Fillable Transfer-on-Death Deed Document for Florida

In the evolving landscape of estate planning, the Florida Transfer-on-Death (TOD) Deed form stands as a pivotal tool, empowering property owners to bypass the often complex and lengthy probate process by directly transferring real estate to beneficiaries upon death. This instrument, which must be correctly executed and recorded prior to the owner's demise, offers a seamless transition of property ownership, ensuring that the intended heirs receive their inheritance without undue delay or financial burden associated with probate court proceedings. The TOD Deed, distinguished by its simplicity and efficiency, requires meticulous attention to detail in its completion to avoid common pitfalls that could invalidate the document. Its introduction into estate planning reflects a broader trend towards streamlining asset distribution to beneficiaries, highlighting the form's importance in the strategic management of one’s estate. As such, understanding the nuances of the Florida Transfer-on-Death Deed form becomes paramount for property owners looking to leverage this instrument effectively, underscoring the balance between convenience and the imperative of precise legal formalities.

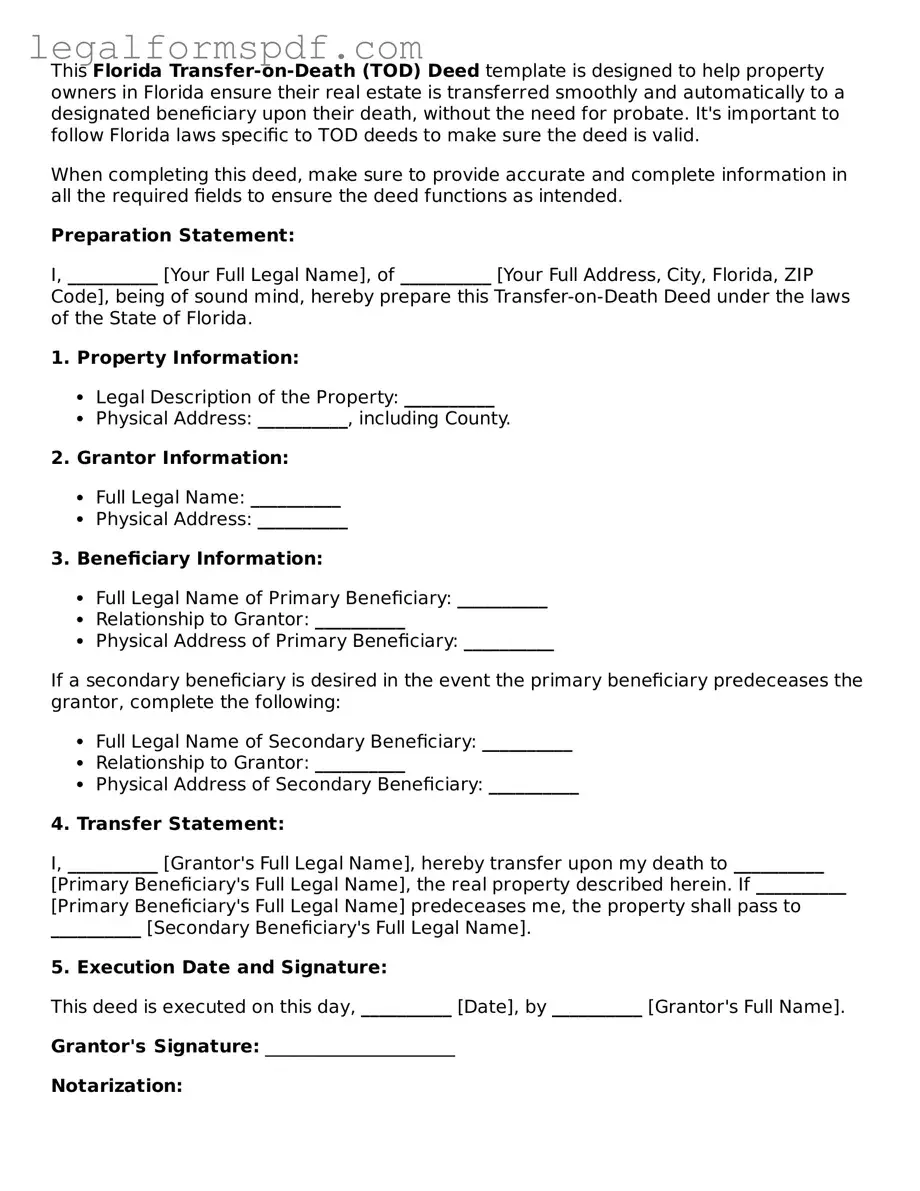

Document Example

This Florida Transfer-on-Death (TOD) Deed template is designed to help property owners in Florida ensure their real estate is transferred smoothly and automatically to a designated beneficiary upon their death, without the need for probate. It's important to follow Florida laws specific to TOD deeds to make sure the deed is valid.

When completing this deed, make sure to provide accurate and complete information in all the required fields to ensure the deed functions as intended.

Preparation Statement:

I, __________ [Your Full Legal Name], of __________ [Your Full Address, City, Florida, ZIP Code], being of sound mind, hereby prepare this Transfer-on-Death Deed under the laws of the State of Florida.

1. Property Information:

- Legal Description of the Property: __________

- Physical Address: __________, including County.

2. Grantor Information:

- Full Legal Name: __________

- Physical Address: __________

3. Beneficiary Information:

- Full Legal Name of Primary Beneficiary: __________

- Relationship to Grantor: __________

- Physical Address of Primary Beneficiary: __________

If a secondary beneficiary is desired in the event the primary beneficiary predeceases the grantor, complete the following:

- Full Legal Name of Secondary Beneficiary: __________

- Relationship to Grantor: __________

- Physical Address of Secondary Beneficiary: __________

4. Transfer Statement:

I, __________ [Grantor's Full Legal Name], hereby transfer upon my death to __________ [Primary Beneficiary's Full Legal Name], the real property described herein. If __________ [Primary Beneficiary's Full Legal Name] predeceases me, the property shall pass to __________ [Secondary Beneficiary's Full Legal Name].

5. Execution Date and Signature:

This deed is executed on this day, __________ [Date], by __________ [Grantor's Full Name].

Grantor's Signature: _____________________

Notarization:

This document was acknowledged before me on __________ [Date], by __________ [Grantor's Full Name], who is personally known to me or has produced __________ [Type of Identification] as identification.

Notary Public's Signature: _____________________

Printed Name: __________

Commission Number: __________

My Commission Expires: __________

PDF Specifications

| Fact Name | Detail |

|---|---|

| Definition | A Transfer-on-Death (TOD) deed allows property owners in Florida to pass their real estate directly to beneficiaries upon the owner’s death, without the need for probate court proceedings. |

| Governing Law | Florida Statutes, Chapter 732, which pertains to the descent and distribution of the estate, governs Transfer-on-Death deeds in Florida. Additionally, certain aspects are influenced by Chapter 689, concerning real property conveyances. |

| Revocability | The owner can revoke a Transfer-on-Death deed at any time before death, ensuring flexibility and control over the property during the owner’s lifetime. |

| Property Type | Only applies to real estate property located in Florida. This includes homes, buildings, and land. |

| Beneficiary Designation | Owners may name one or more beneficiaries, including individuals, organizations, or trusts, to receive the property upon the owner's death. |

| No Probate Required | Upon the death of the property owner, the real estate transfers directly to the beneficiary without needing to go through probate court, streamlining the process. |

| Recording Requirement | To be effective, a Transfer-on-Death deed must be properly executed according to Florida law and recorded in the county where the property is located before the owner's death. |

| Impact on Estate Planning | The use of a Transfer-on-Death deed fits into broader estate planning goals and strategies, potentially reducing the complexity and ensuring a smoother transition of property ownership. |

Instructions on Writing Florida Transfer-on-Death Deed

Filling out a Transfer-on-Death (TOD) Deed form in Florida requires attention to detail and an understanding of your desires regarding property transfer after your passing. This document allows individuals to name beneficiaries who will inherit their property without the need for probate, simplifying the process significantly. While dealing with legal documents can seem daunting, breaking down the process into step-by-step instructions can make it manageable. By following these steps, property owners can ensure their wishes are clearly documented, and their loved ones are taken care of in the future. Remember, it is always wise to consult with a legal professional to ensure the form is completed correctly and aligns with your estate planning goals.

- Gather Required Information: Before starting, have all necessary information on hand. This includes your legal name, the address of the property you're transferring, and the full names and addresses of your beneficiaries.

- Identify the Grantor(s): As the current property owner, fill in your name as the grantor. If the property is owned jointly, include the names of all co-owners.

- Specify the Beneficiaries: Clearly list the name(s) of the person(s) or entity you wish to inherit your property upon your death. Make sure to spell names correctly and provide accurate addresses.

- Legal Description of the Property: Enter the legal description of the property as it appears on your deed. This is not the same as your address; it’s a detailed description used in legal documents to identify the property.

- Specify Ownership Transfer Details: Indicate how you want the beneficiaries to take ownership of the property, whether equally, in specific shares or another manner you specify.

- Sign and Date the Form: Your signature is required to make the TOD deed valid. Sign the form in the presence of a notary public. The date of your signature is also necessary.

- Notarize the Document: Have the form notarized. This typically involves signing the document in front of a notary public, who will then complete, sign, and stamp the form, verifying your identity and signature.

- Record the Deed: Finally, file the completed TOD deed with the county clerk's office where the property is located. This may require a filing fee. Check with the local office for any specific filing requirements.

Completing the Florida Transfer-on-Death Deed form is a proactive step towards ensuring your property is transferred according to your wishes without the need for probate court. Following these steps carefully will help streamline the process and secure peace of mind for you and your beneficiaries. It's a big responsibility, but with careful attention and possibly the advice of a lawyer, you can accomplish this important task successfully.

Understanding Florida Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Florida?

A Transfer-on-Death Deed in Florida allows property owners to automatically transfer their real estate property to a designated beneficiary upon their death, without the need for probate court proceedings. This legal document must be properly completed, signed, and recorded in the county where the property is located to be effective.

How does a Transfer-on-Death Deed differ from a traditional will in Florida?

A traditional will outlines a person's wishes for distributing their estate after death, which requires probate to validate and execute. In contrast, a Transfer-on-Death Deed bypasses the probate process for real estate, as the property automatically transfers to the named beneficiary. This process simplifies the transfer, making it faster and less costly.

Who can be named as a beneficiary on a Transfer-on-Death Deed in Florida?

Almost anyone can be named as a beneficiary on a Transfer-on-Death Deed, including individuals, multiple people, trusts, or organizations. It is crucial to clearly identify the beneficiary to prevent any confusion upon the property owner's death.

Can a Transfer-on-Death Deed be revoked in Florida?

Yes, a Transfer-on-Death Deed can be revoked at any time before the property owner's death. Revocation must be completed in the same manner as creating the deed: by completing a new deed that either explicitly revokes the old one or designates a new beneficiary and recording it in the county where the property is located.

Are there any specific forms required for a Transfer-on-Death Deed in Florida?

Florida requires the use of a specific legal form for a Transfer-on-Death Deed to be valid. It must meet all state requirements, including proper acknowledgment before a notary public. It is wise to consult legal resources or an attorney to ensure the deed is completed and recorded correctly.

What happens if the beneficiary predeceases the property owner?

If the beneficiary named on a Transfer-on-Death Deed predeceases the property owner, the deed typically becomes void, and the property would be handled according to the owner's will or, if there is no will, under Florida's intestate succession laws. Property owners can avoid potential issues by naming alternate beneficiaries on the deed.

Common mistakes

Filling out the Florida Transfer-on-Death (TOD) Deed form often seems straightforward, but several common mistakes can trip people up. The first mistake is not checking for updates or changes in the state law. Laws governing TOD deeds can and do change. By not staying informed, individuals might use an outdated form or miss critical legal requirements, potentially invalidating the deed.

Another mistake involves incorrectly listing the property description. A legal description of the property is required, not just the address. This description can usually be found on an existing deed or property tax statement. An incorrectly described property may lead to disputes and could complicate the transfer process upon the owner's death.

Not properly identifying the beneficiaries is a third mistake people make. Beneficiaries must be identified with complete names and addresses, and the owner's relationship to them should be clear. Ambiguities in identifying beneficiaries can lead to confusion and possible legal battles among potential heirs after the owner's death.

A fourth mistake is failing to have the deed signed in the presence of a notary. The TOD deed must be notarized to be valid. Skipping this step is a sure way to invalidate the deed, making the entire effort a waste. Sometimes, people mistakenly believe that a witness's signature is enough, but the requirements are specific: notarization is mandatory.

Fifth, many forget to file the deed with the Florida county clerk’s office where the property is located. Simply completing and notarizing the deed is not enough; it must be officially recorded to be effective. This oversight might lead to the TOD deed not being recognized upon the owner's death.

The sixth mistake is not considering the impact of debts and taxes. Some believe that transferring property through a TOD deed will avoid all forms of estate settlement. However, property transferred this way may still be subject to debts and taxes owed by the estate. Failing to plan for these obligations can create financial complications for beneficiaries.

A seventh error is neglecting to coordinate the TOD deed with one's broader estate plan. The TOD deed is just one piece of the estate planning puzzle. It should work harmoniously with wills, trusts, and other estate planning tools. Discrepancies between these documents can lead to unintended consequences and disputes.

An eighth common mistake is assuming the TOD deed cannot be revoked or changed. Until the property owner's death, the deed can indeed be revoked or amended if life circumstances change. However, many neglect to update their TOD deed after significant life events, such as marriage, divorce, or the birth of a child, potentially leading to unintended heirs inheriting the property.

Lastly, many underestimate the value of legal advice when filling out a TOD deed. Though it's tempting to go it alone, consulting with an estate planning attorney can prevent these and other mistakes. An attorney can offer customized advice that software and generic forms cannot, ensuring that the TOD deed meets all legal requirements and aligns with the owner’s estate planning goals.

Documents used along the form

When planning for the future of one's assets and property, a Transfer-on-Death (TOD) Deed is a valuable document used in Florida to bypass the probate process for real estate. Besides the TOD Deed, individuals often utilize additional forms and documents to ensure a comprehensive estate plan. These documents not only complement the TOD Deed but also provide a solid foundation for managing one's affairs after passing away or if they become unable to make decisions for themselves.

- Last Will and Testament: This fundamental estate planning document specifies how an individual's assets should be distributed after their death. It also names an executor to manage the estate and can appoint guardians for minor children.

- Living Trust: A legal arrangement allowing one to transfer assets into a trust for their benefit during their lifetime, and to their beneficiaries upon their death. It avoids probate for the assets held in the trust.

- Durable Power of Attorney: This document grants someone else the authority to make financial decisions and handle financial matters on an individual's behalf, should they become incapacitated.

- Medical Power of Attorney: It designates a trusted person to make healthcare decisions for the individual if they are unable to communicate their wishes directly.

- Living Will: Also known as an advance healthcare directive, it outlines the types of medical treatments and life-sustaining measures an individual wishes or does not wish to receive if they are terminally ill or permanently unconscious.

- Designation of Health Care Surrogate: Similar to a Medical Power of Attorney, this document specifies an individual to make healthcare decisions on behalf of the person, potentially in more detail or under different circumstances.

- Beneficiary Designations: Separate from a will or TOD deed, these designations are used to specify beneficiaries for financial accounts (like retirement accounts) and insurance policies, ensuring these assets transfer directly to the designated beneficiaries without going through probate.

- Declaration of Preneed Guardian: In case of future incapacity, this document indicates an individual's preference for a guardian to take care of their personal and property matters.

- Digital Asset Management Plan: With increasing online presence, this plan provides instructions and permissions for someone to manage an individual’s digital assets, including social media accounts, digital files, and online accounts, after their death or incapacitation.

Gathering these documents together with a Transfer-on-Death Deed ensures comprehensive coverage of one’s estate planning needs. It's beneficial for individuals to consult with legal professionals to understand how each document fits within their personal estate planning strategy and ensure all are properly executed according to Florida law. This vigilant approach to estate planning significantly eases the administrative and emotional burden on loved ones during challenging times.

Similar forms

A Transfer-on-Death (TOD) deed, also known in some states as a beneficiary deed, allows property owners to pass their real estate directly to beneficiaries without going through probate upon their death. This deed is similar to several other legal documents that also bypass the probate process or allow for the transfer of assets upon death. Each of these documents has its unique features but shares the underlying principle of simplifying the transfer of assets.

One similar document is the Payable-on-Death (POD) account, commonly used with bank accounts. Like a TOD deed, a POD account allows the account holder to designate one or more beneficiaries who will receive the funds in the account upon the holder's death, without those funds having to go through the probate process. The primary difference is that while a TOD deed is used for real estate property, a POD applies to bank accounts.

Another document with a similar function is the life insurance policy. A life insurance policy allows an individual to designate a beneficiary or beneficiaries who will receive the proceeds from the policy upon the policyholder's death. This bypasses probate and ensures that the beneficiaries can access the benefits relatively quickly and with minimal legal complication, akin to the immediate transfer of property under a TOD deed.

The retirement account, such as an IRA or 401(k), also shares similarities with the TOD deed. Account holders can name beneficiaries who will inherit the funds directly upon the account holder's passing. This arrangement streamlines the process of asset transfer upon death and avoids the probate process, providing a direct mechanism to pass on wealth similar to what a TOD deed accomplishes for real estate transactions.

A living trust is another vehicle that parallels the TOD deed in functionality. It allows an individual to place assets within a trust to be managed according to their wishes while they are alive. Upon their death, those assets are transferred to the designated beneficiaries as laid out in the trust agreement. Like a TOD deed, a living trust avoids probate and provides a clear path for asset distribution upon the grantor's death.

Lastly, joint tenancy with right of survivorship (JTWROS) is a form of property co-ownership allowing property to pass automatically to the surviving owner(s) upon one owner's death. This method closely resembles the TOD deed's transfer mechanism by bypassing the probate court. However, it's distinct in requiring the owners to take on equal shares and responsibilities during their lifetimes. This shared ownership and the automatic transfer feature upon death make it functionally akin to how a TOD deed operates for a sole owner.

Dos and Don'ts

In Florida, preparing a Transfer-on-Death (TOD) deed requires careful attention to detail to ensure your real estate is transferred smoothly to your designated beneficiary upon your death. Here are some important do’s and don’ts to keep in mind when completing this important form:

Do's:

- Double-check the legal description of the property. This should match exactly what is listed on your current deed or property records to avoid any confusion.

- Clearly identify the beneficiary or beneficiaries. Include full names and any other necessary identifying information to prevent any uncertainty about who should inherit the property.

- Sign and date the form in the presence of a notary public. This formalizes your intentions and fulfills a legal requirement for the deed to be valid.

- Keep the original document in a safe place, such as a safe deposit box, where it can be found when needed.

- Inform your beneficiaries about the TOD deed. This ensures they are aware of their future interest in the property and can take appropriate actions when the time comes.

- Consider consulting with a legal professional. Although not mandatory, getting expert advice can help ensure the deed is completed correctly and aligns with your overall estate plan.

Don'ts:

- Avoid using vague language or descriptions that could be open to interpretation. Precision is key in legal documents.

- Do not leave the form unnotarized. A notary public must witness your signature for the document to be legally binding.

- Refrain from hiding the TOD deed or forgetting to tell anyone where it is. If your beneficiaries or executor cannot find the document, it cannot be enforced.

- Do not assume that a TOD deed is a substitute for a will. Other aspects of your estate need to be managed through different estate planning tools.

- Avoid using a TOD deed to transfer property to a minor directly, as minors cannot legally own property. Instead, designate a guardian or trust.

- Do not neglect to review and update the deed if circumstances change. Life events such as births, deaths, marriages, or divorces may necessitate changes to your designated beneficiaries.

Misconceptions

Many people have misconceptions about the Florida Transfer-on-Death (TOD) Deed form, which can lead to confusion about how it works and its benefits. Here are six common misconceptions explained:

It's the same as a will: A common misconception is that a TOD deed is the same as a will, but they serve different purposes. A TOD deed allows property to be transferred directly to a beneficiary upon the owner’s death without going through probate, whereas a will is a document that outlines how a person's assets should be distributed after they die and usually requires probate.

It overrides a will: Some believe that a TOD deed can override the provisions of a will. However, the TOD deed only controls the specific property described in the deed. If there are conflicts between the TOD deed and a will, the TOD deed typically prevails regarding the property it covers, but it does not negate other provisions of the will.

It's irrevocable: Another misconception is that once a TOD deed is executed, it cannot be changed. In reality, the property owner can revoke or modify a TOD deed at any time before death, as long as they are mentally competent.

It avoids all estate taxes: While a TOD deed can help avoid the probate process, it does not inherently avoid all estate taxes. The value of the property transferred may still be subject to federal and, depending on the circumstances, state estate taxes.

It's a tool for avoiding creditors: Some people mistakenly believe that a TOD deed can protect a property from creditors. However, creditors may still make claims against the deceased's estate, including property transferred via a TOD deed, within the boundaries of state law.

It transfers property immediately upon death: While it's true that the property is meant to transfer to the beneficiary without the need for probate, the process is not instantaneous. The beneficiary must often take certain steps, such as filing the deceased's death certificate and a form to claim the property, before legally owning the property.

Key takeaways

Filling out and using the Florida Transfer-on-Death Deed form correctly is crucial for ensuring a smooth transfer of property upon the owner's death. Below are key takeaways to keep in mind:

- Accuracy is paramount: Every detail entered into the form must be accurate, including the legal description of the property and the names of beneficiaries.

- Witnesses are required: The deed must be signed in the presence of two witnesses for it to be legally binding.

- Notarization is a Must: Alongside witness signatures, the deed needs to be notarized to verify the authenticity of the signatures.

- Revocability: The Transfer-on-Death Deed can be revoked by the owner at any time before death, offering flexibility and control over the asset.

- Does Not Bypass Probate for Other Assets: While the deed allows the specified property to bypass probate, other assets not covered by such a deed will still go through the probate process.

Adhering to these guidelines ensures the transfer process is executed as intended, providing peace of mind to all parties involved.

More Transfer-on-Death Deed State Forms

Transfer on Death Deed Form Ohio - Assists in the strategic planning of estate distribution, offering clarity and direction for future property succession.

Tod Deed Georgia - A straightforward document, it simplifies the process of designating who will inherit your real estate assets.

Todi Illinois - This legal document enables individuals to easily transfer real estate to a beneficiary without the complications of a will or trust.

Texas Deed Transfer Form - This deed acts as a safeguard, ensuring that the property lands in the hands of the intended beneficiary with minimal fuss or delay.