Fillable Transfer-on-Death Deed Document for New York

In recent years, the conversation around estate planning and the mechanisms for transferring property upon one’s death has taken a significant turn with the introduction of the Transfer-on-Death (TOD) Deed form in states like New York. This legal instrument offers a relatively straightforward way for individuals to pass on real estate to a beneficiary without the need for the property to go through probate, the often lengthy and costly court process by which a deceased person's will is proven valid or invalid. The TOD form, thereby, serves as a critical tool for those looking to circumvent these conventional hurdles, simplifying the transfer of ownership in a manner that is both efficient and legally sound. Importantly, it allows the property owner to retain full control over the property until their death, at which point the previously designated beneficiary gains ownership directly, without any need for judicial intervention. This development represents a notable shift in the landscape of estate planning, aiming to reduce administrative burdens and ensure a smoother transition of assets from one generation to the next. As such, understanding the nuances and potential implications of the TOD Deed form is essential for anyone engaged in planning their estate or advising clients on the best strategies for asset distribution after death.

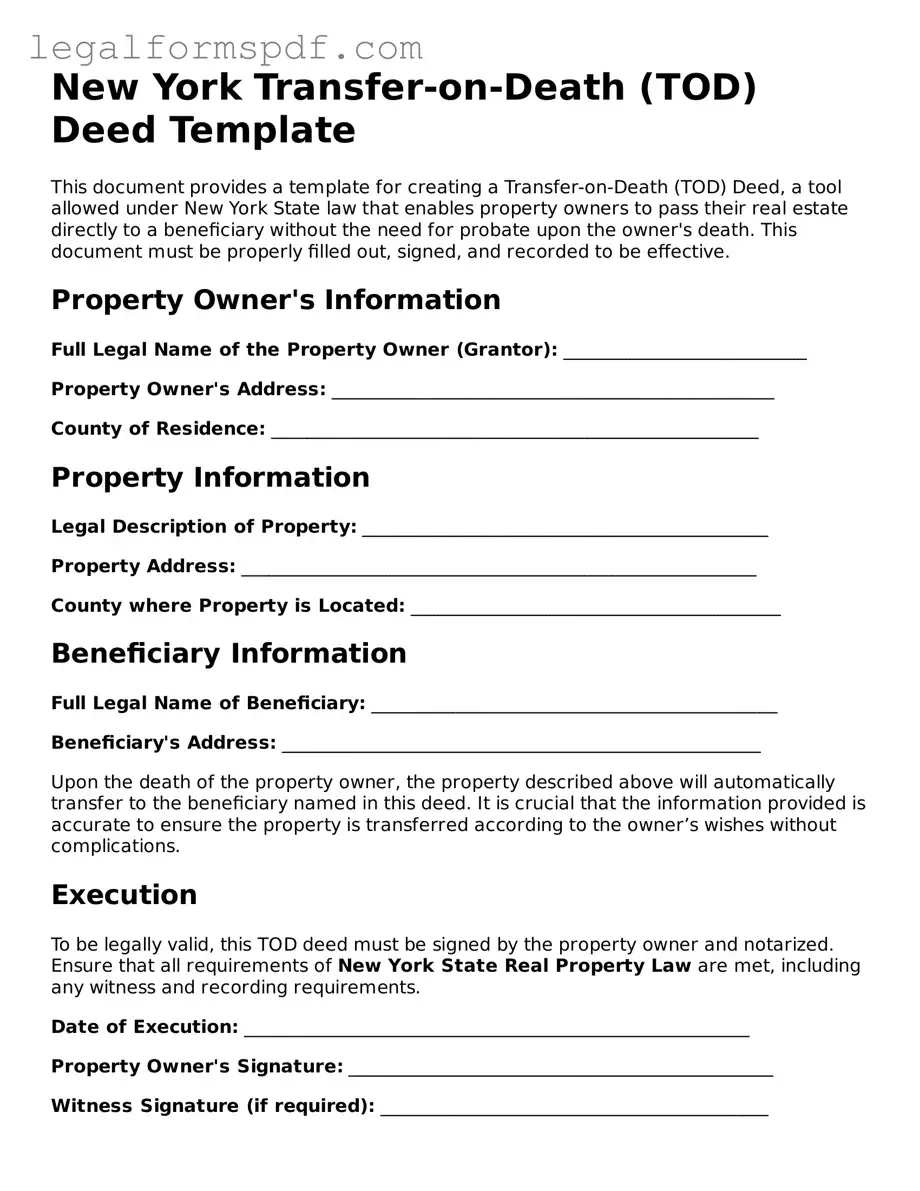

Document Example

New York Transfer-on-Death (TOD) Deed Template

This document provides a template for creating a Transfer-on-Death (TOD) Deed, a tool allowed under New York State law that enables property owners to pass their real estate directly to a beneficiary without the need for probate upon the owner's death. This document must be properly filled out, signed, and recorded to be effective.

Property Owner's Information

Full Legal Name of the Property Owner (Grantor): ___________________________

Property Owner's Address: _________________________________________________

County of Residence: ______________________________________________________

Property Information

Legal Description of Property: _____________________________________________

Property Address: _________________________________________________________

County where Property is Located: _________________________________________

Beneficiary Information

Full Legal Name of Beneficiary: _____________________________________________

Beneficiary's Address: _____________________________________________________

Upon the death of the property owner, the property described above will automatically transfer to the beneficiary named in this deed. It is crucial that the information provided is accurate to ensure the property is transferred according to the owner’s wishes without complications.

Execution

To be legally valid, this TOD deed must be signed by the property owner and notarized. Ensure that all requirements of New York State Real Property Law are met, including any witness and recording requirements.

Date of Execution: ________________________________________________________

Property Owner's Signature: _______________________________________________

Witness Signature (if required): ___________________________________________

Notary Public: ___________________________________________________________

Recording

After signing, this TOD deed must be recorded with the county recorder's office in the county where the property is located. Failure to record the deed before the property owner's death may invalidate the transfer.

Disclaimer

This template is provided as general information and not legal advice. Laws and procedures can change. Always consult with a legal professional before executing a Transfer-on-Death deed.

PDF Specifications

| Fact Number | Fact Detail |

|---|---|

| 1 | New York does not currently recognize Transfer-on-Death (TOD) Deeds as a valid legal instrument for transferring real estate upon death. |

| 2 | Under New York law, alternative estate planning tools such as wills, trusts, or joint tenancy agreements are utilized for the transfer of property after death. |

| 3 | The absence of Transfer-on-Death Deeds in New York means property owners must plan for the succession of their real estate through other means, ensuring alignment with both state and federal law. |

| 4 | For individuals interested in avoiding probate for their real estate in New York, consulting with a legal professional about setting up a living trust or other estate planning strategies is advisable. |

| 5 | Despite the non-recognition of TOD deeds, New York does offer a Transfer-on-Death (TOD) registration for securities and certain other financial accounts, demonstrating an element of TOD applicability in personal asset management. |

| 6 | Should New York laws change to include Transfer-on-Death Deeds for real estate, such legislation would detail the requirements for executing a valid TOD deed, including witness and notarization protocols. |

| 7 | Probate in New York can be a lengthy and costly process, which underscores the importance of estate planning and exploring legal mechanisms for asset transfer that do not involve TOD deeds. |

| 8 | Estate planning in New York, including the transfer of real property, is governed by the New York Estates, Powers & Trusts Law (EPTL) among other statutes. |

| 9 | It is imperative for property owners to periodically review and update their estate plans, especially as personal circumstances and state laws evolve, to ensure their real estate and other assets are disposed of according to their wishes. |

Instructions on Writing New York Transfer-on-Death Deed

When securing the future of your property in New York, a valuable tool at your disposal is the Transfer-on-Death (TOD) deed. This document allows you to pass on real estate to a beneficiary without the complexities of going through probate court after your passing. While it's a straightforward process, it's crucial to fill out the form accurately to ensure your wishes are carried out as intended. Follow these steps carefully to complete the New York TOD deed form accurately.

- Obtain the correct form: The first step is to make sure you have the correct Transfer-on-Death Deed form for New York. This specific form is tailored to adhere to New York's legal requirements, ensuring the process is valid and binding.

- Read the form thoroughly: Before you begin filling out the form, take the time to read through it carefully. This will help you understand the type of information you need to provide and how to correctly enter it.

- Enter the owner's information: The form will ask for the current owner's detailed information. This includes your full legal name, address, and the nature of your ownership (whether it's solely yours, joint, etc.).

- Specify the property: You will need to describe the property being transferred accurately. This includes the property's physical address, legal description, and any other identifying details to ensure there's no confusion about which property you're referring to.

- Designate the beneficiary(s): Clearly write the full legal name(s) of the beneficiary(s) who will receive the property upon your death. If there are multiple beneficiaries, spell out what share of the property each will receive.

- Sign and date the form: For the TOD deed to be valid, you must sign and date it in the presence of a notary public. The notary public will also need to sign the form, confirming they witnessed your signature.

- Record the deed: After the form is notarized, the final step is to record it with the New York county recorder's office where the property is located. This officially registers the deed, making it a legal document.

Filling out the TOD deed form with precision is vital for ensuring your property is smoothly transferred to your designated beneficiary without the need for probate proceedings. It's worth consulting with a legal expert to review the completed form before taking the final step of recording it, guaranteeing everything is in order and your future wishes are secure.

Understanding New York Transfer-on-Death Deed

What is a Transfer-on-Death (TOD) Deed in New York?

A Transfer-on-Death Deed, often abbreviated as TOD, is a legal document that allows property owners in New York to transfer their real estate to a beneficiary upon the owner's death without the need for the property to go through the probate process. This type of deed is advantageous as it helps to simplify the estate planning process, ensuring that the designated property is transferred directly to the named beneficiary upon the death of the property owner.

Who can use a Transfer-on-Death Deed in New York?

Any individual who owns real property in New York and seeks to ensure a smooth transition of that property after their death can use a Transfer-on-Death Deed. It is particularly beneficial for individuals who wish to bypass the lengthy and sometimes costly probate court process. To use a TOD Deed, the property owner must have full ownership of the property with no other co-owners, unless the co-owners are also executed on the deed as joint owners with rights of survivorship.

How can you create a Transfer-on-Death Deed in New York?

Creating a Transfer-on-Death Deed in New York involves several steps. Firstly, the property owner must complete the TOD Deed form, including accurately describing the property and naming the beneficiary who will receive the property upon the owner's death. The deed must then be signed by the property owner in the presence of a notary public to ensure it is legally binding. After notarization, the TOD deed must be filed with the local county recorder's office where the property is located before the owner's death to be effective.

Can a Transfer-on-Death Deed be revoked?

Yes, a Transfer-on-Death Deed can be revoked at any time before the death of the property owner. To revoke the deed, the owner must either create and notarize a new deed that explicitly states the revocation of the prior TOD deed, transfer the property to someone else, or sell the property. Additionally, executing a subsequent TOD deed that contradicts the earlier one can also serve as a form of revocation. For the revocation to be effective, it must be filed with the county recorder's office where the property is located.

What happens if the beneficiary predeceases the property owner?

If the named beneficiary of a Transfer-on-Death Deed predeceases the property owner, the deed generally becomes null and void, and the property will not transfer upon the death of the owner. In such cases, the property will be handled according to the rest of the owner’s estate plan or, in the absence of such a plan, under the state’s intestate succession laws. It is advisable for property owners to name an alternate beneficiary when creating a TOD deed to avoid complications in such situations.

Common mistakes

One common mistake people make when filling out the New York Transfer-on-Death (TOD) Deed form is not correctly identifying the beneficiary. This mistake can lead to confusion about who is entitled to the property upon the death of the property owner. It's crucial to provide the full legal name of the beneficiary and to double-check the spelling. If there are multiple beneficiaries, the form should clearly indicate each person's share or interest in the property.

Another error occurs when individuals neglect to properly describe the property. The TOD deed form requires a precise legal description of the property, not just its physical address. This legal description can typically be found on the current deed or property tax documents. Without the correct legal description, the transfer could be deemed invalid, potentially leading to legal disputes or probate court involvement.

People often overlook the requirement to have the TOD deed form notarized. In New York, as in many other jurisdictions, for a TOD deed to be legally binding, it must be signed by the property owner in the presence of a notary public. Failing to notarize the document can render it invalid, preventing the intended transfer of property upon the owner’s death.

A further mistake involves not properly recording the TOD deed with the county recorder's office. After the TOD deed is filled out and notarized, it must be filed with the office of the county clerk where the property is located. If this step is ignored, the deed might not be effective. This filing ensures that the deed becomes a matter of public record, which is necessary for the transfer of the title to the beneficiary upon the property owner's demise.

Lastly, some people fail to update the TOD deed when circumstances change. Life events such as marriage, divorce, the birth of a child, or the death of a named beneficiary can impact the intended distribution of property. Regularly reviewing and, if necessary, updating the TOD deed ensures that it accurately reflects the current wishes of the property owner.

Documents used along the form

In the state of New York, the Transfer-on-Death (TOD) deed form allows property owners to pass their real estate to a beneficiary without the need for probate court proceedings after their death. To effectively execute a TOD deed and ensure a smooth transition of property, various supporting documents are often utilized alongside it. These documents ensure that all legal aspects are covered and comply with New York state laws. The understanding and preparation of these documents are crucial for the property transfer process to be duly recognized and enforced.

- Last Will and Testament: This document complements the TOD deed by specifying the grantor's wishes regarding the distribution of their other assets and personal property. While the TOD deed directly transfers real estate, the will covers all other aspects of the estate.

- Revocable Living Trust: Property owners might use this to manage their assets during their life. Although similar in purpose to a TOD deed for property transfer, a trust can include various assets and provides broader control over their distribution.

- Power of Attorney: This grants another individual the authority to manage the property owner’s financial affairs, possibly including actions related to the property, if the owner becomes incapacitated before their death.

- Death Certificate: After the property owner's death, a certified death certificate is often required to prove the owner's demise and is necessary to transfer the property to the beneficiary listed on the TOD deed.

- Affidavit of Heirship: While not always necessary with a TOD deed, this document can be useful if there are disputes among potential heirs or if the TOD deed's validity is questioned.

- Property Tax Forms: Depending on local regulations, there may be tax implications or exemptions available upon the transfer of property. Relevant tax forms must be completed to ensure the property is properly assessed and taxed under the new ownership.

The above-listed documents serve as a toolkit to navigate the legal landscape surrounding the Transfer-on-Death deed process in New York. Property owners and beneficiaries should consider seeking legal advice to ensure all documents are correctly executed and filed. This prepares all parties for a seamless transition, safeguarding the property owner's final wishes and providing peace of mind to both the giver and receiver of the estate.

Similar forms

The New York Transfer-on-Death (TOD) Deed form shares similarities with a Last Will and Testament, chiefly in its function to designate beneficiaries for property upon the owner's death. Both documents allow the owner to specify who will receive their property, ensuring a smoother transition of assets. However, unlike a Last Will and Testament, which goes through probate, a TOD Deed bypasses this process, providing a direct transfer to the beneficiary.

Comparable to a Joint Tenancy Agreement, the TOD Deed ensures the transfer of property rights upon death. In a Joint Tenancy, the property automatically transfers to the surviving owners without the need for probate. The TOD Deed operates under a similar principle but is unilateral, affecting solely the property owner's interest, without involving other joint owners.

Living Trusts share a common goal with TOD Deeds: avoiding the probate process. Property held in a Living Trust is transferred to the trust beneficiaries upon the grantor's death, outside of probate. While a Living Trust can hold various assets and offers more control over distribution, the TOD Deed is specific to real estate and is a simpler, more straightforward document.

The Beneficiary Deed, akin to the TOD Deed, allows property owners to name beneficiaries. Used in some states, it serves the same purpose: to transfer property upon the owner's death directly to the beneficiary, avoiding probate. While the principle remains constant, the actual name and the legal requirements might differ based on state laws.

A Revocable Living Will share similarities with the TOD Deed, particularly in how both can be altered or revoked as long as the grantor is alive. Both documents allow for changes to be made, providing flexibility and control over the disposition of assets. However, the Revocable Living Will encompasses broader assets, while the TOD Deed is specifically designed for real estate.

The Durable Power of Attorney (POA) for Assets, although designed for different circumstances, intersects with the TOD Deed by addressing asset management. The POA grants someone the authority to manage your assets if you become incapacitated, while the TOD Deed designates beneficiaries upon death, both facilitating a transfer of assets under specific conditions.

The Healthcare Proxy is another document that, like the TOD Deed, plans for future events. The Healthcare Proxy designates someone to make healthcare decisions on behalf of the individual if they are unable to do so. Although it pertains to medical decisions rather than the transfer of property, both documents are essential in estate planning, ensuring individuals' wishes are honored in critical situations.

Dos and Don'ts

When preparing a New York Transfer-on-Death (TOD) Deed, it's crucial to follow specific guidelines to ensure the process is handled correctly. This legal document allows property owners to pass on real estate directly to beneficiaries upon their death, bypassing probate. Below are ten key dos and don'ts to consider:

- Do verify that the form is the correct version for New York. Laws and regulations vary by state, and using the incorrect form can invalidate the deed.

- Do include all required personal information accurately, such as full legal names, addresses, and descriptions of the property being transferred. This detail is essential for the valid transfer of ownership.

- Do ensure the property description is precise and matches the one on the current deed or property record. Errors here can lead to disputes or a failure in the transfer process.

- Do have the deed signed in the presence of a notary public. Notarization is mandatory for the document to be legally binding and recognized by New York law.

- Do file the completed deed with the county recorder’s office where the property is located. Until this step is taken, the deed does not take effect.

- Do not leave any sections blank. Incomplete documents may result in rejection or legal complications down the line.

- Do not assume verbal agreements will be honored. The TOD deed must explicitly state the beneficiary’s details to ensure your wishes are carried out.

- Do not neglect to review and update the deed if circumstances change, such as the death of a beneficiary or a change in relationship.

- Do not forget to consult with a legal professional if you have questions or unique circumstances. While many can fill out the deed on their own, complex situations may require professional advice.

- Do not use the TOD deed to bypass creditors or avoid taxes. The transfer may still be subject to estate recovery laws and taxation.

Adhering to these guidelines will help ensure that the Transfer-on-Death Deed achieves your goals without unforeseen complications. Remember, this deed is a powerful estate planning tool that needs to be handled with diligence and care.

Misconceptions

When we talk about planning for the future, especially in terms of estate planning in New York, the concept of a Transfer-on-Death (TOD) Deed often comes into the conversation. However, there's a lot of confusion surrounding TOD Deeds, which can lead to misconceptions about their utility and function. Below, we address some common misunderstandings:

- Transfer-on-Death Deeds are available in all states. This is not true. The availability and rules surrounding TOD Deeds vary significantly from one state to another. As of my last update, New York does not recognize Transfer-on-Death Deeds as a tool for estate planning. It's crucial to check the current laws in your specific state.

- TOD Deeds allow you to bypass probate for all assets. Even in states where TOD Deeds are valid, their application is mostly limited to real estate. Other assets, like personal belongings, vehicles, and sometimes even bank accounts, might not fall under the purview of a TOD Deed and may still go through probate.

- Creating a TOD Deed is a one-step, simple process. While less complicated than some other estate planning measures, drafting a TOD Deed requires careful consideration of current laws, precise language, and proper filing. Missteps can invalidate the deed or create unintended consequences.

- Once executed, a TOD Deed cannot be revoked. This is false. Most states that allow TOD Deeds also provide a process for revocation. However, the specific process can be intricate and usually requires certain formalities to be validly completed.

- TOD Deeds relieve you from all property-related responsibilities immediately. Actually, as the donor, you maintain ownership and responsibility for the property until your demise. This means you're still on the hook for property taxes, maintenance, and any debt obligations tied to the property.

- Having a TOD Deed means you don't need a will. This couldn't be further from the truth. A TOD Deed only covers specific assets, namely real estate in those states that recognize it. A comprehensive estate plan, including a will, ensures that all your assets are distributed according to your wishes.

- TOD Deeds are a foolproof way to avoid family disputes. While TOD Deeds can simplify the transfer of property, they are not a panacea for family conflicts. Without a comprehensive estate plan, disputes can still arise over other assets or even the property itself, if there was any ambiguity or perceived unfairness in the TOD Deed.

- You don't need an attorney to create a TOD Deed. Technically, you might be able to draft a TOD Deed on your own; however, due to the nuances of estate law and potential for costly mistakes, consulting with an attorney who specializes in estate planning is highly recommended. An expert can help ensure your TOD Deed aligns with your overall estate plan and complies with state law.

Understanding these misconceptions about Transfer-on-Death Deeds can help you navigate your estate planning with greater confidence, ensuring that your assets are distributed according to your wishes, with minimal stress on your loved ones.

Key takeaways

Filling out and using the New York Transfer-on-Death (TOD) Deed form can help streamline the process of transferring real estate upon the death of the property owner. Here are seven key takeaways to consider:

- Eligibility: Not all states recognize Transfer-on-Death Deeds, so it’s important to confirm that New York law permits these instruments for transferring property upon death.

- Intent: A Transfer-on-Death Deed allows property owners to pass their real estate to a beneficiary upon their death without the property having to go through probate.

- Revocability: The property owner can revoke the TOD Deed at any time before their death, affording them flexibility and control over their real estate.

- Beneficiary Designations: Property owners should clearly identify the beneficiary or beneficiaries in the TOD Deed, including their full legal names and a description of how title to the property should pass.

- Legal Requirements: For a TOD Deed to be valid, it must comply with all state-specific legal requirements, such as being properly signed, witnessed, and notarized.

- Filing: The completed TOD Deed must be filed with the appropriate local government office, such as the County Recorder, before the property owner’s death to be effective.

- Impact on Estate Planning: Including a TOD Deed in an estate plan should be done with consideration of its impact on the overall estate, including tax implications and consistency with other estate planning documents.

Taking these key points into account can help individuals effectively utilize a Transfer-on-Death Deed in New York, ensuring a smoother transition of property to beneficiaries, while possibly avoiding the probate process.

More Transfer-on-Death Deed State Forms

How to Avoid Probate in Pennsylvania - This tool is not suitable for all types of property or situations, so understanding its limitations is essential for effective estate planning.

How to Transfer Land Ownership - Transfer-on-Death Deeds can be particularly useful for individuals who own property in multiple states, streamlining the inheritance process.