Fillable Transfer-on-Death Deed Document for California

In California, the Transfer-on-Death (TOD) Deed offers a straightforward and cost-effective way for property owners to transfer their real estate to a beneficiary without the complication of going through probate after their demise. This legal document, which allows for the direct transfer of ownership of real property upon the death of the property owner, bypasses the often lengthy and expensive probate process, ensuring a smooth transition for the designated recipient. By simply completing and properly recording the form with the appropriate county recorder's office before the property owner's death, individuals can ensure their real estate is passed on according to their wishes, providing peace of mind and financial security for the beneficiary. It's a tool designed with simplicity in mind, yet it requires careful attention to detail to guarantee its validity and effectiveness. Understanding the major aspects of this form, including its benefits, limitations, and the specific procedural requirements for its execution and revocation, is vital for anyone considering this method for estate planning in California.

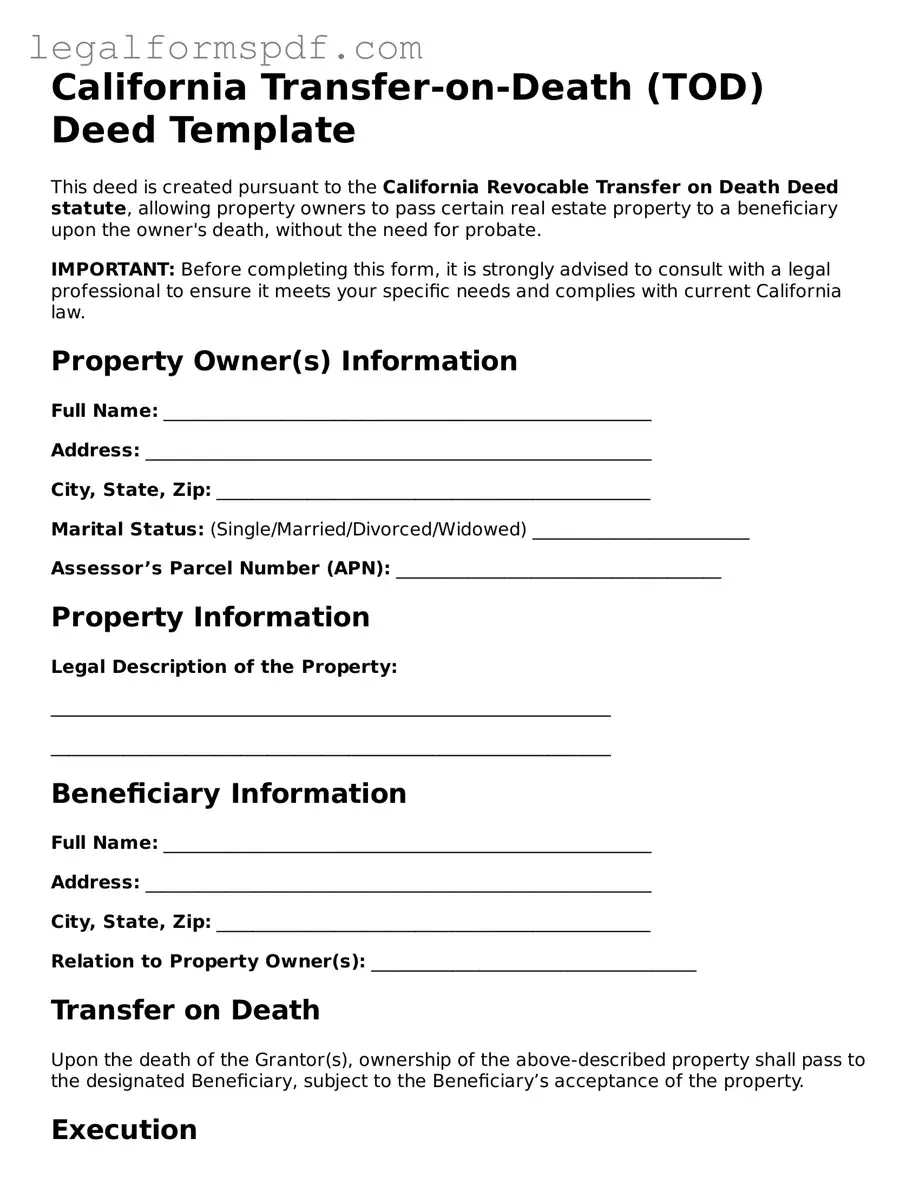

Document Example

California Transfer-on-Death (TOD) Deed Template

This deed is created pursuant to the California Revocable Transfer on Death Deed statute, allowing property owners to pass certain real estate property to a beneficiary upon the owner's death, without the need for probate.

IMPORTANT: Before completing this form, it is strongly advised to consult with a legal professional to ensure it meets your specific needs and complies with current California law.

Property Owner(s) Information

Full Name: ______________________________________________________

Address: ________________________________________________________

City, State, Zip: ________________________________________________

Marital Status: (Single/Married/Divorced/Widowed) ________________________

Assessor’s Parcel Number (APN): ____________________________________

Property Information

Legal Description of the Property:

______________________________________________________________

______________________________________________________________

Beneficiary Information

Full Name: ______________________________________________________

Address: ________________________________________________________

City, State, Zip: ________________________________________________

Relation to Property Owner(s): ____________________________________

Transfer on Death

Upon the death of the Grantor(s), ownership of the above-described property shall pass to the designated Beneficiary, subject to the Beneficiary’s acceptance of the property.

Execution

This document must be signed in the presence of a notary public and recorded with the county recorder's office before the transferor's death to be effective.

Signatures

Property Owner(s) Signature: ______________________________________

Date: __________________________________________________________

State of California

County of _________________________

On this _____ day of _____________, 20__, before me, _________________________ (name and title of the officer), personally appeared ____________________________________________________, who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument, the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct.

WITNESS my hand and official seal.

Signature of Notary Public: ______________________________

My Commission Expires On: _______________________________

PDF Specifications

| Fact Name | Detail |

|---|---|

| Governing Law | California Probate Code sections 5600-5696 govern the Transfer-on-Death (TOD) Deed form. |

| Eligible Property Types | The form applies to residential properties, including single-family homes, condominiums, and up to 4-unit buildings. |

| Beneficiary Requirements | Beneficiaries can be individuals, trusts, or organizations, and there is no limit to the number that can be named. |

| Revocability | The TOD deed is revocable. The owner may change the beneficiary or withdraw the deed without the beneficiary's consent. |

| Effect on Property Taxes | Transferring property through a TOD deed does not automatically reassess property value for tax purposes until the owner's death. |

| Filing Requirement | The deed must be notarized and recorded with the county recorder’s office before the owner’s death to be effective. |

| Avoids Probate | Property transferred via a TOD deed bypasses probate, streamlining the transfer process to the named beneficiary upon the owner's death. |

| Limitations | The TOD deed cannot transfer property held in joint tenancy or as community property with right of survivorship unless signed by all owners. |

Instructions on Writing California Transfer-on-Death Deed

Completing the California Transfer-on-Death (TOD) Deed form allows for the direct transfer of real estate to a designated beneficiary upon the death of the property owner, bypassing the probate process. This legal document is pivotal for those looking to ensure their real estate assets are seamlessly transferred to their chosen successors without legal complications. After the death of the property owner, the beneficiary must take specific legal steps to claim ownership of the property. The steps to fill out the form correctly are critical in making this transition smooth and legally binding.

Steps for Filling Out the California Transfer-on-Death Deed Form:

- Identify the current record owner(s) of the property as listed on the existing property deed. This information must match the public record exactly.

- Specify the legal description of the property. This can typically be found on the current deed or property tax bill. It includes the assessor's parcel number (APN) and may include a lot, block, or tract number.

- Provide the name and mailing address of the beneficiary or beneficiaries. If naming multiple beneficiaries, specify whether they will own the property equally or in different shares.

- Sign and date the form in the presence of a notary public. The signature must be notarized to be valid.

- File the completed and notarized form with the county recorder's office in the county where the property is located. There may be a filing fee.

Once the form is properly completed and filed, the property will be transferred to the beneficiary upon the death of the owner without going through probate. It is crucial to follow these steps carefully to ensure the legality of the transfer and to avoid any potential issues that may arise during the transfer process. Each step should be approached with attention to detail and an understanding of the responsibilities that come with property transfer.

Understanding California Transfer-on-Death Deed

What is a Transfer-on-Death Deed in California?

A Transfer-on-Death (TOD) Deed allows property owners in California to pass on their real estate to a named beneficiary without the need for probate after their death. This deed is effective only upon the death of the property owner, allowing them to maintain control over the property during their lifetime.

How can someone create a Transfer-on-Death Deed in California?

To create a TOD Deed, the property owner must complete and sign a form that complies with California law, have the signature witnessed by a notary public, and then record the deed with the county recorder's office in the county where the property is located. It's essential to use the correct form and follow all legal requirements to ensure the deed is valid.

Who can be named as a beneficiary on a Transfer-on-Death Deed?

Almost anyone can be named as a beneficiary on a TOD deed, including individuals, trusts, or organizations. However, the beneficiary must be clearly identifiable in the deed. Property owners can name multiple beneficiaries and specify how the property should be divided among them.

Can a Transfer-on-Death Deed be revoked?

Yes, a TOD Deed can be revoked at any time before the death of the property owner. Revocation can be accomplished by completing and recording a revocation form, transferring the property to someone else, or creating and recording a new TOD Deed that names a different beneficiary, which automatically revokes the previous deed.

Are there any restrictions on what types of property can be transferred using a Transfer-on-Death Deed in California?

The TOD Deed in California is limited to certain types of real property, including single-family homes, condominiums, and land containing no more than four residential dwelling units. It is not applicable for transferring other types of assets or properties held in joint tenancy or as community property with right of survivorship.

What happens to the property if the named beneficiary predeceases the property owner?

If the beneficiary named in the TOD Deed dies before the property owner, the deed has no effect, and the property will be part of the property owner's estate, subject to distribution under their will or the state's intestacy laws if there is no will.

Are there any tax implications for transferring property using a Transfer-on-Death Deed?

The transfer of property using a TOD Deed may have tax implications, including potential impact on estate taxes and capital gains taxes for the beneficiary. Property owners should consult with a tax professional to understand these implications tailored to their individual circumstances.

Common mistakes

Many individuals encounter difficulties when filling out the California Transfer-on-Death (TOD) Deed form. One common mistake is neglecting to provide the legal description of the property. It is crucial to include this information exactly as it appears on the current deed to ensure the rightful transfer of ownership. Omitting or inaccurately describing the property can lead to significant legal complications after the grantor's death.

Another frequent error is failing to sign the form in the presence of a notary public. The California TOD Deed form requires notarization to be valid. Sometimes, people either overlook this requirement or believe that a witness's signature can substitute for notarization. This misunderstanding can invalidate the deed, preventing the intended transfer of property.

People often forget to name an alternate beneficiary. While this step is not mandatory, it is highly recommended. Naming an alternate beneficiary ensures that the property will transfer to the intended person if the primary beneficiary cannot inherit. Without an alternate, the property might go through probate, which the TOD deed aims to avoid.

Incorrectly spelling the names of beneficiaries is another common mistake. The names on the TOD deed must match the beneficiaries' legal names exactly. Discrepancies can create confusion and potential disputes among potential heirs, leading to delays and possibly court intervention to clarify the beneficiaries' identities.

Some individuals mistakenly believe that filling out a TOD deed form will suffice for all their real estate holdings without realizing that a separate form must be used for each property. This error can result in some properties not being covered by a TOD deed, leaving them subject to probate.

Occasionally, property owners fail to record the deed with the county recorder's office after completing it. In California, for the TOD deed to be effective, it must be recorded before the property owner's death. Failure to record the deed renders it ineffective, as if it were never completed in the first place.

A lack of clarity when describing how co-owners will hold the property is another pitfall. If the property is owned jointly, it's important to specify whether the surviving owner(s) will inherit the deceased's share automatically (right of survivorship) or if the deceased's share should transfer through the TOD deed.

Not consulting a legal professional for advice and review of the completed form is a significant oversight. Although the TOD deed form may seem straightforward, legal nuances can affect the deed's validity and the property transfer's success. Professional advice can prevent errors that could nullify the intended effects of the deed.

Ignoring the need to update the TOD deed after significant life events, such as marriage, divorce, or the birth of a child, is a common error. Life changes might alter one's intentions regarding beneficiaries, necessitating updates to the TOD deed to reflect current wishes.

Finally, some people assume that a TOD deed transfers property immediately upon completion. In reality, the transfer does not take effect until the death of the property owner. This misunderstanding can lead to confusion about the property owner's rights and responsibilities towards the property during their lifetime.

Documents used along the form

When planning for the future, it’s important to have all the necessary legal documents prepared and in order. A California Transfer-on-Death Deed form is often used to ensure real estate property can be passed directly to a beneficiary without going through probate. However, this form is just one part of a comprehensive estate plan. Several other documents are commonly utilized alongside the California Transfer-on-Death Deed form to make sure all aspects of an individual's wishes are covered and legally documented.

- Last Will and Testament: This fundamental document outlines how a person’s assets and belongings should be distributed after their death. It can also specify guardianship preferences for minor children.

- Revocable Living Trust: A legal arrangement where assets are placed into a trust for the benefit of the trust maker during their lifetime, and then transferred to designated beneficiaries upon the maker's death, bypassing the probate process.

- Power of Attorney for Financial Affairs: Authorizes a designated individual to manage financial matters on behalf of the person creating the document, should they become unable to do so themselves.

- Advance Health Care Directive: A document that allows an individual to outline their wishes concerning medical treatment and end-of-life care. It also allows them to appoint someone to make health care decisions on their behalf if they are unable to communicate their decisions.

- Beneficiary Designations: Forms that identify individuals or entities as beneficiaries on financial accounts and policies (like life insurance and retirement accounts), allowing these assets to bypass probate and directly transfer to the named beneficiaries after death.

- Pour-Over Will: Often used in conjunction with a Revocable Living Trust, this type of will ensures any assets not included in the trust at the time of the individual’s death will be transferred into the trust and then distributed according to its terms.

- Property Agreement: For married couples or registered domestic partners in community property states, this document can specify how property owned jointly is to be treated and can affirm which property is considered separate or community property.

- Guardianship Designation: While also addressed in a will, a standalone guardianship designation can provide more detailed instructions and preferences for the care of minor children or dependents with special needs.

- Letter of Intent: A non-binding document that provides additional context to a will or trust, explaining the reasons behind certain decisions or outlining wishes not covered by legal documents.

Each of these documents plays a unique role in a comprehensive estate plan, working together to ensure an individual's wishes are respected and efficiently carried out. Utilizing the California Transfer-on-Death Deed form alongside these other documents can provide peace of mind, knowing that both real and personal property will be handled according to the individual's wishes, minimizing the burden on loved ones during a difficult time.

Similar forms

The California Transfer-on-Death (TOD) Deed shares similarities with a Last Will and Testament. Both allow an individual to specify who will receive their property when they die. However, unlike a Will, a TOD Deed does not go through probate, which can save time and money. The key similarity is in their core function: they provide a way to direct the distribution of assets upon death.

Similar to a Living Trust, the TOD Deed allows for the transfer of property upon the death of the property owner. Both instruments avoid probate by allowing direct transfer to beneficiaries. The main difference is that a Living Trust can take effect during the grantor's lifetime, providing a mechanism for managing the property before death, which a TOD Deed does not.

The Beneficiary Deed, used in some states, is another name for a document that functions similarly to the California TOD Deed. It permits the property owner to designate who will inherit real estate upon their death, bypassing the probate process. The terms and function of these deeds are so alike that the difference is primarily in the name and jurisdiction.

A Joint Tenancy with Right of Survivorship deed also serves to transfer property automatically upon death, but it does so between co-owners. When one owner dies, the surviving owner automatically inherits the deceased owner's share. Unlike the TOD Deed, it involves the immediate transfer of rights upon death but only between co-owners, not to a beneficiary outside the ownership agreement.

A Payable-on-Death (POD) account is a financial arrangement similar to the TOD Deed but applies to bank and investment accounts rather than real estate. It allows account holders to designate beneficiaries who will receive the assets in the account upon the holder's death, without going through probate. The similarity lies in the bypassing of probate and the direct transfer to beneficiaries.

A Life Estate Deed allows an individual (the life tenant) to occupy, use, and control the property during their lifetime, but upon their death, the property automatically passes to a remainderman designated in the deed. This arrangement shares the TOD Deed's characteristic of avoiding probate while providing for the transfer of property interest upon death, albeit with lifetime benefits to the life tenant.

Finally, the Revocable Living Will, similar in nature to a Living Trust, shares the feature of being alterable during the life of the document creator. While primarily serving to direct health care decisions rather than manage property, it parallels the TOD Deed's posthumous transfer intent by allowing changes up until death, ensuring that the creator's final wishes are honored.

Dos and Don'ts

Filling out the California Transfer-on-Death (TOD) Deed form requires attention to detail and adherence to state laws governing these documents. Below are crucial dos and don'ts to guide you through this process.

- Do ensure that the property is eligible for transfer using a TOD deed. In California, this includes single-family homes and condominiums, as well as certain residential properties with no more than four units.

- Do correctly identify and clearly print the legal description of the property on the form. This description can typically be found on your property deed.

- Do name one or more beneficiaries who will receive the property upon your death, and clearly identify their relationship to you, if any.

- Do sign the TOD deed form in the presence of a notary public. The notarization of your signature is a legal requirement for the document to be valid.

- Don't forget to file the completed and notarized TOD deed with the county recorder's office where the property is located. The deed must be recorded before your death to be effective.

- Don't use the TOD deed to transfer property to a minor direct. Consider using a trust or naming an adult custodian under the California Uniform Transfers to Minors Act as the beneficiary.

- Don't neglect to review and, if necessary, update the TOD deed whenever there are significant changes in your life or the intended beneficiary's circumstances.

- Don't overlook other estate planning tools. A TOD deed might not be the best or only tool for your situation. Consult with an attorney to understand all of your options.

Misconceptions

The California Transfer-on-Death (TOD) Deed form is a legal document allowing homeowners to designate a beneficiary to receive their property upon their death, bypassing the probate process. While it can be a useful tool for estate planning, there are several misconceptions about its application and effect. Understanding these can help property owners make informed decisions about managing their estate.

Misconception #1: Creating a TOD Deed is complicated and requires an attorney. In reality, the process is straightforward, and the forms are designed to be completed without the necessity of a lawyer. However, consulting with an estate planning attorney can provide valuable advice tailored to an individual's specific situation.

Misconception #2: A Transfer-on-Death Deed offers the same protections as a trust. Unlike a trust, a TOD Deed does not provide the same level of control over the property during the owner's life, nor does it shield the property from creditors’ claims.

Misconception #3: The beneficiary cannot sell or borrow against the property during the owner's lifetime. The owner retains full control over the property until death, meaning they can sell, lease, or refinance the property as they see fit.

Misconception #4: TOD Deeds avoid estate taxes. While a TOD Deed may help avoid the probate process, it does not exempt the beneficiary from potential estate taxes that the property may be subject to upon the owner’s death.

Misconception #5: All types of real property can be transferred using a TOD Deed. Certain types of real property, such as those owned in joint tenancy or as community property with right of survivorship, may not be eligible for transfer by a TOD Deed.

Misconception #6: A Transfer-on-Death Deed is irrevocable. The property owner can revoke the deed at any time before death, allowing for changes in circumstances or decisions regarding the property beneficiary.

Misconception #7: The beneficiary's creditors have no claim against the property until the owner dies. Once the property is transferred upon death, it may become available to satisfy the beneficiary’s creditors, potentially subjecting it to their claims.

Misconception #8: Filing a TOD Deed is all that's needed to transfer property. While filing the deed with the county recorder is necessary, the beneficiary must also take steps to affirmatively accept the property following the owner's death to ensure the transfer is completed properly.

While a Transfer-on-Death Deed can be a beneficial instrument for transferring property efficiently and bypassing the probate process, property owners should be aware of these common misconceptions. Proper legal advice and a strong understanding of the TOD Deed's limitations and requirements can help ensure that estate planning objectives are achieved in accordance with California law.

Key takeaways

The California Transfer-on-Death (TOD) deed form is a valuable tool for estate planning, allowing property owners to bypass the probate process by directly transferring their real estate to a beneficiary upon their death. Understanding how to correctly fill out and use this form is essential for ensuring a smooth transfer of property. Here are six key takeaways to consider:

- Eligibility Criteria: Not all properties can be transferred using a TOD deed. The property must be located in California, and it can include a single-family home, condominium, or a parcel of land with no more than four residential units on it. Checking the eligibility of your property is an essential first step.

- Complete Information Is Crucial: For a TOD deed to be valid, it must include complete information about the current owner, the designated beneficiary, and a legal description of the property. Inaccuracies or missing details can render the deed void and ineffective, leading to potential legal disputes among heirs.

- Notarization Is Required: After filling out the TOD deed form, it must be signed in the presence of a notary public. Notarization authenticates the identity of the person signing the deed and verifies that the signature was made willingly and without duress, adding a layer of protection against fraud.

- Recording with the County Recorder: Simply completing and notarizing the TOD deed is not enough. For it to be effective, the deed must be recorded with the county recorder’s office in the county where the property is located. The form must be recorded before the property owner's death; otherwise, it will not be valid.

- Revocability: One of the advantages of a TOD deed is its flexibility. The property owner can revoke it at any time should their circumstances or wishes change. It is crucial to follow the proper procedure for revocation to ensure that the previous TOD deed is no longer valid and to avoid any confusion upon the owner’s death.

- Impact on Benefits and Assistance Programs: The use of a TOD deed might affect the owner's eligibility for certain state and federal assistance programs. It is wise to consult with a lawyer or a financial advisor to understand how transferring property via a TOD deed could impact your eligibility for programs like Medicaid.

Properly used, a Transfer-on-Death deed in California can be an effective estate planning tool that simplifies the process of transferring property to a beneficiary without the need for probate. However, it's important to pay attention to detail and understand the implications of its use, including its limitations and benefits. Consulting with a legal professional to navigate these waters can be incredibly helpful.

More Transfer-on-Death Deed State Forms

How to Avoid Probate in Pennsylvania - This estate planning instrument is recognized in several states, each with its own specific requirements and restrictions.

Where Can I Get a Tod Form - This form of deed is not available in all states, so it's essential to check local laws to see if it's an option for estate planning.

Tod Deed Georgia - By filling out a Transfer-on-Death Deed, you maintain control over the property until your death, including the right to sell or change the beneficiary.