Fillable Transfer-on-Death Deed Document for Michigan

When planning for the future, many individuals seek ways to pass on their real estate holdings to loved ones with minimal complications. Among the tools at their disposal, the Michigan Transfer-on-Death (TOD) Deed form stands out as a powerful option. This document allows property owners, referred to as grantors, to designate beneficiaries who will inherit their property upon the grantor's death, bypassing the often lengthy and complex process of probate. It's a straightforward mechanism: the property title automatically transfers to the named beneficiary when the current owner dies, provided that the deed was correctly filled out and recorded before the owner's passing. Importantly, while the owner retains full control over the property during their lifetime, including the right to revoke the deed, the beneficiary has no rights to the property until after the owner's death. Thus, the TOD deed form strikes a balance, ensuring that property owners can plan for the future without sacrificing control over their assets today.

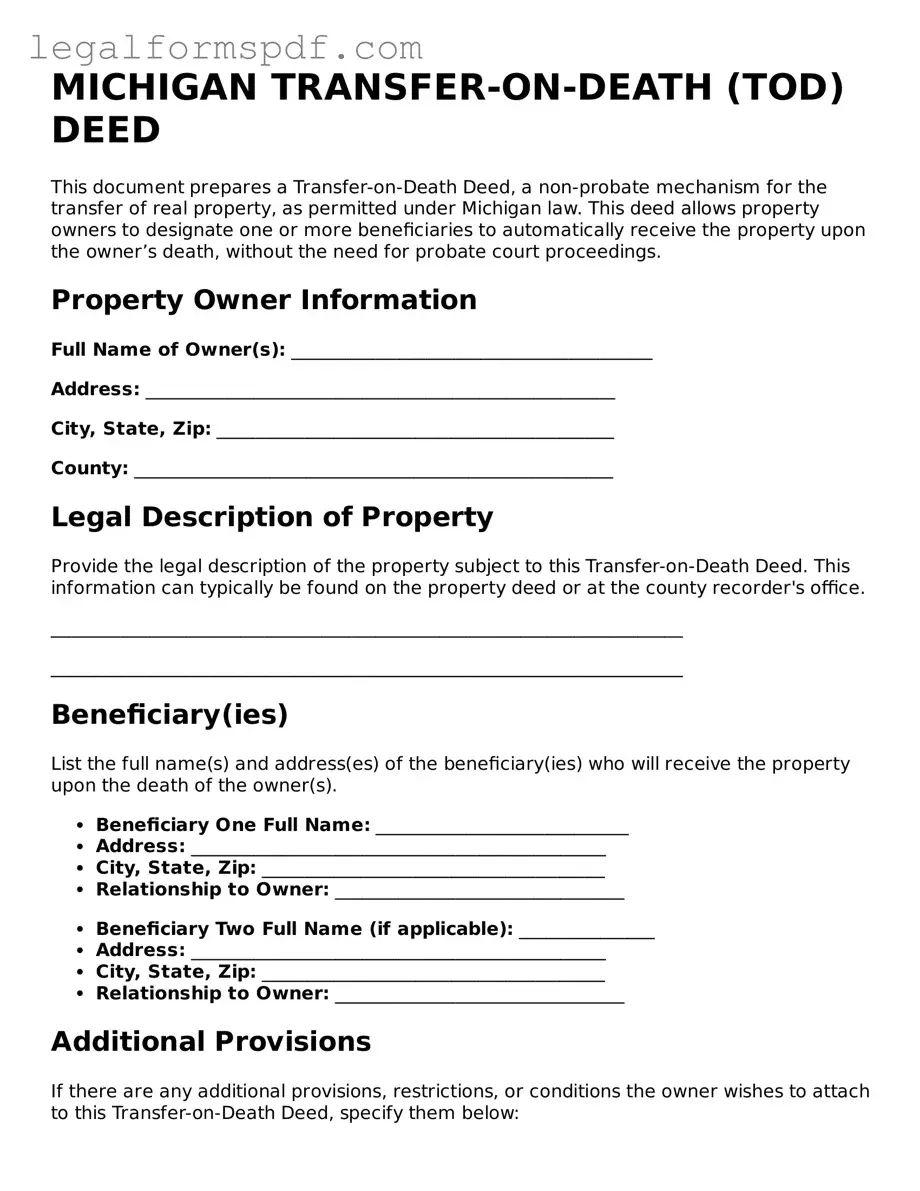

Document Example

MICHIGAN TRANSFER-ON-DEATH (TOD) DEED

This document prepares a Transfer-on-Death Deed, a non-probate mechanism for the transfer of real property, as permitted under Michigan law. This deed allows property owners to designate one or more beneficiaries to automatically receive the property upon the owner’s death, without the need for probate court proceedings.

Property Owner Information

Full Name of Owner(s): ________________________________________

Address: ____________________________________________________

City, State, Zip: ____________________________________________

County: _____________________________________________________

Legal Description of Property

Provide the legal description of the property subject to this Transfer-on-Death Deed. This information can typically be found on the property deed or at the county recorder's office.

______________________________________________________________________

______________________________________________________________________

Beneficiary(ies)

List the full name(s) and address(es) of the beneficiary(ies) who will receive the property upon the death of the owner(s).

- Beneficiary One Full Name: ____________________________

- Address: ______________________________________________

- City, State, Zip: ______________________________________

- Relationship to Owner: ________________________________

- Beneficiary Two Full Name (if applicable): _______________

- Address: ______________________________________________

- City, State, Zip: ______________________________________

- Relationship to Owner: ________________________________

Additional Provisions

If there are any additional provisions, restrictions, or conditions the owner wishes to attach to this Transfer-on-Death Deed, specify them below:

______________________________________________________________________

______________________________________________________________________

Execution

This Transfer-on-Death Deed must be signed by the property owner(s) and notarized to be effective. The deed does not need to be delivered to the beneficiary during the owner’s lifetime but must be recorded in the county where the property is located before the owner's death.

Owner(s) Signature: __________________________________________

Date: ________________________________________________________

State of Michigan

County of _________________________

This document was acknowledged before me on (date) ____________________ by (name of owner) ________________________________________.

Notary Public: ______________________________________________

My commission expires: ____________________________________________

Disclaimer

This template is provided as a general guide to prepare a Michigan Transfer-on-Death Deed and may not suit every individual situation. Property owners are encouraged to consult with a qualified attorney to ensure that this deed meets their specific needs and complies with Michigan law.

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Michigan Transfer on Death (TOD) deed is regulated under the Michigan Compiled Laws, specifically MCL 700.6101 to 700.6105, part of the estates and protected individuals code. |

| Eligible Property | Real property, including land and any buildings on it, can be transferred using a Transfer on Death deed in Michigan. |

| Beneficiary Designation | Owners can designate one or more beneficiaries to inherit the property upon their death, without the property having to go through probate. |

| Revocability | The Transfer on Death deed is revocable, meaning the property owner can change their mind at any time prior to death. |

| No Probate Necessary | Upon the death of the property owner, the property passes directly to the named beneficiary(ies) without the need for probate court proceedings. |

| Effectiveness | The Transfer on Death deed only becomes effective upon the death of the property owner, allowing them to retain full control over the property during their lifetime. |

| Witness Requirements | The deed must be signed in the presence of two or more competent witnesses who are not named as beneficiaries in the deed. |

| Recording Requirements | To be valid, the completed and notarized Transfer on Death deed must be recorded with the register of deeds in the Michigan county where the property is located before the owner's death. |

| Impact on Medicaid Eligibility | Ownership of property via a Transfer on Death deed may affect the owner’s eligibility for Medicaid and other public benefits, due to asset consideration rules. |

Instructions on Writing Michigan Transfer-on-Death Deed

When planning for the future, managing your assets in a way that ensures they are distributed according to your wishes is crucial. Michigan's Transfer-on-Death (TOD) deed is a useful tool for this purpose. It allows you to pass on real estate directly to a beneficiary upon your death, bypassing the often lengthy and complex probate process. Completing the TOD deed requires attention to detail and an understanding of the necessary steps to ensure the form is legally valid. Below is a straightforward guide to filling out the Michigan Transfer-on-Death Deed form, designed to help you confidently secure your real estate assets for your loved ones.

- Identify the Current Property Owner: Start by providing the full legal name of the current property owner, as recorded on the existing deed.

- Include the Legal Description of the Property: Enter the detailed legal description as it appears on the current deed or property tax documents. This typically includes lot numbers, subdivision names, and measurements.

- Name the Beneficiary(ies): Clearly list the full legal name(s) of the beneficiary(ies) who will receive the property upon your death. If there are multiple beneficiaries, specify the ownership share each will receive.

- State the Conditions of Transfer (if any): If the transfer to the beneficiary is conditional, outline these conditions in detail. This section is optional and should only be filled out if specific requirements must be met before the transfer can occur.

- Review the Revocation Provision: Understand that this document can be revoked at any time before your death, as long as the revocation is executed according to Michigan law. There’s no need to fill out anything here, but be aware of this provision.

- Sign and Date the Deed: The current property owner must sign and date the deed in the presence of a notary public. This notarization gives the document legal strength.

- Record the Deed: Finally, for the deed to be effective, it must be recorded with the county registrar's office where the property is located. Make sure this is completed before the property owner's death to ensure a smooth transition of ownership.

By carefully following these steps, you can successfully draft a Transfer-on-Death deed in Michigan. This allows you to rest easy, knowing that your real estate will be transferred to your chosen beneficiary with minimal legal fuss. Remember, it’s always wise to consult with a legal professional to ensure all aspects of the deed meet current legal standards and accurately reflect your wishes.

Understanding Michigan Transfer-on-Death Deed

What is a Transfer-on-Death (TOD) Deed in Michigan?

A Transfer-on-Death Deed allows property owners in Michigan to pass their real estate to a designated beneficiary upon their death without the need for probate court proceedings. This document is effective upon the death of the property owner and does not impact the owner’s rights to use and control the real estate during their lifetime.

How does a Transfer-on-Death Deed differ from a traditional will?

Unlike a traditional will, a Transfer-on-Death Deed is a non-probate instrument specifically designed for real estate. It directly transfers property to a beneficiary upon the property owner’s death, without the estate going through probate court. This means the beneficiary can often claim the property more quickly and with less legal expense.

Who can I name as a beneficiary on a Transfer-on-Death Deed in Michigan?

Property owners can name an individual, multiple individuals, or a legal entity as beneficiaries. It is important to clearly identify each beneficiary by their full legal name to avoid any confusion upon the property owner's death. Multiple beneficiaries can be named with specified percentages of ownership if desired.

Can a Transfer-on-Death Deed be revoked or changed?

Yes, a Transfer-on-Death Deed can be revoked or changed at any time during the property owner's lifetime, as long as the owner is mentally competent. To revoke or change the deed, the owner must complete a new deed or a formal revocation document. It's important that this new document be recorded in the public records in the county where the property is located to be effective.

What happens if the beneficiary predeceases the property owner?

If the beneficiary designated in a Transfer-on-Death Deed dies before the property owner, the deed typically becomes null and void unless alternate beneficiaries are named. Property owners are encouraged to update their Transfer-on-Death Deed if their designated beneficiary dies or if their intentions change.

How do I create a Transfer-on-Death Deed in Michigan?

Creating a Transfer-on-Death Deed in Michigan requires drafting a document that meets specific state legal requirements. This includes correctly describing the property and clearly naming the beneficiary. The deed must be signed by the property owner and notarized. Finally, the completed deed has to be recorded with the county register of deeds where the property is located. It might be wise to consult with a legal professional to ensure all requirements are accurately met.

Common mistakes

In Michigan, the Transfer-on-Death (TOD) Deed offers a streamlined process for property owners to pass real estate directly to their beneficiaries upon their death, without the property having to go through probate. However, despite its benefits, mistakes are often made when filling out the TOD Deed form, leading to complications that could hinder the smooth transfer of property rights.

One common mistake is the failure to properly describe the property. The legal description of the property, as it appears on the current deed or property tax documents, must be used. Some individuals mistakenly provide only the address or an incorrect or insufficient legal description, potentially creating confusion or disputes over the property boundaries or the exact piece of property intended to be transferred.

Another error occurs when individuals do not correctly identify the beneficiaries. It's crucial to use the full legal names of the beneficiaries to avoid ambiguity. Additionally, specifying the relationship to the beneficiary may help in identifying them more clearly, especially if the beneficiary's name is common. Failing to clearly identify beneficiaries can lead to disputes among potential heirs after the property owner's death.

Notary errors also plague TOD Deeds. In Michigan, as in many other states, TOD Deeds must be notarized to be valid. However, some individuals neglect this step or the notarization is completed improperly. This oversight can invalidate the entire deed, as notarization is a critical requirement for the document's legality and enforceability.

Another significant mistake is neglecting to file the deed with the appropriate county register of deeds. After signing and notarizing the TOD Deed, it must be filed with the county where the property is located. Failing to file the deed or filing it in the wrong county means the transfer might not be recognized upon the death of the property owner, requiring the estate to go through probate to transfer the property.

Some people mistakenly believe that creating a TOD Deed removes their rights to the property while they are alive. This misunderstanding may lead to reluctance to use this estate planning tool. However, the property owner retains full control over the property during their lifetime, even after executing a TOD Deed. They can sell, lease, or mortgage the property as they wish, and even revoke the TOD Deed if they change their mind about the transfer.

Last but not least, a fundamental oversight is not updating the TOD Deed as circumstances change. Marriage, divorce, death of a beneficiary, or changes in the property owner's intentions can all necessitate updates to the TOD Deed. Failure to review and revise the deed as life circumstances evolve can result in the property not passing according to the current wishes of the owner, leading to potential legal battles among heirs.

Documents used along the form

When planning for the future, it's crucial to ensure that all necessary preparations are in place. The Michigan Transfer-on-Death (TOD) Deed form is a valuable tool for estate planning, allowing individuals to pass on property to their beneficiaries without going through probate. However, to complete a comprehensive estate plan, several other forms and documents should also be considered. These complement the TOD deed by covering various aspects of one's legal and financial affairs, ensuring a smooth transition for loved ones and executors handling the estate.

- Last Will and Testament: This document outlines how the individual's assets will be distributed among beneficiaries. It also names an executor who oversees the process of distributing the estate according to the will's stipulations.

- Financial Power of Attorney: This form grants a designated person the authority to make financial decisions on behalf of the individual, should they become unable to do so themselves.

- Healthcare Power of Attorney: Similar to a Financial Power of Attorney, this document designates someone to make healthcare decisions for the individual, in case they are incapacitated and unable to make those decisions on their own.

- Living Will: Sometimes referred to as an advance healthcare directive, this outlines the individual's wishes regarding medical treatment and life support in situations where recovery is unlikely.

- Revocable Living Trust: This trust allows individuals to maintain control over their assets while they are alive. Upon their death, the assets are transferred to the beneficiaries named in the trust, often bypassing the probate process.

- Beneficiary Designations: Forms for retirement accounts, insurance policies, and other financial accounts that allow the individual to name who will receive the assets in these accounts upon their death.

- Property Inventory: A comprehensive list of valuable personal and real property owned by the individual, which can be particularly helpful for the executor and beneficiaries in understanding and managing the estate.

Gathering and completing these documents provides a solid foundation for any estate plan. Together with the Michigan TOD deed, they ensure that an individual's wishes are honored and that their assets are distributed smoothly and efficiently to their chosen beneficiaries. Taking these steps not only provides peace of mind but also significantly eases the administrative burden on loved ones during a time of loss.

Similar forms

The Michigan Transfer-on-Death (TOD) Deed form shares similarities with a Last Will and Testament, as both serve the purpose of directing how a person's assets are distributed after their death. Like the TOD Deed, a Last Will and Testament can designate beneficiaries for property and assets, ensuring that an individual's wishes are respected. However, while a TOD Deed is specific to the transfer of real estate upon death without going through probate, a Last Will and Testament covers a broader range of assets and must go through the probate process.

Similarly, a Living Trust aligns closely with the TOD Deed in its function to manage and transfer an individual's assets upon their death, bypassing the often lengthy and costly probate process. Both documents allow for the direct transfer of assets to designated beneficiaries, but a Living Trust is more comprehensive, encompassing a wider variety of assets beyond real estate, and also offers the option to specify conditions or timelines for the distribution.

Revocable Transfer on Death Deeds share a specific connection with the TOD Deed as they both allow the property owner to retain control over the property during their lifetime, with the ability to revoke or change the deed. These deeds ensure that upon the death of the property owner, the property is transferred directly to the named beneficiary, streamlining the inheritance process by circumventing the probate court.

Beneficiary Designations, commonly found in retirement and bank accounts, resemble the TOD Deed in their ability to bypass the probate process by directly transferring assets to the named beneficiaries upon the account holder's death. Both types of designations avoid probate and enable a smoother, faster transfer of assets, although beneficiary designations are typically used for financial accounts, while TOD Deeds are specific to real estate.

Joint Tenancy with Rights of Survivorship agreements parallel the intent behind the TOD Deed, as they both allow for the direct transfer of property upon death to another individual without going through probate. In a joint tenancy, upon the death of one tenant, the property automatically passes to the surviving tenant(s), similar to how a TOD Deed transfers real estate to the named beneficiary.

A Life Estate Deed, while establishing an immediate transfer of property, has common ground with a TOD Deed because it specifies a future transfer of ownership upon the death of the life tenant. However, with a Life Estate Deed, the original owner relinquishes certain rights immediately, unlike with a TOD Deed, where the owner maintains control over the property until death.

The Payable on Death (POD) Agreement, typically utilized for financial assets like bank accounts, mirrors the TOD Deed's function in real estate. It permits assets to be passed on to the beneficiary immediately after the account holder's demise, avoiding the probate process. This makes the transfer of assets swift and uncomplicated, albeit in the context of financial assets instead of real property.

The Durable Power of Attorney (POA) for Finances has an indirect resemblance to the TOD Deed, as it allows an individual to designate another person to manage their financial affairs potentially until death. Although a POA does not deal directly with the transfer of assets after death, it facilitates the management of an individual's assets during their lifetime, potentially informing how assets are positioned for eventual transfer through mechanisms like a TOD Deed.

Lastly, the Advance Healthcare Directive, though primarily focused on healthcare decisions rather than the transfer of assets, shares the preemptive planning aspect with the TOD Deed. It allows individuals to outline their wishes for medical treatment in case they become unable to communicate these themselves, underscoring the importance of planning for the future and ensuring wishes are respected, much like how a TOD Deed plans for the transfer of real estate.

Dos and Don'ts

When preparing the Michigan Transfer-on-Death (TOD) Deed form, it's important to proceed with attention to detail and an understanding of the requirements. The following guidelines provide crucial do’s and don’ts to help ensure the form is completed accurately and effectively:

Do's

- Use clear and legible writing: Whether filling out the form by hand or typing, ensure that all entries are easy to read.

- Verify property description: Double-check the legal description of the property against your property deed to avoid discrepancies.

- Include all necessary parties: Ensure that all co-owners, if any, are included in the deed as required by law.

- Consult with an attorney: Consider seeking legal advice to understand the implications of the TOD deed and ensure it aligns with your estate plan.

- Notarize the form: Michigan law requires the TOD deed to be notarized. Ensure it is signed in the presence of a notary public.

- Witnesses: Have the deed signed in the presence of witnesses as required by law, noting their names clearly on the document.

- File the deed promptly: Record the completed deed with the county register of deeds where the property is located, ideally soon after completion.

- Keep a copy: Retain a copy of the notarized and filed deed for your records and for the beneficiary.

- Review periodically: Review and update the deed as necessary, especially after major life events or changes in intentions.

- Communicate with beneficiaries: Inform the beneficiaries of the TOD deed to ensure they understand what will happen upon your passing.

Don'ts

- Postpone filing: Avoid delaying the recording of the deed, as it must be on file to be effective.

- Forget to update: Do not neglect updating the deed in the event of the property description changes or adjustments in personal wishes.

- Overlook potential claims: Be mindful of any outstanding mortgages, liens, or claims against the property that could affect the transfer.

- Avoid discussions: Do not avoid discussing your plans with family members or beneficiaries to prevent surprises and potential disputes.

- Assume state laws are the same: Don’t assume Michigan’s laws regarding TOD deeds are the same as other states. Property laws can vary significantly from one state to another.

- Ignore tax implications: Be aware of any potential tax implications for yourself and the beneficiary to avoid unexpected liabilities.

- Misjudge the need for a will: Do not assume that a TOD deed replaces the need for a will. Other assets may not be covered by this deed.

- Skimp on details: Avoid providing vague or insufficient details about the property or the beneficiaries.

- Use outdated forms: Ensure that you are using the most current version of the TOD deed form as laws and requirements can change.

- Rely solely on generic advice: While general guidelines are helpful, personal circumstances vary, necessitating tailored legal advice.

Misconceptions

When it comes to planning for the future, understanding the tools at your disposal is crucial. In Michigan, one option that often comes with misconceptions is the Transfer-on-Death (TOD) Deed. This document allows property owners to name beneficiaries who will inherit their property, avoiding probate, upon the owner’s death. Clarifying these misconceptions can help make informed decisions. Here are nine common misunderstandings:

- It avoids taxes: A common misconception is that a TOD Deed can help you avoid estate or inheritance taxes. While it can bypass the probate process, it doesn't exempt the property from estate or inheritance taxes that the state of Michigan might impose.

- It overrides a will: People often believe that a TOD Deed will override whatever is stated in a will regarding the property. However, the TOD Deed specifically governs the transfer of the real estate upon death, and it takes precedence over provisions in a will related to the property.

- The beneficiary’s creditors can claim the property before the owner dies: This is incorrect. The beneficiary’s creditors cannot place claims against the property until after the owner's death, when the property is legally transferred.

- It's irrevocable: Some think once a TOD Deed is made, it cannot be changed. This is not the case. As long as the property owner is alive and competent, they can modify or completely revoke a TOD Deed.

- It's a tool only for the elderly: While it's true that many people start thinking about estate planning later in life, a TOD Deed can be a beneficial tool for anyone who owns real estate, regardless of their age.

- The property automatically transfers upon death: While it is true that the property transfers to the beneficiary without the need for probate, the transfer is not "automatic" in the sense that there are still steps the beneficiary must take, such as filing a death certificate and TOD Deed with the county clerk.

- It can transfer any type of property: A TOD Deed in Michigan is specifically for real estate. It does not cover other types of property or assets that one might wish to bequeath, such as cars or financial accounts.

- Joint owners cannot use a TOD Deed: Actually, joint owners can use a TOD Deed, but how it works upon the death of one owner depends on the rights of survivorship. If the property is owned as joint tenants with the right of survivorship, the surviving owner(s) would inherit the deceased’s share, not the TOD beneficiary, until the last surviving owner’s death.

- Creating a TOD Deed is a complicated process: While legal documents can be intimidating, creating a TOD Deed does not have to be complicated. It requires clear information about the property, the owner, and the designated beneficiary, as well as proper signing and recording with the local registry of deeds. Consulting with a legal professional can ensure it is done correctly.

Understanding what a Transfer-on-Death Deed can and cannot do is the first step in effectively incorporating it into your estate planning. By dispelling these misconceptions, Michigan property owners can make more informed decisions that best suit their and their beneficiaries' needs.

Key takeaways

When preparing to use the Michigan Transfer-on-Death (TOD) Deed form, it's crucial to grasp its key aspects fully. This form enables property owners to pass on their real estate without the need for a lengthy probate process after their death. Here are several critical takeaways to consider:

- The Michigan TOD Deed form must be filled out accurately, reflecting the current owner's details, the designated beneficiary's full name, and a legal description of the property. Errors in these details can lead to disputes or even invalidate the deed.

- To be legally binding, the form requires notarization. This step ensures that the signature of the property owner is verified, adding a layer of protection against fraud.

- It is essential to clearly specify the beneficiary or beneficiaries. If more than one beneficiary is named, the form should clarify how the property will be divided among them.

- Recording the deed with the county recorder’s office where the property is located is mandatory for the TOD Deed to take effect. Until recorded, the deed does not legally transfer any interest in the property.

- Property owners retain full control over the property during their lifetime, including the right to sell or mortgage the property. The TOD Deed arrangement does not limit the owner's rights in any way while they are alive.

- Revoking or changing a TOD Deed is possible at any point during the property owner's life. The process usually involves executing and recording a new deed or a formal revocation statement.

- It’s important to understand that the TOD Deed does not eliminate the need for overall estate planning. Other assets not covered by the TOD Deed will still go through the probate process unless otherwise arranged.

Ensuring clarity and precision when filling out and recording a TOD Deed is paramount. Taking the time to consult legal guidance tailored to individual circumstances can prevent potential issues and make the property transfer process seamless for beneficiaries.

More Transfer-on-Death Deed State Forms

Tod Deed Georgia - The deed is particularly valuable in states that recognize its validity, making it a key part of estate planning strategies.

How to Avoid Probate in Pennsylvania - In states where it is recognized, the Transfer-on-Death Deed adds a layer of flexibility to estate planning strategies.