Fillable Transfer-on-Death Deed Document for Georgia

In the beautiful state of Georgia, property owners have a powerful tool at their disposal to ensure the smooth and efficient transfer of their real estate to a beneficiary upon their passing, without the need for the property to go through probate. This tool is known as the Transfer-on-Death (TOD) Deed form. Providing a hassle-free method for transferring property, this legal document allows property owners to name a beneficiary who will automatically become the new owner of the property upon the original owner's death. What makes the TOD deed particularly appealing is its simplicity and the fact that it can be executed without altering the rights of the property owner while they are alive. They retain the ability to use, sell, or even revoke the TOD deed if they choose to do so, offering a flexible approach to estate planning. This method not only bypasses the time-consuming and often costly probate process but also offers peace of mind to property owners, knowing their real estate will pass directly to someone they trust. Understanding the ins and outs of this form, including who can use it, how to fill it out, and the requirements for it to be considered valid, can significantly ease the estate planning process and ensure that one's final wishes are honored regarding their property.

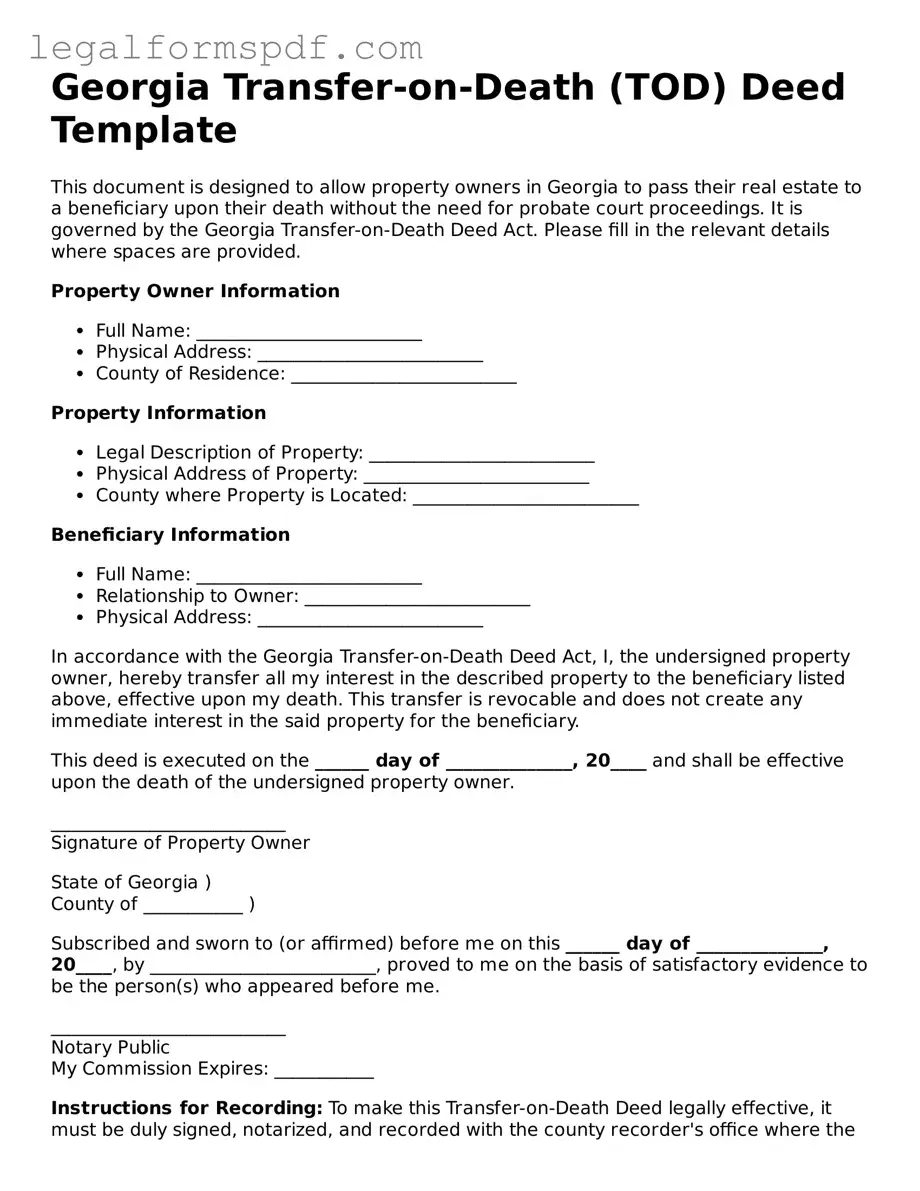

Document Example

Georgia Transfer-on-Death (TOD) Deed Template

This document is designed to allow property owners in Georgia to pass their real estate to a beneficiary upon their death without the need for probate court proceedings. It is governed by the Georgia Transfer-on-Death Deed Act. Please fill in the relevant details where spaces are provided.

Property Owner Information

- Full Name: _________________________

- Physical Address: _________________________

- County of Residence: _________________________

Property Information

- Legal Description of Property: _________________________

- Physical Address of Property: _________________________

- County where Property is Located: _________________________

Beneficiary Information

- Full Name: _________________________

- Relationship to Owner: _________________________

- Physical Address: _________________________

In accordance with the Georgia Transfer-on-Death Deed Act, I, the undersigned property owner, hereby transfer all my interest in the described property to the beneficiary listed above, effective upon my death. This transfer is revocable and does not create any immediate interest in the said property for the beneficiary.

This deed is executed on the ______ day of ______________, 20____ and shall be effective upon the death of the undersigned property owner.

__________________________

Signature of Property Owner

State of Georgia )

County of ___________ )

Subscribed and sworn to (or affirmed) before me on this ______ day of ______________, 20____, by _________________________, proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

__________________________

Notary Public

My Commission Expires: ___________

Instructions for Recording: To make this Transfer-on-Death Deed legally effective, it must be duly signed, notarized, and recorded with the county recorder's office where the property is located before the property owner's death.

Revocation: The property owner may revoke this Transfer-on-Death Deed at any time before death by executing a new deed or a revocation form.

PDF Specifications

| Fact Name | Detail |

|---|---|

| Governing Law | The Georgia Transfer-on-Death (TOD) Deed is governed by the Georgia Code Title 53, specifically the provisions relating to the transfer of real estate upon death. |

| Purpose | Enables property owners to automatically transfer ownership of their property to a designated beneficiary upon their death without going through probate. |

| Revocability | A Georgia TOD Deed is revocable, allowing the property owner to change their mind at any time prior to their death. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries, including individuals or entities, to inherit the property. |

| Recording Requirements | To be effective, the TOD Deed must be signed, notarized, and recorded in the county where the property is located before the owner's death. |

Instructions on Writing Georgia Transfer-on-Death Deed

When it's time to ensure that your property is passed on smoothly to your loved ones, the Georgia Transfer-on-Death (TOD) Deed form can be a valuable tool. This document allows property owners to name beneficiaries who will receive their property once they pass away, without the need for the property to go through probate. Properly completing and filing this form is crucial for making certain your wishes are followed. Below are the steps you need to take to fill out the form correctly.

- Start with your full legal name as the current property owner. Make sure to include any middle names or initials that are part of your legal identity.

- Fill in the complete legal description of the property. This information can typically be found on your property deed or tax assessment documents. Make sure every detail is accurate to avoid any disputes or issues in the transfer process.

- List the full legal names of your designated beneficiaries. Just like with your name, it's important to include all middle names or initials. If there are multiple beneficiaries, clearly state their names and the proportion of the property each will receive.

- Specify any conditions or limitations of the transfer. Although the TOD deed is straightforward, there might be specific stipulations you want to include. This part requires careful thought to ensure your wishes are precisely documented.

- Sign and date the form in the presence of a notary public. The notarization of the deed is a critical step, as it validates the document and your signature. Make sure to bring a valid identification to the notary appointment.

- File the completed form with the appropriate county records office. The requirements can vary slightly from county to county, so it's wise to call ahead or check online for specific filing instructions and fees.

By following these steps, you can successfully complete the Georgia Transfer-on-Death Deed form. It's a straightforward process, but paying close attention to each step ensures that your property is transferred according to your wishes, providing peace of mind for you and your loved ones.

Understanding Georgia Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Georgia?

A Transfer-on-Death (TOD) Deed in Georgia is a legal document that allows property owners to pass real estate directly to a beneficiary upon their death, without the need for the property to go through probate. This deed is effective upon the death of the owner and does not give the beneficiary any rights to the property until the owner's death.

How can someone create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, the property owner must complete a TOD Deed form that includes the legal description of the property, the name of the beneficiary, and must be signed by the owner in front of a notary public. Once completed and notarized, the deed must be recorded with the county recorder’s office where the property is located.

Can a Transfer-on-Death Deed be revoked or changed?

Yes, a Transfer-on-Death Deed can be revoked or changed by the owner at any time before their death as long as the owner is mentally competent. To revoke or change the deed, the owner must complete a new deed or a formal revocation document, have it notarized, and record it with the county recorder’s office.

Who can be named as a beneficiary in a Transfer-on-Death Deed?

Almost anyone can be named as a beneficiary in a Transfer-on-Death Deed. This includes individuals, multiple beneficiaries, trusts, or organizations. However, careful consideration should be given to the choice of beneficiary, as the property will pass directly to them upon the owner's death.

Does a Transfer-on-Death Deed avoid probate in Georgia?

Yes, one of the main advantages of a Transfer-on-Death Deed is that it allows the property to pass directly to the beneficiary without going through probate. This can save time and expense in administering the deceased's estate.

Are there any limitations to what property can be transferred with a Transfer-on-Death Deed?

The Transfer-on-Death Deed is primarily used to transfer real estate. It may not be used to transfer personal property, such as vehicles or furniture. Additionally, it is important to check if any restrictions apply to the real estate that could limit the use of a TOD Deed.

What happens if the beneficiary predeceases the owner?

If the named beneficiary in the Transfer-on-Death Deed predeceases the owner, the deed would typically become void unless an alternate beneficiary is named in the deed. The property would then be included in the owner's estate and would be distributed according to the owner's will or state law if there is no will.

Common mistakes

One common mistake people make when filling out the Georgia Transfer-on-Death Deed form is not correctly identifying the property. The legal description of the property, which may include lot number, subdivision, and county, must match exactly what is on record. This specific information is crucial to ensure the correct transfer of the property upon the death of the owner. Any discrepancies can lead to complications and potentially invalidate the transfer.

Another error occurs when individuals do not properly designate beneficiaries. It's essential to provide the full legal names of the beneficiaries and to specify their relationship to the owner. This clarity helps avoid any ambiguity in identifying who the intended recipients of the property are upon the owner's death. Additionally, if multiple beneficiaries are named, the owner must clearly state the share each beneficiary is to receive, if not equally divided.

Failure to sign the document in the presence of a notary public is a critical mistake. Georgia law requires that the Transfer-on-Death Deed form be notarized to be valid. This step is crucial for the document's legitimacy and enforceability. Without notarization, the deed will not be legally effective, and the intended transfer of the property may not occur.

Not registering the form with the county recorder's office is a frequently overlooked step. After the Transfer-on-Death Deed form is properly filled out and notarized, it must be filed with the local county recorder’s office where the property is located. This filing officially records the deed, making it a public record and effective upon the owner's death. Failure to file can result in the deed not being recognized as valid.

Some people mistakenly believe that once the Transfer-on-Death Deed form is completed, no further action is required for the maintenance of the property. It's important to understand that the owner retains responsibility for the property, including taxes and debts, until their death. Beneficiaries are only entitled to the property after the owner’s death and are not responsible for its maintenance or financial obligations beforehand.

Lastly, not reviewing and updating the deed as circumstances change is a mistake that can lead to unintended outcomes. Life events such as marriage, divorce, birth of children, or death of a named beneficiary can affect the intentions of the property owner. Regularly updating the Transfer-on-Death Deed to reflect current wishes ensures that the property transfers as intended upon the owner's death.

Documents used along the form

When handling estate planning in Georgia, the Transfer-on-Death Deed form is a crucial document that allows property owners to pass their real estate to a beneficiary without the need for probate. However, this form does not stand alone in the estate planning process. Several other forms and documents are frequently used alongside it to ensure a comprehensive estate plan. We'll explore some of these key documents below.

- Last Will and Testament: This legal document outlines how the person's assets and belongings are to be distributed upon their death. It can also appoint a guardian for minor children.

- Financial Power of Attorney: This grants someone the authority to manage the financial affairs of the person, including handling real estate transactions, if they become incapacitated.

- Advance Directive for Health Care: It combines a living will and a power of attorney for health care, detailing the person’s wishes for medical treatment and appointing someone to make health care decisions on their behalf if they are unable to do so themselves.

- Revocable Living Trust: This allows the person to maintain control over their assets while they are alive but transfer them to beneficiaries upon their death, often bypassing the probate process.

- Beneficiary Designations: For assets that do not pass by will or trust, such as life insurance or retirement accounts, beneficiary designations specify who will receive these assets.

- Property Inventory: A comprehensive list of personal and real property, which can help in the organization and distribution of assets according to the person’s wishes.

Integrating the Transfer-on-Death Deed form with these additional documents ensures a well-rounded and effective estate plan. It not only clarifies the person’s wishes regarding their estate but also aids in avoiding potential legal hurdles and familial disputes after their passing. It’s recommended to consult with a legal professional when preparing these documents to ensure they align with Georgia law and the person’s individual needs.

Similar forms

The Transfer-on-Death (TOD) Deed in Georgia shares similarities with the Last Will and Testament in several ways. Both are estate planning tools that dictate how certain assets will be distributed upon the death of the document's creator. While the Last Will and Testament covers a broad array of assets and can include provisions for guardianship and other instructions, a TOD Deed specifically targets real estate ownership. They both require the person creating the document to be of sound mind and to follow state-specific guidelines to ensure validity. However, a key difference is that property transferred through a TOD Deed passes directly to the beneficiary without going through probate, a process that is typically required for assets distributed per the terms of a will.

Similar to a TOD Deed, a Living Trust allows individuals to manage their assets during their lifetime and instruct how they should be handled after their death. Assets placed in a Living Trust can include real estate, bank accounts, and other personal property. The main similarity between a TOD Deed and a Living Trust is the ability to avoid probate for the assets they cover. Both instruments allow for the direct transfer of assets to the designated beneficiaries upon the death of the asset's owner. However, a Living Trust provides more control and flexibility, as it can be altered or revoked as long as the grantor (the person who created the trust) is alive and competent.

Joint Tenancy with Right of Survivorship (JTWROS) is a form of co-ownership that allows property to pass automatically to the surviving owner(s) when one owner dies, without the need for probate. This arrangement is quite similar to how a TOD Deed functions, as it also allows for the direct transfer of property to a beneficiary upon the death of the property owner. However, while a TOD Deed applies only at the death of the owner and to a specifically named beneficiary, JTWROS involves immediate co-ownership and the automatic transfer of the deceased owner's share to the surviving co-owners, not necessarily to a named beneficiary outside of the co-ownership arrangement.

The Beneficiary Deed, where available, is another legal document closely related to the Transfer-on-Death Deed in function and purpose. As with TOD Deeds, Beneficiary Deeds allow property owners to name one or more beneficiaries who will inherit their property automatically upon the owner’s death, bypassing the probate process. The primary difference between them often lies in the terminology and specific legal provisions applicable in the jurisdiction where they are used. Both serve essentially the same estate planning goal: ensuring a smooth, direct transfer of real estate to a named beneficiary or beneficiaries without entanglement in probate court proceedings.

Dos and Don'ts

When preparing the Georgia Transfer-on-Death (TOD) Deed form, it is crucial to adhere to specific guidelines to ensure the document is legally binding and accurately reflects the property owner’s intentions. Here are eight key do’s and don’ts to consider:

- Do thoroughly review the form instructions before you start. Understanding the requirements and limitations of the TOD deed in Georgia is vital for a successful transfer of property.

- Do clearly identify the property being transferred. Include the full address and any legal descriptions that can help precisely mark the property in question.

- Do list the beneficiary/beneficiaries accurately. Provide their full names and addresses to avoid any confusion or disputes after the death of the property owner.

- Do sign the deed in the presence of a notary public. This step is compulsory for the TOD deed to be recognized as valid in the state of Georgia.

- Don’t leave any sections blank. If a section does not apply to your situation, it is advisable to mark it as “N/A” rather than leaving it empty, which can raise questions about the completeness of the document.

- Don’t forget to file the deed with the county recorder’s office. A TOD deed must be properly filed to be effectively recognized under Georgia law.

- Don’t use the TOD deed to evade creditors or legal obligations. The transfer of property rights does not absolve the estate of debts or liabilities that may be attached to the property.

- Don’t hesitate to seek legal advice. If there are complexities in your property, family situation, or if you simply want assurance that the deed is completed correctly, consulting with a legal professional can provide valuable guidance.

Misconceptions

When it comes to planning for the future, understanding how specific forms like the Georgia Transfer-on-Death (TOD) Deed work is crucial. There are some common misconceptions about the TOD Deed that can lead to confusion or missteps in estate planning. Let's clarify these misunderstandings.

It overrides a will. Some believe that a TOD Deed can override provisions in a will regarding the same piece of property. However, the TOD Deed takes precedence over a will. This means that the property passes directly to the beneficiary named in the TOD Deed, regardless of what the will says about it.

It avoids all types of taxes. While a TOD Deed can help avoid the probate process, it doesn't necessarily avoid all taxes. Beneficiaries may still be responsible for state or federal estate taxes, depending on the value of the estate.

You can't revoke it. Some think once a TOD Deed is created, it cannot be revoked. However, the property owner can revoke a TOD Deed at any time before their death, as long as the revocation is done according to legal procedures.

It’s only for individuals. The misconception that TOD Deeds can only be used by individuals, not entities, is common. In truth, trusts and other entities can also use TOD Deeds to pass on property, assuming they comply with Georgia’s specific legal requirements.

It's complicated to create. Many people believe that creating a TOD Deed is a complex legal process. While it's important to follow legal formalities, creating a TOD Deed can be relatively straightforward, especially with the help of a knowledgeable professional.

It transfers property immediately upon signing. Another common misconception is that the TOD Deed transfers ownership of the property as soon as it’s signed. In reality, the transfer only takes effect upon the death of the property owner.

All debts on the property are forgiven. Some may mistakenly think that once a property is transferred through a TOD Deed, all debts related to that property are forgiven. The beneficiary actually takes the property subject to any existing debts or encumbrances.

It’s the best option for everyone. While TOD Deeds can be an effective estate planning tool for many, they are not necessarily the best option for everyone. Each individual's circumstances are unique, and other estate planning tools may be more appropriate depending on the situation.

Understanding the true features and limitations of the Georgia Transfer-on-Death Deed can help ensure that your estate planning strategies are in line with your intentions and legal requirements.

Key takeaways

Filling out a Georgia Transfer-on-Death (TOD) Deed form allows individuals to transfer their property to a beneficiary when they pass away without the need for the property to go through probate. Probate can be a time-consuming and expensive process, so utilizing a TOD deed can offer a more straightforward process for transferring property upon death. Here's what you should know:

- Revocability is a central feature of the TOD deed. This means that the individual creating the deed, known as the property owner, retains the right to change or revoke the deed at any point during their lifetime without needing to consult with or get permission from the named beneficiary. This allows for flexibility if the property owner’s intentions change.

- When filling out the form, it is crucial to be precise. The property description needs to be accurate and match the description used in the property’s current deed. Even a minor mistake or discrepancy in describing the property can lead to disputes or a failure to properly transfer the property upon the property owner's death.

- The TOD deed must be duly signed and notarized to be valid. Georgia law requires that the property owner sign the form in the presence of a notary to ensure that it’s legally binding. This step is essential for the deed to be recognized under state law.

- Recording the deed with the appropriate county office is a necessary step. Once the TOD deed form is completed, signed, and notarized, it must be filed with the registrar's office in the county where the property is located. This makes the deed a matter of public record and notifies interested parties of its existence.

- The TOD deed allows the property to pass to the beneficiary outside of the probate process. However, it's important to understand that the deed does not remove the property from the estate for all purposes. For instance, creditors may still have claims against the estate that can affect the property. Therefore, analyzing the full financial situation and considering potential debts or claims is essential when planning an estate.

Effectively using a Georgia Transfer-on-Death Deed can facilitate a smoother transition of property ownership upon death and reduce the administrative burden on loved ones. However, it's important to handle the process with care to ensure that the deed accomplishes its intended purpose without unforeseen complications. Consulting with a legal professional experienced in estate planning in Georgia can provide guidance tailored to an individual's specific situation.

More Transfer-on-Death Deed State Forms

Where Can I Get a Tod Form - By using a Transfer-on-Death Deed, individuals can maintain control over their property until their passing, then it directly transfers to their named beneficiary.

Texas Deed Transfer Form - By specifying a beneficiary, the owner can prevent the property from becoming part of the taxable estate, potentially saving on taxes.

Transfer on Death Deed California - Its flexibility allows property owners to amend beneficiary designations as circumstances change, ensuring their estate plan remains current.

How to Transfer Land Ownership - This deed allows the property owner to retain full control over the property during their lifetime, including the right to sell or change the beneficiary.