Fillable Transfer-on-Death Deed Document for Illinois

When it comes to estate planning, the Illinois Transfer-on-Death (TOD) Deed form stands out as a notable tool that both simplifies and streamlines the process of transferring property upon death. This relatively straightforward document offers a myriad of benefits, allowing property owners to bypass the often lengthy and complicated probate process. In essence, the TOD deed enables individuals to name beneficiaries who will inherit their real estate upon their demise, without the beneficiaries having legal rights to the property until that time comes. This not only facilitates a smoother transition of property ownership but also offers a layer of control and peace of mind to property owners, knowing their real estate will directly pass to their designated heirs. This legal instrument, specific to Illinois, reflects an evolving approach to estate planning, aiming to reduce bureaucratic red tape and make the process more accessible to the population. Understanding the major aspects of the Illinois TOD Deed form is crucial for anyone looking to ensure their estate affairs are handled according to their wishes, with minimal stress for their loved ones.

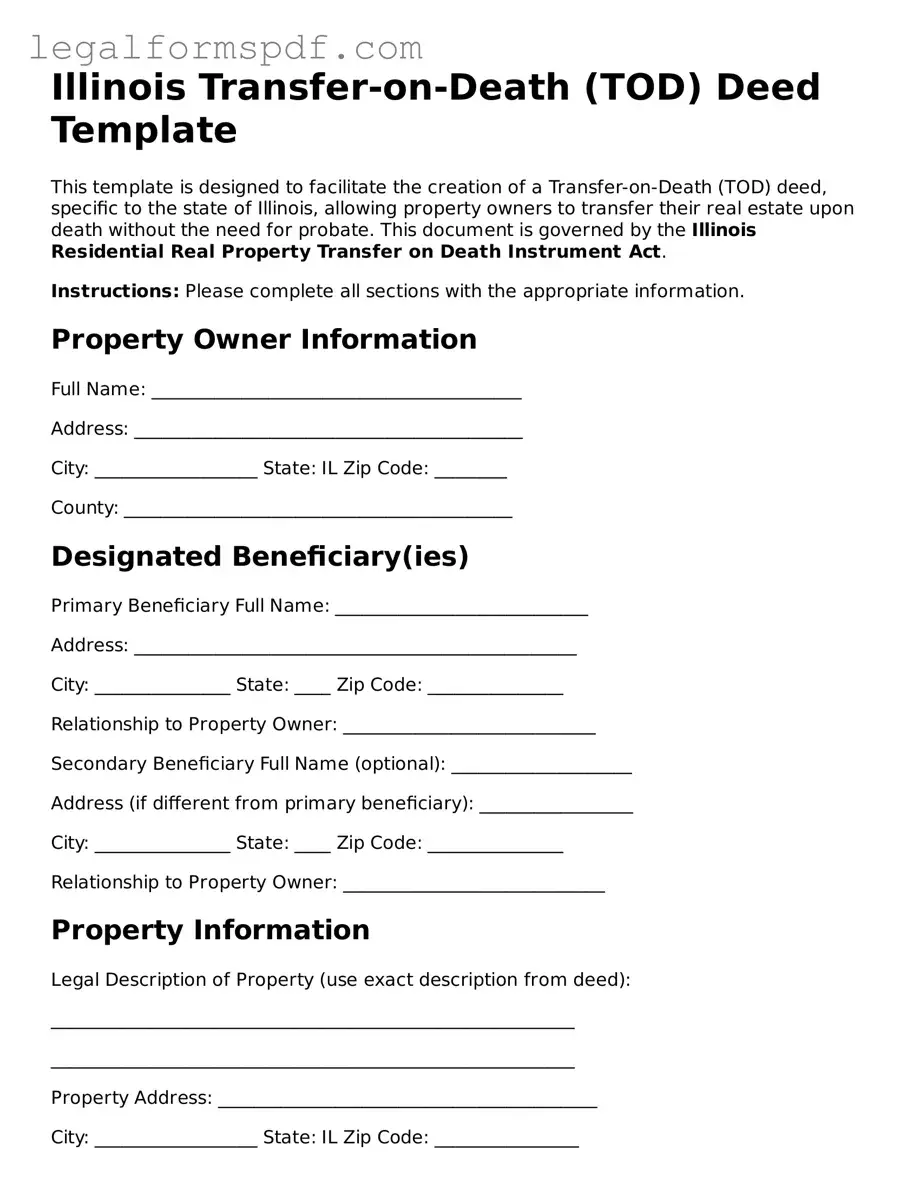

Document Example

Illinois Transfer-on-Death (TOD) Deed Template

This template is designed to facilitate the creation of a Transfer-on-Death (TOD) deed, specific to the state of Illinois, allowing property owners to transfer their real estate upon death without the need for probate. This document is governed by the Illinois Residential Real Property Transfer on Death Instrument Act.

Instructions: Please complete all sections with the appropriate information.

Property Owner Information

Full Name: _________________________________________

Address: ___________________________________________

City: __________________ State: IL Zip Code: ________

County: ___________________________________________

Designated Beneficiary(ies)

Primary Beneficiary Full Name: ____________________________

Address: _________________________________________________

City: _______________ State: ____ Zip Code: _______________

Relationship to Property Owner: ____________________________

Secondary Beneficiary Full Name (optional): ____________________

Address (if different from primary beneficiary): _________________

City: _______________ State: ____ Zip Code: _______________

Relationship to Property Owner: _____________________________

Property Information

Legal Description of Property (use exact description from deed):

__________________________________________________________

__________________________________________________________

Property Address: __________________________________________

City: __________________ State: IL Zip Code: ________________

Parcel Identification Number: _______________________________

Transfer Conditions

This transfer-on-death deed shall become effective upon the death of the named property owner(s) and shall transfer the described property to the designated beneficiary(ies) subject to all claims against the estate.

Signatures

To be valid, this deed must be signed by the property owner(s) in the presence of two witnesses and notarized. All parties must provide full legal names and signatures below.

Property Owner's Signature: ______________________ Date: ________

Witness 1 Signature: _____________________________ Date: ________

Witness 2 Signature: _____________________________ Date: ________

Notary Public Signature: __________________________ Date: ________

My commission expires: _____________________________

Note: After completion, this document must be filed with the county recorder's office in the county where the property is located before the death of the property owner.

PDF Specifications

| Fact | Detail |

|---|---|

| Legal Foundation | The Illinois Transfer-on-Death Instrument (TODI) Act, 755 ILCS 27/, governs the use of Transfer-on-Death Deed forms in Illinois. |

| Property Types Covered | This form can only be used for residential real estate, which is limited to 1-4 residential dwelling units, a single tract of agricultural real estate up to 40 acres with a residential dwelling, or a condominium unit. |

| Revocability | A Transfer-on-Death Deed can be revoked by the owner at any time before their death without the consent of the beneficiaries. |

| Beneficiary Designation | Owners can designate one or more beneficiaries, including individuals, trusts, or organizations, to receive the property upon the owner’s death. |

Instructions on Writing Illinois Transfer-on-Death Deed

Creating a Transfer-on-Death (TOD) deed in Illinois is a critical step for homeowners looking to pass on their property seamlessly to a beneficiary when they pass away. This document allows for the direct transfer of real estate to the designated recipient without the need for probate court involvement. It's essential to approach this task with care to ensure the deed is filled out correctly and fulfills all legal requirements. The following steps provide detailed guidance to help you confidently complete the Illinois Transfer-on-Death Deed form.

- Begin by obtaining the latest version of the Illinois Transfer-on-Death Deed form. Ensure it's the correct form specifically for use in the state of Illinois, as laws and forms can vary by state.

- Enter the current owner's full name and address in the designated section. This person is creating the transfer-on-death deed and is commonly referred to as the grantor.

- Specify the legal description of the property. This information can be found on your current deed or by contacting your local county recorder's office. It must be accurate to ensure the correct property is transferred.

- Identify the beneficiary (or beneficiaries) who will receive the property upon the grantor's death. Include full names and addresses. If there are multiple beneficiaries, detail the percentage of the property each will inherit.

- Review the form carefully to ensure all sections are completed accurately and the legal description matches the property records.

- The grantor must sign the deed in front of a notary public. Most banks offer notary services, often free of charge for account holders.

- After notarization, record the deed with the county recorder's office where the property is located. There may be a fee associated with recording the deed, which varies by county.

Once the Illinois Transfer-on-Death Deed is properly filled out, signed, notarized, and recorded, it enables the direct transfer of the property to the named beneficiary without going through the probate process. This ensures a smoother transition and helps alleviate potential stress for loved ones during a difficult time. Always make sure to keep a copy of the recorded deed for personal records and inform the beneficiary(s) about the existence of the TOD deed.

Understanding Illinois Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Illinois?

A Transfer-on-Death Deed (TODD) in Illinois is a legal document that allows property owners to pass their real estate directly to a beneficiary upon their death, without the need for probate court proceedings. It is a non-probative mechanism that acts much like a life insurance policy for real estate, ensuring a smoother transition of property ownership.

Who can create a Transfer-on-Death Deed in Illinois?

Any person owning real estate in Illinois who is of sound mind and legal age (18 or older) can create a Transfer-on-Death Deed. It's important that the person understands the implications of the deed and is making the decision freely, without coercion.

How do you create a Transfer-on-Death Deed in Illinois?

To create a Transfer-on-Death Deed, the property owner must complete a form that includes a legal description of the property, the name of the beneficiary, and the owner's signature, which must be notarized. This deed then needs to be recorded with the county recorder's office in the county where the property is located before the owner's death.

Can you change your mind after creating a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed is revocable. This means the property owner can change the beneficiary or completely revoke the deed at any time before their death, as long as they follow the proper legal process to do so. This often involves executing a new deed or a formal revocation.

Does the beneficiary need to accept the deed before the owner's death?

No, the beneficiary does not need to accept the deed or even be aware of its existence before the owner's death. The transfer of property ownership occurs automatically upon the death of the owner, but the beneficiary must survive the owner to inherit the property.

What happens to the property if the beneficiary predeceases the owner?

If the designated beneficiary predeceases the property owner, the Transfer-on-Death Deed becomes ineffective, and the property will be handled according to the owner's will or, if there's no will, through the state's intestacy laws, which govern succession in the absence of a will.

Are there any tax implications of using a Transfer-on-Death Deed?

While a Transfer-on-Death Deed simplifies the transfer of property, it does not necessarily exempt the beneficiary from taxes. The beneficiary may still be responsible for estate taxes, inheritance taxes, or other tax implications depending on the total value of the estate and the state's tax laws.

Is the Transfer-on-Death Deed a public record?

Yes, once the Transfer-on-Death Deed is recorded with the county recorder's office, it becomes a public record. This means that the information contained within the deed, including the identity of the beneficiary, is accessible to the public.

Does a Transfer-on-Death Deed supersede a will?

Yes, in terms of the property designated in the deed, the Transfer-on-Death Deed takes precedence over a will. This means that even if your will has different instructions regarding the property, the Transfer-on-Death Deed directs the property transfer upon your death.

How does a Transfer-on-Death Deed affect the beneficiary's rights?

The beneficiary gains no present rights to the property until the owner's death. Until then, the owner retains full control and use of the property, including the right to sell or mortgage it. Upon the owner's death, the beneficiary gains ownership of the property, subject to any existing obligations or encumbrances (like a mortgage) on the property.

Common mistakes

One common mistake people make when filling out the Illinois Transfer-on-Death (TOD) Deed form is not properly identifying all the beneficiaries. It's crucial to provide complete and accurate information for each beneficiary, including their full legal names, addresses, and their relationship to the grantor. Failure to do so could lead to confusion and potential legal disputes after the grantor's death, complicating the intended smooth transfer of property.

Another pitfall involves not clearly describing the property being transferred. The legal description of the property, which is more detailed than just an address, must be included on the TOD deed form. This description often requires referencing the property’s deed records to ensure accuracy. If the description is vague or incorrect, it could invalidate the deed or lead to challenges in executing the transfer upon the grantor's death.

People often overlook the requirement for the TOD deed to be witnessed and notarized to be valid in Illinois. This isn’t just formality; it's a legal safeguard. The deed must be signed in the presence of a notary and two credible witnesses who are not beneficiaries under the deed. Skipping this step can render the entire document void, undermining the grantor’s intentions for their property after their passing.

Another frequently encountered error is failing to record the deed with the county recorder’s office before the grantor’s death. Simply completing and signing the deed does not complete the process. For a TOD deed to be effective, it must be recorded in the county where the property is located, ensuring that the transfer is public record and recognized under state law.

A misunderstanding that arises is the belief that a TOD deed can be revoked by merely creating a new will or by making alterations to an existing will. However, if one wishes to revoke a TOD deed, it must be done in a manner prescribed by law, usually by executing a new deed that expressly revokes the prior one or conveys the property to someone else, and then recording it.

Lastly, individuals sometimes fail to consider the impact of debts and taxes on the property being transferred. Property transferred using a TOD deed can still be subject to the grantor’s debts and taxes upon their death. Beneficiaries may inherit not just the property, but also responsibility for settling these liabilities. Knowledge of these potential obligations and planning accordingly is essential for avoiding unexpected financial burdens on beneficiaries.

Documents used along the form

In Illinois, the Transfer-on-Death (TOD) Deed form is a convenient tool for estate planning, allowing property owners to name beneficiaries to whom the property will pass upon their death, bypassing the probate process. While the TOD Deed is powerful in its right, it is often used in conjunction with other forms and documents to ensure comprehensive estate planning and address various contingencies. Understanding these additional documents can provide a more robust plan for managing one's estate.

- Last Will and Testament: This is a legal document where an individual can outline their wishes regarding how their property and affairs should be handled after death. While a TOD Deed transfers real estate automatically upon death, a Last Will and Testament covers the distribution of other assets and personal properties not included in the TOD Deed.

- Power of Attorney for Property: This legal document allows an individual (the principal) to designate another person (an agent) to make financial and property decisions on their behalf, especially useful in case of incapacitation before death. It complements the TOD Deed by ensuring the property can be managed if the owner cannot do so themselves.

- Power of Attorney for Healthcare: Similar to the Power of Attorney for Property, this document permits an individual to appoint someone to make healthcare decisions on their behalf if they're unable to do it themselves. Although not directly related to the property, it's a crucial part of comprehensive estate planning.

- Living Will: A Living Will is a document that records a person's wishes regarding end-of-life medical care. It ensures that an individual’s healthcare preferences are respected and followed, serving as a guide for family members and healthcare providers in difficult times.

- Revocable Living Trust: This is a trust created during an individual's lifetime where they can alter or revoke the trust as they see fit. The property within the trust can be transferred without going through probate, similar to the TOD Deed, but offers more control and privacy over the distribution process.

Each of these documents plays a unique role in estate planning, complementing the Transfer-on-Death Deed for a more thorough approach to managing one's assets and health decisions. Together, they provide a safety net that ensures an individual's wishes are respected and their loved ones are taken care of according to their desires. It's advisable to consult with a legal professional when preparing these documents to ensure they align with current laws and accurately reflect the individual's wishes.

Similar forms

The Illinois Transfer-on-Death (TOD) Deed form is akin to a Last Will and Testament in that both serve as vehicles for directing the transfer of an individual's assets upon their death. While a Last Will and Testament can cover a wide range of assets and appoint executors and guardians, the TOD Deed specifically deals with the transfer of real estate and bypasses the probate process, directly transferring property to a named beneficiary upon the death of the property owner.

Similar to a Beneficiary Designation on a life insurance policy or retirement account, the Illinois TOD Deed allows an individual to name a beneficiary to whom the property will pass at the time of the owner's death. Both types of designations avoid probate by directly transferring assets to the beneficiary, but while life insurance and retirement accounts typically deal with cash assets, a TOD Deed applies to real estate property.

Like a Revocable Living Trust, the Illinois TOD Deed offers a way to manage the transfer of assets upon death without going through probate. Both allow the granter to maintain control over the property during their lifetime and specify beneficiaries to receive the property upon their death. However, a Revocable Living Trust can be more comprehensive and cover more than just real estate, providing additional privacy and flexibility in managing a wider array of assets.

The Illinois TOD Deed bears resemblance to a Joint Tenancy with Right of Survivorship agreement, as both involve the transfer of property upon death. In a Joint Tenancy, the property automatically transfers to the surviving owner(s) upon the death of one owner. The TOD Deed differs in that it does not require the beneficiary to be a co-owner of the property during the owner's lifetime, offering a straightforward method to leave real estate to someone without sharing ownership prior to death.

The Durable Power of Attorney for Property is another document that deals with the control and handling of an individual’s property, but its similarity to the Illinois TOD Deed is limited to the aspect of handling real estate. The primary difference is that the Durable Power of Attorney for Property takes effect while the principal is alive, potentially incapacitated, and ceases upon the principal's death, whereas the TOD Deed becomes effective only upon the owner’s death.

A Health Care Power of Attorney designates someone to make health care decisions on behalf of the grantor if they become unable to do so. While it is fundamentally different from the Illinois TOD Deed in purpose and function, focusing on health decisions rather than the transfer of property, it emphasizes the importance of planning ahead for the unexpected and ensuring that one's wishes are followed.

Lastly, a Living Will, also distinct in focus, shares the premise of making one's wishes known in advance with the Illinois TOD Deed. A Living Will specifies an individual's preferences regarding medical treatment and life-sustaining measures in critical health situations, whereas the TOD Deed lays out the plan for real estate transfer after the owner's death. Both documents are critical components of estate planning that help ensure an individual's wishes are respected and followed.

Dos and Don'ts

Filling out the Illinois Transfer-on-Death (TOD) Deed form is an important process that can help ensure your property is transferred smoothly to your designated beneficiary upon your death. It's a powerful estate planning tool, allowing property owners to bypass the often lengthy and expensive probate process. However, like any legal document, it's crucial to fill it out correctly to avoid any potential issues or disputes down the line. Here are nine things you should and shouldn't do when completing this form:

- Do thoroughly read the instructions provided with the form. Understanding each section fully can help prevent mistakes that might invalidate the deed.

- Do consult with an estate planning attorney if you have any questions or need clarification on the legal terminology. Professional advice can ensure the deed accomplishes your goals and is filled out correctly.

- Do clearly identify the property being transferred. Include the legal description of the property, which can typically be found on your deed or at the county recorder's office.

- Do designate a beneficiary (or beneficiaries) by their full legal names to avoid any confusion about who should inherit the property.

- Do sign the form in the presence of a notary public. The notarization process is crucial for the document to be legally binding.

- Don’t leave any sections blank. If a section doesn’t apply, it’s better to write "N/A" (not applicable) than to leave it empty, as this could raise questions about whether the form was filled out correctly.

- Don’t forget to file the deed with the county recorder’s office where the property is located. An unfilled deed will not be effective.

- Don’t use the TOD deed to try to transfer property that is co-owned, unless the co-owner is in agreement and the legal requirements for such a transfer are met.

- Don’t ignore the potential impact on your eligibility for Medicaid or other benefits. Transferring property can have implications for government assistance eligibility, so consider consulting with an expert in elder law or estate planning.

By following these dos and don'ts, you can help ensure the Illinois Transfer-on-Death Deed form is filled out correctly and effectively achieves your estate planning objectives.

Misconceptions

When it comes to the Transfer-on-Death (TOD) Deed in Illinois, there are several misconceptions that people commonly hold. It's crucial to clear up these misunderstandings to ensure property owners and beneficiaries understand the legal processes involved and the effects of executing a TOD deed.

- It replaces a will: A common misconception is that a TOD deed can replace a will. While a TOD deed does allow property to pass to a beneficiary without going through probate, it only applies to the specific property mentioned in the deed. Other assets not included in the TOD deed would still be subject to the will or, if there's no will, to state intestacy laws.

- It allows the transfer of any type of property: Many believe a TOD deed applies to all types of property. In reality, it's specifically designed for real estate. Other assets, like vehicles or bank accounts, have their own forms of transfer-on-death arrangements.

- It takes effect immediately: Another misconception is that a TOD deed takes effect as soon as it's signed. In truth, the property owner retains full control and ownership of the property until their death. Only then does the property transfer to the beneficiary.

- The beneficiary's approval is needed: Some think that the beneficiary must agree to the TOD deed for it to be valid. However, the beneficiary's consent is not required for the deed to be effective. The beneficiary's acceptance is only necessary when the property owner has passed away and the property is being transferred.

- A TOD deed avoids all taxes: There's a belief that transferring property through a TOD deed avoids taxes, such as inheritance or estate taxes. While it can help avoid the probate process, tax obligations may still apply, depending on the value of the estate and the laws in place at the time of the property owner's death.

- It's irrevocable: Some assume that once a TOD deed is executed, it cannot be changed. This is not accurate. The property owner can revoke or amend the TOD deed at any time before their death, as long as the changes are made in accordance with Illinois law.

- It's valid in all states: A few individuals think that a TOD deed executed in Illinois will be recognized in all other states. The truth is, while many states have laws allowing for TOD deeds, the requirements and legalities can vary significantly. It's crucial to understand the specific laws of the state where the property is located.

- It prevents a mortgage from being due: There's a false belief that if a property is transferred by a TOD deed, the mortgage on the property does not have to be paid by the beneficiary. In reality, the beneficiary inherits the property subject to any existing mortgages or liens.

- Only family members can be beneficiaries: Another common misunderstanding is that only family members can be named as beneficiaries on a TOD deed. In fact, the property owner can designate any individual, multiple individuals, or even organizations as the beneficiary.

- No lawyer is needed to execute a TOD deed: Many believe that a TOD deed is simple enough to execute without the aid of a lawyer. While it's possible to complete the form on your own, consulting with a legal professional can help ensure that the deed complies with Illinois law and accurately reflects the property owner's wishes.

Key takeaways

The Illinois Transfer-on-Death Deed form is an important tool for estate planning, allowing property owners to pass on real estate directly to their beneficiaries without going through probate. Understanding its use and requirements ensures individuals can effectively leverage this option. Here are key takeaways to consider:

A Transfer-on-Death Deed must be properly completed and signed in the presence of a notary public to be effective. This step is crucial for ensuring the document's legality and enforceability.

The beneficiaries named in the deed will not have any legal rights to the property until the death of the property owner. This arrangement allows the owner to retain full control over the property during their lifetime, including the right to sell or change the beneficiary.

To be valid, the Transfer-on-Death Deed must be recorded with the county recorder’s office in the county where the property is located before the owner's death. Recording the deed is a mandatory step to make the transfer effective upon death.

It is possible to revoke a Transfer-on-Death Deed, provided the revocation is executed with the same formalities as the initial deed. Property owners can change their minds for various reasons, so understanding the process for revocation is important.

By following these guidelines, individuals can ensure their Transfer-on-Death Deed is executed correctly, offering a seamless transition of property to their chosen beneficiaries.

More Transfer-on-Death Deed State Forms

Transfer on Death Deed Form Ohio - Employs a direct approach to estate planning, concentrating on the hassle-free transfer of real property to a beneficiary.

Transfer on Death Deed Form Florida - They provide a way to pass on one’s home or other real estate pieces directly to a beneficiary, sidestepping complicated legal procedures.

Texas Deed Transfer Form - Can be a key component of a well-thought-out estate plan, complementing wills and trusts, and adding another layer of assurance for the property owner.

How to Avoid Probate in Pennsylvania - This deed helps bypass the lengthy and often costly probate process, directly transferring property to the beneficiary.