General Warranty Deed facilitates an immediate transfer, providing a guarantee against title defects, a TOD Deed arranges for a future transfer upon the owner's death without such guarantees, emphasizing ease of transfer over the complexities of immediate property conveyance and warranties.

Dos and Don'ts

When preparing the North Carolina Transfer-on-Death (TOD) Deed form, various actions can significantly impact the effectiveness and legal standing of the document. To ensure the deed accomplishes its intended purpose, it is crucial to adhere to a set of dos and don'ts. Below are lists compiling essential points to consider throughout the process:

Do:

- Ensure all information is accurate and complete. Double-check property descriptions, names, and addresses for any errors.

- Consult a legal professional. Although the form might appear straightforward, the implications of a TOD deed and how it fits into an overall estate plan are complex matters that benefit from professional advice.

- Notarize the document. For a TOD deed to be valid in North Carolina, it must be notarized. This step is crucial for the deed to be legally recognized.

- Record the deed with the county recorder’s office. A TOD deed only becomes effective upon recording in the office of the county where the property is located, before the death of the owner.

- Maintain an updated deed. Life changes, such as marriage, divorce, or the death of a beneficiary, necessitate updates to ensure the deed reflects current wishes.

Don't:

- Forget to designate an alternate beneficiary. In the event the primary beneficiary predeceases the owner, having an alternate can prevent the property from going into probate.

- Overlook the need to coordinate this deed with your broader estate plan. The TOD deed should complement, not contradict, other estate planning documents.

- Assume the deed eliminates all potential for disputes. Clear communication with all involved parties about the contents and intentions of the deed can mitigate future conflicts.

- Fail to consider potential tax implications. While a TOD deed can be a useful tool for avoiding probate, it may not shield heirs from estate or inheritance taxes.

- Dismiss the possibility of needing to revoke the deed. Circumstances change, and revoking a TOD deed properly requires specific actions to ensure it is legally nullified.

Misconceptions

When considering the Transfer-on-Death (TOD) deed form in North Carolina, numerous misconceptions may arise, leading to confusion and potentially significant legal issues. It's crucial to dispel these myths for property owners to make well-informed decisions regarding their estate planning.

- One deed fits all. Many believe that a standard TOD deed can be used in any situation. However, each situation may require a specific approach or additional considerations, depending on factors such as the type of property and the owner's intentions.

- A TOD deed overrides a Will. Another common misconception is that a TOD deed will take precedence over a Will. Although a TOD deed does directly transfer property to a beneficiary upon death, bypassing probate, it does not inherently override the provisions of a Will in cases where other assets or matters are involved.

- Creating a TOD deed eliminates the need for a Will. Some think that once they have a TOD deed in place, there's no need for a Will. This is misleading as a Will covers more than just real estate—it handles the distribution of other personal property, nominates an executor, and can address guardianship issues, which a TOD deed cannot do.

- A TOD deed guarantees the beneficiary will accept the property. There's a false assumption that beneficiaries have no choice but to accept the property transferred via a TOD deed. In reality, beneficiaries may refuse the inheritance for various reasons, including potential tax burdens or other liabilities.

- Joint owners cannot utilize a TOD deed. Many incorrectly believe that TOD deeds are not an option for property held in joint tenancy or as tenants by the entirety. Although the approach may differ, joint owners can indeed use TOD deeds, but it's essential to understand how survivorship rights might affect the transfer.

- No need to update a TOD deed. A dangerous myth is that once a TOD deed is created, it doesn't need to be revisited. In contrast, life changes such as marriage, divorce, and the birth of children can significantly impact estate plans, necessitating updates to the TOD deed.

- A TOD deed avoids all taxes. Some people wrongly assume that transferring property through a TOD deed means the beneficiary avoids inheritance or estate taxes. While TOD deeds may help avoid probate, tax implications still exist, and the specifics depend on the value of the estate and state laws.

- TOD deeds are too complex for individuals to create without legal help. While it's wise to consult with an estate planning attorney, the belief that a TOD deed is too complex for individuals to handle can lead people to avoid using them altogether. With proper guidance and understanding of state laws, individuals can effectively incorporate TOD deeds into their estate planning.

Debunking these misconceptions is essential for property owners in North Carolina to navigate the complexities of estate planning effectively. Understanding the true nature of Transfer-on-Death deeds can help individuals make informed decisions that align with their long-term plans and intentions.

Key takeaways

When considering the utilization of a Transfer-on-Death (TOD) Deed in North Carolina, it is essential to understand its purpose and the correct process for filling it out and using it. This document allows property owners to pass their real estate to a designated beneficiary upon their death, bypassing the probate process. Here are seven key takeaways to remember:

- Eligibility Requirements: The property owner must be competent and understand the nature and extent of the property being transferred. Additionally, the beneficiary must be clearly identified and must survive the property owner to inherit the property.

- Document Specificity: It's crucial for the property being transferred to be described with precise legal terminology. This ensures the correct property is transferred upon the owner's death.

- Revocability: A major benefit of a TOD Deed is its revocability. The property owner retains the right to sell, change, or revoke the deed without the beneficiary's consent at any time before their death.

- Witness and Notarization Requirements: For a TOD Deed to be valid in North Carolina, it must be signed in the presence of a notary and, depending on current state law, may also require witnessing. This formalizes the deed as a legal document.

- Filing with the Register of Deeds: After completion and notarization, the TOD Deed must be filed with the county's Register of Deeds where the property is located. This step is critical for the deed to be effective.

- Impact on Medicaid Eligibility: Property owners considering a TOD Deed should be aware of its potential impact on Medicaid eligibility. Property transferred at death might still be considered part of the estate for Medicaid recovery purposes.

- No Protection from Creditors: The TOD Deed does not protect the property from the owner’s creditors. Debts, taxes, and other financial obligations may still be claimed against the property upon the owner’s death.

Understanding these key points ensures that property owners and beneficiaries can navigate the process of transferring real estate through a TOD Deed in North Carolina efficiently and with the intended legal and financial outcomes.

More Transfer-on-Death Deed State Forms

Tod Deed Georgia - This deed is an effective way to bypass common challenges faced by estates, reducing the burden on your loved ones after you're gone.

Where Can I Get a Tod Form - The deed must be properly executed and recorded in the county where the property is located to be valid.

Avoiding Probate in California - The Transfer-on-Death Deed is an empowering tool for property owners, giving them control over the future of their assets without the complexities of probate.

Transfer on Death Deed California - Its simplicity and effectiveness make it a popular choice for those looking to ensure a seamless transition of their property.